The world continues to lurch along beneath the weight of the COVID crisis and as each day goes past the economic outlook gets worse. Bad news follows bad news: millions more unemployed; output is down; borrowing is up and, to make matters worse, there’s no telling when the next series of Succession may be due.

Yet, as with any crisis worthy of the name, there are always those who benefit. A lot has been written about the companies and individuals making money in these dark times and we can’t get enough of reading about the tech giants are getting richer than ever, as we all sit clicking our way through the days.

Losers & Winners

Just today, it was revealed that Mark Zuckerberg had joined the exclusive centibillionaires club - a fact that manages to be both unsurprising and infuriating at the same time. On that note, I implore you not to look at the graphic that visualizes Jeff Bezos's wealth. It’ll only make you depressed.

Despite the grim reality of Jeff, Mark and their buddies making money while the rest of us stew, there are glimmers of light. One of these emanates from the decentralised finance (de-fi) space. At the start of 2020, there was around $665 million locked into de-fi; a figure which has grown to $4.2 billion. As our faith in mainstream financial systems wavers, so more of us are turning to alternatives.

The Rich Get Richer. Image via Shutterstock

The Rich Get Richer. Image via ShutterstockDe-fi offers us the chance to take control of our own crypto assets and make use of them as we see fit - all beyond the reach of banks and other traditional lenders. We can take out loans, supply liquidity to earn interest and trade, all outside the financial mainstream.

The decentralised aspect cuts out the middlemen (and their hefty cuts) and gives us greater returns to complement our increased control. It’s a rare and welcome case of the little guy coming out on top.

Things move fast in the world of blockchain and crypto. Many of us may only be starting to get our heads around the specs and potential of de-fi, but others are way ahead. For those new to the space, it can seem like the best de-fi gains have already been made.

Big de-fi platforms like Aave and Kava have rocketed in value as money pours into the sector and smaller investors could be forgiven for thinking that the train may have pulled out of the station.

The Decentralised Finance Revolution. Image via Shutterstock

The Decentralised Finance Revolution. Image via ShutterstockBut another train is pulling in, bringing with it yet more potential for those able to jump aboard. Non-fungible tokens (NFTs) are considered by many to be the next big thing in the cryptoverse and could help take de-fi itself to the next level.

There are already some exciting use cases for NFTs, as well as new platforms springing up to help us take advantage of them. But before we get into all that, let’s take a look at exactly what NFTs are and how they work.

