The past few weeks in the crypto world have been nothing short of remarkable. Market volatility remains a constant, with major crypto experiencing significant price swings and high-profile security breaches at several crypto exchanges have heightened concerns over cybersecurity in the digital asset space. Let’s dive in!

L1s, L2s & DeFi

State Of The Market: The Crypto Circus

This recent period has been marked by a mix of challenges and breakthroughs. For enthusiasts and investors alike, it’s a realm where change is the only constant, ensuring there’s never a dull moment in crypto!

TL;DR:

- Hacks impacted the crypto space, with notable breaches at Poloniex, Kronos Research, Velodrome, Aerodrome, Heco Bridge, and most notably Kyber raising security concerns.

- Inflows of $346M into digital asset investment products flowed into the space.

- Arbitrum is experiencing increased activity and inflows, surpassing other Layer 2 solutions.

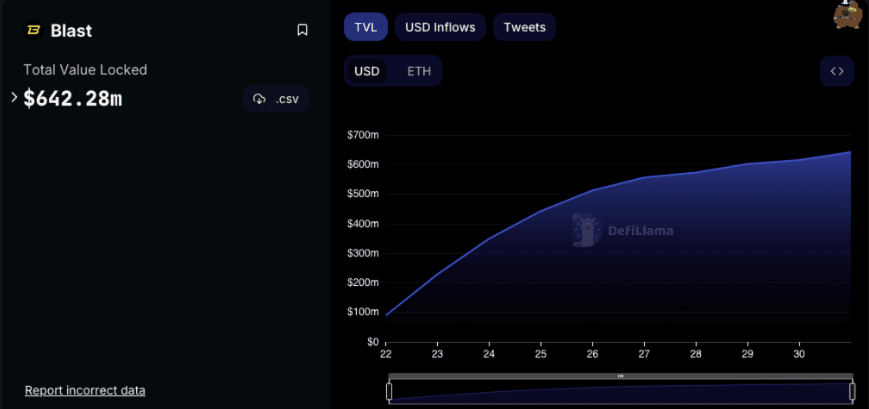

- Blast, an Ethereum-based Layer 2 network, gained attention with a Total Value Locked of $621 million within 10 days of launch.

Hacks

In recent developments, the digital asset space continues to grapple with significant security breaches. Notably, Poloniex suffered a substantial hack resulting in a loss of approximately $114M. Additionally, Kronos Research, known for its algorithmic trading and market-making in the crypto domain, faced a security breach with $26M in losses.

The incidents also extend to Velodrome and Aerodrome, where compromises in their front-end systems were reported. These incidents highlight the ongoing vulnerabilities in the infrastructure of digital asset platforms. Furthermore, the Heco Bridge, a cross-chain interoperability platform, was hacked, leading to a staggering loss of $115M.

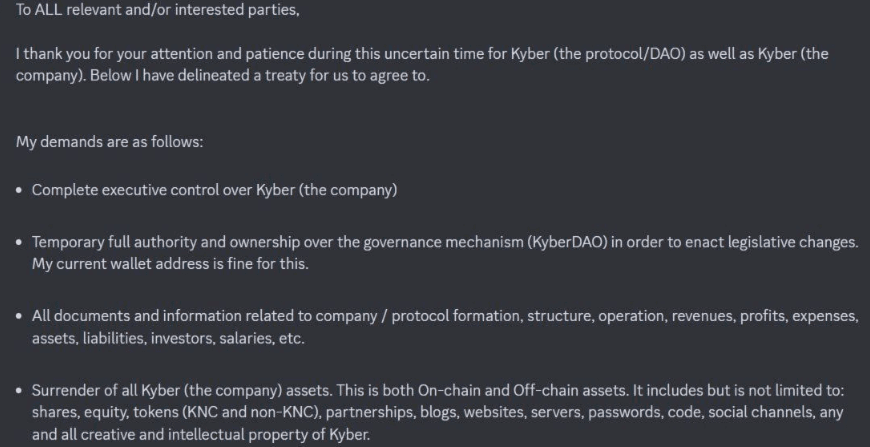

These events are not isolated but part of a series of significant breaches in the digital asset space. The most notable incident of the week involves the Kyber Network, where the hacker responsible has issued specific demands. This event has drawn considerable attention within the community. Read some of the hacker’s demands below.

