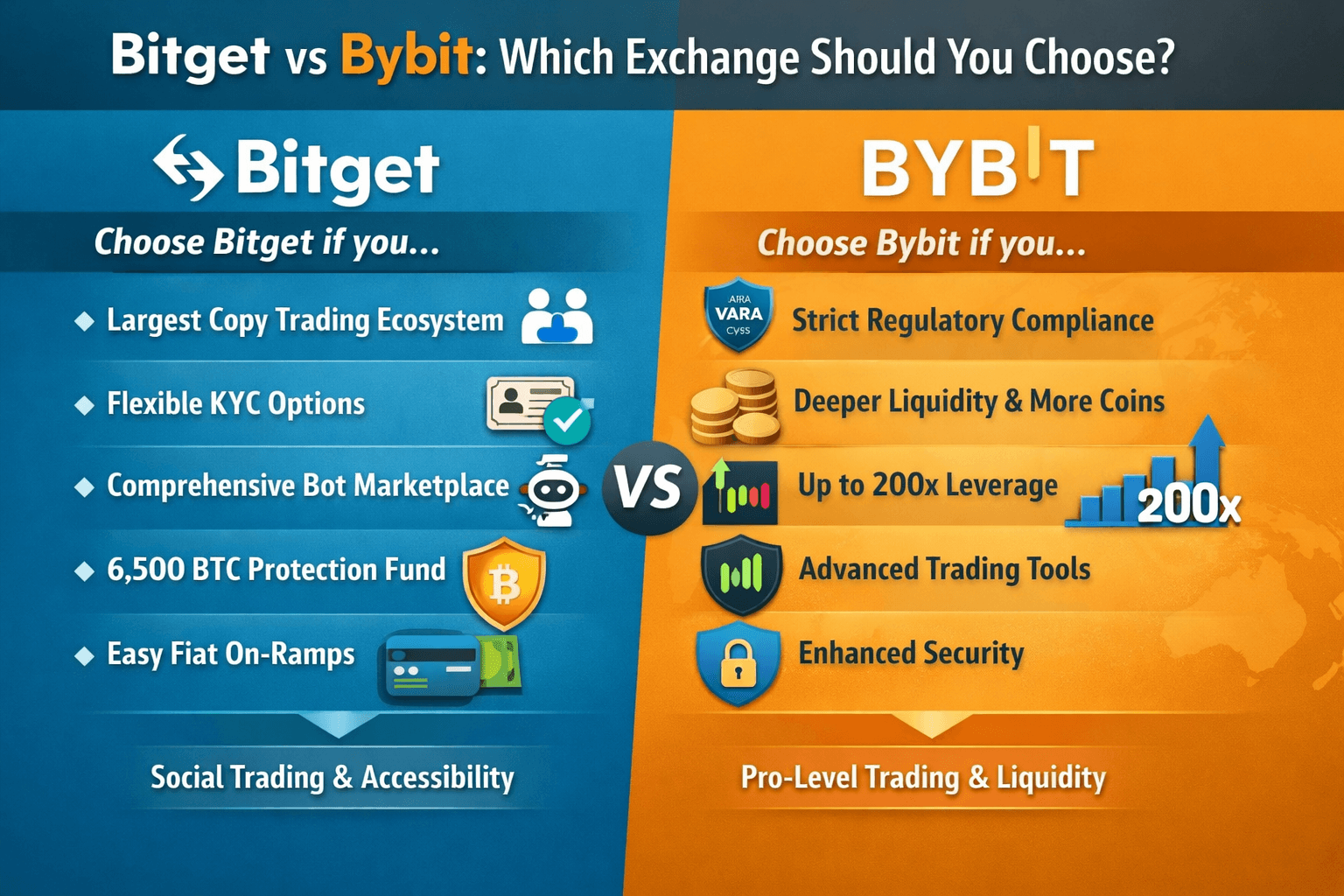

Quick Verdict

Bitget is the easier on-ramp for social and automated trading, backed by a sizable protection fund and flexible KYC. Bybit is the performance pick for pros thanks to deeper derivatives liquidity, higher leverage, and broader market coverage under stronger regulatory oversight. Beginners and copy-trading fans lean Bitget; active derivatives traders and institutions lean Bybit.

Who Should Choose Which?

Choose Bitget if you want:

- The largest copy-trading ecosystem and easy bot marketplace (GRID, Martingale, quant strategies)

- Flexible KYC tiers and a friendlier non-trading UX for newcomers

- Wide fiat on-ramps & P2P options for quick funding

- A sizable self-funded protection fund for added peace of mind

- Lower effective fees at mid-VIP tiers when using BGB discounts

Choose Bybit if you need:

- Tier-1 regulatory oversight (e.g., VARA/Cyprus) and broader global licensing

- Deeper liquidity across perps/options and broader coin breadth

- Higher max leverage (up to 100× on derivatives)

- Institutional-grade APIs, UTA/portfolio margin, and advanced TradingView tooling

- A high-performance UI optimized for active, professional traders

Comparison Table

| Criterion | Bitget | Bybit | Winner |

|---|---|---|---|

| Overall Rating | 4.3 | 4.8 | Bybit |

| Total Users | 120 Million | 61.72 Million | Bitget |

| Listed Coins | 750+ | 1870+ | Bybit |

| Trading Pairs | 500+ | 490+ | Bitget |

| Max Leverage | Up to 10× (spot margin) | Up to 100× (derivatives) | Bybit |

| Base Spot Fee | 0.1% | 0.1% | Tie |

| Base Futures Fee (Taker) | 0.06% | 0.055%–0.06% | Bybit (slightly) |

| Protection Fund | $610 Million (as of Jan. 2026) | N/A (Mutual insurance pool) | Bitget |

| KYC Requirement | More flexible/optional for basic use | Mandates strong ID verification | Bitget |

| Major Licenses | Singapore (HQ) | Dubai, Cyprus (regulatory clearance) | Bybit |

| 24h Volume Rank | Ranks ninth in derivatives | Ranks fourth in derivatives | Bitget |

"Data current as of Jan. 6, 2026."

