Imagine entering the vibrant world of a bustling theme park or a lively food court. To streamline transactions within these enclosed ecosystems, you must often exchange your everyday cash for a specialized form of currency — tokens. These tokens, uniquely designed for and valued within that specific environment, simplify purchases ranging from snacks to rides. This method ties the experience of the park or food court to a unique economic system distinct from the external monetary systems.

This concept of localized and specialized tokens provides an excellent framework for understanding Runes, an innovative tokenization project on the Bitcoin network. Runes applies a similar principle to the digital realm of Bitcoin, assigning unique identifiers to the arbitrary units of Bitcoin, thereby transforming them into fungible tokens within the blockchain. These tokens are not just digital currency; they carry unique attributes or identifiers that set them apart within the vast ledger of Bitcoin transactions.

In this article, we will explore what are Bitcoin Runes, and how they leverage the inherent strengths of the Bitcoin network to create a distinct layer of tokenized assets. From their creation and significance to their potential applications, we will uncover all aspects of Runes, providing you with a comprehensive understanding of this fascinating facet of blockchain technology.

The Creator

The Runes Protocol was created by Casey Rodarmor, a software developer and a notable figure in the Bitcoin community, particularly known for his work related to the Ordinals Protocol. Ordinals is a tokenization project that emerged due to SegWit and Taproot upgrades to the Bitcoin Network.

Ordinals leveraged these upgrades to inscribe individual satoshis (the smallest unit of bitcoin) with data to turn them into unique identifiers capable of carrying digital artefacts, like NFTs. Ordinals used each satoshi’s unique position in the series of Bitcoin blocks to assign them rarity levels, leading to one of the most unique collections of tokens in the cryptosphere.

Community Reaction

Rodarmor's role in proposing and developing this concept has positioned him as an influential figure in exploring Bitcoin's potential. His work encourages both developers and enthusiasts to reimagine the uses of Bitcoin’s blockchain, highlighting its robustness and adaptability. This has led to a reinvigorated discussion about scalability, utility, and the philosophical direction of Bitcoin's development.

Runes

On April 19th 2024, just as the Bitcoin network successfully implemented the last halving at block number 840,000, the Runes Protocol, another tokenization project, went live on the Bitcoin network. Runes was different from other Bitcoin tokenization standards like Taproot Assets by Lightning Network and BRC-20s, some even consider it the superior token standard.

What makes Runes so unique? Let’s break down Runes.

What are Bitcoin Runes?

Rodarmor spearheaded the tokenization frenzy on the Bitcoin network with the Ordinal Theory. While the Bitcoin NFT scene was growing in billions, creating newfound interest in the Bitcoin protocol, another class of token standards was also getting popular.

Innovators were also experimenting with two groundbreaking upgrades to the Bitcoin protocol — SegWit and Taproot.

Using the additional space created by SegWit and the enhanced scripting capabilities of Taproot, it was now possible to create fungible token standards on Bitcoin. Soon BRC-20s and Lightning Network’s Taproot Assets mixed on and off-chain components to issue tokens tied to the Bitcoin network.

Here's Guy explaining Bitcoin Runes.

The Runes Protocol is also a new token standard on the Bitcoin Network. Rodarmor claims that Runes is superior to any other Bitcoin-based token standard because it is simpler and does not strain the network as much as others. Are these claims justified? Let’s understand Runes to find an answer.

What Makes Runes Unique?

You can conceptualize Runes as a lighter version of Ordinals. Runes follows a similar idea: using unique identifiers to separate units of Bitcoin and give them additional intrinsic, often subjective value.

Runes are tokens on the Bitcoin network. They are not built on the Ordinals theory, are much simpler in functionality, and consume significantly less space than Ordinals. Moreover, while tokens like Ordinals, BRC-20s, and Taproot Assets may rely on newer upgrades like SegWit and Taproot, Runes works using key foundational principles of the Bitcoin network, like UTXOs.

The Two Pillars of Runes

To create new tokens on the Bitcoin network, Runes defines rules for a bunch of basic practices, like etch (create), mint and transfer. These codes do not consume a lot of space and are easy to include in Bitcoin transactions. Two fundamental elements of the Bitcoin block are key to understanding Runes, these are UTXOs (Unspent Transaction Outputs) and OP_RETURN opcode.

