AppCoins (APPC) is a project that aims to decentralise the in-app payment economy and create a universal digital advertising protocol for mobile devices.

AppCoins will incorporate blockchain technology into the established mobile internet transaction system. It was developed by the same people who are behind Aptoide, an alternative Android app store. Appcoins completed a blockbuster ICO in 2017 and has been through highs and lows since.

Is the project still viable and can they achieve their goals?

In this Appcoins review, I will attempt to answer that. I will analyse their technology, development and use cases. I will also look at the long term potential for APPC token adoption.

What is AppCoins?

As mentioned, AppCoins was built by the Aptoide team. Aptoide was launched back in 2009 by Alvaro Pinto and Paulo Trezentos. As of the latest reporting, there are more than 800,000 apps available in the Aptoide store and the store is used by more than 200 million people around the world.

Similarly to other coins and tokens, the AppCoins token (APPC) gives users a decentralized payment system that is linked to mobile applications and the distribution of apps.

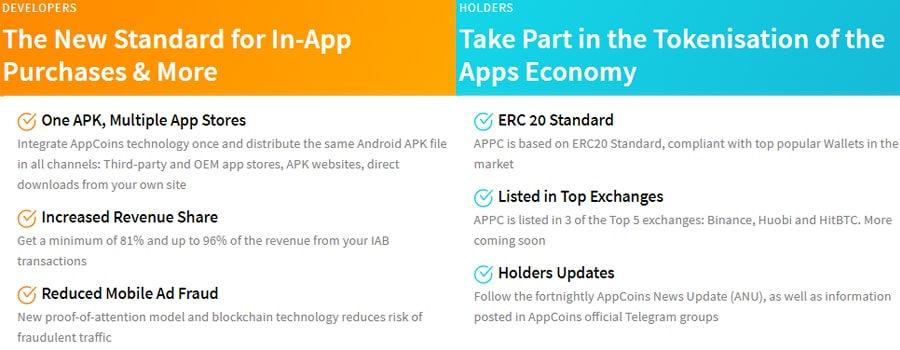

Benefits for developers and holders of Appcoins

Benefits for developers and holders of AppcoinsThe project isn’t interested in building any distributed apps itself, instead, it seeks to add a decentralized solution, and add its token as a payment option for in-app purchases. Its success or failure hinges on convincing users and other app stores that its solution is the best for all involved.

When you compare the AppCoins platform you quickly see that it is attempting to reduce third-parties and middlemen who do little more than inflate the price of apps. It also seeks to improve app advertising, in-app purchases and improve the current slow and inefficient app approval process.

AppCoins Technology

The AppCoins team believes that by moving the entire mobile app ecosystem to the blockchain it will become fully transparent and there will be incentives for users and developers alike.

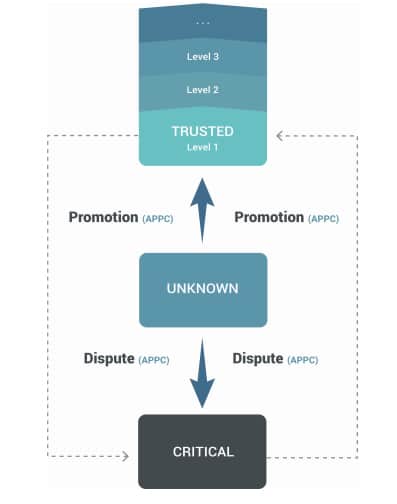

One example of an improvement is a transparent dispute system, and another is a ranking system for developers, that works based on the trustworthiness of the developer based on past transactions.

The AppCoins Solution. Source: AppCoins Whitepaper

The AppCoins Solution. Source: AppCoins WhitepaperThe AppCoins APPC tokens are ERC-20 compatible tokens running on the Ethereum network. The team will allocate these tokens based on something they call “Cost per Attention”, which is similar to the system used by the Basic Attention Token (BAT). Tokens can be given to users in exchange for watching advertisements, or in some cases for downloading and trying new apps. The APPC tokens can then be used for in-app purchases.

