Quick Verdict

Kraken is a regulation-forward venue with quarterly Proof-of-Reserves, a MiCA license in the EU, and a dismissed SEC case in the U.S. (2025). With 526+ assets, 1,200+ pairs, and Pro fees that scale down from 0.25%/0.40%, it blends trust signals with depth.

Who It’s For

- Security-first users who value PoR verification

- Active traders using Kraken Pro and tiered fees

- U.S./EU clients who want clear licensing and coverage

Who Should Consider Alternatives

- Residents of Maine or New York

- Traders chasing the lowest entry fees

- Users who prefer a pure instant-buy app

Kraken Quick Facts

| Founded | 2011 (14-year track record) |

|---|---|

| CEO | David Ripley (co-CEO Arjun Sethi) |

| Cryptocurrencies Supported | 526+ assets; 1,200+ pairs (USD / EUR / GBP bases) |

| Trading Fees (Maker/Taker) | Pro: 0.25% / 0.40% (as low as 0% / 0.0125% at high tiers) |

| Funding & Withdrawals | ACH / FedWire / SWIFT in (often free); ACH out free; FedWire $4; BTC ≈ 0.000015 BTC |

| Licensing Snapshot | U.S. service (excl. Maine & NY); EU MiCA license via Central Bank of Ireland |

| Proof of Reserves | Quarterly Merkle-tree attestations; user-verifiable |

| App Ratings | iOS 4.7★ / Android 4.1★ |

| Trustpilot Average | 3.1 / 5 (verification & fee-clarity complaints) |

| Security Certifications | ISO 27001; SOC 1 & SOC 2 Type 2; cold storage majority; FIDO2; allowlists |

Helpful Links

Data current as of Jan. 6, 2026.

Kraken at a Glance

| Field | Detail |

|---|---|

| Founded | 2011 |

| HQ | United States |

| CEO | David Ripley |

| Users and coverage | Global availability with notable restrictions. See service availability |

| Supported cryptos and fiat | 526 cryptocurrencies with live catalog on Kraken support. Fiat bases include USD, EUR, GBP |

| Licensing snapshots US and EU | United States service with exclusions for Maine and New York. EU authorization under MiCA via the Central Bank of Ireland |

| Proof of Reserves cadence | Quarterly attestations with user verification on Proof of Reserves |

| App ratings iOS and Android | iOS 4.7/5 and Android 4.1/5 as of Jan. 6, 2026 |

| Trustpilot average | 3.1/5 as of Jan. 6, 2026 |

| Big milestones | SEC case dismissed with prejudice, U.S. staking returns, NinjaTrader and Small Exchange acquisitions |

How We Tested And Reviewed Kraken (Methodology)

We evaluated Kraken using a practical, user-first testing framework focused on security, cost, access, and real trading usability rather than marketing claims.

What We Tested

- Account setup & verification: Signup flow, KYC tiers, processing times, and feature gating by region.

- Markets & liquidity: Asset coverage, fiat pairs, depth on major spot and derivatives markets, and availability for U.S. and EU users.

- Fees in real use: Compared Instant Buy costs vs Kraken Pro maker–taker fees across common trade sizes and 30-day volume tiers.

- Trading experience: Tested Kraken vs Kraken Pro for order types, charting, margin controls, and workflow clarity.

- Security & transparency: Reviewed Proof of Reserves cadence, user verification process, account protections, certifications, and incident history.

- Staking & earn features: Checked availability, supported networks, reward ranges, and regional restrictions.

- Mobile apps & support: Compared app feature parity, update frequency, store ratings, and responsiveness of live chat and email support.

What We Didn't Test

- We did not audit internal custody systems or attempt to bypass regional restrictions.

- We did not test institutional-only services beyond publicly documented capabilities.