Who should choose which?

The choice between Bitget and Bybit depends on your specific trading style, experience level, and priorities. Bitget is generally more suited for traders who prioritize social features, ease of use, and integrated automation, while Bybit caters to more experienced traders seeking high-performance tools, deep liquidity, and regulatory assurance.

A Simple Diagram To Help You Choose Whether Bitget or Bybit Is Right For You

A Simple Diagram To Help You Choose Whether Bitget or Bybit Is Right For YouChoose Bitget if you…

Bitget is a cryptocurrency exchange and has gained users at a rapid rate since its founding in 2018. The platform distinguishes itself with a strong focus on social trading and user-centric features and aims to make crypto trading more accessible for a wider audience, from beginners to seasoned traders, through its innovative tools.

- Largest copy-trading ecosystem: Bitget is a recognized leader in copy trading, featuring a vast community of traders and sophisticated "quant" strategies that users can automatically follow. This is ideal for those who want to automate their trading or learn from others.

- Flexible KYC options (with limits noted): While KYC is mandatory for full access, Bitget offers flexibility in its verification tiers, which can be advantageous for users who value a less intrusive onboarding process.

- Comprehensive Bot Marketplace: Bitget provides a wide range of built-in trading bots, such as GRID and Martingale, that are easy to deploy directly on the platform, making automated trading highly accessible.

- Substantial Reserve fund: With its protection fund of 6,500 BTC, Bitget offers a significant financial buffer to safeguard user assets against security incidents.

- Simpler non-trading UX: Many users find Bitget's interface to be more straightforward to navigate for non-trading activities, providing a less intimidating experience for newcomers.

- Wide range of fiat on-ramps: Bitget supports a larger variety of fiat payment methods and P2P trading options, making it easier to buy crypto directly on the platform.

Check out our top picks for the best crypto exchanges for trading.

Choose Bybit if you…

Bybit is a powerhouse in derivatives trading, headquartered in Dubai with a focus on delivering high-performance trading tools for professional and high-volume users. Although it experienced a significant exploit in early 2025, Bybit has since strengthened its security and regulatory compliance.

- Seek tier-1 regulatory oversight (VARA/CySEC): Bybit has actively pursued and secured regulatory licenses in major jurisdictions, including the UAE (VARA) and Europe (MiCA), providing a higher level of regulatory assurance.

- Need deeper liquidity and broader coin selection: For high-volume traders, Bybit offers exceptionally deep liquidity, especially in the derivatives market, which minimizes slippage. It also lists a larger number of crypto assets compared to Bitget.

- Want higher max leverage: Experienced traders can access significantly higher leverage on Bybit, with some products offering up to 200x, enabling advanced strategies.

- Require stronger institutional features: Bybit provides a more developed suite of features for institutional and professional traders, including advanced APIs for algorithmic trading and the best institutional-grade tools.

- It has historically strong security: Although Bybit experienced a major exploit in February 2025, it had a relatively spotless hack history before that incident. In response, it has since enhanced its security measures and regulatory compliance.

- Prefer an advanced, high-performance UI: While potentially overwhelming for beginners, Bybit's interface is optimized for advanced traders who need professional-grade charting and tools.

How We Tested Bitget and Bybit

We reviewed Bitget and Bybit using the same real-world workflow most traders follow, then scored them on what affects outcomes: cost, execution, access, and risk controls.

What We Tested

- Onboarding + KYC: Compared signup friction, verification tiers, and what features are gated behind ID checks.

- Markets + liquidity checks: Evaluated coin coverage and depth on key spot and perp pairs, plus how quickly liquidity thins outside majors.

- Fees in practice: Modeled common scenarios (small spot buys, frequent spot trading, perp taker orders) and accounted for VIP tiers + token discounts (BGB/MNT).

- Core trading experience: Tested order types, margin modes, risk controls (TP/SL, isolated vs cross, liquidation UX), charting/TradingView, and platform stability during fast markets.

- Copy trading + bots: Compared marketplace depth, transparency metrics (ROI, drawdown, AUM), setup friction, and follower risk controls.

- Security + transparency: Reviewed Proof of Reserves tooling, user security features (2FA, whitelists, anti-phishing), and major incident history/protection mechanisms.

- Support + education: Assessed help-center quality and live chat responsiveness for typical account/trading issues.

What We Didn't Test

- We didn’t run penetration tests or audit internal custody systems.

- We didn’t test geo-restriction workarounds or assume features are available in every region.

- We didn’t evaluate institutional colocation/HFT setups that don’t reflect typical retail use.

