It is by now clear that the digital asset space and its diverse ecosystem of tokens are here to stay. However, apart from the on-going regulatory uncertainties, the constant banning of cryptocurrency in different geographical regions and the incessant FUD revolving around crypto’s disruptive technology, some of the most widely discussed topics across the space involve blockchain’s energy consumption and computational power expenditure.

Blockchain, defined as a digital ledger technology, is primarily known for its application to cryptocurrencies and constitutes the foundational layer of this relatively new, exciting financial infrastructure.

Introduced in 2009 to serve as a public ledger for Bitcoin, blockchain has given rise to thousands of value-rich, diverse and unique crypto assets, and has furthermore pioneered an emerging ecosystem of applications in various fields, including supply chains, DeFi, NFTs, patents, smart contracts and on-chain governance.

Blockchain First Emerged With Bitcoin In 2009 And Has Ever Since Produced A Dynamic Ecosystem Of Various Crypto Assets

Blockchain First Emerged With Bitcoin In 2009 And Has Ever Since Produced A Dynamic Ecosystem Of Various Crypto Assets The European Union Agency For Network And Information Security defines blockchain as:

… a public ledger consisting of all transactions taking place across a peer-to-peer network. It is a data structure consisting of linked blocks of data … This decentralised technology enables the participants of a peer-to-peer network to make transactions without the need of a trusted central authority and at the same time relying on cryptography to ensure the integrity of transactions. - ENISA (2019)

In contrast to traditional ledger systems used by banks and governments for centuries, which are inaccessible and centralised, blockchain ledgers are decentralised and transparent. In fact, there is no central authority acting as the exclusive manager of the ledger and the main responsibilities of said ledger involve storage, updates and verification of transactions.

Blockchain stores, shares and synchronises data as ‘chains of blocks’ using cryptographic techniques. Blocks represent a set of recorded transactions and each new block of transactions is linked to the previous one, creating an ever-growing ‘block’ chain. The creation of each block must be approved by all network participants and this process can be achieved through a ‘consensus mechanism’ that establishes the rules for transaction verification and validation.

Blockchain Stores And Processes Transaction Blocks Via Cryptographic Techniques

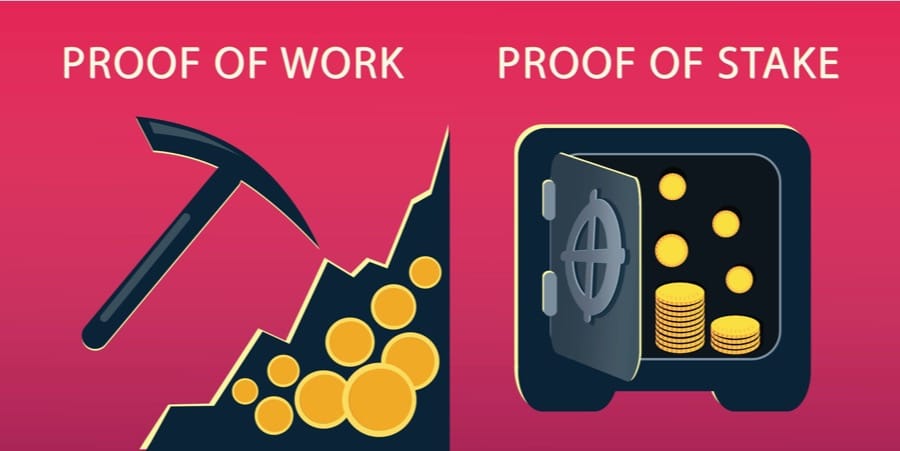

Blockchain Stores And Processes Transaction Blocks Via Cryptographic Techniques One of the most common approaches is ‘mining’, which relies on the Proof-of-Work (PoW) mechanism. With PoW, in order to add a block of transactions to a blockchain, network participants compete to find a solution to a complex mathematical problem based on cryptographic algorithms, and these network participants are commonly referred to as ‘miners’. When a miner finds the solution to the problem, and after validation from other participants, the block of transactions is added to the blockchain.

