New data from crypto asset manager CoinShares suggests that amongst institutional investors, Ethereum (ETH) stands out as the most compelling digital asset on the market.

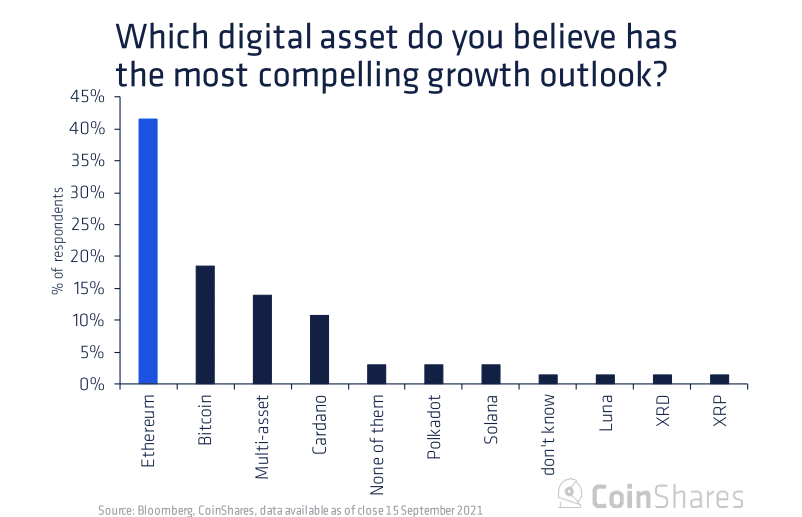

In their latest weekly report, CoinShares outlines how 42% of institutions surveyed believe Ethereum has the "the most compelling growth outlook", outdoing Bitcoin (BTC) by quite a massive margin.

"42% of investors see Ethereum as having the most compelling growth outlook, and by a significant margin, outstripping Bitcoin at 18%. This mirrors the growth in assets under management (AuM) we have seen in Ethereum, where market share of investment products has risen from 11% at the beginning of the year to 26% today."

CoinShares

CoinShares

CoinShares says that while Ethereum and Bitcoin remain at the core of digital asset portfolios, Cardano (ADA) and Polkadot (DOT are picking up steam, gaining popularity among institutions.

"While investors see Ethereum as having the most compelling growth outlook, their current positioning suggests they have not fully invested yet."

Though the firm can't specifically say why Ethereum is highest on institutions' radars, they do provide some insight into their general sentiment on the crypto markets.

"35% of investors see their investments into digital assets as predominantly a speculative one. Although, 25% see it as a diversification tool. Others see digital assets as an effective way to invest into the growth of distributed ledger technology.

Interestingly, despite the retail-led investment into digital assets, client demand was not a major reason for investing."

The asset manager explains that of survey respondents who hadn't invested in crypto yet, 21% cited regulation as a main reason, while 19% said corporate restrictions were holding them back.

While Ethereum winning the hearts of institutions may come as a surprise to some, earlier this week macro investor and Real Vision Group CEO Raoul Pal said ETH made up 70% of his allocation, with Bitcoin only comprising 5%. The ex-Goldman Sachs executive said Ethereum being earlier in its adoption cycle was one of the main reasons he viewed it as a better bet.

“My current allocation is probably 70% ETH, 5% Bitcoin, and then a tail of others. So why that allocation? Nothing against Bitcoin, it’s not against anything else, it’s because I’m a financial markets guy and we use risk curves. So at certain points in the cycle, in the middle of the bull market you want to take as much risk as possible, so you want to go to the more speculative end of the market. So firstly, I slated that I thought Ethereum was going to see further flows, it’s early in its adoption cycle, and that will probably drive prices further than Bitcoin and that seems to be playing out.”