I'm sure most of you know the feeling of getting laughed at when talking about cryptocurrencies. You get shot down by people who don’t even understand or try to understand cryptocurrencies. What they do is simply look at traditional news sites reporting on how JP Morgan’s CEO once again called cryptos “a fool's gold”. Meanwhile, his bank is starting to offer and gain exposure to cryptocurrencies since a large portion of their wealthy clients demand it. Are those clients too fools?

But to the point, there are still many people who want to stop cryptocurrencies and are afraid of something they don’t understand. However, slowly and steadily the industry is growing and we’re seeing more and more powerful people join the industry. In 2021, Soros Fund Management, the fund of George Soros managing his almost $9 billion net worth, revealed that they own Bitcoin. And even better than that, one large bank you might have heard of called Morgan Stanley also reported that they started buying Grayscale BTC shares after repeatedly, for many years, offering a negative outlook on cryptocurrencies.

The cryptocurrency industry is growing and that’s a fact. Bank of America even published a 140-page-long bullish outlook on cryptos, calling Bitcoin and other cryptocurrencies too big to ignore. We have seen institutional adoption grow throughout 2021-2023 as more banks and public companies like Tesla came out and informed of their Bitcoin exposure.

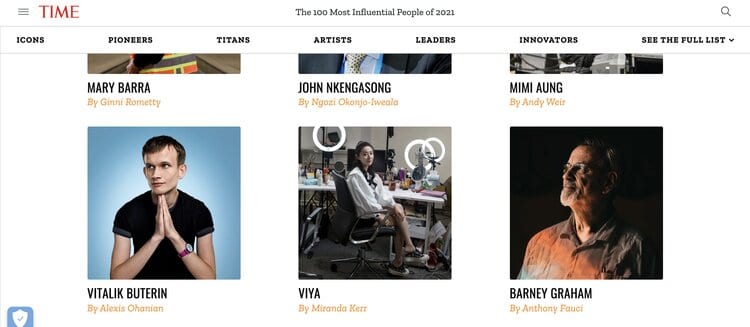

This is also seen by the community where the number of wallets and active users is growing faster than ever. This has pushed the pro crypto people up in the world rankings and as a huge milestone Vitalik Buterin was added to this year's list of the top 100 most influential people in the world by Time Magazine.

Vitalik Buterin

Naturally, after an introduction like that, it’s only fair to start with none other than Vitalik Buterin himself. He’s one of the founders of the second-largest cryptocurrency, Ethereum. He's arguably one of the most, if not the most, influential person in the whole of crypto space. One reason for this could be that since Bitcoin doesn’t have more than an anonymous founder, or founders, Buterin is then basically the biggest person in Crypto since he founded the second-largest crypto. Another reason is also that he’s extremely active, he makes tons of appearances at different events and conferences while keeping an active Twitter profile. On top of that, he also publishes articles on his website vitalik.ca in which he goes through upgrade proposals surrounding the whole crypto industry and Ethereum itself.

There we have him, in the "Innovators" category. Image via Time.

There we have him, in the "Innovators" category. Image via Time. What truly amazes me is how remarkably smart a person can be while still being such a great educator and performer. Buterin is only 27 years old, which means that when creating Ethereum he was only 21 years old. Still, he has managed in a couple of years to become a leading front figure for a rapidly growing community and industry. Also, what glows through him is a spark of true interest in development rather than money. Listening to this guy speak about all the developments, you can sense the excitement he speaks with. It’s truly great to know that we have people like him in our world where sometimes everything and everyone can seem evil.

If I had to choose one person to educate me about cryptocurrencies it would be Vitalik Buterin. On top of being super involved in Ethereum he’s also aware of everything else in cryptocurrency. He makes quality comments on everything happening in cryptocurrencies while tackling all its issues. Many articles on his website address problems we will face in the future along with potential solutions. If I were a project developer looking into his proposals is something I’d do. I know I’m repeating myself on how much I appreciate and like what he’s doing but it’s just something I can’t emphasize enough.

Charles Hoskinson

To continue this list with the same kind of person, with nearly the same background, I decided to go with Charles Hoskinson. He’s also one of the founders of Ethereum but was “forced” to leave Ethereum in 2014 after having a dispute with Vitalik Buterin on whether Ethereum should be made commercial or kept as a non-profit. Hoskinson wanted the first option. After this he decided to start his own project now called Cardano.

