Bad actors caused over $7.7 billion in losses from cryptocurrency scams in 2021, an 81% increase from 2020, according to a new report from blockchain insights company Chainalysis.

Chainalysis explains that the decrease from two years ago was largely due to the relative absence of crypto ponzi schemes last year, and the reemergence of them this year.

In particular, Chainalysis makes note of the notorious Finiko scheme that originated in Russia, which stole over $1.1 billion from investors primarily in Eastern Europe.

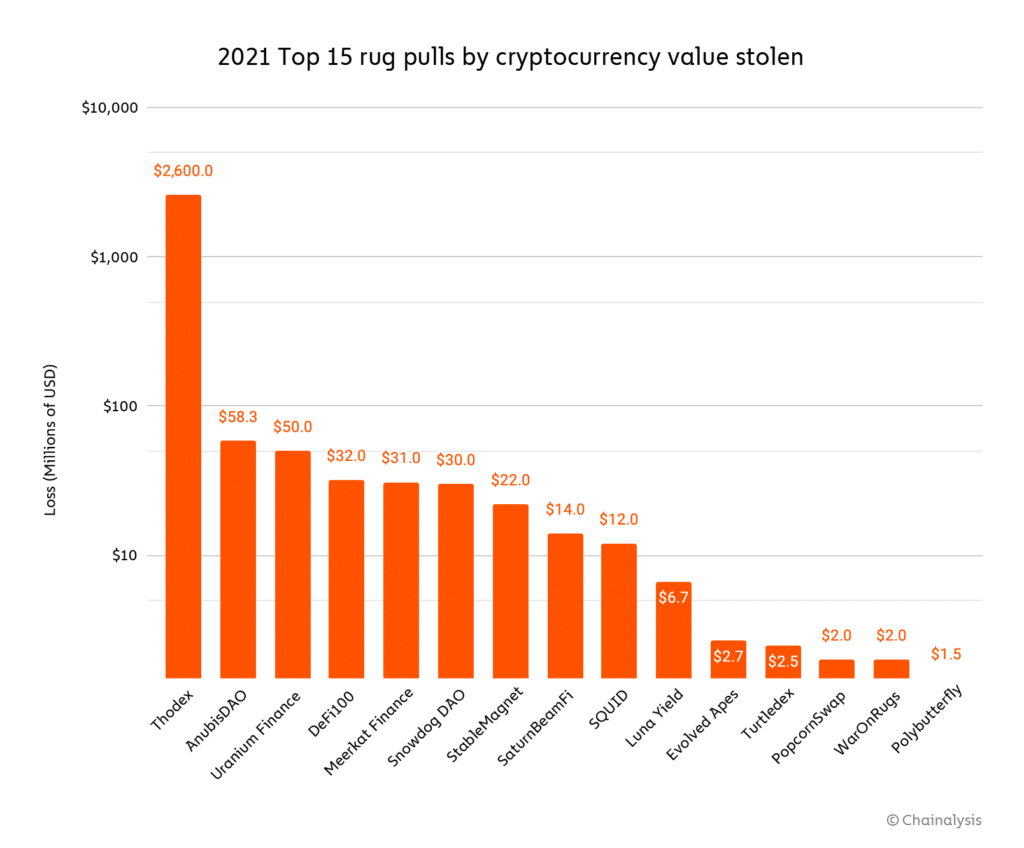

The other main contributor to the surge in scams, according to Chainalysis, are rug pulls, or when a crypto project raises money and then disappears with investor funds before actually delivering on anything. As many in the space already know, rug pulls are mostly commonly seen in the decentralized finance (DeFi) sector of crypto.

“Rug pulls are prevalent in DeFi because with the right technical know-how, it’s cheap and easy to create new tokens on the Ethereum blockchain or others and get them listed on decentralized exchanges (DEXes) without a code audit.

That last point is crucial — decentralized tokens are meant to be designed in such a way that investors holding governance tokens can vote on things like how assets in the liquidity pool are used, which would make it impossible for the developers to drain the pool’s funds.”

Chainalysis

Chainalysis

According to Chainalysis data, the biggest rug pull of 2021 — by far — was Thodex, a Turkish crypto exchange whose founder went missing with over $2 billion in investor funds. Faruk Fatih Ozer, the exchange’s CEO, has reportedly fled Turkey and has yet to be found nearly 8 months later.

An honorable mention was AnubisDAO, a project which claimed to provide a free-floating currency backed by a basket of assets. With no working product or public team members, the project managed to raise nearly $60 million in funds using a stylish dog-themed logo. All the funds, held in Wrapped Ethereum (wETH), vanished from the prohect’s liquidty pool and was sent to various addresses.

“It’ll be difficult for DeFi’s growth to continue if potential new users don’t feel they can trust new projects, so it’s important that trusted information sources in cryptocurrency — whether they’re influencers, media outlets, or project participants — help new users understand how to spot shady projects to avoid.”