Binance is one of the world’s largest crypto exchanges, known for deep liquidity and a big selection of coins. Whether you’re making a quick buy in the app’s Lite mode or placing advanced orders in Pro, the platform covers both beginners and power users. Fees are competitive, the toolbox is wide (from spot to derivatives), and availability varies by country, so knowing what’s actually on offer where you live matters.

In this review, updated for 2025, we will unpack the Binance platform in plain English: what you can trade, how fees and BNB discounts really work, and where Binance shines, or falls short.

We’ll also look at safety and legitimacy (SAFU, Proof-of-Reserves, and recent regulatory changes), the user experience on mobile and web, and customer support. The goal is simple: an unbiased, beginner-friendly review so you can decide if Binance fits your goals and risk tolerance.

TL;DR — Binance Review

- Verdict in one line: Binance remains the most complete venue for active traders thanks to low fees, deep liquidity, and a wide product stack (spot, margin, perps, options, P2P, Earn, Launchpad), now operating under tighter compliance oversight.

- Best for: High-frequency and derivatives/API users who value tight spreads and breadth of markets; global users with full Binance.com access. Beginners can start in Lite and graduate to Pro.

- Maybe skip if: You’re in a restricted region or prefer ultra-simple, domestically regulated platforms; always confirm what’s available in your country before depositing.

- Fees & discounts: Spot starts at 0.10% maker/taker with 25% off when paying fees in BNB; USDⓈ-M futures base 0.02%/0.04% with an extra 10% BNB discount; actual costs depend on tier, product, and region.

- Safety & transparency: Post-2023 $4.3B U.S. resolution, leadership change to Richard Teng, and multi-year monitorships; SAFU disclosed near ~$1B in USDC; Merkle-tree Proof-of-Reserves with zk-SNARKs = inclusion checks, not a full audit.

- Availability caveat: Feature set is geo-specific; U.S. users route to Binance.US (separate entity). Verify fiat rails, promos, and derivatives eligibility locally.

- UX snapshot: Mobile-first with Lite for basics and Pro for the full cockpit; 24/7 chat-led support, but expect slower responses during volatility. Keep KYC/source-of-funds docs handy.

- Risk controls to use: Enable app-based 2FA or security keys, set an anti-phishing code, use withdrawal allowlists, and verify balances via the PoR portal; self-custody long-term holdings.

- Getting started: Begin on Spot, avoid or keep leverage low until you understand liquidation/funding; use P2P for local on/off-ramps, Simple Earn for passive yields if eligible.

Bottom line: If fees and liquidity top your list and your jurisdiction allows it, Binance is a top-tier trading hub; pair it with strict account security and self-custody for long-term assets.

Detailed Verdict

Let's first give you a bird's eye view, and save the juicy details for later

Is Binance good & safe in 2025?

For active traders, yes, but with caveats. Binance still offers deep liquidity and low fees, which is why many pros use it for day-to-day trading. But it has also faced strict U.S. enforcement actions:

- A $4.3B resolution, guilty pleas, and

- Multi-year compliance monitoring,

- Leadership handover to Richard Teng.

Simply put, the exchange you’re using today is running with far tighter guardrails than it had pre-2023.

Who it’s best for:

- Active/derivatives/API traders who care about fees, depth, and product range.

- Global users with access to the full Binance.com feature set (availability is region-specific).

Who should avoid it:

- Newcomers who find Pro overwhelming can start in Lite (or consider simpler platforms).

- Users in restricted regions: confirm what’s allowed where you live before depositing.

Trust signals to actually verify:

- Proof-of-Reserves (PoR): Binance’s Merkle-tree portal lets you confirm your balances are included and check reserve ratios (it’s transparency, not a full audit).

- SAFU emergency fund: Moved to USDC to keep the fund stable and trackable on-chain; it’s a platform-controlled backstop, not insurance.

Bottom line:

If you value fees + liquidity, Binance remains hard to beat; just pair it with sensible self-help (2FA, withdrawal allowlists, and PoR checks). And remember: the platform operates under heightened oversight after 2023, which is good for compliance, but still something to factor into your own risk management.

