GM, Anon! It appears that the market is on the rise once more. Could this signal that we're emerging from the recent downturn and heading towards new all-time highs? We certainly hope so! In the meantime, airdrops are in full swing, adding to the excitement in the crypto ecosystem across the board. Let’s dive in!

Alpha Take

Source

SourceL1s, L2s & DeFi

State Of The Market

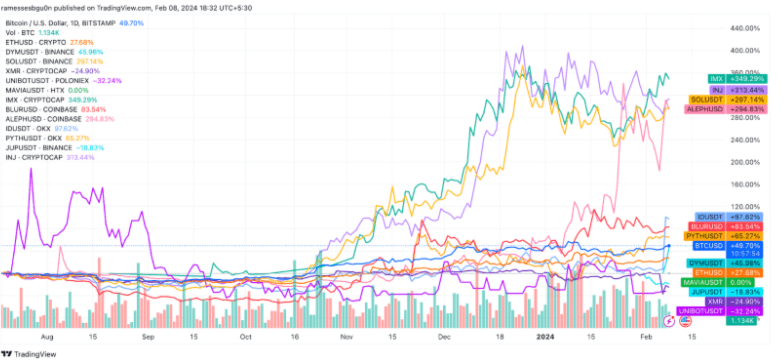

TLDR

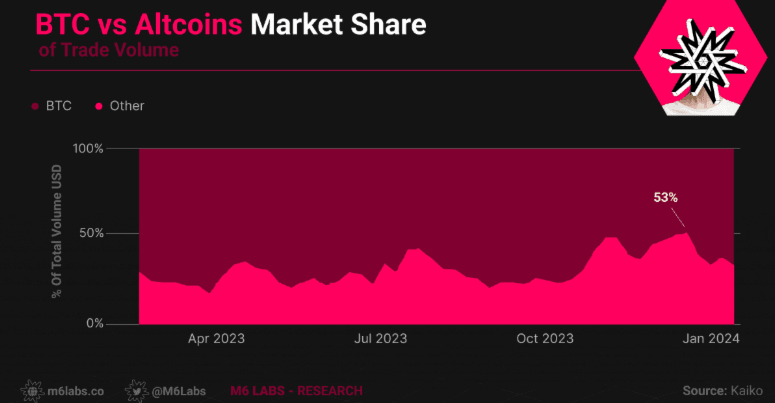

- BTC dominance has risen, indicating a preference for Bitcoin over alternative digital assets.

- Altcoins have dipped from their recent local high, suggesting a short-term decline in investor interest and confidence.

- GBTC's dominance in daily trading volumes among ETFs has diminished, now representing approximately 30% of the market.

- Solana's bridge activity has surged by 335%, largely due to the Jupiter airdrop, stimulating cross-chain interactions and liquidity flows.

- Ethereum staking has reached its highest point since last summer, with approximately 30M ETH staked, reflecting growing confidence in Ethereum's future.

- Various airdrops have captured attention, including DYM's mainnet launch setback, Stride's Celestia stakers' airdrop, and Eigenlayer's removal of caps on staking pools to attract liquidity.

Industry Updates: In the realm of finance and regulations, Federal Reserve Chairman Powell hinted at a delay in interest rate cuts until after March to ensure sustainable achievement of the 2% inflation target, with expectations of three cuts this year, albeit at a slower pace than anticipated. Meanwhile, US Treasury Secretary Yellen advocated for crypto legislation to address existing gaps in enforcement, while Trump expressed concerns over central bank digital currencies and AI's power.

- In other developments, the SEC introduced a rule potentially requiring DEX liquidity positions above $50M to register, and a judge ruled in favor of the SEC in demanding Ripple disclose financial statements.

- On the market front, New York Community Bank stock plummeted 25%, prompting concerns over its assets, while Major French Bank SocGen announced plans to cut around 900 jobs.

- Solana forged a partnership with Abu Dhabi Global Market to accelerate web3 adoption in the UAE, as OKX encountered potential probes in South Korea. In regulatory changes, Thailand exempted value-added tax on crypto gains, highlighting a distinction from India's persistent controversial crypto tax stance.

- Concurrently, Hong Kong initiated an inquiry into Worldcoin due to data privacy apprehensions. Amidst the recent market stagnation, Michael Saylor capitalized by acquiring an additional 850 BTC.

- In ETF news, Ark Invest and 21Shares amended their joint application for a spot Ethereum ETF, focusing on cash-based transactions and hinting at ETH staking. Additionally, FTX filed a motion to offload a stake in AI startup Anthropic, while Binance faced a data leak on GitHub, exposing security measures.

- Finally, Chinese scholars emphasized the urgency of addressing cryptocurrency-related money laundering, with the revised draft of China's Anti-Money Laundering Law expected in 2025.

