Crypto today is nothing like the old buy-and-sell era. Exchanges have evolved into full financial ecosystems with yield products, bots, NFTs, and Web3 tools. And although the exchange landscape has grown more competitive, one pairing continues to dominate the discussion: Binance and OKX.

Binance remains the global heavyweight. Its size, liquidity, breadth of products, and fiat rails make it the most complete exchange in the industry. OKX, on the other hand, has become the platform many traders prefer day-to-day because of its cleaner design, better Web3 tools, and incredibly well-developed trading bot ecosystem.

This review aims to cut through the noise. It doesn’t dance around the decision or hide behind vague comparisons. The goal is simple: to help you choose between Binance and OKX by breaking down what actually matters when you’re trading, investing, earning yield, or exploring DeFi.

If you value breadth and depth, go for Binance. If you value design and efficiency, choose OKX.

Binance — The stronger choice if you want depth. It wins on fiat support, liquidity, asset variety, and sheer product range. Traders who want an exchange that “does everything” typically gravitate to Binance.

OKX — Not just a runner-up. Its interface is modern, its Web3 wallet is one of the best, and its trading bots are far more advanced. If automation and day-to-day smoothness matter, OKX can feel like the smarter option.

Both are excellent. Your trading style is the real deciding factor.

Summary Comparison Table

| Metric | Binance | OKX | Winner |

|---|---|---|---|

| Overall Score | 4.5 / 5 | 4 / 5 | Binance |

| Fees | 0.1% maker/taker | 0.2% maker, 0.35% taker | Binance |

| Fiat Support | Strong global fiat on-ramps | Limited fiat options | Binance |

| Trading Bots | Solid, mostly standard tools | One of the best bot suites in crypto | OKX |

| Asset Selection | 400+ assets (region-dependent) | ~300 assets (region-dependent) | Binance |

| Security | Long track record, strong PoR | Robust PoR, excellent risk engine | Tie |

| Customer Support | Broad but mixed response times | Good quality, faster replies | OKX |

| Ease of Use | Familiar and smooth | Cleaner UI, more advanced layout | Tie |

| Features | Massive CEX + Web3 ecosystem | Deep tools + elite bot system | Tie |

| Best For | Liquidity, depth, global coverage | Automation, Web3, advanced tools | Depends on user |

Who Should Choose Which

Choose Binance if you:

- Want deep liquidity

- Need a large list of assets

- Rely on fiat deposits or withdrawals

- Prefer the broadest feature set

- Want an all-in-one platform

- Trade futures often

- Use launchpads or launchpools

Choose OKX if you:

- Use trading bots frequently

- Prefer a clean, modern UI

- Rely on a Web3 wallet

- Care about PoR transparency

- Trade NFTs or interact with DApps

- Want a smoother day-to-day experience

Helpful Links

Overall Scores

We'll now look at our scores in detail.

Binance Score (4.5/5)

Binance still stands on its own tier. No other exchange matches it in sheer scale. It lists more assets, clears more volume, offers more fiat rails, and has more products than most platforms combined. For many users, Binance becomes the home base for trading, earning, and longer-term investing.

The trade-off is complexity. The interface is dense, features stack up quickly, and it takes time to learn your way around. The flip side is that Binance holds up when markets get chaotic: the app stays responsive, executions are reliable, and the futures markets are among the most liquid anywhere.

OKX Score (4/5)

OKX has evolved into one of the most refined exchanges in crypto. The interface is modern, organised, and easy to navigate. It doesn’t have Binance’s massive product range, but everything on OKX fits together cleanly and is far easier to learn.

If Binance feels like a high-powered trading terminal, OKX feels like a bright, structured workspace. The bot marketplace is one of the best available, complete with strategy templates, transparent metrics, and AI-supported tools. The Web3 wallet is fast, multichain, and integrates smoothly with the exchange.

The drawbacks mostly relate to coverage. OKX lists fewer assets and doesn’t offer as many fiat corridors. Liquidity on top pairs is excellent, but it thins out faster than Binance once you move beyond major assets.

