These are exciting times for crypto. Unless you sealed yourself into an underground bunker when the pandemic broke out, only to find that you couldn’t get a phone signal down there and nobody had turned up to connect the Wi-Fi, then you’ll have noticed that we are currently in the midst of a bull run.

Bitcoin has blazed past its 2017 all-time high and isn’t stopping yet, while the altcoin market is following along in its wake. For many of us, its been a ray of light in an otherwise gloomy year.

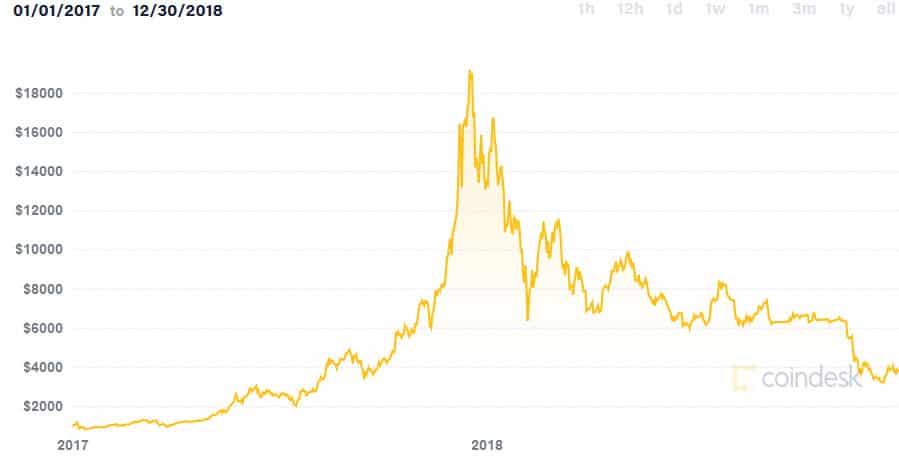

The last bull market, back in 2017, came to a pretty abrupt and painful end. Bitcoin fell from over $17,000 in December of that year to less than $7,000 a couple of months later. By early 2019, you could pick up one BTC for under $4,000. Ouch. Many critics wrote BTC and other cryptos off as overly volatile assets that wouldn’t last.

The Epic 2017 Bitcoin Bull Run. Image via coindesk

The Epic 2017 Bitcoin Bull Run. Image via coindesk What’s important to note is that, back in 2017, that bull run was largely driven by retail investors piling in and hoping to make a quick profit. It was driven as much by hype and FOMO as by any deeper understanding or appreciation of crypto’s potential. As such, it’s no surprise that prices subsequently tanked.

Fast forward to 2020 and the picture is radically different. This bull run is testing new highs, with hundreds more cryptos having emerged since the last one, and this time it’s not being driven by every man and his dog opening up a Coinbase account and having a punt.

The money powering this surge is coming from institutional investors, and boy do they have a lot to spend. Big companies and investment giants are queuing up to buy BTC and many are predicting that this is only the beginning of what could be a surge in price and adoption that will put 2017 in the shade.

Back in 2017 there was no shortage of powerful men in expensive suits eager to write bitcoin off. Mainstream finance seemed either appalled or indifferent and not even the longest of lunches would induce any major CEO to put so much as a dime of their company’s money into it. Bitcoin was ‘magic internet money’ and the preserve of drug dealers and fraudsters.

A Different World

Time moved on. BTC rallied, though nowhere close to its previous heights. The world kept turning, Trump kept doing his thing, Brexit kept not getting done and we all tried to stay excited about ETH 2.0. The altcoin market kept growing and everyone wondered when the next bull run would come. Then people started getting ill in Wuhan.

When the WHO declared the Covid-19 outbreak a pandemic, markets around the world went into freefall and so too did the price of BTC. But then, as stimulus money was pumped into economies to keep them from collapsing and dire predictions began to be made about hyperinflation, BTC took off. Investors everywhere began to realise that they needed to diversify their holdings.

Some went for gold, a safe haven asset for the ages. But others saw that the best hedge against inflation was an asset with a fixed supply and which was stored on an immutable, public and decentralised ledger. An asset which many still viewed with deep suspicion.

Covid-19. Good for BTC, bad for pretty much everything else. Image via Shutterstock

Covid-19. Good for BTC, bad for pretty much everything else. Image via Shutterstock Huge piles of corporate cash are now being ploughed into BTC. PayPal recently announced that its customers would be able to buy and spend it and other cryptos on its platform. Jack Dorsey’s Square put $50 million into BTC back in October.

Just a couple of weeks ago life insurance giant Mass Mutual was revealed to have gone in with $100 million. If anyone had predicted any of this back in 2017 they would probably have been taken away by men in white coats.

Leading the way in getting corporate bucks into bitcoin however was business intelligence and software company MicroStrategy and its all-powerful founder and CEO Michael Saylor. To date, the company has over $1 billion invested in BTC and Saylor is one of its most forthright evangelists.