Coins, Markets & Liquidity

Bitget and Bybit are both top-tier exchanges offering some of the best trading environments. However, they cater to different user profiles, which is most evident in their asset listings, market types, and liquidity.

Crypto Tokens Listed Represent Tradable Digital Assets On Blockchain Networks. Image via Shutterstock

Crypto Tokens Listed Represent Tradable Digital Assets On Blockchain Networks. Image via Shutterstock Bitget stats

- Coins: Bitget supports over 800 tokens and offers more than 900 spot trading pairs.

- Pairs: As of early 2025, Bitget offered over 800 spot and 400 futures pairs, a number that has been growing rapidly.

- Listing Cadence: The exchange demonstrates a fast listing cadence, driven by its integrated AI algorithm, Bitget Seed, which identifies early-stage Web3 crypto projects with growth potential.

Market Types Supported:

- Spot: Supports spot trading with hundreds of pairs.

- Perpetuals: Provides access to USDT-M and Inverse perpetual futures.

- Options: Offers options trading with up to 125x leverage.

- Leveraged Tokens: Does not offer leveraged tokens but focuses on futures with high leverage.

Bybit stats

- Coins: Bybit offers a broader selection, with over 1,600 crypto tokens listed across various market types.

- Pairs: The platform offers approximately 1,292 markets in total, including over 300 spot trading pairs and a large number of perpetuals and options contracts.

- Listing Cadence: Bybit also maintains a fast listing speed, using its Launchpad and Launchpool to quickly introduce new projects with high ROI potential.

Market Types:

- Spot: Offers standard spot trading.

- Perpetuals: A market leader in perpetual contracts, including USDT, USDC, and Inverse perpetuals.

- Options: Provides USDC-settled options trading.

- Leveraged Tokens: Supports leveraged tokens, which can be traded directly from a spot account.

Coins & Pairs Matrix

| Metric | Bitget | Bybit |

|---|---|---|

| Listed coins | Over 800 | Over 543 (1,600 across all products) |

| Trading pairs | Over 900 spot pairs | Approximately 1,292 markets total, over 300 spot pairs |

| Market types | Spot: Yes Perps: Yes Options: Yes Leveraged Tokens: No | Spot: Yes Perps: Yes Options: Yes Leveraged Tokens: Yes |

| Depth/Liquidity | Strong, particularly for altcoin spot trading, ranking highly on CoinGecko. | Long-established leader in derivatives liquidity, with deep order books and consistently high trading volume. |

Winner: Bybit

Bybit is the overall winner for market depth, liquidity, and coin breadth, offering a more extensive range of assets and a well-established derivatives market for advanced traders. Bitget is highly competitive, especially in its growing spot market liquidity and its leadership in copy trading and bot features, but Bybit remains ahead in sheer market scale.

Fees

Crypto Exchange Fees Are Charges For Trading, Deposits, And Withdrawals. Image via Shutterstock

Crypto Exchange Fees Are Charges For Trading, Deposits, And Withdrawals. Image via ShutterstockFee Schedules (Base & VIP)

Both Bybit and Bitget utilize a maker-taker fee model with tiered VIP programs and native token discounts. Bybit's fees are highly competitive for futures trading, while Bitget offers a strong discount for spot trading with its BGB token.

| Metric | Bitget | Bybit |

|---|---|---|

| Spot Maker/Taker (Base) | 0.10% / 0.10% | 0.10% / 0.10% |

| Futures Maker/Taker (Base) | 0.02% / 0.06% | 0.02% / 0.055% |

| VIP Reductions | Tiered discounts based on 30D volume or asset balance. Futures maker can reach 0%, taker as low as 0.02%. | Tiered discounts based on 30D volume or asset balance. Futures maker can reach 0%, taker as low as 0.03%. |

| Token Discounts | 20% spot fee discount with BGB. Futures discount available. | 25% spot fee discount with MNT. Futures discount available. |

| Withdrawal policy | Pass-through network fees; costs vary by crypto and network. No deposit fees. | Pass-through network fees; costs vary by crypto and network. No deposit fees. |

| Card/Bank/P2P | P2P trading is generally free for takers, but payment provider fees may apply. Bitget Card has transaction fees. | P2P trading is free for takers. Card fees apply depending on region. |

Real Trade Examples

Assumes BTC price of $70,000 for simplicity

Let’s compare how Bitget and Bybit stack up in actual trading scenarios when fees are applied.

For spot trading, both exchanges are identical at the base tier. A $10,000 buy or sell would incur roughly $10 in maker fees and $10 in taker fees on either platform. There’s no cost advantage here as both exchanges charge the same flat rates for standard users.

In futures trading, Bybit edges slightly ahead at the base level. For a $100,000 taker order, Bybit charges $55, compared to $60 on Bitget. This reflects Bybit’s slightly lower base taker fee of 0.055% versus Bitget’s 0.06%, making Bybit marginally cheaper for one-off market executions.

However, the balance shifts at higher trading volumes. At the mid-VIP level, where traders maintain roughly $50 million in 30-day volume on Bitget or around $5.5 million on Bybit, Bitget’s futures taker fee drops to 0.032% with a BGB token discount, equating to $32 on a $100,000 trade. In comparison, Bybit’s VIP2 taker fee with MNT discount sits at 0.0375%, or $37.50 on the same trade.

Here, Bitget’s fee structure becomes more favorable for active traders, as it offers a steeper reduction and an easier path to achieving deeper discounts.

