Coinbase has been one of the dominant players in the exchange industry since its launch back in 2012 and has served as a fantastic exchange for those new to crypto or anyone looking for a simple crypto trading platform.

Like any highly competitive industry, there is a lot of innovation happening in the space, with many crypto exchanges taking market share away from Coinbase and battling to get into the coveted top five ranking for exchanges by trading volume.

OKX is one of those exchanges, enjoying a faster rate of growth than much of the competition and making waves in the crypto space. Already ranked as the #8 exchange in the world for Spot and #2 for Derivatives trading, OKX is quickly becoming the preferred place for many traders and crypto enthusiasts. Today’s OKX vs. Coinbase review will help you determine if OKX or Coinbase is right for you.

If you want a deeper understanding of these exchanges and their features, be sure to check out our deep-dive articles below:

To help you in your search to find the perfect exchange, you may also find the following article helpful:

Now, without further ado, let’s crack into these two exchange Titans and unpack what they have to offer.

OKX vs Coinbase

OKX and Coinbase are both fantastic exchanges for users looking for a safe, reputable, regulated and licensed exchange. Because of US regulatory compliance, Coinbase will probably be the preferred choice for US-based users while OKX is often favoured for anyone located outside of the States.

These two exchanges are quite different in their products and features. Here is a quick TL; DR to summarise these two at a glance:

Like most US-based exchanges, Coinbase does not offer nearly as many tradeable instruments or products as many of its international counterparts. Users will find OKX significantly outmatches Coinbase when it comes to advanced trading features, tradeable instruments, derivatives and margin trading.

OKX also features a robust earn platform, a Launchpad, Bot trading, and plenty of other features that Coinbase does not, making OKX better suited to a wider range of users.

👉 Sign up to OKX and get a 40% discount on trading fees for life!

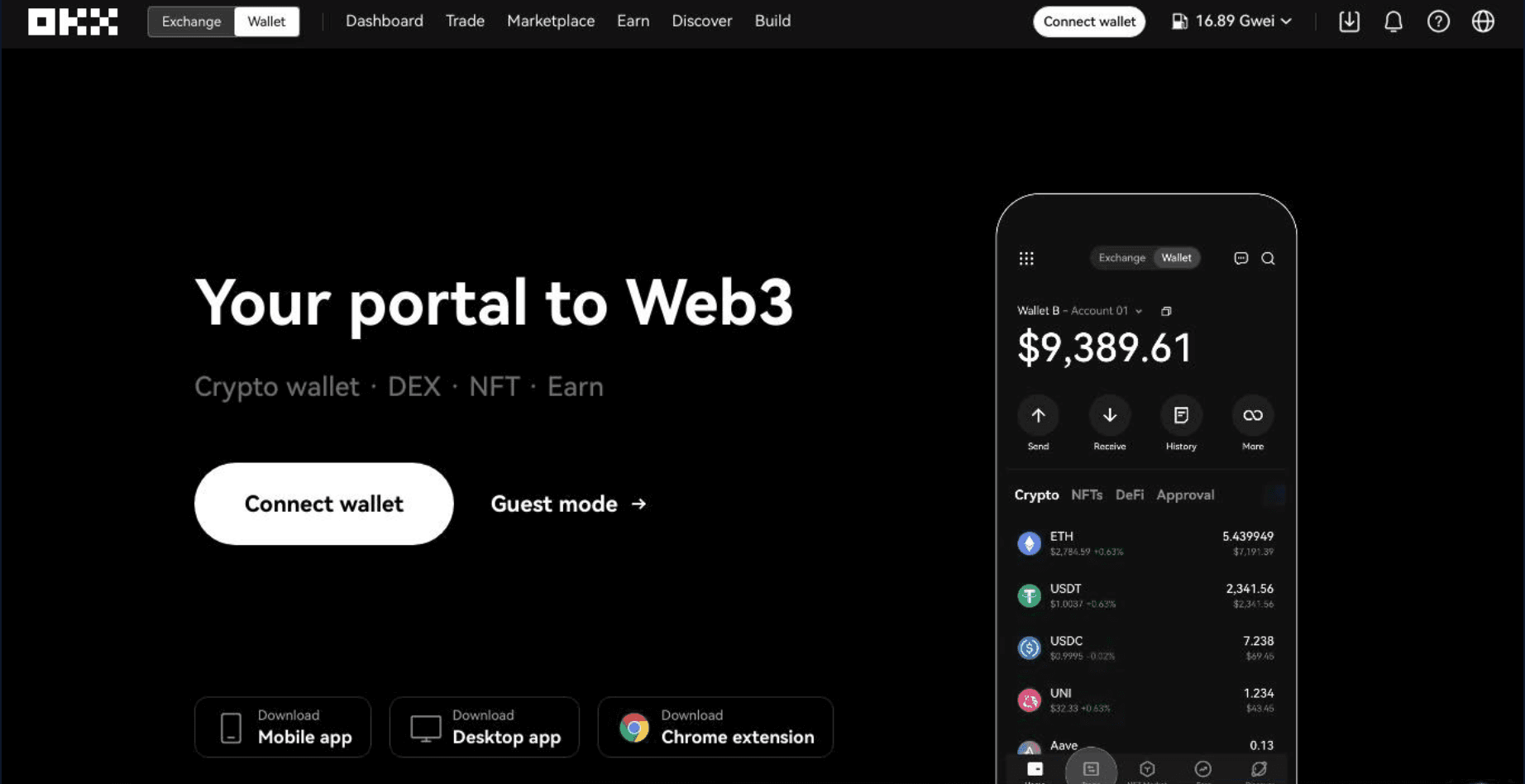

It is also worth mentioning the OKX Web Wallet, a pretty nifty self-custodial wallet that is a potential game changer. It may just be the most versatile and useful software crypto wallet made to date. You can learn more about it in our OKX Web Wallet Review.

OKX is a Leader in Web3 Innovation. Image via OKX

OKX is a Leader in Web3 Innovation. Image via OKX As Coinbase is regulated in the US and is a publicly traded company, unfortunately, there seems to be a lot of red tape dictating what products they can and cannot offer, making their product and asset selection not the greatest. Though many crypto users do not consider that to be too much of a weakness, and as they are the second biggest exchange in the world, it doesn’t seem to hold them back too severely.

Many consider Coinbase’s simplicity and lack of products/features as a strength, as it makes Coinbase the perfect exchange for new users. It is incredibly beginner-friendly, and most crypto veterans you talk to will likely tell a similar story that Coinbase was where they bought their first Bitcoin before graduating to other platforms like Binance, KuCoin, or OKX.

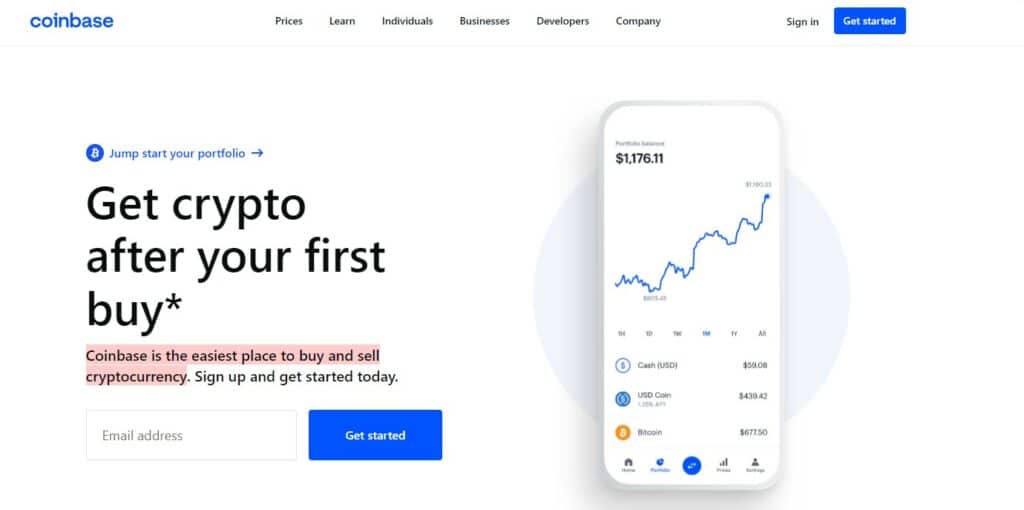

Quite the Bold Claim, Can’t Say I Disagree. Image via Coinbase

Quite the Bold Claim, Can’t Say I Disagree. Image via Coinbase Along with SwissBorg and Kraken, Coinbase is often recommended to new users and the one major benefit Coinbase has over OKX is the ability to withdraw fiat to bank account with full fiat on and offramp services. Many crypto users will have accounts at more than one crypto exchange and use Coinbase primarily as a fiat on and offramp and conduct their trading elsewhere. Coinbase really is one of the best platforms for crypto users who enjoy simplicity and is one of the safest exchanges for fiat to crypto transactions.

Let’s take a closer look at each exchange individually, but first, we will cover an overview of our findings when we compared OKX to Coinbase.

OKX vs. Coinbase: Products Offered

As mentioned above, OKX has a far better selection of products to offer its users than Coinbase. Coinbase is primarily a cryptocurrency exchange with a few basic methods for users to earn passive income via staking, lacking behind the earn features offered by competitors such as Binance and OKX.

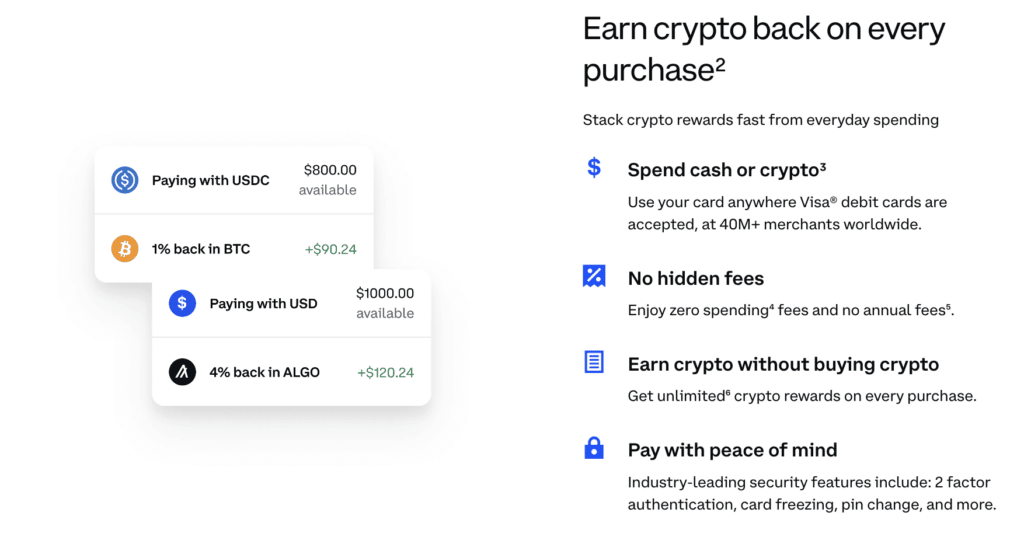

Both Coinbase and OKX offer an NFT marketplace, OKX provides an easy way for users to get involved in Polkadot parachain slot auctions, while Coinbase users can enjoy the use of the Coinbase crypto debit card.

