Crypto assets investors can do much with their crypto holdings today. Beyond hodling cryptocurrencies, you can make them work for you and earn passive income. Both centralized and decentralized platforms are available today that offer numerous cryptocurrency-based financial products, spanning both decentralized finance (like yield farming and staking) and traditional finance (Tradfi), like loans and fixed deposits.

Binance is one such centralized platform. This article reviews Binance Earn, a culmination of financial products built on top of crypto assets available on the Binance exchange. This article will cover the various investment avenues under Binance Earn and how they fare against other crypto financial service providers regarding safety, revenue, ease of use, and much more. As our crypto investments sit idle on exchanges when we ride the bear market, Binance Earn may prove lucrative in extracting more value from our static assets, so buckle up!

Binance Earn Review: Summary

Binance Earn is a comprehensive financial platform within the Binance ecosystem that offers a variety of investment products aimed at helping users earn returns on their cryptocurrency holdings. From fixed and flexible savings accounts to staking, liquidity farming, and more complex financial instruments, it provides opportunities for both novice and experienced investors. While it offers the potential for high yields, it also comes with various levels of risk and complexity, making due diligence essential for all users.

The Key Features of Binance Earn Are:

- Simple Earn: Cryptocurrency-based loans.

- Staking: Participate in DeFi with Binance.

- Farming: Farm liquidity on Binance.

- Dual Investment: Simplified options-like trading strategy.

- Range Bound: Earn interest in sideways markets.

Note: Users located in the US and UK are not supported.

Binance Earn Review: Summary

| Year Established | 2017 |

| Regulation | Holds regulations across several countries in Europe, Asia-Pacific, the Middle East, the Americas and Africa |

| Earn Products Listed | 11 |

| Native Token | BNB |

| Fees | Variable |

| Beginner Friendly | Advanced products can be confusing for new users |

| Earn Rates | 0.1% - 60% |

Review: What is Binance?

Binance is a global (except in the US) company behind the Binance exchange, BNB chain, and the BUSD stablecoin. 2017, Changpeng Zhao, a software engineer, founded Binance in China. Binance has since moved its operations and headquarters from the country owing to the regulatory crackdown against blockchain businesses and the ban on cryptocurrency trading in September 2017.

Zhao, better known by his initials CZ, resigned as CEO in November 2023 after pleading guilty to a money laundering charge by US authorities.

Core features of Binance include -

- The Binance exchange - The crypto exchange harbours several traditional and DeFi investment products and hundreds of digital assets to trade, making it the world’s largest centralized cryptocurrency exchange in terms of daily trading volume and users. It offers low trading fees and has high liquidity, ensuring fast settlements and efficient trading by reducing market volatility.

- The BNB Chain - Build N Build (BNB) Chain comprises two blockchains:

- The BNB Beacon Chain is responsible for blockchain governance, staking, and voting.

- The BNB Smart Chain is the EVM-compatible component used to support Ethereum dapps in the BNB ecosystem.

- The BNB Chain also offers many scaling solutions, including zk-Rollup inspired zkBNB and opBNB powered by the Optimism bedrock stack.

- BNB token - As the governance token of the BNB Chain, the BNB token powers the Proof of Staked Authority consensus design of the BNB Chain. It initially launched as an ERC-20 token on Ethereum and later moved to Bianance Smart Chain as it merged with the Beacon Chain.

- BUSD - Binance USD is a US dollar-backed stablecoin developed by Binance and Paxos. It was the first stablecoin to receive regulatory approval from the New York State Department of Financial Services.

The Binance platform offers all-inclusive cryptocurrency solutions across centralized/decentralized and TradFi/DeFi settings. The focus of this review is the Binance Earn section of the exchange. If you wish to delve deeper into the specifics of Binance, check out our Binance review.

Binance Earn Products Available:

To begin using Binance Earn products, crypto investors must first create a Binance account, which entails completing a KYC verification check to verify the user's identity (it also ensures only one account is associated with each identity). Once registered, all Binance products, including Earn, spot wallet and derivatives trading, leverage, and margin trading, and others like the Binance NFT marketplace, are accessible. Earn can be accessed either through the Finance section or via assets in your spot wallet. If you haven't already signed up for Binance, we have a handy Step-by-Step Guide to Signing up for Binance.

If you are interested in Guy's take, he also has a great Binance Guide, which you can view below:

Let’s begin with a rundown of Binance Earn, traversing through all the products section-wise:

