Ladies and Gentlemen! Children of all ages!

Welcome to the greatest show on Earth, the world of pumps, dumps, scams, exploits, grifts, hacks, and compromised wallets! It’s none other thaaaannnn the Wonderous, Whimsical World of Web3!

We’ve got tricks and scams you’ve never seen before. From vanishing funds to cascading liquidations, you’re sure to find at least one trick that will leave you clutching your wallet tighter.

Now, for the first act of the evening, let me present to you- RUG PULLS!

It’s a famous act (read as scam) that’s always left participants speechless and stunned. I personally call it the ‘Houdini of Crypto’. Your funds are worth something one minute and nothing the next.

Just sit back and enjoy the performance. You might even learn a secret or two behind the trick and some of its greatest performers of all time.

Well, I hope you enjoyed that theatrical intro. Dramatics aside, we’re going to talk about ‘Rug Pulls’ one of the most common scams in the crypto space. It’s notorious for leaving investors blindsided. But don’t worry, we’ll share some tips on how you can protect yourself from getting the rug yanked out from under your feet.

Keep reading to find out.

What is a Rug Pull Scam?

A ‘Rug Pull’ scam is a type of exit scam in the cryptocurrency space. While the specifics differ from case to case, it can be explained broadly as a scam which leaves investors or token holders suddenly illiquid with worthless holdings.

A common example of a rug pull scam is a project whose founders have stopped development on the project and have sold or removed all liquidity making the tokens essentially worthless.

Projects that rug pull are typically new projects trading primarily on DEXs. This is because it’s easier for new projects to source liquidity and commence trading on DEXs as they are mostly permissionless and do not require any KYC or AML documentation.

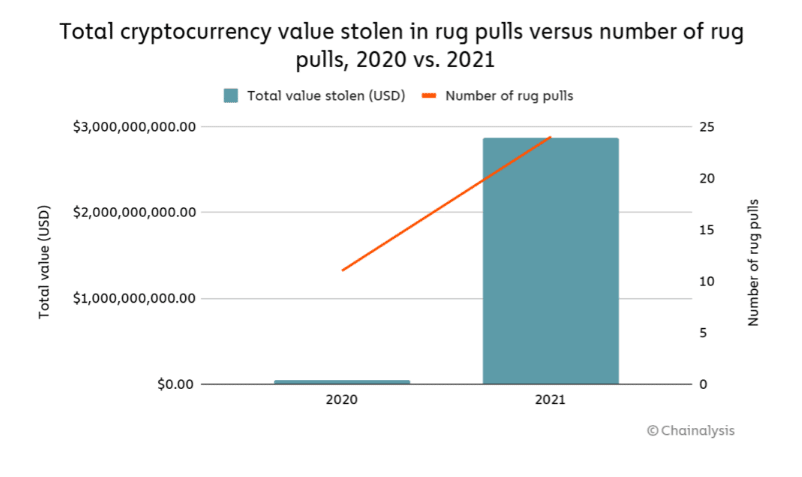

Rug Pulls 2020 vs 2021 via Chainalysis

Rug Pulls 2020 vs 2021 via ChainalysisThe ‘Rug Pull’ scam seems to have picked up steam last year, a report by Chainalysis found that nearly 37% of all cryptocurrency scam revenue in 2021 was from Rug Pulls. This is quite a leap in comparison to the 1% in scam revenue contribution that rug pulls had in 2020. I suspect this is likely due to the increased inflow of retail investors and projects entering the market due to the 2021 bull run.