NFTs: A Beginner’s Guide

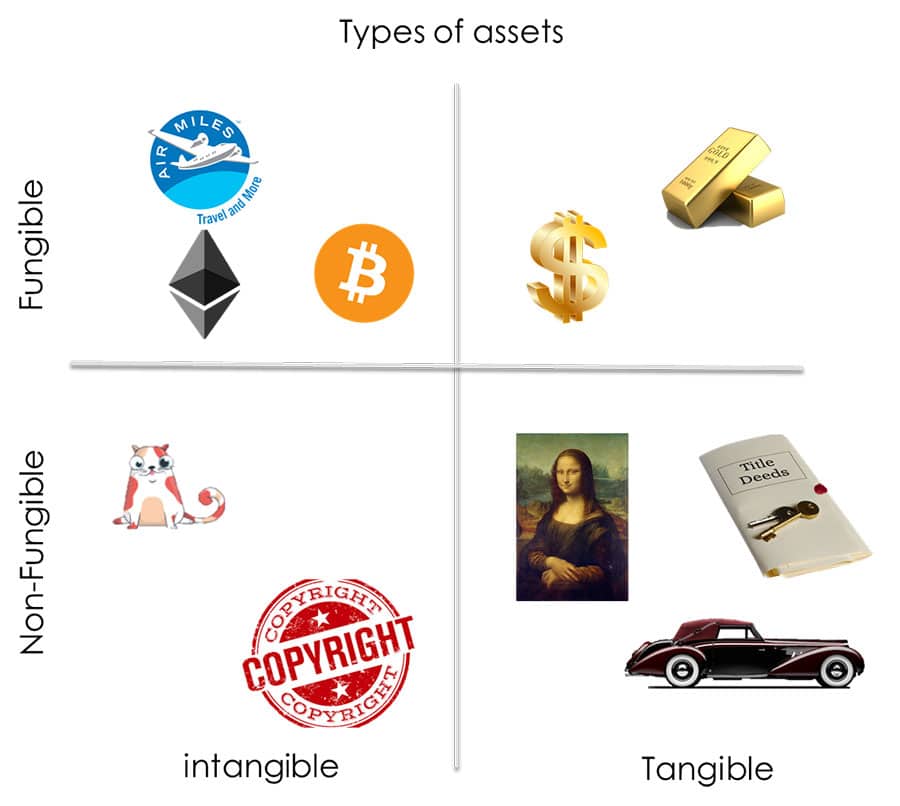

When explaining NFTs it’s perhaps best to start by talking about their polar opposite. Fungible assets are something we encounter every day with the fiat currencies we use. So for example, one US dollar is like every other US dollar out there.

The buck in my wallet is worth exactly the same as the buck in yours and both are completely interchangeable. These dollars, like every other dollar in existence, are thus fungible. Cryptocurrencies are fungible too: a bitcoin is a bitcoin is a bitcoin.

Fungibility & Tangibility Explained. Image Source

Fungibility & Tangibility Explained. Image SourceA non-fungible asset is therefore one that has its own unique qualities and cannot be readily exchanged with another. Let’s take a book as an example. Back in 1998, John Paul Getty Jr paid $7.5 million ($11.5 million today) for a first edition of The Canterbury Tales by Geoffrey Chaucer. Not everyone’s idea of a little light reading, but each to their own.

When I looked on Amazon just now, the most expensive copy available was the ‘deluxe gift edition,’ retailing at the princely sum of £14.95 ($19.57). A quick calculation tells me that I can settle down and read the Wife of Bath’s and the Miller’s tales just like the late Mr Getty may have done, having paid $11,499,980.43 less for the pleasure of it than he did.

The point here is that although my copy of Chaucer’s page-turner may contain the same material as the first edition, they are palpably not interchangeable. One is a rare and valuable piece of England’s literary history, the other is a mass-produced hardback delivered to my door by one of Bezos’s henchmen. If I were to turn up and try and swap one for the other then the chances are I’d find myself in prison with plenty of time to catch up on some reading. Both books are non-fungible.

Some of the exotic pets on offer over at Cryptokitties

Some of the exotic pets on offer over at CryptokittiesPerhaps by this point, you’ve made the natural progression from The Canterbury Tales to the CryptoKitties phenomenon. The latter is currently the best-known example of an NFT in the crypto sphere. This frankly baffling trend sees users pay to buy, sell, breed and customise digital cats.

Each cat is unique and some change hands for large sums, thus proving the adage that a fool and their money are soon parted. CryptoKitties was developed by Axiom Zen on the Ethereum blockchain and became so popular that in December 2017 it almost brought the entire network to a standstill.

Happily for proponents of NFTs, their potential extends way beyond the brightly-coloured inanity of the digital cat sphere. Before we look at these in more detail, it’s worth taking a glance at the two different types of NFT out there.

Token Types

You’re probably familiar with ERC-20 tokens - the Ethereum-based assets created by smart contracts that can be sent and received. Many popular cryptocurrencies use the ERC-20 standard, including Basic Attention Token, 0x, EOS, Augur and TRON. These are, of course, all fungible tokens.

Non-fungible tokens have two different issuance standards. The first and most popular is ERC-721. Your lovingly-collected Cryptokitties are basically ERC-721 tokens. Then there are the more versatile ERC-1155 tokens. These allow for both non-fungible and fungible issuance and are currently most common in blockchain games.

Some Valuable Fortnite vBucks. Image via PC Games

Some Valuable Fortnite vBucks. Image via PC GamesIf you’ve ever played Fortnite then you’ll be familiar with the various weapons and outfits you can acquire, which are non-fungible. But the game also has its own native currency (V-bucks) which allows you to make those in-game purchases.

These V-bucks are the fungible assets that the ERC-1155 standard can support alongside the non-fungible ones. ERC-1155 essentially allows developers a much greater level of flexibility.

