We've all heard the rumors; a bear market is coming eventually. Whether it be in 2 months or six months is up for anyone to guess; however, we know it will be here, and you want to be prepared when it does. It's nothing new in the crypto industry, and those that have been here the longest will still be sitting on massive gains regardless if we were to drop 80% from current prices. However, it would be nice to know that our portfolio will hold it together and bounce back stronger than ever for those who entered a bit later and aren't sitting on those massive gains. But how do you prepare your portfolio for that?

In this article, I'll go through some basic things about building a solid portfolio and some more in-depth suggestions (not financial advice, though). Of course, no one portfolio structure is suitable for all of us, but avoiding stupid mistakes will save you a lot of money and hopefully also make you a lot of money later in the future. So, let's start.

Why Will There Be a Bear Market?

First, explaining how the crypto market cycles work to those just starting with crypto is essential. The crypto market has so far moved in 4-year cycles mainly because of Bitcoin and Bitcoin's block halving's. We've always seen a huge run-up in prices towards the end of the cycle, followed by at least an 80% crash. In every cycle, we've seen higher highs and lows that confirm cryptos' long-term outlook. However, many projects have disappeared during the years, and often people forget to talk about those projects that went to 0. Instead, we talk about the astonishing performance of both Bitcoin and Ethereum. That's why you need to realize that buying just any crypto won't guarantee your success. Or yes, at the peak of the bull market, everything tends to go up, but not all cryptos recover from a bear market.

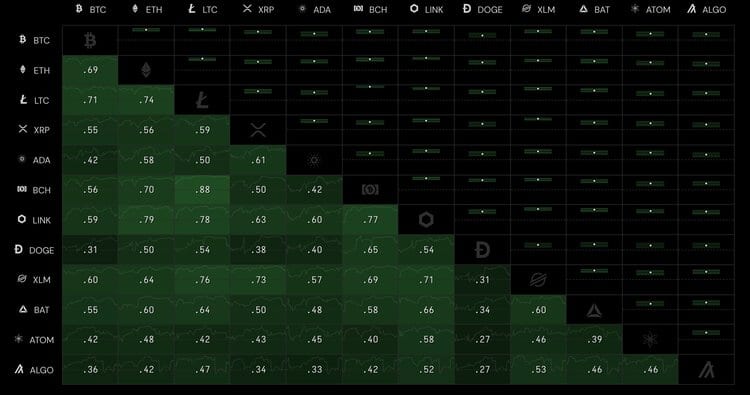

Here's a look at how correlated many cryptos are to Bitcoin. Image via Cryptowatch

Here's a look at how correlated many cryptos are to Bitcoin. Image via Cryptowatch Some say this could be a super cycle, meaning that we won’t see a hard bear market; it’s still good to prepare. We’re already on the edge of a bear market, at least by looking at the timeframe from earlier cycles. And if we want to be correct, a bear market is defined by a 20% in prices which we already saw in Bitcoin dropping from $69k to a low of about $53k. However, for it to be a true bear market, the downturn should be more sustainable, and it might be that we can still go on with the bull market for a while since retail FOMO hasn’t struck yet.

Usually, just before the end of a sharp rise, retail investors with little to no knowledge tend to flood the market, which initially catapults the prices, but eventually, smart money (those familiar with Bitcoin) and big money (institutions) tend to dump on the newbies. This leads to a drop in prices further fueled by panic by those who entered last and now want to get out. This is why I believe that a bear market is unavoidable until we have good enough education about Bitcoin and cryptocurrencies. Those newbies will always rush in at any price because of FOMO, which pushes the price up too fast and too much, and that’s an irresistible selling opportunity for others. Just look at the price of Bitcoin and other cryptos. If something starts rising, leaving the chart to look like a hockey stick, it’s bound to come down at some point when those sitting on astronomical gains want to cash out.