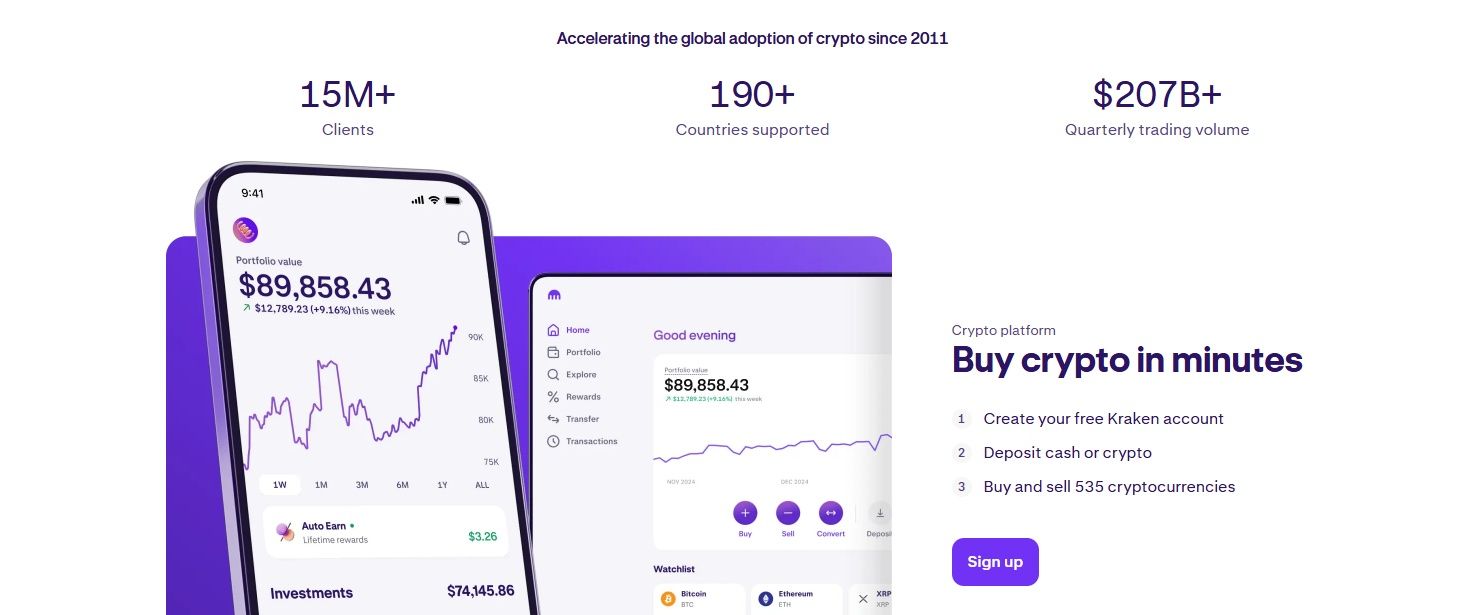

What Is Kraken? Company Overview & History

Kraken is one of the longest-running crypto exchanges, founded in 2011 with an emphasis on security, reliability, and regulatory compliance. These priorities are consistently reflected in the company’s public communications.

Kraken’s History Shows a Consistent Focus on Security. Image via Kraken

Kraken’s History Shows a Consistent Focus on Security. Image via KrakenOrigins & Leadership

The exchange’s beginnings trace back to 2011, when co-founder Jesse Powell set out to build a platform with security and operational discipline at its core. Leadership later transitioned as long-time COO David Ripley became CEO and Powell moved to Chairman, a planned change detailed in Kraken’s CEO announcement. He was later on joined by Arjun Sethi as a co-CEO. Security remains a defining theme under Chief Security Officer Nick Percoco, whose team operates Kraken Security Labs and outlines user protections within the broader security overview.

2025 Financial & Expansion Snapshot

For Q2 2025, Kraken reported ~$412 million in revenue with an 18% year over year increase and $80 million in adjusted EBITDA, figures presented in the company’s Q2 2025 update.

The exchange also acquired NinjaTrader for $1.5 billion in May 2025. The goal is to expand professional-grade tooling and multi-asset capabilities for advanced and institutional users.

In October 2025, Kraken acquired Small Exchange, a CFTC-licensed designated contract market from IG Group for $100 million, allowing it to launch a fully U.S.-native derivatives product suite.

Read: Best Crypto Exchanges

Regulatory Status

Kraken’s regulatory picture centers on the resolution of a major SEC case, the return of on-chain staking for eligible United States clients, and a clearer licensing footprint across the United States and the European Union.

The Dismissal of the SEC Case Closed a Significant Chapter. Image via Freepik

The Dismissal of the SEC Case Closed a Significant Chapter. Image via FreepikSEC 2023 Lawsuit and Dismissal in March 2025

The SEC litigation release records a dismissal with prejudice in March 2025, which prevents the same civil claims from being refiled. The Washington Post reported that the case ended without penalties and without an admission of wrongdoing. Kraken provided additional detail in its statement on the dismissal, noting that operations continued without changes. For users, this outcome reduces legal overhang and supports continuity of core features subject to the rules that apply in each jurisdiction.