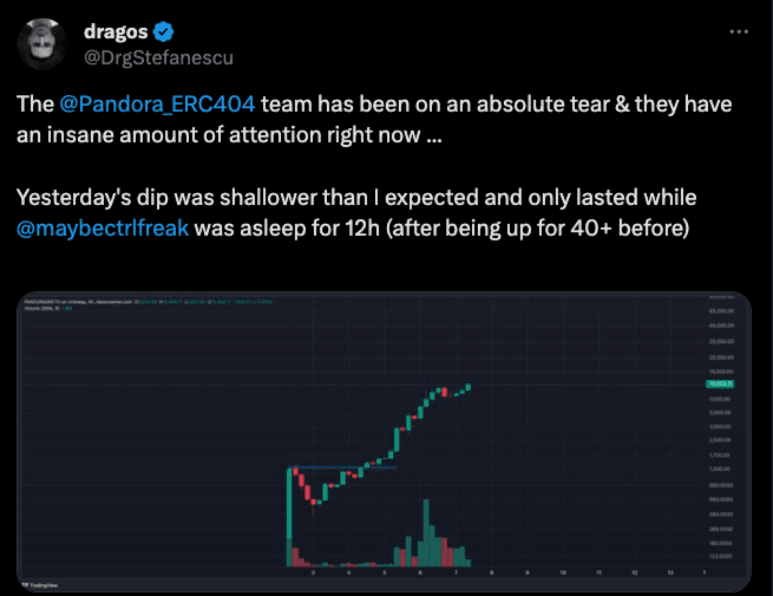

Project Updates: Within the Ethereum ecosystem, some significant developments have emerged. Notably, the Ethereum experiment ERC404, blending NFTs and crypto, has gained considerable traction, boasting $87M in trading volume.

- Additionally, prominent bots like BananaGunBot have integrated support for ERC404, signaling growing adoption.

- Meanwhile, the Ethereum Dencun upgrade has gone live on Holesky, introducing "proto-danksharding" to enhance scalability and reduce transaction costs for layer-2 blockchains.

- In a bid to enhance scalability and explore new avenues for growth, the Ethereum Name Service (ENS) has expressed openness to constructing its layer 2 solutions. ENS director Khori Whittaker underscores the organization's commitment to intensive research and development efforts, with a particular focus on Optimism and other layer 2 solutions.

- Elsewhere in the DeFi space, dYdX has unveiled its ambitious 2024 product roadmap, centered on three core areas: permissionless market, core transaction enhancements, and UX/onboarding updates. This roadmap includes plans for instant liquidity through LP Vaults, scalable oracles, and the implementation of cross-margin and isolation margin features.

- EigenLayer has reopened uncapped restaking deposits, coinciding with a surge in market capitalization, while Dymension gears up for its imminent mainnet launch.

- On the accessibility front, MetaMask has expanded its functionality to allow users to purchase cryptocurrencies directly through Robinhood, aiming to streamline the crypto acquisition process for its users.

- In terms of innovative advancements, 0xngmi has introduced smolrefuel for gasless swaps, offering a convenient solution for users navigating gas fees. Additionally, Helium Mobile has been added to Coinbase Assets Roadmap.

- Frax has recently launched Fraxtal, its Layer 2 network, alongside various partner applications, marking a significant expansion in its ecosystem. Concurrently, Ondo Finance has broadened its offerings by introducing its US Treasury-backed stablecoin to the Sui blockchain. These developments highlight a growing trend of financial innovation and blockchain interoperability, with Frax enhancing its network capabilities and Ondo Finance leveraging new blockchain platforms to extend the reach of its stablecoin.

- However, not all news is positive, as Polygon Labs has announced a 19% reduction in its workforce, citing the need for "enhanced performance." Furthermore, the 3AC Founders-Backed Exchange OPNX is set to cease operations by February 14, marking the end of its tenure as a hybrid bankruptcy claims platform and crypto exchange.

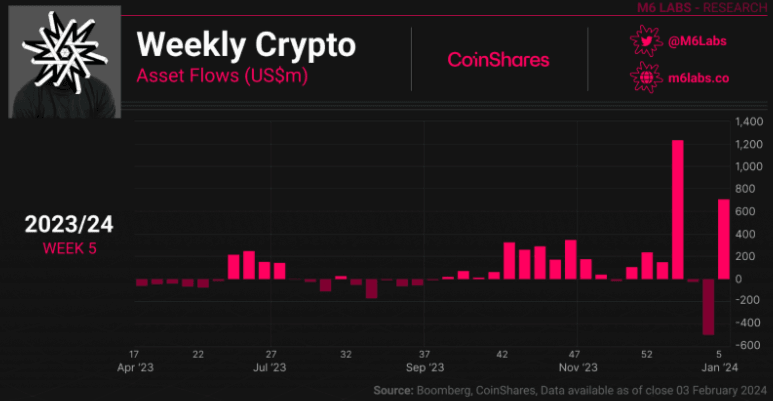

Inflows & Outflows: Last week, digital asset investment products received significant inflows totaling $708M, bringing the year-to-date inflows to $1.6B and total global assets under management to $53B.

- Bitcoin dominated the inflows, comprising 99% of all flows, with Solana also seeing notable inflows of $13M.