Looking at a high-volume trader with $1 million in monthly volume, Bitget again demonstrates an advantage. Assuming an even split between maker/taker and spot/futures trading, a trader using Bitget with BGB discounts could save around $4,800 annually compared to standard rates. On Bybit, the equivalent trader using MNT token discounts would save about $3,600 per year.

In summary, Bitget’s structure rewards loyalty and volume more aggressively, especially for derivatives traders leveraging BGB for fee discounts. Bybit maintains a slightly lower entry cost on base futures orders, but Bitget provides stronger long-term savings for active or high-frequency users.

| Scenario | Bitget (Fees Paid) | Bybit (Fees Paid) | Analysis |

|---|---|---|---|

| $10,000 spot buy/sell (base tier) | $10 (maker), $10 (taker) | $10 (maker), $10 (taker) | For base-tier spot traders, both exchanges have identical flat fees, resulting in no difference in cost. |

| $100,000 futures taker order (base tier) | $60 | $55 | Bybit has a slightly lower base futures taker fee (0.055% vs. 0.06%), making it slightly cheaper for one-off market orders. |

| $100,000 futures taker order (mid-VIP) | At VIP2 (approx. $50M 30D volume), futures taker fee is 0.032% with BGB discount. $100,000 x 0.032% = $32 | At VIP2 (approx. $275k 30D spot vol + $5.5M 30D derivatives), futures taker fee is 0.0375% with MNT discount. $100,000 x 0.0375% = $37.5 | Bitget offers more aggressive futures taker fee reduction at a similar trading volume level due to its token discount, making it cheaper for high-frequency trading. |

| $1M monthly volume trader (annualized savings) | Assuming 50% maker/taker, 50% spot/futures, and BGB discount: ~$4,800 saved vs. non-BGB rates annually. | Assuming 50% maker/taker, 50% spot/futures, and MNT discount: ~$3,600 saved vs. non-MNT rates annually. | Bitget's BGB discount combined with lower VIP rates for takers can lead to greater annualized savings for high-volume traders compared to Bybit's standard VIP tiers. |

Don't miss out on the top low-fee crypto exchanges in 2025.

Verdict

Based on the fee schedule above, Bybit emerges as the winner, primarily due to having a marginal edge in futures trading with a lower taker fee of 0.055% compared to Bitget's 0.06%, and a better potential spot fee discount (25% with MNT vs. 20% with BGB). The two exchanges remain in a tie on their base spot maker and taker fees, both set at 0.10%. Ultimately, Bybit gains an overall edge for users prioritizing high-volume futures trading efficiency and maximum token discounts.

Copy Trading (The Big Differentiator between Bybit and Bitget)

Copy trading has emerged as a crucial feature in the cryptocurrency exchange landscape, allowing novice traders to automatically replicate the trades of experienced professional traders.

Scale, Options & Data

- Registered copy-traders (quant): Bitget has a larger overall user base of over 120 million users, according to CoinGecko. Bybit has a user base of around 61.7 million active users.

- Supported copy types (spot, futures, bots, options): Bitget supports spot and futures trading copy, along with the ability to copy bots. Bybit offers Classic (USDT perpetuals and bots), Pro (spot and USDC perpetuals with strategy shares), and TradFi (Forex, Indices, Commodities via MT5) copy trading types.

- Profit-share: Bitget elite traders can earn up to 10% of their followers' profits. Bybit Master Traders can earn a profit share of 10% to 15% in Classic mode, while Pro Masters can set their profit share up to a maximum of 30%.

- Transparency (P&L, ROI, AUM): Both platforms provide detailed analytics, including ROI, maximum drawdown (MDD), and Sharpe Ratios, to help users evaluate traders.

- Marketplace maturity: Bitget, founded in 2018, is often considered a pioneer in crypto copy trading, having launched the feature in 2020 and built a large, socially oriented community. Bybit is also well-established, known for its advanced trading tools and deeper liquidity.

Even the most experienced traders make mistakes, and these can be very costly. So read our guide to avoid the most common mistakes made while doing copy trading.

Copy Trading Head-to-Head

| Metric | Bitget | Bybit | Verdict/ Winner |

|---|---|---|---|

| Registered copy-traders | 900k followers | 800k followers | Bitget (more followers) |

| Pro traders listed | 200k traders | Tiers (Cadet to Gold) | Bitget (clear count) |

| Copy types (tickmarks) | Spot, Futures, Bots | Spot, Futures, MT5, Pro | Bybit (more variety) |

| Profit split | Up to 10% | Up to 15% (Classic), 30% (Pro) | Bybit (higher max %) |

| Risk controls (max drawdown, stop copy) | Stop-loss, take-profit, margin modes | Max drawdown data, TP/SL, leverage settings | Both (comprehensive tools) |

| Social metrics | Strong emphasis on community, social trading, and user interaction | Offers detailed performance data and leaderboards | Bitget (focus on social aspects) |

| Platform maturity | Pioneer in crypto copy trading (since 2020) | Strong platform, slightly newer to copy trading space | Bitget |

Check out our top picks for copy trading platforms in 2025.

