KuCoin is a prominent cryptocurrency exchange known for its vast altcoin and product support and a user-friendly interface brimming with features that attract customers from around the globe. This piece is an in-depth guide to navigating the KuCoin exchange and using its wide range of features. This KuCoin guide will cover everything there is to know about trading on the platform. For Beginners, this is a primer on getting started with KuCoin and making your first trade in the cryptosphere.

The focus of this guide is to help you start trading on KuCoin. Therefore, it leaves out several features like KuCoin Earn and Wealth. If you want to know more about KuCoin’s offerings, we have dedicated articles that dive deeper into other aspects of the exchange; check out our:

Note: Users located in the US and UK are not supported.

Short Summary

KuCoin is a global cryptocurrency exchange founded by Johnny Lyu and Michael Gan in September 2017. The company is headquartered in Seychelles, owing to its friendlier crypto regulations. The exchange offers features beyond spot trading, like a trading bot, passive income products, DeFi services, and advanced trading strategies.

KuCoin has experienced a steady growth in customers and boasts strong customer support and security measures, including a transparent Proof of Reserves report that is updated regularly.

If you want Guy's take on KuCoin, he put together the following video:

Getting Started With KuCoin Trading

You must be a registered user of the KuCoin exchange to use its services. Registration entails creating an account with the exchange with an email address and completing their KYC requirements.

Once registered, the next step is depositing funds and using exchange services. KuCoin supports on-chain crypto deposits for several cryptocurrencies and direct fiat deposits, and a P2P market for select countries. With funds in your account, you can begin trading on the exchange or using its diverse crypto-based financial products. Let’s go over these steps in more detail.

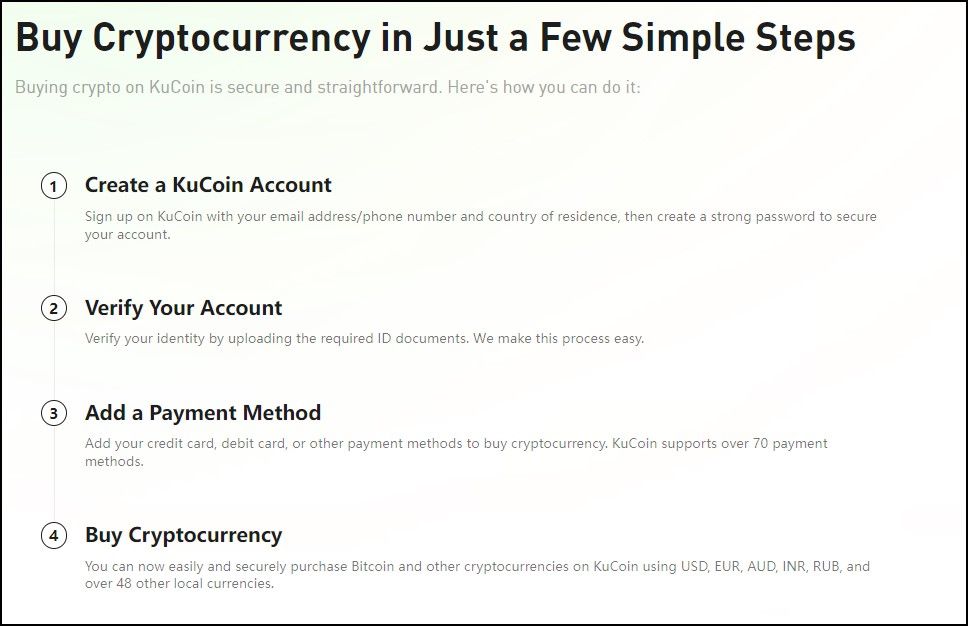

KuCoin Registration Steps | Image via KuCoin

KuCoin Registration Steps | Image via KuCoinAccount Registration

Registering with KuCoin is straightforward. Ensure you have a secure email account or phone number and the required proof to fulfil the KYC requirements on the exchange before commencing registration.

KuCoin Registration Screen | Image via KuCoin

KuCoin Registration Screen | Image via KuCoinHere are the following steps:

- Signing up: Find the ‘Sign Up’ button on the exchange homepage and click on it to navigate to the registration screen.

- Fill in the details: Enter your email address or phone number. Ensure a secure email ID is used for registration and create a strong password for additional security.

- Terms of Use: Read the KuCoin terms of use thoroughly before accepting their conditions.

- Complete the Captcha: KuCoin prompts the user with a captcha test before accepting a new registration.

- Verify registration: KuCoin sends a verification code to your registered email. Use the code on the registration screen to complete security verification.

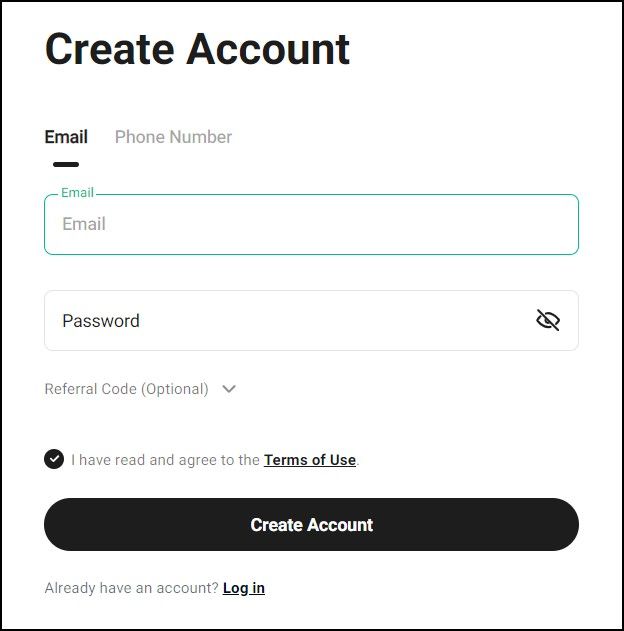

- KYC verification: The exchange mandates customers complete KYC before depositing funds or using its investing features. The verification process involves providing national identity proof issued by your government and a selfie. You may do this process later, but remember that it will become necessary for the steps that follow in this guide.

Tip: I recommend using the mobile application for completing KYC as it has a better pass rate. Also, using identity pictures instead of scanned copies is recommended. Also, avoid a public network during registration and use a respected VPN service if accessible.

KYC Registration Screen on the KuCoin Website

KYC Registration Screen on the KuCoin WebsiteDepositing Funds

You need funds to use any service on KuCoin. The exchange supports multiple pathways to buy crypto with a fiat currency or perform an on-chain deposit of cryptocurrencies.