Simple Earn

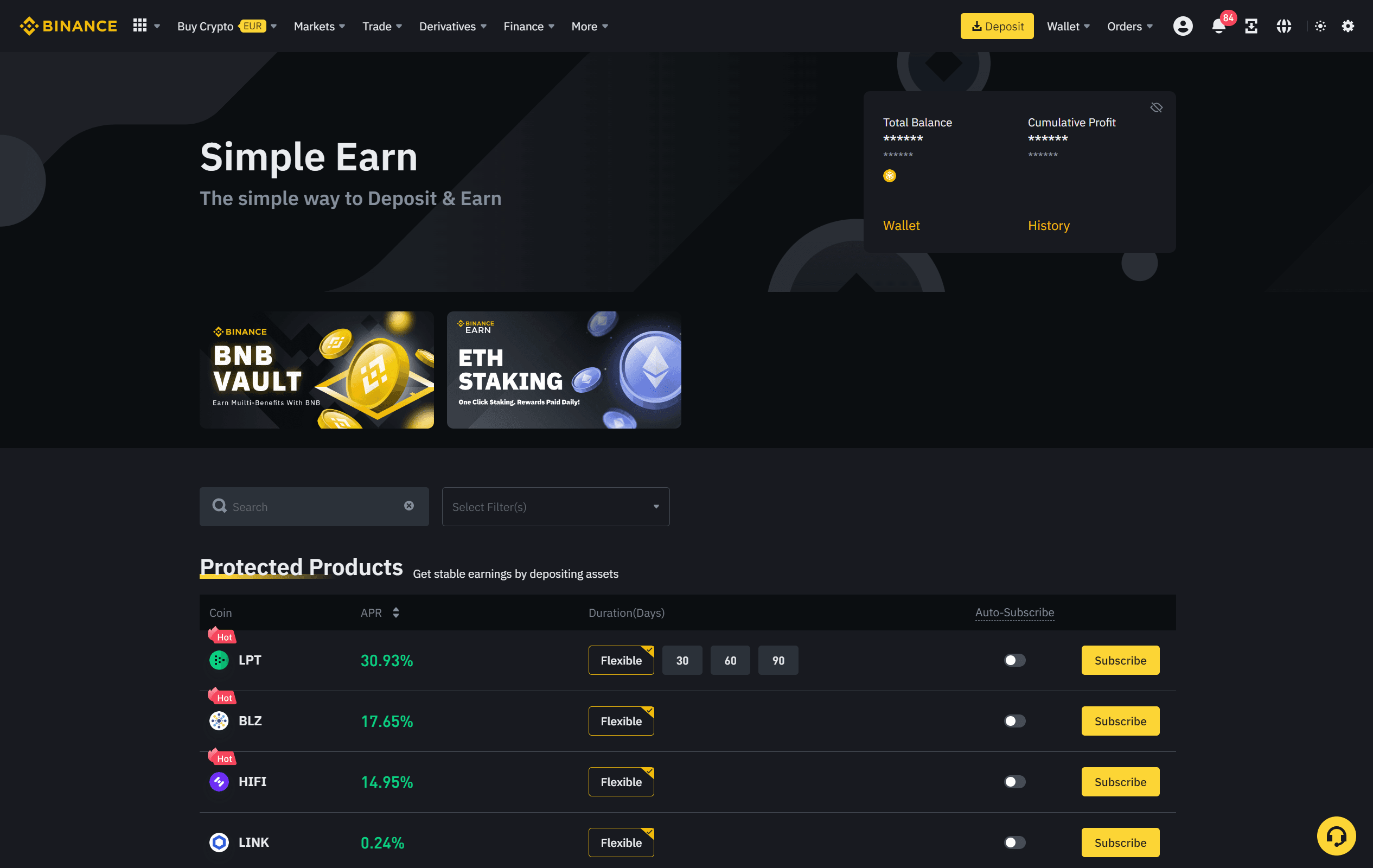

Binance Simple Earn Homepage. Image via Binance Earn

Binance Simple Earn Homepage. Image via Binance EarnAs the name suggests, Simple Earn offers investors interest in their crypto deposits. There are three products available under this section -

Binance Simple Earn

Investors can make zero-fee crypto deposits under flexible savings or locked savings terms. These deposits are lent out and earn interest over time. While flexible savings are redeemable anytime, locked savings are locked for a predetermined period (typically 30, 60, or 90 days, with varying interest rates). The principle and the interest under these terms are directly sent to the user’s ‘Spot Wallet.’

Binance also offers an ‘Auto-Subscribe’ feature for these flexible savings and fixed savings products. Opting for this feature allows Binance to roll back your crypto investment and accrued interest into the same investment plan upon its maturity.

**Pro Tip** Deploy Simple Earn for the crypto investments you don’t intend to sell for the foreseeable time.

Fixed and locked savings compared:

| Flexible Savings | Locked Savings | |

| Redeemability | Redeemable immediately | Redeemable upon maturity |

| Interest rate | Typically lower than locked savings | Typically higher than flexible savings |

| Supported assets | 356 | Selected |

Binance Simple Earn Benefits

- Suitable for novice and risk-averse traders.

- Compound interest benefits.

- Wide range of supported assets.

BNB Vault

Since Binance released the BNB Coin through an Initial Coin Offering (ICO) in July 2017, it has enabled multiple utilities for the coin within the ecosystem. As the native token, it fuels transactions on the BNB Chain, settles transactions on the Binance exchange, makes in-store payments to affiliated stores and merchants, and offers many more benefits spanning centralized and decentralized finance settings.

Binance offers the BNB Vault, which can maximize and automate BNB earnings via all these avenues, requiring minimal effort from investors. All they need to do is to add the desired amount of BNB to the vault (or enable “Auto-Subscribe,” allowing Binance to access the BNB in the ‘Spot Wallet’), and the system takes care of the rest, acting as the BNB yield aggregator to earn crypto for Binance users. Here’s what is happening behind the scenes -

The Vault will typically earn crypto by investing the available BNB across three major plans:

- Simple Earn Flexible Products: Your BNB will earn interest in the ‘Spot Wallet’ over time, with the principle redeemable anytime. The staked BNB is securing the following benefits simultaneously;

- Binance Launchpool: Farm new tokens participating in the Binance Launchpool.

- Defi Staking: Use your BNB Vault holdings to participate in smart contracts-powered Defi staking protocols, similar to DeFi yield farming.

(More on Launchpool and DeFi Staking later.)

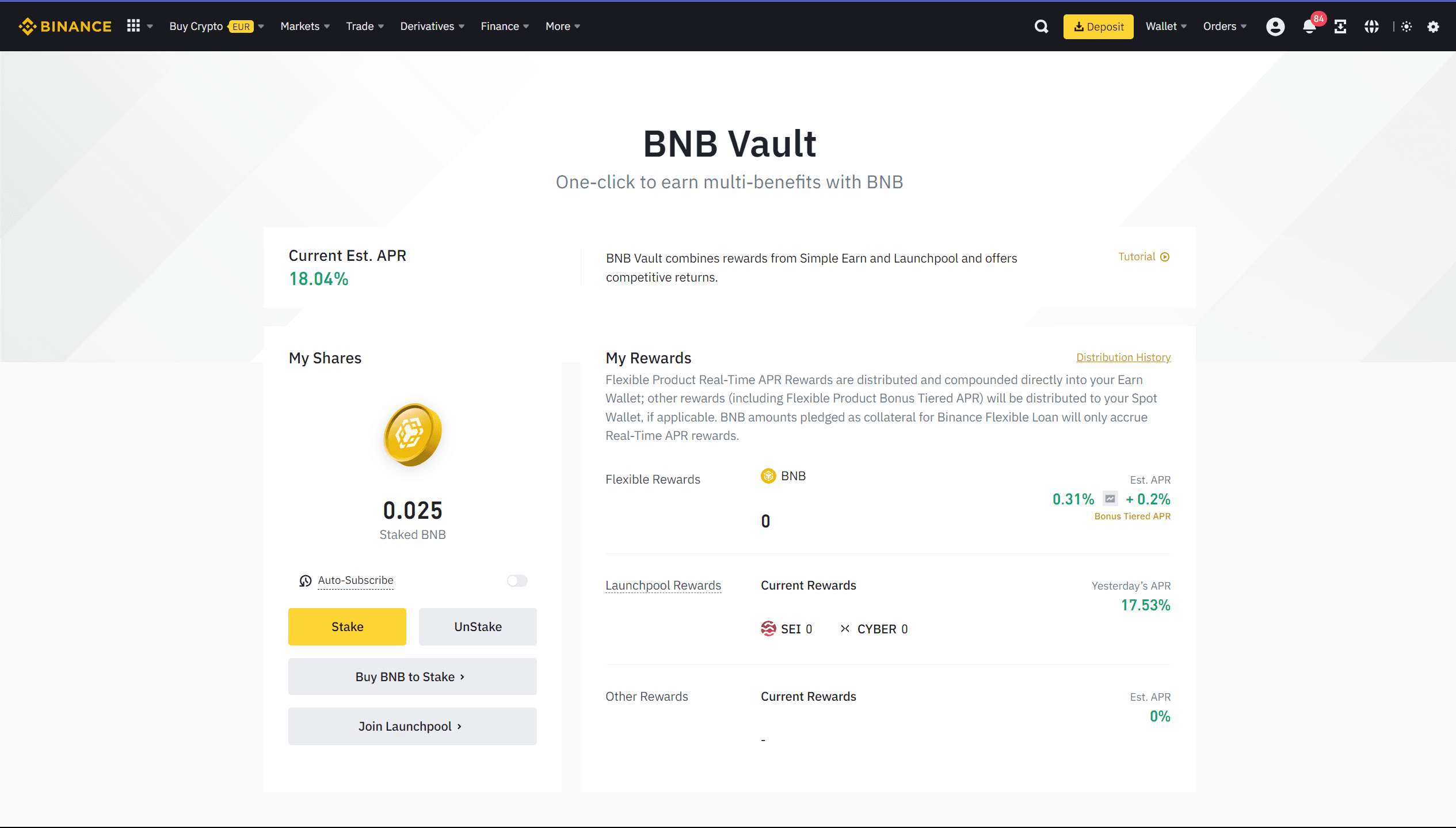

BNB Vault Homepage. Image via Binance Earn

BNB Vault Homepage. Image via Binance EarnBNB Vault Benefits:

When writing this review, we can make the following observations about the BNB Vault’s value:

- Automatic Asset Allocation and Rebalancing: The Vault dynamically allocates and rebalances the vault BNB asset across Launchpool, DeFi Staking, and other benefits to offer the best possible returns to users.

