We live in the digital age: the era of too much information. Those of us who wish to – and plenty of us do – can keep ourselves permanently plugged in to the constant stream of news and content that gushes forth, non-stop, day after day after day.

The idea of waiting to read the news in the morning paper is becoming a quaint and quirky relic of the past. We have unlimited information at the swipe of a finger; we can hear of events from far away almost as soon as they’ve happened. One thing follows another in quick, unending succession; news is old news almost immediately.

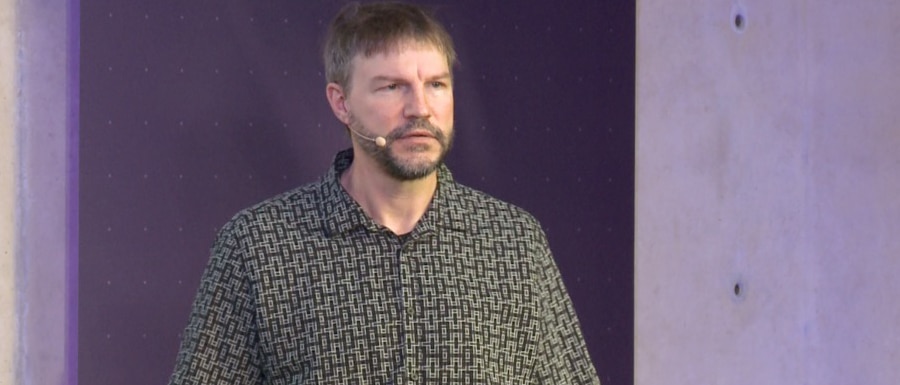

The man, the myth the legend. Presenting Bitcoin. Image via slidelive.

The man, the myth the legend. Presenting Bitcoin. Image via slidelive. As such, it’s easy to get swept along by the torrent and to lose sight of the past. The world moves too quickly for us to keep track of everything that’s happening, as new information constantly barges its way into our brains. The passage of time becomes distorted and it becomes difficult to stop and get a perspective on recent history.

We have become so caught up in the turmoil of the 21st Century that the events of the 20th can seem too distant to matter anymore. The world has moved on. We have more pressing concerns. Yet the thread that connects the past to the present is not so easily broken, even if we do forget its existence. The events of today still have roots in those of many years ago. We just need to look closer in order to see them.

From Budapest to Bitcoin

The recent rise of cryptocurrencies and the blockchain technology that supports them may at first glance have little to do with events that took place over 60 years ago in a corner of Eastern Europe. Try to find the thread connecting bitcoin to the Hungarian revolution of late 1956 and you’d be forgiven for overlooking it.

But it does exist and it runs through one of the most revered names in crypto: someone who has arguably done more than almost anyone to bring about this paradigm shift in how we create, store and use wealth. Nick Szabo’s and bitcoin’s stories both begin under the leaden skies of communist Eastern Europe.