Fast facts (2025):

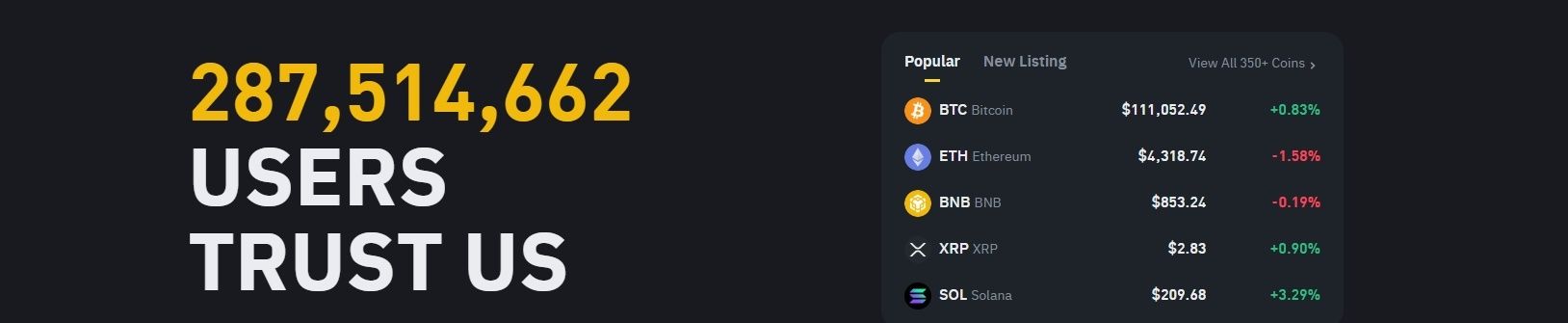

- ~287M registered users (Binance boasts this at the top of its main page).

- $4.3B U.S. resolution; Richard Teng is CEO (Nov 2023) after founder Changpeng Zhao as part of a U.S. settlement.

- SAFU disclosed at ~$1B in USDC (Apr 2024).

- PoR portal live with Merkle-tree + zk-SNARKs.

Our Review Methodology

Here’s exactly how this review was built:

1) Hands-on testing (start to finish)

The team runs a complete user journey on Binance: open an account, complete KYC, make a fiat/crypto deposit, place and close spot and futures trades (small size), try P2P for on/off-ramp, sample Simple Earn, and check Launchpad/Launchpool eligibility. We test on iOS, Android, and web, toggling Lite → Pro, and we verify security controls (2FA, anti-phishing code, device management, withdrawal allowlist). Where features are region-locked, we note it.

2) Scoring model (100 points)

We assign a weighted score that you can compare across exchanges:

- Security (25) – account protections, platform controls, PoR depth, incident track record.

- Fees (20) – spot/margin/futures schedules, native-token discounts, promos, and transparency.

- UX & Mobile (15) – ease in Lite, power in Pro, stability, app ratings.

- Liquidity (15) – depth/spreads on majors, derivatives availability.

- Features (15) – spot, margin, perps/options, P2P, Earn, Launchpad, wallet.

- Support (10) – channels, response patterns, multilingual coverage.

3) Sources & verification

We prioritize primary sources like official fee pages, Proof-of-Reserves portal, security/SAFU disclosures, legal filings/agency announcements, and exchange status pages. For context, we summarize app-store ratings and Trustpilot patterns, but we don’t treat public reviews as facts without corroboration. When sources disagree, we: (a) default to the most recent official document, (b) state an “as of” date, and (c) link readers to the live page.

4) Recency & updates.

Numbers (fees, promos, user counts, PoR ratios) change. We time-stamp this review in Sources & Last Updated and recheck high-volatility items (promos/fees/availability). No referral bias: analysis first, links for verification.

What’s New with Binance in 2024–2025

In November 2023, Binance agreed to pay $4.3 billion to the US government in one of the largest penalties the federal government has ever obtained from a corporate defendant. Importantly, Binance admitted to breaking the law, a mostly uncommon practice in white-collar crime and one that's reserved for the most serious cases.

According to the US Justice Department, Binance admitted to engaging in anti-money laundering, unlicensed money transmitting, and sanctions violations. The department also imposed a monitorship as well as reporting requirements on Binance as part of the resolution. Zhao, more commonly known by his initials CZ, also admitted to felony charges for failing to maintain an effective anti-money laundering program. As part of CZ's settlement, he agreed to step down as CEO.

The resolutions closed the curtain on investigations by the Department of Justice, the Commodity Futures Trading Commission, the Office of Foreign Assets Control, and the Financial Crimes Enforcement Network.

Richard Teng, the global head of regional markets at the time, was handed over the reins of the world's largest exchange with immediate effect. He has a wealth of financial services and regulatory experience.

In response, Binance said the settlement removes a major overhang.