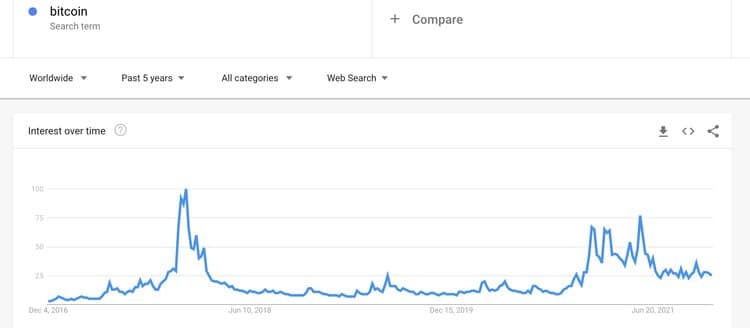

A great place to follow the retail buzz around Crypto and Bitcoin is Google Trends. Image via Google Trends

A great place to follow the retail buzz around Crypto and Bitcoin is Google Trends. Image via Google Trends Now ignoring the possibility of a supercycle, there’s still one question to be asked, what leads to the bear market? To find out the answer to this, I suggest you watch Guys YouTube video on Coin Bureau about how to prepare for a bear market. There he goes through different scenarios on what might lead to a bear market. This is important because some cryptos might benefit depending on the cause. For example, blockchain games and metaverse projects might benefit from a depression or a lockdown due to a certain pandemic. Guy points this out in the video, backed by statistics of previous cases. The reason for a bear market will also determine how much we drop and how fast we’ll recover, so watching that video I linked to isn’t a bad idea.

Risk/Reward

Again, as you’ll see many times in this article, I borrow some of Coin Bureau’s and Guy’s hard work. This time I suggest you watch Guy’s video on Crypto Portfolio 101. There he goes through different risk/reward combinations and gives a good view of which cryptos go into these different categorize.

Much of it is basic logic, like taking, for example, Bitcoin. When compared with other cryptos, it’s undeniably a low-risk crypto, it’s been here the longest, and it has a good user base, along with a use case. On the flip side, though, because of its massive market cap of over one trillion dollars, it kind of limits its upside potential. Yes, over the long run, we could see another 10x, maybe even more, but from what I understand, that’s pretty much it. However, take a small-cap altcoin, market cap under $100 million, and it could “easily” 100x even in the short term. It goes without saying that the project needs many things to succeed, and the process is, in reality, far from easy. But for you as a holder, you just wait a year and maybe have 100x more in your portfolio. Unfortunately, there’s just that little thing called risk. Buying a small-cap coin also comes with the possibility that when you look at your portfolio in one year, the value is 0.

There are still these great 100x projects out there, and by all means, you should go for them if you believe in something. To find them, you simply have to do a lot of research. Not to disappoint you but, although the project you choose can be great, it might not thrive if you buy it before a bear market. The market might cool off, and your project might be forgotten about, and in the next bull market, there may be others that are even better that gain the attention. Also, while it’s true that crypto is still in its early stages, it’s far from what it was a few years ago and finding the next Bitcoin, Ethereum, and Solana seems to get harder and harder. Plus, as Guy points out in the video, some cryptos simply carry an unproportionable high amount of risk compared to their reward potential. Nevertheless, you can still get significant gains with relatively low-risk holdings; just look at the price action of Solana this year.

Finding the perfect balance is highly dependent on your life situation so make sure to put some time into thinking about risk/reward.

Finding the perfect balance is highly dependent on your life situation so make sure to put some time into thinking about risk/reward. The key is to find a balance in your portfolio's risk/reward. Of course, this highly depends on your age, finances, other investments, mental risk tolerance, family, job, and much more. But since I here didn't cover the risk/reward ratio more in-depth, I urge you to check out the video I linked to earlier. It's genuinely excellent, and it helps you gather a mental image of what might suit you. Next up, let's start looking at what your portfolio needs to come back from a bear market.

Diversification

I don't think it comes as a surprise to anyone that to have a solid portfolio, you need diversification. But, it doesn't matter how positive and bullish you are on one project; it still can't be your only bet. There are always factors you can't foresee, and they might be the most unlikely things ever, something that's a one in a million thing. But, the sad truth is that no matter how unlikely it is, if it happens and your holding goes to zero, the only thing you're going to get is a conciliation hug from a few friends or family.