UTXO (Unspent Transaction Outputs)

UTXOs, or Unspent Transaction Outputs, are a fundamental concept in the Bitcoin network and form the backbone of how Bitcoin tracks ownership and facilitates transactions. Here’s a detailed explanation of UTXOs and how they function:

Concept of UTXOs

- UTXOs can be thought of as the individual pieces of bitcoin that you own and can spend. Unlike traditional bank accounts that show a balance as a single figure, Bitcoin's ledger does not keep track of balances. Instead, it tracks every output from every transaction that has not yet been spent — these are the UTXOs.

How UTXOs Work

- Transaction Outputs: When a Bitcoin transaction occurs, it generates transaction outputs. Each output specifies an amount of Bitcoin and a condition under which it can be spent, typically requiring a digital signature from the appropriate private key holder.

- Spending UTXOs: To create a new transaction, a user must reference these UTXOs as inputs. The user proves they are allowed to spend the UTXOs by fulfilling the spending condition, usually by signing the transaction with their private key.

- Creating New UTXOs: Once UTXOs are used in a transaction, they are considered spent and can't be used again. The transaction will generate new UTXOs, which will then be available for future transactions. This cycle ensures that Bitcoins are neither created nor destroyed but merely transferred from one party to another.

Characteristics of UTXOs

- Immutable: Once UTXOs are created, they cannot be modified; they can only be spent and replaced with new UTXOs.

- Ownership Verification: UTXOs are tied to a specific cryptographic key. To spend the UTXOs, you must prove you hold the corresponding private key.

- No Identity Information: UTXOs do not contain real-world identity information.

Implications of UTXO Model

- Transaction Fees: Every transaction has a cost, primarily driven by the data size of the transaction. Transactions that consolidate many small UTXOs can be larger and, therefore, more expensive.

- Transaction History: Since UTXOs are spent entirely and new ones are created with each transaction, Bitcoin does not have a simple account/balance ledger but rather a chain of ownership through UTXOs.

- Scalability and Performance: The need to store and update a list of all unspent outputs can affect the scalability and performance of Bitcoin. This is a significant consideration for Bitcoin's design and future enhancements.

In summary, the UTXO model is central to how transactions are processed and validated on the Bitcoin network. It ensures the integrity and tracking of Bitcoin ownership without a centralized ledger, embodying the decentralized ethos of Bitcoin. Understanding UTXOs is crucial for anyone deeply involved in Bitcoin, whether they are developers, investors or users.