A great channel. Image via YouTube.

A great channel. Image via YouTube. Being the founder of the currently fourth largest cryptocurrency naturally makes him also extremely influential. Cardano has a large community and Hoskinson is the front figure for that. Also, as with Vitalik he has become a front figure for the whole cryptocurrency industry due to his activity in social channels. He has a YouTube channel with almost 300k subscribers and a Twitter account with over 700k followers. He has also recently gained a lot of attention due to Cardano's upgrades and release of smart contracts.

Andres M. Antonopoulos

Now I believe that Antonopoulos might be the least well-known one out of all the people on this list. However, in an online world where your screen time per day is getting longer than the time you sleep it might just be relaxing to read a book once a while. If you do want to read a book, then looking up Antonopoulos is the right thing to do.

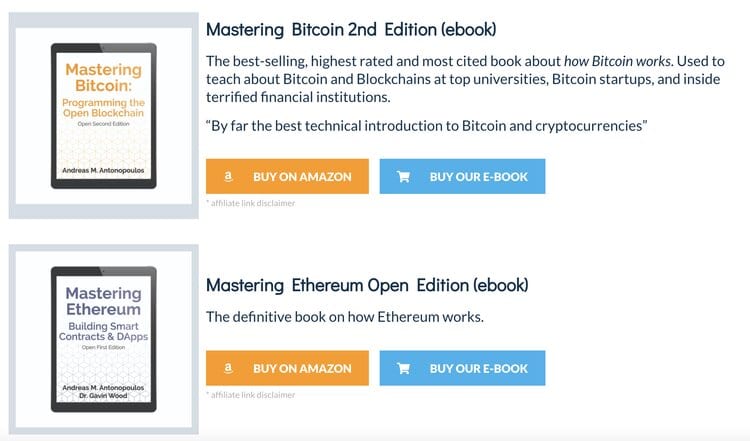

A great educator. Image via Aantonop.

A great educator. Image via Aantonop. Antonopoulos is perhaps most famous from his book “Mastering Bitcoin” which essentially is a deep dive into Bitcoin. This book came out in 2014, which shows his involvement in the growth of cryptocurrencies. He’s also published other similar books, first “Mastering Ethereum” and now in 2021 “Mastering the Lightning Network”. On top of publishing these deep dives into a specific project he’s also published a book series on cryptocurrencies as a larger phenomenon. If you’re interested in that you’ll find it by searching for “The Internet of Money”, there’s volume one, two and three of this book. However, if you’re not a fan of books then you can head on to Antonopoulos’ own website here. There you’ll find educational content from videos to workshops. He's also the host of two podcasts if you’re a fan of those.

Highly recommended books for everyone interested in cryptocurrencies. Image via Aantonop.

Highly recommended books for everyone interested in cryptocurrencies. Image via Aantonop. All in all, I think it’s clear that Antonopoulos is an important piece of the crypto community due to his early involvement. Providing educational content for those who seek to get involved in the industry is a key for adoption. Also, a lot of cryptocurrency related content is currently focused on the internet and while I understand that it’s the future it’s still important to have content in all forms. It also brings more credibility in the eyes of newcomers since an industry only seen on YouTube and TikTok might not seem reliable.

Nayib Bukele

For those of you who do not know who he is, he’s the president of El Salvador. The guy who made a country mine Bitcoin with power from a volcano, also the guy who made a country buy Bitcoin with millions of dollars, and oh I almost forgot, the guy who made Bitcoin legal tender in a country. I understand that for many of these ideas, if not for all, he’s not the brains behind it but rather just a front man. However, he’s the only one talked about from there which makes him the man with all the influence.

There’s just so much that this person has done for the cryptocurrency industry altogether. Just think about it, if you where the leader of a country would you have the courage to even suggest making a volatile currency that some people still call a pyramid scheme legal tender, I must admit myself that don’t know if a could do that. But thank God Nayib Bukele did. After El Salvador announced that they would make Bitcoin legal tender many countries have started to think about it too. Also, nowadays more people in El Salvador have Bitcoin wallets than traditional bank accounts, talk about adoption.

Keep your eyes on the developments in El Salvador.