Although it did turn out good, one example is the Dogecoin millionaire ProTheDoge. He put all his life savings ($250K) into Dogecoin, and even though he had over 3 million at the top, I would still argue it was the stupidest thing ever. Playing around with your life savings like that isn't responsible. What If it goes to zero? What then? Depression, at least, and that's for sure. And I want to emphasize that I'm not just saying it because he put everything into a memecoin like Doge. I just don't think it's a good idea to have all your eggs in one basket. I don't even think it's responsible for Michael Saylor, the CEO of MicroStrategy, just to buy Bitcoin for the company. However, that decision is more motivated due to the lower risk on Bitcoin and the multimillion-dollar software business MicroStrategy would have, even if Bitcoin were to go to zero.

Not one basket but MANY baskets.

Not one basket but MANY baskets. So, now that we’ve concluded that we won’t put all eggs in one basket, how do we diversify in crypto? Well, when looking into this, it turns out that it wasn’t as straightforward as I would have thought. Naturally, diversification means that you’ll pick a few coins from different categories; however, defining different categories makes it hard. That’s because there are different ways of dividing cryptos. You can do it by consensus mechanism, use case, what’s it built on, and a lot more. Guy has a relatively good video on categories, but that also lacks a few that I think deserve a separate mention like NFT focused ones and metaverse ones. So, I would approach this issue by simply picking some that clearly have different use cases and approaches. Here are some which I would consider separate categories and one example (thank you, Guy, for your YouTube video, it helped a lot).

- Smart contract – Ethereum

- Store of value – Bitcoin

- Oracles – ChainLink

- Payments – Bitcoin Cash

- Exchanges - Crypto.com Coin

- Metaverse – Decentraland

- DeFi - Aave

- Blockchain Gaming (kind of flows into metaverse too) - Axie Infinity

- NFTs – Rarible

- Supply Chain – Vechain

There were a few ideas, and if you filter by categories on CoinMarketCap, you’ll find plenty of different use cases for cryptos. However, there’s also another problem with diversifying in crypto: the dominance of the first two categories. Bitcoin plus smart contract cryptos dominate the market with probably over 70%. These are seen as the fundamentals of crypto, and naturally, that’s why they deserve a more considerable portion in the portfolio. If you disagree with me, here are a few reasons these categorize should make up the majority of your portfolio.

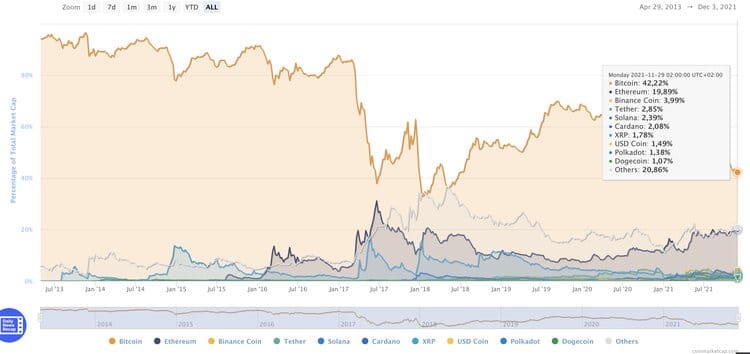

Bitcoin and Ethereum dominate the market even alone (over 60% market share). Image via CoinMarketCap

Bitcoin and Ethereum dominate the market even alone (over 60% market share). Image via CoinMarketCap Store of value obviously because of Bitcoin. Not only is the underlying thesis of Bitcoin excellent, but it also has the biggest market cap and the advantage of being first. Bitcoin is something that I would say at least 90% of the crypto community believe in, and it's also the first choice for new players, including institutions. Cryptocurrency without Bitcoin isn't something that's going to happen.

Then smart contracts because that's where the innovation lies. Many of the categories I listed, like metaverse and NFTs, are just subcategories for smart contract cryptos. Smart contract cryptocurrencies power almost every use case you can find. They power entire sectors of the market, and if you don't believe in these or own these, then it's implied that you don't believe in anything built on them either, which of course is the opinion of some of us, and that's fine. I just think that smart contracts and the blockchains powering these are the sources to most use cases of cryptocurrencies just think of NFTs.

Plus, there are still so many things we haven't even started exploring with smart contracts. It's not a coincidence that some talk about the flipping (when Ethereum overtakes Bitcoin as the biggest crypto by market cap). So, in conclusion, buying smart contract platforms is in itself diversification since you're relying on many different categories building on top of that. Then if those built on top takeoff, you will also benefit from that. You can simply look at the success of Ethereum. You didn't have to buy an NFT or invest in DeFi to benefit from their success; you can simply see it in the demand and price action of Ethereum, on top of which many of these are built.

