Bitcoin Cash ABC is an interesting moniker, because it only lasted for a couple weeks, and as of November 23, 2018 Bitcoin Cash ABC is now just Bitcoin Cash.

Confused?

This is all because of a very contentious split that happened in the Bitcoin Cash community where one group of developers decided that they had a better vision of how the project should progress. Hence, you had the competing chains of Bitcoin Cash Satoshi's vision (BCHSV) and Bitcoin Cash ABC (BCHABC).

In this post, we will take you through the hard fork, the different arguments of the competing chains and what it means for the long term prospects of Bitcoin Cash. But first, let's start with some basics.

Bitcoin Cash Overview

Bitcoin Cash (BCH) is a cryptocurrency that was created as a hard fork of the Bitcoin blockchain on August 1, 2017. The fork was the result of a long-standing dispute regarding scaling of the blockchain, with Bitcoin Cash proponents choosing to increase the block size limit. These proponents still see Bitcoin Cash as “the real Bitcoin”.

The great Bitcoin / Bitcoin Cash Divide...

The great Bitcoin / Bitcoin Cash Divide...Prior to the August hard fork that created Bitcoin Cash there was an implementation being called Bitcoin Cash ABC, with ‘ABC’ standing for ‘Adjustable Blocksize Cap’. This implementation featured no set blocksize, instead specifying that users would be able to choose their own blocksize. Bitcoin Cash ABC got its greatest support from mining pools, and from bitcoin.com CEO Roger Ver and Bitmain co-founder Jihan Wu.

Bitcoin Cash ABC Versus Bitcoin Cash SV

November 15, 2018 was the date set for a Bitcoin Cash fork, and because of some suggested changes the Bitcoin Cash community was split. This created two competing factions: Bitcoin ABC, which is the original Bitcoin Cash implementation backed by Roger Ver and Jihan Wu, and Bitcoin SV (Satoshi’s Vision), which looks to make Bitcoin Cash the same as Bitcoin circa 2009, and was backed by Craig Wright, who claims to be Satoshi Nakamoto, though that has never been proven.

Bitcoin ABC is the original implementation, and it has a policy of forking every 6 months to implement upgrades. The November 15 upgrade was set to introduce Canonical Transaction Ordering (CTOR), which will force transactions to be included in a block in a specific order. The development team believes this change will help with future scaling improvements.

The team also planned to add a new script that would enable oracles, as well as making some smaller fixes, like the minimum size for transactions.

Against the Bitcoin Cash ABC protocol stands Bitcoin Cash SV, which was recently developed by Craig Wright, and looks to restore Bitcoin Cash to the original Bitcoin protocol 0.1.0 launched in 2009.

Differing visions of the BCH Future. Craig Wright (Left), Roger Ver (Right)

Differing visions of the BCH Future. Craig Wright (Left), Roger Ver (Right)Bitcoin Cash SV proposed very few changes now, the chief of which would be a default block size of 128 MB. It also rejects CTOR and removes the size limit on scripts.

Eventually Wright planned on more changes to bring Bitcoin Cash SV closer to the 2009 Bitcoin protocol. One change would be a further increase in block size, or even removing the block size limit entirely. There were additional contentious changes suggested by Wright, and he also went as far as to hint at bringing coins that haven’t moved in a very long time (the Satoshi Nakamoto address) back into circulation.

Support for each Version

The Bitcoin Cash community was pretty clear in picking sides ahead of the hard fork. Bitcoin Cash ABC received support from Ver and Wu of course, but the Bitcoin Cash ABC chain was also supported by most of the major exchanges. Most other Bitcoin Cash implementations, such as Bitcoin Unlimited, BCash and Bitprim also made their software compatible with Bitcoin Cash ABC.

The Bitcoin Cash SV implementation was most popularly supported by media outlet CoinGeek, which is owned by billionaire Calvin Ayre. Most of the Bitcoin Cash mining pools were also in support of Bitcoin Cash SV, which gave the protocol a significant amount of hash power heading into the hard fork, and brought up the possibility of a hash war after the fork. These mining pools represented as much as 70% of the network hash power.

Users seemed to be in favor of the Bitcoin Cash ABC version, and futures for BCHABC were priced significantly higher than BCHSV futures on Poloniex and on Bitmex.

The Hash War Scenario

The idea of a hash war came in response to a lack of separation between the two chains by the technical trick known as replay protection. With replay protection any transactions on one chain are invalid on the other chain, so it’s not possible to spend the same coins on both chains.

What happened is that while Bitcoin ABC implemented replay protection, Bitcoin SV copied this “protection” to cancel it out. This would allow for replay attacks to take place.

A replay attack is when transactions to look the same on both chains, and allows transactions to be replayed or repeated on both chains, leading to double spending. A similar scenario occurred in 2016 when Ethereum and Ethereum Classic split, causing significant losses for unprepared cryptocurrency exchanges.