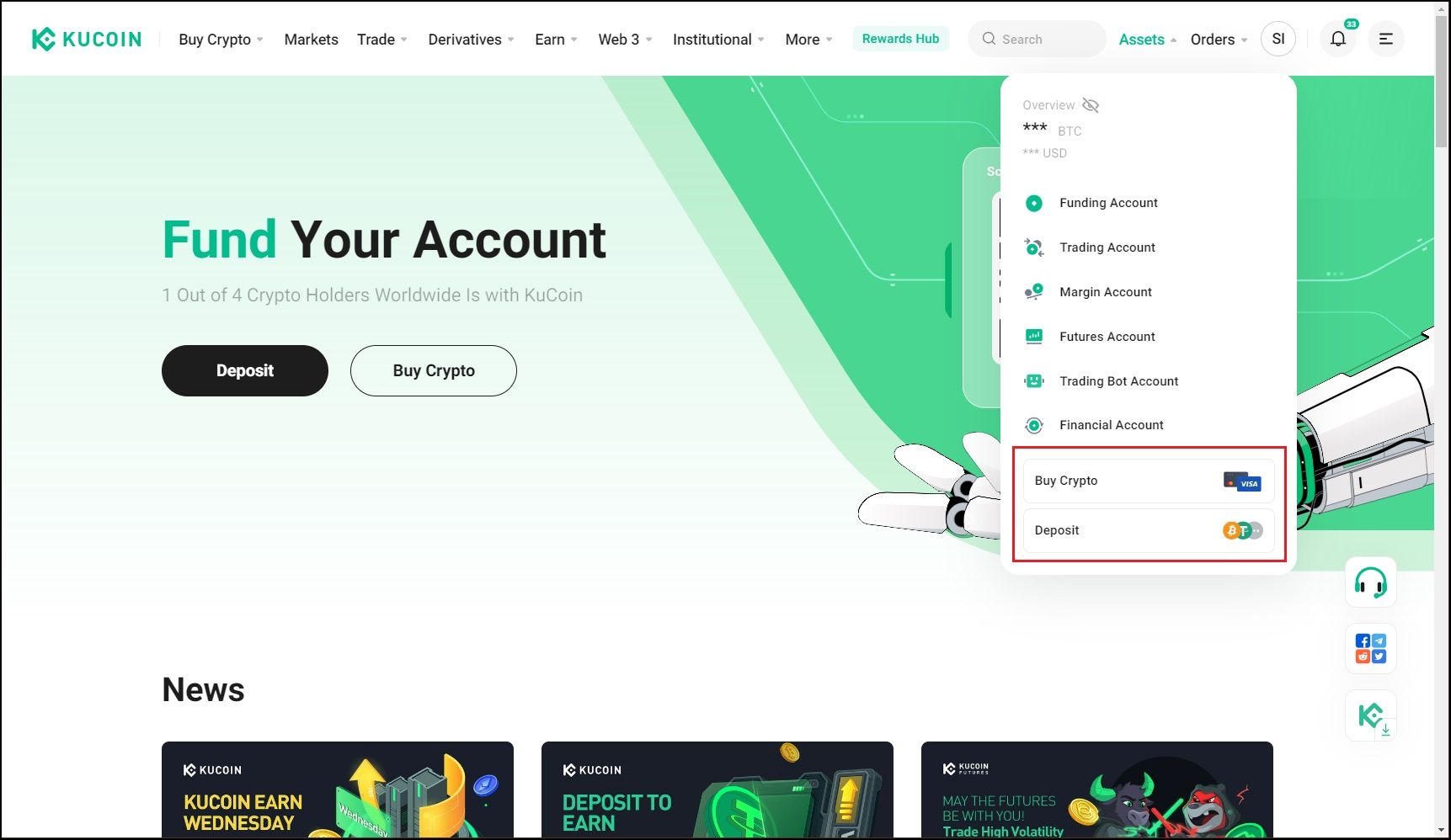

KuCoin Deposit Types on the Exchange Website

KuCoin Deposit Types on the Exchange WebsiteFind the ‘Assets’ tab in the upper right corner. The drop-down menu lists different types of accounts to store your crypto based on how you plan to use them. For instance, the Trading Account is used for trading in the spot, while the Funding Account is for the KuCoin Earn program.

There are two broad ways to acquire crypto in your KuCoin account:

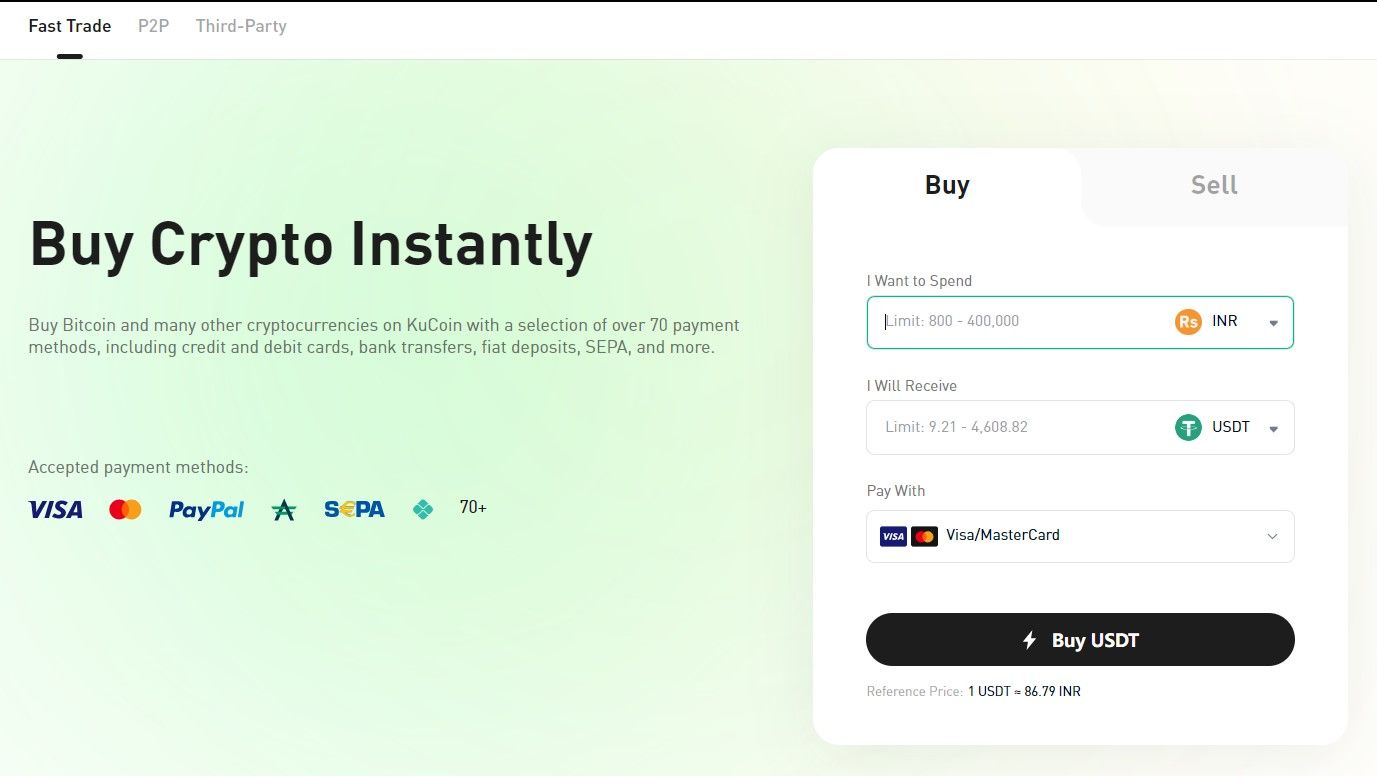

Buy Crypto - This option lets you buy cryptocurrencies with your fiat. KuCoin supports four fiat-based pathways:

- Fast Trade - Buy a few supported cryptocurrencies with a direct bank transfer or bank card.

- P2P - Connect with cryptocurrency sellers and pay them directly. KuCoin mediates this exchange to ensure the buyer’s security.

- Third-Party - Institutions like Banxa and Simplex support cryptocurrency orders on KuCoin. Please note that these are external parties beyond KuCoin’s control.

- Fiat Deposit - KuCoin also allows a direct fiat deposit for a few currencies on the exchange.

Fiat Deposit Screen on the KuCoin Website

Fiat Deposit Screen on the KuCoin WebsiteBuying crypto with fiat currencies is not available worldwide. Therefore, you must check if the exchange supports your currency and payment channels before proceeding with fiat. Select the channels you are most comfortable with and follow the corresponding payment gateways to complete the transaction. Once complete, the KuCoin accounts will reflect your funds.

Tip: From my experience, many banks around the globe soft-ban cryptocurrencies by intentionally making the experience of transacting with crypto-related accounts complex. Therefore, check with your banking provider before proceeding with the fiat channels.

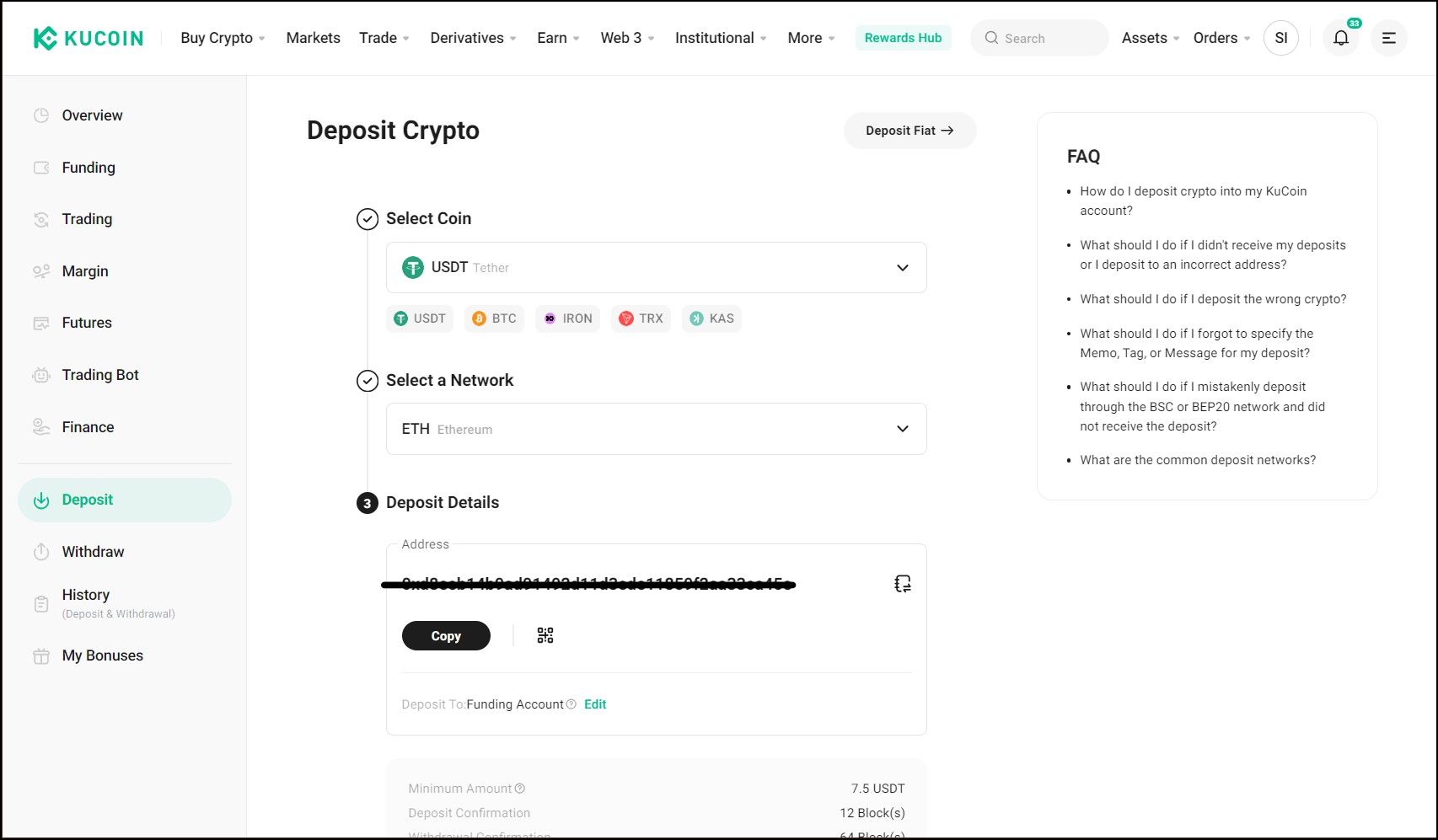

Deposit - Use this method when you already have cryptocurrency in an on-chain wallet that you wish to transfer to your KuCoin account.