Regulation & Geographic Availability

Geographic Availability Of Crypto Exchanges Determines Where Trading Services Are Legally Accessible. Image via Shutterstock

Geographic Availability Of Crypto Exchanges Determines Where Trading Services Are Legally Accessible. Image via ShutterstockCompliance is a critical factor for cryptocurrency exchanges, influencing user trust, service offerings, and overall operational safety. The strategies of the two exchanges differ, with Bybit focusing on major Tier-1 licenses and Bitget prioritizing VASP registrations across numerous countries.

| Jurisdiction | Bitget status | Bybit status | Regulator |

|---|---|---|---|

| UAE (Dubai Mainland) | No | Licensed | SCA/VARA |

| EU (various) | Registered (VASP) in PL, LT, IT, BG | Licensed (Austria/MiCA) | FMA/Local authorities |

| India | In talks with FIU-IND | Registered (FIU-IND) | Financial Intelligence Unit |

| El Salvador | Licensed (DASP/BSP) | No | CNAD |

| USA, UK, Canada | Prohibited | Prohibited | N/A |

Licenses & Registrations

Bybit holds a full Virtual Asset Platform Operator License from the VARA/SCA (Dubai/UAE) and a MiCA (Markets in Crypto Assets) license from Austria's Financial Market Authority (FMA), which unlocks access to 29 European Economic Area countries. It is also registered as a Virtual Digital Asset Service Provider (VDASP) with the Financial Intelligence Unit – India (FIU-IND).

Bitget holds multiple VASP registrations in specific regions. Bitget has successfully registered as a VASP in several European countries, including Poland, Lithuania, Italy, and Bulgaria, adhering to local AML (Anti-Money Laundering) rules. Outside of Europe, it holds a Digital Asset Service Provider (DASP) license and a Bitcoin Services Provider (BSP) license in El Salvador.

Where You Can (and Can't) Use Them

Bybit is available in over 160 countries. Restricted/Prohibited jurisdictions currently include the United States, Mainland China, Hong Kong, Singapore, Canada, France, the United Kingdom, North Korea, Cuba, Iran, Syria, and Russian-controlled regions of Ukraine.=

On the other hand, Bitget serves users in over 150 countries. Restricted/Prohibited jurisdictions currently include the United States, Singapore, North Korea, Hong Kong, Iran, Iraq, Libya, Sudan, Syria, and other sanctioned regions.

Verdict

When comparing Bybit and Bitget based strictly on regulatory oversight tier and geographical breadth, Bitget is the winner. While Bybit has a slightly wider operational scope, serving over 160 countries compared to Bitget's 150+, Bitget takes the lead due to the quality and diversity of its regulatory compliance. Bitget holds approved platform status with the globally recognized UK Financial Conduct Authority (FCA), a clear Tier 1 regulator, and maintains several other EU licenses.

Security & Proof of Reserves

Bybit and Bitget both employ multi-layered security measures, including storing the vast majority of user funds in offline cold wallets protected by advanced multi-signature (multi-sig) and Threshold Signature Schemes (TSS) technologies. Both platforms also mandate robust user security practices such as Two-Factor Authentication (2FA), enable address whitelisting, and offer anti-phishing codes to enhance email security.

Track Record & Protections

A key difference between the two exchanges is in their public security track records and their approach to insurance/protection funds.

Bybit suffered a major security breach in February 2025, where approximately $1.4 billion to $1.5 billion was stolen from a compromised cold wallet due to a third-party software vulnerability. The platform demonstrated significant financial resilience by quickly replenishing the funds with emergency capital within 72 hours, ensuring no user losses. Bybit's "insurance fund" is primarily used to protect traders from extreme losses during derivatives liquidations, not a general user asset insurance policy. While you're here, check out our article: Is Bybit safe?

Bitget has maintained a spotless track record for its core exchange platform since its establishment in 2018. It has a self-funded Protection Fund (check out Proof of Reserve), which had an average monthly valuation of approximately $735 million in September 2025, reaching a peak of over $779 million in July-Aug 2025. This fund acts as an explicit safeguard for user assets against non-user-caused losses or extreme market events.

Verdict

While Bybit has a higher overall user rating and platform functionality, Bitget has maintained a spotless track record for its core exchange and offers an established, self-funded protection fund as a primary safeguard. The decision between the two may depend on whether the user prioritizes Bitget's history of no major platform hacks or Bybit's demonstrated resilience and strong liquidity despite a recent significant security incident.

Trading Experience (Web, Pro, & API)

The overall trading experience on Bybit and Bitget is a critical factor for users. This comparison outlines key technical aspects, including the performance of their matching engines, available order types, risk management tools, and API capabilities. Bybit generally caters to more advanced, high-frequency traders, while Bitget focuses on a user-friendly interface and a platform equipped with the best social trading tools.

| Area | Bitget | Bybit | Notes |

|---|---|---|---|

| Matching Engine Speed | Fast, reliable execution | Ultra-low latency | Bybit is often cited for superior speed for HFT |

| Orders/second ballpark | High throughput | Extremely high | Both handle massive loads; Bybit engineered for institutional scale |

| Order Types | Limit, Market, Stop-loss | Limit, Market, Stop Loss, Trailing (via API) | Bybit offers slightly more built-in variety |

| Margin Modes | Cross, Isolated | Cross, Isolated, Portfolio | Bybit offers a professional Portfolio Margin mode |

| Unified Margin Account | Yes, multi-asset collateral | Yes (UTA) | Bybit's UTA is a core feature for advanced risk management |

| API Rate Limits | Standard/Good limits | Higher limits available | Bybit prioritizes API speed for HFT |

| Demo/Sandbox Access | Yes, demo account available | Yes, demo account available | Both provide practice environments |

Matching Engine & Latency

Both exchanges utilize centralized, high-speed matching engines designed for low latency and high throughput.