The other danger of this type of split is a hash war.

Ahead of the hard fork both Bitcoin Cash ABC and Bitcoin Cash SV proclaimed that they would use all the hash power under their control to ensure they had the surviving chain. Craig Wright even went so far as to say he would institute a 51% attack on the Bitcoin Cash network if necessary to ensure that Bitcoin Cash SV is the surviving chain.

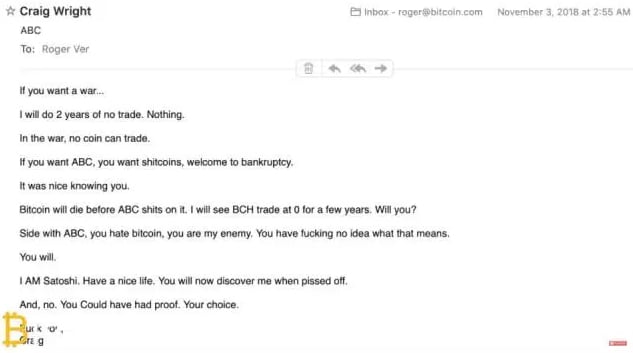

Email sent from Craig Wright to Roger Ver. Source: Bitcoin.com

Email sent from Craig Wright to Roger Ver. Source: Bitcoin.comThis was all very speculative, but the Bitcoin Cash ABC side knew they had several potential responses to such an attack. They could simply wait it out, since the attackers are giving up money for as long as the attack continues.

They could also deploy more of their own hash power, even drawing on Bitcoin miners to mine the Bitcoin Cash ABC blockchain. Or in what is considered a “nuclear option” they could fork again, but also change the proof-of-work algorithm to render the attacking hardware incompatible with the blockchain.

After the Hard Fork

What actually happened was nowhere near as dramatic as the possibilities, but was still a significant impact on the cryptocurrency community.

Bitcoin Cash ABC quickly took the lead in hash power, and while both sides were seen mining empty blocks at some points, there was never a 51% attack on the network.

The Bitcoin Cash ABC chain was quickly accepted by nearly all exchanges as the BCH ticker version.

However, the sharp drop in the price of Bitcoin in the days following the hard fork is being laid at the feet of this hash war. It appears that quite a bit of hash power was shifted by Bitmain from BTC mining to BCH mining. This loss of hash power on the Bitcoin network contributed to the falling price of BTC, which contributed to broad based selling in the cryptocurrency markets.

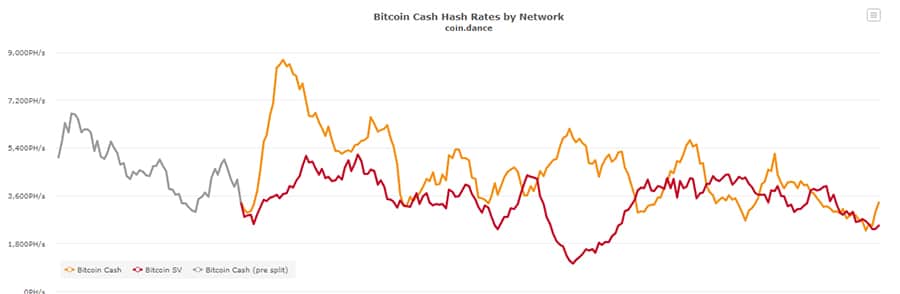

Bitcoin Cash and Bitcoin SV share of network hashrate. Source: coin.dance

Bitcoin Cash and Bitcoin SV share of network hashrate. Source: coin.danceAs of November 23, 2018 it appears that the Bitcoin Cash SV camp have not given up, and according to data provided by Coin.Dance the Bitcoin SV group controls 53% of the network hash power. At the same time data from Binance shows that Bitcoin Cash SV price has jumped by more than 50% over the past 24 hours.

Clearly Craig Wright was not simply spouting empty words on November 15, when he tweeted about sustainable hash.

This hash war, which had been declared finished several days ago, clearly is not finished at all.

Conclusion

Bitcoin Cash ABC is nothing more than the original implementation of Bitcoin Cash that occurred when the Bitcoin blockchain hard forked on August 1, 2017. As of November 15, 2018 this implementation of the Bitcoin Cash protocol is coming under fire from a portion of the Bitcoin Cash community, led by Craig Wright on nChain, who have put forward their own Bitcoin Cash SV vision of how Bitcoin Cash should be going forward.

While the major cryptocurrency exchanges have declared that Bitcoin Cash ABC will use the BCH ticker, that might not remain the case, as the issue seems far from resolved on November 23, 2018.

Eventually, if Bitcoin Cash SV wins this hash war and takes the BCH ticker symbol as its own, we may see a BCHABC ticker used to denote what was the original Bitcoin Cash protocol.