On November 14, 2021, at block number 709,632, the Bitcoin network underwent a significant evolution with the activation of the Taproot upgrade. This upgrade, almost unanimously elected by the Bitcoin community, marked a harmonious contrast to the divisive Segregated Witness (SegWit) upgrade.

The SegWit upgrade, a response to Bitcoin's scaling challenges, had previously caused a rift in the community, leading to the fork that birthed Bitcoin Cash. The near-universal support for Taproot highlighted the community's growing maturity and consensus-building capabilities.

Segregated Witness, or SegWit, introduced in 2017, was a pivotal upgrade in Bitcoin's history. It addressed the critical scalability issue by segregating the digital signature data from transaction data. This segregation effectively increased the block size without altering the block size limit, allowing more transactions to be processed in each block. SegWit also resolved the long-standing transaction malleability issue, laying the groundwork for future innovations on the Bitcoin network.

Note: The transaction malleability issue in Bitcoin refers to a vulnerability in the network's protocol that existed prior to the implementation of Segregated Witness (SegWit). This issue allowed the modification of transaction details in a way that affected the transaction ID without invalidating the transaction itself.

The combined impact of SegWit and Taproot is poised to broaden the scope of Bitcoin's capabilities significantly. While SegWit improved the network's transaction capacity and efficiency, Taproot has introduced privacy and smart contract functionality enhancements. Together, these upgrades have set the stage for exploring new and exciting use cases for the Bitcoin network.

This piece will delve into one such emerging application: creating and managing tokenized assets on the Bitcoin network. With the enhanced features brought by these upgrades, the Bitcoin blockchain is now better equipped to handle a variety of asset classes, potentially transforming it into a more versatile and comprehensive financial platform.

Making Bitcoin Smarter

The Taproot upgrade represented a rare moment of near-universal consensus in the Bitcoin community. This was largely because it promised significant improvements without controversial changes to Bitcoin's core principles. Unlike previous upgrades like SegWit, which caused significant debate and even led to a blockchain fork, Taproot was seen as a win-win: it enhanced functionality while preserving Bitcoin's fundamental ethos of decentralization and security.

Taproot was implemented as a soft fork. This meant it was compatible with the existing Bitcoin protocol, and nodes that did not upgrade could still participate in the network without being forced off. This approach minimized disruption and contributed to its broad acceptance.

If you need a refresher on the basics of Bitcoin Network, we have a dedicated Bitcoin 101 Guide that covers it in depth.

Inspiration:

The Taproot upgrade was inspired by the need to enhance Bitcoin's efficiency, privacy, and smart contract capabilities. It responded to the growing demand for more sophisticated functionality on the Bitcoin network while maintaining its hallmark security and stability.

Historical context:

- Preceding Upgrades: Following the SegWit upgrade in 2017, which resolved transaction malleability and improved scalability, the Bitcoin community focused on further enhancing the network.

- Growing Smart Contract Interest: As the blockchain space evolved, there was increasing interest in expanding Bitcoin's smart contract capabilities, especially in ways that could be executed more privately and efficiently.

Privacy and Scalability Concerns: Bitcoin's transparency exposed details of complex transactions and smart contracts, leading to privacy concerns. Additionally, complex scripts consumed more block space, raising scalability issues.

What is Taproot?

Taproot was proposed in Bitcoin Improvement Proposal 341 (BIP 341) and was largely developed by Bitcoin developer Greg Maxwell. It consisted of the following components:

- Schnorr Signatures

- A new signature scheme replacing the Elliptic Curve Digital Signature Algorithm (ECDSA).

- Allows for signature aggregation and batch verification, reducing transaction size and verification time.