On-Chain Crypto Deposit Screen on the KuCoin Website

On-Chain Crypto Deposit Screen on the KuCoin WebsiteFollow these steps:

- Select the cryptocurrency you want to deposit.

- Select the deposit network, which is the network on which KuCoin will look for your deposit transaction. Selecting the right network is crucial and may result in funds loss if done incorrectly.

- Send the transaction. KuCoin will provide a deposit address based on your network selection. Send the transaction to the provided address. The funds will be credited to your KuCoin account once the transaction is processed successfully.

FYI: Please be aware of the gas fees when conducting on-chain transactions. Copy the deposit address instead of entering it manually to avoid the chance of errors.

Place Your First Trade

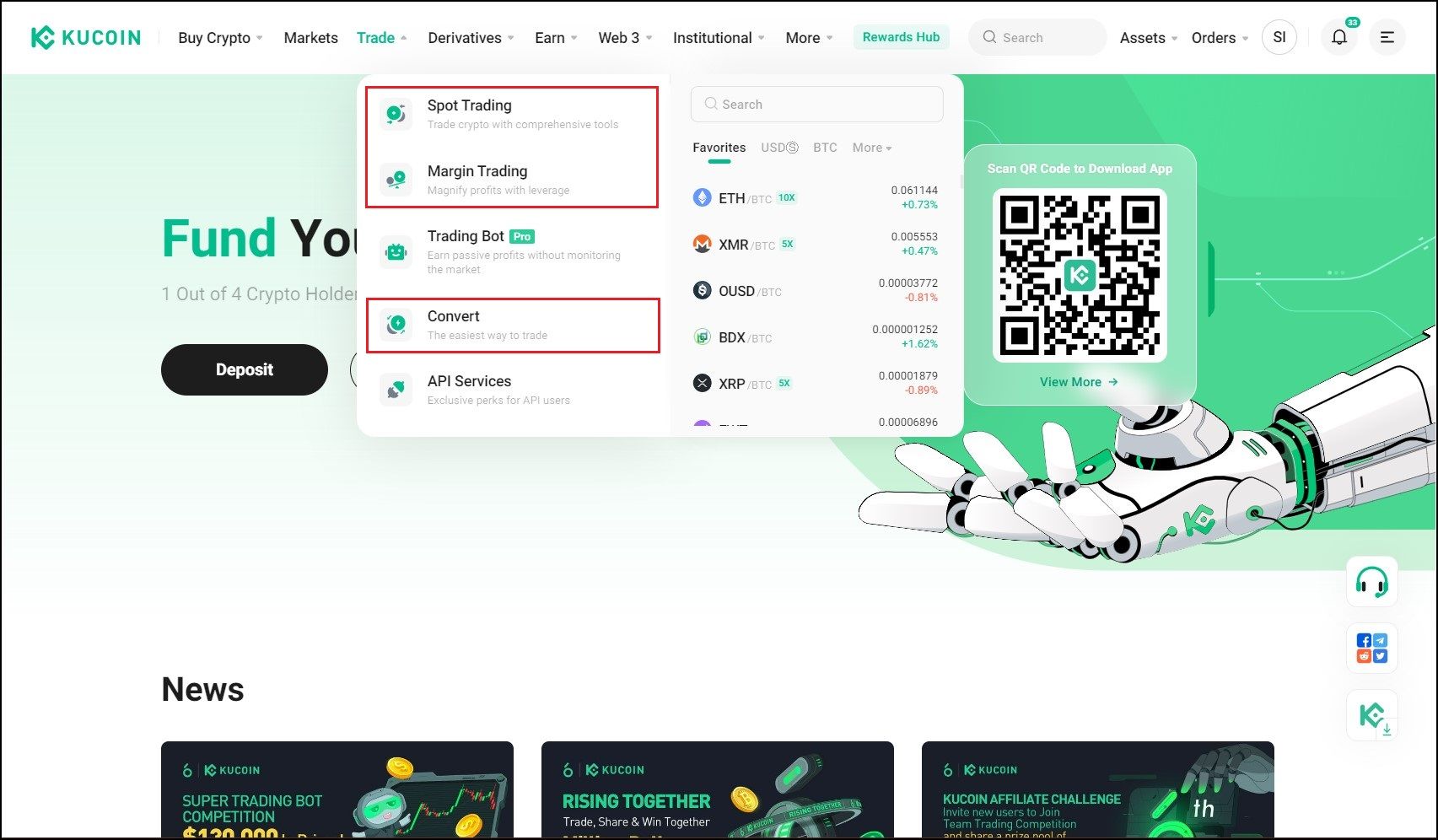

You registered an account with KuCoin and deposited some funds. Now is the time to put those in action and place some trades! Find the ‘Trade’ tab on the top row. The drop-down menu lists options like Spot or Margin Trading and the Convert feature. Let’s talk about them.

Trading Modes on the KuCoin Website

Trading Modes on the KuCoin WebsiteKuCoin Convert

Convert is a simple feature that lets users swap one cryptocurrency for another. The most conventional use would be to swap stablecoins for other cryptocurrencies like Bitcoin, Ethereum, or Doge. The swap is done instantly based on the current market price and limits access to trading features like placing custom orders.

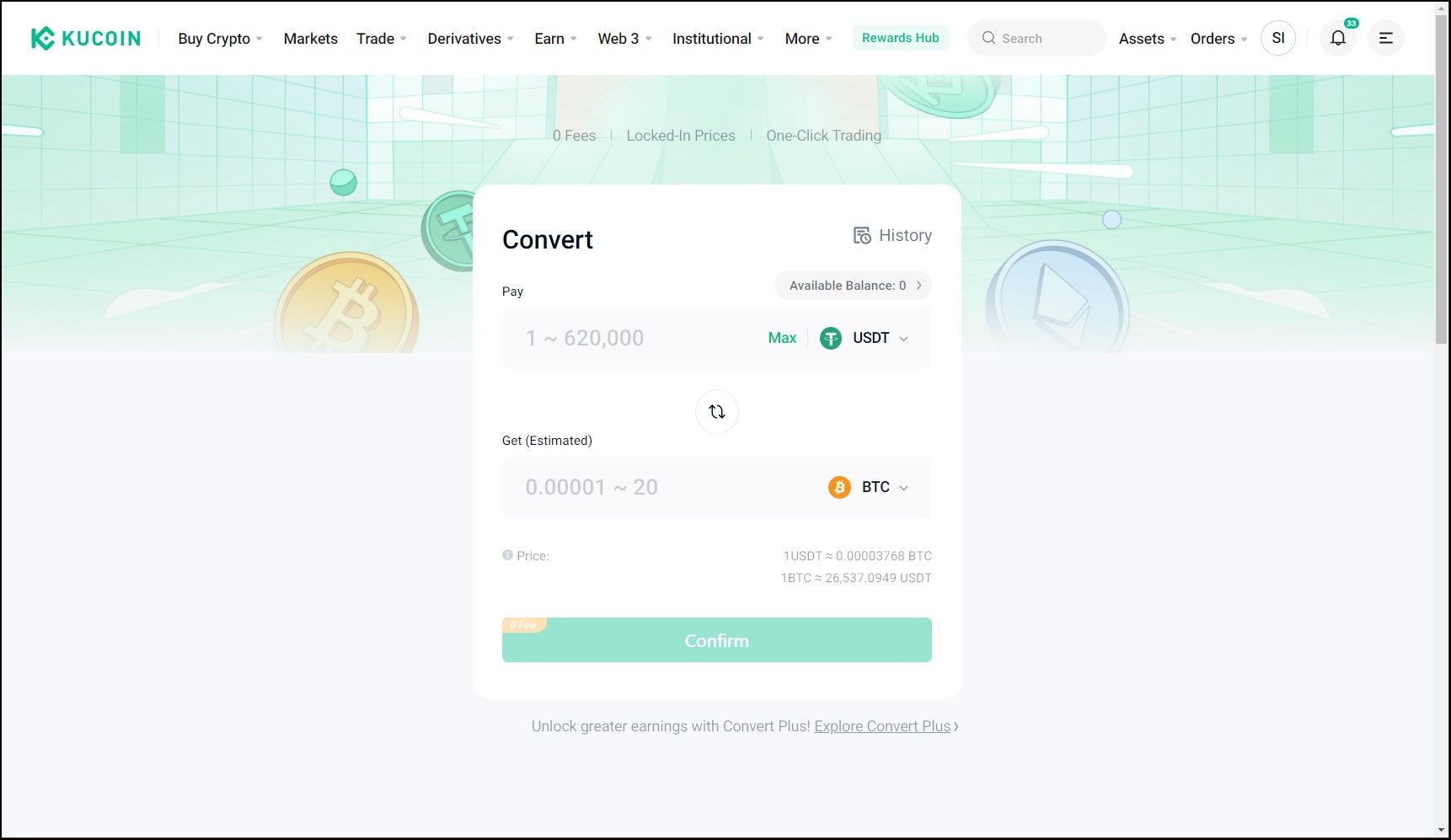

Convert Trading Screen on the KuCoin Website

Convert Trading Screen on the KuCoin WebsiteLike many traders, trade on the Spot market if you wish to exercise more control over your trades and make calculated decisions based on historical price movements.