The cumulative effect of these hacks is multifaceted. On one hand, they undermine trust in the digital asset space, causing concern among investors and users. On the other hand, some analysts suggest that these continuous attacks serve to strengthen the ecosystem by exposing and addressing vulnerabilities, essentially battle-testing the infrastructure.

Despite the resilience demonstrated by the space, the recurrent nature of these attacks poses a critical challenge. The pathway to a more secure and robust digital asset environment is contingent upon effectively addressing and mitigating these security vulnerabilities.

This evolution is essential for the advancement and mainstream acceptance of digital assets and blockchain technology. The situation also often prompts regulatory bodies to consider and potentially implement stricter regulatory measures to safeguard investors and maintain market integrity, which is ultimately stifling for the crypto industry.

In-flows

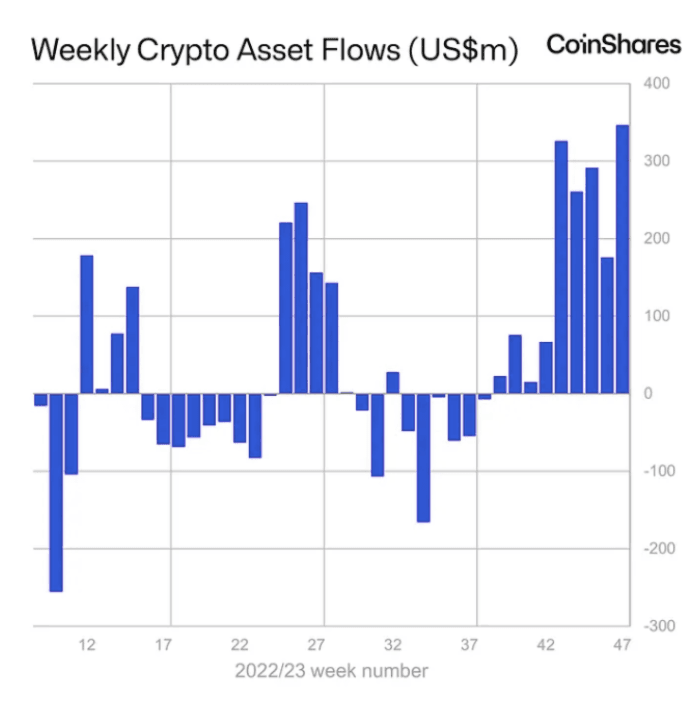

Last week, digital asset investment products experienced significant inflows of $346M, the largest in a nine-week streak, primarily driven by anticipation of a US spot-based ETF launch. This surge in inflows pushed total assets under management to $45B, the highest in over a year and a half.

Canada and Germany contributed 87% of the total inflows, while the US, presumably awaiting the ETF launch, only saw $30M in inflows. Additionally, other cryptocurrencies like Solana, Polkadot, and Chainlink received inflows of $3.5M, $0.8M, and $0.6M, respectively.

Source: Coinshares

Source: CoinsharesThe derivatives market is seeing a notable increase in activity, with DEX volume on track to surpass $75B, marking its highest monthly total since February 2022. DYdX is emerging as a frontrunner in the perpetuals ecosystem. Presently, it maintains a strong presence with daily volumes around $1B.

Source: Messari

Source: MessariArbitrum has recently seen a resurgence in activity. This is largely attributed to the introduction of a new Short-Term Incentive Program. Launched in September 2023, this program aims to allocate up to 50M ARB tokens from the Arbitrum DAO Treasury to support its ecosystem, particularly focusing on decentralized applications and DeFi projects.