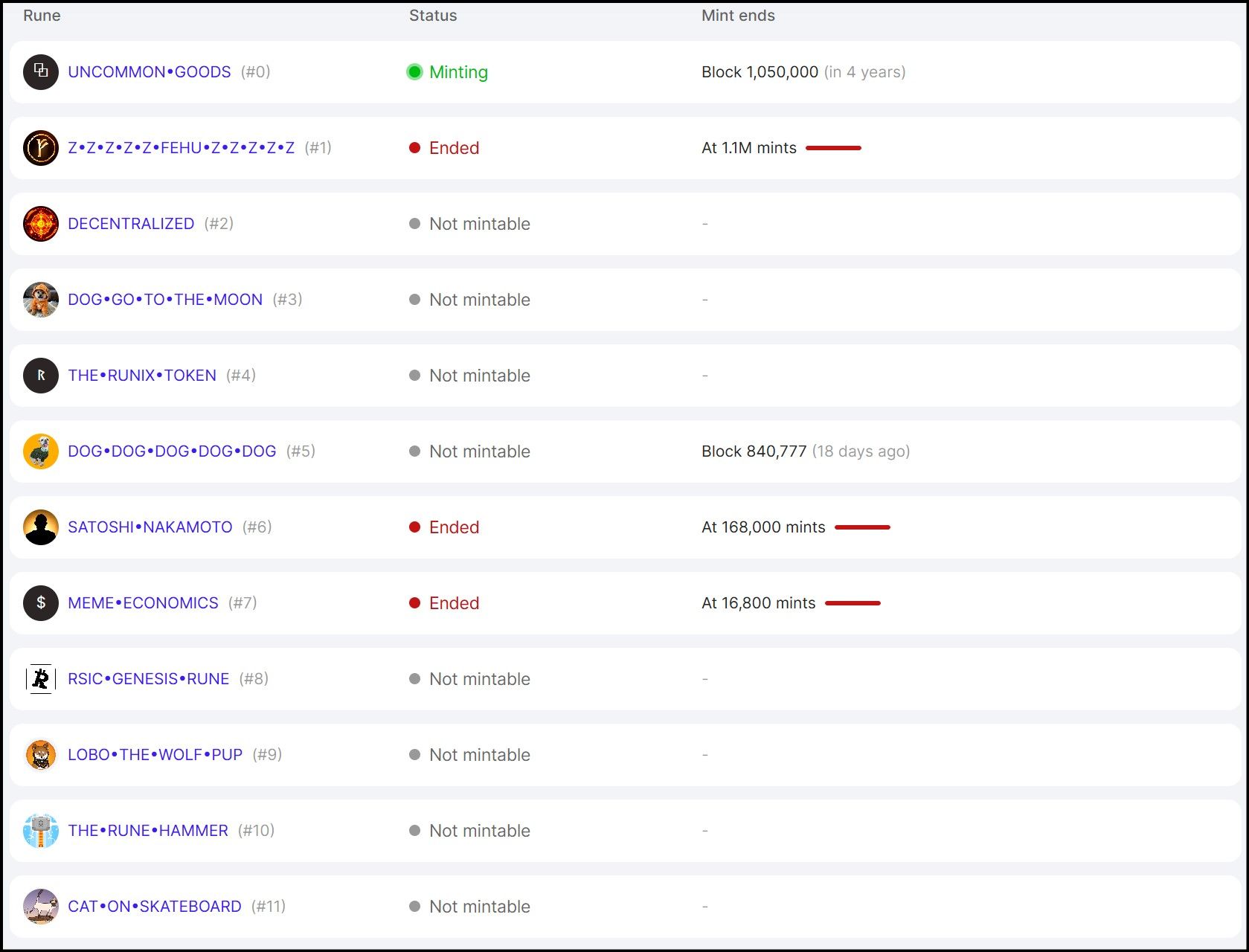

One of the First Runes Minted | Image via Ordiscan

One of the First Runes Minted | Image via OrdiscanWhat is OP_RETURN?

The OP_RETURN opcode in Bitcoin is a script operation used within Bitcoin's scripting system, primarily for creating transactions that include data on the blockchain that is provably unspendable. This opcode plays a specific role in how data is handled and stored in Bitcoin transactions, serving as a means to embed arbitrary data without affecting the spendability of outputs.

Here's a detailed explanation of how OP_RETURN works and its implications:

Purpose of OP_RETURN

OP_RETURN is used to mark a transaction output as unspendable. When a transaction output contains an OP_RETURN opcode, it signals to the network that the output can never be used as an input in a future transaction. This is important because it ensures that outputs containing OP_RETURN do not need to be kept in the UTXO database, which helps in reducing blockchain bloat and optimizing the efficiency of the network.

How OP_RETURN Works

- Transaction Creation: A Bitcoin transaction can contain multiple outputs, and one of these outputs can include an OP_RETURN opcode followed by the data intended to be stored on the blockchain.

- Script Format: The typical script for an OP_RETURN output starts with the OP_RETURN opcode, followed by a data push opcode that specifies the number of bytes of data to follow, and then the actual data bytes themselves.

- Data Embedding: The data embedded using OP_RETURN can be anything from plain text to hexadecimal strings representing more complex information. The maximum size of the data that can be appended after an OP_RETURN opcode has varied over time. Initially, it was limited to 40 bytes, but as of recent Bitcoin core releases, it can be up to 80 bytes.