Users interested in launchpad investing or auto-trading bots will opt for OKX, as will any traders looking for better asset support and leverage trading. But Coinbase has one thing that no other exchange can match, and that is the confidence Coinbase users have in knowing that they are trusting one of the safest, most reputable, respectable, regulated and licensed crypto exchanges in the world.

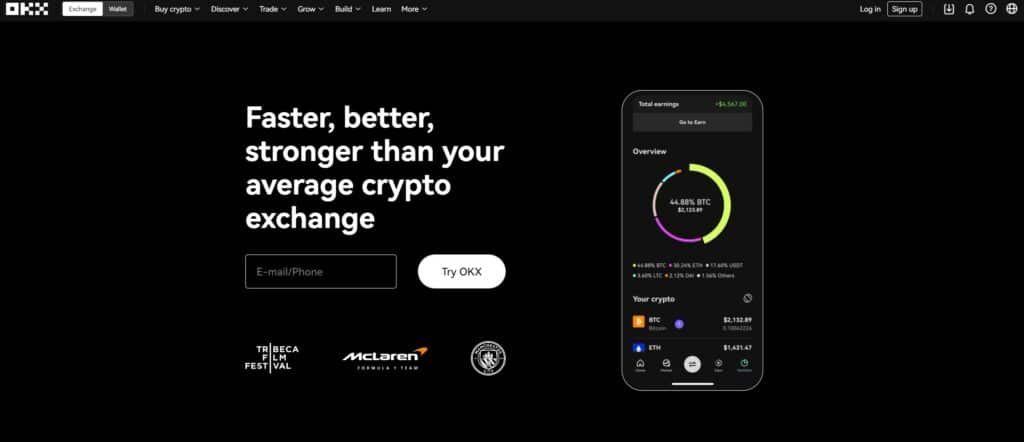

A Bold Claim. Image via OKX

A Bold Claim. Image via OKX Breaking down the products, here is what OKX offers its users:

- Buy crypto with over 90+ fiat currencies.

- Swap crypto easily with the convert feature.

- Access an advanced trading interface for spot, margin, and derivatives trading.

- 125x leverage on Futures, 5x Leverage on spot pairs.

- Easy integration to DeFi and Web3 DApps.

- OKX Web3 Wallet

- Trading bots.

- Earn section, crypto lending, and launchpad.

- NFT marketplace.

- Safety + security with comprehensive licensing and regulatory compliance and robust security measures.

Here is what Coinbase has going on:

- Buy crypto with 60+ fiat currencies

- Deposit and withdraw fiat with full banking services

- Trade with a beginner-friendly interface

- Access to advanced trading interface for experienced traders

- Coinbase Crypto card

- Basic crypto staking support

- Coinbase Wallet

- Spot and derivatives trading

- NFT marketplace

- Safety + Security with the most trusted exchange in crypto.

That covers the products and features at a high-level overview. How else do these two measure up?

Coinbase vs OKX: User Friendliness

For anyone who has ever used an online bank or a brokerage account, you should have no issues navigating either of these platforms. They are both very easy to use and have an intuitive layout and design.

I think most would agree that OKX has a more aesthetically pleasing interface and is more beautifully designed, with the eye candy providing a satisfying user experience. I mean, just look at the homepage:

A Look at the Beautifully Designed OKX Homepage

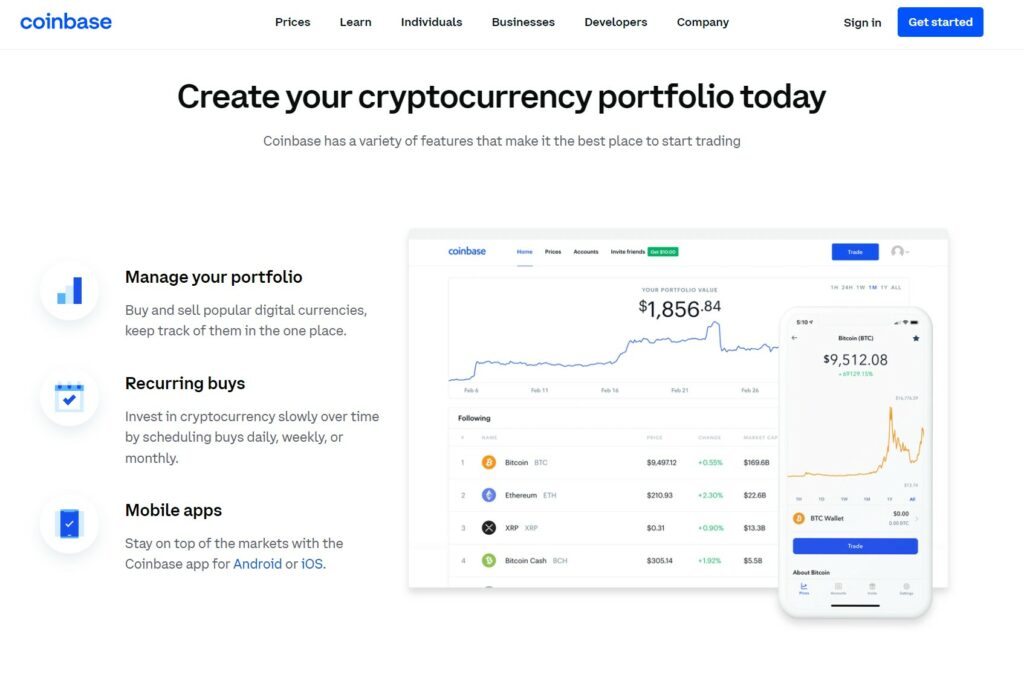

A Look at the Beautifully Designed OKX Homepage But it isn’t all about the looks, is it? Functionality is more important and when it comes to the user-friendliness of these platforms, you can’t beat the simplicity and cleanliness of Coinbase.

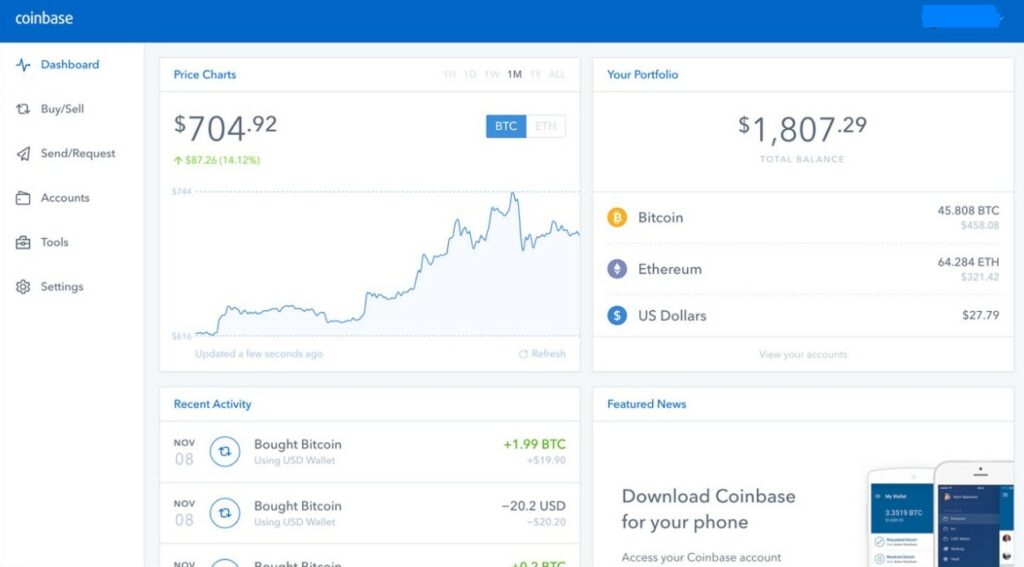

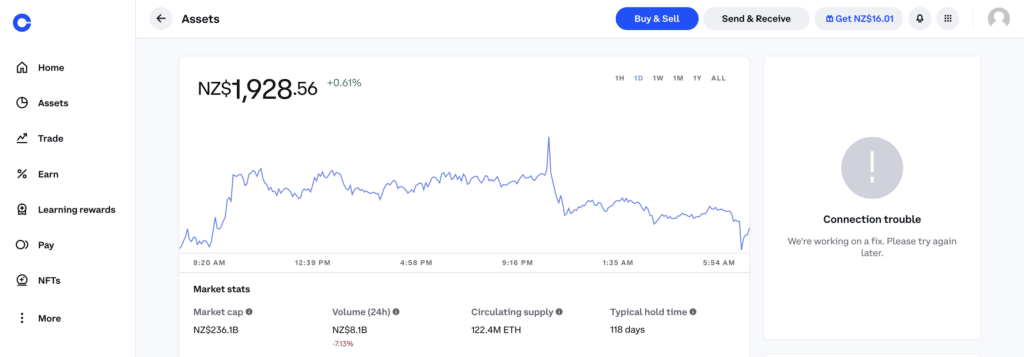

Nice, Clean and Simple Coinbase Interface

Nice, Clean and Simple Coinbase InterfaceIf I had to recommend one of these exchanges to my grandfather, at the worry of OKX giving the guy a heart attack, I’d have to recommend Coinbase.

Coinbase is so simply designed that you can get familiar with all the features, functions, and settings of the platform in no time. It’s a true minimalist's dream.

In the defence of OKX, I don’t know how anyone could design a platform as robust as OKX, with so many products and features without having the site be a little overwhelming and cluttered. Despite it not being as easy to use as Coinbase, it is still a very well-designed platform, highly intuitive and functional enough to navigate. I think the OKX team absolutely nailed their platform design; the millions of users around the world who use the OKX exchange would likely agree.