- The focus remained on the US, with newly issued ETFs averaging $1.9B inflows over the last four weeks, totaling $7.7B since launch.

- However, there were minor outflows from short-bitcoin products totaling $5.3M.

- Despite this, trading volumes in ETPs fell compared to the prior week, but remained well above the average in 2023.

- Regionally, the US saw $721M inflows, with significant reductions in momentum of outflows from incumbent issuers observed in recent weeks.

- Additionally, blockchain equities experienced $147M outflows from one issuer, while other issuers saw $11M inflows.

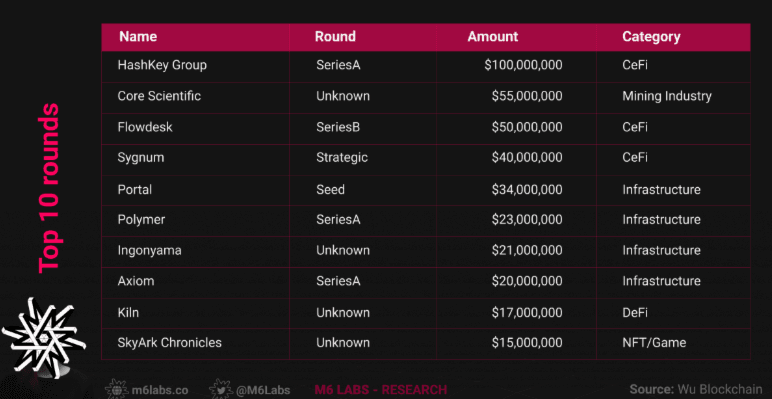

In January, the crypto venture capital space saw a total of 113 publicly disclosed investment projects, marking a 10.8% increase from December 2023 and a 1.8% increase from January 2023.

- Among various industries, DeFi accounted for approximately 19% of financing, while infrastructure projects constituted about 12%, NFT/GameFi and CeFi each represented around 12% and 6%, respectively, and L1/L2 made up roughly 4%.

- The total fundraising amount for the month reached $650M, showcasing a 28.6% decrease from December 2023 but a 3.2% increase from January 2023.

- Notable funding rounds included HashKey Group's Series A funding, Core Scientific's successful equity offering, Flowdesk's Series B round, and Sygnum's strategic financing round.

- Other significant investments were made in projects like Portal, Polymer Labs, Ingonyama, Axiom, Kiln, and SkyArk Chronicles, illustrating the diverse range of initiatives garnering investor interest in the crypto space.

This rise in BTC dominance suggests a preference among investors for Bitcoin over other digital assets at the moment.

- the dip in altcoins from their recent local high indicates a relative decline in investor interest and confidence in alternative crypto. This downturn can be attributed to factors such as profit-taking, market corrections, or a reevaluation of risk appetite among investors, highlighting the cyclical nature of altcoins.

Airdrops

- This week, DYM, a token recently launched on Binance and subsequently listed on major exchanges like Kucoin and Bybit, has been the talk of the town as it continues to reach new highs. However, the project faced a hiccup during its mainnet launch due to a consensus issue with its primary validator, Chorus One.

- Stride has also garnered attention with its airdrop targeting Celestia stakers, demonstrating the strategic importance of engaging with active blockchain communities.

- Meanwhile, "Heroes of Mavia," a Binance-backed project, celebrated a milestone of 1M downloads with a significant airdrop, showcasing the impact of such campaigns on user acquisition in the gaming sector.

- Eigenlayer's decision to remove caps on its staking pools, coinciding with TVL surpassing $3B, has generated anticipation for the project's future, illustrating how airdrops can bolster visibility and attract liquidity.

- Wormhole's surprise airdrop announcement came as surprise with the snapshot already having being taken.

- The recent rush to order the Solana phone underscores the growing interest in leveraging blockchain functionality in everyday devices, while the airdrops associated with owning the mobile device highlight a novel approach to incentivize adoption and loyalty among users.

- Degen stands out for its targeted approach to rewarding Farcaster users.

- While the Pyth Network's second phase of token airdrops supports over 160 decentralized applications, signaling a commitment to ecosystem development.

Blue Chip and Majors Overview

Dymension (DYM)

Dimensions highly anticipated airdrop took place on Tuesday with the network’s mainnet going live. The airdrop saw Dymension distribute $390M worth of DYM tokens among early users and select communities. What’s more, the DYM token surged in value following the launch of the mainnet. DYM has registered a staggering increase of 72% over the past 24 hours, according to data sourced from CoinGecko. The token is trading at an all-time high of $6.10, beating its previous all-time high of $6.08, set barely 24 hours earlier.

Solana (SOL)

Solana has been in the news for two major reasons over the past week. The protocol’s active users hit an all-time high on the 31st of January, reaching 875,940 active users. This was the highest since the protocol’s inception in 2020. However, the other reason is nothing to cheer about, as Solana faced its first major outage of 2024, with the network going down for 5 hours. The freeze triggered a drop in the price of the SOL token, which dropped by 4% in the hours after the freeze. In the days leading up to the outage, SOL was trading above the $100 mark.