If the AppCoins team is correct and successful we will get a mobile app ecosystem that better serves developers, users and the app stores that choose to implement the AppCoins protocol. For the time being AppCoins only works with Android apps, but the project claims to be “app store agnostic” and will eventually launch for iOS apps as well.

AppCoins Solves these Problems

The number of smartphones continues to increase dramatically, with estimates of over 6 billion smartphones being in use by 2020. This is going to ensure continued growth for the app economy, but it will also ensure that problems will continue to grow within the ecosystem as well.

AppCoins believes moving its app store to the blockchain will solve three of the most glaring flaws in centralized app stores: advertising, in-app purchases, and developer/app approvals.

Advertising

Advertising mobile apps these days is fragmented and expensive for developers. AppCoins will create a standard that allows developers to easily advertise their app to new users for 2 minutes of their attention. Because the platform is using blockchain technology there is proof-of-attention, and no concerns over fake identity, double attribution, or repudiation.

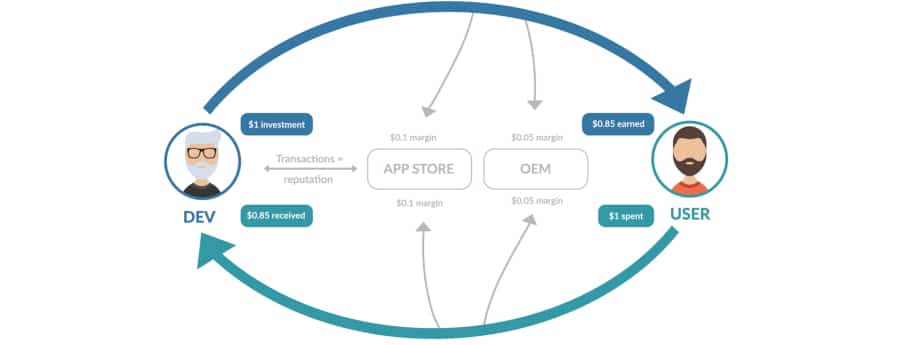

Below is the process that will take place in the Appcoins advertising model:

- Developer pays for the users attention (CPAt)

- User will receive 85% of this in their wallet. This can then be used to pay for in-app purchases.

- App store will retain 10% for distribution of the APK files and for being the Oracle

- The Original Equipment Manufacturer (OEM) will receive 5% of the revenue as compensation for pre-loading the app store

Flow of advertising revenue in Appcoins ecosystem

Flow of advertising revenue in Appcoins ecosystemIn-App Purchases

AppCoins will solve issues with billing and purchase of digital items within apps through the cross-platform use of its APPC token. Once integrated, this solution will work across all app stores using the AppCoins solution. It will give users an easy way to pay for anything in-app using the APPC token that can be purchased with fiat currency or earned through advertising from the AppCoins platform.

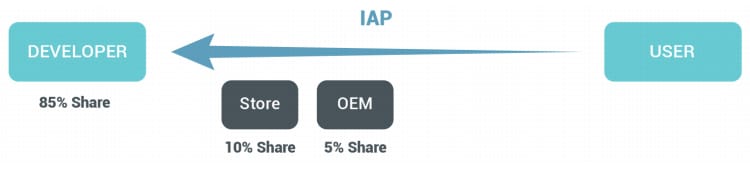

Here is a simplified overview of how the in-app purchases will work:

- Price of each item in-app is stored on the blockchain. This is done through the use of the developer's own private signature.

- Users will buy the items in that app using AppCoins

- The developers will receive 85% of the in-app purchase transaction

- The app store will get 10% of the purchase amount for performing the same tasks that I mentioned above

- The OEM will receive the remaining 5% again

In App purchases flow of coins

In App purchases flow of coinsDeveloper and App Approval

The current approval process is inefficient and too lengthy. AppCoins will give developers a new trust model where they become ranked based on their past transaction history. This is stored on the decentralised blockchain in an immutable manner.

This all operates on AppCoins "chain of trust". There are three different reputations for the developers in the ecosystem:

- Trusted: These developer's apps are considered safe

- Critical: Malicious apps that are blacklisted

- Unknown: No reputation has been established yet. They have not uploaded any apps yet and hence can't be rated.