Currently inflows into Arbitrum eclipse other L2s. Source: DefiLlama

Currently inflows into Arbitrum eclipse other L2s. Source: DefiLlamaBlast, a new Ethereum-based Layer 2 network, has reached a Total Value Locked of $621M within 10 days of its launch, closely approaching Solana's TVL. Blast was founded by Tieshun “Pacman” Roquerre, also the creator of the NFT marketplace Blur.

In summary: Despite recent challenges and security breaches, the crypto market remains healthy and on a positive trajectory. Major exchanges faced regulatory issues, but the market remained stable. Hacks occurred, raising security concerns, but the market continues to show resilience. Inflows of $346M into digital asset investment products indicate strong investor confidence. Layer 2 solutions like Arbitrum are experiencing increased activity, and new networks like Blast are gaining attention.

Blue Chip and Majors Overview

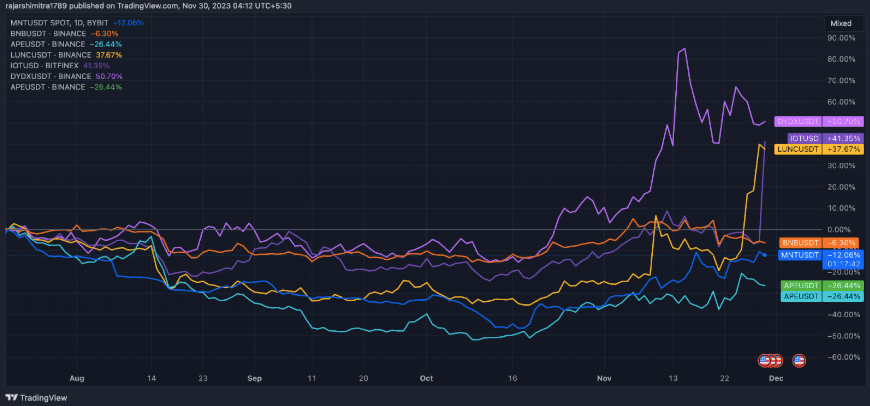

Source: TradingView

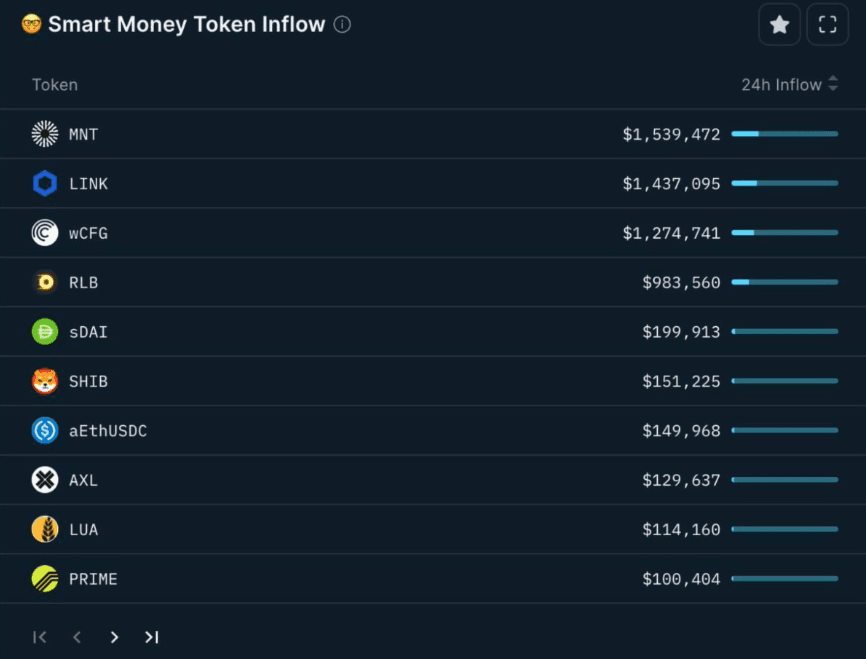

Source: TradingViewMantle has been on a tear this past week, going up by 13%. In fact, since October 19, 2023, MNT has been on an upward trajectory, delivering an impressive return of 62.5%. Currently, Mantle ranks as the world’s 6th largest layer 2 platform, boasting a Total Value Locked of $218M.