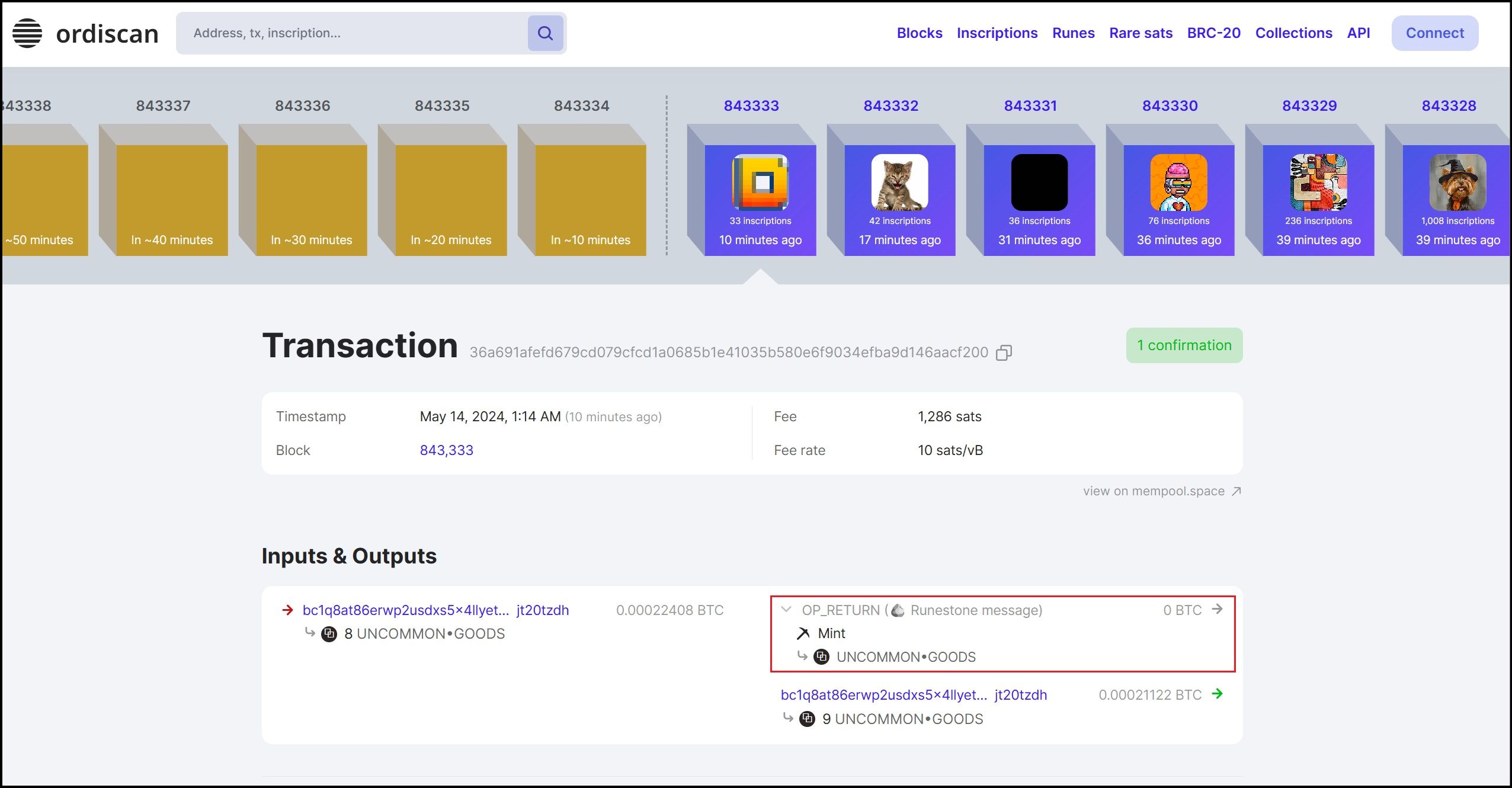

You Can Check OP_RETURN Data on Blockchain Explorers like Ordiscan

You Can Check OP_RETURN Data on Blockchain Explorers like OrdiscanUses of OP_RETURN

- Data Timestamping: Developers can use OP_RETURN to embed hash values of documents or digital files, providing a decentralized proof of existence at a specific timestamp.

- Marking Transactions: Certain applications use OP_RETURN to mark transactions for specific purposes, such as identifying transactions belonging to particular applications or protocols built on top of Bitcoin.

- Creating Provably Unspendable Outputs: This is useful for making statements or storing data without the intention of spending those outputs in the future.

Implications and Considerations

- Non-Spendable Outputs: Outputs that use OP_RETURN are explicitly marked unspendable and do not clutter the UTXO set, which is beneficial for network efficiency.

- Blockchain Space Usage: While OP_RETURN outputs are pruned from the UTXO set, they still take up space in the blockchain. Therefore, there's a trade-off between the utility of embedding data and the cost of increasing the blockchain size.

- Best Practices: The Bitcoin community generally encourages judicious use of OP_RETURN, considering the balance between the need for embedding data and the principles of keeping the blockchain lean and efficient.

In summary, OP_RETURN provides a standardized, consensus-enforced way to embed data into the Bitcoin blockchain safely and efficiently, ensuring that such data does not interfere with the essential transactional functions of the network.

UTXOs and OP_RETURN are the two technologies required to operate Runes. Let’s now explore how Runes leverages these elements to function.

How Bitcoin Runes Work?