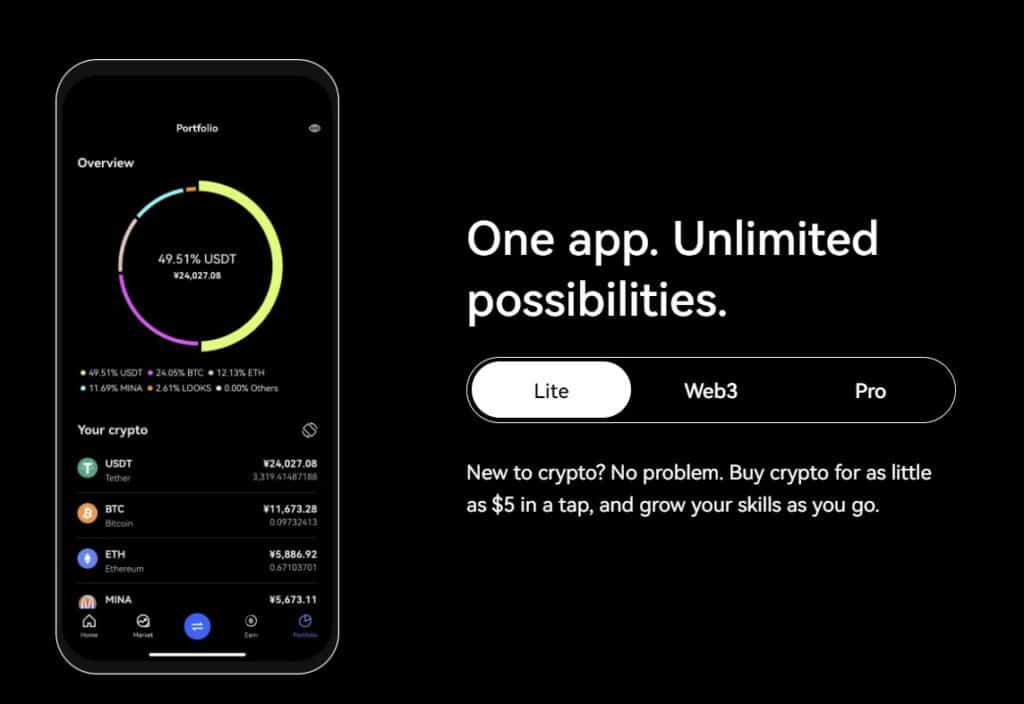

OKX seems to have anticipated the concern about all the products and functions being overwhelming to new users and has done a fantastic job in segregating their platform into different areas for users with different needs so new users don’t have to be bombarded with all the features they are unlikely to use.

Different Settings Make OKX Suitable for Newbies and Pros Alike. Image via OKX

Different Settings Make OKX Suitable for Newbies and Pros Alike. Image via OKX When doing research for both of these platforms, I found both OKX and Coinbase have fairly robust knowledge base/self-help sections. This is pretty important for users, especially new ones as many of the issues faced may be a quick knowledge base article away from being able to resolve within minutes on your own.

I found the OKX knowledge base easier to find the information that I was searching for as the search function returned more relevant articles. The search function on Coinbase is pretty terrible, to be honest, you may be better off using Google to find Coinbase help articles if you need them.

One thing Coinbase deserves serious Kudos for is their dedication to crypto education. Obviously, for us here at the Coin Bureau, we place a lot of emphasis and importance on educating the world in all things crypto-related, and it is good to see platforms like Coinbase also fighting the good fight. Coinbase Learn is a great resource to soak up as much crypto knowledge as you can, and you can even earn free crypto by going through some lessons.

A Look at Coinbase Learn

A Look at Coinbase Learn To sum up this section, Coinbase is considerably more user-friendly, clean, and has a minimalist interface, but it comes at the cost of having fewer features and products. The OKX platform has a lot of bells and whistles and is more robust for experienced traders or users with crypto needs outside of just trading, though new users may find it overwhelming.

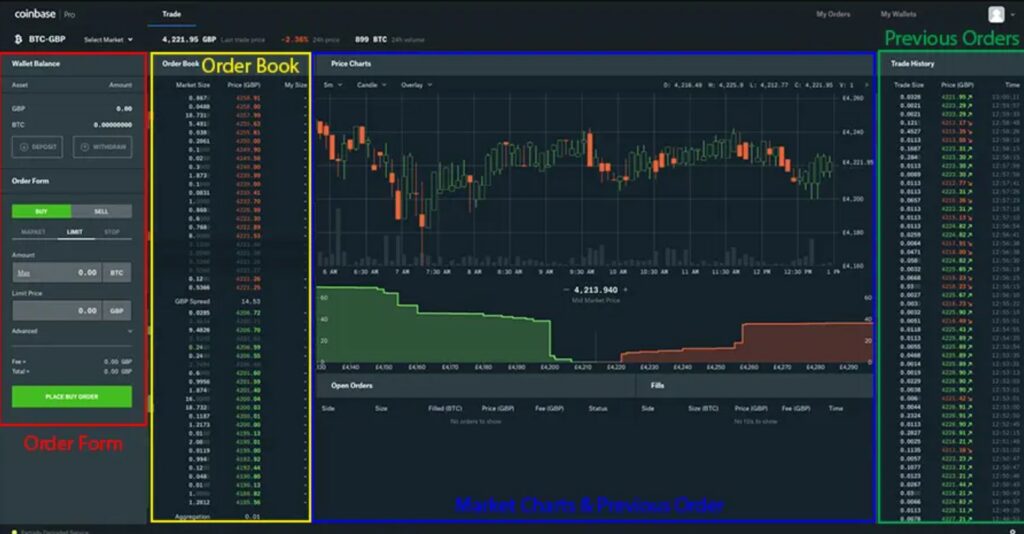

If we turn our attention to the main trading function itself, Coinbase offers two versions: simple and advanced. The simple version is designed with new traders in mind, and those who do not need advanced charting or order functionality.

With simple trading on Coinbase, all a trader needs to do is select the asset they want to trade, click the Buy or Sell button, enter the amount and they are done.

The advanced trading feature on Coinbase is similar to ones offered on the likes of KuCoin, Binance and OKX, which is powered by TradingView and capable of meeting the needs of advanced traders.

The Simple Screen for Trades, Good for Newbies. Image via Coinbase

The Simple Screen for Trades, Good for Newbies. Image via Coinbase OKX also offers a Convert feature that allows for “one-click-trading” similar to Coinbase, which is great for newbies or those looking for simplicity. For active traders, OKX houses an advanced trading interface with all the order types and charting capabilities needed, suitable for the most hardcore technical analysis traders.

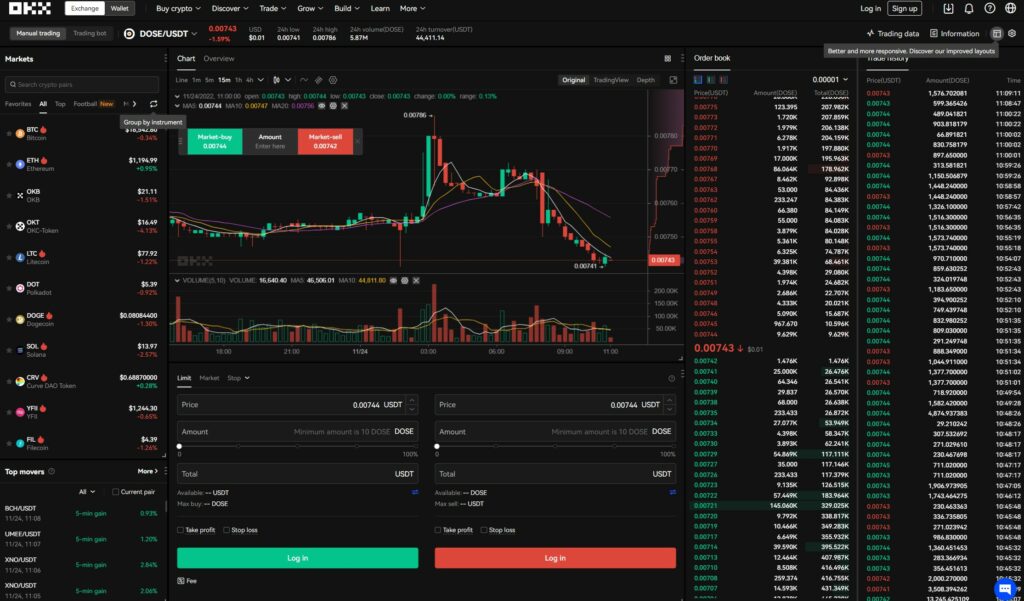

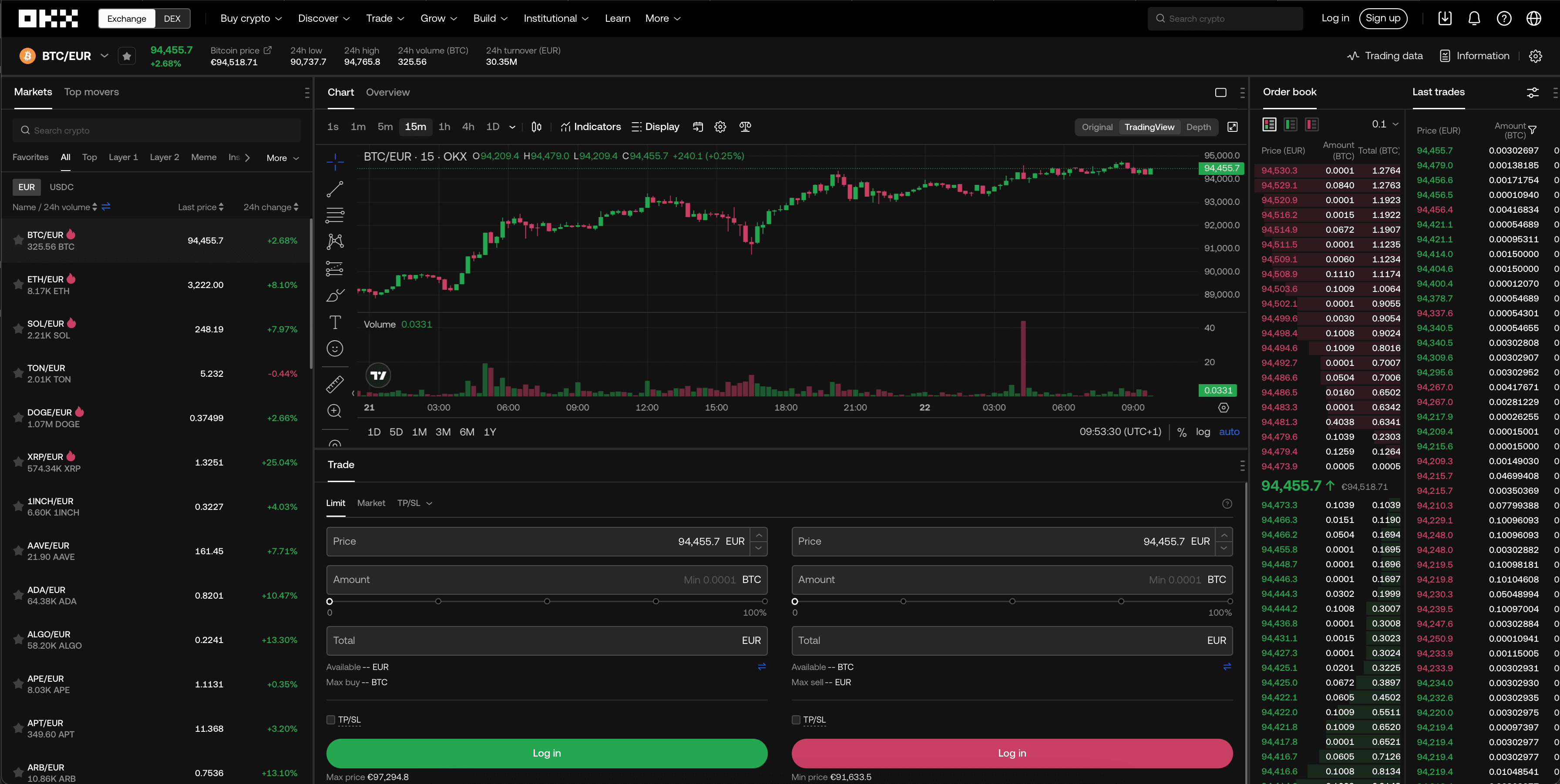

A Look at the OKX Trading Interface

A Look at the OKX Trading Interface Along with the TradingView integration, OKX traders can also use its native trading interface, which supports a depth chart and additional functionality.