Source: Nansen

Source: Nansen- dYdX experienced an 8.5% decline in anticipation of a significant token release scheduled for December. This event will introduce $500M worth of tokens into the market, a development that is closely watched by investors and market analysts.

- Terra Luna Classic LUNC has experienced a remarkable surge, which saw it gain 60% in valuation over the last week. Since October 20, LUNC has gained a staggering 111.4% in valuation.

- BNB witnessed a 4% decrease over the past week amidst ongoing legal challenges involving its former chief, Changpeng Zhao. The situation escalated as CZ was officially designated a flight risk in the wake of the indictment proceedings by the Department of Justice.

- UNI pumped from $4.90 to $6.35, between November 22 and 28, as liquidity flowed in amid the Binance drama. However, the price has since dumped to $5.90.

- TORN has dumped by 57% since November 27 after its Binance delisting.

- SOL is up 5% this week. This is partly due to the performance of the Solana-based memecoin BONK, which is up 600% over the last 30 days.

- XRP dumped and broke below the $0.60 support line before recovering as whales dumped over 57 million XRP tokens.

- BLUR is up 7.5% this week due to the overall sentiment around its sister protocol BLAST - a new layer 2 platform.

Smart Money Movements

Tokens

- BitStable ($BSSB) has captured the attention of smart money, facilitating stablecoin generation against Bitcoin ecosystem collateral assets—a project that has piqued considerable interest.

- Recently, Smart Money has also acquired some $Auction, likely influenced by the launch of $BSSB on their platform (Bounce Finance).

- Another noteworthy development is the smart money bids on $BYPASS ,this week, a bot enabling users to trade on centralized exchanges like Binance without the need to log in.

- Additionally, $PLANET has caught the attention of smart money, shining in the realm of Real World Assets narratives.

- In the past week, several smart money addresses have accumulated $RVF as well.

Yield Farms

- Smart farmers are actively engaged in farming ETH and stablecoins on Ambient Finance pools on Scroll, waiting for the $Ambient drop, and maybe $Scroll soon too :)

- Lybra Finance continues to be a preferred choice among big investors.

- Smart Farmers are heavily involved with Prisma Finance, participating in various pools offering decent APRs, including mkUSD/USDC - Convex with an unboosted APR of 29.37% and a Total Value Locked of $3.67M!

- Some smart farmers have acquired $BLUR and deposited them on blur.io to farm points for the $BLUR S3.

Major Onchain Movements

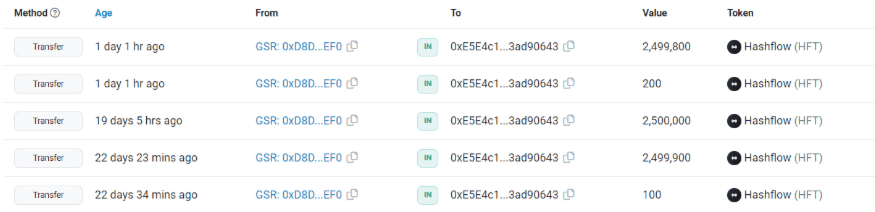

GSR has made a significant acquisition, obtaining $2.5M worth of $HFT which is close to 5% of the circulating supply in the last month and storing them in a newly created address.