- Merkelized Abstract Syntax Trees (MAST)

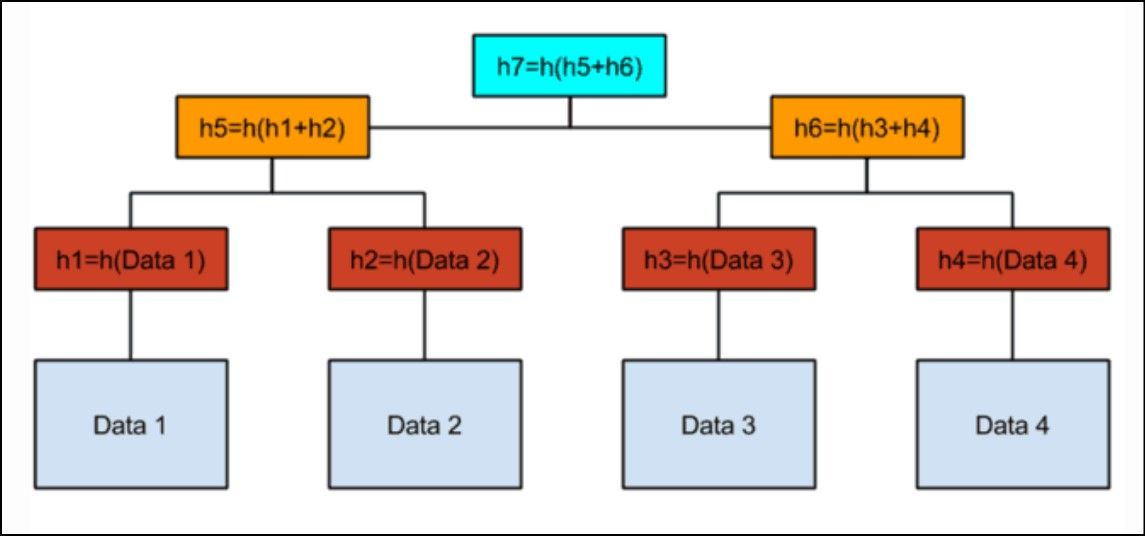

- A combination of Merkle trees and Abstract Syntax Trees.

- Enables hiding of unexecuted transaction paths, revealing only the executed path in a smart contract.

- Tapscript

- A new scripting language that works with Schnorr signatures and MAST.

- Ensures future scalability and flexibility for upgrades.

Greg Maxwell | Image via Coingeek

Greg Maxwell | Image via CoingeekSchnorr signatures were favored over the traditional ECDSA signatures due to their simplicity and security advantages, which made them ideal for multi-signature transitions. Schnorr signatures work similarly to their predecessors; in principle, they generate a pair of keys used to send and store cryptocurrencies. These signatures are more capable of handling multi-signature transactions and wallets.

Improved Efficiency With Schnorr Signatures

Schnorr signatures can concatenate signatures from multiple private keys into a single master signature indistinguishable from any other signature in form, which enables two advantages-

- Earlier, anyone could tell if a transaction originated from a multi-signature wallet by simply looking at the on-chain transaction data. With Schnorr, multi-signature transactions being indistinguishable from regular transactions is a favored scenario for privacy and security.

- With ECDSA, multi-signature transactions had to store signatures from every involved key pair, which made such transactions bulky and expensive to store on-chain. Multi-signature transactions under the new scheme consume the same space as regular signatures, improving the network efficiency.

Claus-Peter Schnorr | Image from Wikipedia

Claus-Peter Schnorr | Image from WikipediaMAST's Role in Smart Contracts

MAST introduces significant advancements in the way smart contracts can be executed on the Bitcoin network. Transactions that involve complex logic statements comprise several ‘if, then’ statements that define several paths that could lead to a successfully executed transaction.

Traditional scripts in Bitcoin before Taproot mandated the disclosure of all such paths and conditions for smart contracts on the network. MAST allows users to reveal only the specific conditions of a smart contract that are met for a transaction, which enables several possibilities-

- Privacy Benefit - This enhances privacy because less information is exposed on the blockchain. Only the relevant parts of a smart contract are made public when a transaction occurs.

- Conditional Flexibility - MAST enabled the construction of smart contracts with a variety of potential execution paths, particularly useful for contracts that require multiple, complex conditions, such as those involving escrow arrangements, multi-party agreements, or staged disbursements.

- Scalability Improvements - By only revealing the necessary parts of a smart contract during a transaction, MAST reduces the amount of data that needs to be stored on the blockchain, making individual transactions smaller and cheaper.

This is how MAST Trees look like | Image source: themoneymongers

This is how MAST Trees look like | Image source: themoneymongersTaproot Features

- Enhanced Privacy - Complex transactions look identical to standard transactions, improving anonymity and fungibility.

