GM, Anon! Welcome to this week's edition of the Crypto Market Pulse by M6 Labs, where we equip you with all the data necessary to navigate the market and capitalize on numerous lucrative opportunities.

Airdrop and points season is currently underway, and active traders stand to reap rewards beyond their wildest imagination in what promises to be the greatest bull market in history. Let's dive in! 🚀

Be sure to read through to the end and explore the complete report! We're delving into a plethora of ongoing and emerging opportunities such as,

- Check out Reboot, a native Arbitrum game offering potential rewards for future users.

- Initiatives such as Ethena Labs' Shard campaign

- Participate in the Apeiron airdrop campaign on Axie Infinity's Ronin chain.

- Register for the Masa token sale on Coinlist platform on March 4th.

- Engage with Lava Network's Magma reward points program by switching RPC connection to Lava.

- Contribute to Capx's Incentivized Testnet on CoinList and earn CAPX tokens.

- Follow the provided guide to start earning points with the Crystal Fun web3 gaming ecosystem.

- Consider staking BLUR tokens or bridging ETH to Blast L2 network to receive bonus BLSTR tokens.

- Participate in the Zap testnet bug bounty campaign and win prizes.

- Keep an eye on upcoming projects like Portal, set to join Binance Launchpool.

And much more!

*This is just a preview of our Crypto Market Pulse report, be sure to check out the full version of this report here.

Alpha Take

Source

SourceState Of The Market

Industry Updates

- In the United Kingdom, Economic Secretary to the Treasury Bim Afolami announced plans to introduce legislation for stablecoin and crypto staking services within six months, signaling the government's recognition of the growing importance of digital assets.

- European Central Bank states Bitcoin’s fair value is still zero, and is not suitable for payments or as an investment.

- Nvidia adds $277B in market value, the largest single-day gain in history.

- Reddit disclosed it has been investing excess funds into BTC and ETH.

- Meanwhile, the CME Group announced the upcoming launch of euro-denominated micro Bitcoin and Ethereum futures in response to increasing demand in the derivatives market. The move follows the success of their US dollar-denominated counterparts and is pending regulatory review, with a launch date set for March 18.

- In Asia, the Hong Kong Monetary Authority provided guidance on custodial services to enhance regulatory clarity, while Japan is considering allowing Venture Capital firms to hold crypto assets, aiming to support innovation in the tech sector.

- Honduras took a different stance by banning cryptos and related derivatives like ETFs in banking operations, diverging from the broader trend of crypto adoption seen in Latin America.

Project Updates

- ETHDenver 2024, the world's largest Web3 #BUIDLathon, is scheduled to take place from February 29 to March 3.

- Additionally, the Uniswap Foundation announced a tentative launch date for Uniswap v4, indicating that it is likely to debut in Q3 of this year.

- Andreessen invest $100M in EigenLayer.

- YCombinator's latest “Request for Startups” list includes a focus on crypto stablecoin startups, reflecting the growing interest in stablecoins within the startup ecosystem.

- The Worldcoin app has achieved a significant milestone, surpassing over 1M daily active users, indicating a strong uptake and adoption of the platform.

- Three Arrows Capital and Alameda Research continue to hold substantial amounts of WLD (WorldCoin).

- Chiliz's partnership with South Korea’s premier football league involves integrating "K League Fantasy" into the Chiliz chain, enhancing fan engagement and expanding the platform's reach into new markets.

- Fixed Float's confirmed hack of $26M hack.

- The dYdX DAO is currently engaged in a voting process to consider adding an EOS market to the dYdX chain, potentially expanding its offering and user base.

- With $375.28M of AVAX set to unlock on February 22, there may be potential market impacts as these tokens become available for trading or other purposes.

What is the Dencun Upgrade?

The forthcoming Ethereum Dencun update, scheduled for March 13, is anticipated to bring significant advancements to the Ethereum ecosystem, particularly impacting Layer-2 platforms.

- This upgrade aims to enhance scalability, bolster security measures, and improve user experience within the Ethereum network.

- Noteworthy enhancements introduced by the Dencun update include scalability boosts, reductions in on-chain data storage costs, fortified security measures, optimization of EVM performance, and enhancements to network security protocols.

- A standout feature of the Dencun update is the introduction of Proto-Danksharding, which introduces novel 'blob-carrying transactions' to alleviate transaction costs for Layer-2 users and elevate Ethereum's transaction throughput.

- Analysts forecast a substantial decline in transaction fees for Layer-2 platforms, rendering them more commercially attractive for both developers and users.

- This shift is poised to positively impact various sectors, including DeFi, gaming, and on-chain trading.

- Following the Dencun update, platforms are anticipated to witness heightened adoption and activity, thereby contributing to the overall expansion of the Ethereum ecosystem.