Binance vs OKX — Exchange Overview

It helps to know what each exchange stands for before getting into the details.

Quick Histories

Binance

Binance’s rise is already a well-known part of crypto’s early history. The exchange launched in 2017 and quickly pulled ahead of rivals with low fees, fast listings, and a global approach that few others were willing to take at the time. While many platforms moved slowly, Binance pushed into new markets and added assets at a rapid pace. The strategy worked. Within a year, it had become the largest exchange in the industry.

BNB ultimately shaped Binance’s direction significantly. The token caught on quickly, and BNB Chain pulled the company deeper into DeFi, NFTs, and many on-chain projects. By 2020, Binance did not feel like a simple exchange anymore. It felt like its own world, with products and services branching out in every direction.

That kind of rapid expansion doesn’t stay under the radar for long. By the time Richard Teng took over as CEO in 2023, it was clear Binance needed to ease off the accelerator and tighten up its compliance playbook. The company didn’t stop growing, but it became more deliberate about how it moved. A few products were trimmed, and some internal processes became stricter. Even with all that happening, Binance kept its place at the top in trading volume.

And even now, it’s still the biggest exchange in the game. Binance has weathered enough cycles, setbacks, and comebacks to feel like one of the more seasoned players in the industry.

For more details on Binance, take a look at our full Binance review.

Binance Is The Largest Crypto Exchange Despite Its Ups And Downs. Image Via Shutterstock

Binance Is The Largest Crypto Exchange Despite Its Ups And Downs. Image Via ShutterstockOKX

OKX took a slower, more deliberate path. Its roots go back to 2013 under the name OKCoin, one of the early crypto trading platforms. It evolved into OKEx and then rebranded to OKX in 2017 to reflect a broader mission: bridging centralized trading with decentralized finance.

Instead of copying Binance’s all-in-one growth strategy, OKX invested in areas that Binance would later expand into, such as NFTs, multichain wallets, DApp access, and automated trading tools.

Some exchanges keep adding features until the platform feels crowded. Binance took that path. OKX chose a different approach. It focused on how the parts fit together and how the user moves through the platform.

The result is an exchange that feels calmer and more refined. It does not come across as a pile of disconnected tools. It feels like a platform shaped by a clear plan from the very beginning.

Take a look at our full OKX review to know more.

Key Stats

| Metric | Binance | OKX |

|---|---|---|

| Founded | 2017 | 2013 |

| User Count | About 300M | Claims “millions” on its website |

| Supported Countries | 180+ | 100+ |

| 24h Trading Volume | $16 billion+ | $2 billion+ |

| Native Tokens | BNB | OKB |

How We Tested And Reviewed Binance And OKX

This comparison is built around real trading and real user workflows, not just reading marketing pages. We tested both exchanges the way most Coin Bureau readers actually use them: onboarding, funding, executing trades, managing risk, using earn products, and moving funds out safely.

What We Did

- Created and verified accounts, then compared onboarding, KYC friction, login/security prompts, and account recovery paths.

- Tested funding and withdrawals using common rails: card purchases, bank transfers (where available), and stablecoin deposits, then measured deposit/withdrawal UX, fees, and confirmations.

- Ran spot and futures trades across majors and mid-caps to compare execution quality, order types, depth on order books, and how the UI behaves during high volatility.

- Compared fee schedules in practice by modeling common scenarios (small buys, active spot traders, futures users), including discounts and VIP tier impacts where relevant.

- Used core product stacks: earn/savings, staking flows, conversions, swaps, and any integrated offerings that a normal user would actually touch weekly.

- Evaluated risk controls like address whitelisting, withdrawal locks, anti-phishing codes, device management, 2FA options, and session controls.

- Reviewed Proof of Reserves tooling and how easy it is to validate assets and liabilities, including the clarity of dashboards and update cadence.

Tested Web3 tooling and integrations:

- On OKX: Web3 wallet flows, DApp connections, NFT/DeFi navigation, and bridging/swap UX.

- On Binance: Web3 access and wallet-related tooling where available, plus how smoothly it connects to external wallets and DApps.