- Multi-Exposure Benefits: As the BNB in the vault earns interest under the SimpleEarn Flexible Product, Binance also offers exposure to the Launchpool and Defi Staking products. The Vault stands at 18.04% APR at the time of writing. The investor can earn the following returns when investing in the products separately:

- Simple Earn: Maximum return is achieved by locking BNB in the savings account for 120 days at 2.1% APR.

- Launchpool: The BNB-CYBER pool offers 15.59% APR, while the BNB-SEI pool offers 19.05% APR.

- DeFi Staking: Staking BNB in DeFi earns 0.9% APR.

- Liquidity: The Vault also enables Simple Earn flexible deposit of BNB, which is not available if you deposit BNB to the Simple Earn product directly.

The investor’s risk profile may devise strategies such as -

- A risk-averse approach would avoid exposure to speculative and higher-risk assets.

- A risk-friendly investor may deploy their BNB on the Launchpools on more speculative asset pools, earning them a higher APY.

Risk-reward management of the BNB Vault:

- If higher-risk tokens lose all their value, the Vault will earn 0.31% APR or less from the BNB Flexible savings account, which is 0.59% less than the Binance Staking BNB in DeFi. The risk-averse strategy wins in this case.

- If the higher-risk tokens hold on to their value, the Vault will make 18.05% APR or more from its collective investments, which is 1% less than Launchpool rewards. The risk-friendly strategy wins this case.

- The Vault would mitigate the risks in the above scenarios by dynamically reallocating BNB and ensuring optimum returns. The Vault currently earns over 20x more than the risk-averse strategy and just 1.05x less than the risk-friendly strategy, offering good upside potential for the extra risk assumed.

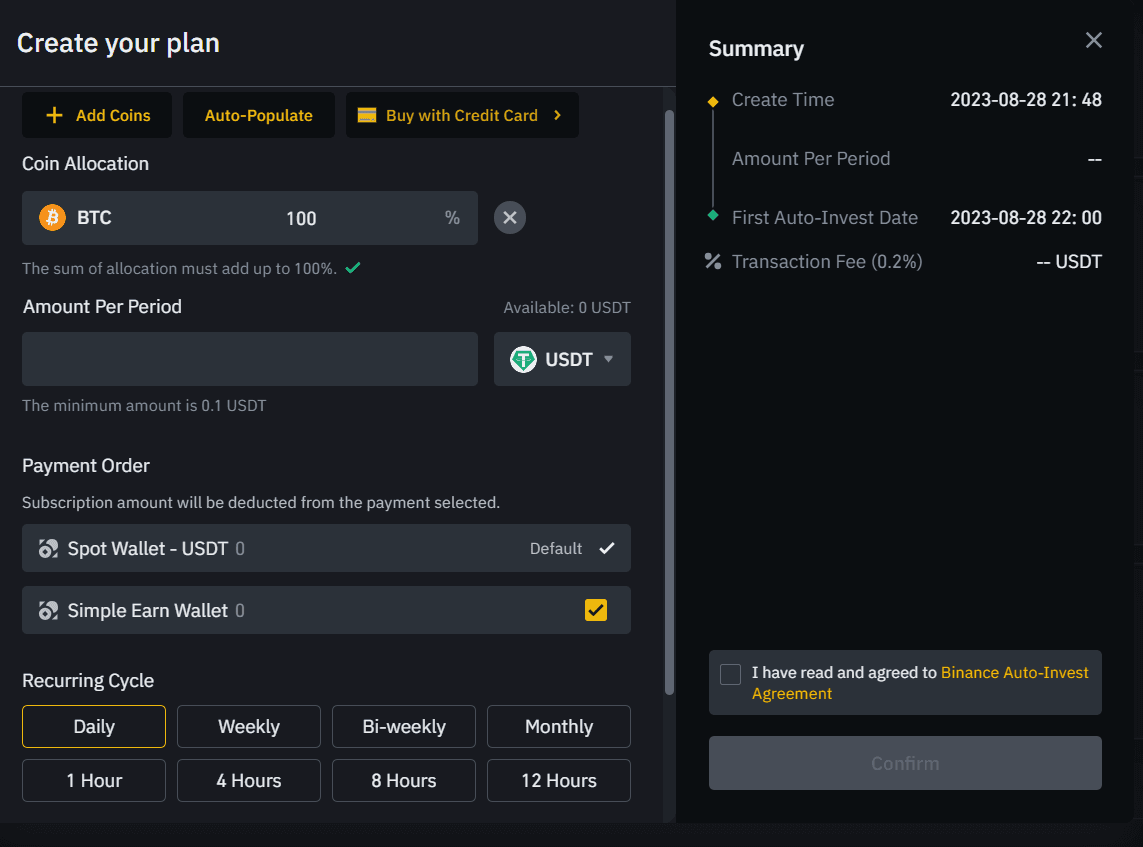

Auto-Invest

The Auto-Invest plan under Binance Earn is similar to SIP (Systematic Investment Plan) products widely used in the equity market. The technique allows the user to automate the purchase of supporting cryptocurrencies so the specified amount is purchased at predetermined intervals. This method is called Dollar Cost Averaging (DCA).

**Note** DCA is a widespread investing technique where a certain amount of crypto is purchased at predetermined intervals. The idea is to safeguard from the opportunity cost of inaccurately timing entry into the market by spreading holdings across time.

Auto Invest Homepage. Image via Binance Earn

Auto Invest Homepage. Image via Binance EarnAuto-Invest is remarkably customizable:

- It allows investors to curate unique portfolios that resonate with their risk profile.

- It offers various payment options spanning several stablecoins and tokens.

- The supported assets are automatically invested into the BNB Vault or Simple Earn Flexible Product, as applicable.

- If the users run out of the spot funds to pay for the automated purchases, Auto-Invest can also redeem assets from the Simple Earn Flexible Products to pay for the transactions if the users opt in for the feature.

Benefits of Binance Earn Auto-Invest:

- Dollar-cost averaging minimizes the impact of market volatility.

- It saves time by not having to make recurring purchases every time.

- It safeguards investors from making emotional and impulsive decisions in times of volatility.

Binance Earn Staking

In DeFi, staking involves locking up crypto to participate in various network operations. Initially referring to participating in blockchain consensus exclusively, staking has expanded to include liquidity provider services, yield farming, governance, and liquid staking.