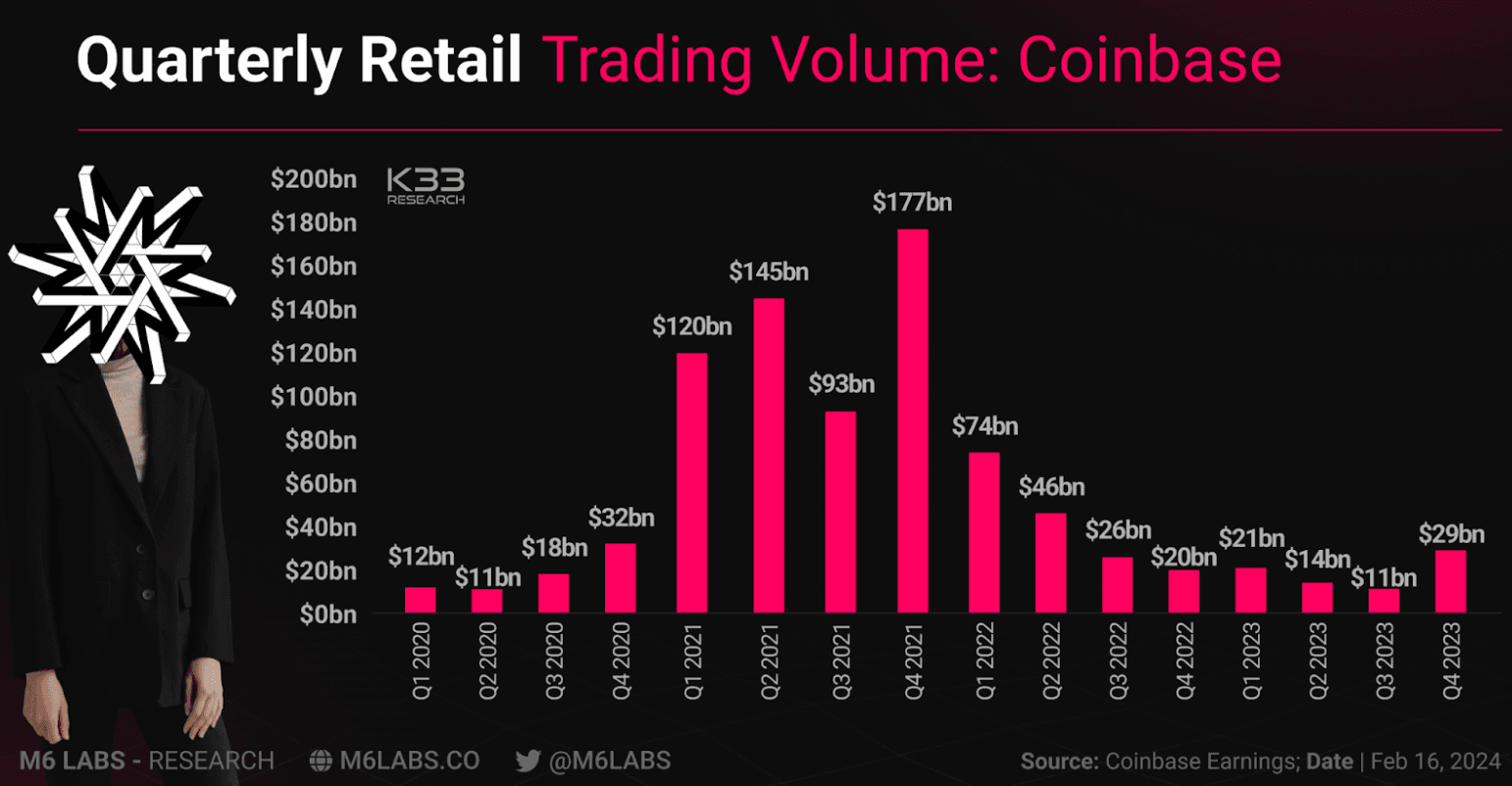

Retail trading activity on Coinbase remained subdued throughout the fourth quarter of 2023.

- While it represented the highest quarterly retail volume since the second quarter of 2022, it remained notably below the levels observed in the fourth quarter of 2020.

- Additionally, it accounted for only 16% of the peak retail trading volume witnessed in the fourth quarter of 2021.

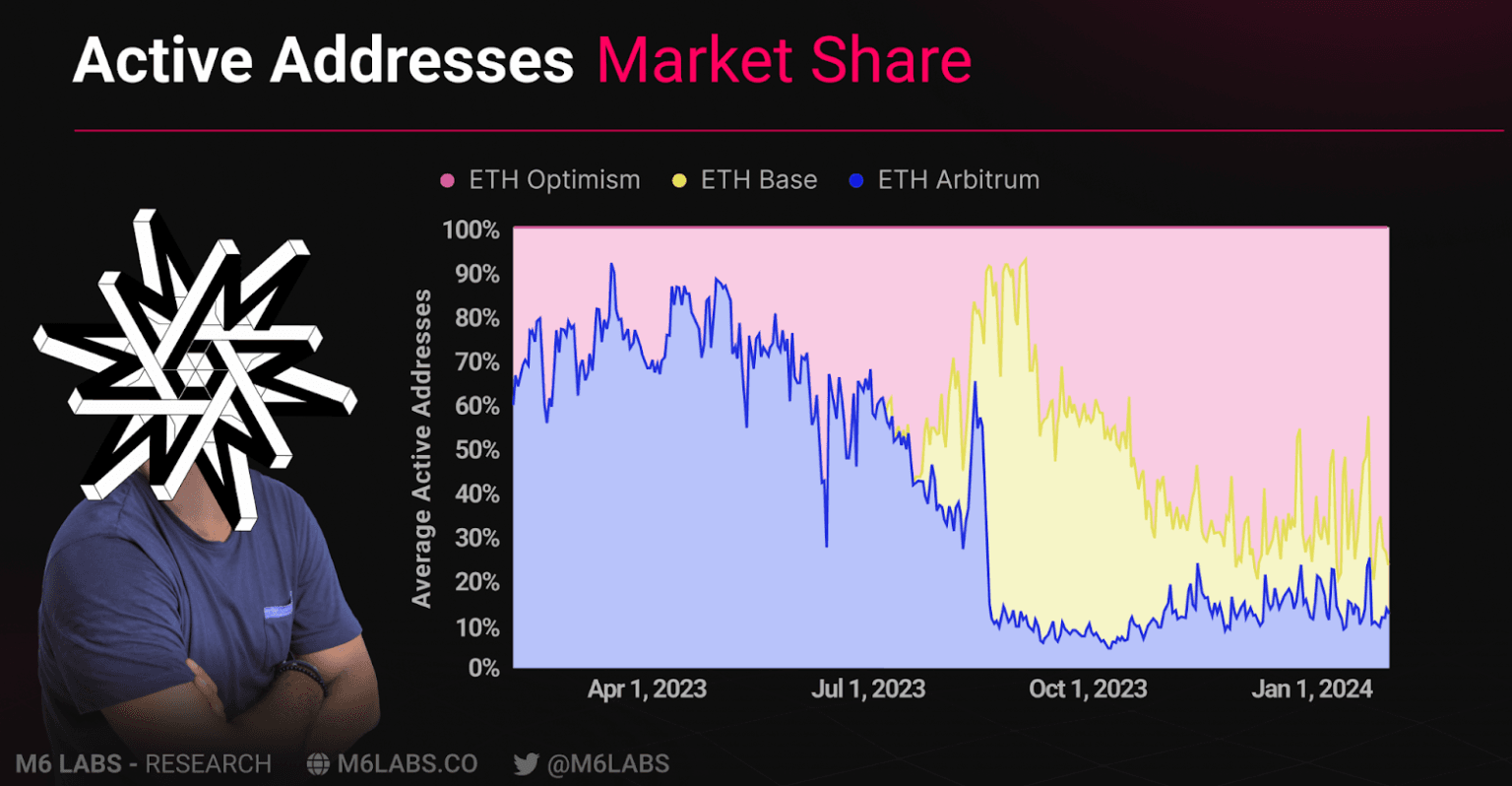

Consistently, the Optimism Mainnet maintains over 60% of the daily active addresses among the top optimistic rollups.

Optimism has recently launched its 4th airdrop for creators within its ecosystem, with a significant amount of OP still available for upcoming distributions.

- If you're a frequent user of Layer-2 solutions, now might be an opportune moment to consider transitioning some of your activities to Optimism to capitalize on future rewards.