Staking Reinstated in the United States

Kraken announced the return of on-chain staking for United States clients on Jan. 30, 2025. The initial rollout covered select states and territories with support for a menu of major networks that included Ethereum, Solana, Polkadot, and Cardano. Availability depends on residence and can change as local rules evolve, so prospective participants should confirm coverage and program terms on the staking page before committing funds.

Licensing Footprint in the United States and European Union

Kraken’s licensing and regulatory overview explains where services are available and which entities hold local permissions. The United States quick start guide clarifies that service is not offered to residents of Maine and New York and outlines feature limitations that can apply in other locations. In Europe, Kraken announced a MiCA license from the Central Bank of Ireland on June 25, 2025, which enables service across the European Economic Area under a single regulatory framework.

The dismissal of the SEC case closed a significant chapter, the return of on-chain staking expanded options for eligible United States clients, and a maturing licensing footprint in the United States and the European Union provides clearer guidance on access and coverage.

How Kraken Works

Kraken moves new users through three steps. Create an account and complete verification, add funds, then place a first trade on the standard interface or on Kraken Pro.

Move to Kraken Pro for Greater Control as your Activity Grows. Image via Kraken

Move to Kraken Pro for Greater Control as your Activity Grows. Image via KrakenAccount Creation & KYC

- Open the Kraken sign-up page, create your account with a strong, unique password, confirm your email, and sign in.

- Select a tier that matches your needs. Verification levels explain deposit, withdrawal, and trading limits for each option.

- Prepare documents in advance. Document requirements list a government-issued ID, a selfie or liveness check, and proof of residence.

- Submit the application and check the status in your profile. Kraken’s verification guidance notes that most reviews are completed within a few days once all items are received.

Funding

- Pick a deposit route that fits your location and currency. Methods, fees, and timelines are summarized in the funding overview.

- Add bank details for fiat transfers and start with a small test amount.

- For crypto deposits, generate the asset address, confirm the correct network, and include any memo or tag where required.

Trading Flow

- Use the standard interface for quick purchases. Choose the professional interface for limit and advanced orders, deeper charts, and order book tools. A side-by-side view is in Kraken versus Kraken Pro.

- Review costs before placing an order. Instant Buy uses a simple quote while Pro follows a maker and taker ladder by thirty day volume.

- If you plan to place advanced orders, walk through how to buy and sell on Kraken Pro, then practice with a small order.

Create and verify your account, fund it by bank transfer or crypto deposit, and place a first order on the standard interface or move to Kraken Pro for greater control as your activity grows.

Kraken Features Overview

Kraken offers a simple trading interface for quick orders, a professional suite for active traders, broad asset coverage, margin and futures for eligible users, staking and rewards programs, and fully featured mobile apps.

Kraken Offers a Simple Trading Interface for Quick Orders, a Professional Suite for Active Traders. Image via Kraken

Kraken Offers a Simple Trading Interface for Quick Orders, a Professional Suite for Active Traders. Image via KrakenUI & Trading Experience

Kraken Pro supports configurable boards and widgets for charts, order books, positions, and watchlists, with layout controls described in the trading interface guide. Depth charts, time frames, and indicators can be arranged through module settings. Price alerts and volatility notifications are available on the web and mobile through Market Alerts.

Range of Crypto & Pairs

Kraken’s main page highlights 526 assets and also a live catalog. Market depth spans majors and DeFi, with fiat bases that include USD, EUR, and GBP. According to CoinGecko, there are 1,200 plus trading pairs, and the pairs list updates as listings roll out.

Margin & Futures

Spot margin limits vary by pair and eligibility, and can reach up to 10× on selected assets, with many markets operating at up to 5×. Pair-level limits are posted in margin trading pairs and their maximum leverage.

Kraken Derivatives supports perpetuals and fixed maturities with a fee ladder that starts at 0.0200% maker and 0.0500% taker, stepping to 0.0100% maker and 0.0350% taker at $10M 30D volume, then 0.0000% maker and 0.0125% taker at $100M, with higher tiers offering negative maker rates. Leverage on derivatives can reach 50× for eligible clients. Liquidations are governed by the Equity Protection Process, designed to prevent negative balances and to close positions when maintenance thresholds are breached.

Staking & Rewards

Kraken offers staking on major networks with published reward ranges that can reach up to 21% depending on the asset and your region. Common networks such as Ethereum, Solana, Polkadot, and Cardano appear in the program menu, with mechanics and payout timing explained in Overview of Staking on Kraken.