Keep your eyes on the developments in El Salvador. However, not to give out only roses, there are many things that Bukele is being criticized about. Recently Vitalik Buterin criticized the approach El Salvador has taken since it forces merchants to accept Bitcoin. According to Buterin this goes against the core values of cryptocurrencies. I too have to agree with that and often times forcing people to do something they don’t understand or want to do will just make them more reluctant to do it in the future. Bukele has also been criticized for wanting to spend up to $5 million from the El Salvador BTC trust to fund a veterinary hospital in the midst of a human pandemic. However, while many things he and El Salvador does isn’t approved by everyone you still have to give credit to him for being the first one to actually do something. El Salvador is a front figure for many countries wanting to adopt cryptocurrencies and hopefully they can learn from El Salvador's mistakes.

Plan B

What’s the value of Bitcoin? This is a common question, and it has sent many people on a path to find an answer. Many have also proposed formulas and indicators which could predict the future price of Bitcoin. Now, some of these have been rather close while some have proved to be complete gibberish. The one that has proved to be extremely accurate is Plan B’s stock-to-flow (S2F) model. I’m not going to go too deep into this since you’ll find an article on Plan B and his models from the Coin Bureau. But here’s a short background.

Plan B's Twitter account is a great place for those interested in his models. Image via Twitter.

Plan B's Twitter account is a great place for those interested in his models. Image via Twitter. Plan B is an anonymous person with a long background in finance. He’s been into Bitcoin since 2013 and in 2019 he published the S2F model. Basically, every commodity that has a limited supply and a certain production can be given a S2F value. It’s based on how many years it would take to produce the amount currently available. The scarcer an asset the higher the number. Since Bitcoin’s flow is halved roughly every 4 years it then doubles its S2F value which should make it more valuable since it becomes scarcer. Then, Plan B has compared Bitcoin’s values to other assets like precious metals gold and silver to get a price prediction. However, this naturally doesn’t take into account any actual events which could have an impact on the price, like China banning cryptocurrencies. Therefore, there’s often a certain margin of error from the target price.

Here's a chart on the S2F model. As you can see next up would be $100k. Image via Twitter.

Here's a chart on the S2F model. As you can see next up would be $100k. Image via Twitter. Now, if you want to learn more, I suggest you read the article mentioned earlier. And remember, while the model does have many flaws and has lately been criticized a lot it doesn’t mean that Plan B and his model hasn’t made a huge impact. It has been the closest model to predict Bitcoin’s price and I’m sure that looking at the high price targets has got many people to buy their first cryptocurrencies. I’m also sure that many who criticize him are just maybe a little too deep into crypto and can’t wait patiently for the price to catch up. It’s of course natural that no model can predict the price of an asset 100% correctly all the time, otherwise we would all be billionaires.

Elon Musk & Jack Dorsey

Talk about influence when a tweet of your dog makes a crypto pump hundreds of percent higher. Yep, that’s Elon Musk. No but, even if we were to take away all of his ridiculous tweets that make certain cryptos move like they were the cure for everything, he’s still an important part of the crypto community. He’s one of the biggest names in cryptocurrency, if not the biggest. He’s a person that not only crypto people know but the entire world. There’s not many who don’t know who the richest man in the world is. The founder of Tesla, SpaceX, PayPal, and the man with roughly $200 billion.

He’s one of the first people who has gained mainstream media attention when associated with cryptocurrencies. And on top of news coverage, he has his own following consisting of the most loyal people. This combined with how positively he talks about cryptocurrency has made an impact on the industry. Not to forget how big of an impact he made through Tesla when he announced they would be accepting Bitcoin and bought it themselves too. Even though they currently don’t accept Bitcoin due to environmental concerns it did start a round of companies adopting cryptocurrencies, mostly Bitcoin. It could even arguably be a positive thing that Tesla stopped accepting Bitcoin since it combined with China’s mining ban to kick off a transition to climate neutral mining. Lastly, although I don’t want to speculate, I can’t even imagine what he’s done behind the scenes trying to push forward and direct crypto regulations in the right direction.

Tesla accepting Bitcoin was a huge milestone for cryptocurrency and there's no denying that.

Tesla accepting Bitcoin was a huge milestone for cryptocurrency and there's no denying that. Jack Dorsey is another pro crypto company leader. He’s the CEO of both Square and Twitter, and as we’ve seen both of these companies are getting into cryptocurrency, mostly Bitcoin. Jack Dorsey is quite the Bitcoin maximalist which becomes clear listening to his interviews. When it comes to his companies, you might have seen that Twitter recently announced their tipping feature using the lightning network, along with NFT verifying. Square on the other hand has been implementing crypto payments and it has generated billions in revenue. I think it’s clear already just by reading this short section on Jack Dorsey that both his companies and he himself are an important part of the crypto industry.