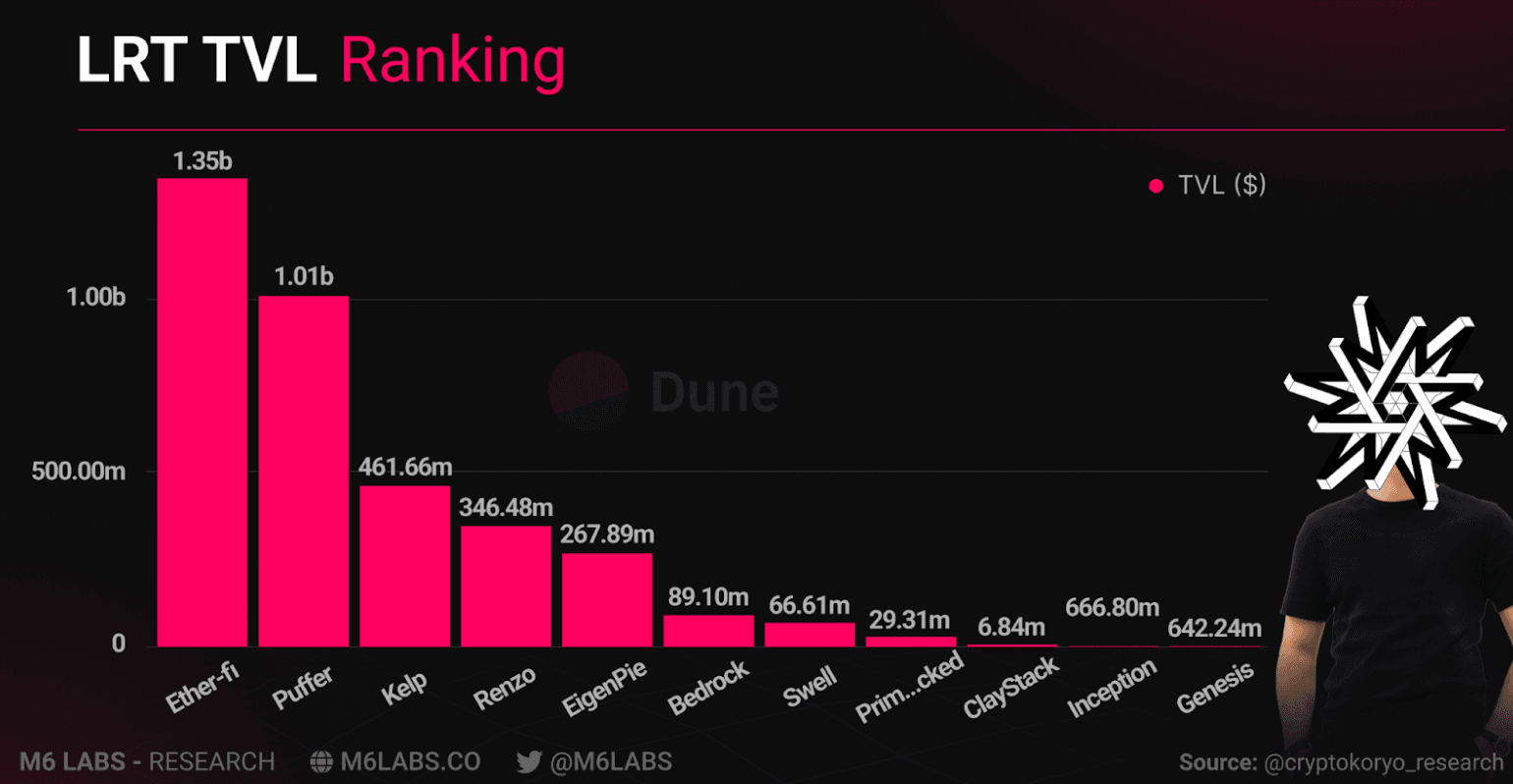

The rise of Liquid Restaking Tokens (LRTs) has injected new life into Ethereum's DeFi arena, Platforms such as Puffer and Ether.Fi have attracted substantial deposits, leveraging EigenLayer's restaking protocol, which taps into Ethereum's security framework.

- While investors are enticed by the promise of higher yields, skeptics caution against the speculative nature of the "points" frenzy associated with these liquid restaking platforms.

- These points, offering potential future rewards and airdrops, have driven a surge in deposits reminiscent of the yield farming frenzy of 2021.

- Despite the risks involved, proponents argue that there is genuine value beyond the hype, as liquid restaking presents a novel method for securing blockchain protocols and networks.

- Consider staking ETH on platforms like Ether-fi, Puffer, and others if you find this intriguing and have funds you can afford to potentially lose.

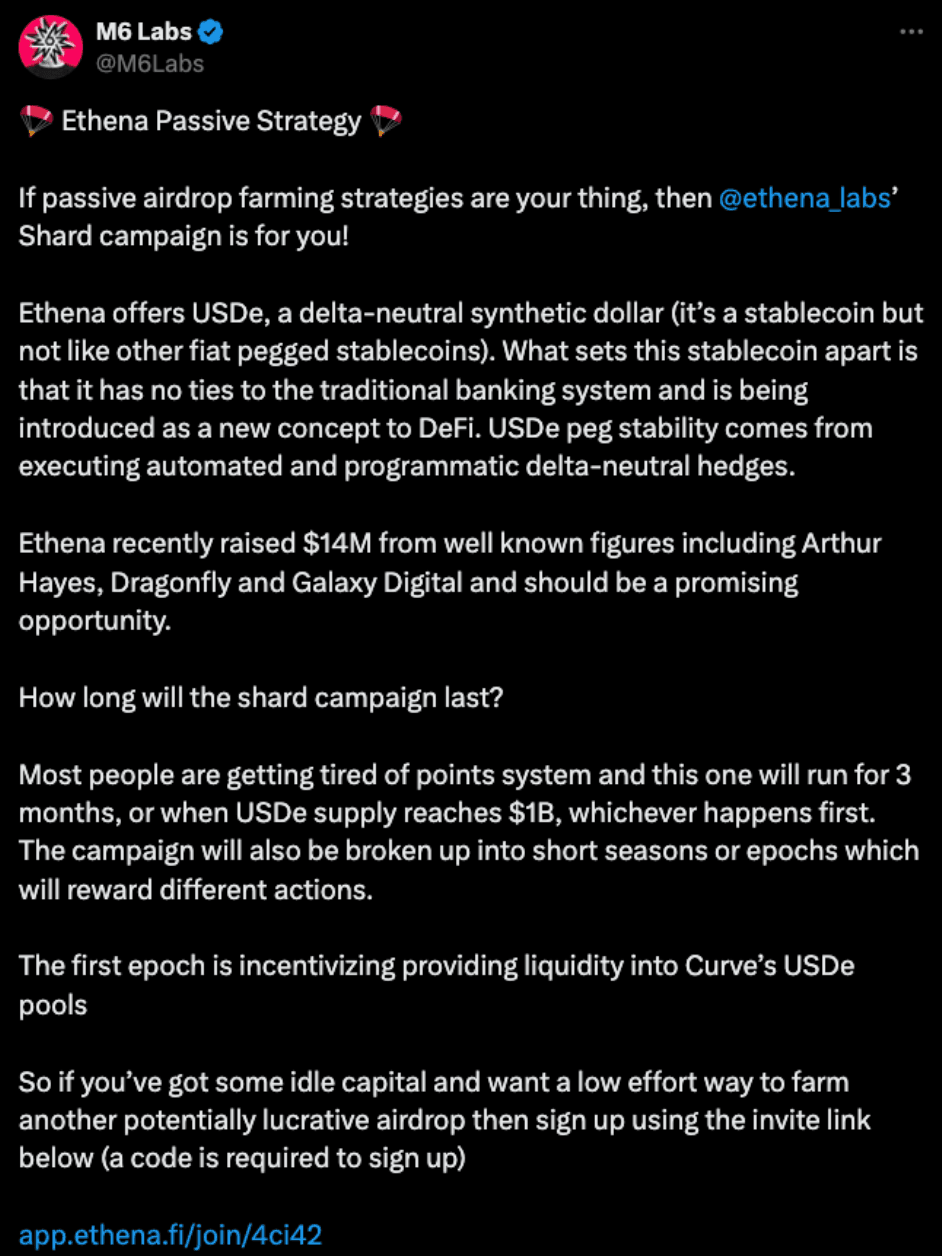

On February 19th, Ethena Labs unveiled its mainnet, a significant milestone in the project's development. The launch of Ethena's Shard campaign marks the official debut of USDe to the public

- Shards, designed to track and quantify users' contributions during the campaign, will play a crucial role in fostering community participation and activity.