Spot Trading

The Spot is the primary market for dealing with tradable assets. Access the spot market from the drop-down menu under the ‘Trade’ tab.

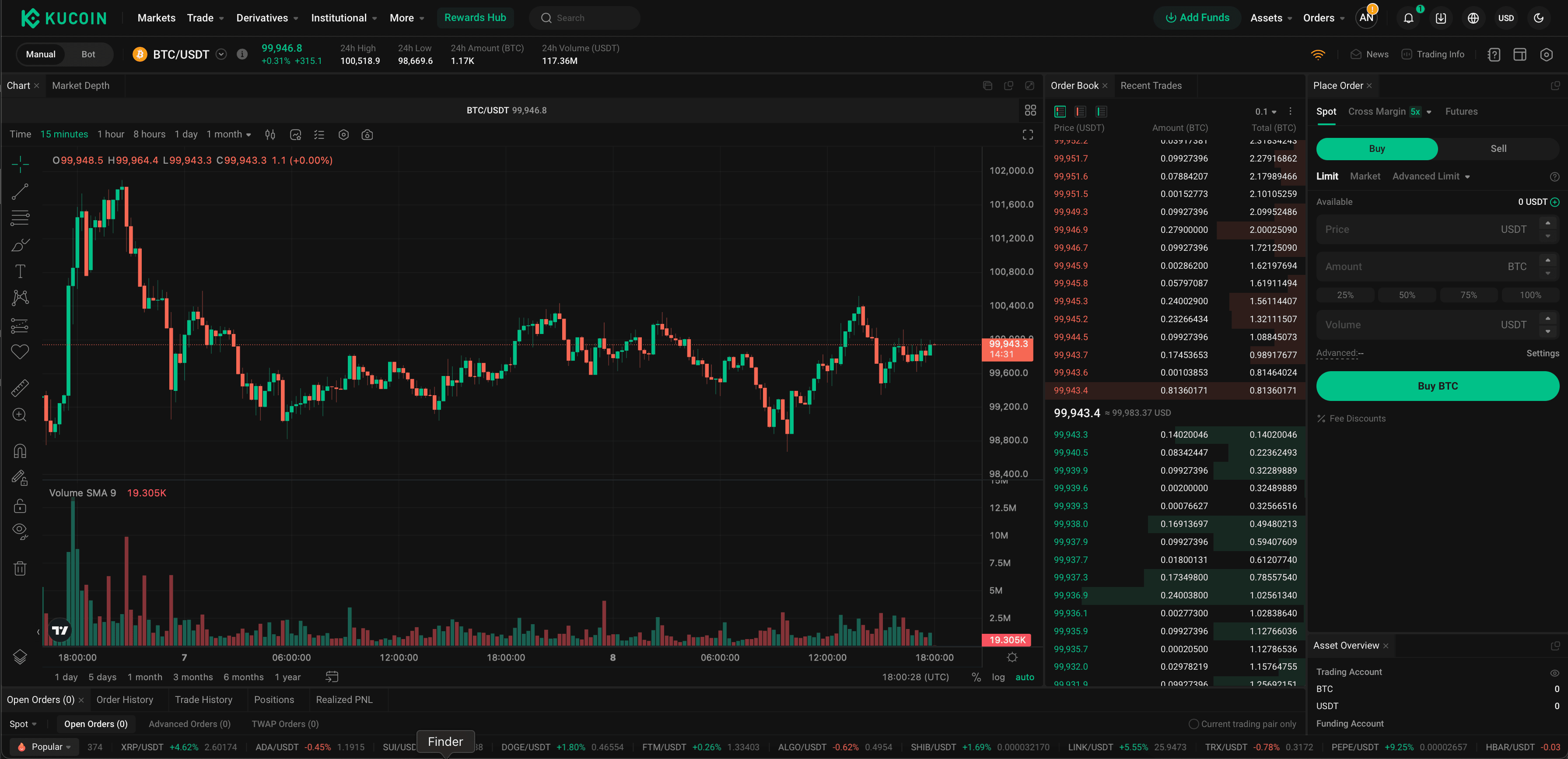

Spot Trading Screen on the KuCoin Website

Spot Trading Screen on the KuCoin WebsiteThis is what the Spot trading screen looks like on the KuCoin exchange. Let’s break it down to understand the essential elements:

- Header - The top row summarizes basic information about the spot market, like the selected trading pair, its current price, highs, and lows. The picture above displays the chart of the BTC/USDT trading pair. You can click on the trading pair to change it.

- Chart - The candlestick chart displays the price history for the selected asset. Traders can adjust the time frame to match their trading strategy and use drawing tools available on the column on the left to draw patterns. TradingView provides the charts on KuCoin, which offers one of the best collection of technical indicators.

- Order book - It lies on the chart’s right and displays the volumes of buy and sell orders other traders have placed at different price levels. The order book lets traders deduce the market depth, an essential indicator of the overall market sentiment.

- Order window - You can place spot orders with the window on the order book’s right. A buy order on a BTC/USDT pair purchases BTC for USDT, whereas a sell order sells BTC for USDT. KuCoin supports various crypto-stablecoin and well as crypto-crypto pairs.

FYI: KuCoin also enables margin trading. If you select ‘Cross’ or ‘Isolated’ instead of ‘Spot’ in the order window, you may place leveraged orders that multiply your purchasing power for the same collateral. Leveraged positions are at risk of liquidation if the positions drop under a specific threshold. Therefore, I advise extreme caution while dealing with these instruments.

Order Types

Traders can set buy or sell orders at any price on the Spot market. All such positions at different price levels make up the order book. An order waits for execution until the trader's target price reaches the current market price. At this point, the exchange matches the buyer to a seller (or vice versa) to execute the order.