Bench-tested automation and bots:

- On OKX: Bot marketplace depth, strategy templates, performance stats visibility, setup friction, and risk controls.

- On Binance: Available bot/automation tools and how “central” they feel to the platform.

Assessed customer support through help-center quality, live chat availability, and how quickly issues are routed (especially during peak market traffic).

Cross-checked claims with third-party references (fees pages, PoR disclosures, and public track-record items like historical incidents) to avoid relying on self-reported numbers only.

What We Didn’t Do

- We did not run forensic security audits or penetration tests on Binance or OKX infrastructure. We evaluated security through features, disclosures, and historical handling of incidents, not internal code access.

- We did not attempt to bypass KYC, geo-restrictions, or sanctions controls, or test workarounds like VPNs. Access varies by region and should be treated as a compliance constraint, not a “hackable” problem.

- We did not treat every feature as globally available, since product access can differ by jurisdiction and account type.

- We did not use extreme edge-case trading (ultra-high-frequency colocated strategies, institutional APIs at scale) that don’t reflect typical retail usage.

- We did not consider either exchange a substitute for self-custody. This comparison focuses on exchange performance and tooling, not replacing a hardware wallet for long-term storage.

1. Asset Selection & Trading Pairs

Binance’s asset list is enormous. Whether you’re trading majors, mid-caps, or newer tokens, Binance almost always lists assets earlier and maintains deeper liquidity. The breadth of trading pairs allows traders to construct highly specific strategies without needing to hop across multiple exchanges.

OKX offers about 300 coins and tokens, according to CoinGecko, which is more than enough for most traders but noticeably fewer than Binance. Its listings are more conservative. It tends to add projects only after they establish a record of demand or traction.

For traders focused solely on the top 50 coins, both exchanges perform similarly. But if your strategy requires hunting for new opportunities, Binance is the clear leader.

Comparison Table

| Factor | Binance | OKX |

|---|---|---|

| Number of Assets | 400+ | About 300 |

| Listing Speed | Lists new tokens earlier and more frequently | More conservative, adds assets after clear demand |

| Trading Pairs | Very wide pair variety (spot, cross-asset, niche pairs) | Fewer pairs but enough for major strategies |

| Liquidity Depth | Extremely deep across majors and mid-caps | Strong on majors, thinner in smaller markets |

| Best For | Traders seeking broad opportunities | Traders focusing on established assets |

Winner + Score

Winner: Binance

Score: Binance 4.8/5, OKX 4.3/5

2. Trading Fees

Trading fees sit at the center of any long-term trading strategy. A few basis points might not matter today, but over months or years, they add up.

Binance starts cheaper with a 0.1% base maker fee. OKX begins at 0.2%. When fees are paid in BNB, Binance’s maker fee drops to as low as 0.075% for non-VIP users.

| Factor | Binance | OKX |

| Base Maker Fee | 0.10% | 0.2% |

| Discount Options | BNB fee discount brings maker fees to 0.075% | No token-based discount |

Fee Scenarios

To make the fee gap clearer, here are two simple scenarios that show how much a typical user actually pays on each platform.

1. A trader doing $10,000 in monthly volume

Binance

Maker fee: 0.10%

Approximate monthly cost: $10.00

OKX

Maker fee: 0.20%

Approximate monthly cost: $20.00

Result:

Binance is clearly cheaper in this case, about half the cost of OKX at these fee levels.

2. A user buying $1,000 worth of crypto

Binance

Cost at 0.10%: $1.00

OKX

Cost at 0.20%: $2.00

Result:

The difference is small in dollar terms, but Binance still comes out cheaper, with OKX costing roughly double at the 0.2% rate.

Winner + Score

Winner: Binance

Score: Binance 5/5, OKX 4.5/5

Choosing The Right Exchange, Depending On Your Needs, Is The First Step Towards Achieving Your Crypto Goals. Image Via Shutterstock

Choosing The Right Exchange, Depending On Your Needs, Is The First Step Towards Achieving Your Crypto Goals. Image Via Shutterstock3. Fiat Support & Payment Methods

This is one of the biggest gaps between the two exchanges.