NFTs On The Market

We’ve seen how NFTs essentially function as digital collectables. And, as they are issued on the blockchain, they have a number of advantages over other non-fungible assets such as rare books or works of art.

They cannot be counterfeited, replicated or printed on demand and they enjoy the same ownership rights and permanence guarantees that you find with Bitcoin. As a result, they can function as a much less unwieldy store of wealth than many of their physical equivalents.

The NFT market has already seen over $100 million in volume since its inception and is growing rapidly. Much of its focus is currently on blockchain games and the opportunities contained within them, but other platforms are making use of the technology and opportunities are opening up.

NFTs and Defi

DeFi has a limitation in that it’s confined to the cryptocurrency sphere. All the services it offers revolve around crypto - the loans taken out, the interest earned and the trades made are all done through the leveraging of crypto assets. NFTs offer a chance to expand DeFi’s scope beyond all that and bring real-world assets into play.

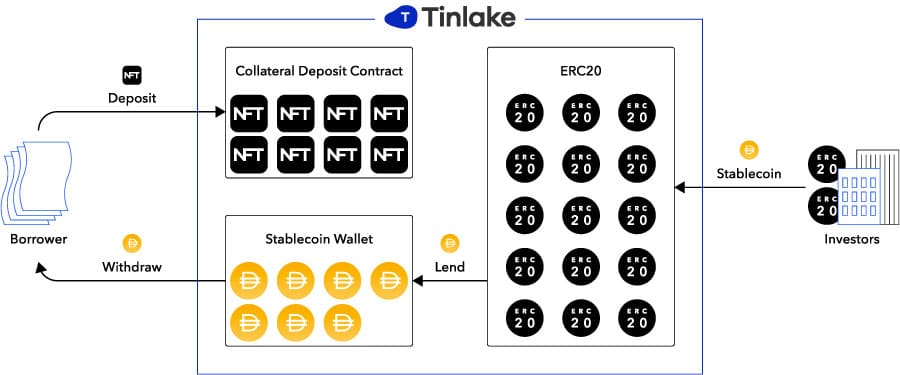

One platform set up to make this happen is Tinlake, this securitization Dapp on Ethereum allows investors and borrowers to finance their own asset pools. That’s done with open sourced smart contracts which easily integrate with the DeFi ecosystem.

In short, companies seeking finance or cash flow in the real-world can offer up assets as collateral. Tinlake then tokenizes these assets and brings them on-chain as non-fungible tokens.

How Tinlake Works. Image via Tinlake

How Tinlake Works. Image via TinlakeOn the flipside, the investors get access to a new asset class that may previously have been out of reach. Banks are kept out of the picture all along the way.

The smart contracts that Tinlake uses pool the NFTs representing the real-world assets. These pools then raise funds in stablecoins like DAI by issuing fungible tokens as shares of the pools’ proceeds. These tokens are interest-bearing and take the form of risk tokens (TIN) and yield tokens (DROP). Both tokens are burned when funding is paid out.

There’s a lot more to Tinlake than this article has scope for, but it is essentially offering an entry point for NFTs into the de-fi space with enormous benefits for both. Companies can use the platform to raise capital, get advances on cash flow or securtize real-world assets, while investors can diversify into new asset types that leverage NFT’s.

Blockchain Games

This sector is currently dominating the NFT project rankings, with in-game collectables forming the primary use for the tokens. As we’ve seen with Fortnite, such collectables are a huge part of the appeal for gamers and the use of ERC-1155 tokens also enables native tokens to be used as well.

Both play a vital role in building and maintaining the worlds that such games look to create. The more immersive the experience for the player, the more they are likely to play the game.

Many of these games have taken already-existing formats and updated them for the blockchain era. Where once upon a time kids traded football cards in the playground (sigh), now they can do so on the blockchain, using Sorare.