MicroStrategy’s share price is soaring and its eye-watering investment is prompting yet more institutions to hop aboard the BTC express. So, what is MicroStrategy, who is Michael Saylor and what does all this mean for the future of crypto?

The Company

Perhaps the most eye-catching aspect of MicroStrategy’s splurge on bitcoin (other than that $1 billion figure) is the fact that the company itself has no previous involvement with crypto. Its massive investment is driven by Saylor’s deeply-held faith in bitcoin and its value in a post-Covid world.

The crypto space is full of people and organisations ready to talk up bitcoin’s potential and value, but MicroStrategy has shown that the hype has now spread well beyond crypto’s borders.

Image via MicroStrategy.com

Image via MicroStrategy.com MicroStrategy provides business intelligence services to its clients, along with educational materials, analytics and software tools to streamline workflows. Since being founded by Saylor and his business partner Sanju Bansal in 1989, it has become a market leader in its field, with over 2,000 employees and thousands of clients across the world.

In 2019 it generated $486 million in revenue, with a $2.4 billion market cap. Its share price is currently around $330, having been around $144 at the start of 2020.

MicroStrategy Riding Bitcoin to the Moon. Image via ShutterStock

MicroStrategy Riding Bitcoin to the Moon. Image via ShutterStock These figures may pale in comparison to some of the big Silicon Valley tech companies that have also enjoyed a bumper 2020, but MicroStrategy has now been around for over 30 years and his holdings have made Saylor a billionaire. This is no blink-and-you’ll-miss-it success story. If bitcoin does indeed go where Saylor thinks it will, then both he and MicroStrategy are set to get a whole lot richer.

The Man Himself

Michael Saylor was born in Nebraska in 1965. His father was in the US Air Force and so Michael spent much of his early life on airbases around the world, before the family settled in Ohio when he was eleven.

He initially harboured dreams of becoming a pilot, and was accepted into the Massachusetts Institute of Technology (MIT) on an Air Force ROTC scholarship in 1983. Whilst at MIT he double-majored in aeronautics and astronautics, (yup, pretty sure that is a fancy way of saying rocket science), graduating in 1987. It was also while at MIT that he first met Sanju Bansal.

Sanju Bansal: MIT buddy of Michael Saylor and co-founder of MicroStrategy. Image via Business Wire

Sanju Bansal: MIT buddy of Michael Saylor and co-founder of MicroStrategy. Image via Business Wire When he was misdiagnosed with a heart murmur that ruled out his becoming a pilot, Saylor instead joined The Federal Group, Inc. – a consulting firm which promptly put his computer skills to good work designing simulation modelling. A year later he moved to DuPont, where he continued developing computer modelling programs.

Saylor and Bansal started MicroStrategy in 1989, using $250,000 in seed capital provided by DuPont. The pair drew on what they had both learnt at MIT to produce data mining and business intelligence software, eventually securing a $10 million contract with McDonald’s in 1992.

From there revenues began to climb and MicroStrategy soon had to upscale, moving its offices and staff from Delaware to more spacious premises in Virginia in 1994. In 1998 the company went public in an IPO, selling four million of its shares at $12 apiece.

The Man, the Myth, The Legend. Image via CryptoGlobe

The Man, the Myth, The Legend. Image via CryptoGlobe Saylor’s star was by now also on the rise and he was heralded for his entrepreneurial skills by the likes of Ernst & Young, KPMG and the MIT Technology Review for his achievements. His reputation and his personal fortune suffered a blow in March 2000 however, when he was accused by the Securities and Exchange Commission (SEC) of inaccurately reporting MicroStrategy’s financial results.

In December 2000 he eventually settled with the SEC without admitting wrongdoing, resulting in a $350,000 fine and a personal disgorgement payment of just over $8 million. This hit to his finances was nothing when compared to the subsequent fall in MicroStrategy’s share price, which wiped a further $6 billion from his net worth.

Staying on Top

Despite this setback, as well as reports of a hard-partying and lavish lifestyle, Saylor retained his place at the top of MicroStrategy and has continued to steer the company, even while spending a lot of his time away from the office in places like Florida and St. Tropez. This feat is all the more impressive given that the company’s share price remained relatively moribund in the years following the SEC investigation.

Not letting that $6 billion loss get him down too much. Image via gawker

Not letting that $6 billion loss get him down too much. Image via gawker He used some of his spare time to found the Saylor Academy, a non-profit organisation designed to ‘offer free and open online courses to all who want to learn.’ To date it has partnered with a number of educational institutions to provide access to nearly 100 college and professional-level courses via its website.

Although some saw fit to criticise Saylor for not spending too much time on his yacht and his side-projects, he was all-the-while keeping abreast of technological change and its likely effects on society. He outlined his ideas on where he saw the worlds of science and technology heading in his 2012 book The Mobile Wave: How Mobile Intelligence Will Change Everything.

In this book he identifies many ways in which mobile technology will affect our daily lives, including - intriguingly – his belief that monetary and payment systems will be one of the sectors that will see the most change.

It was this eye on the future that enabled Saylor to keep MicroStrategy ticking along, as he constantly sought to keep the company evolving and thus staying ahead of its competitors.