Binance has built one of the strongest fiat infrastructures in crypto. It supports bank transfers, card deposits, SEPA, ACH, PIX in Brazil, FPX in Malaysia, local e-wallets, P2P markets, and a wide range of currencies.

Users across Africa, Southeast Asia, Eastern Europe, the Middle East, and Latin America often find Binance to be the easiest entry point into crypto.

OKX, by comparison, relies more heavily on third-party processors. Its direct bank transfer corridors are fewer. In many regions, you may need to use external on-ramps to convert local currency to stablecoins before interacting with OKX.

This doesn’t make OKX unusable; it simply adds friction and cost.

| Factor | Binance | OKX |

|---|---|---|

| Bank Transfers | Broad global support including SEPA, ACH, PIX, FPX | Limited corridors, varies widely |

| Cards | Direct card deposits supported | Often routed through third-party processors |

| Local Payment Methods | Excellent in emerging markets | Fewer native integrations |

| P2P Market | Very large global P2P network | Functional but smaller |

| Ease of Fiat Onboarding | Smooth in most countries | Sometimes requires external ramps |

Winner + Score

Winner: Binance

Score: Binance 5/5, OKX 4/5

4. Products & Features

Binance Has An Edge, But Both Platforms Remain Major Players In Crypto World. Image via Shutterstock

Binance Has An Edge, But Both Platforms Remain Major Players In Crypto World. Image via ShutterstockThere is an important point to keep in mind. More features are not always better for everyone. Binance offers an impressive amount of depth, but that depth can feel heavy for some users. New tools appear often, some overlap, and many sit inside menus that take time to learn. Experienced traders enjoy having so many options. Casual users sometimes feel lost in the complexity.

OKX approaches features differently. Instead of trying to build every possible tool under the sun, OKX focuses on cohesion. The platform offers all the core trading and earning essentials, such as spot, futures, margin, staking, NFT access, P2P trading, and savings, but without the sense that the products are competing for your attention.

The two standout OKX features are the trading bot marketplace and the integrated Web3 wallet. These aren’t tacked-on additions; they feel central to how the platform is designed. Everything from launching a DCA plan to setting up a grid bot feels intuitive, not intimidating.

So while Binance wins the category on sheer scale, OKX wins for refinement and focus.

| Factor | Binance | OKX |

|---|---|---|

| Spot & Futures | Extremely deep markets | Strong but smaller |

| Staking & Earn | Huge range of products | Clean, focused lineup |

| Launchpad / Launchpool | Industry-leading | Smaller, selective |

| Bots | Basic bot tools, less central | One of the best bot marketplaces |

| Web3 Wallet | Functional but secondary | Fully integrated, intuitive Web3 hub |

| Overall Breadth | Largest in the industry | More streamlined and cohesive |

Winner + Score

Winner: Binance overall, but OKX wins in bots and Web3.

Score: Binance 4.8/5, OKX 4.5/5

5. User Experience & Interface

This is where the biggest philosophical difference between Binance and OKX appears.

Binance feels like it grew in layers. You can see traces of its early design language glued beside newer updates. The app and desktop interfaces are loaded with icons, menus, tabs, banners, and switchable modes. It’s incredibly capable, but visually dense. Experienced traders get used to the layout quickly, but newer users often spend their first few days trying to figure out where everything lives.

That doesn’t make Binance poorly designed. It is built for power users. It assumes you want control and gives it to you immediately.

OKX takes the opposite approach. Its interface feels like a modern financial application. The typography, spacing, and overall layout follow a consistent design style. The navigation bar looks cleaner, the product sections feel intentional, and moving between the main exchange and the Web3 wallet is smooth and intuitive.

Everything in OKX is placed where you expect it to be. While Binance can feel like a cockpit with a long list of controls, OKX feels more like a well-organized panel where every option is clearly labeled and easy to reach.