When Binance first launched, it did not have compliance controls adequate for the company that it was quickly becoming, and it should have. Binance grew at an extremely fast pace globally, in a new and evolving industry that was in the early stages of regulation, and Binance made misguided decisions along the way. Today, Binance takes responsibility for this past chapter. - Binance

In an exclusive interview with The Coin Bureau soon after being handed over the reins, Teng admitted that Binance had “inadequate” controls for its size and that the exchange took “certain misguided decisions.” He said the exchange's focus is not only on becoming user-focused but also a “compliance-led” company.

There has also been some chatter online regarding whether Binance can even afford to pay the hefty fine. “We can pay those fine without any problems,” Teng remarked. He said conversations with VIP clients have been “overwhelmingly positive.”

We caught up with Teng again recently, discussing the U.S. regulatory shift, UAE’s crypto leadership, and how Binance is driving adoption in Africa and beyond. He also touched on Binance Alpha, tokenized securities, real-world asset trading.

You can watch the full interview below:

What changed under the settlements?

Two separate monitors sit over Binance’s shoulder. Under the DOJ plea, Binance must retain an independent compliance monitor for three years; a formal, hands-on watchdog to rebuild anti-money-laundering and sanctions controls. In parallel, the U.S. Treasury (FinCEN) imposed a five-year monitorship, with Treasury retaining access to Binance’s books, records, and systems, plus detailed remediation steps.

In plain English: multiple examiners, long time horizons, and clear accountability.

Leadership handover and why it matters

Right after the plea, Binance named Richard Teng as CEO. Public reporting at the time framed his mandate as credibility and compliance first, bringing a more regulatory-friendly tone while keeping the exchange operational.

Operational status & where you can use Binance

Binance continues to operate globally, but your exact feature set depends on where you live. As part of the U.S. resolutions, the company must fully exit the U.S. market; Americans instead use a separate platform (Binance.US) that isn’t covered by the main Binance.com settlement.

Wherever you are, always check the live availability and disclosures on Binance before moving funds, as rules can differ country by country.

Proof-of-Reserves (PoR) & transparency, explained simply

Binance runs a Merkle-tree PoR system. Picture a giant tree where each leaf is a user’s balance. The exchange also added zk-SNARKs, a cryptographic method that lets Binance prove the totals add up without revealing anyone’s individual balance. As a user, you can log in, find your record/leaf, and verify you’re included in liabilities; you can also view reserve ratios for major assets on the public PoR page. It’s not a full audit of everything, but it’s a verifiable snapshot that’s better than a “trust us” blog post.

Bottom line for beginners: Regulatory fire forced real changes: big fines, leadership change, and long-term monitoring. Day-to-day, Binance remains available in many countries (with regional limits). If you choose it, confirm your local access first and use the PoR portal to sanity-check backing for the assets you hold there.