A Swarm of Cyber Hornets

Let’s face it, without bitcoin MicroStrategy would probably have continued to tick along, doing what it does and letting the more glamorous denizens of Silicon Valley hog the limelight. It’s never going to have the sex appeal of an Apple or a Tesla and it’s hard to imagine business analytics software getting many pulses racing.

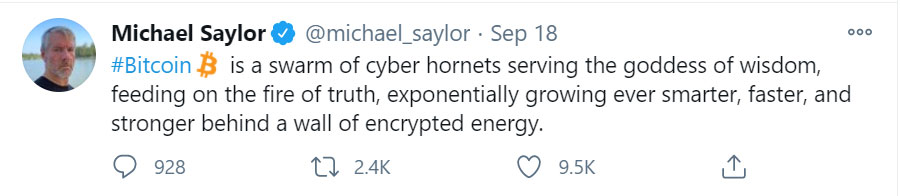

So… you’re saying I should buy some, right? Image via Twitter

So… you’re saying I should buy some, right? Image via Twitter But it turns out that sparks flew when Michael Saylor and bitcoin came together, despite his initial prediction that nothing would come of it. In the last few years Saylor has become one of bitcoin’s greatest apostles, spreading the word far and wide and likening it to ‘a battery charged with monetary energy’ and ‘a chain reaction spreading like a fire in cyberspace.’ In a good way, that is.

Saylor reportedly owns 17,732 bitcoins personally, bought at an average of $9,882 – a position which convinced his company to get involved as well. His Twitter feed is a non-stop parade of bitcoin-positive opinions and soundbites, while YouTube is well-stocked with videos of him singing its praises. One is left with the impression that, even if he’s only half right, this current bull run we’re enjoying is merely the tip of one almighty iceberg. Again, in a good way.

MicroStrategy’s Big BTC Call

And so to the small matter of MicroStrategy’s investment in BTC. While the likes of Grayscale may have even more invested in the digital gold, it’s MicroStrategy’s previous status as a non-crypto company that makes its huge commitment all the more telling.

The company’s investment is twofold. Firstly, $450 million in cash from its balance sheet was ploughed into BTC in a series of transactions, which bought it a little over 38,000 bitcoins by the middle of September this year.

Not messing about. Image via MicroStrategy

Not messing about. Image via MicroStrategy Then in early December the company issued a convertible note sale to raise $650 million, which it announced it would be using to buy yet more BTC. This essentially means that MicroStrategy has saddled itself with over half a billion dollars of debt in order to increase its BTC holdings.

Just a couple of days ago, the company announced that it had secured another 29,646 BTC using the proceeds from the sale of its debt. This means that it now holds 70,470 BTC in its reserves, worth around $1.5 billion. Given that it has paid an average of $15,964 for every bitcoin it now owns, the company is already sitting on a healthy profit from its investment. In Saylor’s own words, ‘the stock is up $100 a share, and bitcoin is up, and everybody’s happy.’

We Are Still Early

Having helmed MicroStrategy for three decades without generating too much in the way of hype, Michael Saylor has now lit a fire underneath bitcoin which is helping to propel its latest and most exciting surge in price. As we have seen, this bull run is markedly different from its 2017 predecessor, with the money now flooding in from some big players.

Yup, I hate him. Image via Twitter

Yup, I hate him. Image via Twitter There is a whole lot of belief, from a whole lot of super smart and super rich people, that bitcoin is going to go even higher and could become the asset to hold in the uncertain years that lie ahead. We may avoid hyperinflation and the world economy may well recover better than expected from the ravages of Covid. Let’s hope so. But even if we do, it looks like bitcoin’s time has come and it has broken out into the mainstream.

There is no shortage of people out there ready and willing to hype bitcoin to the moon and beyond. Some are cranks and some have more than a little skin in the game, having themselves been behind the development of crypto for the last few years. But Michael Saylor truly takes matters to the next level in this regard. He has shown himself as not only willing to invest his own money in BTC, but also his company’s balance sheet and debt into the bargain.

Saylor believes that we are still at the beginning of this upward trajectory and that it’s not too late for corporate or private investors to get into BTC. In his own words:

With all these technologies, I think, the time to buy them is when they’re big enough that it’s obvious they work and they’ve got massive momentum, but when 99% of the people on the street don’t understand them.

Bitcoin is indeed a word on many lips, but still a concept which few can adequately explain. But those with deep pockets are getting their heads around it and are starting to buy it up like there’s no tomorrow.

See you on the Moon. Image via Shutterstock

See you on the Moon. Image via Shutterstock MicroStrategy, PayPal and Square’s investments are all big news, but Mass Mutual’s entry into the fray marks yet another big moment for BTC, as it finds itself in the sights of a company with $234 billion in assets under management. The floodgates could be about to open.

2021 is going to be an interesting year for many reasons, but bitcoin’s journey through it should be one of the most riveting. Just make sure Michael Saylor’s buying the drinks – you know he can afford to.