Both platforms offer industry-leading matching and trading engines with nearly flawless trade execution and deep liquidity, making either of these platforms suitable for professionals, institutions, and amateurs alike.

OKX vs Coinbase Fees

So far, we’ve covered that Coinbase is often considered the better platform for new users, while OKX caters to a more sophisticated level of trader looking for more functionality from a trading platform.

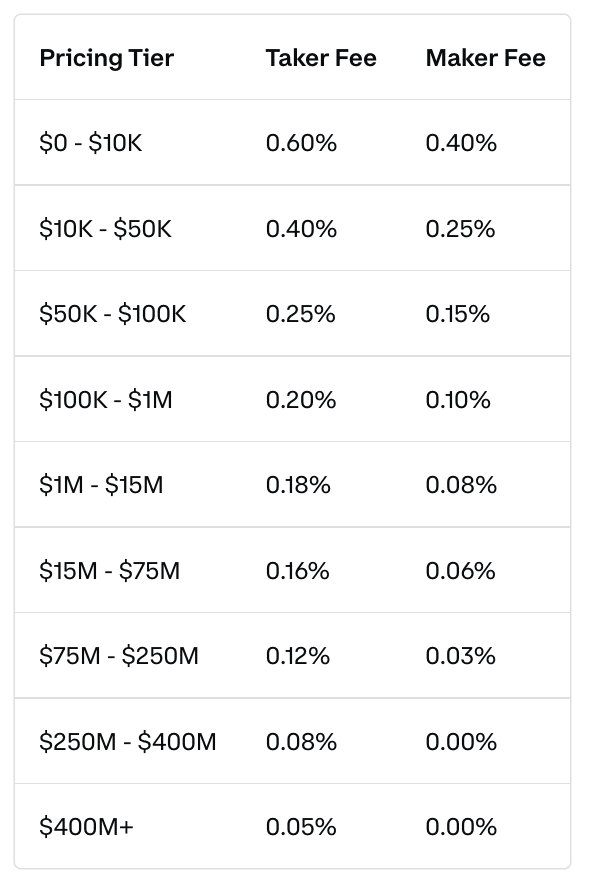

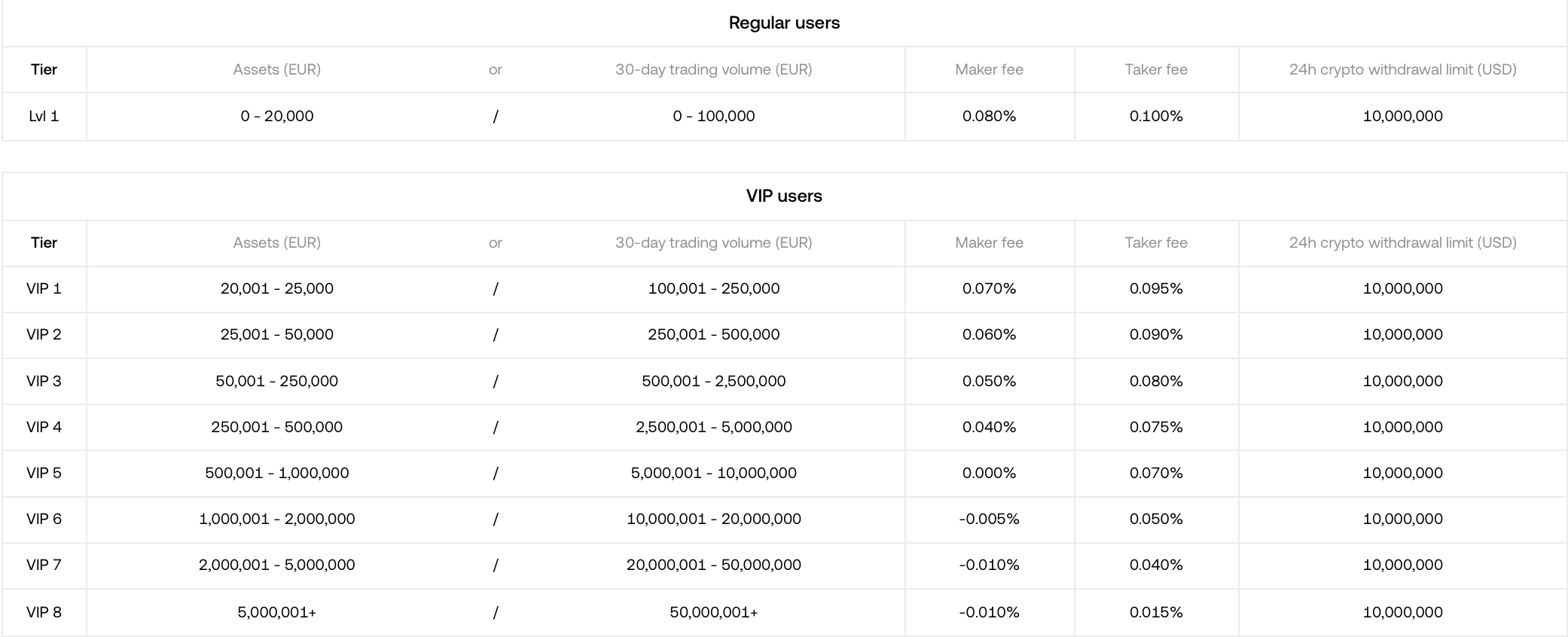

When it comes to fees, there is no getting around the fact that OKX takes a massive win in this category. These two are about as different as night and day.

The largest criticism against Coinbase, aside from poor customer support response times, is its brutally high fees, which has left me wondering how they have remained such a dominant exchange for so long. OKX is a leader in the low-cost space, along with the most popular exchange in the world, Binance.

Together, OKX, KuCoin, and Binance offer incredibly low trading fees while Coinbase remains on the higher end.

Both Coinbase and OKX use a maker/taker fee model, with fees being determined by trading volume and/or assets held. Entry-level traders on Coinbase can expect to pay 0.60% maker and 0.4% taker fees, while entry-level traders on OKX are looking at a mere 0.08% for maker and 0.1% for taker fees.

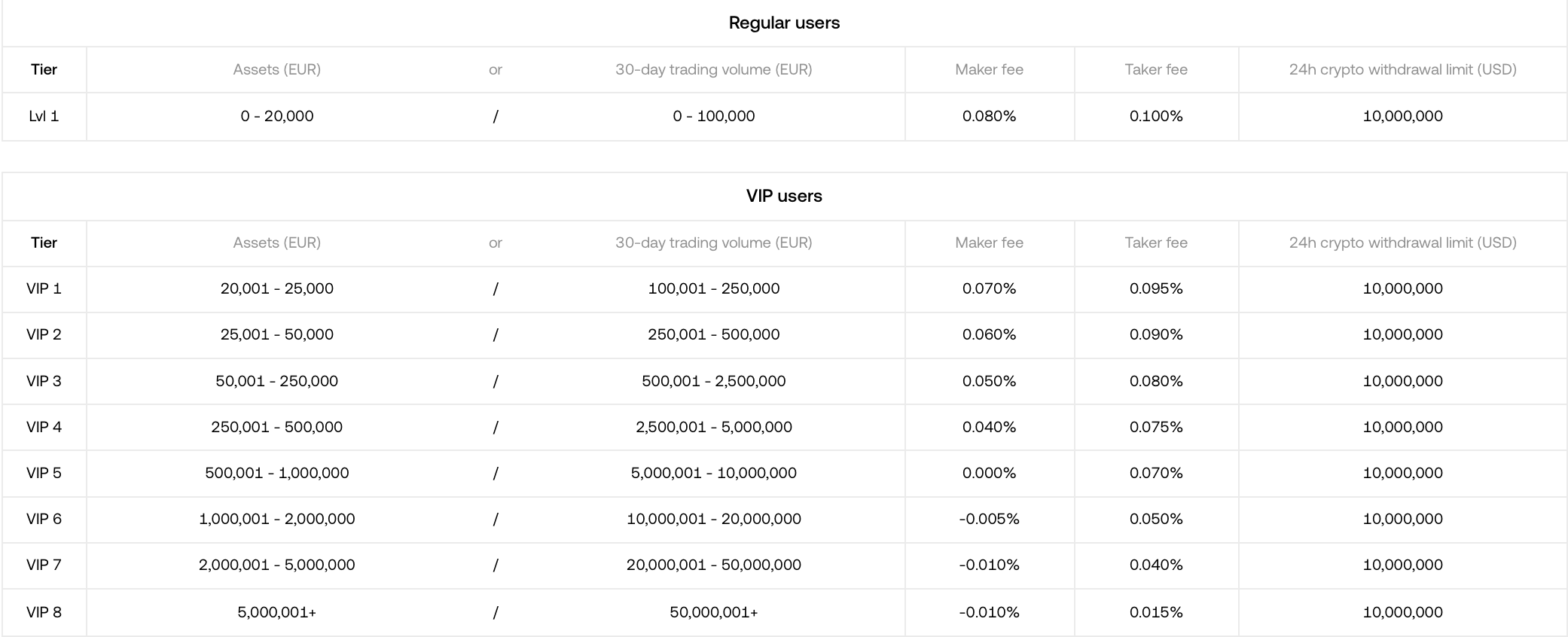

Here is a look at OKX fees for spot trading:

Image via OKX

Image via OKXHere is a look at Coinbase fees:

What you can expect to pay in fees using Coinbase. Image via Coinbase

What you can expect to pay in fees using Coinbase. Image via Coinbase Pro Tip: With the same Coinbase account, Coinbase users can access Coinbase Pro for no extra cost. The trading fees on Coinbase Pro are lower than the standard Coinbase platform, so it is definitely worth learning to use it.