- Bitcoin (BTC) - The world’s largest crypto has seen considerable movement as whales begin to accumulate the asset with the Bitcoin halving event on the horizon. BTC made considerable gains over the past 24 hours, rising by over 4% and edging closer to the $45K mark. Currently, the cryptocurrency is trading at $44,727, as bulls eye the $51K price level.

- Ethereum (ETH) - Ethereum jumped past $2400 as building bullish momentum took the asset past the $2380 zone. ETH’s recent gains can be credited to two major events, as it emerged that the supply of staked Ethereum tokens hit 25% on Thursday. This is a critical milestone for ETH as the staked supply represents ETH removed from circulation. The second catalyst is the amendment of spot Ethereum ETF filings by Ark Invest and 21 Shares, sparking anticipating of an imminent approval. However, the past 24 hours have seen the price remain unchanged, even as the Dencun upgrade went live on the Holesky testnet on Wednesday. ETH has been stuck between $2200 and $2400 since the 23rd of January. In fact, the token has registered an increase of just 1.0% over the past week.

- Monero (XMR) - Things have gone from bad to worse for Monero as the XMR token plummeted by around 30%, falling to a 20-month low after it emerged that Binance would be delisting the token from the 20th of February. Monero slumped to as low as $114 before falling further, dropping to $101.65, and recovering. Currently, XMR is trading at $133.

- Banana Gun (BANANA) - Banana Gun has seen considerable bullish activity over the past 30 days, registering a considerable increase. BANANA has seen an increase of almost 87% over the past 30 days, going from $8.60 to its current price of $17.10.

- Unibot (UNI) Meanwhile, UNIBOT has been in the red, losing almost 24% over the past two days. The volatility in BOT’s price can be attributed to Unibot issuing a native Solana ecosystem token. Developers hope the UNISOL token will ultimately boost UNIBOT’s value accrual.

- Bittensor (TAO) - Following Vitalik Buterin’s comments, Bittensor (TAO) registered a considerable increase over the past month. TAO hit another all-time high on the 6th of February when it reached $516. However, the token’s price has dropped since, falling just over 9% in the past 24 hours. The TAO token is currently trading at $439.

- Sui (SUI) - Sui, the Layer-1 blockchain from the creators of the Diem crypto project, broke into the top ten DeFi rankings on the 30th of January, achieving this milestone within a year of launch, Sui also registered a massive increase in TVL which registered an increase of 1000% in just four months. However, the SUI token has pulled back after its recent bull run, dropping from $1.64 to its current level of $1.55. We could see positive momentum return after it emerged that Ondo Finance will expand its US Treasury-backed stablecoin to Sui.

- Dogwifhat (WIF) - Meme coins have been on the rise if we look at Dogecoin, Shiba Inu, and Bonk. However, in recent days, WIF has been the exception, as the token has dropped considerably since reaching its all-time high. However, the token has registered a 26% increase in the past 24 hours and is currently trading at $0.220. The news that Bitfinex will be listing the token can be attributed as one of the reasons for this increase.

- Myro (MYRO) - The MYRO token saw an unprecedented surge in January 2024, gaining a staggering 3605% over the past year. This surge was fueled by celebrity endorsements, social media posts, increased trading volume, and positive investor sentiment, and saw the token reach its all-time high of $0.258 on the 19th of January. However, the price has dropped since, with MYRO currently trading at $0.066.

- Optimism (OP) - Back in December, it was predicted Optimism would see a price drop following the unlock of 24M OP tokens. OP defied these predictions, instead surging to an all-time high of $4.23 on the 12th of January. Now, with another unlock on the horizon, how OP will react remains to be seen. Currently, the token is trading at $3.37, up nearly 5% over the past 24 hours.

- Arbitrum (ARB) - 2024 has been rather eventful for Arbitrum, with the ARB token reaching its all-time high of $2.39 on the 12th of January. However, since then, the price of ARB has been on a downward trajectory, falling as low as $1.56 on the 23rd of January. However, the price has recovered since and is currently trading at $1.89, looking to get back above the $2 level.

- Flare (FLR) - The FLR token’s performance over the past month has been nothing short of impressive. During the past week, when most cryptos have struggled, FLR has surged by 44%, reaching $0.033, its highest price level for 2024. While the token has since retreated, it has gained an impressive 65% over the past month and is currently trading at $0.029.

- Chainlink (LINK) - The Chainlink (LINK) price has been on an upward trajectory since late October 2023. By December, LINK had surged to $16 before entering a period of volatility. However, LINK embarked on another bullish run since late January, with its price rising by over 40%, considerably surpassing Bitcoin, Ethereum, Solana, and Cardano. Chainlink was also recently integrated across Avalanche, Base network, BNB-chain, and Ethereum.