Which Cryptos Should You Pick?

Naturally, the only thing I can say is to do your own research. However, I can give you some advice based on my research. I can first say to trust those with a proven track record, namely Bitcoin and Ethereum. Bitcoin has been around since 2009, and it’s also the biggest cryptocurrency by market cap (by far). I think that pretty much explains why I believe that this is a crypto that’ll survive a bear market. Ethereum is also quite the OG crypto or, more accurately, OG smart contract crypto, the second biggest market cap, and the leading smart contract protocol with high institutional demand. Therefore, I think it’s safe to assume that Ethereum too will bounce back and be higher in 5 years than it is now.

Then next, although I previously talked about diversification into different categorize, I would add some competitors for Ethereum. That’s because many high-profile crypto people have said that they believe in a more extensive ecosystem not only ruled by one protocol. Most recently, I believe Solana Labs co-founder Raj Gokal said that he doesn’t view Solana as an Ethereum killer and that he believes they can co-exist with potentially different use cases.

Then looking at where institutions are parking their money, we have the highest year-to-date inflows in Solana, followed by Cardano and Polkadot. The percentage allocation you decide to put into each is up to you, but I just want to point out that Ethereum has the best track record. When you look at the price action of Ethereum, it’s more mature and isn’t likely to fall as much as the others in a bear market. However, in a bull market, we can assume some smaller market cap coins might outperform Ethereum as Solana has.

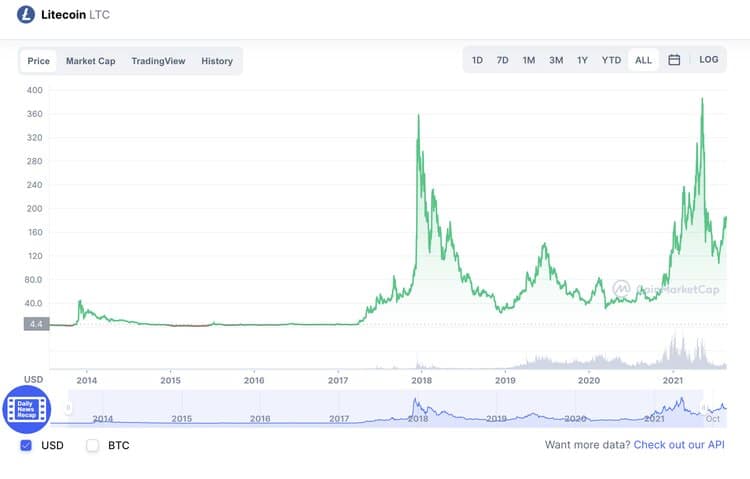

Then lastly, on these two categories, I want to mention Litecoin since I know there are many fans out there. However, I’m not a fan of it, and that’s purely because of price action. Looking back, we see that in this bull market, Litecoin barely broke its all-time high compared that to Bitcoin, which more than tripled its price since the 2017 ATH. Therefore, I don’t believe any crypto can compete with Bitcoin in the store-of-value category.

Here's the proof. Image via CoinMarketCap

Here's the proof. Image via CoinMarketCap Other individual picks to add to your portfolio that have gained much attention in recent months are metaverse projects, The Sandbox and Decentraland, maybe even Enjin or Axie Infinity. These would be a great diversification, and as I mentioned in the beginning, they could even thrive in some bear market scenarios. They also have a great deal of momentum behind them, which was shown in the recent dip when they too initially plunged, but before anyone else, they bounced back to hit ATHs. (See the picture down below). Although now, they’ve cooled off a bit too. However, I have to say that the valuations are quite high. If you consider this a metaverse bubble, then it’s very likely that these projects fall even more than the broader market when a bear market strikes and the hype winds down, so be careful and do your own research.