- Reduced Transaction Size - Aggregated signatures lead to smaller transactions, saving block space and potentially lowering transaction fees in multi-signature transactions.

- Improved Scalability - Efficiency in transaction size and verification aids overall network scalability.

- Advanced Smart Contract Capabilities - Enables more complex and efficient smart contracts while maintaining privacy.

- Future-Proofing - Tapscript allows for more straightforward future upgrades.

Tokenized Assets on Bitcoin

The Taproot upgrade, with its new capabilities, particularly through the inclusion of MAST (Merkelized Abstract Syntax Trees) and Schnorr signatures, has opened up more advanced possibilities for tokenizing assets and creating smart contract tokens on the Bitcoin network. While Bitcoin's functionality in these areas remains more limited compared to networks like Ethereum, Taproot has expanded the potential use cases:

- Enhanced Tokenization Capabilities - MAST enables the creation of more complex conditions around token ownership and transfer. It can also hide certain conditions of smart contracts, making private token transactions a possibility.

- Smart Contract Tokens - Taproot enables more sophisticated multi-signature requirements and conditional transfers for tokenized assets. This could be used, for example, in creating tokens that require consensus from multiple parties before they can be transferred or that have certain conditions tied to their movement.

- Financial instruments and DeFi - While Bitcoin's DeFi ecosystem is not as mature as Ethereum's, Taproot paves the way for more complex financial instruments on Bitcoin, such as tokenized stocks, bonds, or other financial assets, with embedded smart contracts to automate actions like dividend distribution or interest payments.

- NFTs and Unique Digital Assets - Although Bitcoin's structure is not inherently designed for NFTs as seen in the Ethereum ecosystem, Taproot's enhanced smart contract capabilities could enable a more basic form of unique digital assets or NFTs on the Bitcoin blockchain.

The Taproot upgrade broadens the scope of what's possible on Bitcoin, moving it a step closer to the functionalities seen on more smart contract-centric blockchains, albeit within its unique design philosophy and limitations.

Taproot Assets

The Taproot Assets protocol is a sophisticated system for issuing Bitcoin-native assets using the Bitcoin blockchain. This protocol leverages several advanced concepts in blockchain and cryptography to create a secure and efficient way of managing assets on the Bitcoin network.

Image via Twitter.

Image via Twitter.Here's a breakdown of how it works:

Taproot Transactions

Taproot is a significant upgrade to the Bitcoin protocol introduced in BIP 341. It allows for more privacy and efficiency in Bitcoin transactions. Taproot transactions differ from conventional Bitcoin transactions in that they can include complex scripts (smart contracts) in a tree structure, known as the 'tapScript branch', which is committed to the transaction. These scripts can remain private unless executed, reducing the data needed on the blockchain and enhancing privacy.

The Taproot Assets protocol utilizes several advanced cryptographic and blockchain concepts to enable the creation of Bitcoin-native assets. Among these, Taptweak, Sparse Merkle Trees, and Merkle Sum Trees play pivotal roles. Understanding the individual functions of each of these components helps in grasping how they collectively enable the creation of token contracts on Bitcoin.

Taptweak

Taptweak is a cryptographic technique used in the Taproot Assets protocol. It plays a crucial role in committing arbitrary data to a Bitcoin transaction without revealing it on the blockchain. Here's how it works:

- Committing to Data: Taptweak allows the modification (or tweaking) of a public key in a Taproot transaction. By tweaking the public key with a hash of the data (like asset information), the protocol commits to this data within the transaction.

- Privacy and Flexibility: This technique enables the inclusion of additional data (like token contract details) in a transaction while maintaining privacy. The data is committed to but not directly revealed on the blockchain.

- Selective Disclosure: Taptweak allows for the selective disclosure of the committed data. This means that the issuer can prove the existence and specifics of the asset without revealing all the underlying details on the blockchain.

Sparse Merkle Trees (SMTs)

Sparse Merkle Trees are a type of data structure used to efficiently prove the presence or absence of specific data within a set. In the context of Bitcoin-native assets, they serve several purposes:

- Efficient Proof of Inclusion: SMTs are used to prove whether a particular piece of data (like an asset or a transaction) is included in a set without revealing the entire set. This is crucial for verifying asset ownership or transactions.