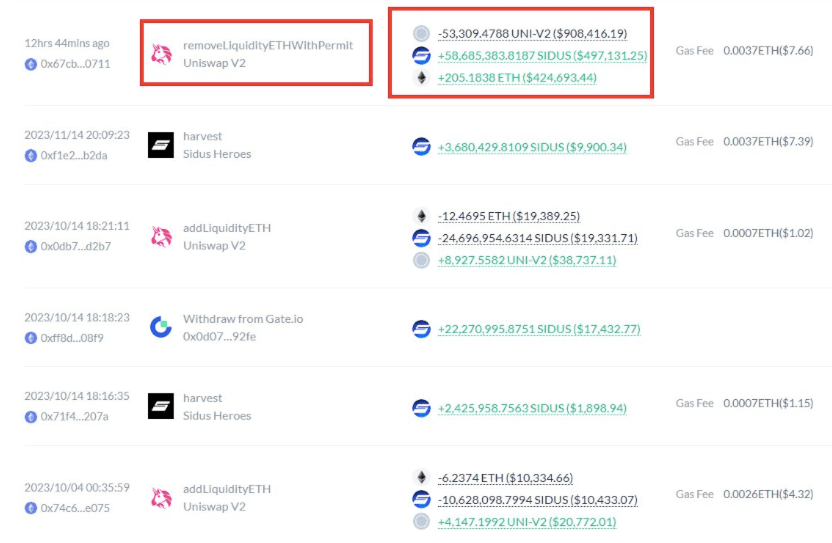

A whale (0xd5) recently removed 35% of the onchain liquidity of $Sidus. Explore their Debank Profile

This is just a preview of our L1, L2 and DeFi Weekly report, be sure to check out the full version of this report here.

NFTs & Gaming

Project Updates

- ReadON and MOBOX announce strategic partnership with the aim of unifying the Web3 gaming community.

- Ubisoft's 'Champions Tactics' NFT Game Is Coming to Animoca's 'Mocaverse'.

- Japanese giant SquareEnix to launch NFT auction for new Web3 game built on Ethereum and Polygon.

- Azuki DAO rebrands to ‘Bean' and abandons lawsuit against founder Zagabond.

- Pudgy Pendguins release an exclusive Walmart product titled ‘Influencer Box’.

- Game studio behind Matr1x Fire raises $10M for NFT mobile shooter.

- Magic Eden has introduced a wallet that will support Bitcoin, Ethereum, Solana, and Polygon. Users can apply for the waiting list via a link posted on their Twitter.

- According to CoinGecko research, 2,127 Web3 games failed in the past five years, accounting for 75.5% of the total, with an average failure rate of 80.8%.

- Blast, the new L2 built by Pacman, founder of Blur, has seen its TVL reach $600M in10 days.

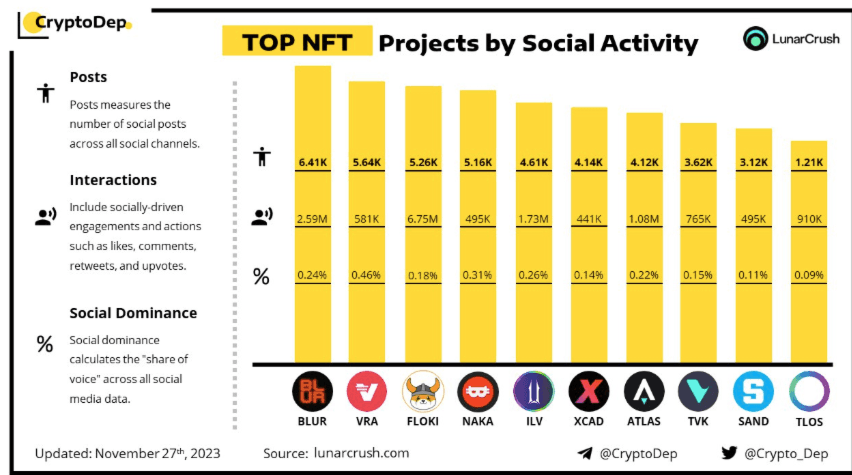

Social activity for numerous projects continues to be putting in higher highs. Blur is expected, but the addition of Floki, Naka, and VRA are noteworthy.