- Notably, Ethena Labs recently secured $14M in funding, led by Dragonfly Capital and backed by PayPal Ventures and other investors.

- Furthermore, it's worth noting that the mkUSD/USDe pool is the only remaining 20x pool available, with all other pools already at capacity.

- However, users still have the opportunity to farm Shards by holding USDe tokens, which offers a 5x multiplier and presents an alternative pathway to participate in the ecosystem's rewards program.

- Follow the strategy below released by M6 labs earlier this week to get in on the action.

Source

SourceLava Network, a modular blockchain developer, recently secured $15 million in a seed funding round, co-led by Jump Capital, Hashkey Capital, and Tribe Capital.

- Ahead of its mainnet launch, Lava introduced a reward points program called Magma, allowing users to earn points by switching their RPC connection to Lava.

- While details about the utility of Magma points are undisclosed, this move reflects a growing trend in crypto to incentivize user engagement.

- Follow this guide to get start earning points.

Capx, a project launched on CoinList, endeavors to create an inclusive platform where all contributions, ranging from data curation to computational prowess, are esteemed and compensated with CAPX tokens.

- This initiative aims to cultivate a global community dedicated to shaping the future of AI. The project has recently unveiled its Incentivized Testnet on CoinList, marking a grassroots initiative aimed at propelling the network's expansion.

- To incentivize participation, Capx is offering 15,000,000 tokens (~1.5% of the total token supply) to eligible users who contribute to the testnet.

- Get involved here.

Bitcoin

Spot Bitcoin ETFs have made significant strides, boasting a combined total of $37B in assets under management, a remarkable feat that brings them closer to rivaling the holdings of gold ETFs.

- In January alone, Bitcoin ETFs garnered the lion's share of new launches' AUM, capturing an impressive 83%.

- Looking ahead, Standard Chartered predicts a substantial influx of funds into Bitcoin ETFs, with forecasts suggesting that US retirement plans could inject a staggering $100B into these investment vehicles by 2024.

- This anticipated surge reflects a growing recognition of Bitcoin's potential as a lucrative investment opportunity among institutional and retail investors alike, further solidifying its position as a mainstream asset class with significant growth prospects.

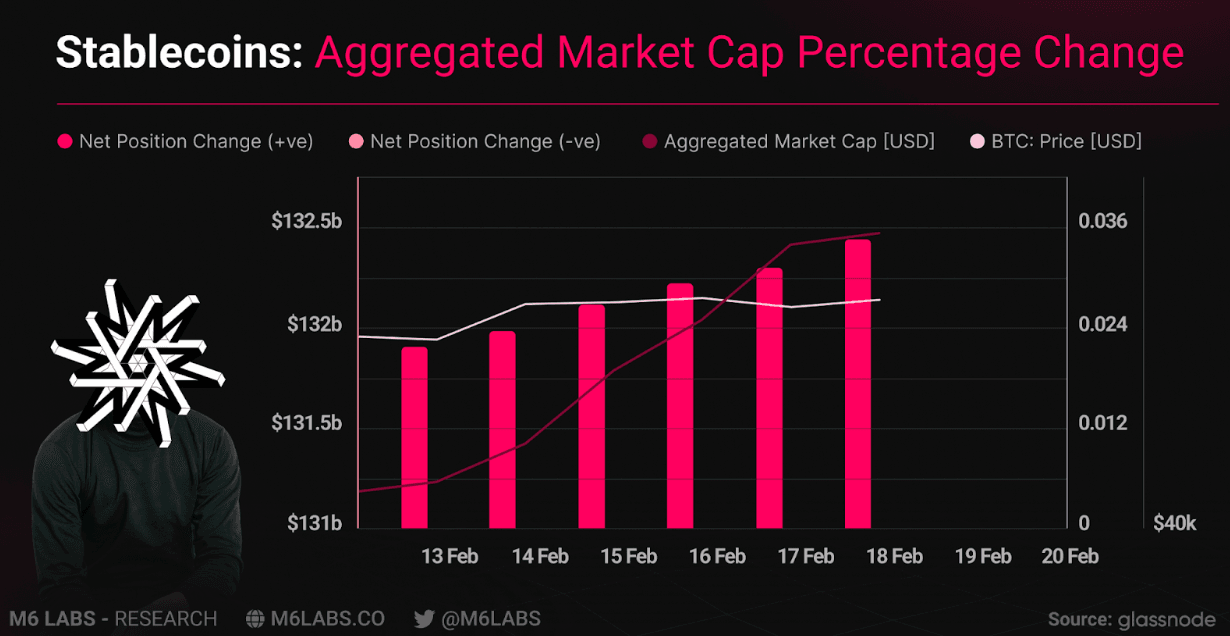

The recent surge in Bitcoin's value has coincided with a rise in the combined market capitalization of leading stablecoins, including USDT, USDC, BUSD, and DAI.