Binance at a Glance

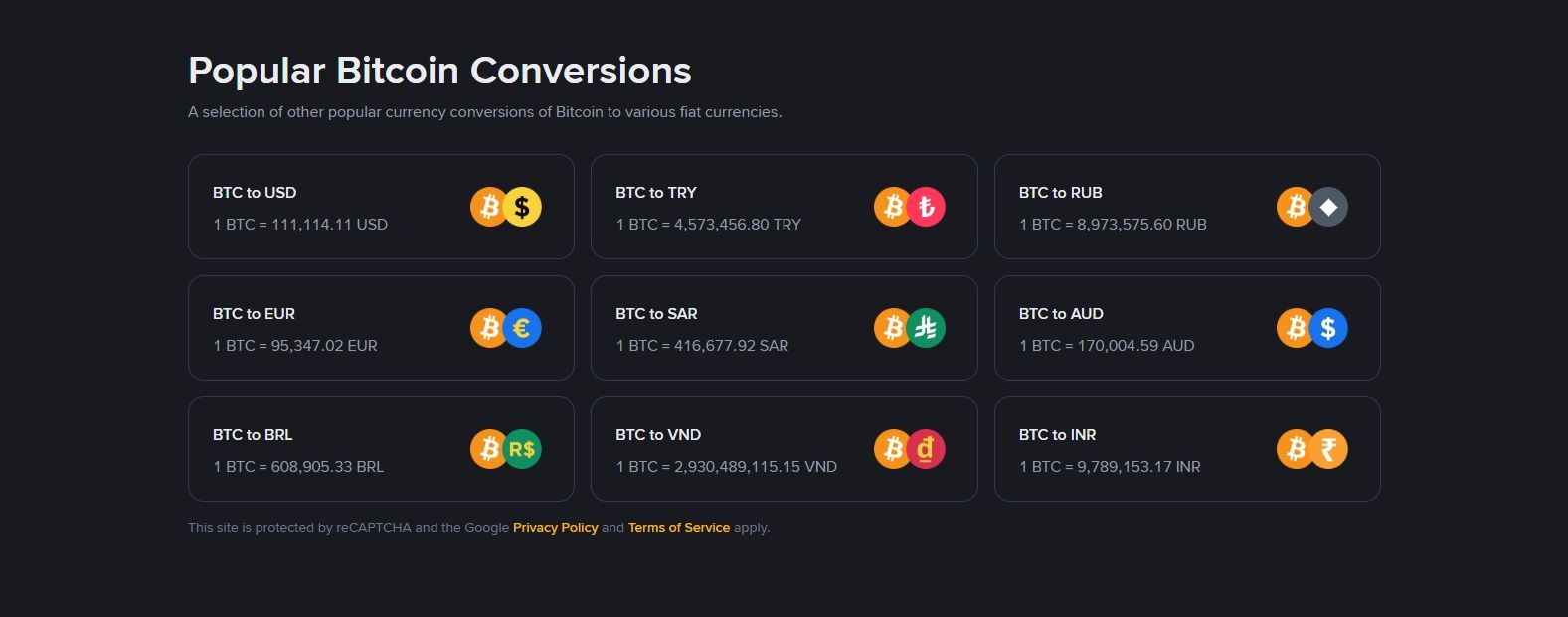

As of today, Binance says it has over 287 million registered users, a good shorthand for its global reach. Third-party trackers also indicate that Binance is at or near the top for trading activity; for example, CoinGecko estimates a spot market share of ~39.8% in July 2025, and Kaiko notes that Binance is one of the leaders in perpetuals, alongside Bybit and OKX.

Binance Boasts a Big User Base, Deep Liquidity, and Visible Transparency Tools. Image via Binance

Binance Boasts a Big User Base, Deep Liquidity, and Visible Transparency Tools. Image via BinanceSAFU (the emergency fund)

Binance’s Secure Asset Fund for Users (SAFU) is a reserve the exchange says it can use to compensate eligible users if losses stem from problems in Binance’s own systems (not market moves or user mistakes). Binance updated the composition on April 18, 2024, to $1B in USDC and published a wallet address; eligibility and payouts remain at Binance’s discretion, with a stated 90-day claim window. Think of it as a safety net that the platform controls, and not an insurance policy.

Security incidents (short timeline).

- May 2019: A hack drained 7,000 BTC from a hot wallet (about 2% of Binance’s BTC at the time). Binance paused withdrawals and said it would cover the loss fully via SAFU, so users’ balances weren’t haircut.

- Oct 2022: The BSC Token Hub bridge on BNB Chain was exploited and 2M BNB were minted (about $570M at the time). BNB Chain says users on the exchange were not affected; validators coordinated to freeze most funds and plan burns to remediate supply.

Live Proof-of-Reserves (PoR)

As we have discussed, Binance runs a Merkle-tree PoR portal. Always stay on top of things. To self-check: log in to your Binance account, open the Proof of Reserves page, copy your record/leaf ID, and confirm your balances are included. You can also view asset-by-asset reserve ratios (e.g., BTC, ETH, USDT) without logging in. Remember, it’s a transparency snapshot, not a full audit, but it lets you verify inclusion and see coverage levels in real time.

Takeaway for beginners: Big user base, deep liquidity, and visible (if imperfect) transparency tools. Just remember: SAFU covers limited scenarios, and PoR is a verification aid, not a blanket guarantee.

User Experience & Mobile App

Here’s how Binance feels in the hand: the mobile app is designed to meet you where you are, starting simple and letting you level up when you’re ready. Most beginners land in Lite, a clean, no-stress view for buying, selling, and checking balances; a quick toggle unlocks Pro with the full trading toolkit when you want more control. Below, we’ll walk through Lite vs Pro and how the mobile and web experiences compare so you can pick the right cockpit from day one.

Lite Mode is a Clean, No-Stress View for Buying, Selling, and Checking Balances. Image via Shutterstock

Lite Mode is a Clean, No-Stress View for Buying, Selling, and Checking Balances. Image via ShutterstockMobile vs Web

Binance is genuinely mobile-first: most people can do their day-to-day trading right from the app, while the web interface remains handy for multi-window charting and research. A practical approach is to start with Lite and move to Pro once you need advanced orders or derivatives.

For a quick pulse on real-world experience, the Android app shows ~4.6★ from ~3.28M reviews and 100M+ downloads, while the iOS app sits around 4.8★ (≈10.5K ratings). The ratings vary by country/storefront and change over time.