We are familiar with the ERC-20 token standards of Ethereum. ERC-20 tokens are smart contracts deployed on Ethereum that represent the token code, including essential information like a ledger of transactions, max supply, inflation rules, and transfer rules, along with other operational logic. Smart contracts are immutable. Once deployed, the smart contract logic cannot be altered, even by the creator, which is essential to safeguard the token rules from tampering or changing later.

To define immutable token standards on Ethereum, Runes works with UTXOs and OP_RETURN to create immutable conditions similar to those of Ethereum smart contracts. To achieve this configuration, Runes needs:

- Storage: A location to store token logic like supply and transactions. Bitcoin does not support smart contract accounts, so Runes leverages UTXOs as the location of this logic. However, UTXOs are owned by an on-chain address, so they are not immutable.

- Immutability: This is achieved with OP_RETURN opcodes. We know that UTXOs containing OP_RETURN data become unspendable or immutable.

Therefore, Runes creates new tokens by embedding its logic in OP_RETURN of UTXOs, creating an immutable token that lives on Bitcoin and receives all its network benefits of security and decentralization.

Runestones

Runestones are protocol messages stored in the OP_RETURN area designated in each UTXO. A Runestone contains instructions to interact with the Runes Protocol. The instructions may include commands for creating new runes and minting or transferring existing runes.

While a UTXO transaction can have only one runestone, UTXOs themselves can hold balances of any number of runes. Let us understand the nuances of creating runes, called etching, and learn how to transfer and mint runes.

Etching

Etching is the process of creating new runes. It is the process of writing the properties of the rune, such as name, ID, divisibility, supply and others in the OP_RETURN of a UTXO. Finalizing an Etching transaction makes the properties of that rune immutable. Even the etcher, who initially created the rune, cannot alter these properties once they are written and accepted on the Bitcoin network.

Here’s a summarized list of properties defined in the etching process for Runes, based on the information provided:

- Name

- Length and Characters: Names are composed of letters A through Z, ranging from one to twenty-six letters.

- Spacers: Names can include spacers (represented as bullets) to improve readability (e.g., UNCOMMON•GOODS), but these do not affect the uniqueness or length count of the name.

- Uniqueness: The name's uniqueness is based strictly on the sequence of letters, independent of spacers.

- Divisibility: Refers to how finely a rune may be divided, expressed as the number of decimal places that can be used in an amount of the rune.

- Divisibility of 0: Cannot be divided.

- Divisibility of 1: Divisible into ten sub-units.

- Divisibility of 2: Divisible into a hundred sub-units, etc.

- Symbol

- Currency Symbol: Each rune can have a unique currency symbol (e.g., $, ⧉, 🧿) that is displayed after quantities of that rune.

- Default Symbol: If no specific symbol is chosen, the generic currency sign ¤ (scarab) is used.

- Premine: Allows the etcher to allocate a certain number of rune units to themselves during the creation process.

- Terms (Related to Minting)

- Open Mint: A rune may have terms that allow for open minting, meaning anyone can create units of that rune under specific conditions.

- Conditions:

- Cap: Limits on the total number of times a rune may be minted.

- Start and End Heights: Specifies the blockchain heights between which the rune can be minted.

- Start and End Offsets: Adjust the minting window based on the height of the block in which the rune was originally etched.

- Cap: Once the cap mint limitation is reached, no further minting of the rune is possible.

- Minting Amounts: Each mint transaction creates a predetermined number of new units of the rune.

These properties collectively define how a Rune is created, its characteristics, and the rules governing its use and distribution within the blockchain network. This structured approach ensures that once a rune's properties are set, they are immutable, preserving the integrity and expectations associated with its use.

Minting Runes

After the Etching process, Runes are available for minting. A Rune's mint may be open or closed. If it is open, it means anyone can create mint transactions that create a fixed amount of those runes tokens, as defined by the Rune rules in the etching process. The creator of a Rune may also create some amount of tokens during the minting process. Once minting is closed, no one can mint new units of that Rune.

Transferring Runes

Transferring Rune tokens within the Bitcoin network involves using the properties of a runestone, which is essentially a Bitcoin transaction that contains additional rules for handling these tokens. Here's how the transfer process works:

Process of Transferring Runes

- Transaction Inputs and Outputs: When a transaction includes inputs that contain runes, or when new runes are generated through premining or minting within the transaction, these runes are allocated to the transaction's outputs based on specified rules.