For balances not actively staked, Auto Earn can allocate idle assets and credit rewards on a scheduled basis, as summarized in the Overview of Auto Earn. Availability and APYs can vary by location and are updated on the staking page.

Mobile Apps iOS and Android

The main app supports quick buys, recurring orders, and portfolio tracking, while Kraken Pro focuses on advanced order control and market depth.

As of Jan. 6, 2026, the iOS listing for both the Kraken and Kraken Pro apps shows the current release and rating of 4.7/5 on the App Store.

Over at the Google Play Store, Kraken is rated at 4.1/5, and Kraken Pro is rated 4.2/5.

Feature sets align closely across platforms, and both apps are updated regularly through their respective store channels.

Kraken combines a beginner-friendly interface with a professional environment that supports configurable layouts, broad market access, and programmatic ways to earn. Margin and futures add advanced exposure for eligible clients, while staking and weekly rewards provide yield options that are easy to monitor in the mobile apps.

Fees & Pricing Structure

Kraken Fees Stack up Somewhere in the Middle of Binance and Coinbase. Image via Freepik

Kraken Fees Stack up Somewhere in the Middle of Binance and Coinbase. Image via FreepikInstant Buy / Convert Fees

| Item | Fee | $100 | $1,000 | $50,000 |

|---|---|---|---|---|

| Instant trading fee | 1% | $1.00 | $10.00 | $500.00 |

| Kraken+ monthly allowance | 0% up to $10,000 | $0.00 | $0.00 | $0.00 on first $10,000 |

Kraken Pro Maker–Taker

| 30D volume | Maker | Taker |

|---|---|---|

| $0 to $10k | 0.25% | 0.40% |

| $10k to $50k | 0.20% | 0.35% |

| $50k plus | 0.14% | 0.24% |

Deposits and Withdrawals

USD deposits

| Method | Fee |

|---|---|

| ACH (Plaid) | Free |

| FedWire | Free |

| SWIFT | Free |

| Debit card | $0.25 + 3.75% |

USD withdrawals

| Method | Fee |

|---|---|

| ACH | Free |

| FedWire | $4 |

| SWIFT | $13 |

Major Crypto withdrawals

| Asset | Network fee |

|---|---|

| Bitcoin | 0.00001500 BTC |

| Ethereum | 0.00033 ETH |

Competitor Fee Comparison

Order book model

| Platform | Entry maker | Entry taker |

|---|---|---|

| Kraken Pro | 0.25% | 0.40% |

| Coinbase Exchange / Advanced | 0.40% | 0.60% |

| Binance | 0.10% | 0.10% |

Broker routing model

| Platform | Entry fee |

|---|---|

| Robinhood Crypto | 0.85% |

Security & Transparency

Kraken frames security as a discipline that combines process, people, and public verification. The company publishes regular reserve attestations, offers multiple account protections, and documents its controls and certifications. That still doesn't mean any exchange can be completely foolproof.

Kraken States that it Holds ISO 27001 Certification and has Completed SOC 2 Examinations. Image via Freepik

Kraken States that it Holds ISO 27001 Certification and has Completed SOC 2 Examinations. Image via FreepikTrack Record & 2024 Incident

In June 2024, a security researcher identified a critical flaw and withdrew about $3 million from company funds before a resolution was reached, a sequence summarized by Bitdefender. Kraken’s security team fixed the issue and stated that client assets were not at risk, as set out in the company’s bug bounty update. The case reinforced the exchange’s emphasis on coordinated disclosure and on prompt patching when new issues surface.

Proof of Reserves Quarterly

Kraken operates a Proof of Reserves program that lets clients verify their balances through a Merkle tree check inside the account. The company reported its latest attestation as of June 30, 2025, with results published in a PoR update. The process confirms that in scope assets are backed one-to-one and explains how each client can download a record and match it to the auditor’s root.

Custody & Physical or Digital Controls

Operational controls include cold storage for the majority of client crypto, segregated infrastructure, and a dedicated security program described on the security overview noted above as well. Account protections include phishing-resistant passkeys, FIDO2 security keys, a Global Settings Lock that prevents changes to critical settings, and a Master Key for recovery and additional safeguards. The platform also supports funding two factor authentication and withdrawal allowlists through the security menu so that outgoing transfers only reach approved addresses.