By contrast, Trustpilot skews negative (~1.6/5 from ~5.7K reviews), with common complaints about KYC rechecks, withdrawals, and support responsiveness. Treat app-store ratings as usability signals and Trustpilot as a reminder to keep your verification and withdrawal ducks in a row.

Now let's get some more information on the Lite and Pro modes.

Binance Lite (Beginners)

Lite mode is the “easy button” inside the Binance app. It trims the screen down to the basics so you can check prices, buy/sell, convert, peek at your wallet balance, and even dip a toe into Earn, without wading through pro tools. By default, new users see Lite first. To switch modes later, tap your profile icon (top-left) and flip the Binance Lite toggle; you can hop to Pro anytime from the account center. If you want a simple “buy and hold” start, stay in Lite.

Binance Pro (Advanced)

Pro mode is the full cockpit: advanced charts, a wider order type menu, and access to Spot, Margin, Futures, Options, plus P2P. It’s built for users who want order books, depth tools, and customization rather than a simplified flow. Switching is instant; just open the account center and choose Binance Pro. So, you can learn in Lite and graduate to Pro when you’re ready for things like stop-limits, margin, or futures.

Core Trading Features

Before we get fancy, here’s the big picture: Binance gives you four main ways to trade.

- Spot (buy/sell the actual coins),

- Margin (borrow to amplify trades),

- Futures & Options (derivatives with leverage),

- P2P/Earn/Launchpad (fiat on/off-ramps and yield or new-token access).

Binance has many Trading Features that Cater to All Kinds of Users. Image via Freepik

Binance has many Trading Features that Cater to All Kinds of Users. Image via FreepikSpot Trading

On Spot, you’ll find hundreds of markets and a toolkit that scales from simple to advanced. Core order types include market and limit, plus stop-limit / stop-market, OCO (one-cancels-the-other), trailing stop, and even iceberg orders that split a large order into smaller visible chunks. These help you automate entries/exits and reduce slippage without babysitting the screen.

Margin Trading

Margin lets you borrow to go long or short. In Isolated mode, you fence off collateral per position (a mistake can’t drain the rest of your account). In Cross mode, your whole Margin balance backs positions, which is more capital-efficient but riskier if markets move fast. Liquidations happen if your margin level falls below maintenance; interest accrues on what you borrow. Beginners typically start with small sizes (and often Isolated) until they understand fees and liquidation math.

Futures & Options

Futures come in two flavors: USDⓈ-M (USDT/USDC-settled) and COIN-M (crypto-settled). Pairs have specific margin tiers and max leverage; headline leverage can be up to 125x on major pairs, but always check the actual limit on the contract you trade. Funding keeps perpetuals tracking spot and updates periodically.

Options on Binance are European-style and stablecoin-settled (USDT/other stablecoins), offered in Classic or Easy modes, which are useful for hedging or expressing views with limited upfront cost (the premium). Derivatives are powerful but unforgiving: use small leverage, define risk with stops, and understand funding/premiums before you begin.

P2P, Earn & Launchpad

P2P is the peer-to-peer fiat ramp with escrow: Binance locks the seller’s crypto and only releases it once both sides confirm payment (and there’s an appeal path if things go sideways). We also shortlisted some of the best P2P exchanges in our dedicated review.

Simple Earn lets you deposit assets into Flexible (redeem anytime) or Locked products to earn rewards; yields vary by asset and terms, and availability depends on your region. We have a detailed review of Binance Earn. Don't miss it.

Launchpad/Launchpool are Binance’s token access rails: typically you hold/commit BNB (or designated tokens) during a subscription or farming window to receive allocations or airdrops, subject to eligibility and announcements. We also have a detailed coverage of Binance Launchpad & Launchpool for more insight.

Other Features

Let's not forget, Binance also provides an NFT Marketplace for NFT fans; Megadrop, mining pool, referral and affiliate programs, Binance wallet, copy trading, trading bots, and the Binance Academy for learning and growth as a trader.

Bottom line: Start with Spot, experiment cautiously with Isolated Margin if you must, and only touch Futures/Options once you’re comfortable with liquidation and premium risk. Use P2P for local on/off-ramps, Simple Earn for hands-off yields, and Launchpad/Launchpool if you’re keen on early-stage token access.