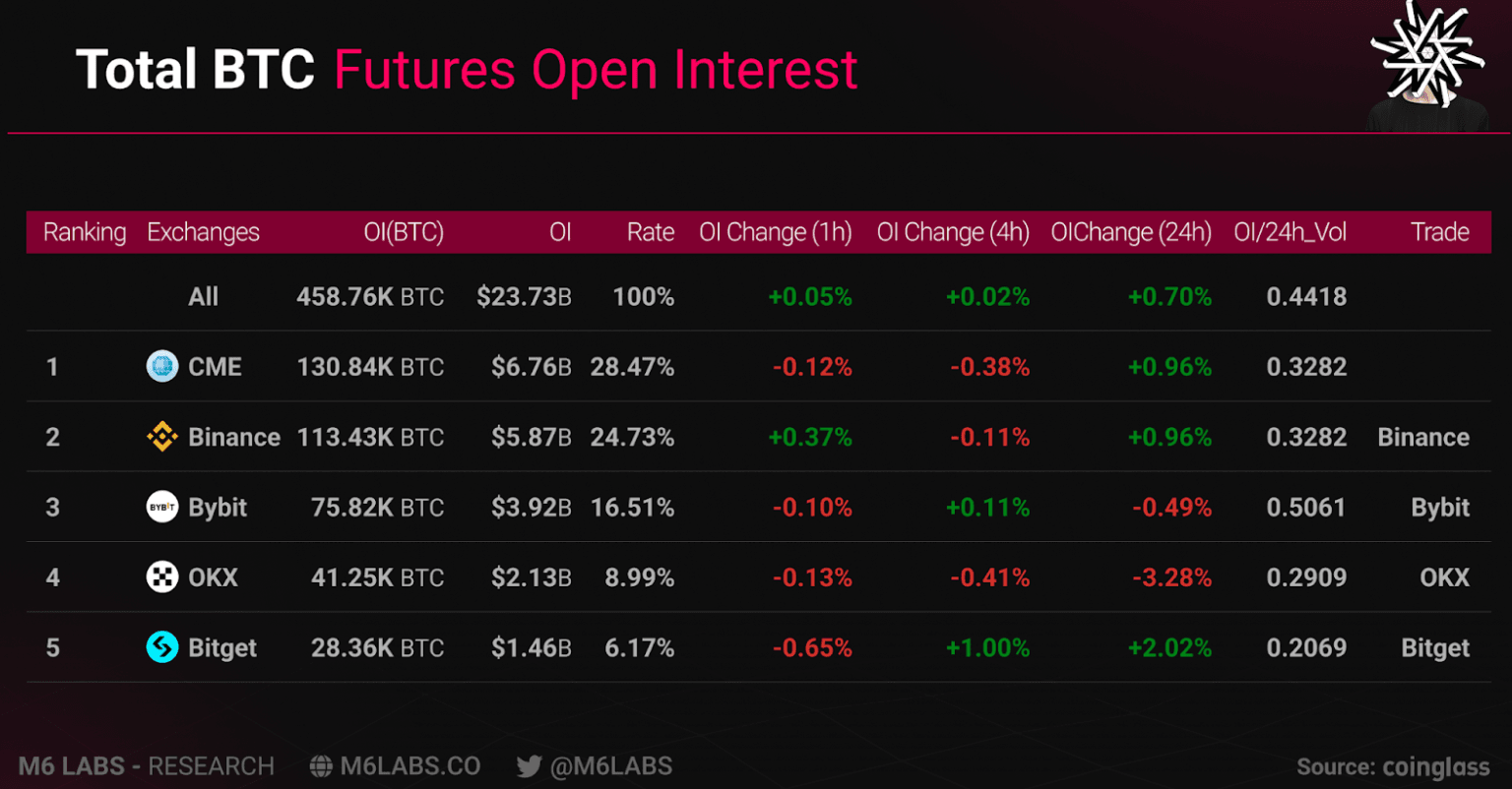

The surge in Bitcoin open interest marks a significant milestone, reaching levels not witnessed since 2021, at over $23B.

- The notable increase in open interest suggests heightened speculation and anticipation regarding future price movements, indicating a growing number of market participants taking positions in Bitcoin derivatives.

Source

SourceL1s, L2s & DeFi

Blue Chip and Majors Overview

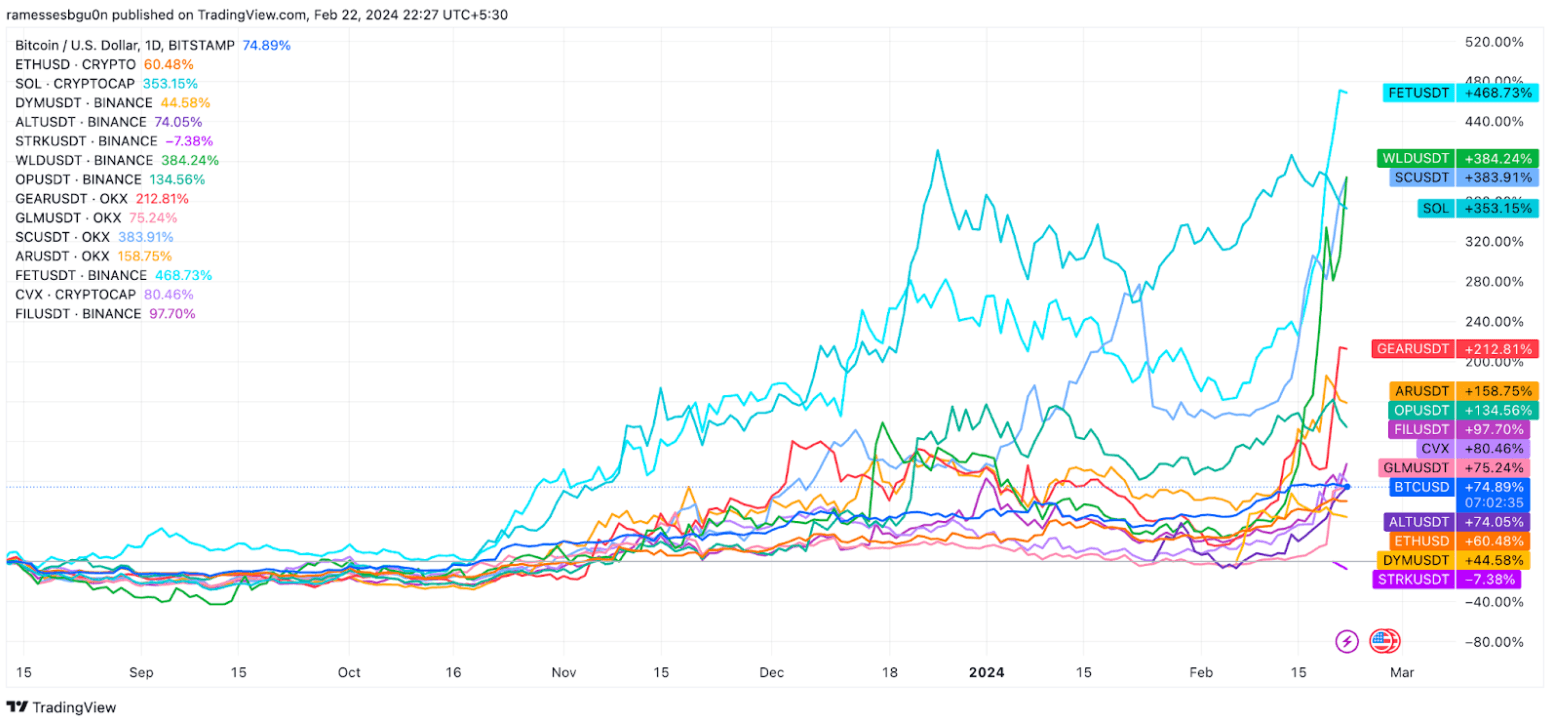

Bitcoin (BTC)

Bitcoin’s price surged during the first half of February, helping it cross the $50k mark. However, things have been sluggish lately. Despite all the noise around recent developments, the premier crypto has struggled to make any meaningful gains since reaching the $52k mark. Despite this recent sideways movement, many, such as Fundstrat’s Tom Lee, believe Bitcoin could surge to $150k this year. An unprecedented rally is possible thanks to two major events: the approval of the spot Bitcoin ETFs, which has increased demand, and the upcoming Bitcoin halving event, which will reduce supply. However, some have suggested that Bitcoin prices may cool down for a while.

Ethereum (ETH)

The Ethereum price surged past $3k on the 21st of February, 2024, a price level not seen since April 2022. ETH hit the $2800 price level on the 20th of February and has since then been on an upward trajectory, hitting $2881 on the 19th and then rising 4% over 24 hours to reach a level of $3014. However, after reaching this level, the price has retreated, albeit only marginally, receding by 1.6% over 24 hours. Several factors are driving ETH’s recent stellar performance, such as the Dencun upgrade and news about the spot Ethereum ETF.