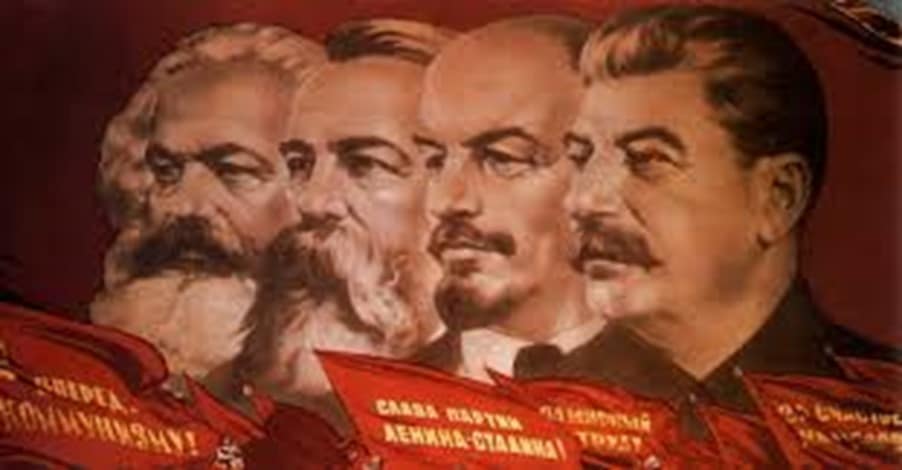

Communism’s Big Four: probably not thinking about BTC. Image via history.com

Communism’s Big Four: probably not thinking about BTC. Image via history.com Before we examine how this post-war flare-up of anti-Soviet sentiment helped shaped bitcoin, it’s worth pointing out that Nick Szabo is a rather mysterious figure. This is fitting for someone who has done so much to help create bitcoin and cryptocurrency in general.

Bitcoin was born out of a yearning for greater privacy and reduced oversight from governments and institutions. Privacy and anonymity are central to its development and to the beliefs of those who helped create it. Nick Szabo in many ways embodies the bitcoin philosophy.

The Hungarian uprising, 1956. Image via Daily News Hungary

The Hungarian uprising, 1956. Image via Daily News Hungary So central is Szabo to the story of crypto that many have speculated that he could be that most famous privacy hawk of all: Satoshi Nakamoto, the inventor of bitcoin. Although he has repeatedly denied this, he is one of small field of people known to have the necessary skills and know-how needed to be a serious candidate.

That said, his achievements in the fields of computer science and cryptography, as well as his formidable understanding of the nature of money, all make him remarkable enough, even allowing for the fact that he might not be Satoshi. Whoever he may be, and whatever the facts of his story, he is undoubtedly a key figure in the financial revolution we’re all living through.

Background

So, what exactly does the Hungarian uprising of 1956 have to do with crypto? Well, one of the most notable things about Nick Szabo is the lack of biographical information we have on him. We know he’s an American and we know he studied computer science at the University of Washington, graduating in 1989. We also know that he then read for a law degree at the George Washington University Law School. Of his childhood, early life and parentage we know almost nothing.

However, Szabo revealed in an interview that his father fought in the Hungarian uprising against the Soviet Union, all the way back in the late ‘fifties. As a result,

…he along with many other people from communist societies that I’ve encountered have plenty of horror stories to tell about the oppression, the killing of people, the stealing of their property and so forth. So, if you had just been born and raised in the US, you might not have known as much about the potential for government to be abused.

It seems therefore that Szabo grew up with a deep understanding of how easily governments and, by extension, other centralised authorities can abuse the power that they have. In the most extreme examples, such as that of the Soviet Union, those governments can send troops onto the streets to kill protesting civilians. But the abuse of power does not all take place at the end of a gun barrel.

The 2008 financial crash hits home. Image via The Globe and Mail

The 2008 financial crash hits home. Image via The Globe and Mail The power that comes from controlling the financial system is far more insidious and open to abuse. Many in crypto will point to the aftermath of the 2008 financial crash as evidence of this: the banks that caused the disaster were bailed out and propped up by governments across the world, while ordinary taxpayers were left to shoulder the cost.

It was in this atmosphere of the status quo preserving itself at the expense of the rest of us that bitcoin began to emerge, with Szabo at the forefront of the revolution. The proposals which he had been putting forward for years were about to break into the mainstream.

Laying the Foundations

Szabo is best known for his two key contributions to bitcoin and crypto as a whole: his paper on Bit Gold and his conception of smart contracts. Bit Gold is seen as the precursor to bitcoin, which Satoshi Nakamoto would go on to refine in his bitcoin whitepaper. Smart contracts, which Szabo first wrote about back in 1996, enable the execution of cryptocurrency transactions and underpin the viability of the entire field. Quite simply, there wouldn’t be crypto without Nick Szabo’s work.

Trust-minimisation in action. Image via Shutterstock

Trust-minimisation in action. Image via Shutterstock Central to understanding this work – and Szabo’s philosophy as a whole – is the concept of what he terms ‘trust-minimisation.’ This posits the theory that, as a species which is optimised to best function in groups of no more than 150 individuals, we need to develop ways in which the need to trust strangers is kept to a minimum.