Source: LunarCrush

Source: LunarCrushBlue Chip Overview

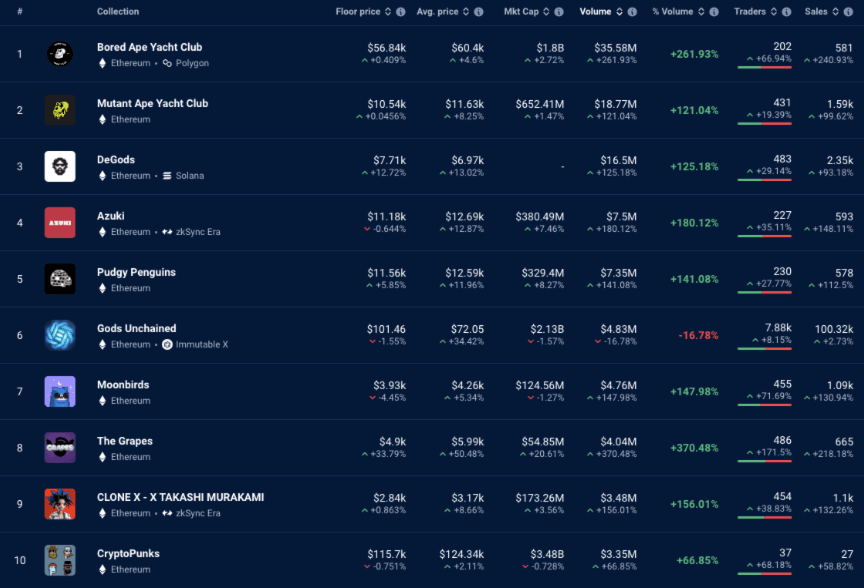

NFT trading volumes continue to rise, indicating a persistent interest among users in traditional NFTs. Despite concerns that the bear market would negatively impact NFTs, their popularity remains strong, with users recognizing the value of these digital collectibles.

It is likely that established blue-chip NFT collections will maintain their importance and value in the future. Notably, despite Crypto Punks dominating the highest sales in the last 7 days, this original blue-chip collection has either dropped out of the top ranks or moved toward the lower end. Additionally, Ordinals are experiencing significant trading volume on marketplaces like those launched by OKX, suggesting this trend is becoming a permanent feature of the BTC ecosystem.

Top 10 collections over the last 7 days. Source: DappRadar

Top 10 collections over the last 7 days. Source: DappRadarBlur continues to lead in NFT trading volume, surpassing OpenSea and demonstrating that a well-thought-out incentive structure can overcome the advantage of being a first mover in the space.

However, users should be aware that Blur has been flagged for a higher degree of wash trading. The recent launch of OKX’s NFT marketplace has seen a successful launch with a major increase in trading volume, most of this trading volume has been from BTC Ordinals. Meanwhile, Magic Eden has solidified itself as the go-to marketplace for NFTs on Solana.

Top 5 NFT marketplaces over the last 30 days with Non-EVM metrics included. Source: DappRadar.

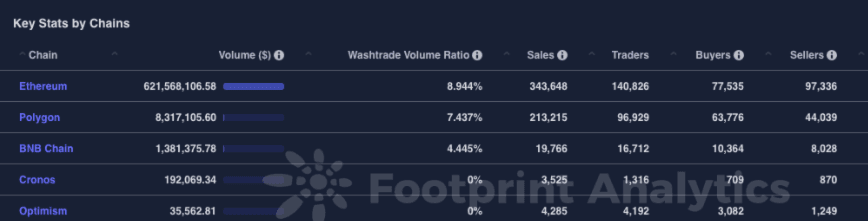

Top 5 NFT marketplaces over the last 30 days with Non-EVM metrics included. Source: DappRadar.Ethereum mainnet remains the primary hub for NFT trading, with many users showing a preference for trading on the mainnet. Despite the growth of successful NFT platforms on Layer 2 solutions like Arbitrum and Optimism, NFT trading on these networks has yet to gain significant traction. Interestingly, even with the increasing volume and liquidity in Arbitrum's ecosystem, NFTs appear to be a lower priority for Arbitrum traders, while Polygon continues to be the L2 favorite for NFTs.