- AltLayer (ALT) - AltLayer has just closed a $14.4M strategic round led by Polychain and Hack VC. This comes against the backdrop of the protocol coming under fire after its recent airdrop as concerns grew that it favored select users, leading to the protocol facing considerable community backlash. The ALT token has done rather well since its airdrop and has risen by nearly 50% over a 14-day period.

- Starknet (STRK) - The initial euphoria around the STRK token seems to have long dissipated as the token continues to tank in value. The STRK airdrop has seen eligible users claim 45M tokens so far. Following the listing, STRK was trading at $5 on some exchanges. However, the current scenario is in stark contrast, as the price has plummeted to $1.85. This staggering drop can be attributed to Nethermind and airdrop farmers dumping millions of STRK tokens, driving down the token’s value.

- Worldcoin (WLD) - Worldcoin is Sam Altman’s iris biometric cryptocurrency project. WLD, its native token, has seen an unprecedented surge, gaining nearly 250% over a 14-day period. The token has already beat its previous all-time high of $7.95, set just three days ago, and is currently trading at $8.27 after breaking past the $8 level. Apart from bullish market sentiments, several other factors have driven this rally, such as the growing adoption of the Worldcoin project and the whale accumulation of the WLD token. Additionally, the potential and hype around Sora have also added to the optimism around the WLD token.

- Optimism (OP) - Optimism recently announced its fourth airdrop, with the OP token currently bullish across all charts. OP has registered an increase of 61% over the past year. The token recently reached its all-time high of $4.23 just over a month ago. OP is currently trading at $3.82, up by over 13% over the past couple of weeks.

- Dymension (DYM) - The initial hype around the DYM token seems to have settled down a bit after it was launched in one of the most hotly anticipated airdrops of the year. However, since hitting its all-time high on the 6th of February, the price has retreated. DYM has shed over 12% over the past week and is currently trading at $7.11

- Sui (SUI) - Sui has seen a considerable increase since the beginning of the year and has registered an increase of nearly 60% over the past 30 days. The token hit its all-time high on the 14th of February. However, the price has dropped after failing to get past $2, and is currently trading at $1.69. Sui has seen significant inflows of over $300M in 30 days, helping it overtake protocols such as Aptos and Cardano in total value locked. This could have a positive impact on the price of the SUI token.

- Solana (SOL) - Solana has seen the price of its SOL token decline considerably amid waning investor interest, bringing an end, for the time being, to its blistering run in 2024. SOL started 2024 in a surging fashion. However, the token could not push past $120, and the past seven days has seen its value maintain a downward trajectory. SOL dropped to $101 on the 22nd of February before staging a recovery. Currently, SOL is trading at $106.22. Additionally, the network has also seen a 30% drop in active addresses.

- Gearbox (GEAR) - The GEAR token has seen a considerable increase over the past week, reporting an increase of nearly 60% over the 7 days. GEAR jumped from $0.0092 on the 20th of February to its currency level of $0.016. Gearbox is the first DeFi protocol to add leverage into Ethereum re-staking.

- Golem (GLM) - GLM has seen a significant jump in price beginning on the 19th of February. In fact, the token has reported a nearly 70% increase over seven days, with the price peaking at $0.42. Currently, GLM is trading at $0.37 after experiencing a slight decline. However, news that Binance has launched GLM perpetual contracts with leverage options could positively impact the price.

- Siacoin (SC) - Siacoin (SC) has seen its price jump by nearly 70% over the past week. This significant jump in price has been attributed to several factors, such as ongoing market trends, technical developments, and major updates from the Siacoin team. The update from the team highlighted several achievements regarding stability, performance, and user experience. However, most of this price rise came from investors and traders.

- Fetch.ai (FET) - AI-based tokens are pumping following renewed interest in the sector thanks to OpenAI’s Sora, and Fetch.ai is no different. The FET token has reported an increase of nearly 100% over the past 14 days in a rally that saw the token almost beat its all-time high of $1.19. Currently, FET is trading at $1.11 and could set a new all-time high if AI-based tokens continue to pump.

- Arweave (AR) - Arweave’s AR token recently hit an 18-month high as developments continue within the Arweave ecosystem. The token has gained nearly 60% over 14 days in a rally that has seen it surge to $16 on the 20th of February. This substantial price movement became one of the top gainers among the top 100 cryptocurrencies. Currently, the AR token is trading at $13.30.

- Ondo (ONDO) - ONDO has generated a surge of interest since its launch on the 18th of January, with the token maintaining its upward trajectory. The token has risen by over 22% in 24 hours, registering a new all-time high of $0.40 merely hours ago. The token is currently trading at $0.38.

- Convex Finance (CVX) - Convex Finance recently suffered a breach that led to $180.25M worth of BEAM tokens being stolen. However, the platform’s CVX token does not seem to have been impacted by the bad news, given it has reported an increase of nearly 40% over the past 7 days. Currently, CVX is trading at $4.88, an 11% increase over 24 hours.

- The Graph (GRT) - The GRT token has registered a 19% increase over the past 24 hours, a 54% increase over the past week, and a near 100% increase over the past 30 days, suggesting it may have put a bearish January behind it. But what is behind this meteoric rise? With the surging interest in AI tokens, The Graph, which provides critical infrastructure, has been attracting renewed interest from users and traders alike, leading to a surge in value.

- Filecoin (FIL) - Filecoin’s FIL token has seen a surge in value over the past couple of days, helping it register an impressive increase of 30% over the past 7 days. The surge can be attributed to the news of Solana integrating Filecoin to help increase its block data accessibility. Another development that could positively impact the price of the FIL token is the news that Binance will be listing the token in a slew of new additions to its offerings.

Smart Money Movements

Smart Money is still into AI tokens, especially the ones with a working network.

- $NMT is still favoured among the smart money; the team cut the emissions heavily, and the sell pressure has been reduced because of it.

- The $NMT mining rewards were CRAZY, you could mine 1000 $NMT a day with a 4090 GPU, which means that you could cover the cost of the GPU in 12 hours! It got diluted in a few days and reduced to 400 tokens/day for each 4090 GPU, until today that it's around 100 tokens. A 90% reward decrease in a few days, as it got diluted by more miners and also the team decreased the emissions.

- Another interesting AI token that caught the attention of smart money is $CDX. CodeX allows users to create dApps on more than 20 chains, it means that you can deploy your DEX, launchpad, or any smart contracts with a few clicks with zero coding experience. Pretty interesting, yeah?:)

- Smart Money has been interacting with mixer projects like $WHIRL and $LOCK, as the fixed float has been exploited, and the mixer protocols were able to cover their absence pretty well, so they got good traction.

- By the way, WHIRL utilises rhino.fi, and they've built a privacy layer around it. rhino.fi is a new bridge that supports a variety of chains, something similar to Orbiter, which is fast and cheap. One of the most favoured bridges among the airdrop farmers.

- While $LOCK is utilising CEXs' APIs like Binance and OKX, and their privacy layer is built around these exchanges, which is still pretty centralised, but it works really well. FYI, $LOCK is the new version of $POOF, The HoudiniSwap.