- Data Integrity: They ensure the integrity of data by linking each piece of data to a unique hash. Changes in any data would result in a different hash, making tampering evident.

- Scalability: Due to their sparse nature, these trees are efficient in terms of space and computation, making them suitable for blockchain applications where resources are at a premium.

Merkle Sum Trees

Merkle Sum Trees are a variation of Merkle Trees where each node in the tree contains not just the hash of its children but also the sum of a numeric value (like the quantity of an asset) associated with its children. They are essential for:

- Verifying Asset Quantities: They allow for the efficient verification of the total quantity of assets without revealing individual holdings. This is crucial for ensuring that asset issuance and transfers adhere to the rules of conservation (like preventing double-spending or asset inflation).

- Integrity and Verification: Similar to SMTs, they provide a way to verify the integrity of the data. Any change in the quantity of assets would result in a different sum and hash, indicating a discrepancy.

Collective Role in Enabling Bitcoin-Native Assets

Together, these components enable the creation of token contracts on Bitcoin by:

- Embedding Contract Details: Taptweak allows for the inclusion of token contract details in a Bitcoin transaction in a private and secure manner.

- Managing and Verifying Assets: Sparse Merkle Trees and Merkle Sum Trees manage and verify the existence, integrity, and quantities of assets, ensuring that the rules defined in the token contracts are adhered to.

- Enhancing Privacy and Efficiency: These technologies collectively enhance the privacy and efficiency of asset transactions on the Bitcoin blockchain, making it feasible to issue and transfer assets in a decentralized manner.

In summary, the Taproot Assets protocol introduces a highly efficient and private way to issue and manage assets on the Bitcoin blockchain, leveraging the latest advancements in blockchain technology and cryptography. It represents a significant step forward in the capabilities of Bitcoin beyond just a currency.

Bitcoin Ordinals

Bitcoin Ordinals are a method of uniquely identifying and inscribing individual satoshis on the Bitcoin blockchain. Each satoshi, being the smallest divisible unit of a Bitcoin (1 Bitcoin = 100,000,000 satoshis), can be marked with unique information. This capability opens up a range of applications, including the creation of non-fungible tokens (NFTs) directly on the Bitcoin network. This concept leverages the Bitcoin blockchain's capabilities, particularly the enhancements brought by the Taproot upgrade, to create a new realm of possibilities for digital artefacts on Bitcoin.

Are Ordinals more than just NFTs? Check out our deep dive on Bitcoin Ordinals to know more!

Bitcoin Ordinals

Bitcoin OrdinalsHow do Ordinals Work?

- Inscription of Satoshis: The core idea behind Bitcoin Ordinals is the ability to inscribe data onto individual satoshis. This is done by embedding small pieces of data, such as images, text, or other digital artefacts, into a Bitcoin transaction. These inscriptions are permanently recorded on the blockchain, tied to the specific satoshi.

- Ordinal Theory: The concept relies on the ordinal theory, where each satoshi in the total Bitcoin supply (approximately 2.1 quadrillion satoshis) is assigned a unique ordinal number. This numbering starts from the genesis block and continues sequentially with each newly mined Bitcoin.

- Tracking and Ownership: Through these ordinal numbers, it becomes possible to track the movement and ownership of individual satoshis across the blockchain. This tracking is akin to following a serialized dollar bill as it moves through the economy.

Leveraging Taproot

The Taproot upgrade plays a significant role in facilitating Bitcoin Ordinals:

- Increased Efficiency and Privacy: Taproot introduces more efficient and private transactions through Schnorr signatures and Merkelized Abstract Syntax Trees (MAST). This efficiency is crucial for embedding and managing the additional data associated with Bitcoin Ordinals.

- Smart Contract Flexibility: Taproot enhances Bitcoin's smart contract capabilities, allowing for more complex rules and conditions to be embedded in transactions. This flexibility can be leveraged for managing the inscriptions and interactions of Bitcoin Ordinals.

- Reduced Transaction Costs: Taproot transactions can be more space-efficient, which is beneficial for inscribing data onto satoshis, as it potentially reduces the cost and blockchain space required for these inscriptions.

