One of the hottest projects in the NFT space is the Bored Apes Yacht Club, affectionately known as BAYC. For those of you who are new to the NFT space but might've seen it mentioned in Jimmy Fallon's show or elsewhere, it's a series of 10,000 apes with a bored expression on their face but dressed differently and with various traits like accessories. This type of NFT is known as Profile Picture NFT because you can use these images as your profile picture on social media or anywhere that gives you the space to upload one.

Great for bragging rights Image via Opensea

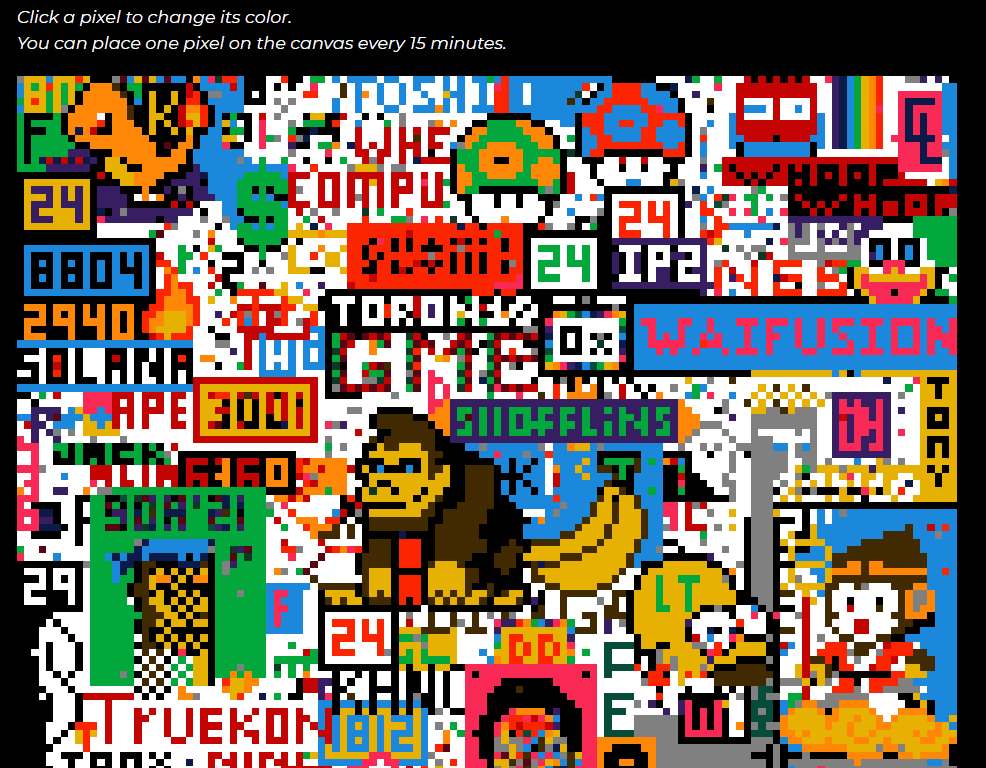

Great for bragging rights Image via OpenseaWhat makes this NFT collection stand out from other similar-minded projects is that they were one of the first to pioneer the concept of a membership NFT. This means owning one of these apes gives you access to a members-only area known as The Bathroom. This graffiti wall allows members to contribute to the graffiti by painting one pixel every 15 minutes.

Can you make your pixel(s) stand out in the Bathroom? Image via Blockchaingene1.medium.com

Can you make your pixel(s) stand out in the Bathroom? Image via Blockchaingene1.medium.comThe current floor price for a BAYC NFT is around 90 ETH. In dollar terms, that's about $103,000 based on the current ETH price of $1146 / ETH. Depending on where you stay, that's at least a 20% deposit for a property. Not something regular joes like you and I can afford. As we salivate and pontificate on how we can also take part in some of the madness surrounding this project to our benefit, lo and behold, an opportunity came up in the guise of a token known as ApeCoin.

What is APECoin (APE)?

In its essence, ApeCoin is a ERC20 token created on the Ethereum network. The token was designed to have three functions: as a medium of exchange, i.e. used like fiat money, an in-game token for games using it and a governance token that allows holders to create and vote on proposals. Token holders also have access to a members area and participate in members-only activity.

Guy has a video on ApeCoin for those of you who learn best through multimedia. If you prefer the written word, read on!