- Injective (INJ) - The recent token unlock saw 3.67M INJ tokens enter the market. As expected, the INJ token price registered a drop following the unlock, dropping down to $30.68 before recovering and rising to $38.85. However, frustratingly, INJ has been unable to move past $40 since the start of the year. The previous unlock of INJ tokens dropped the price by 12%.

- Jupiter (JUP) - Jupiter has seen a considerable slump since making its much-hyped debut of the JUP token through its airdrop. The token is currently trading at around the $0.55 mark, an increase of 6% over the past 24 hours. Make no mistake, interest in the JUP token is high, thanks to major strides being made by Jupiter in the DeFi sector.

- Pyth Network (PYTH) - Pyth Network recently kicked off the second phase of its airdrop, which will see PYTH tokens distributed to over 160 DeFi applications. The PYTH token has nearly doubled after bottoming in early January when the price hit $0.23. Since then, PYTH has reported an increase of 89% and is currently trading at around $0.49. However, some analysts have predicted that PYTH risks a 10% price correction.

- Ethereum Name Service (ENS) - The native token of the Ethereum Name Service, ENS, has been quite bullish over the past month, registering an increase of 55%. The token has been one to watch after its partnership with domain name registrar GoDaddy, which has had a positive impact on the price. The token is currently trading at $21.05.

- Stride (STRD) - Stride has made a series of major announcements over the past couple of weeks, such as its partnership with dYdX and the airdrop of 5M STRD tokens to stTIA holders. The token’s price has also been on the up since the beginning of February. In fact, STRD has gained over 75% over the past couple of days, and is currently trading just under $6.

- Pendle (PENDLE) - On the 2nd of February, Pendle was testing the resistance at $2.54, and it was predicted it could see a move to $3.19. This gave investors a sweet buying opportunity. That prediction came true on the 7th of February when PENDLE surged to its all-time high of $3.30. However, the price has since dropped, with the token down 7% over the past 24 hours and currently being traded at $2.91.

- OKT Chain (OKT) - The OKT Chain was last in the news in December 2023, when it surged by 80% in 24 hours due to heightened interest from the inaugural inscription-minting event hosted on the OKT chain. However, since then, the token has been on a downward trajectory, with its price more than halved since the heady days of December 2023. OKT token is currently trading at $16.44.

- Space ID (ID) - Space ID has seen a remarkable surge of over 80%, driven by the news of Upbit introducing a Korean won trading pair for the ID Coin. This has led to considerable optimism and investor interest, pushing the token’s price past $0.5. The surge in price can be attributed to the anticipated surge in demand from the Asian market following Upbit’s announcement.

Smart Money Movements

- We've observed a notable shift in smart money activity recently, transitioning from LBP Meta to ERC404 meta. Over the past week, smart money addresses have shown significant engagement with ERC404 tokens, particularly with $PANDORA leading the pack, attaining a market cap of $200M.

- $PANDORA currently stands as the favored token among smart money players, owing to its association with the ERC404 standard. This standard, although unofficial and experimental, aims to blend the attributes of fungible tokens and NFTs, garnering attention and adoption.

- Another interesting token within the ERC404 narrative is $MNRCH, which has caught the interest of numerous smart money addresses.

- In contrast, smart money has divested from $RSTK, a pioneering restaking protocol constructed on EigenLayer.

- Additionally, smart money activity has been detected in My Pet Hooligan NFTs, a gamefi project that gained traction following the launch of $KARRAT.

- Furthermore, noteworthy activity has been observed on Hyperliquid, with several smart money addresses interacting with it, likely in anticipation of an upcoming airdrop, contributing to heightened engagement and interest.

This is just a preview of our L1, L2 and DeFi Weekly report, be sure to check out the full version of this report here.

NFTs & Gaming

What an eventful week it has been for NFTs! Farcaster experienced a surge in activity, and the introduction of the new standard ERC-404 is making significant changes. Let’s dive in!

Project Updates

- NFTPerp, a DEX specializing in perpetual futures for NFTs, concluded its Grants funding round, with support from the Arbitrum Foundation. The specific amount raised in the funding round has not been disclosed.

- Saltwater Games, a web3 gaming enterprise, secured $5.50M in a Seed funding round. Deus X Capital and Fourth Revolution Capital (4RC) participated in the investment.

- Binance list RON.

- Floor V2 is LIVE with 15 ETH Sweeps

- Sudoswap is now live on Base

- Art Blocks acquired the Sansa marketplace.

- Mastercard's new UEFA Champions League game offers cardholders the chance to win tickets using NFT passes.

- 'Doom' expands its range by running on Bitcoin, Dogecoin, and even gut bacteria.

- A judge dismisses Ryder Ripps' counterclaims against Yuga Labs and orders him and Jeremy Cahen to pay nearly $9M in compensation to the digital collectible company.

- Pudgy Penguins partners with Magic Eden as their preferred marketplace.

- GameStop tribute meme coin on Solana experiences a 52% plunge amidst GME crash.

- Vitalik Buterin stated: "Bad gamefi is using financial speculation as a substitute for fun. Blockchain games need to be fun as games" - approx quote I've said many times.