Top 5 Chains for NFT trading over the last 30 days. Source: Footprint Analytics.

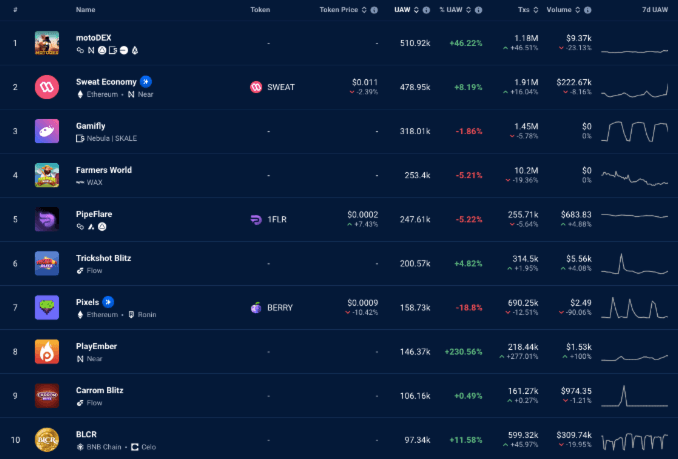

Top 5 Chains for NFT trading over the last 30 days. Source: Footprint Analytics.Gaming Activity: In recent weeks, the blockchain gaming landscape has witnessed a significant shift, with the majority of activity moving away from Polygon. Surprisingly, games like MotoDex and Sweat Economy have managed to surpass Alien Worlds in popularity. This is likely due to their play-to-earn mechanics.

Additionally, blockchain gaming has seen a surge in players using chains such as Flow, Near, Ronin, and Wax, indicating a dynamic and evolving gaming ecosystem across multiple platforms.

Top 10 NFT games over the last 7 days. Source: DappRadar.

Top 10 NFT games over the last 7 days. Source: DappRadar.Degen Corner

- DeFimons continues to make significant progress. The game is currently free to play and there is significant blockchain integration coming. Try it out here.

- Pixels is a casual farming game gaining popularity on the Ronin chain within the Axie Infinity ecosystem. The game's concept revolves around resource gathering, farming, and building your homestead while encouraging others to join. Check it out here.

- Duel Arena is a 1v1 dueling game for ETH prizes, integrated into Cambria. In this mini-game, players stake ETH in an on-chain escrow system and engage in virtual fights to the death for the staked ETH. The game is currently live and has gained significant traction, with over $1M USD worth of ETH staked in its duels.

- Kamigotchi is an on-chain pet RPG game originally developed on Canto and now set to launch on the Optimism Layer 2 (L2). The game features mechanics similar to Pokémon and includes an on-chain rooms system. While there isn't an exact release date, it is expected to be available in the first half of 2024. Keep an eye out for this one.

- Gaming related tokens have seen noticeable gains in the last week: $MAGIC(+16%), $ILV (+8.3%), $RON(+28.2%), $WILD(+32.9%), $RARE(76.4%), TLM(16.9%) and $GENE(48.1%).

- Major leaders in the NFT space such as $IMX(-9.3%) and $BLUR(-2.3%) have pulled back after making recent gains.

This is just a preview of our NFT Weekly report, be sure to check out the full version of this report here.

Enjoyed this article?

- Subscribe to Crypto Pragmatist by M6 Labs newsletter for crypto-native industry insights and research read by 30k+ subscribers

- Follow us on Twitter for Tweets providing top-notch insights and bridging the gap between users, builders, and leaders in the crypto space