Our largely urbanised society of today means that, in order to go about our lives and do business, we are forced to interact with strangers on a regular basis and thus need to take steps to protect ourselves from possible abuses at their hands.

The creation of legal systems is one way of doing this, though Szabo prefers to see it in simpler terms. For him, the reason we might lock our doors (unless we live in a small community and know everyone there) is trust-minimisation in its most basic form.

Bit Gold

This idea of trust-minimisation fed into Szabo’s idea of a secure, decentralised and trustless payment network, which he called Bit Gold. He first published his theory back in 2005 and, with its use of timestamped blocks, the solving of cryptographic puzzles to earn rewards and reliance on proof-of-work, it bears a striking resemblance to the bitcoin network. His proposal can be broken down into seven steps:

- A public challenge string is generated

- A computer node uses a benchmark function to create a proof-of-work string from the challenge string

- The proof-of-work is timestamped by one of a number of services, to ensure decentralisation

- The computer node takes both strings (the proof-of-work and the challenge string) and adds them to a distributed property title registry for Bit Gold.

- The most recent Bit Gold string generates the challenge bits for the next string to be created

- Another computer node verifies the Bit Gold string in the title registry

- This second node then verifies the remaining parts of the process: the challenge bits, the timestamp and the proof-of-work string

Bit Gold was by no means the finished article, but its proposals were fundamental to the core architecture for bitcoin that Satoshi would go on to refine. It also signalled for perhaps the first time that there was a possible antidote to the many flaws of the monetary system, as Szabo himself acknowledged:

In summary, all money mankind has ever used has been insecure in one way or another. This insecurity has been manifested in a wide variety of ways, from counterfeiting to theft, but the most pernicious of which has probably been inflation. Bit gold may provide us with a money of unprecedented security from these dangers.

Smart Contracts

Bit Gold alone would be an incredible achievement for anybody to lay claim to, but for Szabo it was only one area of development. His work in this field would lay further groundwork for the development of both bitcoin and the concepts of cryptocurrencies and blockchain.

Smart contract self-execute, having been coded with a set of criteria embedded in them. When one party fulfils their part of the contract (for example by depositing money into an account), the contract automatically fulfils the obligation of the other party (for example delivering a product or service). All aspects of the smart contract are supported on a blockchain network, which allows the transactions to be both immutable and trackable.

Smart Contracts are the Future. Image via Shutterstock

Smart Contracts are the Future. Image via Shutterstock As with Bit Gold, the functionality of smart contracts allows for trustless transactions or agreements to be carried out between discrete and anonymous users in a decentralised manner. Their self-executing nature removes the need for any method of enforcement or any system of authority. They essentially self-regulate.

Szabo first proposed smart contracts in 1994, long before he began laying out his thinking regarding Bit Gold. These two strands of his thinking, published a long time before Satoshi’s bitcoin whitepaper, are the reason many people suspect Szabo of being the elusive founder of bitcoin and holy father of all things crypto.

Nick Szabo Being Interviewed. Image via Medium

Nick Szabo Being Interviewed. Image via Medium Although he continues to deny this, his knowledge and understanding, not only of the underlying technologies involved, but also of economics and the workings of monetary systems, make him a convincing candidate.

An interesting sidenote to this theory is that subsequent investigation has shown how the date of the original post was changed to make it appear as though it was published after Satoshi’s whitepaper. This begs the question of whether or not Szabo tried to deliberately cover his tracks in order to quash rumours of him being bitcoin’s creator.

Economic Thinking

Szabo is deeply sceptical about the system of fiat money that we use today, calling it an ‘experiment’ with a ‘spotty history.’ Having replaced previous monetary systems that were backed by gold or other precious metals, fiat has concentrated power into the hands of governments and bankers.