- Edicts: A runestone (the transaction containing runes) can have multiple edicts. An edict specifies how runes should be allocated and consists of three parts:

- Rune ID: The identifier of the rune being transferred.

- Amount: The quantity of runes to be transferred.

- Output Number: The specific output within the transaction where the runes will be sent.

Edicts are processed sequentially and they direct the transfer of unallocated runes from inputs to specified outputs within the transaction.

- Pointer: After processing all edicts, if there are any runes left unallocated, they are automatically transferred to the transaction's first non-OP_RETURN output. However, the transaction can include a pointer—a directive that specifies a different output to receive any remaining unallocated runes.

- Burning Runes: Runes can also be intentionally destroyed or "burned" by directing them to an OP_RETURN output via an edict or a pointer. This permanently removes the runes from circulation, reducing the total supply.

This structured approach to transferring Rune tokens allows for complex transactions where runes can be redistributed, minted, or even burned, providing flexibility in how these digital assets are managed on the blockchain.

General Guidelines for Minting and Etching Runes

Luminex is a highly recommended platform for minting and etching Runes due to its reliability and ease of use. It is noted for higher fees but offers a user-friendly experience.

Steps to Mint Runes

- UTXO Preparation: Before minting, split your Bitcoin into multiple UTXOs (Unspent Transaction Outputs). This is necessary because each UTXO can only be used once per transaction, so having multiple UTXOs allows for simultaneous transactions.

- Choosing Minting Mode:

- Pre-split: If you have pre-split your UTXOs, select this mode to proceed with minting.

- Auto-split: If you have not split your UTXOs, choose Auto-split, which automatically handles the splitting but takes longer.

- Transaction Speed: Select the speed of the transaction to ensure it doesn't get stuck or outpaced by other transactions. "Fast" is recommended to avoid delays.

How to Etch Runes

- Creating a Rune: Go to the Etch tab on Luminex, input the specifics of your Rune—name, divisibility, symbol, and the amount for pre-mine, if applicable.

- Transaction Submission: After setting up your Rune's details, choose the transaction speed and pay the associated fees.

- Tracking Progress: Use tools like the mempool to monitor your transaction's status until it is confirmed.

Choosing Platforms

Other platforms for minting and etching include Unisat, Xverse, and Magic Runes. Compare fees and user experiences to choose the best option for your needs.

Additional Tips

- Research and Tracking: Utilize platforms like GeniiData for in-depth data and tracking of Rune transactions.

- Marketplace Trading: For trading Runes, platforms like Magic Eden and Unisat offer marketplace services where you can buy or sell Runes. Ensure your wallet is compatible and connected.

- Fee Management: Always check the current state of the mempool to adjust your transaction fees appropriately. This ensures your minting or etching processes are completed successfully without unnecessary delays.

These guidelines provide a comprehensive starting point for anyone looking to engage with Bitcoin Runes through minting or etching, offering both technical and practical advice to navigate this new digital asset landscape effectively.

Runes vs Other Token Standards

Runes and BRC20 tokens represent two distinct approaches, each with its unique method of leveraging Bitcoin's blockchain technology for token creation and management. This section explores the key differences between Runes and BRC20 tokens, focusing on their creation processes, network impact, and data management strategies.

| Feature | BRC20 Tokens | Runes |

|---|---|---|

| Creation Process | Engraving via Ordinals protocol | Etching via OP_RETURN |

| Data Storage Location | Witness data section of a Bitcoin block | OP_RETURN section of a UTXO |

| Data Capacity | Around 800 bytes on average | 80 bytes |

| Network Impact | Higher storage requirements; potential for blockchain bloat | Lower storage requirements; streamlined |

| Data Dependency | Requires off-chain indexer for transfer management | Fully embedded in the Bitcoin blockchain |

| Security | Dependent on external data sources; potential vulnerabilities | Enhanced security; maintains decentralized integrity |

| Resource Utilization | Requires more memory and long-term data storage in nodes | Minimal memory requirements; data retrieved from blockchain history |

| Scalability | Potentially less efficient due to extensive data handling | More efficient and scalable due to reduced resource strain |

1. Creation Process: Engraving vs. Etching

- BRC20 Tokens: BRC20 tokens utilize the Ordinals protocol, a method termed "engraving," which involves inscribing data into the Witness data section of a Bitcoin block via SegWit. This method allows for a large amount of data to be stored—typically around 800 bytes on average. While this provides ample space for complex operations and larger data sets, it increases the storage requirements on the network, potentially leading to blockchain bloat.