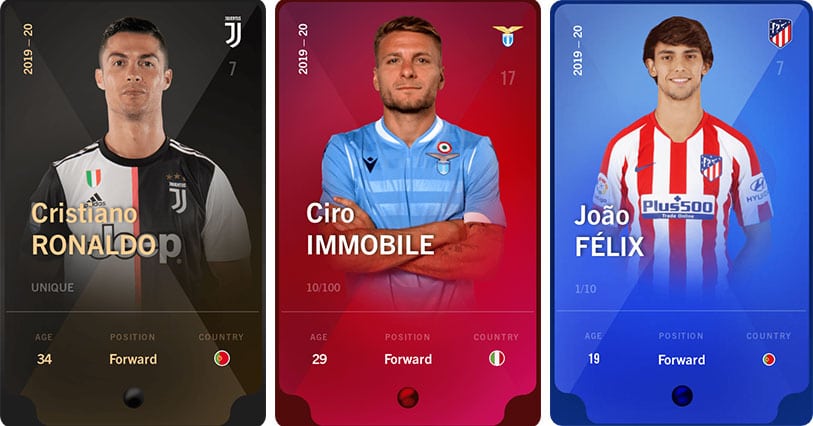

Some of the Blockchain Cards on Sorare. Image via Sorare

Some of the Blockchain Cards on Sorare. Image via SorareHere, cards can be bought and sold, as well as pitted against each other in virtual matches and updated as the season and player stats progress. There are a whole load of other trading card games out there too, including Contract Servant and Gods Unchained, which all offer variants on the theme.

The virtual world sphere is particularly well represented with The Sandbox, Decentraland, Somnium Space and Crypto Voxels all providing places for users to buy land, build empires and see their virtual assets appreciate in value if they have the knack.

Land owned in these games could be rented out to advertisers, with the original owner retaining that ownership throughout, while skins and weapons could also become collectable. Again, this ability to have in-game purchases accrue in value over time plays a big role in building the world of the game itself and retaining players within the ecosystem.

Alongside CryptoKitties sits another big digital pet platform in the form of Axie Infinity. The premise is similar: buy a digital creature (called an Axie), customise it and put it up against those of other players.

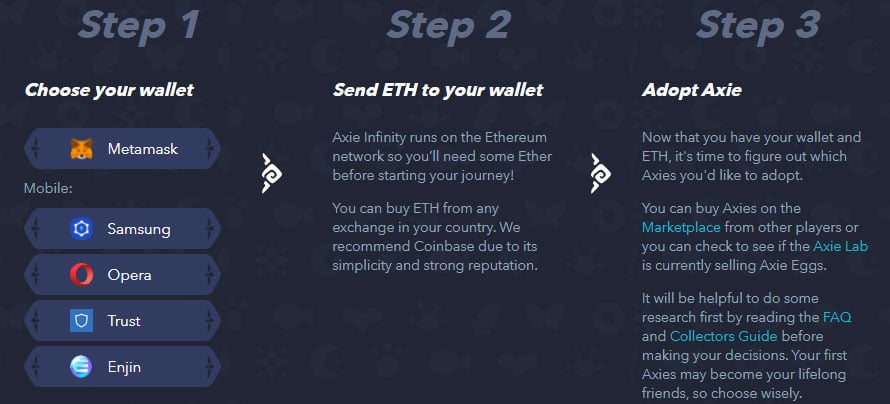

Steps to Getting started on Axie Infinity. Image via Axie Infinity

Steps to Getting started on Axie Infinity. Image via Axie InfinityAs with Sorare bringing football cards into the 21st century, so Axie Infinity is a natural progression from those Tamagotchi and Digimon people were once so obsessed with. NFTs are the magic ingredients making this progress possible.

It’s also worth remembering that the global gaming community numbers in the billions and so is a huge potential market for NFTs to unlock. As these games here and others following in their wake gain users and traction, it’s entirely possible to imagine this market growing exponentially in the near future.

Blockchain Art

If we look again at the table of the most popular NFT projects, then we also see a number of platforms dedicated to creating, collecting and trading digital art on the blockchain.

Projects like SuperRare (number two in the rankings at the time of writing), MakersPlace and Known Origin all make it possible for artists to sell their works in digital form - presumably a godsend in the current circumstances. The blockchain makes these pieces immutable and thus collectable, while NFTs represent the works themselves.

Some stats on the Digital Art Market. Source: Superrare

Some stats on the Digital Art Market. Source: SuperrareThe wider implications for copyright holders are clear. NFTs offer them a chance to further monetise their output, while simultaneously guarding against its unauthorised reproduction. Power is being put back in the hands of the creators.