Know thy Ape. Image via ApeCoin

Know thy Ape. Image via ApeCoinBackground

Although we don't know who the people who first came up with the idea are, we know that the token originated within the ApeCoin DAO community. This community is not directly affiliated with YugaLabs, the creators of BAYC. This situation reminded me a bit of the OpenDAO token and its creation. If you're unfamiliar with them, check out this article. In addition, there is an APE Foundation. It acts as the "operational unit" of the DAO to steer the token towards gaining adoption in a way that benefits everyone. Its role, as outlined on its website, states that:

"It is tasked with administering the decisions of the ApeCoin DAO, and is responsible for day-to-day administration, bookkeeping, project management, and other tasks that ensure the DAO community's ideas have the support they need to become a reality."

The relationship between the two entities is a bit like the head/brain and body. In this case, the DAO is the head/brain that consists of ApeCoin holders who create and vote on proposals, like coming up with ideas, while the Foundation is the body executing the decisions made by the DAO and making them into reality.

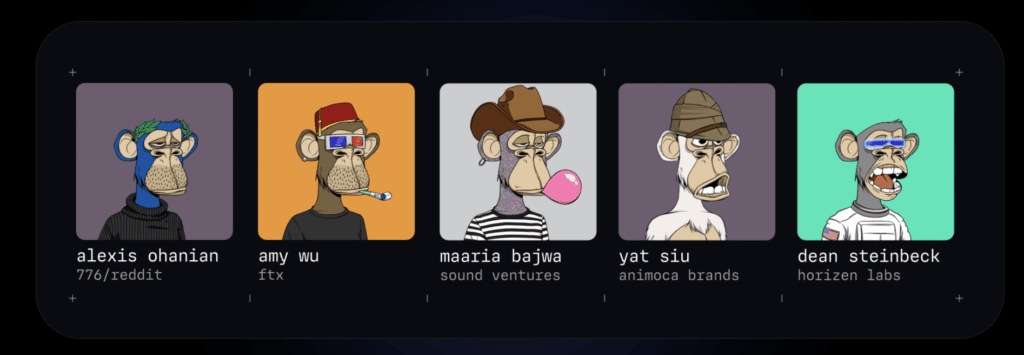

The Foundation also has a Board overseeing it. The first batch of Board members, lasting six months from the inception, comprise known individuals in the crypto world. Their primary duties are to review the successful proposals from the DAO and guide the Foundation in its execution of the proposals. After six months, the DAO will vote on new board members annually. The current crop of Board members are:

- Alexis Ohanian

Co-founder of Reddit; General Partner & Founder of Seven Seven Six - Amy Wu

Head of Ventures & Gaming at FTX - Maaria Bajwa

Principal at Sound Ventures - Yat Siu

Co-founder & Chairman of Animoca Brands - Dean Steinbeck

President & General Counsel at Horizen Labs

"Bored" Members of the Foundation. Image via ApeCoin

"Bored" Members of the Foundation. Image via ApeCoinWhy it was created?

There are lots of material around the token itself but precious little about the reason for its creation. Even the official website doesn't say much. Is it enough to say that the token is about expanding the Ape Ecosystem? Let's have a think: once an NFT is sold, the creators get the initial chunk of money and maybe some royalties for each sale. As a revenue source, it's relatively unstable because it relies on people trading the NFTs. When trading slows down, the revenue dries up. Besides, a single source of revenue is not safe (think eggs in a basket). So what are the creators to do? Why, look for another revenue source, of course!

This article from CoinDesk posits an interesting angle: due to the SEC breathing down everyone's neck, no one wants to be caught with a token that can be claimed as a security. If YugaLabs is the entity issuing the token, it could fall under the SEC's scrutiny. However, if a decentralized entity like the DAO were to do the issuing, it doesn't qualify as a security. Fascinating, huh?

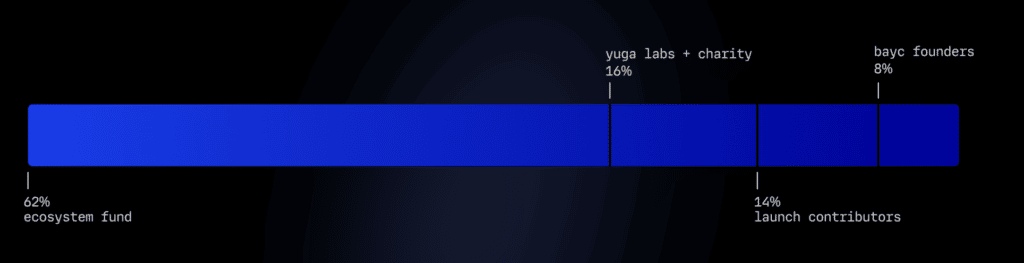

Token Distribution

Following the announcement on March 16, 2022 of the token's launch, the fixed supply of 1 billion tokens are distributed into four chunks:

The Ape Ecosystem (62%) - lion's share of the tokens as a sizable portion of it goes to NFT holders.