- Runes: Contrarily, Runes employ a process known as "etching," which writes data into the OP_RETURN section of a UTXO. This section is limited to 80 bytes, which, while smaller than the capacity used by BRC20s, is sufficient for defining tokens without the complexities enabled by the Ordinals protocol. This method is less taxing on the network's resources, making Runes a more streamlined option for token creation.

2. Data Dependency and Security

- BRC20 Tokens: The operation of BRC20 tokens relies on an off-chain indexer to manage the transfer process. This dependency on external data sources can introduce points of vulnerability and potential centralization concerns, which might compromise security and the decentralized nature of blockchain technology.

- Runes: In contrast, Runes operates entirely within the Bitcoin network. The data for Runes is fully embedded in the blockchain via the OP_RETURN output, enhancing security and maintaining the decentralized integrity of the Bitcoin network.

3. Network Management and Resource Utilization

- BRC20 Tokens: Due to their use of the Witness data section and the need to handle more extensive data, BRC20 tokens require more memory and longer-term data storage within network nodes. This can lead to heavier demands on network resources, affecting overall efficiency and scalability.

- Runes: Runes are designed to minimize their impact on network resources. The use of OP_RETURN for storing data makes Runes immutable and eliminates the need for perpetual storage in node memory. Instead, Runes data can be retrieved from the blockchain history when needed, significantly reducing the memory requirements and easing the strain on the network.

In summary, both Runes and BRC20 tokens illustrate innovative uses of the Bitcoin network for tokenization. However, they cater to different needs and preferences in terms of complexity, network load, and decentralization. Runes offer a simpler, less resource-intensive approach that might appeal to those looking for efficient and secure tokenization without the need for external data sources or significant blockchain overhead. On the other hand, BRC20 tokens provide a robust platform for more complex operations and larger data sets, at the cost of increased storage requirements and potential centralization issues. These distinctions are crucial for users and developers when choosing the appropriate technology for their specific applications on Bitcoin's blockchain.

Conclusion: The Impacts of Runes on the Bitcoin Ecosystem

The introduction and evolution of Runes within the Bitcoin network stand as a striking testament to the ingenuity and creativity prevalent in the cryptosphere. This innovative use of Bitcoin’s existing technology exemplifies how “old” technology can be repurposed to serve new and unexpected functions, significantly diverging from its original purpose. By adapting the underlying capabilities of Bitcoin, Runes open up a realm of possibilities that extend far beyond the traditional boundaries of what was once considered feasible with Bitcoin’s architecture.

Revitalizing the Bitcoin Network

Runes not only introduce a fresh layer of functionality but also contribute to the economic vitality of the Bitcoin network. As block rewards continue to diminish with successive halvings, the additional fees generated from the transactions involving Runes provide a crucial source of revenue for miners. This ongoing economic incentive is essential for maintaining robust participation from miners, ensuring the security and continuity of the network.

Enhancing Network Efficiency

Furthermore, the role of Runes in optimizing the Bitcoin network’s efficiency by consolidating and utilizing small, fragmented UTXOs—often referred to as 'dust'—should not be underestimated. By converting these underutilized fractions into something of greater value and utility, Runes help in cleaning up the blockchain while reallocating dormant assets. This process not only clears the clutter but also enhances the overall liquidity within the Bitcoin system, contributing to a healthier and more dynamic blockchain environment.

Potential Beyond Digital Collectibles

While Runes have so far been prominently featured in the creation of NFT-like digital collections, the potential for broader and more practical applications looms large. From tokenizing physical assets to creating unique digital identities, the scope for Runes is limited only by the imagination of its community. This flexibility could lead to significant innovations in how property, ownership, and identity are managed digitally in the future.

A Catalyst for Innovation

The emergence of Runes highlights an exciting phase of activity within the Bitcoin ecosystem, which is often perceived as stable and unchangeable. This surge of innovation not only challenges the traditional perceptions associated with Bitcoin but also reinforces its position as a foundational technology capable of adapting to meet evolving demands.

In conclusion, Runes represent a pivotal development in the world of cryptocurrency. They not only showcase the versatility and adaptability of Bitcoin but also set the stage for future innovations that could transform the landscape of digital transactions and blockchain technology. As we continue to explore and expand the capabilities of Runes, the potential for new applications and improvements to the network holds promising prospects for the entire Bitcoin community.