For users who value simplicity, a clean interface, and a calmer trading environment, OKX often becomes the platform that feels more comfortable for everyday use.

| Factor | Binance | OKX |

|---|---|---|

| Layout | Dense, feature-heavy | Clean, modern, minimal |

| Learning Curve | Steeper for beginners | Much easier for first-time users |

| Navigation | Lots of menus and sections | Clear, organized, predictable |

| Mobile App | Extremely powerful but busy | Smooth, lightweight, intuitive |

| Best For | Power users who want full control | Everyday users who want clarity |

Winner + Score

Winner: OKX

Score: Binance 4/5, OKX 4.5/5

6. Security & Safety

Security is often invisible until the moment you need it, which makes it one of the most important factors in choosing an exchange.

Binance secures user funds primarily through cold storage and multi-signature control. Its risk systems are large and battle-tested, built to monitor abnormal transaction patterns, unusual device behavior, and suspicious withdrawals. The platform uses device whitelisting, withdrawal address controls, biometric authentication, and layers of internal monitoring.

Binance’s defining security moment came in 2019, when hackers stole funds, but users were made whole through SAFU, the Secure Asset Fund for Users. SAFU has since become one of Binance’s strongest trust signals.

OKX uses a similar cold storage-focused model. It relies on strong multi-signature controls and has published Proof of Reserves reports that are clearer than those from many other major exchanges.

The only notable disruption occurred in 2020, when withdrawals were paused during an internal investigation involving a private key holder. No user funds were lost, and withdrawals resumed once the issue had been resolved.

So, the comparison isn’t about which platform is “safer.” Both have proven themselves. It’s more about which type of transparency you prefer.

| Factor | Binance | OKX |

|---|---|---|

| Storage Model | Cold storage + multi-sig | Cold storage + multi-sig |

| Proof of Reserves | Provides dashboards | Highly transparent and frequently verified |

| Major Incident History | 2019 breach compensated via SAFU | 2020 withdrawal pause (no losses) |

| Risk Systems | Large, advanced internal monitoring | Strong internal controls, clear audits |

| User Protection Fund | SAFU fund, PoR | No SAFU equivalent, relies on PoR visibility |

Winner + Score

Winner: Draw

Score: Binance 4.7/5, OKX 4.5/5

7. Customer Support

Customer support is one of the least glamorous parts of an exchange, but it becomes everything the moment something goes wrong, whether it’s withdrawing funds, adjusting security settings, or trying to understand a margin notification.

Binance has a large support system, although response times can vary. When the market becomes volatile or traffic spikes, tickets often takes longer. The help center contains a lot of useful information, but the volume of articles and product categories can make it difficult to find what you need. Live chat is helpful, though getting issues escalated can take time.

OKX tends to be faster and more consistent. Its help center articles are easier to read and better structured. Live chat agents respond more promptly and escalate issues with less friction. For everyday support needs, OKX often feels more human.

This category doesn’t declare how often you will need support, ideally never, but how helpful support is when you do need it.

| Factor | Binance | OKX |

|---|---|---|

| Response Time | Varies under heavy traffic | Consistently faster |

| Help Center | Large but dense | Clean and easier to navigate |

| Live Chat | Helpful but escalations take time | More responsive |

| Support Experience | Robust but can feel complex | Simple, human, and efficient |

Winner + Score

Winner: OKX

Score: Binance 4.2/5, OKX 4.6/5

8. Web3, Wallets, Bots & Innovation

This is where OKX separates itself from almost every other centralized exchange.

OKX's Superiority Stems From Its Wallet, A Core Part Of The Platform. Image Via Shutterstock

OKX's Superiority Stems From Its Wallet, A Core Part Of The Platform. Image Via ShutterstockThe OKX Web3 Wallet

Most CEX wallets feel like optional add-ons. OKX’s Web3 wallet feels like a core part of the platform. You can:

- Connect to DApps across multiple chains

- Swap tokens

- Bridge assets

- Buy NFTs

- Stake assets

- Manage DeFi positions

- Explore new protocols

Everything flows smoothly because OKX treats Web3 as part of its identity, not an accessory.