A financial system backed by governments and the central banks that serve them has resulted in this centralisation of power. When we use fiat we are, in Szabo’s words ‘trusting basically a bunch of strangers with your life savings.’

The drawbacks to fiat also include the threat of hyperinflation, seen in Weimar Germany in the 1920s and, more recently, in places like Zimbabwe and Venezuela, where inept governance led to the money in people’s pockets becoming worthless, sometime in the course of a few hours.

Fiat vs. Gold. Image via Shutterstock

Fiat vs. Gold. Image via Shutterstock Although seemingly antiquated, those precious metal-backed systems had many strengths, not least the fact that they gave people more control over the money they had. Being backed by finite amounts of gold or other base metals mean that governments couldn’t simply conjure money out of thin air and risk devaluation and inflation.

Szabo’s appreciation of the finer points of economic theory has been pivotal to his work in developing the systems and concepts that make bitcoin and the wider world of crypto possible.

Is He Satoshi?

It’s impossible to say for certain whether Szabo is in fact the man behind bitcoin, rather than someone who merely helped lay the groundwork for its creation. The editing of the date of the Bit Gold proposal is intriguing, as too is a slip of the tongue Szabo made in an interview with Tim Ferriss. When talking about second layer solutions, he can be heard to say that ‘I’d definitely go for a second layer, I mean, I designed Bitco… gold with two layers.’

Satoshi Nakamoto: Still a mystery. Image via Shutterstock

Satoshi Nakamoto: Still a mystery. Image via Shutterstock One last consideration in this case is the fact that, while there are records of correspondence between Satoshi and other cypherpunks such as Hal Finney, there is none between Satoshi and Szabo. It’s a small point, but could indicate that Szabo and Satoshi are in fact one and the same person.

Szabo Today

The crypto space is full of larger-than-life characters, talking up their pet projects and rhapsodising about bitcoin. Szabo is certainly still a vocal advocate for the project he helped bring about (to a greater or lesser degree) but remains a mystery in terms of how much else we know about him.

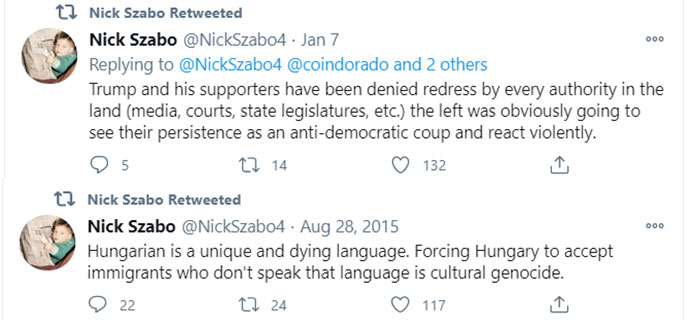

Although he occasionally gives talks and interviews, his main outlet these days is Twitter, where he posts and retweets almost constantly. He’s like many crypto OGs in that he frequently talks up BTC, though not as much as he seems to rage against the iniquities of the left, the mainstream media and others opposed to the Trump administration. The measured, authoritative tone heard in interviews is replaced by a much more strident, conservative voice.

Nick Szabo's Tweets. Image via Twitter

Nick Szabo's Tweets. Image via Twitter This attitude shows a dichotomy at work in the crypto community. While it is united in seeing BTC and its altcoin descendants as a path to financial freedom and an escape from governmental control, the same political divisions that are present in wider society are just as deeply embedded here.

But this division in the crypto space could perhaps point the way forward to finding some common ground. If the space were a firmly right or left-leaning one, then it is doubtful whether mass adoption could ever be achieved.

Instead, it is to be hoped that crypto may offer a chance for those on either side of the political spectrum to unite under one banner and effect the changes in the financial system that the world is crying out for. After all, we all suffer under a centralised system of financial control, regardless of who we vote for or what we believe.

While Nick Szabo’s political views are definitely not to everyone’s taste, we can at least all agree that he’s done as much as anyone to build a better financial future for all of us.