The Trust ranking scales for developers on Appcoins

The Trust ranking scales for developers on AppcoinsThe AppCoins Team

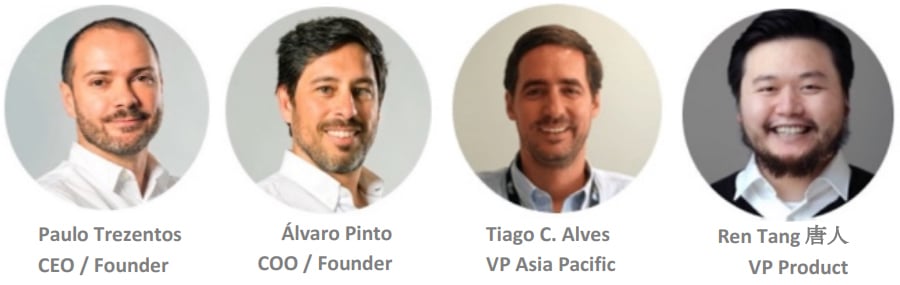

Although the team have listed their information in their original whitepaper, it seems to have been removed from their website. This may leave many in the community guessing about who is still steering the project and who has left.

Based on the whitepaper, we know that the AppCoins team is based in Portugal. They have an additional office in Singapore, where the project is registered because of the friendliness of the Singapore government to blockchain projects.

They also stated at the time that there were 18 members on the team. The co-founders were Paulo Trezentos and Álvaro Pinto, the Aptoide creators. Paulo (the CEO) has a background in development and has been a member of the open source community for a long time. For example, he was the founder and maintainer of LinuxCM, a large Linux distribution.

Some members of the AppCoins team from the Whitepaper

Some members of the AppCoins team from the WhitepaperÁlvaro is taking the COO position and has a background in entrepreneurship. He is a former president of the Portuguese Association of Open Source Software companies. In this previous role, he was advocating for more adoption of open source technology in the country.

AppCoins Communities

AppCoins has a decent sized community on social media, not the largest in the cryptosphere, but certainly not the smallest either. As for engagement, they also fall in the middle here, with a decent amount of engagement from the user community, but certainly nothing mind-blowing.

On Twitter, they have 25.6k followers, and their tweets get several to a dozen re-tweets regularly as well as a dozen or two likes. The telegram channel has over 7,000 subscribers, and the project’s subreddit has nearly 3,400 readers. Updates aren’t much more than once a week, and there are only several comments on most updates.

The project also has over 11,000 followers on Facebook and posts get about a dozen likes.

The APPC Token

AppCoins uses the APPC token on its platform. The APPC token is an ERC-20 compatible token running on the Ethereum network. This means Ethereum gas is required when sending and receiving APPC, and that throughput will be determined by the Ethereum network, which could cause scalability issues.

AppCoins held their ICO back in December 2017, raising $15.3 million and hitting the hard cap for the ICO. The token price at the time was 0.00033389 ETH or $0.10 per 1 APPC (based on ETH price at $299 at the time). Currently, the total supply of APPC is just over 246 million and the circulating supply is just over 100 million.

Following the ICO the coin rapidly rose to its all-time high of $4.49 on January 10, 2018. It didn’t remain there for long as the beginning of the 2018 bear market in cryptocurrencies soon caught it and pulled it lower along with the broader market.

Register at Binance and Buy APPC Tokens

Register at Binance and Buy APPC TokensIt fell throughout the year and reached an all-time low of $0.033891 on December 18, 2018. It climbed off that bottom and reached the ICO price of $0.10 for one day in April 2019, but has dropped back since and as of May 15, 2019, trades at $0.074043.

The APPC token trades on a handful of exchanges, but most of the volume either takes place on the Binance Exchange or on BiteBTC. There is a negligible amount of volume on Huobi Global. The total daily volume is mild which means that coin liquidity could become an issue in any sort of market stress event.