Certifications & Compliance

Kraken states that it holds ISO 27001 certification and has completed SOC 2 examinations. The trust center adds that specific business units maintain SOC 1 Type 2 and SOC 2 Type 2 attestations and that the information security program aligns to the current ISO 27001 standard published there.

The 2024 incident showed a fast fix and no client impact, the reserve attestations provide a repeatable way to verify holdings, and the control set spans modern authentication, settings locks, and allowlists with documented certifications to back the program.

Customer Support & Real-World Feedback

Kraken provides round-the-clock assistance through live chat and email, and public feedback from users spans app stores, Trustpilot, and Reddit communities.

Users can Reach Kraken at any Time through Live Chat and Email. Image via Freepik

Users can Reach Kraken at any Time through Live Chat and Email. Image via FreepikSupport Channels & SLAs

- Live chat and email operate 24/7 from the support hub.

- Guided help and account requests sit in the Support Center.

- A formal first response SLA is not published on public pages. Actual times vary by queue and issue type.

Reviews & Sentiment

- Trustpilot displays 1.5/5 with recent comments citing verification delays, temporary account restrictions, and confusion about fees. It is advised to scroll through some reviews to get a better idea compared to competitors.

- In the latest reviews feed, users report service strain during sharp market moves and note cases where fees were higher than expected or accounts were deactivated without clear communication.

App Store Reviews

- iOS lists 4.7/5 on the App Store with praise for recurring buys and a clean layout.

- Android shows 4.1/5 on Google Play with solid depth tools on Pro and occasional login or performance complaints after major updates.

Reddit Pulse

A post on a two-month-old thread was titled “Having trouble withdrawing funds before Kraken…” describes a hold during additional checks and frustration with back and forth on documents, with other users advising a small test withdrawal and patience during peak volumes.

A discussion on a thread titled “Kraken Trustpilot reviews ***” gathers mixed views. Some point to long-standing security practices and proof of reserves, while others call out delayed responses during volatility and unclear fee expectations on instant buys.

Summary

Users can reach Kraken at any time through live chat and email. App store sentiment is steadier at 4.7/5 on iOS and 4.1/5 on Android, while Trustpilot sits at 1.5/5 with repeated references to verification, withdrawals, and fee clarity.

Kraken vs Competitors

Now, let's take a brief overview of how the Kraken stacks up against the competition.

Kraken vs Binance

If your priority is the lowest entry spot fees and you are not in the United States, Binance generally undercuts Kraken on maker/taker pricing (0.10%/0.10% vs. Kraken Pro’s 0.25%/0.40%). Binance’s fee ladder can drop further with very high 30-day volumes and BNB discounts, while Kraken’s next tier steps down at relatively modest volumes for active retail and pros.

Access and regulation are the big divider: Binance.com isn’t available to U.S. residents, who are instead directed to Binance.US. Kraken, by contrast, is available across the U.S. with the notable exceptions of Maine and New York, as mentioned before.

On custody and safeguards, Kraken emphasizes public Proof of Reserves to verify exchange-held balances, whereas Binance highlights its SAFU insurance fund. Both use an exchange-custody model, but the transparency angle differs.

Bottom line: Kraken suits U.S. users who value verified reserves and straightforward tiering; Binance is compelling for non-U.S. traders chasing the lowest baseline fees.

Don't forget to check out our detailed reviews of Binance.

Kraken vs Coinbase

Coinbase keeps onboarding simple with guided identity checks and tight bank integration, making it a familiar starting point for newcomers. Kraken’s path is also clear; email sign-up, tiered verification, and fiat rails, though it leans more “pro” in tone, especially once users hop into Kraken Pro.

Pricing is a core difference at entry: Kraken Pro starts at 0.25%/0.40% (maker/taker) versus Coinbase at 0.40%/0.60%. Each offers tiered ladders for active traders; Kraken’s fee break at $50k 30-day volume is 0.14%/0.24%, while Coinbase shows 0.15%/0.25% at the same level, with deeper reductions at very high volumes.

On transparency, Kraken publicly publishes Proof of Reserves, a differentiator for users who want balance verification alongside app-store-friendly UX.

Bottom line: Choose Coinbase for the most beginner-friendly onboarding; choose Kraken if lower entry trading fees and public reserve attestations matter more.

See our Coinbase Review for more details.

Kraken vs Robinhood

These services operate on different rails. Kraken is an order-book exchange with maker/taker pricing, on-chain deposits/withdrawals, margin for eligible users, and a derivatives venue. Robinhood Crypto routes orders as a broker, lists a simple percentage fee, and focuses on spot buys/sells, swaps, and a consumer wallet, without an exchange-style order book.