Fees & Current Promotions

Binance uses a classic maker/taker model with VIP tiers based on your 30-day volume (and BNB balance). Base spot fees start low and can drop further if you pay fees in BNB; futures have their own (lower) base rates plus a smaller BNB discount. Always confirm your live tier and any regional promos before trading.

| Category | Details |

|---|---|

| Spot Trading | Base fee: 0.10% maker / 0.10% taker BNB discount: 25% off (e.g., $1,000 trade = $1.00 → $0.75 with BNB) |

| Futures (USDⓈ-M) | Base fee: 0.02% maker / 0.04% taker BNB discount: 10% off |

| Futures (COIN-M Delivery) | Separate schedule, rates vary by product/pair (see Delivery Fee page) |

| VIP Benefits | Apply universally across products |

| Fiat Deposits/Withdrawals | Fees vary by currency and payment channel (bank transfer vs. card).Shown at checkout. Banks/card issuers may add extra charges (e.g., SWIFT intermediary fees). |

| Crypto Deposits/Withdrawals | Deposits: FreeWithdrawals: Flat fee, network-dependent, updates with chain conditions |

| Limited-Time Promo (2025) | Zero-fee swaps in Binance Wallet from Mar 17 – Sep 17, 2025 (08:00 UTC). Applies only to wallet swaps (network gas still applies). Not valid for spot/futures exchange trading. Availability varies by region. |

Binance Uses a Classic Maker/Taker Model with VIP Tiers Based on Monthly Volume. Image via Binance

Binance Uses a Classic Maker/Taker Model with VIP Tiers Based on Monthly Volume. Image via BinanceTrading Fees (Spot/Futures)

- Spot: Base 0.10% maker / 0.10% taker. Pay with BNB to get 25% off spot (and margin) fees. Example: at 0.10%, a $1,000 buy = $1.00; with BNB discount, $0.75. At $50,000: $50.00 → $37.50 with BNB.

- USDⓈ-M Futures: Base 0.02% maker / 0.04% taker is the standard schedule; paying with BNB gives 10% off futures fees.

- COIN-M Delivery: Uses a separate schedule; rates are product/pair-specific and shown on the Delivery Fee page.

VIP logic: Binance confirms VIP benefits apply universally across products.

Fiat Deposit/Withdrawal

Fiat fees vary by currency and channel (bank transfer vs. card) and are shown at checkout; see Binance’s Fiat Deposit & Withdrawal Fees page for your locale. Your bank/card issuer may add its own charges (e.g., intermediary bank fees on SWIFT). For crypto, deposits are free and withdrawal fees are flat, network-dependent, and update with chain conditions.

Limited-Time Promos (2025)

Zero-fee trading in Binance Wallet: From Mar 17, 2025 (08:00 UTC) to Sep 17, 2025 (08:00 UTC), all swaps in Binance Wallet have 0 trading fees (network gas still applies). This promo is wallet-only, and it does not make spot/futures on the exchange free. Availability depends on the region.

How Binance Compares (Fees) — A Quick View

| Exchange | Spot (entry tier) | Perps/Futures (base) | Native-token discount / current promos |

|---|---|---|---|

| Binance | 0.10% / 0.10% (VIP 0) | 0.02% / 0.04% on USDⓈ-M; COIN-M has its own schedule | BNB: 25% off spot & margin; 10% off futures. Promo: Binance Wallet swaps at 0 trading fees Mar 17–Sep 17, 2025 (gas still applies; wallet-only, region dependent). |

| Coinbase | ≤0.40% maker / ≤0.60% taker (tiered, Advanced) | International perps: fee schedule is tiered by liquidity program; Coinbase is currently marketing 0% maker / 0.03% taker (and sometimes 0%/0%) for eligible non-US users on selected markets; check live contract pages | None (no native-token trading-fee discount). |

| Kraken (Pro) | 0.25% / 0.40% at $0–$10k 30-day volume (tiers drop with volume) | 0.02% / 0.05% (Derivatives base; tiered down with volume) | No native-token fee discount (Pro). |

| KuCoin | 0.10% / 0.10% (LV0) | 0.02% / 0.06% (futures base; tiered) | KCS: 20% off spot & margin fees when paying with KCS. |

Takeaways:

For spot, Binance’s base 0.10% can drop to 0.075% with BNB. For futures, many pairs start 0.02%/0.04%, and BNB shaves 10% off. Your actual fee = price × size × (maker/taker rate) minus any BNB/VIP discounts.

Fiat on/off-ramp costs depend on your region and method; banks and card issuers may add their own fees, so preview costs before confirming. For crypto withdrawals, fees are network-based and update dynamically.

Security & Legitimacy

You’ve seen the big picture already: Binance paid record U.S. penalties, CZ was sentenced, and outside monitors are in place. Now we zoom in on the practical safety layers you’ll actually use and what they mean day to day.