In Bitcoin Mining, Miners Compete To Solve Complex Algorithmic Equations To Validate Blocks And Receive Rewards For Doing So

In Bitcoin Mining, Miners Compete To Solve Complex Algorithmic Equations To Validate Blocks And Receive Rewards For Doing So While Proof-of-Work allows Bitcoin, Monero, and other crypto assets to process transactions peer-to-peer in a secure and disintermediated manner, PoW at scale requires huge amounts of computational power, which only increases as more miners join the network. But, on the other hand, a perhaps more sustainable solution exists, and this solution is Staking.

What Is Staking?

Staking can be thought of as a less resource-intensive alternative to mining. Its mechanism involves holding funds in a cryptocurrency wallet to support the security and operations of a blockchain network. In essence, staking is the process of locking crypto assets to receive rewards, which some liken to blockchain dividends. However, in order to gain a better grasp of what staking is, a brief analysis of the Proof-of-Stake mechanism is required.

Staking Constitutes The Foundational Layer Of The Proof-of-Stake Mechanism

Staking Constitutes The Foundational Layer Of The Proof-of-Stake Mechanism This is because Proof-of-Stake implements a consensus mechanism that differs completely from that of Proof-of-Work, and allows blockchains to operate in a more energy-efficient manner while maintaining a substantial level of decentralisation.

Proof-of-Stake

While Proof-of-Work has historically proven to be a robust and efficient mechanism to facilitate consensus in a decentralised manner, the amount of computational power required for it to function correctly has turned into a growing concern across the space.

The Cambridge Bitcoin Electricity Consumption Index From January 2017 To July 2021 - Image via cbeci.org

The Cambridge Bitcoin Electricity Consumption Index From January 2017 To July 2021 - Image via cbeci.org In fact, the complex puzzles that miners are competing to solve serve no purpose other than making sure that the network remains secure, and while one could argue that PoW’s excessive use of resources is justified, this does not equate to the most optimal processing mechanism.

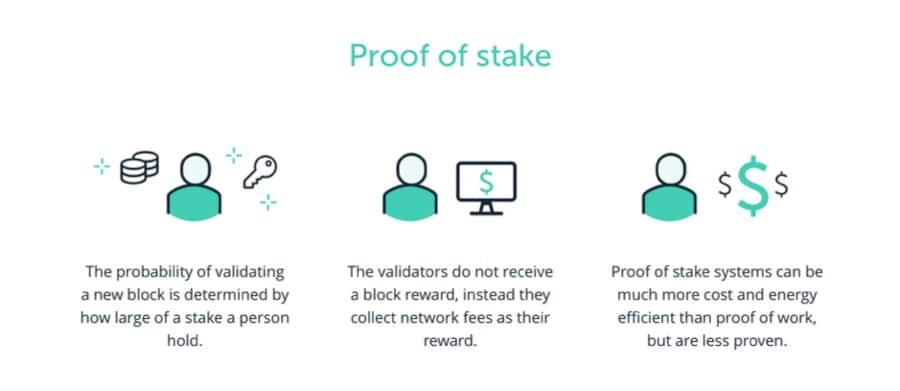

Proof-of-Stake (PoS), on the flip side, was created as an alternative to Proof-of-Work and was designed to solve some of the issues inherent in PoW. The idea with PoS is that network participants can lock their crypto assets into a staking protocol that, at particular times, assigns the right to one of them to validate the next block of transactions, resulting in a reward for doing so.

Proof-of-Stake Is Proving To Be More Energy-Efficient Than Proof-of-Work

Proof-of-Stake Is Proving To Be More Energy-Efficient Than Proof-of-Work In PoS, the probability of being selected to validate block transactions is proportional to the amount of tokens held by a participant. Thus, what determines which participants create a transaction block is not based on their ability to solve algorithmic puzzles, like in Proof-of-Work, but on the amount of staking assets they hold.

Proof-of-Stake arguably constitutes a more sophisticated and scalable blockchain solution due to the fact that, as opposed to Proof-of-Work, which utilises excessive energy to solve hash challenges, a Proof-of-Stake miner is limited to mining a percentage of transactions that is reflective of their ownership stake.

In theory, this means that a miner who holds say 5% of the crypto assets available can mine only 5% of the transaction blocks, which greatly reduces the need for large amounts of computational power to validate transactions and inherently makes the network more efficient.