- $FLIP has been popular among the smart money as well. Flip chain is basically a cross-chain AMM aka bridge, similar to $RUNE that enables BTC <=> ETH native bridge. It's a new token so you know the drill.

NFTs

- Walmart expands availability of Pudgy Toys to 1,100 more stores.

- NFT data platform BitsCrunch (BCUT) had its primary listing on February 20th. KuCoin, Bybit, Gate, and CoinList Pro listed BCUT. BitsCrunch raised $3.8M via a public sale round on CoinList in December 2023, with the token sale price set at $0.055.

- Gmoney's 9dcc Collection 01, the first full NFT fashion collection, caters to the 'Crypto Mob' and is making its debut at NFT Paris and Paris Fashion Week.

- The mobile strategy game Heroes of Mavia (MAVIA) has hit a milestone of 2M downloads. Initially reporting 1M downloads in early February during the launch of the MAVIA token, the startup later announced 2M downloads across both the App Store and Google Play.

- Avalanche's entry into the booming NFT ticketing landscape is significant and not to be taken lightly.

- ApeCoin has introduced the ApeKin 3D model as its official mascot.

- In just two weeks of presale, 5thScape (5SCAPE) has launched its first VR game trailer and raised over 200K.

- The World of Women NFT Collection is hosting its second annual gala event in Paris, featuring WoW's new Friendchip bracelet wearable and Patio networking platform.

- Citizen Conflict has unveiled its 2024 roadmap, outlining game development plans including beta and public launches, new game modes, esports campaigns, and a full public release.

- Ronin's price surged after the Ethereum gaming network announced a halving of RON rewards.

- Moonbeam has teamed up with crypto gamer Animo with the aim of bringing 'Stars Arena' to PlayStation.

- Yuga Labs has acquired Proof and assumed control of the Moonbirds NFT brand.

- LayerZero and Xai Foundation have formed an alliance to revolutionize blockchain gaming.

- Crystal Fun, a web3 gaming mega-ecosystem and studio, secured $5M in a Seed funding round. The investment was made by KuCoin Ventures, Actoz Soft, Waterdrip Capital, Comma3 Ventures, Stratified Capital, Cypher9 Ventures, Aelf Blockchain, W Labs DAO (Watermelon Labs), and Masverse.

Quick Tasks

- Check out Reboot. A native Arbitrum game that seems like it will reward future users.