Though the trading fees are lower on OKX, Coinbase will likely be the cheaper platform for purchasing crypto with fiat in most cases. The reason for this is that Coinbase can natively accept bank transfers and deposits, unlike OKX, which facilitates its purchases through third-party payment providers, many of which charge higher fees on average.

Bank deposits will often be cheaper than purchasing crypto with card. OKX has a few fee-free bank deposit methods depending on the currency and method selected, but on average, Coinbase will be the cheaper place to buy crypto.

This is why it is common for many users to have an account on both Coinbase and OKX, choosing to buy crypto on Coinbase, and then transferring crypto to OKX to take advantage of trading or the plethora of other products.

OKX vs Coinbase Security

When it comes to Crypto exchanges, it is really important not to fall into the “it won’t happen to me,” mindset as Crypto exchanges are notorious for hack attempts and many unsuspecting people were left pretty hurt after hacks did, in fact, happen to them.

It is important to disclose that Coinbase suffered a hack in May of 2021 where over 6,000 Coinbase customer accounts were drained. Another black eye for Coinbase happened when Fox released an article in December 2021 about a couple whose account was hacked and drained of $24,000 even though they stated they had two-factor authentication enabled and the account was password protected.

Coinbase Hack Affected 6,000+ Customers Image via PCMag.com

Coinbase Hack Affected 6,000+ Customers Image via PCMag.comIt is not known how hackers gained access to the account but it is sad to see that Coinbase did not reimburse the couple as they do not cover unauthorised access to accounts. Coinbase reimbursed the funds to the over 6,000 customers that were hacked in May as the fault was found to be in a 2FA breach on the Coinbase platform.

Aside from the major breach in 2021, Coinbase is one of the most trusted and safest brands in crypto, even offering professional custodial services to institutions who trust Coinbase with hundreds of millions of dollars as Coinbase definitely knows a thing or two about how to keep funds secure.

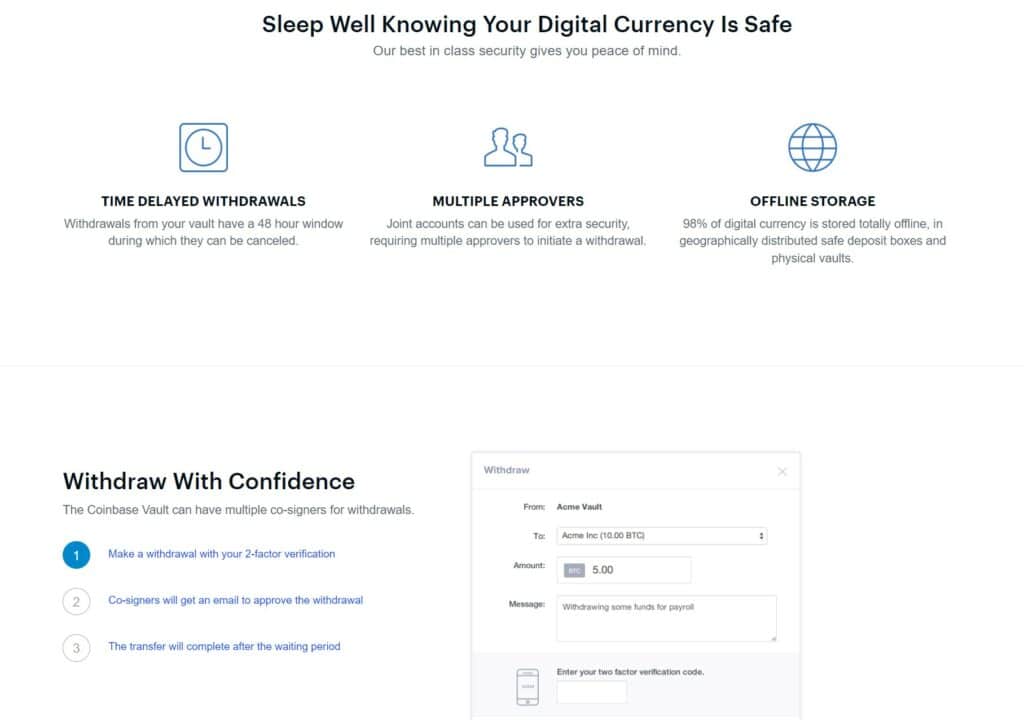

Along with the standard 2FA security measures in place, Coinbase operates on a bulk cold storage policy where 98% of coins held by the company are located in air-gapped cold storage wallets.

Coinbase is one of the few exchanges that provide FDIC insurance to US customers, offer insurance protection for users who want extra coverage, and keep a reserve of their profits to reimburse customers in the event of a security breach.

Coinbase users will find the following security features on the platform:

- 2FA Verification

- Passwords stored in encrypted form using bcrypt algorithm

- Active monitoring of third-party breaches and darknet activity

- Users can access crypto vault

- Users can set up an option to receive security notifications for all major security changes to their account with the option to lock their account if they choose to do so.

Changing focus now to OKX, the OKX team have an ironclad grasp on the security of user funds, going steps further than most exchanges with their unique approach to mixing online and offline storage systems secured with multi-signature protection, multiple backups, and location-separated QR codes and restricted personnel access.

Here is a look at the security lengths undertaken by OKX:

- Each cold wallet address stores no more than 1,000 BTC and each address is only used once.

- Private keys never come into contact with the internet or USB drives. Each private key is encrypted and held on an offline computer using AES with any non-encrypted keys being deleted.

- Employees hold AES-encrypted passwords in different locations.

- The offline private keys are only accessible via QR codes, never coming into contact with the internet.

- QR codes are printed and copies are stored in separate bank vaults on different continents, each requiring in-person access.

OKX keeps 95% of funds in offline, air-gapped cold storage environments, outside of the reach of hackers. The other 5% of funds are held in hot wallets where OKX uses semi-offline multi-signature mechanisms and multiple risk management methods to verify deposits and withdrawals, reducing any likelihood of unauthorised access.

OKX has a solid security track record with no security breaches being noted in recent years, and in the unlikely event of a hack resulting in stolen funds, OKX has a risk reserve fund to reimburse users. All this together makes OKX one of the most secure exchanges in the world.

From a customer perspective, users can enable the following security options to secure their accounts:

- Login password

- Email verification

- 2FA for login

- Google Authenticator

- Mobile verification

- Secondary password for withdrawals

- Anti-phishing code

Now that we have covered a bit of head-to-head, let’s dive into each one a little more in detail.

Coinbase Review

What is Coinbase

I am assuming that you have heard about Coinbase, which is what brings you to this article today. As the largest US exchange, the second-largest global exchange and the first crypto exchange to go public, it is hard not to have heard of them.

A Look at the Coinbase Homepage

A Look at the Coinbase Homepage Along with Binance and Kraken, Coinbase is the other “OG” exchange in the crypto space and has its sights set on being the most regulation-friendly crypto exchange, and the “go-to” for institutions and retail users who prioritise regulatory security. Coinbase is a US-based, full KYC-AML exchange operating in over 100 countries around the world.

To find out more about the Coinbase exchange, feel free to check out Guy’s take on it, or take a look at our in-depth Coinbase Review.

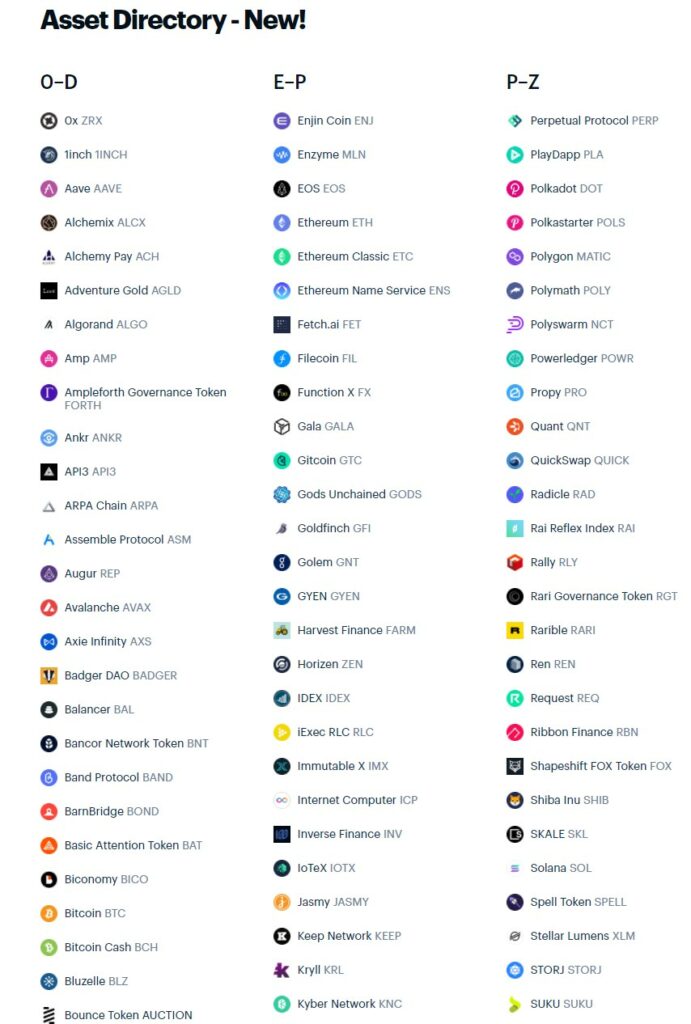

Cryptocurrencies Available on Coinbase

Coinbase has a decent selection of over 100 cryptocurrencies, which is fewer than what is offered on most international exchanges, including OKX, which has a good selection of 350+ crypto assets.

One reason that Coinbase lacks in crypto support is that as a publicly traded company in the US, they need to be careful that the tokens they offer are unlikely to be deemed as securities, as many of the tokens launched via IDOs and ICOs could come under regulatory scrutiny.

A Look at Some of the Tokens Available on Coinbase Image via help.coinbase

A Look at Some of the Tokens Available on Coinbase Image via help.coinbase I am not sure what their excuse is for the lacking fiat support as they only offer fiat onboarding and offboarding for USD, GBP, and EUR. Coinbase also does not have its own exchange token, one of the few exchanges that don’t, which may or may not be a deal-breaker depending on what you are looking to get out of an exchange.