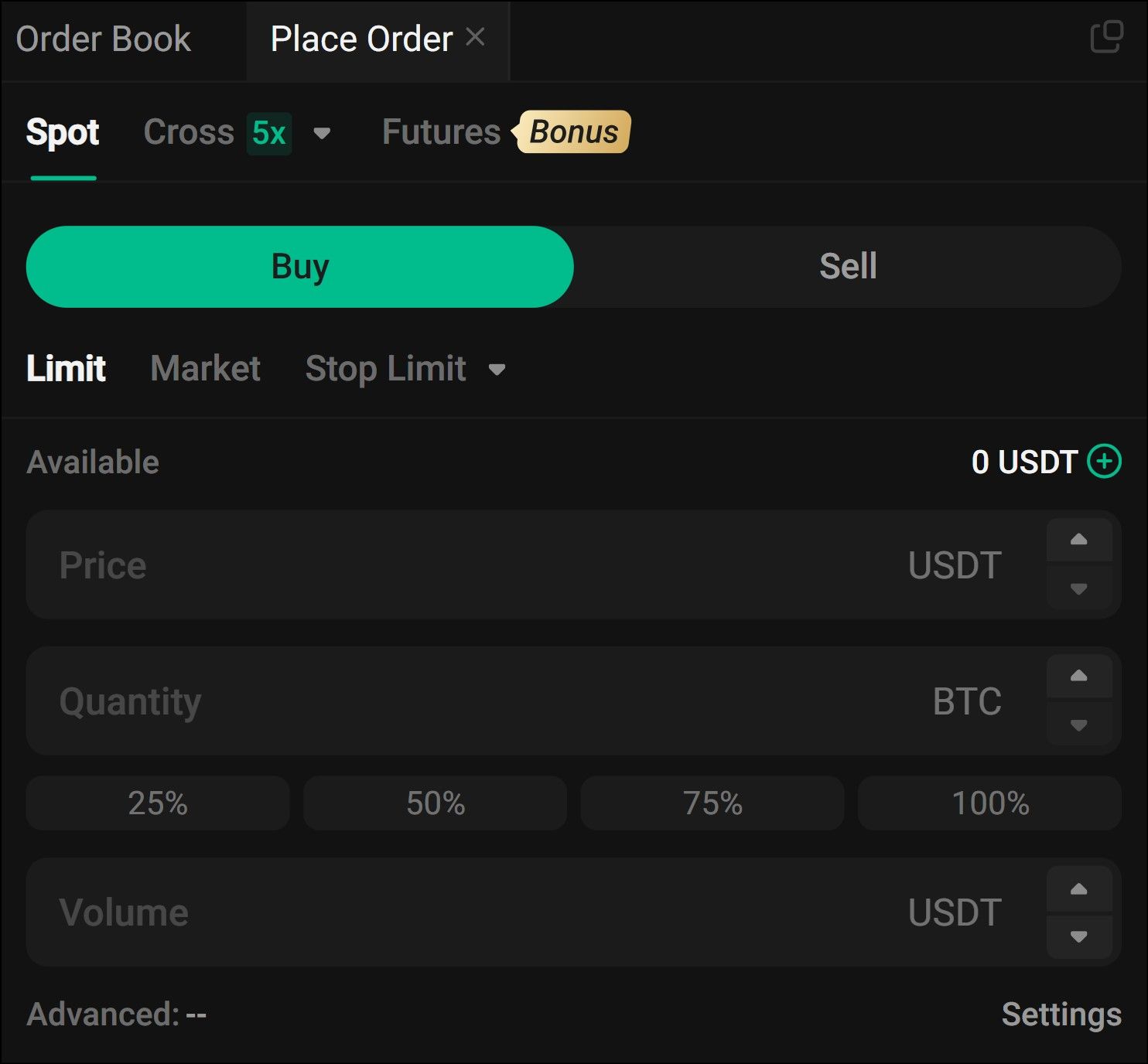

The Order Interface of the KuCoin Website Trading Screen

The Order Interface of the KuCoin Website Trading ScreenWith this feature, traders can speculate on the market direction and set an order in advance to fulfil them even when the trader is offline. There are three types of spot market orders available on KuCoin:

- Limit - A limit order is where you set both the order amount and price.

- Market - You only specify the amount; the exchange executes the order at the market price.

- Stop Orders - This is an order type where the trader specifies precise conditions under which they wish to have their orders executed.

Stop Order Types

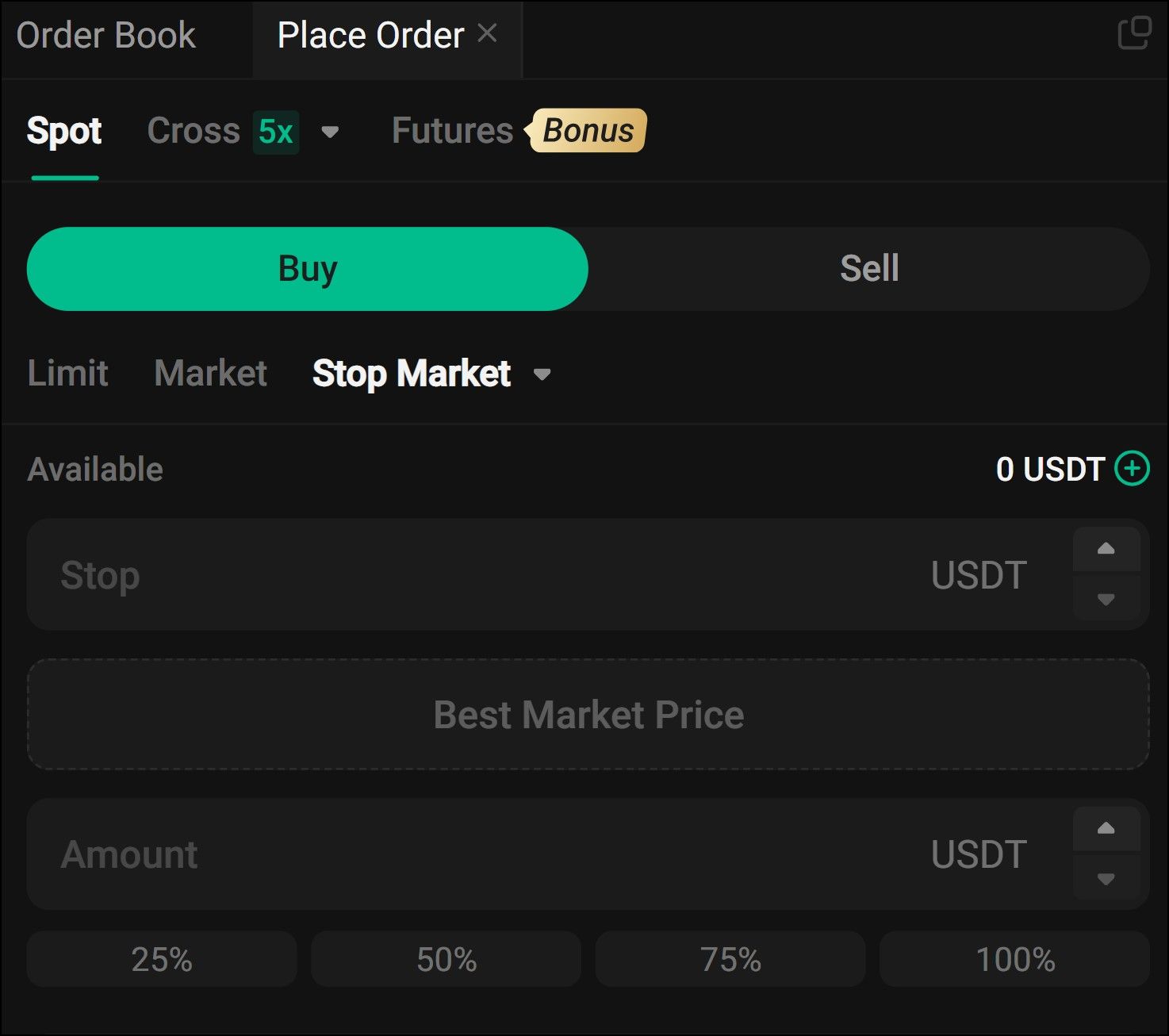

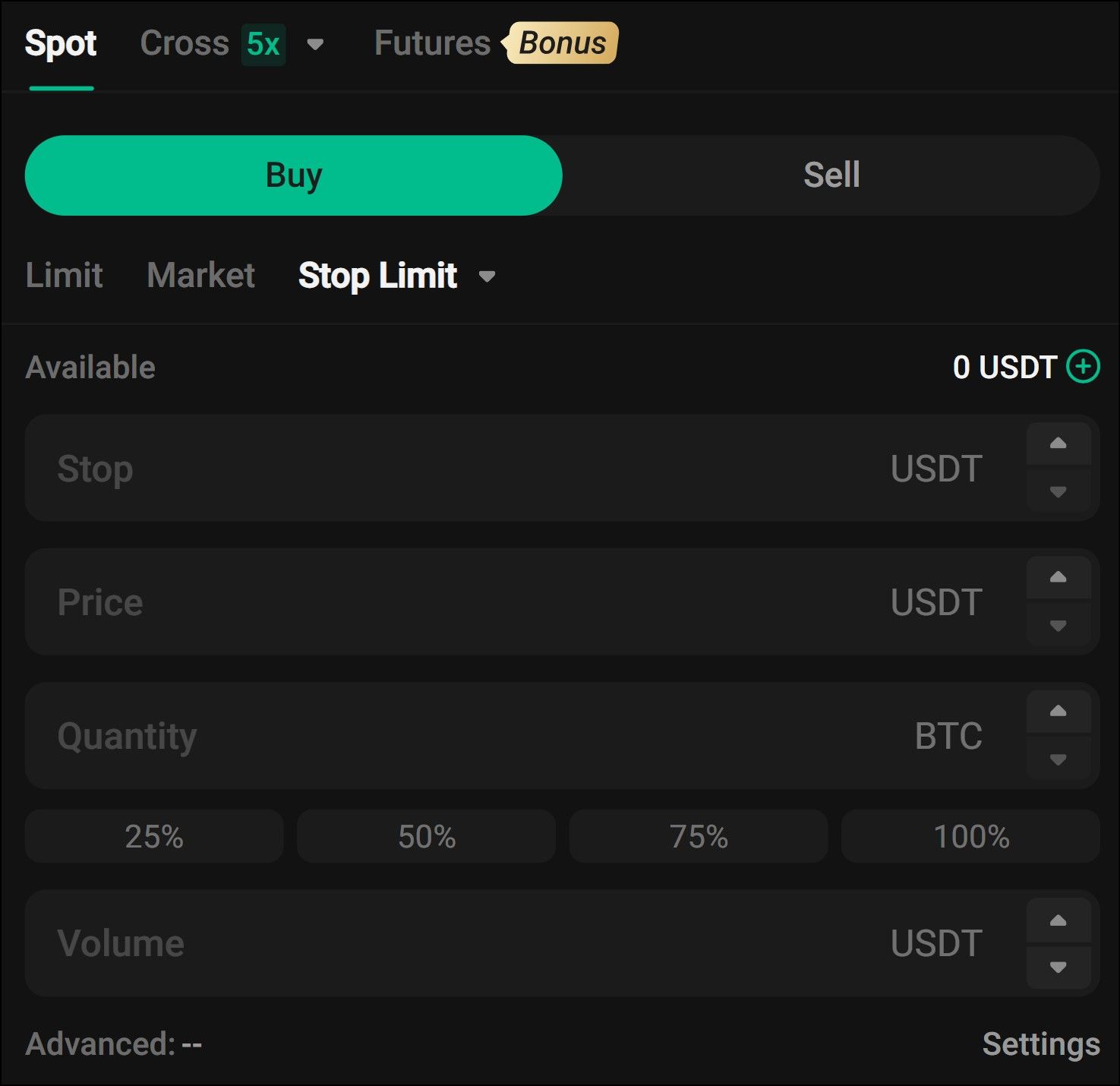

A Stop order lets a trader open a spot position only when a particular condition about the asset price is met. Stop orders are convenient when you have a bullish or bearish sentiment over an asset only when the price hits a threshold. KuCoin supports the following Stop orders:

Stop Market - The trader specifies a Stop value and a purchase amount. If the asset price hits the stop value, the exchange will execute the order to buy or sell the asset at the best market price. Stop Market differs from a Limit order. Where a limit order defines a precise price to execute an order, a Stop Market order executes the order at a Stop or if the market moves at a more favorable price range.