Binance Earn offers three staking products -

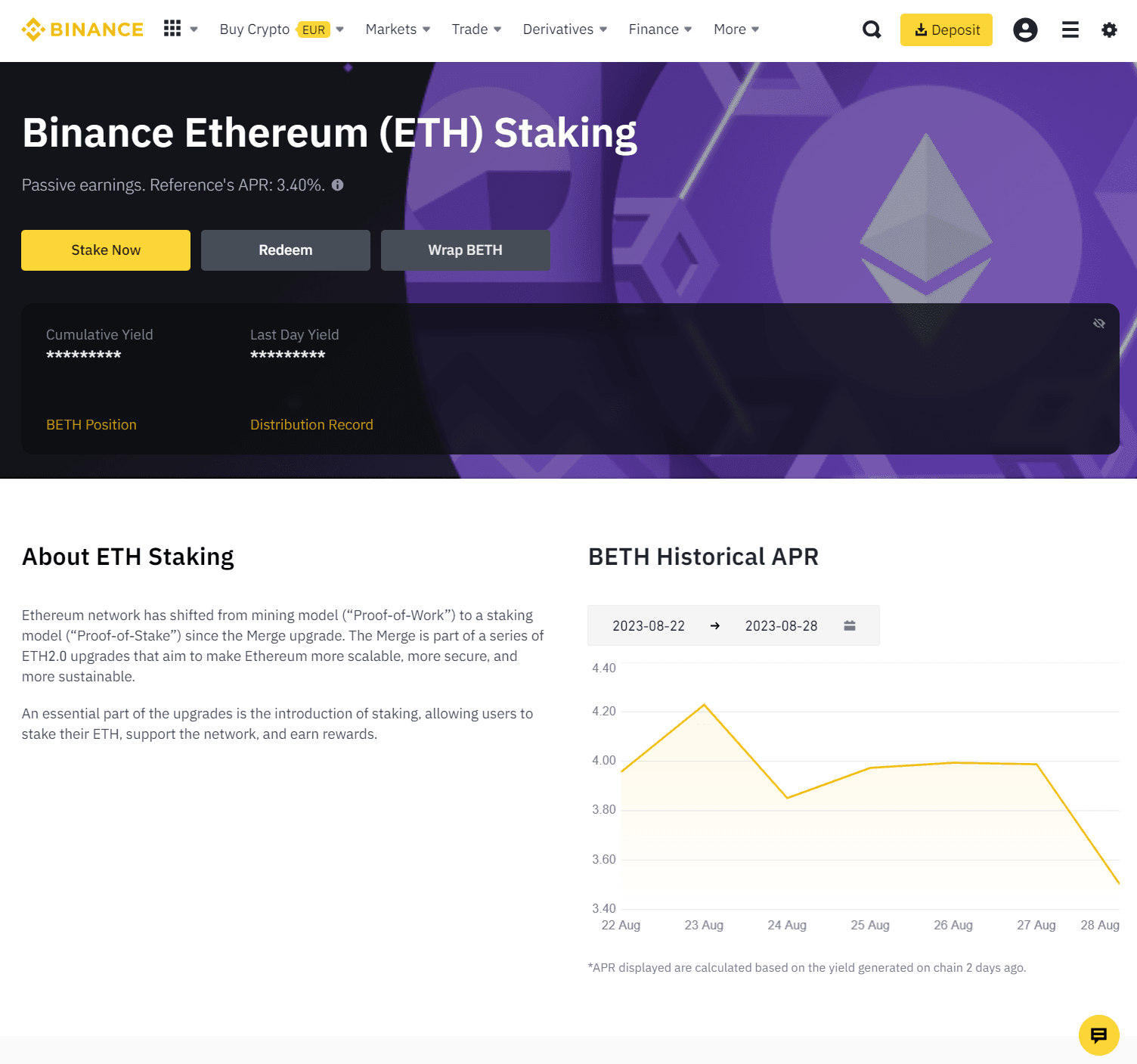

Binance Earn ETH 2.0 Staking

ETH 2.0 refers to the post-merge Ethereum blockchain that migrated to the Proof of Stake consensus system. Binance offers ETH 2.0 Staking as its Ethereum liquid staking solution for users' ETH spot positions. Binance levies a 10% interest on ETH staking rewards to cover operational costs, including hardware and network maintenance. Here’s how it works -

- Subscribers of ETH2.0 Staking Product receive an equivalent BETH to their staked amount in spot directly.

- Staking rewards are also sent in BETH, based on its spot amount. BETH can conduct the same operations ETH does on Binance.

- A certain quota of ETH is redeemable against an equal amount of BETH every day.

Binance ETH 2.0 Staking. Image via Binance Earn

Binance ETH 2.0 Staking. Image via Binance EarnBinance ETH 2.0 Staking Benefits -

- Lower entry barrier - With Binance, earn staking benefits with just 0.0001 ETH instead of 32 ETH required for on-chain staking.

- Mitigated risk - Binance covers operational expenses and protects against slashing, reducing the risk of loss.

- Simple process - Staking as a full node or dealing with decentralized protocols is only feasible for some.

- Binance Simple Earn - BETH can earn further rewards from the Simple Earn Flexible Product on Binance.

Binance ETH 2.0 Staking competition (Cefi and Defi)

| Binance | Coinbase | Kraken | RocketPool | Lido Finance | |

| Commission | 10% | 25% | 15% | Variable | 10% (DAO dependent) |

| Min. Staking Amount | 0.0001 ETH | No min. amount | Unspecified | 0.01 ETH | No min. amount |

| Reward Distribution | Daily | Every three days | Weekly | 2-3 days | Unspecified |

| DeFi/CeFi | CeFi | CeFi | CeFi | DeFi | DeFi |

| Staking Risks | Covered | Covered | Not covered | Not covered | Not covered |

| Other | Simple Earn benefits | Retain ownership | Additional rewards | rETH token benefits | stETH token benefits |