Yuga Labs + Charity (16%) - between the two, YugaLabs gets 150 million tokens while the Jane Goodall Legacy Foundation gets 10 million tokens.

Launch contributors (14%) - these are the companies and people who worked on the launch of the token.

BAYC Founders (8%) - Without them, there wouldn't be any BAYCs.

Breakdown of how the billion tokens are distributed.

Breakdown of how the billion tokens are distributed.Just like more tokens, there is a locked period for the tokens distributed so that not all billion tokens flood the market instantly. In this case, it's 48 months.

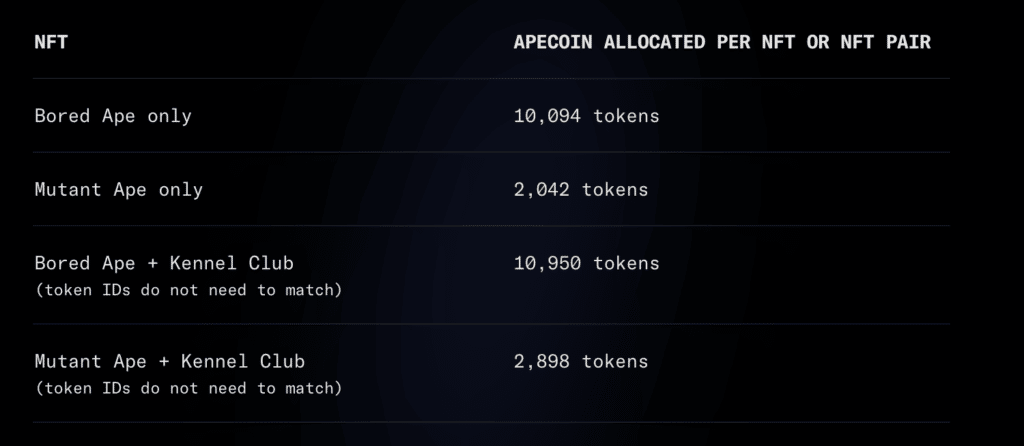

Those who hold BAYC and MAYC (Mutant Ape Yacht Club) are eligible to get the airdropped tokens. If you also have a BAKC (Bored Ape Kennel Club) NFT, i.e. the Ape's pet dog, you also get more tokens. However, just holding the BAKC NFT doesn't qualify for the airdrop because the NFT has no utility on its own. The claim period lasted for 90 days from March 17, 2022 onwards.

It's raining Apes! (for the lucky few) Image via ApeCoin

It's raining Apes! (for the lucky few) Image via ApeCoinAfter all the talk about the token and who's getting it, it's time we look into what you can do with it. Free tokens are well and good, but surely, there's more to it than just holding and waiting for the price to go up?

In-game token

It makes perfect sense for a token like ApeCoin to be used as in-game currency for games. One of the initial ideas for the token was to power the BAYC community. I take that to mean using it as a circulating currency to pay for items of services within the BAYC ecosystem. That isn't enough, though, because you want to attract new users. One way to do that is to launch another NFT project, Otherside.