The Stop Market Order Interface on the KuCoin Website Trading Screen

The Stop Market Order Interface on the KuCoin Website Trading ScreenStop Limit - This order type combines the properties of Stop and Limit orders. The trader specifies two prices: a Stop price and a Limit price. The trade is triggered as a limit order (at the specified limit price) only when the asset hits the stop price, allowing further customizability about the order.

Tip: The advanced settings also let you set a time frame. The order is canceled if not triggered within the time frame.

The Stop Limit Order Interface on the KuCoin Website Trading Screen

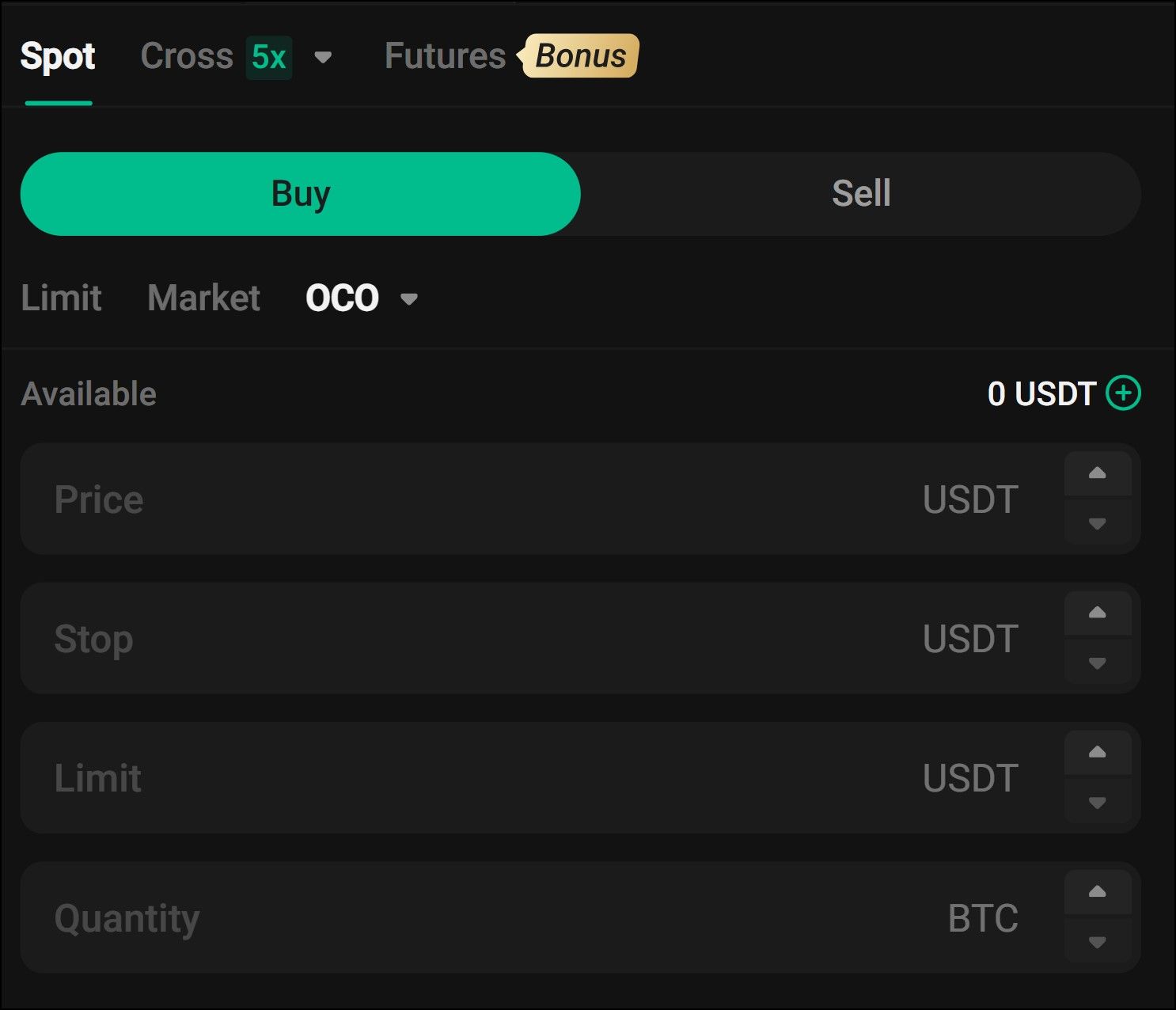

The Stop Limit Order Interface on the KuCoin Website Trading ScreenOne Cancels the Other (OCO) Order - An OCO order lets the trader specify two positions simultaneously. The idea is to place an order if the market moves in the trader’s favorable direction and to cut losses if it does not.

The OCO Order Interface on the KuCoin Website Trading Screen

The OCO Order Interface on the KuCoin Website Trading ScreenWhen the OCO order executes an order in one direction, it automatically cancels the order in the other direction. You need to enter four values here:

- Price - The price at which you want to favorably buy/sell an asset.

- Limit - The price you want to cut losses and close the position.

- Stop - The price level which triggers the Limit order.

- Quantity - The amount of asset you wish to trade.

For instance, you have a unit of coin x you bought at $100. You believe that the price is more likely to go up, but you are unsure about it, so you place a sell OCO order such that:

- Price - $110

- Stop - $95

- Limit - $90

- Quantity - 1

Here, the OCO order sells your assets if it rises to $110. Otherwise, if it falls to $95, a limit sell order at $90 is triggered to cut your losses, and the other order is cancelled.