PoS’s scalability proposition is one of the main reasons why Ethereum has migrated from Proof-of-Work to Proof-of-Stake with ETH 2.0.

Some of the most notable blockchain networks that use Proof-of-Stake, or a variant of it, are the likes of:

- Ethereum

- Cosmos

- Solana

- Cardano

- Avalanche

- Tezos

- Algorand

Delegated Proof-of-Stake (DPoS)

Delegated Proof-of-Stake (DPoS) is an alternative version of PoS that allows network participants to commit their token balances as votes, where voting power is proportional to the amount of tokens held. These votes are then used to elect a number of delegates who manage the blockchain on behalf of their voters, ensuring consensus and security.

Typically, staking rewards are distributed to these elected delegates who then distribute a part of the rewards to their electors, in a manner propositional to their individual contributions.

Basically, DPoS allows for consensus to be achieved with a lower number of validating nodes and, as such, it tends to enhance network performance and processing efficiency.

Notable blockchain networks that use DPoS are Tron, EOS, and Nano.

How Staking Works

As previously mentioned, Proof-of-Work relies on miners to validate and add transaction blocks to the blockchain. In contrast, Proof-of-Stake chains validate and produce new blocks through the staking process. Staking is an umbrella term used to denote the act of pledging crypto assets to a cryptocurrency protocol to earn rewards in exchange.

Moreover, when users stake their assets in a protocol they are inherently contributing to the preservation of the protocol’s security, and they receive rewards in the form of native tokens for doing so.

Consequently, the higher the amount of assets pledged, the higher the rewards received. These staking rewards are all distributed on-chain, meaning that the process of earning these rewards is completely automatic and disintermediated from any third-party escrow.

Some staking coins and current yields. Image via Staked.us

Some staking coins and current yields. Image via Staked.usThis staking rewards mechanism, quite frankly, constitutes a brilliant value proposition for many digital asset enthusiasts as it allows for consistent asset compounding and brings life to the ultimate entrepreneurial dream of ‘earning while you sleep’!

How Are Rewards Generated?

Proof-of-Stake assets such as Cosmos, Solana, Cardano, Tezos and Polkadot all allow users to deploy their assets to their respective protocols and earn rewards via staking, as displayed in the image above. Specifically, there are two types of rewards that get distributed:

- Staking Rewards (Inflationary Rewards)

- Transaction Fees

For staking rewards, users stake their crypto assets with a Proof-of-Stake node to validate a block of transactions. If the node a user has delegated to successfully signs or attests to blocks, the user will receive staking rewards, thereby increasing their total crypto asset net worth. In case the node is unresponsive or malign, a portion of the node’s assets, and therefore the user’s assets, could be significantly reduced or destroyed completely.

Protocols Incentivise Users To Lock Their Assets To Gain Rewards And Contribute Towards Maintaining The Protocol Secure

Protocols Incentivise Users To Lock Their Assets To Gain Rewards And Contribute Towards Maintaining The Protocol Secure Thus, staking rewards are beneficial for both individual stakers and protocol nodes as, on the one hand, they incentivise users to lock their assets in exchange for some kind of native token reward and, on the other, they improve the overall security of the protocol itself. When stakers are selected for block validation and receive freshly minted native asset rewards, these rewards are called inflationary rewards.

This essentially means that every time a block is validated, new tokens of that currency are minted and distributed as staking rewards, hence the term “inflationary”.

With regards to transaction fees, each transaction carries with itself a small fee making it easier for the node to prioritise the selection of transactions to be entered into the block. The set of accumulated fees from the underlying transactions also go to the node.

Transactions are the foundational layer of blockchain and cryptocurrency, and they play a variety of different roles depending on the protocol’s specific architecture. For instance, transactions may vary from token transfers to smart contract execution and, despite the dissimilarity in transaction types, the common thread is that these transactions always get ordered and are aggregated into a new block so that all nodes in a network can agree on the entire state of the blockchain.

How To Participate In Staking

Staking represents a fairly decent investment tool for anyone whose assets are just lying idle in a crypto wallet and not generating any passive income. When it comes to staking, one can perform two roles:

- Validation: Most suitable for blockchain companies and technical enthusiasts.