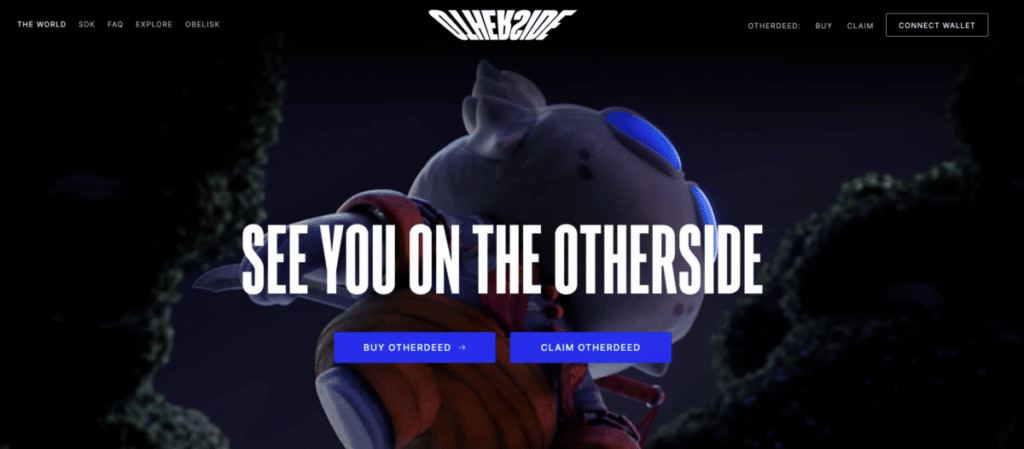

Otherside

This project made headlines for being the NFT project that caused Ethereum gas fees to spike to unprecedented heights and created a major traffic jam in the Ethereum network. Created by YugaLabs, it is billed as a "MetaRPG" game. The project launched on April 30th, 2022, by offering Otherdeeds, your standard parcel-of-land-in-a-metaverse NFT. The launch was the most successful NFT event ever, generating $250 million worth of virtual land sales that have since ballooned to $500 million in the secondary market.

The initial launch price for the NFT was 305 APE, but the gas fees paid for it added a massive overhead to the minting cost. Gas fees ranged from 2 ETH to 4 ETH. Despite the high gas fees, the conviction of the project and its pedigree drove a frenzied crowd to do their utmost to secure one, with a limit of two per wallet. During the minting period, which lasted for about 3 hours, as much as $100 million was burnt while ETH miners hit the jackpot.

In the future, as the Otherside metaverse develops, ApeCoin will most certainly be the de facto currency for that project, so expect to see demand for it continue as prices start going up again.

The next big project launched by YugaLabs after BAYC. Image via Otherside

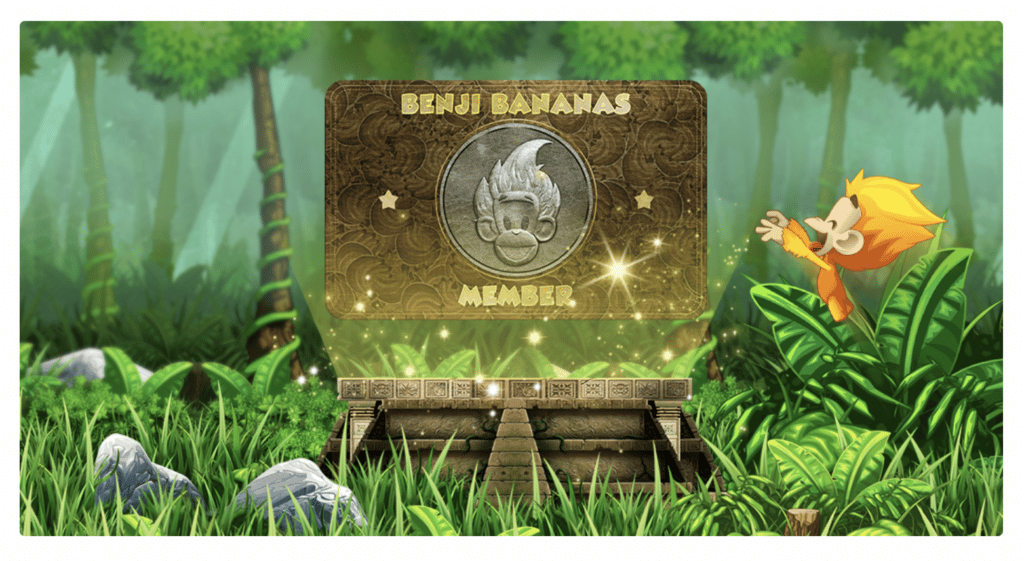

The next big project launched by YugaLabs after BAYC. Image via OthersideBesides Otherside, other games utilise the ApeCoin, such as Benji Bananas. The game is fairly simple: guide Benji, the primate, to swing from one vine to another, collecting bananas on the way. However, to gain access to the game, you will need to purchase a membership pass NFT which can only be bought with APE. $PRIMATE is the token you earn in the game that can be swapped with other tokens that Animoca Brands has a finger in, such as SAND, REVV, TOWER, to name a few, and of course, APE.