Cynthia Lummis

This list wouldn’t be complete without mentioning a politician. However, I was initially reluctant to include her because I can’t overcome my jealousy of her since she bought her first Bitcoins already in 2013 - seriously, why didn’t I do that? However, after calming myself down, I started looking more into what she’s done. Lummis is a US senator from Wyoming. She clearly has an eye for innovation which she partly thanks Wyoming for since they have extremely innovation friendly regulations and laws, at least according to her.

An especially important and excellent quality she has that caught my attention is how humble she is. Listening to a couple of podcasts and reading a few stories shows that she does understand cryptocurrencies but repeatedly highlights the fact that there are many people who know the industry better and she urges these people to contact her and their senators to educate them. She also thinks we need more communication from those who know the industry to regular retail people too, only by educating the majority to understand this technology can we truly adopt it. She’s also mentioned that more and more senators are approaching her to learn about Bitcoin and cryptocurrencies, so at least she’s doing her part in educating people.

If you're interested in politics or crypto regulation I suggest you start following Lummis on Twitter. Image via Twitter.

If you're interested in politics or crypto regulation I suggest you start following Lummis on Twitter. Image via Twitter. It's important that we get crypto friendly people in political circles. It doesn’t matter how much lobbying large companies and high net worth individuals do if there’s no one on the inside. And lastly on Lummis, she recently disclosed a purchase of Bitcoin worth $100,000. Just thought you might like to know.

Cathie Wood & Michael Saylor

If you know what Ark Invest is, you’ll know Cathie Wood. Ark Invest is a large asset manager with over $50 billion in assets under management and Cathie Wood is the founder, CEO and CIO (Chief Investment Officer). She’s also famous in the crypto community for giving a bullish price target for Bitcoin. She believes that Bitcoin could hit $500k by 2025 and it was based on her belief that companies would start allocating up to 5% of their balance sheet to Bitcoin.

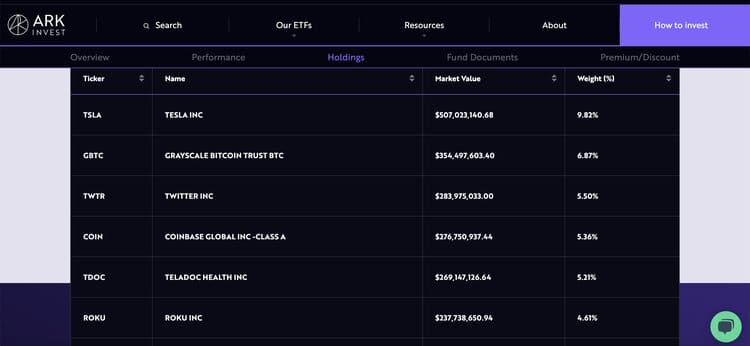

As you can see Ark Invest is clearly crypto positive, at least based on their holdings. Image via Ark.

As you can see Ark Invest is clearly crypto positive, at least based on their holdings. Image via Ark. Now, one company that’s doing its part in that is MicroStrategy. MicroStrategy is led by Michael Saylor, and they own over 114,000 Bitcoins. This is quite a lot which means that both what the company does and how Michael Saylor speaks has an influence on the crypto market. A large player like this can easily influence the price if they wish to. On top of that, MicroStrategy works as BTC exposure for many institutions and individuals who are reluctant to purchase crypto themselves. They see MicroStrategy as less of a risk since they do have an underlying software business with some value. We've also done a piece where you can learn more about MicroStrategy and other crypto related equities.

Other ways people gain exposure is through ETFs. Ark Invest has a few widely popular ETFs that focus on future technologies. Their ETFs are often viewed as high-risk investments, but many are still drawn to them due to their high potential rewards. Why these are important for cryptocurrencies is because one of these ETFs owns a large amount of Grayscale Bitcoin shares and also crypto related equities like Coinbase. Having an asset manager this big pour money in the sector is extremely important for mainstream adoption and awareness. Therefore, both Michael Saylor and Cathie Wood deserved their place on this list.

