As Bitcoin’s (BTC) dropped $1,000 over the past several hours, Bitcoin Cash (BCH)—the cryptocoin that split off during the highly contested August 1st hard-fork—has conversely surged.

At press time, Bitcoin Cash is up a whopping 30% from yesterday, November 9th.

So, what gives?

Surely many BTC holders who were trying to “double up” during the proposed mid-November SegWit2x hard-fork have been disappointed now that SegWit2x has seemingly been called off and are now diverting back into Bitcoin Cash to hedge their bets.

And, as BCH price has skyrocketed today while most of the other top 50 altcoins are temporarily sinking, it’s clear that the fickle crowds of crypto are choosing Bitcoin Cash over other cryptocurrencies right now.

Let’s try to understand why.

First off: what is Bitcoin Cash

As the Bitcoin network gets heftier fees and increasingly sluggish under the burden of growing transactions, the BTC scaling debate has enveloped into a firestorm this year.

Consequently, this firestorm resulted in a Bitcoin hard-fork on August 1st. The resulting two coins were, of course, the current incumbent BTC chain and what we now know as Bitcoin Cash.

The reasons for this split were straightforward.

BTC supporters wanted:

- to scale through Lightning Networks on SegWit1x (Segregated Witness)

- not to scale through raising BTC’s block size higher than 1MB

BCH supporters wanted:

- to scale through raising BTC’s block size to 8MB

- not to scale through SegWit1x

- to respect Satoshi Nakamoto’s alleged original vision of raising block sizes

- to maintain the blockchain with BTC’s genesis block

The two sides failed to reach consensus, and the rest has been history. BCH split off from BTC and has been billing itself as the better Bitcoin chain for backing commercial payments ever since.

Good investment?

So, the grand question now is whether Bitcoin Cash is a sensible investment going forward.

If you have a stomach for moderate to high risk exposure, the ambiguities and uncertainties reigning in the crypto space right now could (keyword: could) end up breaking in BCH’s favor.

A million-and-one things could happen, of course.

There’s no crystal ball, of course, and a black-swan event could turn the crypto world on its head overnight at any time. But aside from this unavoidable truth, there’s a couple of promising bullish signals for BCH.

First, with how contentious the greater Bitcoin community is in general right now, the potential for power shifts in the space are limitless. Just having a high-profile tent open, as it were, means more will users will inevitably migrate to BCH’s show.

Secondly, if BCH can corner the commercial payments market like it’s angling to do, it can achieve a level of dominance that might be enough to edge it over BTC in the long run.

Miners are also an interesting dynamic to consider. Miners ostracized by Bitcoin Core developers during the fiery SegWit2x debates could play a part in shifting mining power—and more users in general—over to BCH.

Short-term considerations:

- BCH could continue experiencing upward price pressure so long as BTC holders continue to sell-off after SegWit2x’s apparent cancellation

- the counterargument, though, is that this could be the tail-end of BCH’s current price rally

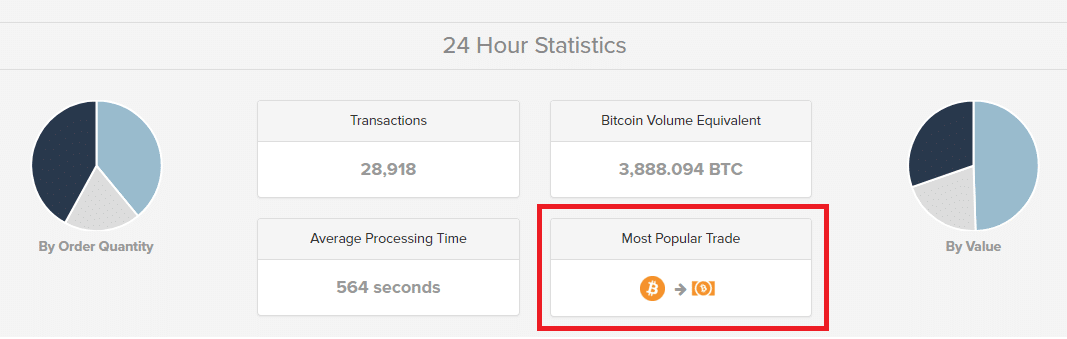

Hottest trading pair on ShapeShift right now? BTC for BCH

Mid- and long-term considerations:

- users / miners migrating to BCH in further community debates

- BCH’s ability to win over more commercial users

Major pro & major con

Perhaps the most exciting and promising aspect about Bitcoin Cash is its low transaction fees. These could become extremely attractive as BTC’s fees continue to get higher and higher.

On the flip side, the main factor that’s unsurprisingly working against Bitcoin Cash is name recognition / intuitiveness.

This factor could be readily enough addressed, of course, especially over the mid- and long-term.

Yet it’s undeniable that outside of the crypto community, mainstream circles have virtually zero awareness of Bitcoin Cash.

And while cryptocurrencies are difficult to explain to mainstream audiences in general, it might be easier, say, to explain the differences between Ethereum and Bitcoin rather than the differences between Bitcoin and Bitcoin Cash. Though surely that’s a matter for debate.

The BCH community can address this issue through coordinated marketing efforts, the likes of which the r/btc subreddit have been collaborating on as of late.

Featured Image via Fotolia