Binance Remains Operational, but Under Multi-Year Government Oversight, which Acts like a Guardrail. Image via Shutterstock

Binance Remains Operational, but Under Multi-Year Government Oversight, which Acts like a Guardrail. Image via ShutterstockAccount-Level Protection

Binance supports multiple 2FA methods (Authenticator app/passkeys/SMS), plus security keys (FIDO2/WebAuthn) for phishing-resistant logins.

You can also set an anti-phishing code that appears in legitimate Binance emails/SMS, review Device Management to remove unknown logins, and enable a withdrawal allowlist so funds can leave only to pre-approved addresses. If you use Wallet/Exchange together, allowlisting applies there too.

Exchange-Level Controls

At the platform layer, Binance says the vast majority of user funds are stored offline (cold storage), with real-time risk monitoring that can slow or pause withdrawals if activity looks suspicious. The SAFU emergency fund remains part of the backstop; in April 2024 Binance transferred SAFU’s assets to USDC (~$1B) to keep value stable and transparent via on-chain addresses.

Proof-of-Reserves & Liabilities

As mentioned before, Binance’s Proof-of-Reserves lets you verify your balances are included in a Merkle tree of liabilities; you can log in, find your record/leaf, and check asset-by-asset reserve ratios. Binance says it uses zk-SNARKs so totals can be proven without exposing individual balances. Helpful translation: it’s a transparency snapshot, not a full financial audit of all assets and liabilities. Use it to verify inclusion and view coverage for majors like BTC/ETH/USDT.

Incident Response Playbook

- 2019 hot-wallet breach (7,000 BTC): Binance halted withdrawals and stated it would cover losses; users’ balances were not haircut.

- Oct 2022 BNB Chain bridge exploit (~2M BNB minted): BNB Chain reported that validators coordinated to pause the chain and freeze most funds; exchange user balances on Binance.com weren’t directly impacted by the bridge mint. Lesson: exchange infra and L1/L2 bridges are distinct; issues on a chain can be contained without hitting exchange user balances.

Is Binance Safe & Legit?

Regulators forced major changes:

- DOJ plea and $4.3B resolution, plus a three-year DOJ monitor;

- FinCEN added a five-year monitorship with deep access and remedial undertakings;

- the CFTC action concluded with court-ordered penalties

Reporting also identifies the two appointed monitors overseeing compliance. In practice, that means tighter onboarding (KYC), sustained AML/sanctions upgrades, and continuing transparency efforts like PoR. (Do check out our in-depth guide on KYC and AML for your own safety and compliance.

Bottom line: Binance remains operational, but under multi-year government oversight, which is a meaningful guardrail for users to factor alongside self-help steps (2FA, allowlists, PoR checks).

Markets, Liquidity & Instruments

Binance’s edge is simple: depth and choice. On spot markets, it consistently leads the pack, as CoinGecko puts Binance at 39.8% of global spot volume in July 2025, while Kaiko notes Binance expanded its EUR share materially this year. What this means for beginners: you’re more likely to find tighter spreads and faster fills on majors like BTC, ETH, and SOL.

Always Start with Majors at Low or No Leverage, then Scale Up. Image via Freepik

Always Start with Majors at Low or No Leverage, then Scale Up. Image via FreepikOn listings, Binance’s catalog is broad. According to CoinGecko, Binance has ~410 cryptocurrencies available to trade, with new pairs added frequently (currently close to 1,500 pairs); so breadth is real, but always check availability in your region.

Derivatives coverage is equally wide: USDⓈ-M (stablecoin-settled) and COIN-M (coin-settled) perpetuals span hundreds of pairs, with pair-specific margin tiers and leverage caps. Headline leverage can go up to 125x on flagship contracts, but your max depends on the instrument, your position size, and risk tiers; so don’t assume 125x is universally available. Funding keeps perpetuals aligned with spot and updates periodically.

How to double-check, quickly:

Open Markets on Binance to see live spot pairs and liquidity; for derivatives, open any contract’s info panel to view its max leverage, margin tiers, and funding before you trade. If you’re new, start with majors at low or no leverage, then scale up only after you understand liquidation and funding mechanics.

Customer Support & Reliability

Support can make or break a beginner’s first week. Binance leans into live chat + a big Help Center, while rivals like Coinbase also offer a request-a-call option. Below is what that looks like in practice, and what to watch out for.