The bot marketplace

OKX has democratized automated trading in a way few exchanges have. Its bot marketplace includes grid bots, DCA bots, arbitrage strategies, smart index bots, and more. The marketplace displays clear performance metrics, risk profiles, and user-submitted strategies.

Traders who use bots frequently often never leave OKX.

Binance’s Web3 and bot features

Binance, on the other hand, offers mobile-based Web3 tools and some automation options, but they don’t feel as integrated or developed. Binance has a massive product suite, but this specific area belongs to OKX.

Trading Bot Comparison Table

| Factor | Binance | OKX |

|---|---|---|

| Bot Types | Basic grid, DCA, TWAP, rebalancing tools | Wide range including grid, DCA, smart index, arbitrage, advanced strategies |

| Marketplace Size | Smaller marketplace with limited public strategies | One of the largest bot marketplaces in the industry with high user activity |

| Ease of Creation | Simple setup but fewer customization options | Very intuitive creation flow with granular controls and templates |

| Community Size | Active but secondary within the platform | Strong community centered around bots with visible performance metrics |

| Copy Trading for Bots | Limited | Deeply integrated, with transparent statistics and leaderboards |

Winner: OKX (by a wide margin)

Pros & Cons Summaries

Both exchanges excel in some areas and fall short in others. Let's look at Binance and OKX's pros and cons.

Binance Pros & Cons

- Huge selection of assets

- Deep liquidity across markets

- Low fees when paying with BNB

- Strong fiat on and off ramps

- Wide range of earning and trading products

- Well-developed derivatives markets

- Excellent launchpad performance

- Feature-rich mobile apps

- Interface can feel crowded

- Learning curve for beginners

- Past security incident (fully resolved)

- Some product redundancy

OKX Pros & Cons

- Clean, modern, intuitive interface

- Lower base maker fees

- Excellent Web3 wallet

- Industry-leading bot marketplace

- Responsive customer support

- Strong proof-of-reserves visibility

- Smooth NFT and DApp access

- Polished mobile experience

- Fewer listed assets

- Weak fiat coverage compared to Binance

- Liquidity thinner on niche pairs

- Fewer structured earning products

Both Platforms Have Some Advantages And DIsadvantages. Choose The One That Suits You The Best

Both Platforms Have Some Advantages And DIsadvantages. Choose The One That Suits You The BestDecision Framework — Which Exchange Should You Choose?