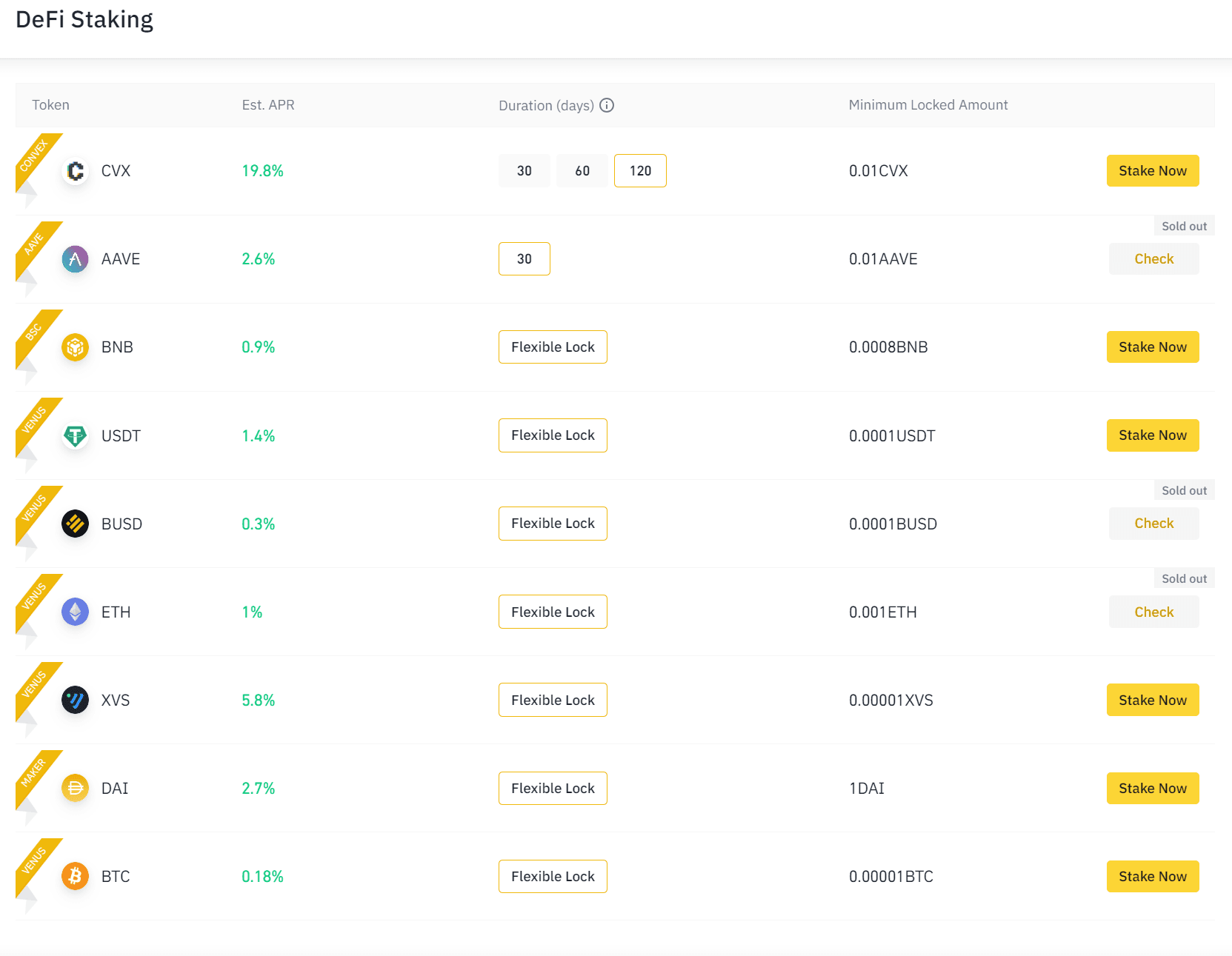

DeFi Staking

The Binance DeFi Staking product allows users to participate in various DeFi protocols and earn passive income. Binance offers a user-friendly interface that stakes users’ crypto on their behalf and covers other overheads such as gas. The staking product may be flexible (redeemable anytime) or locked (redeemable after maturity).

Binance DeFi Staking. Image via Binance Earn

Binance DeFi Staking. Image via Binance EarnBinance only acts as the facilitator between the user and the DeFi protocol, which means it does not guarantee any returns and is not responsible for reimbursing any loss the users' stake may incur. Binance may also charge an interest and margin over the interest earned by the user.

There are a handful of other centralized DeFi service providers. Here’s how they compare against Binance (at the time of writing) -

- Staking ETH on Coinbase and Kraken earns 3.26% APY and 4-7% APY, respectively, while the same stake Binance offers 1% APR on ETH deposits.

- A BTC stake on Binance offers 0.18% APR, while Kraken offers 0.5%.

- While Kraken offers a 3.75% return on staked USDT, Binance offers 1.4%.

- Depositing AAVE on Binance earns 2.6% APR and the same asset on Coinbase records 6.23% APY.

**Note** **Annual Percentage Return (APR)** collects interest on the same amount of principal stake initially till maturity, while **Annual Percentage Yield (APY)** earns compound interest by reinvesting the returns in the principal.

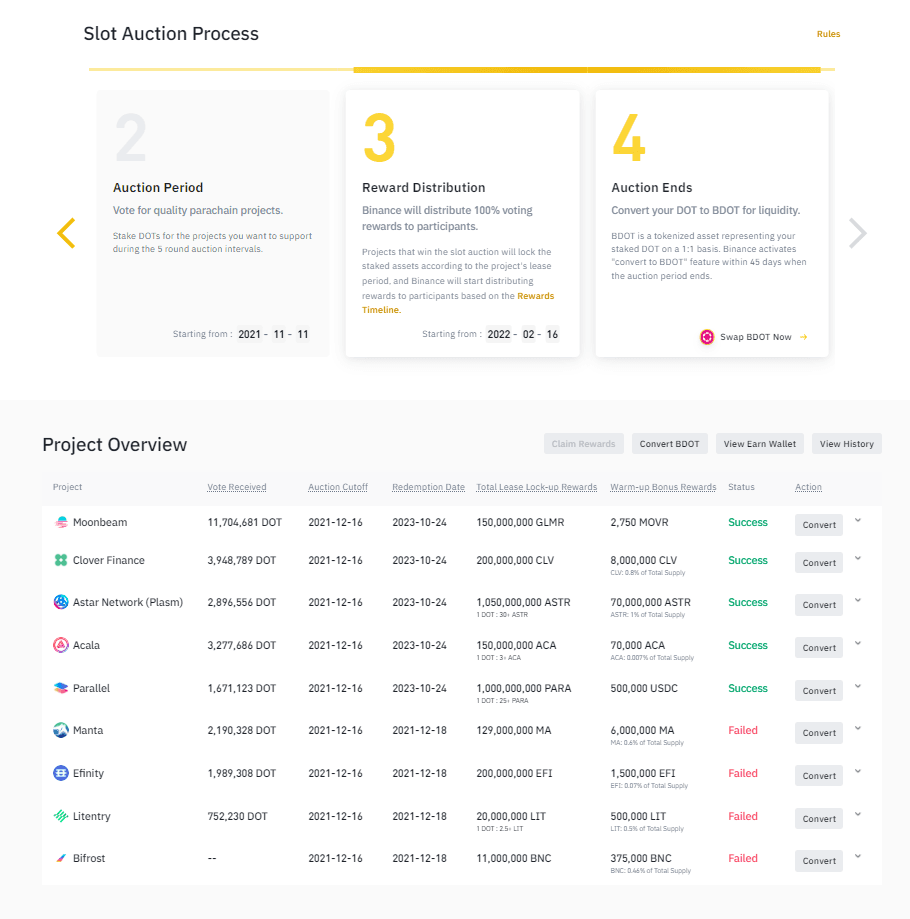

DOT Solt Auction

DOT Slot Auction happens on the Polkadot blockchain. Projects bid to join the ecosystem as parachains, and their supporters can vote with their DOT holdings. If a project wins the parachain auction, its corresponding DOT deposit is locked till it stays as the parachain, which rewards the users with token allocations.

Binance DOT Slot Auction. Image via Binance Earn

Binance DOT Slot Auction. Image via Binance EarnBinance Earn’s DOT Slot Auction allows users to use Binance spot DOT holdings to participate in the auction. By eliminating the need for the DeFi route, Binance offers ease of use and eliminates the need to pay gas fees. Here’s how it works -

- Warm-up period: Seven days before the official start of the auction, Binance and the parachain provide a special warm-up bonus to Binance users (approximately $30 million USDT).

- Voting: Users stake their DOT for the desired projects. Rewards are cumulative.

- BDOT tokens: Binance issues liquid BDOT tokens to users representing their staked DOT. It activates the “convert to BDOT” feature within 45 days when the total auction period ends.

- After the lease period ends, users can convert their BDOT funds back to DOT.