Start Support from Inside your Logged-in App/Site, and Never via DMs, Search Ads, or Cold Calls. Image via Freepik

Start Support from Inside your Logged-in App/Site, and Never via DMs, Search Ads, or Cold Calls. Image via FreepikChannels

Binance directs users to its 24/7 live chat and self-serve Support Center inside the app and on the web; the About page notes customer support in ~40 languages (coverage varies by region). Start in Help Center, then escalate to live chat from the Chat Support entry point.

Real-World Performance

Public reviews skew mixed-to-negative, with recurring complaints about KYC re-verification, withdrawal checks, and account holds, especially during market volatility. Sadly, and as we mentioned before, Trustpilot rating in particular stands at a surprising 1.6 out of 5.

Overall, reviewers aren’t thrilled. Many say support is slow, and issues drag on without a fix. Common pain points include payments not going through, app glitches, and refund hassles. People also report it’s hard to reach a real person, which only adds to the frustration. Put together, these problems leave a sizeable group of users with a negative impression of the service.

Translation? Expect slower turnarounds when markets are busy, and keep your ID, source-of-funds docs, and withdrawal allowlist ready to avoid back-and-forth.

Binance vs. Other Exchanges

| Exchange | Support Channels | Notable Points |

|---|---|---|

| Binance | 24/7 live chat (web + in-app), Support Center | No phone line; rely on official in-app/web chat (avoid social media links). |

| Coinbase | In-account chat + request-a-call | They stress they’ll never call you unsolicited; treat surprise calls as scams. |

| Kraken | 24/7 live chat + voice support (via mobile app) | Voice support is situational, but useful for those who prefer talking to a human. |

| KuCoin | 24/7 Help Center, online chat, ticketing | Multilingual community coverage; no general phone line. |

Practical tip: Whichever exchange you use, start support from inside your logged-in app/site, and never via DMs, search ads, or cold calls. This one habit avoids most impersonation scams.

Final Verdict — Is Binance Right For You?

If you’re an active trader, spot scalps, derivatives, maybe some API automations, and Binance is a strong fit thanks to deep liquidity, low fees (BNB discount), and a full toolbox.

If you’re a long-term, buy-and-hold beginner, start in Lite and keep things simple. If Pro feels overwhelming, there’s no shame in using a simpler platform or moving slowly. Consider self-custody for long-term holdings once you’re comfortable.

If you live in a restricted jurisdiction, check local availability and disclosures first; features vary by region.

No matter who you are, practice basic due diligence. Double-check live fees/promos before trading, verify your balances via Proof-of-Reserves, and turn on 2FA + withdrawal allowlists. Go easy (or avoid) leverage until you understand liquidation and funding. Most importantly, choose tools that fit your goals and risk tolerance, and don’t chase trends because Crypto Twitter says so. Your plan should be bigger than the crowd.

Also Read

- How to Sign Up on Binance: A Step-by-Step Guide

- Binance App Review: Mobile Trading on the Go

- Is Binance Safe?

- BNB Review

- Binance NFT Marketplace Review

- Top Binance Alternatives

- How to Buy Bitcoin on Binance

- A Guide to Trading on Binance

- Binance Earn Review

- Binance Wallet Review

- Binance Sharia Earn

Exchanges Comparisons

Sources

Citations (key facts we referenced):

- U.S. settlement & monitorship: DOJ press release on Binance’s guilty plea and ~$4.3B resolution; BankingDive on penalties and the CEO transition to Richard Teng. Department of Justice, Bankingdive.com

- CZ sentencing (4 months, Apr 2024): Wall Street Journal coverage. Wall Street Journal

- SAFU details: Binance’s official SAFU FAQ (addresses, scope, and notes). Binance

- Proof-of-Reserves: Binance’s PoR portal (Merkle tree + reserve ratios, user self-verification). Binance

- Incidents: 2019 hot-wallet breach (7,000 BTC) — Binance announcement; 2022 BNB Chain bridge exploit — BNB Chain’s official blog; supplementary context from PurpleSec. BinanceBNB Chain PurpleSec

- Promotions: Zero-fee swaps in Binance Wallet (Mar 17–Sep 17, 2025) — Binance announcement. Binance

- User base: Binance Square update noting ~275,020,685 registered users (May 28, 2025). Binance

Author credentials & testing declaration:

This review was produced by the Coin Bureau Research Team. We performed hands-on testing on web, iOS, and Android using small live trades (spot & futures), P2P, Simple Earn, and Launchpad/Launchpool, and verified security features (2FA, anti-phishing code, device management, withdrawal allowlist). We used only official docs/announcements and high-quality news sources; any figures are as of the dates cited.