Kevin O’Leary & Mark Cuban

Two famous sharks have been diving down into the crypto sea deeper and deeper. These two are very well known, especially in the U.S. since they’ve been active many seasons on the popular show Shark Tank. This means that they have a large influence on their audience who look up to their successes. On top of that they are both highly valued business professionals with a lot of capital. Mark Cuban is worth the most of these two at over $4 billion dollars. He’s also been longer into cryptocurrencies while O’Leary was formerly calling Bitcoin worthless.

Do you agree with him? Image via CNBC.

Do you agree with him? Image via CNBC. When it comes to their part in cryptocurrencies, they both have made sizeable investments. Cuban has revealed that his cryptocurrency portfolio consists of 60% Bitcoin, 30% Ethereum and 10% other altcoins. He has also been highlighted as being a part of the Iron Titanium scandal which ended in Mark Cuban losing his whole investment when the project went to $0. In addition to holding cryptocurrencies Cuban has also been investing in cryptocurrency firms which shows his increasing interest and belief in the sector. It’s said that he’s invested in at least a dozen blockchain start-ups, one of them being NFT platform Eternal.

You can clearly see O'Leary being bullish based on how much of his latest content is crypto related. Image via YouTube.

You can clearly see O'Leary being bullish based on how much of his latest content is crypto related. Image via YouTube. O’Leary on the other hand hasn’t disclosed what specifically is in his cryptocurrency portfolio in addition to Bitcoin. However, last month he told CNBC that he’s looking to up the percentage that cryptocurrencies take up in his portfolio from 3% to 7%. Considering his net worth is in the hundreds of millions (some say roughly $400 million) that’s quite the amount of capital to allocate to cryptocurrencies. He has also been highlighted for calling Ethereum ultrasound money, this could imply that in addition to Bitcoin, Ethereum could also be a part of his portfolio. Also, as with Cuban his has made sizeable investments in blockchain companies. Most notable one being his investment in WonderFi that wants to bring DeFi to the masses.

Brian Armstrong

Brian Armstrong is the co-founder and CEO of one of the biggest centralized exchanges, Coinbase. Therefore, I think you all can figure out the correlation between him and the cryptocurrency industry. Why I chose him instead of other exchange persons like Sam Bankman-Fried of FTX or the Winklevoss twins of Gemini is due to a couple of reasons.

Coinbase has to be without a doubt one of the most well-known company in the whole crypto sector.

Coinbase has to be without a doubt one of the most well-known company in the whole crypto sector. Firstly, Coinbase is one of the biggest which makes them a leader in the industry. They are often times the first choice for newcomers since people tend to out of all exchanges always know who they are. This is due to the second reason on my list, which is that Coinbase is a publicly traded company. This brings some sort of transparency to its operations and also a lot of buzz around it. Now the third reason is based on where the company is located and listed, the US. Since Coinbase is listed in the US they are under the microscope of the SEC, which was seen with the scandal around the proposed Coinbase Lend product. However, not all regulations are bad, which is why Armstrong and Coinbase play a huge role in the crypto industry. They have stated multiple times that they want to actively educate and guide regulators to come to reasonable conclusions. It can’t be emphasized enough on how important it is that we have people and companies that try to direct the regulators in the right direction. Because to be fair, we do need some sort of regulations in order for cryptos to be adopted worldwide, however, the regulations should not stifle innovation, or we lose everything.

Conclusion

This list could go on and on for days and since more and more people get into the industry daily I could just sit by my computer and update it as we go without having to stop once. Also, I want to apologize to those who disagree with my list and would prefer to have some other people here. I myself didn’t know what to do with the fact that all the time doing research I came across people who should deserve a spot on this list as well.

What I tried to do here, and what I hope you understand, is pick people with various kinds of influence. For example, while Vitalik Buterin is an extremely important part of the crypto community and also plays an increasing role in the whole world, he’s still not as meaningful as Cathie Wood or Mark Cuban for those who enter from the traditional finance industry. Another example would be that while Cynthia Lummis has a large influence in the U.S. and especially in political circles, she’s not as meaningful as Elon Musk for Europeans. I bet that at least twice as many people in Europe know who Elon Musk is compared to Cynthia Lummis. Furthermore, as you might have already understood, these people are in no specific order or rank since all these people have different circles they influence, it would be wrong to compare them in any way. Each and every one of these people along with each and everyone reading this article is needed in order to push cryptocurrencies to worldwide adoption.