Bybit is known for its technical reliability. Bybit's matching engine processes a high volume of orders rapidly, supporting institutional-grade, high-frequency trading. The platform is built for speed and stability, often cited for its low latency.

Bitget offers a fast, user-friendly trading terminal with quick order execution speeds, though specific latency figures (e.g., milliseconds) are not always officially published in the same way as Bybit.

Both exchanges employ risk engines, insurance funds, and cold/hot wallet storage to maintain stability and protect user funds during extreme market conditions.

Order Types & Risk Controls

The variety of order types and margin controls differs between the platforms, affecting trading flexibility and risk management strategies.

Bybit allows for Market, Limit, and Stop Loss orders. It supports both Isolated and Cross Margin modes on its platform, including the Unified Trading Account (UTA), which allows profits and losses to net across positions using multi-asset collateral. Bybit's UTA also offers a Portfolio Margin mode for professionals. Bitget also allows for Market and Limit orders and offers various stop-loss functions for risk management.

Bybit prominently features a Unified Trading Account (UTA) that acts as a multi-asset collateral system where assets like BTC, ETH, USDT, and USDC can be used as margin across various products, optimizing capital efficiency. Bitget supports a similar concept where some assets can serve as collateral, but Bybit's implementation is often highlighted as more integrated.

API & Automation

Both exchanges provide APIs utilizing both REST for requests like historical data and WebSockets for real-time market data and faster data transfer with lower latency.

- Rate limits: Bybit offers high, even exclusive, API rate limits for users of specific SDKs (up to 400 requests per second in some cases), demonstrating a strong focus on algorithmic trading. Bitget is also free to use and provides guidelines for managing rate limits.

- Historical data: Both APIs offer access to historical data for backtesting purposes. Bybit's API might require multiple calls for large portions of data, while Bitget emphasizes the accuracy and completeness of its data sets.

- Sandbox/demo access: Bitget offers demo accounts for practice. Bybit also allows users to practice trading strategies with a demo account feature.

Winner: Bybit

When it comes to the overall trading experience, Bybit is the winner. It consistently receives higher overall scores and user ratings for its superior ease of use and smoother user experience. Bybit offers an intuitive interface, high performance, and robust charting tools from TradingView, which cater well to experienced traders seeking advanced features like options and high leverage. While Bitget has a strong focus on copy trading and a user-friendly platform, its interface can be slightly more overwhelming for novices compared to Bybit's streamlined experience.

Mobile Apps

A strong mobile experience is crucial for modern crypto traders who need access to trading, account management, and security features on the go. Both exchanges provide full-featured apps, but differences emerge in user ratings, user interface (UI) design, and specific functionalities like charting and withdrawals.

| Metric | Bitget | Bybit | Winner/Verdict |

|---|---|---|---|

| iOS rating | Highly rated (often 4.5+) | Highly rated (often 4.5+) | Tie |

| Android rating | Highly rated (often 4.5+) | Highly rated (often 4.5+) | Tie |

| Copy trading UX | Strong social focus, intuitive | Integrated into core platform, Pro features | Bitget (social strength) |

| Funding/withdrawals | No deposit fees, variable withdrawal fees | No deposit fees, fixed withdrawal fees (low) | Tie (competitive) |

| Notifications | Comprehensive notifications for trades/liquidation | Real-time alerts for market & account status | Tie |

| Biometric login | Yes, standard security feature | Yes, standard security feature | Tie |

| Charting Parity | Good, full features | Excellent, deep TradingView integration | Bybit |

Ratings & Feature Parity

Bitget's app is a top-three most-downloaded CEX app globally, highlighting its market reach and user acceptance. Bybit has a slightly higher overall user experience score in some comparisons, suggesting a smoother UI. User reviews suggest Bybit might have a smoother experience, while some Bitget users praise its easy-to-use, clean interface for beginners.

Biometrics, withdrawals, charting parity:

- Biometrics: Both exchanges offer security measures, including 2FA (Two-Factor Authentication) and likely biometric login options (fingerprint/Face ID) as standard for account security.

- Withdrawals: Both apps facilitate easy on-chain crypto withdrawals and internal transfers without fees, though network fees for on-chain transfers apply.

- Charting parity: Both mobile apps integrate advanced charting tools, with Bybit often cited for its excellent integration with TradingView for advanced analysis.

Earn, Launch, & Extras

Bybit generally offers more structured financial products and has better card integration, while Bitget emphasizes accessibility and a wide variety of VASP registrations.

| Product | Bitget | Bybit | Winner |

|---|---|---|---|

| Savings (Flex/Fixed) | Yes | Yes, with Auto-Earn option | Bybit (integrated features) |

| Launchpad (IEOs) | Yes | Yes (MNT/USDT participation) | Similar |

| Launchpool (Staking) | Yes | Yes (Stake and earn) | Similar |

| Liquidity Mining | Yes | Yes, with leverage options | Bybit (more advanced features) |

| Dual Asset Products | Yes (Structured earn) | Yes | Similar |

| Debit Card | Yes (VIP focus) | Yes (Widely available) | Bybit (better accessibility) |

| Apple/Google Pay | Via card, not core app | Yes, seamless card integration | Bybit |

Earn Products

Let's compare the passive income streams (Earn Products), early investment opportunities (Launchpads), and real-world utility/payment methods offered by Bybit and Bitget.