- Delegation: Appropriate for most crypto asset holders.

To become a validator node in a Proof-of-Stake (PoS) network, crypto asset holders are required to stake their tokens as collateral as opposed to spending electricity as is the case for the Bitcoin PoW network. As previously mentioned, validators are selected randomly to create and validate blocks and the probability of a validator’s selection is contingent on the amount of tokens staked. Participants in a PoS system can essentially vote in on-chain governance with their staked assets, and if PoS were a democracy a user’s stake would constitute their voting power.

In PoS Systems, Validators Are Selected Based On The Amount Of Tokens Held In Their Wallet - Image via Ledger.com

In PoS Systems, Validators Are Selected Based On The Amount Of Tokens Held In Their Wallet - Image via Ledger.com In fact, PoS validators vote with their assets on blocks of transactions that they deem valid. They receive staking rewards if the majority of the network agrees and risk losing their entire stake if they try to cheat, for example by voting on two different transaction blocks simultaneously. This system inherently creates a balanced infrastructure by encouraging a rise in the number of nodes and discouraging nodes from acting maliciously.

Furthermore, it is important to note that not everyone can become a network validator. This is due to the fact that validators need to meet specific requirements imposed by the protocol and, in most cases, the barrier of entry is rather high. For instance, in order to become a validator, one will potentially have to:

- Stake a minimum amount of tokens; In the case of ETH 2.0, a minimum stake of 32 ETH is mandatory.

- Set up a secure and performant infrastructure.

- Build a team of developers and engineers responsible for the continuous development and upgrade of the infrastructure.

Delegation

Owning a massive amount of just one digital asset may not be that appealing to many crypto aficionados out there. However, many PoS systems foresee this issue and implement ways to enable asset holders to stake their tokens with a validator that they do not run themselves. This process of staking assets through a validator is called delegation.

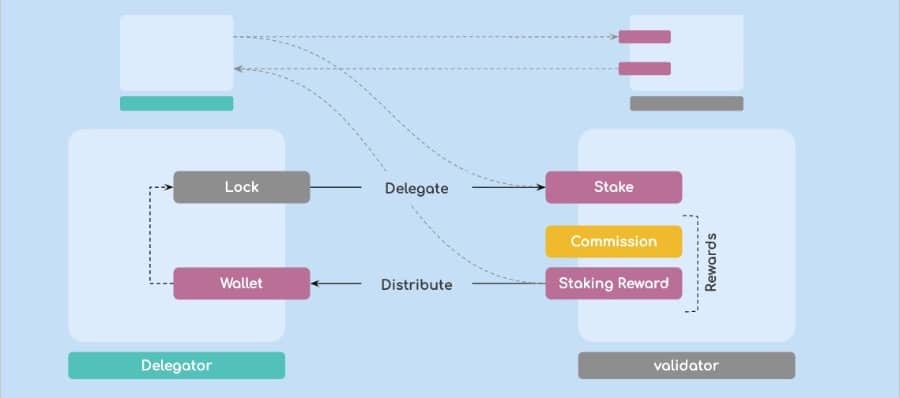

Validator And Delegator Intercommunication Process - Image via Ki Foundation Medium

Validator And Delegator Intercommunication Process - Image via Ki Foundation Medium Delegating assets to a validator entails contributing towards the count of the validator’s stake in return for a percentage of the staking rewards received. In practical terms, a delegator deposits tokens into a smart contract and specifies which validator’s influence in the network they want to increase. Consequently, as the rewards earned in the validation process increase, the staking rewards are automatically split between the validator and the delegator.

Staking Pools

A staking pool is a group of crypto asset holders aggregating their resources to increase their chances of validating blocks and receiving rewards. In a staking pool, holders combine their staking power and share rewards in proportion to their contributions in the pool.

Staking Pool Infrastructures Allow Holders To Pool Their Assets Together To Increase Their Chances Of Earning Higher Staking Rewards - Image via TopStaking

Staking Pool Infrastructures Allow Holders To Pool Their Assets Together To Increase Their Chances Of Earning Higher Staking Rewards - Image via TopStaking Setting up a staking pool often requires high levels of expertise and a substantial amount of initial capital and, as such, pool providers will most likely charge a fee from the staking rewards distributed to pool participants. Typically, the stake has to be locked for a specified period and usually has a withdrawal or unbinding time set by the protocol.