At entry cost, Robinhood advertises 0.85% under $50k 30-day volume (and 0.25% from $50k to $5M), while Kraken Pro posts 0.25%/0.40% maker/taker to start. If you care about asset ownership and transfers, Kraken supports on-chain deposits/withdrawals across listed networks; Robinhood supports blockchain transfers on selected networks within a brokerage custody model.

Bottom line: Robinhood is for casual, one-app simplicity; Kraken is for users who want exchange tools, on-chain transfers, and a broader markets toolkit.

Fee Comparison & “Best For"

| Platform | Entry Fees (Order-Book or Broker) | Best For |

|---|---|---|

| Kraken Pro | 0.25% maker / 0.40% taker | Security-minded users who value Proof of Reserves; active traders using Pro. |

| Coinbase Advanced | 0.40% maker / 0.60% taker | Easiest onboarding and mainstream brand comfort for beginners. |

| Binance | 0.10% / 0.10% (discounts with volume/BNB) | Lowest baseline spot fees; non-U.S. traders. |

| Robinhood Crypto | 0.85% under $50k 30D; 0.25% from $50k–$5M | Simple mobile experience for casual buy/sell with brokerage custody. |

Notes: U.S. access differs—Kraken operates across the U.S. except Maine and New York; Binance.com is unavailable to U.S. residents. Always confirm availability and current fees before trading.

Who Should (and Shouldn’t) Use Kraken?

Kraken suits users who value security, transparent reserves, and professional trading tools. It is less suitable if you need the very lowest entry-level fees on small instant buys or if you live in a restricted state.

Ideal Users

- Long-term holders who want public reserve attestations and self-verification through Proof of Reserves.

- Active traders who prefer depth tools, advanced order types, and configurable workspaces in Kraken Pro.

- Institutions that require onboarding support, reporting, and account controls available through Kraken Institutional.

Consider Alternatives If…

- You live in a restricted state such as Maine or New York, as noted earlier.

- You want the simplest possible app with only basic buy and sell buttons and no advanced views.

- You prioritize the lowest fees for small one-time purchases over professional tools and reserve disclosures.

Kraken serves users who put security, control, and compliance first, while those who want bare minimum simplicity or the rock bottom cost on tiny orders may be better served elsewhere.

Getting Started on Kraken (Step-by-Step)

Send a Small Test Withdrawal before Larger Amounts. Image via Kraken

Send a Small Test Withdrawal before Larger Amounts. Image via Kraken1. Create an account and enable FIDO2 or Passkeys

Go to the Kraken sign-up page, create your account, confirm your email, and turn on passkeys or FIDO2 security keys for phishing-resistant login.

2. Verify identity

Pick a tier under verification levels. Prepare the document requirements, which include a government ID, a selfie or liveness check, and proof of residence. Most Intermediate reviews finish in under 30 minutes when automated checks pass, while manual reviews can take a few days per processing time.

3. Fund by bank or crypto

Choose a route from the funding options. ACH in the United States, SEPA in the European Union, and Faster Payments in the United Kingdom are common and usually low-cost from Kraken’s side. For crypto, generate the asset address in your account, confirm the correct network, add any memo or tag, and start with a small test amount.

4. First trade on Instant or Pro

Use Instant for a quick quote and simple checkout, or switch to Kraken versus Kraken Pro for limit and advanced orders with depth and charts. If you want a short walkthrough, follow how to buy and sell on Kraken Pro and place a small initial order.

5. Secure withdrawal and allowlist

Add a withdrawal allowlist so transfers only go to approved addresses. Lock sensitive settings with Global Settings Lock and keep recovery controls in a Master Key separate from your login. Send a small test withdrawal before larger amounts.

Final Verdict — Is Kraken Worth Using in 2026?

For security-focused holders and long-term planners, Kraken is a yes. The SEC case dismissal removed a major overhang, the return of on-chain staking for United States clients adds utility where eligible, and ongoing Proof of Reserves offers rare transparency.

Active traders get configurable workspaces and deep order control in Kraken Pro with costs that fall as volume rises on the fee schedule. Newer users may prefer simpler apps, and small instant buys will not be the absolute cheapest. If you live in a restricted state, availability rules still apply.

Overall, Kraken suits users who value trust signals and professional tools more than cosmetic simplicity, and it remains a strong all-around choice in 2026.