This is by no means guaranteed and a 5% dip isn't the same as a bear market. Still, it's interesting to see. Image via TradingView

This is by no means guaranteed and a 5% dip isn't the same as a bear market. Still, it's interesting to see. Image via TradingView Other good projects for good diversification could be some DeFi projects or even something completely different from the previously mentioned categories. For DeFi projects, the safest might be to go with big names like Aave or Uniswap. However, as many of you know, due to many factors, DeFi hasn't been the hottest sector out there. That's why addressing the risks of DeFi is up to you, but if I were to give my opinion, I don't think DeFi is going away; it's a key part of cryptocurrencies. The question is that at what scale we'll see it in the future, and will it be new protocols or the existing ones that dominate the market. There's lots of innovation in the space, which brings additional risk, and the thesis about going with projects with proven track records can be broken.

Then for a project not so strongly related to anything brought up here could be Helium. I took a sneak peek into Guy's portfolio (which can be found in the CB weekly newsletter), and his content which led me to the conclusion that a project like Helium with demand from big-name companies could be a good bet since the users of a protocol like this won't stop just because of a bear market. And for those of you who don't know, Helium is a decentralized blockchain-powered network used by, for example, Salesforce. There are naturally other projects with similar advantages, but I trust Guy to guide me through the crypto markets.

Then, of course, not maybe the most responsible thing to say, remember to pick the risky projects you love. I know many, if not to some degree, all of us, are in cryptocurrency for the significant gains. However, making astronomical gains with something as big as Bitcoin just isn't going to happen. That's why if you're looking for those 100x gains, you got to go for the smaller market cap coins, as previously stated. I believe these should be in our portfolios because it keeps our inner gambler in control and makes it more fun.

Naturally, most of your portfolio should consist of safer and more well-established bets but having these risky projects take a small chunk of your portfolio is completely fine. They can be good if they manage to explode since that will offset much of what you might lose with the others in case of a bear market. BUT, with risky projects, I do not, I repeat, I do not mean meme coins. Yes, they can make you filthy rich, but that's 100% speculation. Instead, pick a project you've thoroughly researched with a good use case, strong team, high demand, and hopefully some good partnerships. Even with the riskiest projects, you can somewhat minimize the risk by doing a good job researching before investing.

We all dream of hitting that one in a million project that takes us To The Moon.

We all dream of hitting that one in a million project that takes us To The Moon. Then as the last pick from me, NFTs. Yes, they are not cryptocurrencies, but they can be found in the same wallet with your cryptos (not all wallets). Picking up a piece from the most well-known and well-established projects like Cryptopunks and Bored Ape Yacht Club can be a good bet (also Mutant Ape Yacht Club). With these price levels and even some bubble signs, I would stay with these big projects since picking riskier assets amid a potential bubble might turn out bad, just look at the ICO craze back in 2017. NFTs being still this early, I think the risk is high enough even with these big-name projects. However, I know the prices are incredibly high, and not all of us have the means to purchase even a mutant ape. Therefore, I think NFTs should be the last part of your portfolio, and you should only invest in them with sums that you are absolutely okay losing. So, get an ape if you can, but ensure that your portfolio can handle the allocation.

Conclusion

I know this article didn't maybe provide you with the in-depth tricks on how to avoid a bear market; that's just because it isn't possible. Neither is it possible to give a list of specific cryptocurrencies that are guaranteed to be higher five years from now. The only way to minimize the risk while maximizing the gains is to ensure that your portfolio is built on solid foundations. Again, I will borrow Guy to explain this further. Look at his portfolio. Over 50 % allocated to big names Bitcoin and Ethereum then add to that the next two names Solana and Polkadot, and that's already 76% of his portfolio. Those are big names with plenty of upside but a limited downside. That's the recipe for surviving a bear market. According to the book of diversification, it's not correct, but then as I said, pay the closest attention to store of value and smart contracts because they are the most well established with proven track records. Then, of course, Guy too has a variety of Altcoins which easily might explode to become key holdings in his portfolio which would be great for him. But they might go to zero too, but that won't matter since he still has his solid foundation.

A strong foundation surrounded by diversified altcoins and some risky bets sprinkled on top will get you out of a bear market. And, from what cryptos have shown us so far, that portfolio will also thrive in a bull market. So, yes, you might not make gains like ProTheDoge, but at least you can sleep at night knowing your portfolio is a safe as it can be. Plus, you can always use your gains to play some lottery if you really want to chase those out of this world gains.