Because APPC is an ERC-20 token it can be held in any ERC-20 compatible wallet. The AppCoins team recommends using the AppCoins BDS wallet. BDS provides a fully AppCoins compliant wallet with enhanced features for In-App Purchases and Ad Rewards.

AppCoins Development

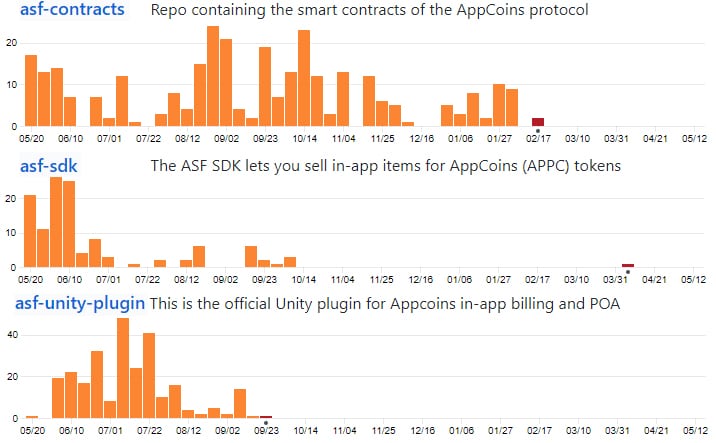

Measuring the development progress can sometimes be a difficult task as there is not one exact benchmark that you can use across all projects. However, you can get a pretty good sense of it by taking a look at their public code commits.

Hence, I decided to jump into the GitHub for the AppCoins project. These repos are all hosted in the App Store Foundation's GitHub. There are a total of 15 repositories but below are the commits for the 2 most recently active.

Code commits for select Repos over past 12 months

Code commits for select Repos over past 12 monthsSo, from the above it shows that the developers are still quite busy working on the project. This level of code commits is about in line with those of other projects that I have reviewed who were at a similar stage.

Given this, it will be interesting to see what updates the team will officially roll out in the coming year. If you wanted to keep abreast of these then you can follow their official blog.

For example, the AppCoins team posts regular bi-weekly AppCoins News Updates (ANUs). These are fairly comprehensive posts that go through some of the most important highlights over that two-week period - great to see.

Pros and Cons of AppCoins

Let's take a look at some of the most simple pros and cons of the AppCoins technology and APPC token.

-

AppCoins has a developed product and a huge user base of 200 million users to roll it out to.

-

The project has a highly experienced development team and a marketing team that is extremely knowledgeable about the app store niche.

-

AppCoins will allow developers to advertise and monetize their apps, all on one platform.

-

The team has been successful in meeting roadmap goals to this point, which instills confidence in the project.

-

AppCoins is not really an original idea, and so far the blockchain space has seen limited success in linking cryptocurrencies with apps.

-

Cryptocurrencies still haven’t reached anything near mainstream adoption, making it difficult to attract users willing to transact with the APPC token.

-

AppCoins still hasn’t attracted major app store partners, and there remains a very real risk that the biggest app stores will simply remain centralized or build their own blockchain solution.

-

The APPC token had a market cap of nearly $250 million in January 2018, but since then it has dropped to just over $7 million as of May 15, 2019. While that may be an opportunity, it is also a risk that the token may never recover fully.

Conclusion

AppCoins had the bad luck to launch its ICO at the height of the bull market in cryptocurrencies, and just before the entire market crashed for an entire year. That cut the market cap of the project’s coin by more than 95%, so it’s understandable if investors might come back to the project with a bit of hesitance.

However the project also has a platform with over 200 million users behind it, so once cryptocurrencies gain wider acceptance from the global user base the AppCoins project, and the APPC token should grow rapidly.

One other potential risk to the platform is the possibility of dishonest developers, apps and phishing attempts that could cause some users to lose coins. The team has put the developer reputation system in place to address this type of misbehavior though, and so far it hasn’t been an issue. One can hope that remains the case as the platform scales.

Speaking of scaling, this project needs Ethereum to adopt some fix that improves scalability, otherwise, it will never be able to handle all the potential transactions that hundreds of millions of users would generate.