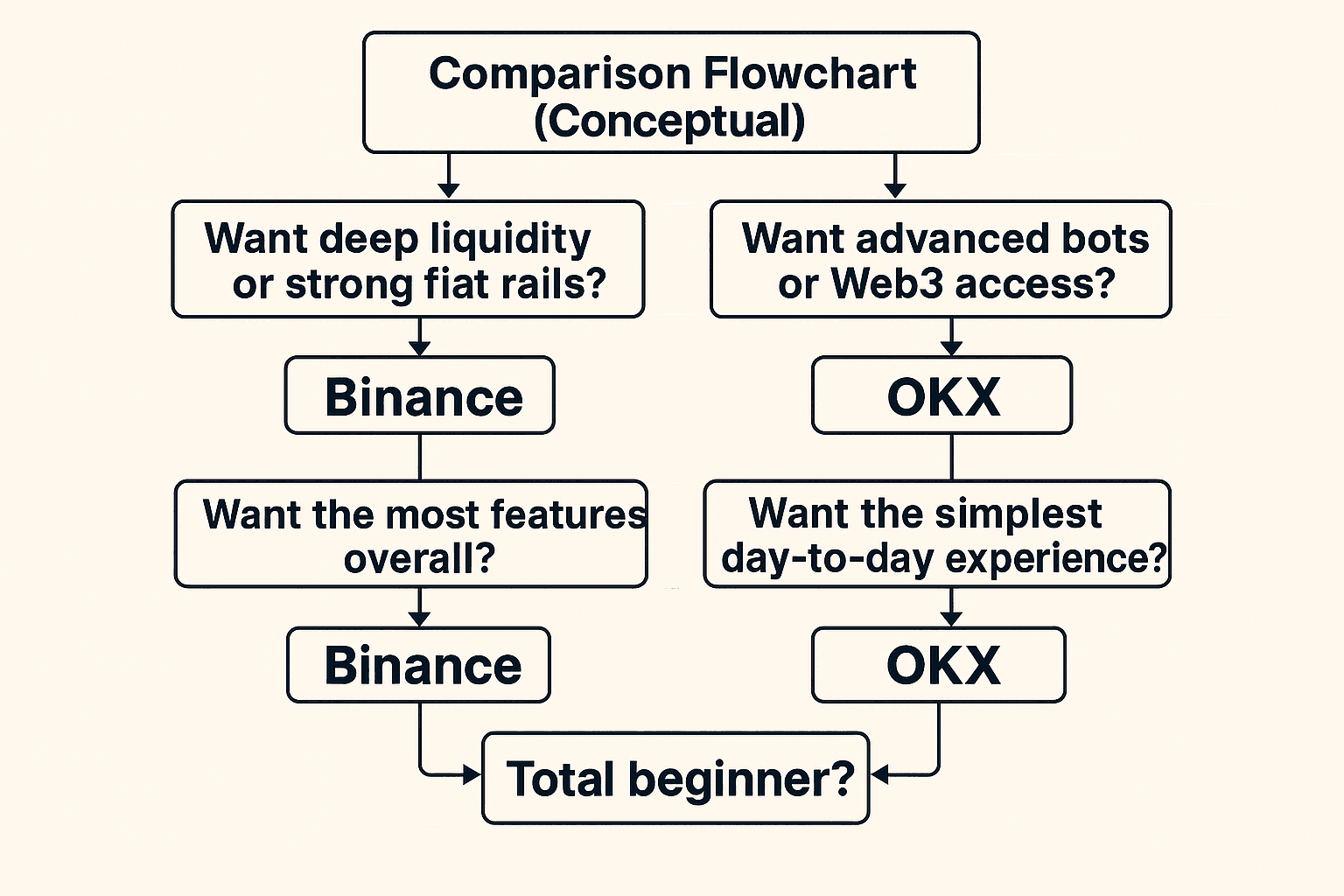

Select Binance If You…

- Want the widest range of assets

- Need deep liquidity

- Rely on fiat deposits

- Want the lowest long-term fees with BNB

- Prefer a complete, “do-it-all” platform

- Are a high-volume derivatives trader

- Want access to industry-leading launchpads

Select OKX If You…

- You use trading bots

- You want easy Web3 access

- You prefer a clean, modern interface

- You interact with NFTs or DeFi

- You value Proof-of-Reserves transparency

- You want automation without coding

Select Neither If You…

- You are a complete beginner

- You live in a restricted region

- You want maximum regulatory protection

- You need traditional banking-grade services

Comparison Flowchart

This flowchart will help you understand better.

Binance Vs. OKX: A Comparison Flowchart

Binance Vs. OKX: A Comparison FlowchartFinal Verdict — Who Wins?

Category Scoreboard

| Category | Winner | Score (Binance-OKX) |

|---|---|---|

| Fees | Binance | 9–8 |

| Features | Binance | 10–9 |

| Bots | OKX | 9–7 |

| Web3 | OKX | 9–6 |

| Security | Draw | 9–9 |

| Support | OKX | 9–7 |

| Fiat | Binance | 10–5 |

| Overall | Binance | 8.5–8.0 |

Final Winner: Binance

Binance remains the best exchange for most traders in 2026. Its liquidity, asset coverage, fiat access, and breadth of features make it the most complete platform on the market. If you want one exchange that does everything and you’re comfortable with a dense interface, Binance is the clear winner.

But OKX is not second place in spirit. It wins decisively in categories that matter to a new generation of crypto users: automation, Web3 access, clean design, and well-integrated tools that make daily trading feel smoother. For many users, especially those active in DeFi or bot trading, OKX feels more advanced.

Both exchanges are excellent. The one you choose depends on what kind of trader you are, someone who values breadth or someone who values refinement.

Either way, both platforms remain at the center of the crypto trading world.