Coinbase Products

Coinbase is pretty basic when it comes to products outside of simply buying and selling crypto. Unlike exchanges like Binance, OKX, KuCoin, Bybit, and others that strive to provide a “one-stop-shop” platform that can do everything under one roof, Coinbase takes more of a “no-frills” approach, keeping things simple and sticking to the basics.

Here is what users can find available on Coinbase:

Coinbase Pro Trading Platform

While Coinbase makes buying and selling Crypto incredibly easy and provides a clean interface for new users or for those who prefer simplicity, Coinbase also has Coinbase pro. Coinbase Pro can be accessed via the same login credentials to access a more robust trading platform that is more suitable for day and swing trading. Here is how that looks:

Coinbase Pro Trading Interface

Coinbase Pro Trading Interface Traders can place buy or sell market orders, limit orders and stop orders depending on their trading needs. Coinbase Pro supports the charting and order functionality needed for advanced traders.

Coinbase Card

US customers from most states can apply for the Coinbase Card, which allows them to earn crypto cashback when spending on the card. Funding the card can be done by either linking your bank account to your Coinbase account or having part of your salary deposited directly onto the card, which is perfect for anyone who earns their salary in crypto.

Spend your USDC or crypto using the Coinbase Card worldwide. Image via Coinbase

Spend your USDC or crypto using the Coinbase Card worldwide. Image via Coinbase If you're in the market for a crypto card, be sure to check out our top picks for crypto cards to find the right one for you.

Coinbase Earn

The Earn feature on Coinbase is quite basic, lacking behind the multitude of Earn products available on most other crypto exchanges.

In their defence, this isn’t the fault of the Coinbase team, but rather the restrictive regulatory framework that exists in the United States.

In 2021, Coinbase approached the SEC with their intentions of rolling out more Earn products, with the SEC’s response being something along the lines of, “try it, and we’ll sue you,” and just like that, Coinbase’s Earn product ambitions were shot down.

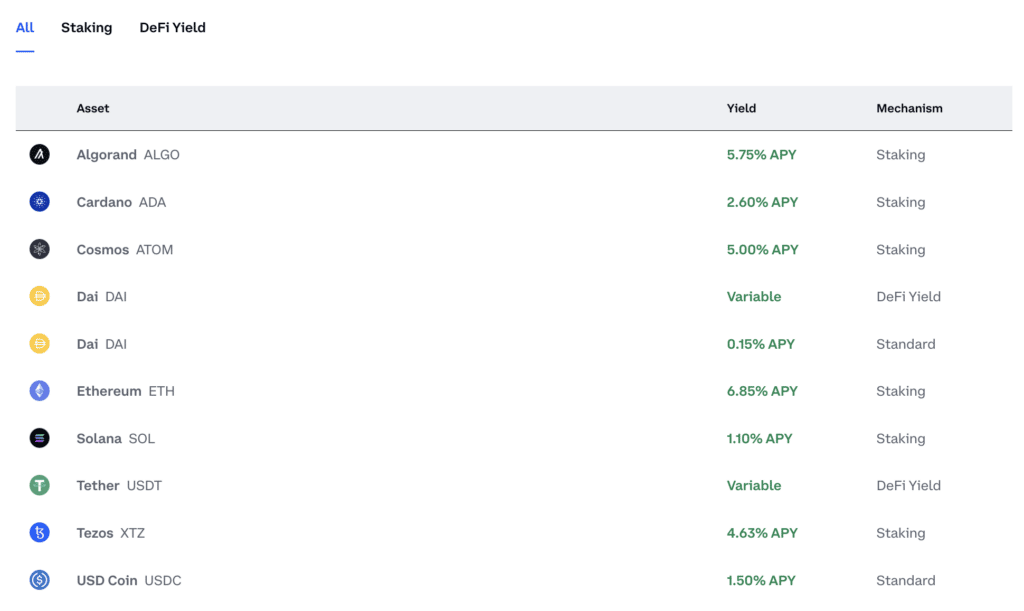

Earn some decent yield at Coinbase.

Earn some decent yield at Coinbase. As you can see from the image above, Coinbase does offer Staking and access to DeFi yields for some assets, offering decent returns.

Coinbase Wallet

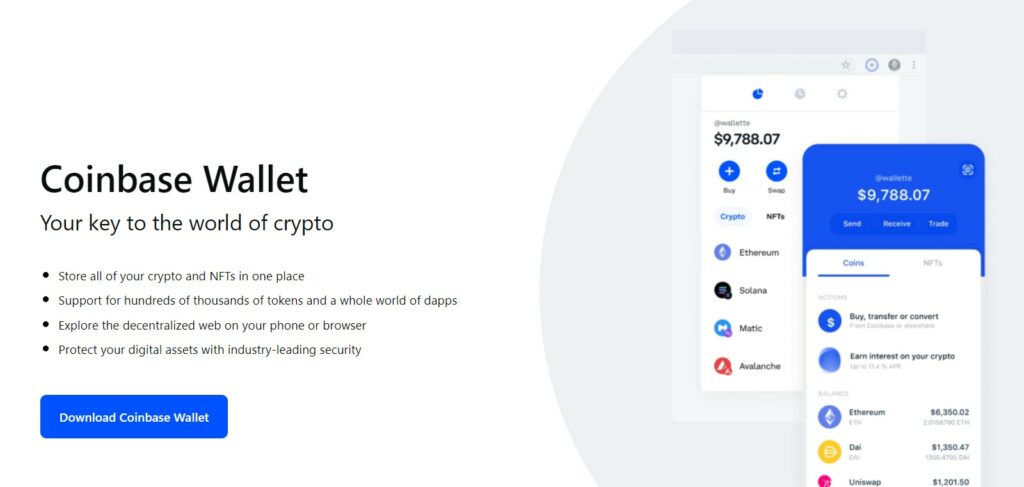

One of the things that users appreciate about Coinbase is the ease of integration and usability of the Coinbase wallet. Similar to the Coinbase Exchange, the Coinbase Wallet is an incredibly simple, clean-looking, and a beginner-friendly wallet, seeing adoption from millions of users worldwide.

Image via Coinbase

Image via Coinbase The Coinbase Wallet can store crypto and NFTs and supports hundreds of thousands of tokens. The wallet also supports a host of DApps, opening up access to the world of DeFi. The Coinbase wallet is highly secure and users have grown to trust the wallet as it is backed by Coinbase’s industry-leading security measures.

Users can purchase cryptocurrencies directly within the wallet via credit or debit card in over 90 countries, and the Coinbase wallet can be linked directly to customers’ Coinbase accounts.

Coinbase NFT Marketplace

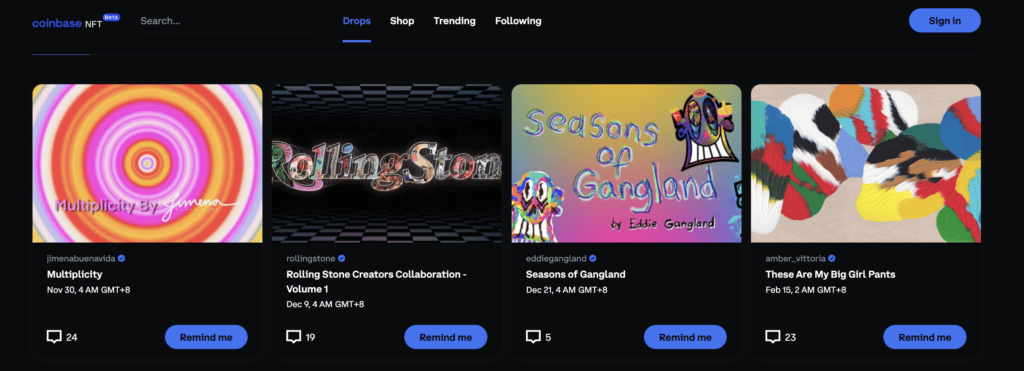

After popular exchanges like Binance and others launched NFT marketplaces, to remain competitive, Coinbase announced the launch of their NFT marketplace in October 2021.

The Coinbase NFT marketplace was met with enthusiastic reception initially, but as interest in the overall digital asset space declined in 2022, so did the hype around the Coinbase NFT marketplace. Despite the current lack of interest, which is likely to return once confidence in crypto is restored, the Coinbase NFT marketplace is a great platform and a solid addition, bolstering the Coinbase experience.

The marketplace features 4 sections: Drops, Shop, Trending and Following. Most of the NFTs listed are on the Ethereum blockchain so expect to pay a bit of gas to purchase any of them.

- Drops is where new collections are unveiled and you can have a reminder sent to you to view them when they’re ready.

- Shop and browse all current NFTs available for sale.

- Trending shows the most talked-about NFTs in the crypto space together with some stats for reference.

- Following displays the on-chain activities of the accounts you follow including popular NFT collections you might be interested in.

Check out the latest NFT collections at Coinbase

Check out the latest NFT collections at Coinbase All the products highlighted above are tailored for individual investors. Business and institutional investors would do well to check out their offerings in this department.

Types of Accounts and Coinbase Fees

Coinbase has two types of accounts. The most common type is the regular trading account which anyone can sign up for and undertake the KYC requirements. Then there is Coinbase One, the pro trading account that is designed for more ambitious traders. It requires a premium subscription but you can try it out for free for 30 days. Benefits include:

- Zero trading fees

- Up to $1 million in protection due to unauthorized access

- 24/7 Priority Support

- Access to Messari Pro with a 90-day free trial for crypto analytics

One thing Coinbase isn’t known for is competitive fees when compared to other exchanges. However, being a regulated exchange does bring a certain level of peace of mind. Tens of millions of users are evidently happy to pay extra fees for the added security and safety of using such a reputable exchange, especially after the FTX fiasco.

Coinbase Security

We’ve already covered the unfortunate hack cases earlier and provided a high-level overview of the security features on Coinbase, but to reiterate, here are the security features supported on Coinbase:

- Phone number verification

- Two-Factor Authentication for login and crypto transactions

- Minimum password complexity requirement

- Address book and whitelisting addresses

- Multi-Email required Crypto Storage Vault feature

Fantastic Feature Offered by Coinbase For Long-Term Crypto Storage Image via coinbase.com/vault

Fantastic Feature Offered by Coinbase For Long-Term Crypto Storage Image via coinbase.com/vault Coinbase is widely considered to be among the most secure exchanges in the industry, and due to their regulatory compliance, users can bet their bottom Satoshi that there isn’t any funny business going on that could put user funds at undo risk.

That covers Coinbase, now let’s look into OKX.

OKX Overview

What is OKX?