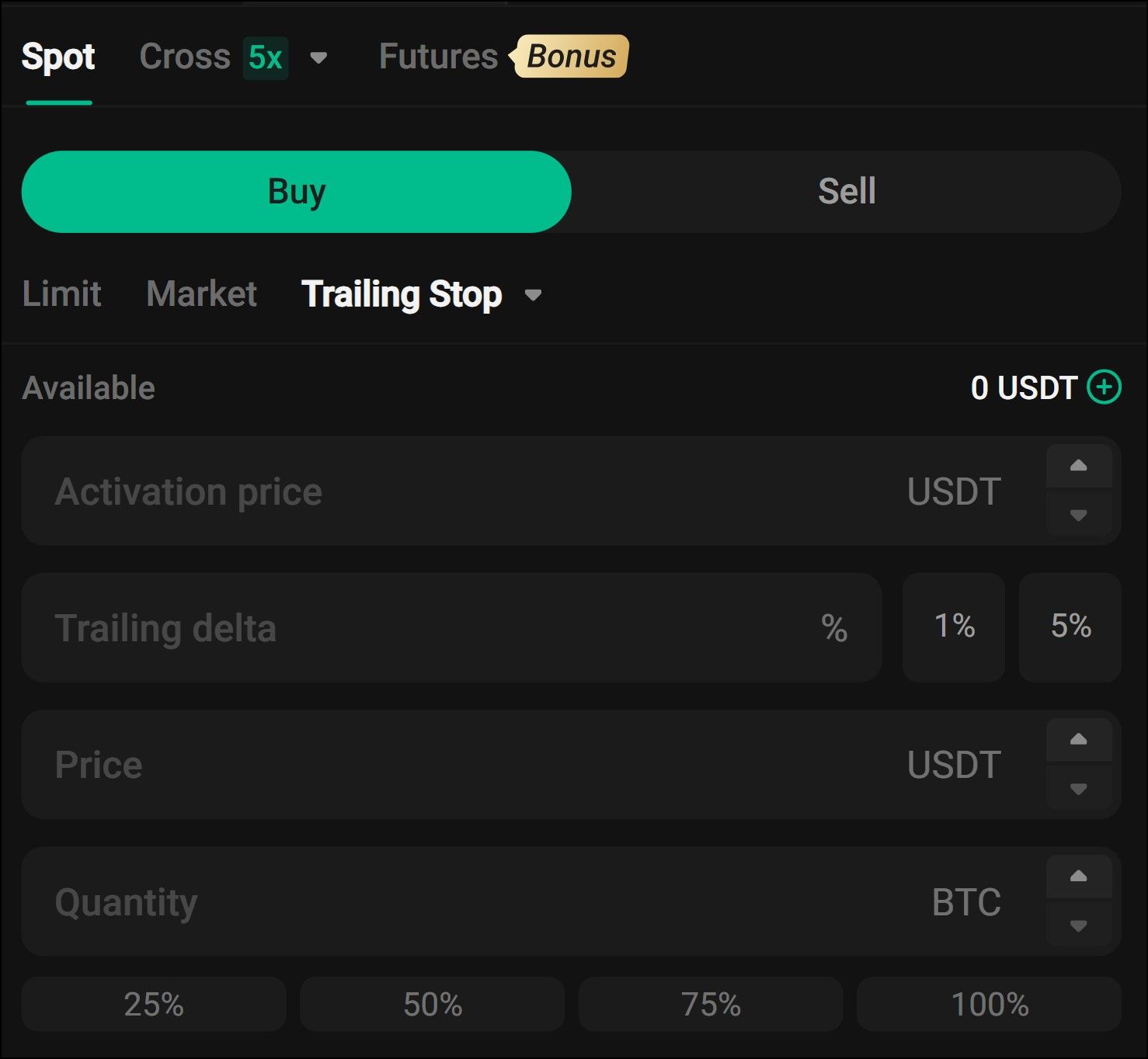

Trailing Stop - A trailing stop order lets you place an order that ‘trails’ the asset price when it is trending in a favorable direction and exits the position of the trend changes direction. The order consists of four values - Activation price, Trailing delta, Price, and Quantity.

The Trailing Stop Order Interface on the KuCoin Website Trading Screen

The Trailing Stop Order Interface on the KuCoin Website Trading ScreenLet’s assume the scenario from above again. The Price value is the point at which you wish to sell the asset X. The activation price activates the trailing stop order. The trailing delta is the percent value below or above the current market price, where your stop price will trail the market price. The stop price trails the maximum or minimum price of the asset on sell or buy orders.

Margin Trading

Margin trading is a strategy where the investor trades with more than what funds they have available by borrowing from the exchange and placing bets in a high-risk-reward environment. The ‘Margin’ refers to the amount of collateral the trader pledges, and the leverage refers to their amplified purchasing power.

Margin trading works by the trader first depositing collateral with the exchange in their margin account. Depending on the broker's capability, the trader can then borrow funds from the exchange in multiples of their margin, which may range from 2x to extremely risky 100x. The exchange protects its loan by withholding the right to close the trader’s open positions and the capital to recover its funds should the market move against the trader; this is called a margin call.

For instance, a 2x leveraged position gets a margin call if the value of the trader’s margin account falls by half, significantly riskier against a spot position, which is retained until the asset goes to zero. However, if the market moves in the trader’s favor, they enjoy double the profit after paying back the exchange their leverage and accrued interest. KuCoin offers Cross 5x and Isolated 10x margin for several major cryptocurrencies. Let’s break it down:

Cross 5x: In Cross Margin, the collateral and different leveraged positions across all cryptocurrencies share a common pool. Traders can only set one cross-margin account, where the account value is a sum of the current value of all margin positions within the account. A margin call liquidates all positions within the account. Conversely, a diverse portfolio helps manage risk where a rising asset absorbs the volatility of a falling asset. Leverage traders can open positions five times larger than their collateral in cross-margin.

Isolated 10x: Isolated Margin is like Cross Margin, but the position is limited to one asset type. Traders may open multiple isolated margin accounts for different asset types, each with separate collateral and margin limits. A trader can open positions ten times their collateral in an isolated margin on KuCoin.

Key Features of KuCoin Trading

Features on KuCoin | Image via X

Features on KuCoin | Image via XKuCoin offers several features culminating in a trading experience ideal for novice traders and advanced professionals. Here is a summary of key features of the KuCoin Trading platform:

- Extensive Coin Variety - KuCoin provides access to a wide range of cryptocurrencies, including popular tokens, stablecoins, DeFi assets, meme coins, and numerous small-cap coins on its trading platform.

- User-Friendly Interface - The platform boasts an intuitive and user-friendly interface, making it easy for novice and experienced users to navigate.

- Competitive Trading Fees - KuCoin stands out for its highly competitive fee structure, making it one of the most cost-effective options among cryptocurrency exchanges.

- KuCoin Trading Bots - KuCoin offers automated trading bots for several well-established cryptocurrencies.

- Advanced Trading Features - Besides the spot market, KuCoin supports advanced trading strategies such as margin, futures, and leveraged trading.

- Passive Earning Opportunities - KuCoin provides avenues for passive income through cryptocurrency fixed deposits.

- DeFi Integration - The platform also features DeFi-specific products, including the ability to stake cryptocurrencies on the blockchain.

- KuCoin Token (KCS) - KCS, KuCoin's native token, offers benefits such as reduced trading fees and a share of KuCoin’s trading fee revenue.

Understanding KuCoin Fees

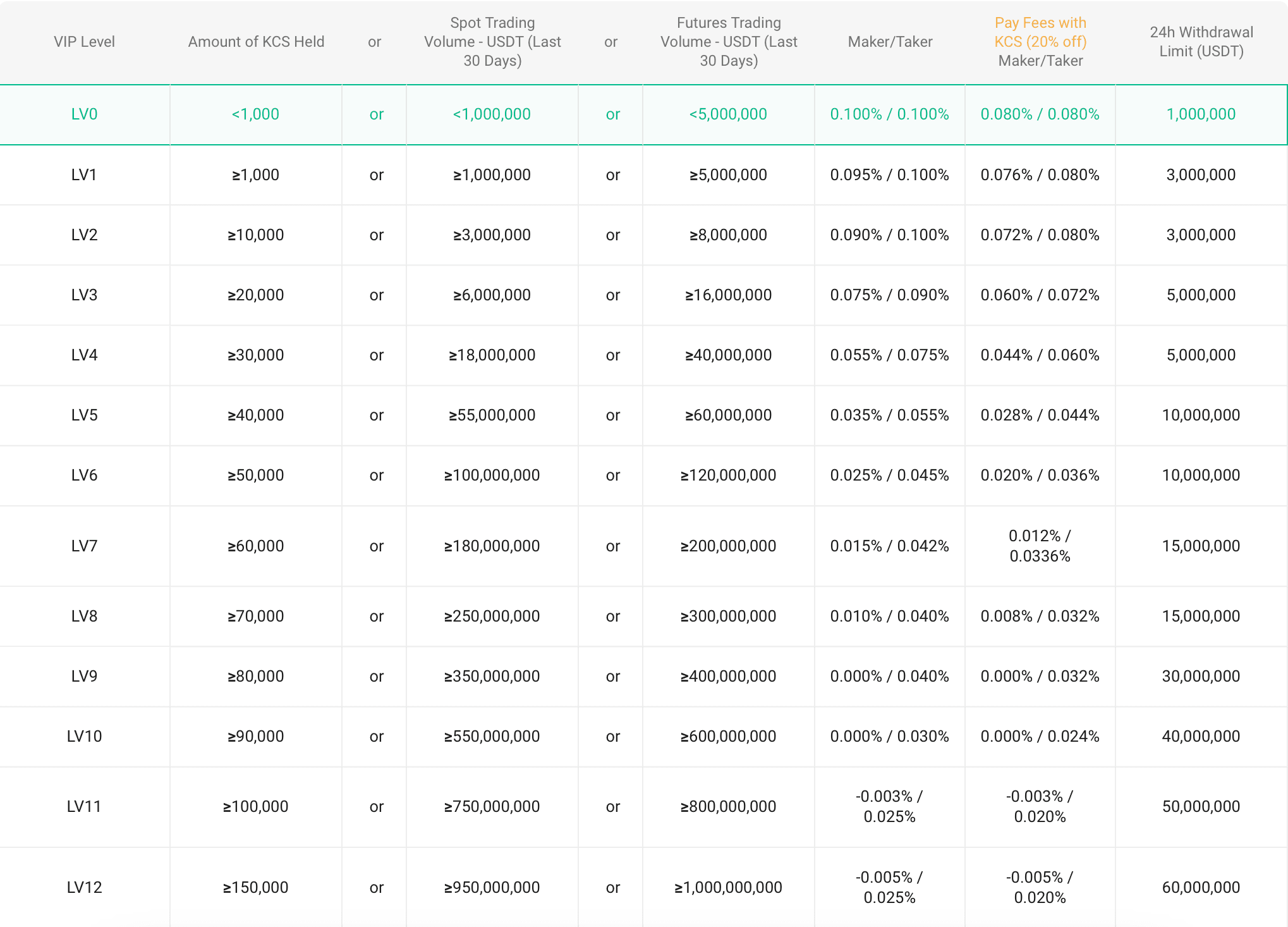

KuCoin follows a tiered fee approach, similar to Binance and OKX. The fee is dependent on the rolling 30-day trading volume on the exchange. Here’s a summary of KuCoin trading fees across its different tiers:

KuCoin Fee Structure. Image via KuCoin

KuCoin Fee Structure. Image via KuCoinFor a deeper breakdown of the KuCoin fee structure, refer to our KuCoin Review.