Savings:

- Bybit Easy Earn allows daily yield accumulation with flexibility (flexible APR varies) or higher fixed returns for locked periods.

- Bitget Simple Earn also offers flexible terms where users can reclaim funds anytime while accruing hourly interest.

Launchpool/Launchpad:

- Launchpad: Both offer Initial Exchange Offerings (IEOs) where users commit assets (like BGB or MNT/USDT) to buy new tokens before they are publicly listed. Projects are vetted for quality.

- Launchpool: Both allow users to stake existing tokens (like MNT, USDT, or USDC on Bybit) to farm or earn newly listed tokens for free. Staked tokens can usually be unstaked anytime.

Dual Asset/Shark Fin, staking, liquidity mining:

- Bybit offers sophisticated structured products like Dual Asset (short-term, high potential yield but non-guaranteed returns on asset value), Liquidity Mining (AMM pools with potential for impermanent loss but leverage options), and ETH 2.0 Liquid Staking.

- Bitget offers a similar suite of diversified products within its Earn section, including staking and liquidity provision, often focusing on a user-friendly experience for these sophisticated options.

- Breadth & APY examples w/ disclaimers: Bybit has a wide variety of assets for earning, and APYs vary greatly by asset and market conditions. Products like Dual Asset carry a higher risk than simple flexible savings.

Verdict

Bybit has the edge in the "Earn" category due to the sheer variety and perceived structure of its offerings. Bybit Earn provides a wider range of tailored products for different risk appetites, from low-risk savings to higher-risk dual asset products. Bybit Savings yields are paid from the platform's income, and it offers specific products like ETH 2.0 Liquid Staking, allowing users to earn daily yields while maintaining asset flexibility. Bitget also has strong earning features, including flexible investment options with competitive APRs for smaller deposits, but Bybit's ecosystem is more extensive and varied for a comprehensive asset management strategy.

Crypto Exchanges Earn Programs Benefit Users With Extra Coins. Image via Shutterstock

Crypto Exchanges Earn Programs Benefit Users With Extra Coins. Image via ShutterstockLaunchpads & New Listings

Bybit and Bitget feature dedicated launchpad platforms for Initial Exchange Offerings (IEOs) and regularly list new tokens through various programs to provide users with early access and trading opportunities.

Bybit Launchpad

This platform offers users early access to new tokens through two primary methods:

- MNT subscription track: Users commit Mantle (MNT), Bybit's native token, for an allocation of the new project's tokens. Your final allocation is based on the amount of MNT you commit relative to the total MNT committed by all participants.

- USDT lottery track: Users stake a minimum of 100 USDT for the chance to win an allocation of the new token. Additional lottery tickets can be obtained by meeting specific holding or trading volume criteria.

Other new listing methods on Bybit

- Bybit Launchpool: Users can stake various cryptocurrencies, like MNT or USDT, to earn new tokens from projects for free over a set period. Staked tokens can typically be redeemed at any time.

- ByVotes: This program allows users to vote for their favorite projects, with the winner being listed on Bybit. Voters who support the winning project receive a token airdrop.

- Token Splash: Users can earn rewards in newly listed tokens by completing specific tasks and participating in promotions.

- Spot listings: Bybit regularly lists new tokens on its spot market after the initial launchpad or launchpool event concludes, making them available for trading to all users. Recent examples include xStocks trading pairs and EAT.

Bitget Launchpad

Bitget's IEO platform is designed to give users early access to carefully vetted projects. The platform leverages a subscription format where participants hold assets or trade to earn lottery tickets.

- Bitget Launchpool: Similar to Bybit's version, this platform allows users to stake assets to earn tokens from new projects through airdrops. It's often promoted as a lower-risk entry for new users.

- Bitget LaunchX and PoolX: These are other parts of Bitget's "LaunchHub" ecosystem.

- Spot listings: Bitget lists new tokens on its spot market regularly. The exchange's announcements page is the best place to find recent additions. Examples include COMMON and KGeN.

Verdict

Bybit is the winner in the "Launch" category because it provides more flexibility and options for participation in new token offerings. Bybit Launchpad offers two distinct tracks: a guaranteed allocation via MNT commitment or a lottery system using USDT. It also features ByVotes, allowing community input on new listings, and Token Splash campaigns with various incentives. While Bitget's Launchpad is effective and vets projects rigorously, Bybit's multi-faceted approach, which includes the separate Bybit Launchpool for staking-based rewards, offers more avenues for users to get involved with new projects.

Cards & Payments

Card type/network, regions, fees:

- Bybit Card (Mastercard) is known for low fees and is available to users in the EEA/UK and supports mainland KYC. It offers no annual fees and competitive transaction fees (0.9% to 3%), plus free ATM withdrawals up to 100 EUR monthly.

- Bitget Card (UnionPay/Mastercard) targets users with a high balance requirement (e.g., 30,000 USDT) and has similar transaction fees (0.9%–3%).

- Bank transfer, P2P, Apple/Google Pay:

- Both exchanges facilitate fiat deposits via bank transfers (zero fees on deposits) and P2P (Peer-to-Peer) trading options.