Use APE to get a membership NFT for Benji Bananas to earn $PRIMATE. Image via Benji Bananas

Use APE to get a membership NFT for Benji Bananas to earn $PRIMATE. Image via Benji BananasReal-world Usage

One of the holy grails for crypto tokens is having real-world usage. When you can use the tokens to pay for actual stuff, that's when you know the token has a fair shot of achieving next-level adoption by the masses. APE has managed to show that it has real-world utility through the following partnerships:

- Time Magazine partnered with Crypto.com to accept cryptocurrency as payment for its Cryptocurrency Digital version. The tokens accepted include BTC, XRP, ETH, DOGE and soon, ApeCoin, for its digital subscription services.

- A luxury residence development known as E11EVEN in Miami, Florida accepts ApeCoin as payment for its posh units. The starting price for a unit is $480,000. We'd need a lot of ApeCoins for that, especially at recent prices.

- Pay for your beer with ApeCoin with Saltwater Brewery and get 50% off! The company, a local microbrewery in Delray Beach, Florida also made headlines when they succeeded in creating plastic-looking rings, used for keeping a six-pack beer together, that disintegrates after two to three months.

Even though three cases do not make a movement (yet), it's gone further than most tokens. Depending on the reception of these initiatives, more might be afoot, which bodes well for the token.

Governance

Last but not least, APE is also a governance token. APE holders get a say in the ApeCoin DAO through the following actions:

- Idea submission

- Commentary

- Proposal submission

- Voting

As with most projects, it's the ones with the most tokens that speaks the loudest. There are talks of this kind of governance being a bit too centralised, with minority voices not being heard. Well-known crypto veteran Cobie voiced his concerns in one of his tweets about the flaws in the current governance structure.

Price Action

Aside from the fixed supply mentioned above, the price action of APE had also sustained the kind of rise and fall common with tokens of a similar nature. Starting with an issue price of $8.64, it peaked at the end of April at $26.70, according to Coingecko. In some exchanges, it even went past $27. Due to current market conditions, it's now trading at around $5.

What can be done to sustain interest in APE? Image via CoinGecko

What can be done to sustain interest in APE? Image via CoinGeckoHow high then, can the coin potentially reach? Let's do some basic math:

- Starting Market Cap: $8.64 billion ($8.64 * 1 billion tokens)

- Peak market cap: $26.7 billion ($26.70 * 1 billion tokens)

- Current ETH market cap: $150.226 billion ($1256.14 * 119,594,095 tokens in circulation)

Comparing apples to apples, APE is currently 5.75% of ETH's market cap. Both are in the valley range of their respective prices. As the market begins to pick up, APE might go up a bit faster than ETH, it being the nimbler of the two. However, I would be hard-pressed to imagine it capturing more than 30% of ETH's value. There are plenty of other DeFi protocols that could easily win that race. However, with the right combination, it is possible to imagine APE going past its last peak price to scale new heights.

It's not too late to get some APE in your portfolio if you wish. It's available for purchase in all major crypto exchanges, centralised or decentralised. Binance offers the option to stake APE too, although you have to question what exactly does staking APE entail. It's certainly not to secure any kind of blockchain network. As Cobie mentioned in his blog post,

"Instead of receiving rewards for contributing to chain security with collateral at stake, modern “staking” just seems to mean idk we give you more coins as a reward if you don’t sell your current coins lol."

From Here to the Future

ApeCoin DAO and the APE token has certainly courted its own share of controversy since its launch. When the Otherside minting even caused the gas fees to blow up, there was a proposal to branch out of the Ethereum layer, but that got voted down by the community. Their Discord channel also got hacked, which was another piece of bad news for the community.

One thing to consider is how APE will be affected if interest in BAYC drops drastically. As long as the token doesn't tie itself exclusively with BAYC, which doesn't look to be the case, it should survive even if interest in BAYC falls. It would still take a hit just by association but not enough to kill the token. The important thing is for the token to stand out of BAYC/ YugaLabs' shadow. If they succeed in doing that, then things will work themselves out.

Unlike Dogecoin, which was a meme coin that went hunting for utility due to its popularity, APE's creation wasn't a random event. As long as it stays true to its initial impetus and work on expanding real-world usage, i.e. more merchants accepting it as payment or having it adopted by other blockchain games as in-game currency, I see a good future for the token in the coming days.