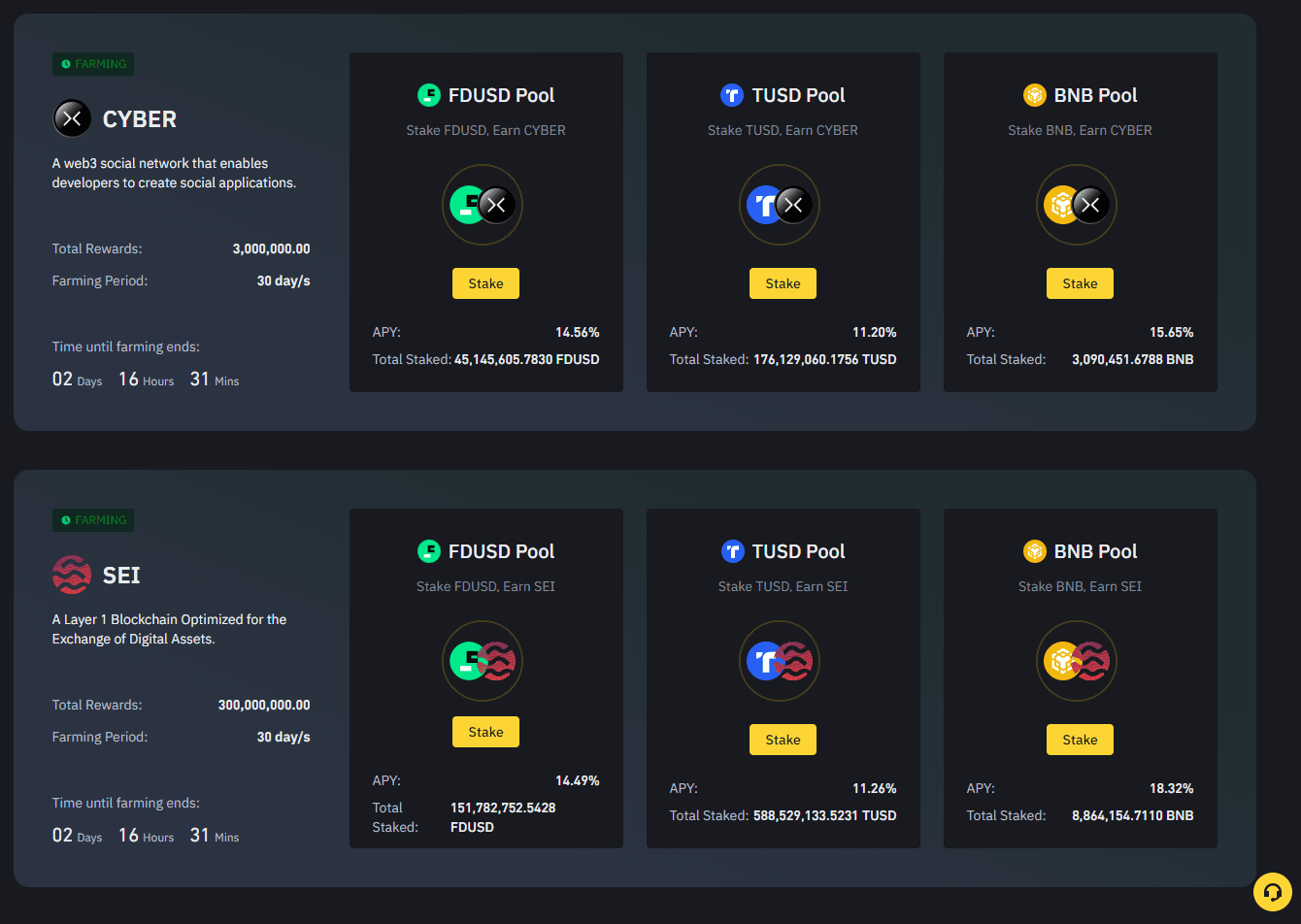

Farming

Yield farming is the process of deploying crypto to work in DeFi protocols and generate passive income. Yield farming services use smart contracts to lock tokens and pay interest to depositors. Binance Earn offers three farming products -

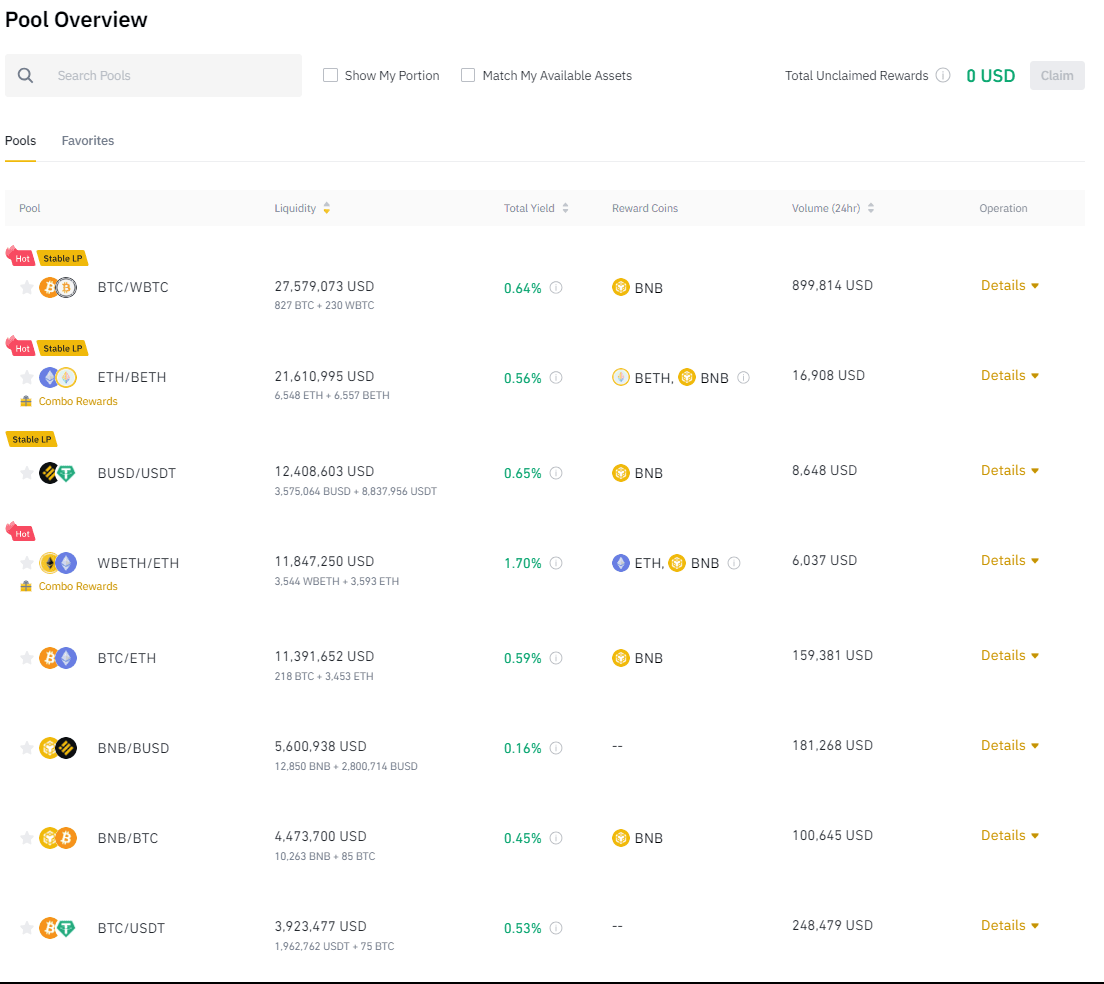

Liquidity Farming

Liquidity farming is a DeFi passive income strategy where liquidity is added to pools to earn fees from swaps. Binance may also offer additional rewards in the form of tokens to incentivize liquidity provision. These could be in the form of BNB or other project tokens Binance partners with.