Bitcoin Ordinals open up a range of applications, most notably the creation of NFT-like assets on the Bitcoin blockchain. These could include digital art, collectables, or other unique digital items, each tied to a specific satoshi. The permanence and security of the Bitcoin blockchain ensure that these digital artefacts are preserved and verifiable.

What Makes Asset Tokenization on Bitcoin a Big Deal

The Taproot upgrade enables the issuance of Bitcoin-native assets, opening up a range of applications. Most notably, Taproot has inspired NFT-like assets and token contracts on Bitcoin, representing a significant cultural shift in the Bitcoin community. While it introduces welcome changes like enhanced privacy and efficient use of space, there are also challenges and implications that deserve attention. We have covered the benefits of Taproot. Let’s analyze some challenges and considerations:

Challenges

- Blockchain bloat: The practice of inscribing data onto satoshis raises concerns about blockchain bloat. As more data is embedded in transactions, it could increase block sizes and strain the network.

- Cultural Shift: Ordinals and Taproot Assets represent a shift in how Bitcoin is perceived and used. From being primarily a digital currency, this introduces a new dimension of digital asset creation and management on the Bitcoin network.

- Complexity and user understanding: The Taproot Assets protocol introduces a level of complexity that may be challenging for average users to understand. The concepts of Taptweak, Sparse Merkle Trees, and Merkle Sum Trees, while powerful, require a deeper understanding of blockchain technology and cryptography, a contrast against the simplistic nature of the Bitcoin ecosystem.

- Scalability: As the protocol allows for more complex transactions and scripts, there could be concerns about its impact on the scalability and performance of the Bitcoin network. Ensuring that these advanced features do not lead to bloating of the blockchain or increased transaction fees is crucial.

- Security Risks: With increased complexity comes the potential for security vulnerabilities. Ensuring the security of Taproot Assets transactions, especially when dealing with complex scripts and off-chain data, is paramount.

Implications

- Regulatory and Ethical Concerns: Issuing assets on the Bitcoin blockchain may attract regulatory scrutiny, especially regarding securities laws and compliance. Navigating the regulatory landscape and ensuring that Taproot Assets adhere to legal requirements is essential.

- Impact on Bitcoin’s Identity: Traditionally, Bitcoin has been viewed primarily as a store of value digital currency. Introducing Taproot Assets could shift this perception as Bitcoin begins to support more complex financial instruments and digital assets. This shift could have implications for Bitcoin's identity and how it's used.

- Adoption and Integration: For Taproot Assets to gain widespread use, there needs to be significant adoption by wallet providers, exchanges, and other key players in the Bitcoin ecosystem. Integration into existing systems and ensuring compatibility can be complex and resource-intensive. These overheads may dampen the incentive to migrate from the Ethereum-optimized product landscape.

In conclusion, Taproot represents a fascinating development in the Bitcoin ecosystem, leveraging scripts to expand the blockchain's capabilities beyond its original financial focus. While offering exciting possibilities, they also bring new challenges and considerations that must be navigated as this concept evolves.

Impact on Bitcoin (BTC)

- Enhanced Functionality: Taproot’s introduction of more complex smart contracts opens new use cases, such as more sophisticated financial instruments and enhanced digital identity solutions. This could broaden Bitcoin's appeal beyond just being a store of value or a medium of exchange.

- Improved Scalability and Efficiency: By making transactions more space-efficient, Taproot could indirectly contribute to better scalability and cheaper fees for the Bitcoin network.

- Increased institutional adoption: More advanced features could appeal to institutional investors and large financial entities, leading to a more stable and growing BTC market.

- Shift in Narrative: Taproot could lead to a change in perception of Bitcoin from a substitute for gold to a dynamic and programmable asset class. This shift could potentially divide the community between purists and experimentalists.

- Regulatory Response: Over the years, Bitcoin has cultivated a reputation and treatment as a commodity rather than a security. The recent upgrades to the protocol can potentially reignite this debate.