Blockchain Domains

The other prominent group of platforms in the NFT project rankings are concerned with blockchain domains, their licencing and distribution. For those of you who haven’t read my earlier piece on this emerging asset class, these are easy-to-read replacements for long and garbled digital wallet addresses, which can also serve as payment gateways.

So if you’re running a site that provides a product or service you can request for crypto payments to be sent directly to your site address. An example would be Coinbureau.crypto. This replaces the need for copying and pasting wallet addresses (a practice which is vulnerable to attack) and makes the whole business of sending and receiving payments a whole lot easier.

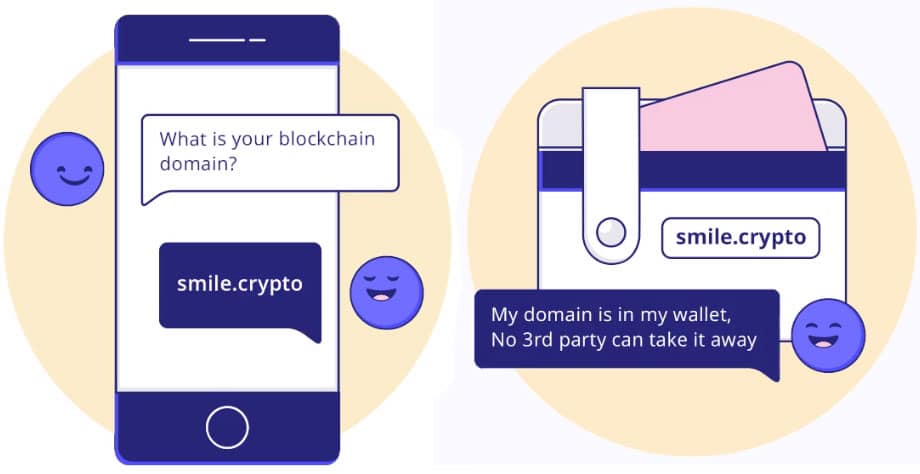

Benefits of a Blockchain Domain. Image via Unstoppable Domains

Benefits of a Blockchain Domain. Image via Unstoppable DomainsA blockchain domain also makes your website censorship-resistant, as the private keys to it are stored in a wallet to which only you have the keys. No third party can interfere with or disable the site without those private keys.

The old system whereby domain name registrars were able to take down websites is looking creaky. The benefits of this are clear: governments cannot suppress free speech and people will have much better access to information as a result.

The big players here are the Ethereum Name Service and Unstoppable Domains, both of which place highly in the NFT project table. Blockchain domains can of course be bought and sold like any other asset, providing those with foresight with an opportunity to make some money. Back in 2018, CryptoWorld.com was sold by one such individual for $195,000.

The Future

NFTs are just getting started and their potential use cases are constantly evolving. They could be employed as an extra layer of security for KYC checks, as peoples’ identities and credentials could be represented and verified by NFTs.

Ticketing systems could be revolutionised, recognising the difference between tickets: after all, a theatre ticket that allows the holder to sit in the front row is different from one that has them parked behind a pillar at the back of the circle. Supply chains are already starting to explore the possibilities that blockchain and NFTs offer, with massive potential gains for suppliers and consumers everywhere.

The projects using NFTs today represent the beginning of another chapter in the blockchain and crypto sphere. As their adoption expands, so too will their potential uses and this makes them an intriguing prospect for those looking to identify new areas of growth. De-fi still has a lot of growing to do and its potential is vast, particularly when NFTs are considered in tandem.

It’s easy to get disillusioned when you read of the vast wealth that a handful of corporations and individuals are able to build up in times like these. But the explosion of blockchain tech and the limitless potential it offers means that there is hope for those of us who don’t have billions of dollars in the bank.

New frontiers are opening up, with new opportunities for investment and reward, that those of us in the know can take advantage of. NFTs are the latest and one of the most exciting of these frontiers and their evolution over the coming years is going to be fascinating to watch.

Just as well, if we’re going to still be waiting for Succession to come back.