- Mint a free Uniswap on Zorb NFT

- Mint a free Coinbase Earnings NFT

- Mint a free Botanix Testnet NFT

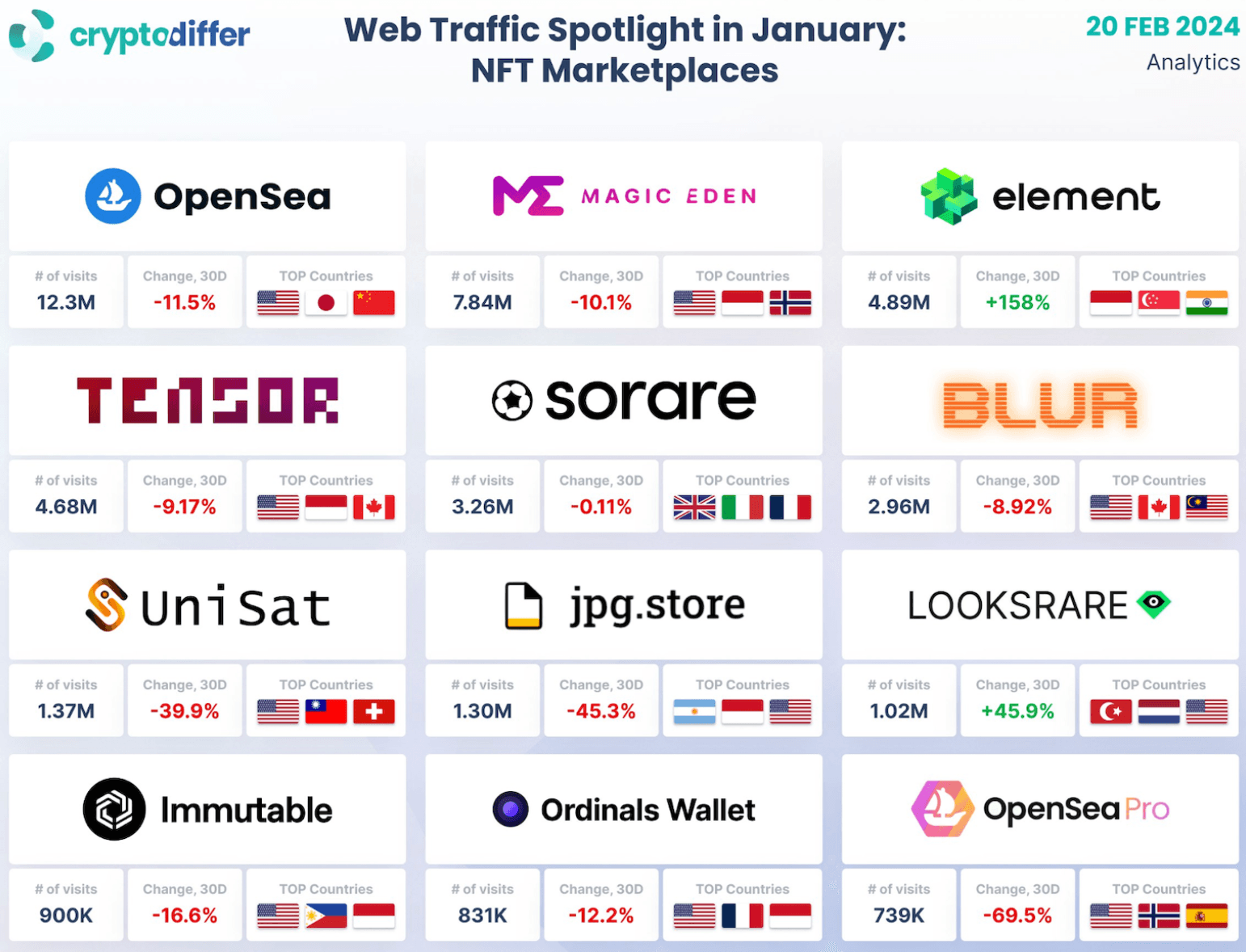

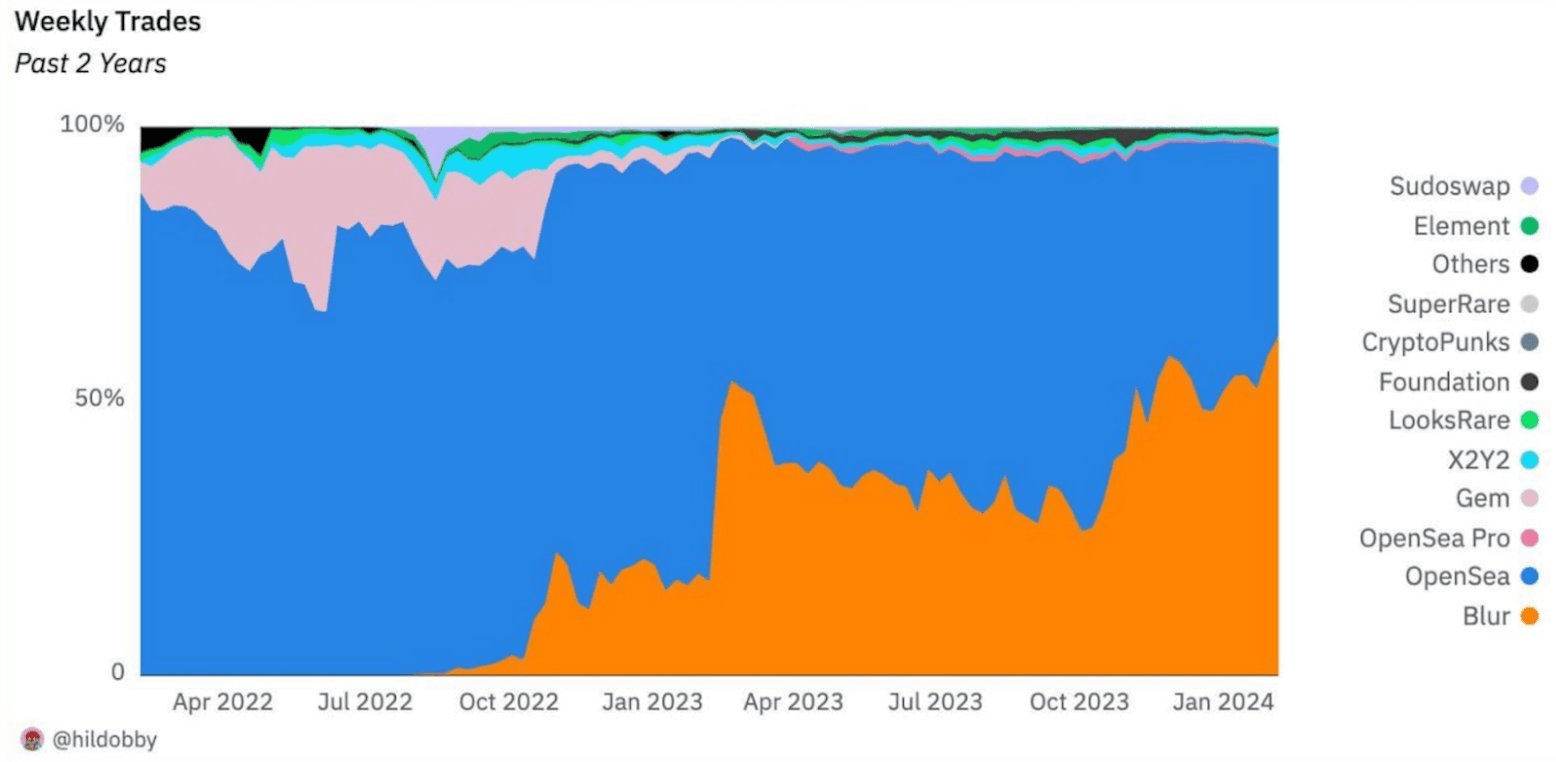

Let's start with an overview of how volumes are faring across the NFT ecosystem. Judging from site visits, it appears that interest in NFTs has declined, with most of the focus shifting to other areas of the market. OpenSeaPro, in particular, has taken a major hit, declining by almost 70%.

Recently, Blur's weekly trade market share soared to an all-time high, reflecting its growing dominance in the NFT market. As the bull market continues to unfold, Blur is poised to further solidify its position as a leading player in the NFT space.

- One key factor contributing to Blur's success is its consistent and enticing rewards system, which has been instrumental in keeping traders engaged with the platform.

- By offering attractive incentives and continued rewards, Blur has effectively incentivized traders to actively participate in NFT trading, thereby bolstering its market share and overall presence in the industry.

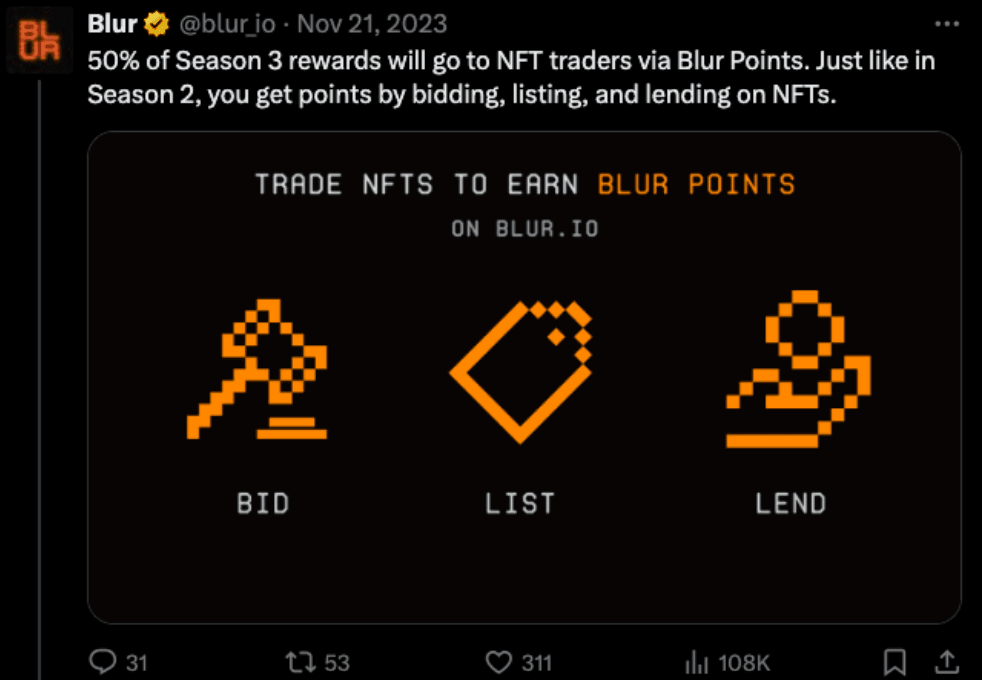

Blur's Season 3 is currently underway until May 2024. If you're into NFTs, now's the time to start listing, buying, and lending on Blur.

Source

SourceWhile on the topic of Blur, BlasterSwap has confirmed an upcoming airdrop.

- BlasterSwap is a decentralized exchange operating on the Blast L2 network. Once their protocol is fully functional, users can trade, earn rewards, launch new tokens, and even participate in gambling activities with a complete gas refund.

- Have you already bridged to Blast or staked Blur? If so, you're in for even more rewards. You'll receive bonus $BLSTR tokens for bridging ETH to Blast or staking BLUR.

Zap is a suite of token launch tools built on Blast. Their testnet is officially open to the public for their bug bounty campaign.

- Users are encouraged to hit retweet, visit https://testnet.zap.tech, use code 1337Z, report bugs using the button at the top, and win prizes.

Enjoyed this article?

- Subscribe to Crypto Pragmatist by M6 Labs newsletter for crypto-native industry insights and research read by 30k+ subscribers

- Follow us on Twitter for Tweets providing top-notch insights and bridging the gap between users, builders, and leaders in the crypto space