- The Bybit Card integrates seamlessly with Apple Pay and Google Pay, adding flexibility for everyday digital and tap-to-pay transactions.

KYC & Limits

Bybit and Bitget have implemented mandatory Know Your Customer (KYC) verification to comply with global anti-money laundering (AML) regulations and provide a secure trading environment.

KYC And Limits Define Verification Requirements And Transaction Caps On Crypto Exchanges. Image via Shutterstock

KYC And Limits Define Verification Requirements And Transaction Caps On Crypto Exchanges. Image via ShutterstockVerification Requirements

Verification for cryptocurrency exchanges like Bybit and Bitget is mandatory for compliance and requires users to submit government-issued documents and complete facial recognition. The requirements and verification tiers vary depending on the level of access you need.

| Aspect | Bitget | Bybit | Notes (link to policy) |

|---|---|---|---|

| KYC mandatory? | Yes (Since Jan 2024) | Yes (Since May 2024) | Mandatory for all major crypto platforms now |

| Non-KYC Limits | No access to core services |

≤20,000is less than or equal to 20 comma 000 ≤20,000 USDT daily (historically) | Both now require KYC for withdrawals |

| Standard KYC (Level 1) | Up to 80 BTC/day withdrawal | Up to 1M USDT daily withdrawal | Requires ID document verification |

| Advanced KYC (Level 2) | Up to 200 BTC/day withdrawal | Up to 2M USDT daily withdrawal | Requires ID + Proof of Address |

| Feature Gating | All features locked without KYC | All features locked without KYC | Access to P2P, Launchpad, Copy Trading requires full verification |

| Compliance | VASP registrations (EU, ES) | Tier-1 Licenses (VARA/SCA, MiCA, FIU-IND) | Both adhere to global AML standards |

Verdict

Regarding KYC and limits, Bybit is the winner due to its more generous withdrawal allowances. While both exchanges mandate Level 1 KYC for full access, Bybit allows daily withdrawals of up to $1 million USDT equivalent at Level 1 and $2 million at Level 2. Bitget's limits are substantial but slightly lower, providing Bybit a practical edge for high-volume users in accepted regions

Customer Support & Education

Both exchanges aim to provide 24/7 assistance and educational materials, but user experiences and the depth of content in their learning hubs can differ. Let's compare the support channels, response times, and educational resources offered by Bybit and Bitget.

| Channel/Resource | Bitget | Bybit | Notes |

|---|---|---|---|

| Live Chat | 24/7 available | 24/7 available | Both offer real-time support |

| Email Tickets | Yes | Yes (longer ETA for complex cases) | Standard channel for detailed issues |

| Languages Supported | Multiple | Multiple | Both cater to a global audience |

| Learning Hub | Bitget Learn (good for beginners) | Bybit Learn (more extensive) | Bybit often has more in-depth guides |

| Tutorial Formats | Guides, articles | Articles, videos, tutorials | Both use varied formats |

| TradeGPT/AI Tools | No specific mention | Yes (AI chatbot for queries) | Bybit uses AI for insights/queries |

Support Channels & Tested Response Times

Both Bybit and Bitget provide 24/7 customer support via live chat and email ticketing systems.

Live chat avg response (own test), ticket email ETA, languages supported:

- Bybit offers 24/7 live chat support. During testing, response times were found to be quick, often within around 5 minutes. However, complex issues that require an email ticket can take significantly longer, sometimes 5 to 7 days for a reply. Bybit is available in multiple languages.

- Bitget also provides 24/7 support. User reviews mention that Bitget customer support “doesn't waste time to attend to their users' complaints,” suggesting relatively quick service. Email inquiries are handled via support tickets.

Learning Hubs

Both exchanges provide extensive educational materials to help users learn about the platform and cryptocurrency trading.

Bybit Learn vs Bitget Learn, depth, formats, tools:

- Bybit Learn is a comprehensive resource library that includes articles, tutorials, and videos tailored for both beginners and advanced traders. It is often praised for its extensive and detailed guides that clearly explain features like options trading, futures, and the Unified Trading Account.

- Bitget Learn also offers a substantial collection of educational materials designed to help users navigate the platform and general crypto concepts. It is generally considered helpful for beginners, though some reports indicate a potential lack of some in-depth material for highly complex topics.

If you’re new to the crypto space, now is the perfect time to equip yourself with the right knowledge. Explore some of the best crypto courses available to gain a solid foundation before diving into the Web3 world.

Verdict

When comparing customer support and education resources, the winner is Bybit. Both exchanges provide 24/7 live chat and email support; however, Bybit consistently scores higher in user reviews for having a smoother, faster customer experience. Bybit's educational platform, Bybit Learn, offers extensive, structured courses, including options trading and even a certified diploma program, which provides a more comprehensive and professional learning environment than Bitget Academy's helpful but slightly less formal Learn2Earn approach.

Bottom Line (Final Verdict)

Both Bybit and Bitget bring strong utility for different kinds of traders. Bybit delivers a more advanced toolkit with deep liquidity, higher leverage, and global licensing. Bitget leans into social and automated trading, offering an approachable interface, flexible KYC, and a sizable protection fund for peace of mind.

The right choice depends on how you trade. If you value professional-grade execution, regulation, and derivatives variety, Bybit fits the bill. If you prefer automation, copy strategies, and easy onboarding, Bitget’s ecosystem is hard to overlook.