OKX is one of the fastest-growing and most popular cryptocurrency exchanges in the industry, favoured for its derivatives products and by active spot market traders.

Located in Seychelles, OKX is a hub that offers a robust selection of crypto-centric products and features, above and beyond just crypto trading, attracting crypto users from all walks of life looking to do more with their crypto.

OKX is a great platform for beginner and experienced traders looking to trade spot, derivatives, margin, futures, perpetual swaps, and options markets. Featuring both a simple and advanced trading interface, along with excellent educational resources, OKX is a top contender for nearly any type of user and has something to offer nearly everyone.

Image via OKX

Image via OKX

Thanks to its comprehensive and advanced trading features, order types, seamless trading interface, along with the safety that comes along with being regulated and licensed, it’s no mystery why this crypto exchange is enjoying a rapid pace of growth.

Aside from trading, OKX also features trading bots, a fantastic Earn section, crypto loans, a launchpad, and the OKX Wallet is the easiest way I’ve seen to access DeFi, NFTs, GameFi and DApps all from one self-custodial wallet.

Note: Users located in the US and UK are not supported.

Cryptocurrencies offered on OKX

The OKX exchange has 350+ crypto assets supported, ranging from the majors like Bitcoin and Ethereum to smaller cap plays and harder-to-find tokens. There are over 500 trading pairs available across the spot, margin, and derivatives markets that can be accessed by traders in over 180 countries.

Unfortunately, OKX is unavailable for users in the US. For US-based users, I recommend checking out Kraken.

OKX Products

OKX has a wide array of products, too many to list them all here. This article will cover the most pertinent features and products, but if you want a deeper dive, feel free to take a gander at our dedicated OKX review.

OKX Cryptocurrency Trading

Traders have come to appreciate the flawless trading experience on OKX, with its nearly instantaneous trade execution and second-to-none matching and trading engine.

OKX provides one of the cleanest and best-performing trading interfaces, becoming a solid choice for serious traders. OKX saw a high of 60 billion in 24hr trading volume during the peak market in 2021, attracting professional, institutional, and retail traders alike.

A Look at the OKX Trading Interface

A Look at the OKX Trading Interface The advanced order functionality and charting interface powered by TradingView makes OKX suitable for any style of trading.

The following order types are available:

- Limit Order: These orders are good till cancelled. They are simply orders that are placed at some predefined level.

- Advanced Limit: This is a standard limit order with more functionality around how you would like the order to be executed. For example, it could be Post Only, Fill-or-Kill or Immediate or Cancel. “Post Only” is a standard order. Fill or Kill will execute the entirety of the order or kill it. Immediate or Cancel will execute it now at the best price or cancel.

- Stop Limit: This is an order placed only once a specific trigger price is met. Once the trigger price is met, a standard limit order is placed.

- Trail Order: With this order, a limit order will be placed once the price has retraced after breaking a certain trigger level. This is called the “Callback Rate.”

- IceBerg Order: This is an order that allows a trader to place a large order without incurring too much slippage. This order automatically breaks up a user’s large order into multiple smaller orders.

- Time-weighted average price (TWAP): TWAP is the average price of the order over a specified period of time. It is basically a strategy that will attempt to execute an order that trades in slices of order quantity at regular intervals. The fill price equals the TWAP price.

OKX also provides an easy-to-use Convert feature for traders who are looking for the most hassle-free way to trade with one click.

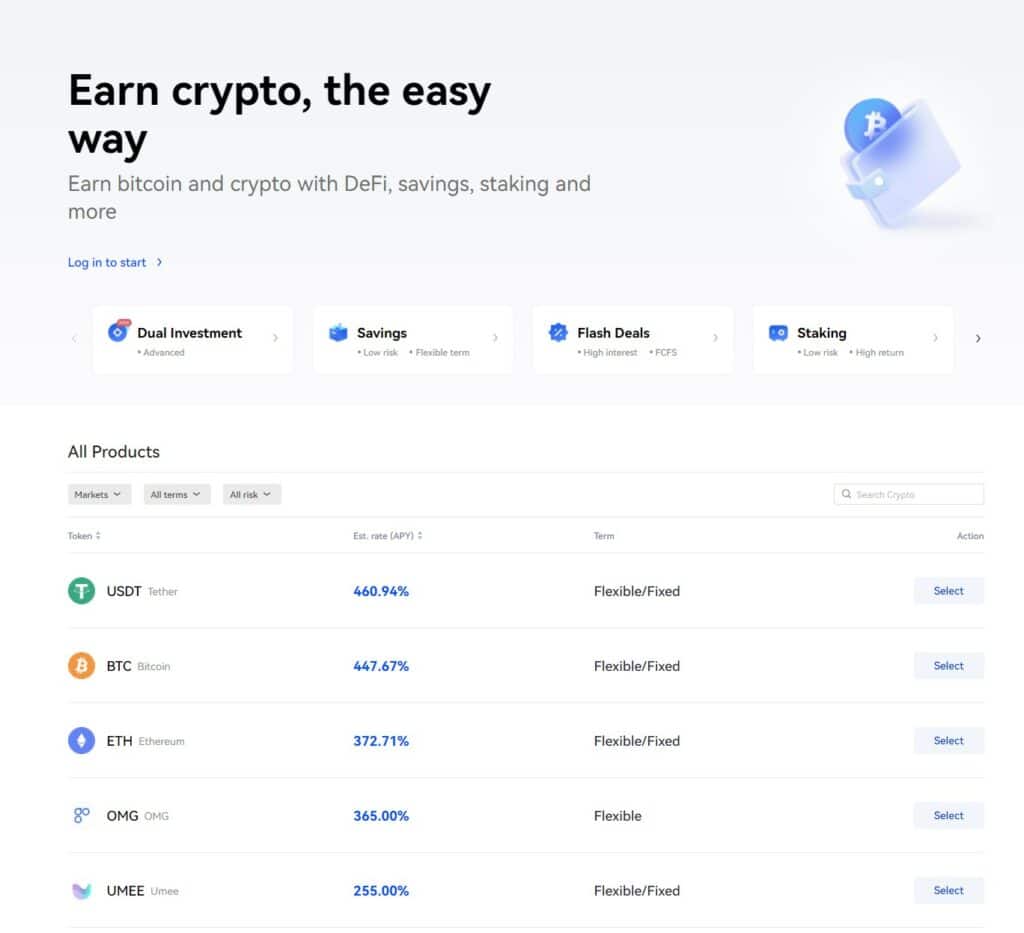

OKX Earn

OKX offers quite a few Earn products for users looking to earn some passive income on their assets. There are low-risk and high-risk options available with different yields and different terms, accommodating various investor goals and risk appetites.

Image via okx.com/earn

Image via okx.com/earn The Earn section includes products like savings and staking, to more advanced and riskier products like dual investment. We have an article covering the OKX Earn products if you want to learn more.

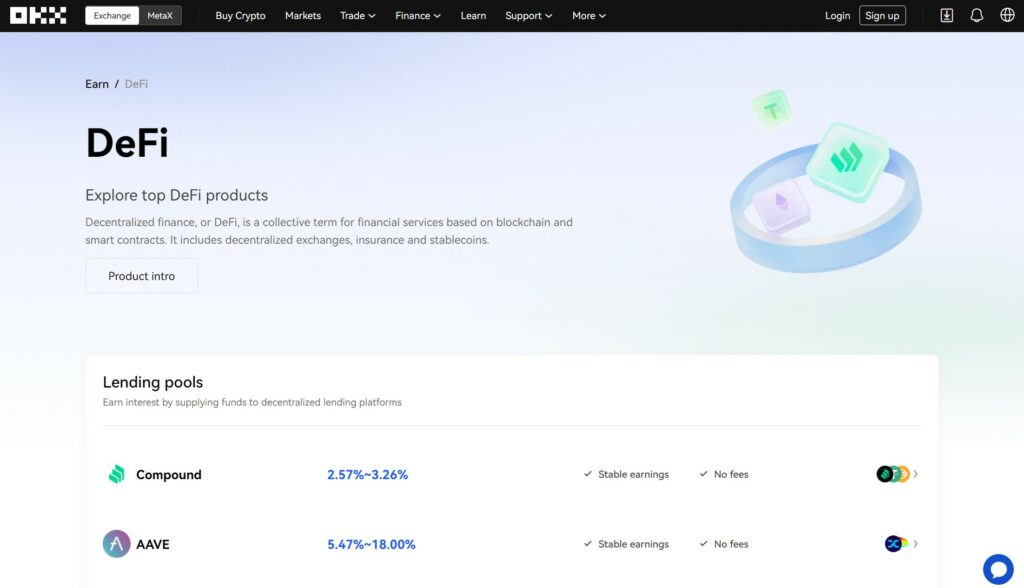

OKX DeFi

OKX has made DeFi access easy, providing a simple interface that allows users to access the world of DeFi without the complex protocols and processes that exist within DeFi platforms.

Image via OKX

Image via OKXDeFi can be quite complex and confusing, especially for new users. With OKX, users can access a whole world of decentralized financial applications all within the one simple-to-use interface powered by OKX, with all the complicated “DeFi stuff” happening behind the scenes.

Through OKX and the self-custodial web wallet, DeFi platforms like Aave, Compound Finance, Sushiswap, and others can all be accessed from one place.

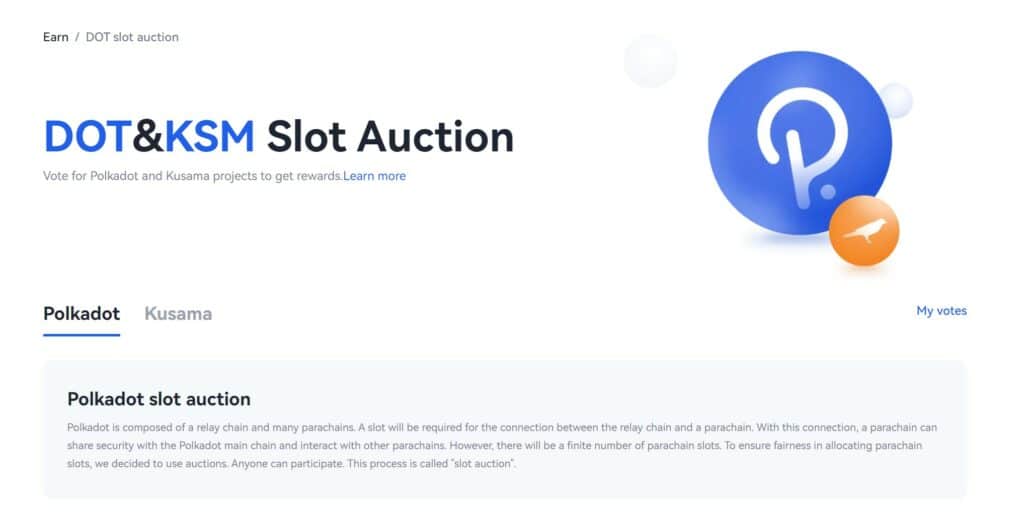

Polkadot & Kusama Slot Auctions

One benefit that I like that separates OKX and Coinbase is that through OKX, fans of the Polkadot and Kusama ecosystems can get involved in the parachain slot auctions in the easiest way possible.