Binance Liquidity Farming. Image via Binance Earn

Binance Liquidity Farming. Image via Binance EarnLet’s compare the top Binance Liquidity Farming pools with similar pools in DeFi protocols (data sourced from DeFi Llama) -

Binance pools -

| Pools | TVL (USD) | APY (%) |

| BTC/WBTC | 27,579,073 | 0.64% |

| ETH/BETH | 21,610,996 | 0.56% |

| BUSD/USDT | 12,408,603 | 0.65% |

| BTC/ETH | 11,391,652 | 0.59% |

| BTC/USDT | 3,923,477 | 0.53% |

DeFi pools constituting similar tokens -

| Pools | Project | TVL (USD millions, appx.) | APY (%) |

| WBTC/SBTC | Convex Finance | 11.47 | 1.30% |

| ETH/FRXETH | Convex Finance | 122.73 | 2.70% |

| USDT/CRVUSD | Convex Finance | 44.210 | 5.59% |

| USDT/WBTC/WETH | Convex Finance | 72.04 | 4.80% |

Observations:

Liquidity mining on Binance is hassle-free and does not require complicated private key and wallet management. However, the data above shows that the opportunity for greater returns that are lost by using Binance pools over its DeFi counterparts is quite substantial.

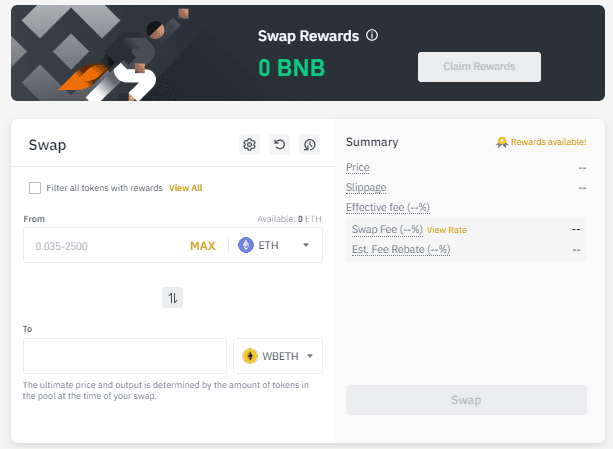

Binance extended its Liquidity Farming product with Swap Farming, where users can earn additional rewards by swapping tokens in liquidity pools on Binance.

Binance Swap Farming. Image via Binance Earn

Binance Swap Farming. Image via Binance EarnLaunchpool

In Binance Launchpool, users can farm tokens to earn new tokens that launch through this platform, for free. To farm tokens on Launchpool, stake the desired amount. The farming period typically lasts 30 days, during which users can farm tokens. The rewards receivable depend on the number of other active users within the Launchpool and the amount of crypto deposited to each pool.

Binance Launch Pool | Source: Binance Earn

Binance Launch Pool | Source: Binance Earn**Pro Tip:** Users can also participate in the Launchpool through the BNB Vault, which offers additional reallocation benefits to optimize returns.

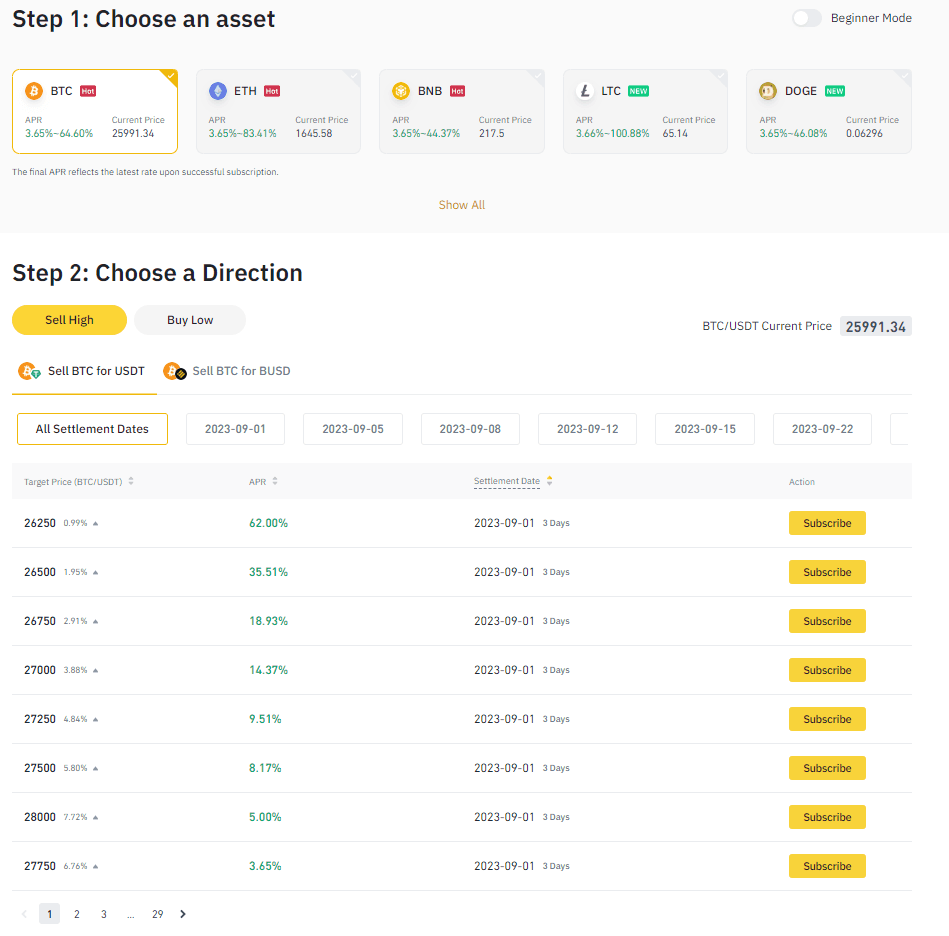

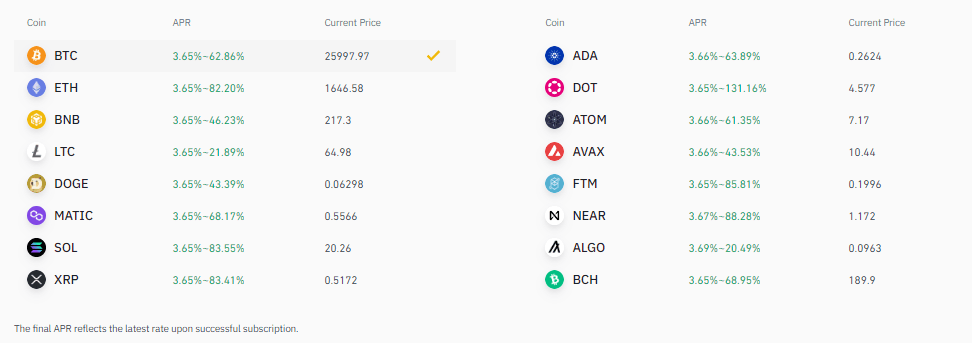

Dual Investment

Binance Dual Investment is a financial product that allows users to potentially gain returns from both the cryptocurrency and fiat markets while also giving them the chance to participate in potential price gains of the chosen crypto.