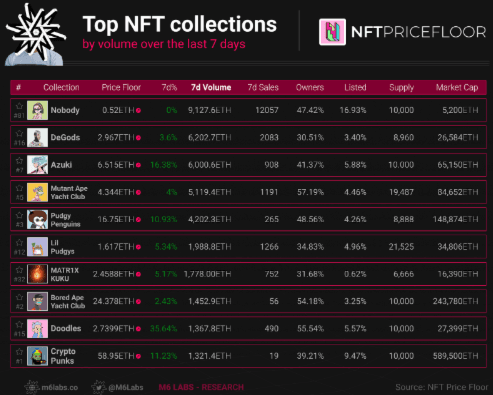

Blue Chip and Market Overview

Over the last seven days, there have been some notable developments in trading volume. Nobody has surged to the top of the charts, with DeGods following closely in second place. Meanwhile, BAYC continues to linger towards the lower end of the list.

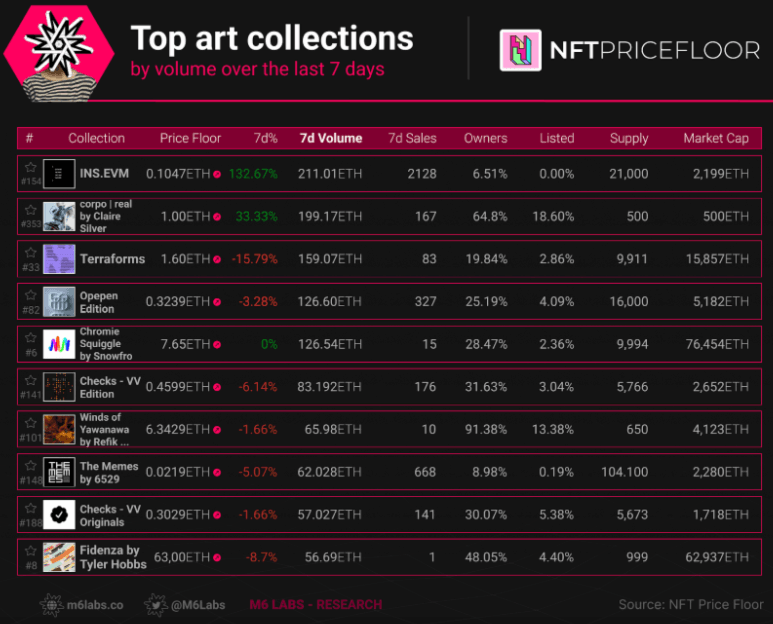

Art collections within the NFT market have experienced predominantly negative volumes over the past seven days. This segment of the market attracts traders with a specific interest in niche artwork, and it tends to be highly speculative, even more so than traditional NFTs. During the last bull run, art collections in this market sector witnessed significant surges in prices, reaching incredible highs. It will be intriguing to observe whether a similar trend occurs once again.

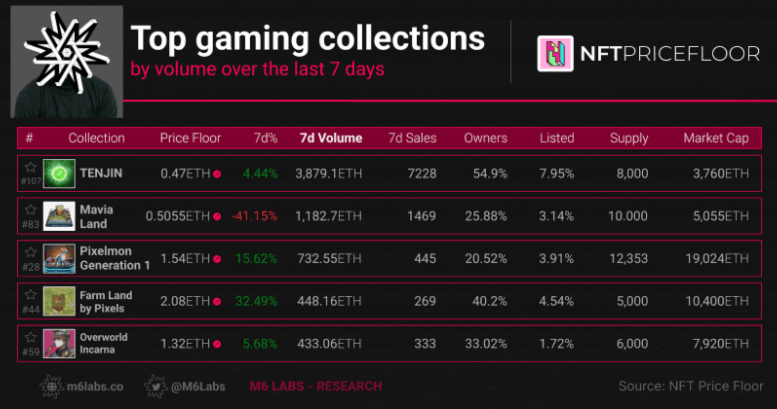

Exciting developments in the gaming NFT ecosystem involve the sustained interest in Pixelmon and Pixels. There's speculation about whether either of these projects will claim the top spot in the coming weeks.

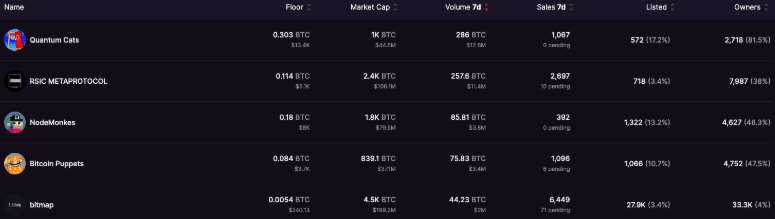

Following the recent sale of Quantum Cats, the collection has surged to the top position in terms of volume, experiencing a remarkable 3x increase in mint price. Similarly, Bitcoin Puppets have exhibited strong performance, with their floor price steadily rising.

Top Ordinals collections by volume over the last 7 days. Source: Magic Eden.