The Taproot upgrade has the potential to significantly impact Bitcoin both in the short and long term. While it brings enhanced capabilities and could lead to broader adoption and new use cases, it also introduces changes that could affect Bitcoin's market perception, regulatory treatment, and overall value proposition. The full extent of Taproot's impact will unfold as the Bitcoin ecosystem continues to evolve and adapt to these new features.

How Does Bitcoin Stack Up Against Other Layer 1 Protocols

The Taproot upgrade in Bitcoin, while significantly enhancing its capabilities, particularly in terms of smart contract efficiency and privacy, has a nuanced impact on other Layer-1 protocols with dedicated execution environments and virtual machines (VMs), like Ethereum. Here's an analysis of how Taproot affects these protocols:

Smart Contract Capabilities

Taproot improves Bitcoin’s smart contract capabilities, particularly around efficiency and privacy. However, these enhancements are still limited compared to the Turing-complete smart contract environments like Ethereum’s EVM or Binance Smart Chain's BSC. Some limitations are:

- Limited Scripting Language: Bitcoin’s smart contract language is intentionally non-Turing complete, lacking certain capabilities such as loops and complex logical constructs, essential for building complex, Ethereum-grade Dapps. Such limitations are essential to preserve Bitcoin’s core value around simplicity and security.

- Scalability Concerns: Bitcoin transactions adhere to a strict block size limit and do not maintain state between executions, limiting the possibility of building complex multi-step operations.

- No Oracle Support: Smart contracts on Bitcoin cannot natively access or interact with external data sources (oracles). This limits their ability to execute contracts based on real-world events or conditions that are not native to the Bitcoin blockchain.

- Transaction Fees: Unlike Ethereum, Bitcoin does not feature a gas-based system to measure the computational effort of transactions. Complex transactions, which could theoretically be more expensive, might become impractical during periods of high fees.

Impact on the Privacy Niche

Developers interested in building highly secure, efficient, and privacy-focused applications might be more drawn to Bitcoin post-Taproot. Users and organizations prioritizing transaction privacy and security over complexity, especially for financial applications, might prefer Bitcoin’s strengthened capabilities, though this won’t drastically shift the user base from more flexible smart contract platforms.

Network Effects and Ecosystem

The block space on Bitcoin is a more finite and precious resource than the space available on Ethereum. Taproot could inspire DeFi and NFT projects that value this resource to develop a vibrant ecosystem on Bitcoin. However, the current momentum in these industries is not feasible on Bitcoin, so this growth will likely be gradual.

Market Perception and Investment: Taproot’s capabilities are likely to attract more investors to Bitcoin, but these capabilities are not strong enough to drive investments away from other established Layer-1 protocols with different value propositions.

Bitcoin vs Layer 1s: Conclusion

The Taproot upgrade enhances Bitcoin’s specific set of capabilities, particularly around smart contract efficiency and privacy. While it marks a significant step forward for Bitcoin, it doesn't drastically alter the landscape for other Layer-1 protocols with dedicated VMs. Instead, it reaffirms Bitcoin's position in the blockchain ecosystem, potentially influencing other protocols in terms of privacy and efficiency features but not significantly encroaching on their domain of complex smart contract execution and diverse DApp ecosystems.

Parting Thoughts

Taproot's introduction to the Bitcoin network marks a pivotal moment for tokenized assets on this foundational blockchain. By enhancing Bitcoin's smart contract capabilities, Taproot broadens the potential for creating and managing tokenized assets with greater efficiency and privacy. The integration of Schnorr signatures, MAST, and Tapscript not only streamlines transactions but also introduces a level of sophistication previously unseen on Bitcoin. This is particularly relevant for tokenized assets, where the need for secure, transparent, and efficient transaction mechanisms is paramount.

Although Bitcoin, even with Taproot, remains fundamentally different from platforms like Ethereum in terms of smart contract complexity, this upgrade is a significant step towards making Bitcoin a more versatile platform for tokenization. It opens new avenues for assets to be tokenized and managed on the Bitcoin network, leveraging its unmatched security and trust. This development is crucial for investors and innovators in the blockchain space, signalling Bitcoin's growing adaptability and its potential to host a more diverse range of financial instruments. In essence, Taproot enriches the Bitcoin ecosystem, positioning it as not just a digital gold standard but also as a burgeoning platform for sophisticated, tokenized assets.