Participating in Polkadot auctions can be quite complex and is often a task undertaken by advanced crypto users. Fortunately, OKX has built a simple front-end interface that allows users to participate without the hassle. Other exchanges that offer DOT auction participation access are the likes of Kraken and KuCoin.

Image via OKX

Image via OKX OKX users can vote on proposals for future DOT and KSM projects with OKX covering the fees involved with voting and dealing with things like token lockups, release dates, etc.

If a user votes on a project that wins the slot auction, they will receive rewards in that project’s token for their participation and have their tokens sent to their OKX account.

You can learn more about Polkadot Slot Auctions in the video below:

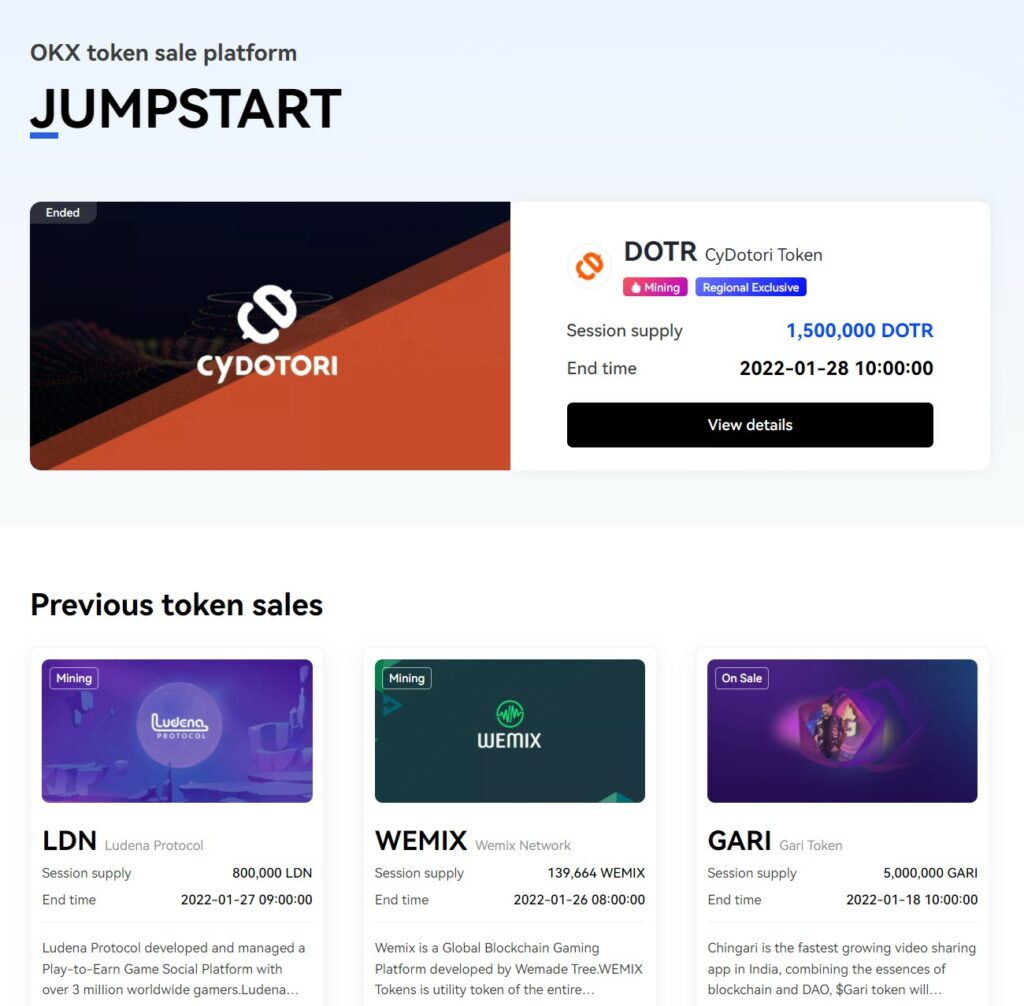

OKX Jumpstart

Many exchanges now offer launchpads, as they are a popular product for crypto investors looking to gain early exposure to exciting crypto projects before they hit mainstream adoption.

This is another benefit that OKX has over Coinbase, as launchpads have been shown to provide higher-than-average ROIs for investors who get in early and sell at the right time.

Image via OKX

Image via OKXLaunchpads are not only great for investors, but benefit the entire crypto ecosystem as new projects can be featured on popular exchanges, raising awareness and the investor capital needed to launch, as well as enjoying the advisory services and marketing efforts from the exchanges themselves.

Investors can get involved by staking their OKB tokens, then receive tokens from new projects based on the staked amounts.

OKX Wallet

The OKX Wallet is a self-custodial wallet where users can store their crypto and NFTs, and access the “Portal to Web3” as OKX words it. This beautifully designed and multi-functional wallet connects OKX users to the thousands of DApps, DeFi, Metaverse, NFT, and GameFi projects in the space.

Image via OKX

Image via OKXThe OKX wallet may just be one of the most functional, convenient and useful Web3 wallets created to date, and is perfect for anyone who wants to degen into DApps. Be sure to check out our dedicated OKX Web Wallet article to learn more about this powerhouse wallet.

OKX Trading Bots

OKX is one of the largest and most popular platforms for trading bots, with over 940,000 traders utilizing the platform and taking advantage of auto-trading bots.

Image via OKX

Image via OKXAuto trading and crypto bots have become valuable tools for experienced traders that know how to use them. Users can either design their own bots without coding experience needed, or simply select from the thousands of user-made and pre-made bots available on the marketplace.

Bots on OKX fall under the following categories:

- Grid bot

- DCA bot

- Recurring buy bot

- Arbitrage bots

- Smart Portfolio rebalancing bot

- Slicing bots

You can learn more about the trading bots available at OKX in our article on OKX Trading Bots.

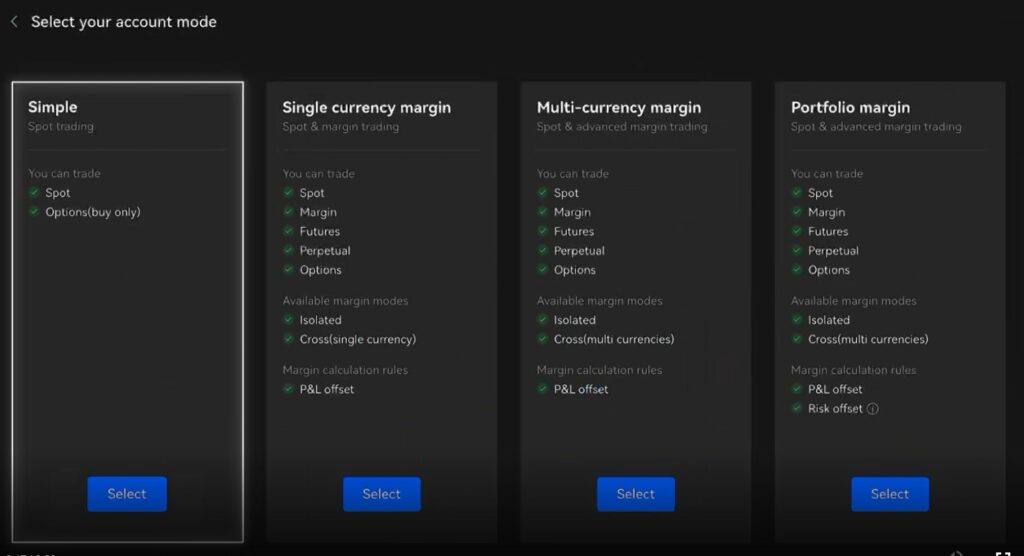

Types of Accounts and OKX Fees

OKX offers individual and corporate accounts. Individual accounts can select different modes based on the needs and KYC level of the user:

Image via OKX

Image via OKXOKX is one of the only exchanges that managed to acquire licensing and regulatory approval.

As if they didn’t have enough going for them already, OKX is also one of the lowest fee exchanges in the industry, along with the low-cost leaders Binance and KuCoin. OKX follows a similar fee structure as most exchanges, with fees being based on a maker/taker fee model depending on asset holdings and/or 30-day trading volume.

Here is a look at the spot trading fees:

Image via OKX

Image via OKXOne downside is that OKX does not natively support crypto purchases or facilitate wire transfers, all this is done through the third-party payment processors integrated into the site. Buying crypto and bank deposits on OKX is easy enough to do, but the payment processors often charge fees that can range between 3-8%. Be sure to double-check the fees before finalizing your purchase to make sure you aren’t being charged more than you are wanting to pay.

OKX does feature a few fee-free deposit options depending on the currency and method used, and purchases can be made in over 90 fiat currencies with 129+ supported services, which is an outstanding supported selection.

OKX Security

We already highlighted OKX’s impressive and comprehensive approach to security and why they are one of the leaders in crypto exchange security, but to reiterate:

Using a mix of online and offline storage, keeping 95% of user funds in air-gapped cold storage environments that never come into contact with online connectivity, OKX further keeps funds safe by ensuring only key personnel on separate continents can access private keys.

Private keys are shown as QR codes, meaning they never need to be entered online, and they are stored in bank vaults in secret locations around the world. OKX also enforces multi-signature authorization, making internal theft possibilities highly unlikely.

Physical and remote unauthorized access to user funds would be extremely unlikely, and OKX has a fantastic security track record, but in the event that hackers did somehow manage to swipe funds, OKX also has an insurance fund in place to reimburse customers.

Being licensed and regulated by multiple authorities also provides a level of security and trust for the platform, along with their publicly published proof of reserves. The full OKX security framework can be found on the OKX Security Page, it is quite impressive and worth the read.

OKX vs Coinbase: Closing Thoughts

I hope this article gave you a good idea of which exchange is better suited for your needs as a crypto user.

Coinbase is definitely the better exchange for brand-new users, or anyone looking for a no-frills, simple exchange where they can buy, sell, and trade crypto.

But for anyone looking to get more out of their crypto, actively trade, and access an all-in-one crypto exchange, OKX is among the best you will find.

👉 Sign up to OKX and get a 40% discount on trading fees!