Furthermore, it is very likely that the staking pool will require participants to hold a minimum amount of tokens before they can be considered as potential contributors, which disincentivises malicious behaviour.

Liquid Staking

Apart from the traditional staking mechanisms discussed thus far, some DeFi protocols have started implementing an alternative staking format called Liquid Staking. The term Liquid Staking is used to describe protocols that issue token representations of staked assets, which creates the possibility to use these representations in other DeFi applications or gain immediate liquidity for the staked amount.

Effectively, Liquid Staking implies the creation of a new on-chain token to represent the staked amount, making staked assets essentially liquid and available for further trading. In addition, tokenised stake representation allows users to circumvent some of the limitations imposed by particular networks such as lock-up and unbonding periods, for instance.

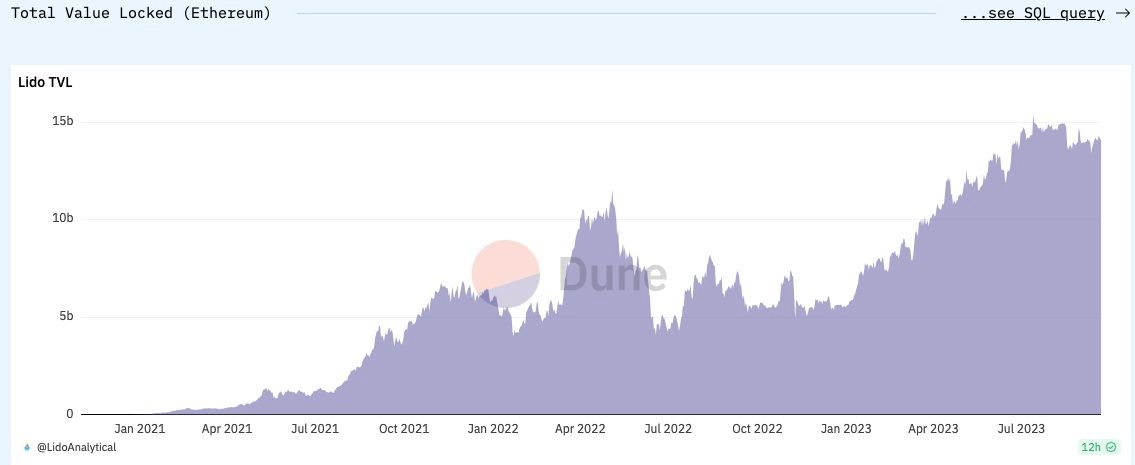

A Look at the Astronomical Trajectory of Liquid Staking Popularity. Image via Dune Analytics

A Look at the Astronomical Trajectory of Liquid Staking Popularity. Image via Dune AnalyticsLiquid Staking opens up a wide array of investment and trading opportunities for stakers as it allows for the creation of additional tokenised capital that can be redeployed in yield farming, high APY and liquidity provision protocols. Because of these advantages and functionalities, tokenised stake representation is proving to be a growing trend in the DeFi space, with projects such as Lido Finance, RocketPool, Ramp DeFi, Kira Network, StaFi, and LiquidStake spearheading the movement.

Staking vs. Yield Farming

Given the incredible diversity of the crypto space, it is fairly easy to get caught up in all of its complexities and various definitions. Therefore, while staking and yield farming do in fact share some similarities, it is important to define the differences between them in order to avoid confusion when navigating the DeFi space.

Both staking and yield farming involve users providing liquidity to a protocol in order to gain rewards in return. Yield farming, also known as liquidity mining, is defined as the process of providing liquidity to earn ‘mining’ rewards. Liquidity mining, however, should not be confused with Proof-of-Work mining, which entails solving algorithmic equations to validate blocks.

Instead, when users provide liquidity to a decentralised exchange or protocol they provide assets such as ETH, for instance, so that when other users of the protocol want to exchange their USDC tokens for ETH, there will be enough of the quoted asset for the trade.