Degen Corner

- Blur (BLUR) - Blur was one of the stars of the crypto market in 2023, reaching astronomical highs. It continued this trend in 2024 as well, registering impressive gains despite the unlocking of 50M BLUR tokens. The token is trading at $0.61, up nearly 40% over the past 30 days.

- Immutable (IMX) - IMX is another token that has maintained an upward trajectory in 2023 and 2024. This comes as no surprise as the blockchain gaming specialist is known for its innovation. The company recently announced the launch of its Immutable zkEVM mainnet. IMX has been fairly bullish over the past 30 days, registering an increase of over 16%, and is currently trading at $2.28.

- Ronin (RON) - Ronin has given followers and investors plenty to cheer about in recent weeks. Following the news of the RON token’s Binance listing, Ronin has announced a new collaboration with Japan-based GMonsters and mobile game publisher MIXI, bringing titles from the Fight League franchise to Ronin. No doubt, the price of RON reflects this positive sentiment and has registered an increase of 5% over the past 24 hours, with the token currently trading at $2.66.

- Heroes of Mavia (MAVIA) - Heroes of Mavia recently airdropped its MAVIA token to over 100K players, with the token spiking by 36% soon after its debut. The token surged to $4.04 before correcting and dropping to its current price of $3.53. Over a million users downloaded the game since its release last week, with the token’s marker cap crossing $100M.

- Echoes Beyond is a celestial strategy game that promises players the thrill of cosmic conquests and riches beyond the stars. The game offers play-to-earn opportunities, from daily GALA token rewards to the creation and trading of NFTs like Ships and Blueprints.

- Champions Rise has transformed to a menu-driven interface, refining gameplay and introducing fresh features. The Grand Emporium allows players to mint select in-game artifacts as NFTs. Champions Rise is now collaborating with four other web3 titles, offering free access to explore its dynamic universe and partake in battles.

- Synergy Odyssey is a web3 game that combines agriculture, fortress construction, and dungeon escapades. Its mainnet debut is on February 22nd and it's generating a lot of excitement in the gaming sphere due to its innovative gameplay mechanics and strategic land distribution.

- EmberVerse is a web3 entertainment project that recently launched its Ember collection NFTs. With over 1,100 ETH in trading volume within a week, it's clear that the project is gaining popularity. As EmberVerse expands and refines its offerings, it's becoming a strong contender in shaping the future of web3 gaming.

- Animoca Brands has launched Anichess, a modernized variant of chess infused with Web3 technology and fantasy-based strategic elements. Developed in collaboration with Hashcode Studio, Anichess offers a "player-versus-environment" version and allows players to collect digital collectibles called "Orbs of Power" on the Polygon proof-of-stake chain. Anichess introduces exotic game mechanics to address cheating concerns, while offering free NFTs and Polygon token airdrops. With intuitive gameplay suitable for all levels of players and Chess.com's involvement, Anichess aims to be a child-friendly yet engaging chess variant.

Bazooka Tango, the game studio behind Shardbound, is launching a limited 10-day playtest of its upcoming NFT card-based strategy game titled "Ascent to the Shards" starting February 21.

- A total of 2,000 players will receive exclusive access on a first-come, first-served basis, with signups available on the Shardbound website.

- Shardbound is being developed on Immutable zkEVM, an Ethereum scaling network, and aims to leverage blockchain technology to enhance gameplay and provide players with unique experiences.

- Immutable Games is collaborating with Bazooka Tango to adapt the 2017 turn-based tactical collectible card game Shardbound into a blockchain game, revitalizing the game's potential and attracting a broader audience.

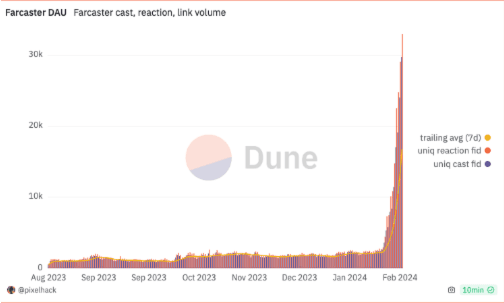

Farcaster has seen a dramatic increase in user activity lately. Let’s dive in and see how you can benefit from getting involved.

- Farcaster is a decentralized protocol that operates on-chain without any centralized servers. On the other hand, Warpcast is a client that uses the Farcaster protocol.

- People often confuse Warpcast for Farcaster. Warpcast is like Twitter and was the first app to use the Farcaster protocol.

- It is essential to note that Warpcast depends on centralized servers which can cause occasional downtimes.

- However, these downtimes do not affect the underlying Farcaster protocol.

- In the Farcaster realm, users have complete control over their data and messages, ensuring that they cannot be censored.

- Developers can also innovate freely on top of the protocol, without any restrictions. Unlike traditional social media platforms, Farcaster operates reliably without being dependent on centralized entities or experiencing downtime.

- Farcaster messages are divided into five different categories. 'Casts' represent user-generated messages that are similar to tweets or Reddit posts.