Three Major Rug Pull Scams

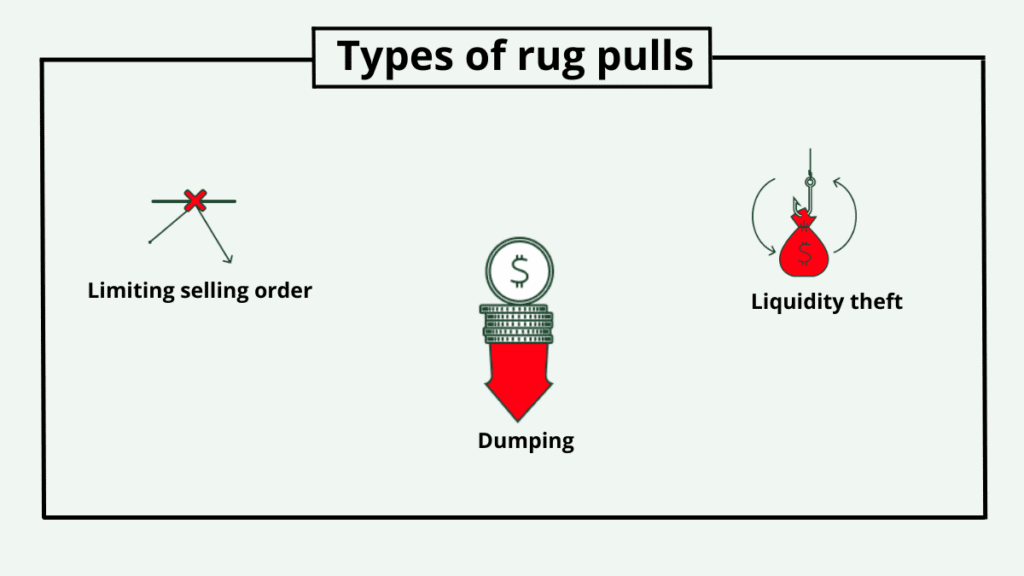

There are three major types of scams that fall under the definition of a Rug Pull scam. The difference between each lies in the method used to execute the scam. As such the three main methods are,

Types of Rug Pulls via Coinscreed

Types of Rug Pulls via CoinscreedLiquidity stealing

When new tokens launch, the development team usually sources liquidity for the token by creating a liquidity pool on a decentralized exchange (DEX). If you’re not sure what a ‘liquidity pool’ is, here’s a simple explanation- a liquidity pool is a combined pot of two assets that traders can trade from by depositing one of the two tokens in the pair and withdrawing an equal weight of the other.

The developers of a project are typically the biggest contributors to a liquidity pool, this means that a large portion of the assets in the pool can be withdrawn by them. Keep in mind that when developers launch liquidity pools, one of the two tokens in the liquidity pool is created by them, meaning it’s zero cost to fund that side of the pool. The other token, typically ETH or BNB depending on the chain is the only real cost acquired by the team when launching the liquidity pool.

However, as the project picks up attention and investors start purchasing the token, the side of the pool funded with ETH or BNB starts growing larger in size while the number of project tokens reduces in size. This means that the liquidity provider’s ETH or BNB stack is relatively higher now that when they created or joined the pool.

This is where the first method of rug pulling called ‘liquidity stealing’ comes in. Once the token has achieved a high enough price, the malicious project developer can exit the scam by pulling their share of the liquidity pool. Since most development teams are the biggest or only liquidity provider in a pool, this means that once they withdraw the liquidity, token holders will be unable to exit their position as there is no liquidity to trade with. This leaves investors with worthless tokens in their wallets. This method of rug pulling is usually classified as a ‘hard pull’, which means that the intention to rug the project was clear from inception.

Limiting sell orders

The second commonly used method in Rug Pulls is ‘limiting sell order’. This means that a malicious team behind a project will design the smart contract of the token to only allow certain wallet addresses to execute sell orders on the token. This is also commonly called a ‘honey pot’ scam.

This method allows the token price to keep pumping upwards at a rapid pace as only buy orders flood in. Retail investors are often enticed by the green-only chart and start buying the token hoping for a quick profit without doing any diligence on the project. Once the news of the investors being unable to sell the token begins gaining traction, the founders have usually exited the project and dumped the remaining project tokens to drain the liquidity of the pool.

Squid Game Meme via 9gag

Squid Game Meme via 9gagOne of the popular examples of this type of rug pull is the ‘Squid Game’ token rug pull (which we’ll read more on later). The Squid Game token rug pull is also iconic due to the fact that the rug pull was caught live on a Twitch live stream. Limiting sell orders is also another method that comes under ‘hard pull’.