The KuCoin KCS Token

The KCS token is the native token of the KuCoin ecosystem. It is a utility token that offers several benefits and discounts to its holders in the exchange. It originated as an ERC-20 token on Ethereum and has been migrating to the KCC Chain since 2021. Here are KCS use cases:

- KSC holders receive 50% of the trading fees collected by the exchange as daily KCS token rewards.

- KCS holders receive a trading fee discount based on their KCS holding tier.

- Spotlight projects on KuCoin use the KCS token.

- Holders can stake KCS for additional benefits.

KuCoin Security and Trustworthiness

KuCoin is a renowned cryptocurrency exchange with a track record dating back to 2017. The platform strongly emphasizes security, implementing measures such as encryption protocols and two-factor authentication to bolster account protection.

Nonetheless, it's essential to recognize that, like any centralized financial service, KuCoin's security cannot be entirely transparent and verifiable. KuCoin stresses the significance of being well-informed about the risks of staking cryptocurrencies. Users must grasp the importance of holding their private keys and carefully weigh the trade-off of surrendering this privilege within their personal investment strategy.

KuCoin is also susceptible to operational and maintenance disruptions and unexpected black swan events, such as exploits. On September 25, 2020, KuCoin faced a security breach in which hackers acquired access to the exchange's hot wallets and siphoned off over $280 million in various cryptocurrencies traded on the platform.

As with any financial service, individuals considering staking assets on KuCoin Earn must exercise due diligence and clearly understand the associated risks.

KuCoin Trading Tips for Beginners

Traders in the blockchain-based digital assets landscape are subject to an acutely dynamic environment on the verge of perpetual evolution. Novice traders coming from equities to cryptocurrencies must understand that an unregulated market that is open 24x7 leaves a tiny window to react to sentiment shifts, which are often and quite sensitive.

Therefore, a good idea of assessing cryptocurrency fundamentals like tokenomics is crucial for success in this market in the long term. Many traders start by trading blue-chip crypto assets with the highest market capitalizations as these are relatively stable compared to other speculative cryptocurrencies, and their developments are easy to track. Coin Bureau has curated several lists of top resource channels that will enrich your knowledge about cryptocurrencies in no time. check these links out:

Use these resources to equip yourself with sufficient fundamental knowledge about this industry to conduct self-due diligence and make informed decisions about investing in this market.

Risk Management

In my opinion, risk is one of the most misunderstood concepts in the investing world. A mistake novice traders make about the psychology of risk is treating it as an absolute concept rather than a relative one.

Traders must not think of risk as a quality to avoid but as a feature to optimize. This stems from the fact that a market cannot exist without risk because in a hypothetical zero-risk market, all traders would be perfectly bullish, and no one would sell, so a market cannot exist without risk.

Risk management is the act of weighing in the opportunity of a successful trade against the loss incurred in case it goes south and optimizing the trading strategy accordingly. Risk is mitigated in two broad ways:

- You learn more about the asset fundamentals, helping you better judge its value potential.

- You learn more about the market technicals to place orders for and against the market and hedge your positions.

A successful trader is one who manages risk with a mix of both strategies. The links above will help you cover all the necessary fundamentals, so let’s move on to understanding technicals:

Trend Analysis

Trend analysis is the act of analyzing the market movement, empirical data, experience, and psychology to establish trade entry and exit points that have the highest probability of a successful trade. Educational resources like Coin Bureau Trading will help you deduce market patterns and analyze markets yourself so that you don’t rely on third-party analysis, here are some sources to get you started:

Technical Analysis

Technical analysis is a method used in financial markets to make predictions about future price movements based on the analysis of historical price data and trading volume. It operates on the premise that historical price and volume data can provide valuable insights into the future direction of an asset's price.

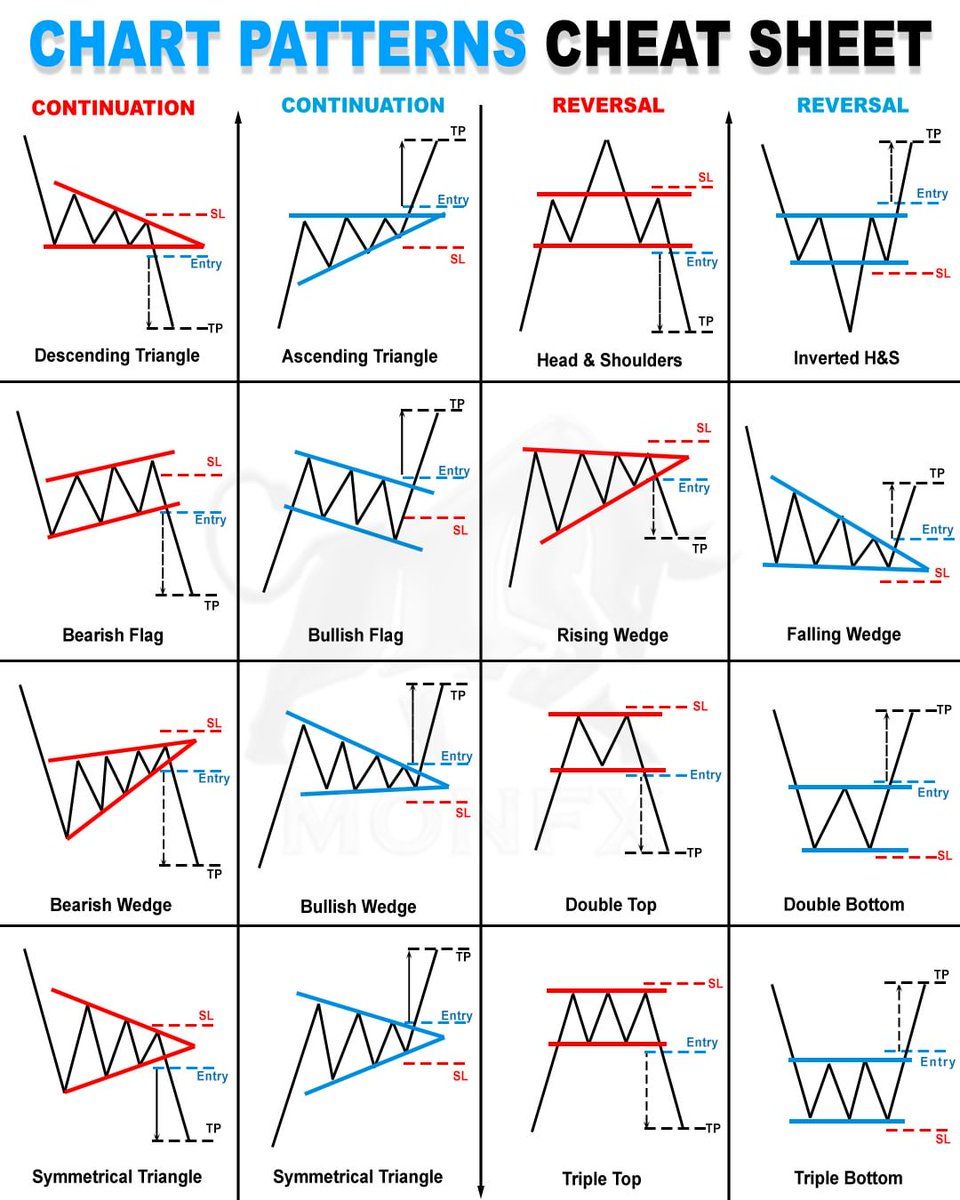

Some Prominent Price Trends | Image via X

Some Prominent Price Trends | Image via XTechnical indicators are mathematical calculations and graphical representations used in technical analysis to help traders and investors make decisions about buying or selling financial assets. They provide insights into market trends, momentum, volatility, and potential reversal points.

The three most widely used technical indicators are:

- Moving Averages: Moving averages, such as the simple moving average (SMA) and exponential moving average (EMA), smooth out price data over a specific period. They are used to identify trends and potential trend reversals.

- Relative Strength Index (RSI): RSI measures the speed and change of price movements and indicates overbought or oversold conditions. It ranges from 0 to 100, with values above 70 suggesting overbought conditions and values below 30 indicating oversold conditions.

- Moving Average Convergence Divergence (MACD): MACD is a trend-following momentum indicator that shows the relationship between two moving averages of an asset's price. It generates buy and sell signals based on crossovers and divergences.

Traders often combine these indicators with other tools and techniques to make informed trading decisions.

Tip: It is important to note that technical analysis is a lagging strategy, meaning it relies on historical data to assess patterns that may develop in the future. An asset’s price movement is a cumulative product of all the participating trader’s cumulative sentiment. Each trader has a certain bias and a trading psychology that sets them apart from others. In light of this logic, it is essential to not rely solely on technicals or fundamentals and to combine all available strategies and different schools of thought.

KuCoin Trading Guide Summary

KuCoin is an excellent choice for beginners looking to make their mark in the blockchain industry. KuCoin's intuitive interface is not overwhelming for a novice trader while providing more advanced features like dual investment, shark fin, futures, and options for when the trader is comfortable indulging in a high-risk-reward environment.

I will close this guide by iterating on the importance of managing fear and greed in a speculative market like cryptocurrencies. This is only possible when the trader learns the right use of risk management tools and pairs it with a thorough knowledge of the digital assets market so that they are not swayed by volatile movements, irrational thoughts, and bold but deceiving ideas spread by market experts.