- When you 'post' something in Warpcast, you're essentially creating a 'Cast' message. Reacting to a 'Cast' means sending a reaction message to the protocol.

- Traditional social platforms allow users to post content for free, without any limitations.

- However, Farcaster has a unique approach where users need to rent storage units to send additional messages to the protocol.

- The main objective behind this approach is to prevent spamming and avoid state expansion within the protocol.

Lastly, the $DEGEN Airdrop

- Farcaster's recent increase in activity can be partly attributed to the DEGEN airdrop, which is an initiative by the Degen community within Farcaster and is based on the Base chain.

- The airdrop started in January and has resulted in substantial price growth. The economic model includes allocations for community, liquidity mining, project development, and other activities.

- DEGEN tokens have become increasingly popular within the Farcaster community. Users actively participate in DEGEN airdrops by completing specific activities like posting 'Casts' and earning points that can be converted to DEGEN tokens. To be eligible for the airdrop, users must have a Farcaster account.

- Users are encouraged to interact on Farcaster for potential future airdrops.

Source: Dune

Source: DuneERC-404 is a novel token standard developed by the Pandora team, aiming to bridge the gap between fungible tokens and NFTs.

- It creatively combines elements from ERC-20 and ERC-721 standards, allowing for native fractionalization and liquidity within NFT projects.

- Pandora, the first project adopting ERC-404, offers PANDORA tokens and associated Replicant NFTs, where each token purchase or sale triggers minting or burning of the corresponding NFT. Replicants come in varying rarities, and their values have surged since launch.

- While ERC-404 presents exciting possibilities, it's still experimental and unaudited, so caution is advised.

- Watch for more collections and platforms adopting this standard, but be mindful of potential risks and vulnerabilities.

- Read the thread below for a deeper dive.

Source

SourceHere is another useful thread on the potential of this technology

Source

SourceSky Mavis, the creator of Axie Infinity, has partnered with GMonsters and MIXI to bring games from MIXI's Fight League franchise to the Ronin blockchain.

- GMonsters plans to launch three Fight League games on Ronin, with the first being Fight League Survivor.

- MIXI, known for Monster Strike, will provide support for the game development process. Ronin, initially launched for Axie Infinity, has been expanding to include third-party games like Pixels and The Machines Arena.

Solana Labs has officially launched its GameShift toolkit, aimed at simplifying the integration of Solana blockchain functionality into game development.

- The toolkit includes a Tensor integration for in-game NFT marketplaces, allowing developers to save time and complexity.

- Game developers can now create custom-branded marketplaces and support other existing Solana NFT collections, while players can trade NFTs using USDC stablecoin within the game.

- GameShift also supports SOL wallets, NFT integration, credit card payments for crypto assets, and asset lending functionality. Notably, Solana already hosts playable video games that allow users to earn crypto rewards while playing.

The Epic Games Store introduced "Shrapnel" a first-person shooter crypto game set in a dystopian world.

- Developed by Neon Machine, the game aims to stand out with community involvement and extensive customization options.

- With experienced developers and $37.5M in funding, including investment from Polychain Capital, "Shrapnel" targets a blockbuster-quality gaming experience.

- Its launch on the Epic Games Store, boasting a PC user base of over 230M gamers, marks a significant milestone for the blockchain gaming industry.

- Check it out here.

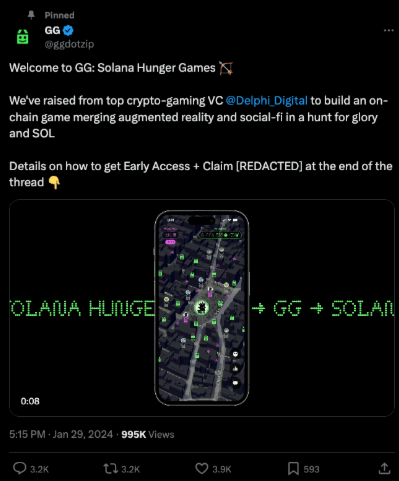

A new crypto-AR game called "Solana Hunger Games" has created a buzz in the crypto community, with over 100K followers on X and its website crashing due to high traffic. Developed by GG.zip and backed by Delphi Digital's crypto VC arm, the game is a mobile augmented reality scavenger hunt inspired by Hunger Games.

- Players can choose to be Hunters or Sponsors and compete for "G" tokens by exploring the Host city and finding AR GBoxes.

- The game set to launch in spring, and promises to blend AR with crypto to create an immersive experience.

- Sponsors can bet on players and acquire "Player cards" to support their favorites.

- While currently invite-only, codes are being shared for eager players to join in the excitement.

Source

SourceThis is just a preview of our NFT Weekly report, be sure to check out the full version of this report here.

Enjoyed this article?

- Subscribe to Crypto Pragmatist by M6 Labs newsletter for crypto-native industry insights and research read by 30k+ subscribers

- Follow us on Twitter for Tweets providing top-notch insights and bridging the gap between users, builders, and leaders in the crypto space