Dumping

This is the third and most commonly used method in a rug pull. It is a pretty straightforward method of rug pulling. In the ‘dumping’ method, the team usually just sells off a massive chunk of the project tokens on the open market which dumps the price all the way down.

The method is typically used by projects that run massive social media campaigns to induce hype and buying pressure on the token. Once the token reaches a high enough price, the team dumps their tokens on the market to pocket the profits.

Meme via imgflip.com

Meme via imgflip.comThis method is also used by projects that start out with good intentions and then turn tail when the future seems bleak. Once some teams realize the project has no future, they either sell off their share of the tokens slowly under the guise of ‘development costs’ or they sell it off in one go.

Depending on whether the token was dumped at one go or slowly over time, this method of rug pulling can be classified as a ‘hard’ or ‘soft’ rug pull respectively. A ‘soft pull’ is one whose intentions to rug aren’t as clear, it could be interpreted as either a mismanaged project or a scam that was slowly executed over time.

How to avoid a Rug Pull

Now that we’ve learnt the different methods of rug pulling, let’s discuss how you can protect yourself from falling for them.

Rug Pull Red Flags via Koinly

Rug Pull Red Flags via Koinly- Locked Liquidity Positions in a Pool

Always make sure the liquidity provided by the developer in a liquidity pool is locked. You can easily find this information by entering the contract address of the token on websites like Token Sniffer or Crypto Watchtower. If the liquidity position is not locked, it means that the funds are susceptible to being withdrawn at any time, resulting in a rug pull through the ‘liquidity stealing’ method.

- Don’t Fall for the Hype or Price Action

Always do the required due diligence before investing in a token. Do not implicitly believe in the legitimacy of a project just because you’ve seen them being featured everywhere on social media. The same goes for positive price action on a token, remember what we discussed regarding Honey Pots or limiting sell order rug pulls?

- Stay Away from Projects with Anonymous Developers

It’s better to err on the side of caution when it comes to projects with anonymous developers. While there certainly are many well-known projects with anonymous developers, the risk of a project with anonymous developers rug pulling is certainly higher due to the decreased risk of reputational damage.

- If it sounds too good to be true, it probably is.

That’s right. If you ever come across a project with an absurdly high yield rate, it’s more likely that it’s a scam designed to pool in money before rug pulling. This also applies to whitepapers and projects with grand roadmaps that do not outline exactly how they are going to achieve their goals. While ambitious roadmaps are commendable, there needs to be a fair outline of the steps needed to accomplish them instead of vague promises.

- Audits

Make sure the project you’re planning to invest in has undergone an external audit from a reputable company. This will help uncover any vulnerabilities in the smart contract of the token.

- Be mindful of gradually declining developments on a project

If you don’t want to find yourself at the short end of the stick after sticking with an investment for years, make sure that you regularly check up on the project’s developmental milestones. If you spot a decline in the activity of a particular project or if the founders seem to be getting more distant, it’s probably time that you reconsidered your investment position as this could be signs of waning interest and a potential soft rug pull.

Case Studies: Some of the Biggest Rug Pulls

Thodex

Thodex, a Turkish crypto exchange, was one of the biggest rug pull of 2021. Contrary to the usual profile of rug-pulling projects, Thodex was a centralized crypto exchange with over $2.6 billion worth of user deposits.

The platform initiated the rug pull by ‘temporarily’ closing the platform to address an “abnormal fluctuation in the company accounts.” This froze users’ access to their funds on the platform. In the meantime, its founder and CEO Faruk Fatih Ozer absconded to Albania with over $2 billion of user deposits with him. He still remains at large and has an active international warrant seeking his arrest.

Frosties

Frosties was an 8888 NFT project that launched in early 2022. It made a total of $1.3 million in primary sales. However, the team behind Frosties rug pulled the project just hours after the primary sales by deleting all their social channels and transferring the funds to various other wallets. It tweeted a message stating “I’m sorry.”

However, what’s really intriguing about this rug pull is that the Department of Justice managed to track down the founders Ethan Nguyen and Andre Llacuna and charged them with money laundering and fraud charges relating to the rug pull. It's one of the first times someone has been charged for an NFT rug pull and if convicted, the creators face up to 20 years in prison.