Staking And Yield Farming Are Quite Similar, However, Yield Farming Involves A More Active Process Of Searching For The Best Staking APYs On The Market

Staking And Yield Farming Are Quite Similar, However, Yield Farming Involves A More Active Process Of Searching For The Best Staking APYs On The MarketConsequently, the user making the trade will pay a fee to the protocol which, in turn, will reward the liquidity provider for supplying the asset in the first place. Yield farming, in a sense, is rather similar to staking but it actually involves the more dynamic process of actively moving assets around different protocols to essentially ‘farm’ the best rewards possible.

Generally speaking, staking is intended for medium to long-term investments, as the tokens are locked up for a set amount of time. In contrast to yield farming, staking is deemed the safer, less risky investment option and results in a fairly decent return on investment. Yield farming and liquidity mining, on the flip side, carry increased risks such as impermanent loss for example, and because of this they will usually result in some of the highest APYs in the crypto sphere.

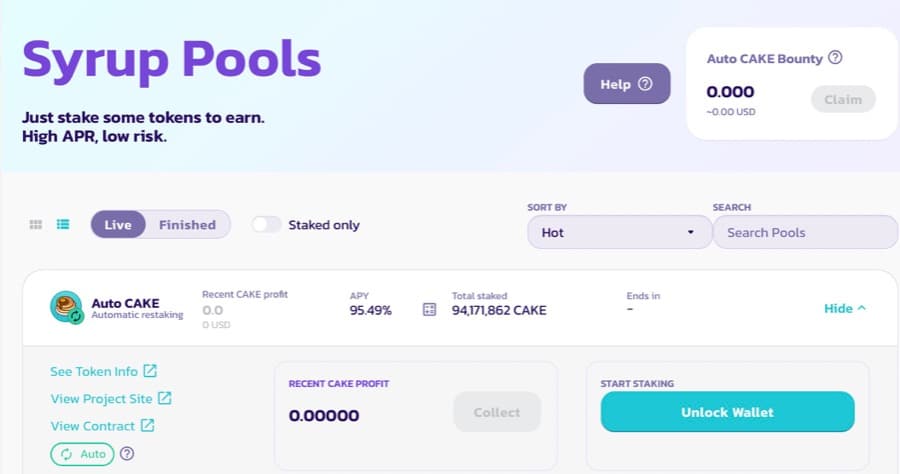

A Visual Of The PancakeSwap Staking Protocol - Image via PancakeSwap.Finance

A Visual Of The PancakeSwap Staking Protocol - Image via PancakeSwap.Finance Historically, we have seen users who provide CAKE tokens to the PancakeSwap protocol reward a yearly APY of approximately 95%, which is, of course, unheard of in traditional financial infrastructures. Thus, while yield farming does indeed come with its risks, it also enables investors to gain access to unprecedented ROI percentages that they wouldn’t be able to find elsewhere.

In Conclusion

Staking is an umbrella term used to denote the act of pledging crypto assets to a cryptocurrency protocol to earn rewards in exchange. When users stake their assets in a protocol they are inherently contributing to the preservation of the protocol’s security, and they receive rewards in the form of native tokens for doing so.

Proof-of-Stake arguably constitutes a more sophisticated and scalable blockchain solution due to the fact that, as opposed to Proof-of-Work, which utilises excessive energy to solve hash challenges, a Proof-of-Stake miner is limited to mining a percentage of transactions that is reflective of their ownership stake.

Therefore, while Proof-of-Work has proven to be a robust mechanism for validating transaction blocks and many Proof-of-Work proponents feel that PoW is more secure than PoS, it is neither the most eco-friendly nor the most efficient processing method. Staking, instead, constitutes a less resource-intensive solution and allows users to validate blocks directly by becoming network validators or through delegation.

Network participants who have a substantial amount of initial capital can become protocol validators and receive staking rewards for verifying transactions, or they may even set up their own staking pool and open it up to potential contributors, charging a fee for their management services.

While the ROI inherent in most staking protocols could be deemed somewhat average for crypto, staking represents a great investment tool for people whose assets are just lying idle in a crypto wallet and aren’t generating any form of passive income. Thus, staking offers not only a more efficient processing mechanism but it is also a great way for investors to increase their crypto asset net worth over the medium to long-term outlook.