Binance Dual Investment. Image via Binance Earn

Binance Dual Investment. Image via Binance EarnHere’s the basic outline -

- Select the Pair: You choose a pair of assets you wish to invest in, usually a cryptocurrency like BTC, ETH, etc., and a fiat currency like USD, EUR, or a stablecoin like USDT.

- Set the Terms: You decide the duration of the investment and the "target price," which is a predetermined price level for the cryptocurrency involved.

- Deposit the Asset: You deposit the cryptocurrency or fiat into the Dual Investment product for the specified period.

- Two Possible Outcomes:

- If the Price Goes Up: If the price of the cryptocurrency goes above the target price by the maturity date, you get your initial investment back in the fiat or stablecoin currency at the predetermined exchange rate. This allows you to lock in gains without having to sell your cryptocurrency.

- If the Price Goes Down or Stays the Same: If the cryptocurrency's price is below the strike price at the maturity date, you get your initial investment back in the cryptocurrency, essentially allowing you to buy more of the asset at a "discount" compared to the target price.

- Interest: During the holding period, your investment may earn a fixed interest, further adding to your potential gains.

The Dual investment plan allows potential gain from rising and falling markets while also earning interest during the holding period. However, the opportunity cost of this strategy may outweigh its gains during times of increased volatility. Several well-known cryptocurrencies are available for Dual Investment.

**Pro Tip:** Use the Beginner mode if you need help navigating through this strategy.

Dual Investment supported assets. Image via Binance Earn

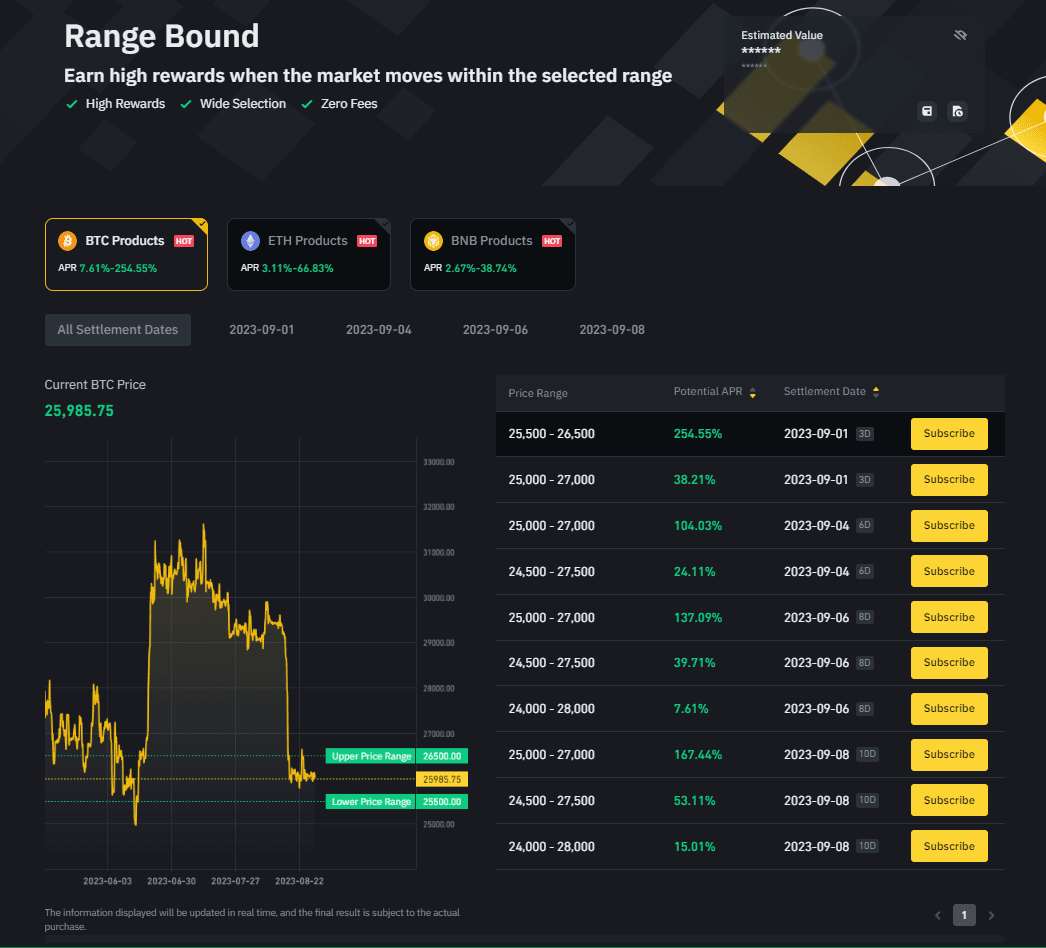

Dual Investment supported assets. Image via Binance EarnRange Bound

Cryptocurrency markets are typically very volatile, but there are times of weakened interest and low volumes when the price hovers in a range; this is called a sideways market. By letting users earn additional interest, Binance Range Bound lets users benefit from this sideways movement.

Binance Range Bound. Image via Binance Earn

Binance Range Bound. Image via Binance EarnOnce you select and deposit the asset, choose the preferred range and duration. There are two possible scenarios:

- Price stays within the range: If it stays within range for the entire duration, you receive rewards equal to the potential APR at the settlement date.

- Price exits the range: If the price touches/exceeds the selected range at any point during the subscription duration, you may receive less than the amount you initially deposited.

Range Bound poses a considerable risk and is suitable for seasoned traders. Binance offers BTC, ETH, and BNB Range Bound plans.

Binance Earn: Benefits, Risks, and Opportunities

Benefits:

- A diverse portfolio of products across DeFi and CeFi for all risk appetites and reward expectations.

- User-friendly interface.

- Good liquidity and flexibility protect against volatility.

- Some products offer the highest yields in the market.

Risks:

- Some products like Dual Investment and Range Bound may be hard for novice traders to understand.

- Some products, like the Launchpool, are tied to very speculative tokens.

- Unstandardized regulation means products are not available uniformly across all geographical locations.

- Risks of centralization and limited direct access to deposits increase default risk.

Opportunities:

- Binance Earn products can potentially help inexperienced traders become seasoned at taking risks, attracting more value into the ecosystem.

- A wide variety of products with cross-functional applications keeps users within the ecosystem.

- Early adopter advantages.

- Users already on Binance have a massive incentive to continue their DeFi activities within the ecosystem.

Binance Earn Review: Closing Thoughts

Binance Earn emerges as a formidable contender in the rapidly evolving landscape of crypto finance. With its diverse array of products, user-friendly interface, and the potential for high returns, it offers both novice and experienced investors unique opportunities to grow their portfolios.

However, as with any investment, it's essential to navigate the inherent risks and complexities carefully. As the crypto ecosystem continues to mature, Binance Earn stands well-poised to capitalize on this growth, offering an all-in-one platform for crypto asset management that sets it apart from its competitors.