Frosties NFTs on OpenSea

Frosties NFTs on OpenSeaTo track the founders, the investigation team issued subpoenas to Discord, the platform on which the project was quite active. Discord then disclosed the IP address on which the founders’ usernames were active on. The team then found a Coinbase transaction that happened on the same IP address. Another subpoena later disclosed the identity of discord user ‘Frostie’ to be Ethan Nguyen.

Interestingly, at the time the authorities charged them, both Ethan and Andre were already making a move for the next NFT project called ‘Embers’. If they weren’t charged, this project would have also most likely ended up as a rug pull.

Squid Game

The Squid Game token was one of those projects that rode the hype train on the back of the incredibly successful hit Korean TV show of the same name. The plot of the show featured a game show in which participants competed for a massive prize pot by taking part in ‘death games’ to be the last man standing.

The Squid Game token also issued a whitepaper that promised to deliver a play-to-earn modelled after the concept of the show. It detailed a token economy involving another ‘Marble’ token. Investors began rushing towards pouring money into the token, hoping to catch some of the price action on the back of the hype.

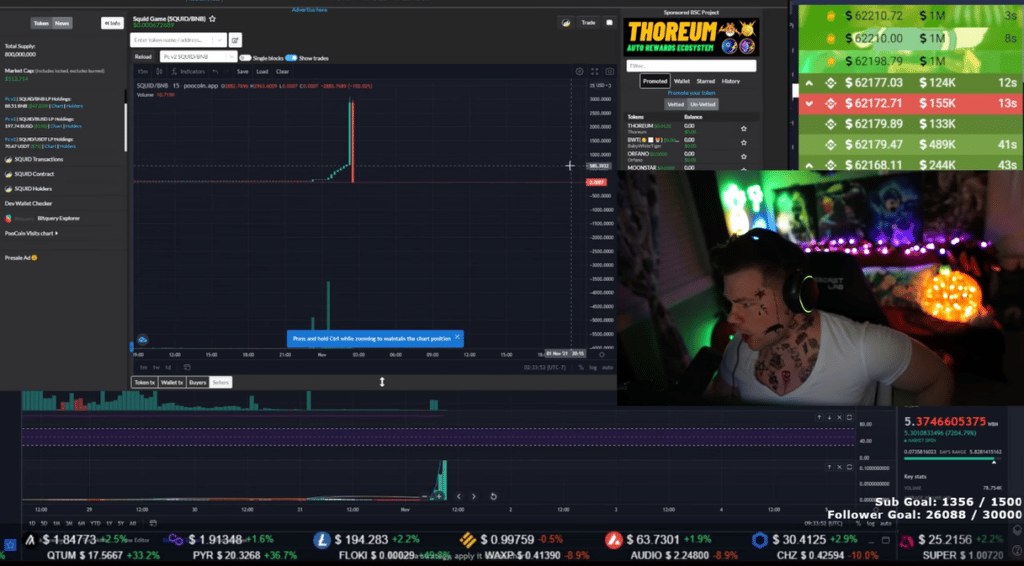

Twitch stream of the exact moment the SQUID token rugged

Twitch stream of the exact moment the SQUID token ruggedUnfortunately, the project was a honeypot that limited the sell orders to only specific wallets owned by the team. This meant that while investors could buy the tokens, they were unable to sell them back on the market.

This caused an upward spiraling price movement that caught headlines all over the world. The token went from $0.01 at launch to almost $3000 in a week. As the token hit $2861, the team started dumping their tokens and draining the liquidity from the liquidity pool. As mentioned earlier, the exact moment was caught on live stream by a Twitch content creator.

In hindsight, investors realized that there were several red flags in the project. The whitepaper of the project had poor grammar, several spelling errors, a lack of detail on the game economy etc. (not to mention the ridiculous market cap)

Conclusion

Now that you have a good idea of how rug pulls work, make sure you spot those red flags the next time you think about investing in a project. Scams will always be rampant in the crypto space, but as long we keep diligent, we can reduce the risk of exposure to such projects.

If you still have a bunch of questions you’d like to get addressed, check out the FAQ section we’ve listed below.