Cindicator (CND) is a project that is attempting to merge artificial intelligence and human forecasting to create a hybrid prediction system for financial markets.

The Cindicator team has dubbed this “hybrid intelligence” and they feel that the combination of human and AI is the future of prediction markets. They have been able to build an ecosystem that generates over 400,000 forecasts a month utilizing over 30 machine learning algorithms.

However, can Cindicator really execute on their ambitious plans?

In this Cindicator review, I will attempt to answer that question by digging into their technology, team members and use cases. I will also analyse the long term adoption and price potential of the CND tokens.

What is Cindicator?

Unlike some of its rivals, Cindicator is already a working platform, with over 115,000 analysts weighing in on daily financial questions to create crowd sourced market predictions. This type of crowd sourcing is increasingly popular due to the accuracy attained through the wisdom of the crowds.

Cindicator uses the wisdom of the crowd each day by sending out questions about financial and cryptocurrency markets. Analysts answer the questions and the answers are aggregated to help make market predictions.

The human intelligence is combined with artificial intelligence as Cindicator AI system evaluates the analyst responses. It also gives a higher weight to those analysts that have historically been more accurate. The AI runs trading simulations to determine the profitability of each analysts responses and once all the data is developed it is aggregated and sent out as a final analysis.

At this point the Cindicator community is able to put the analysis to use through the Cindicator bot and the Cryptometer.

Why Cindicator is Needed

Humans love to predict the future, and this is especially true in financial markets, where correct predictions can create immense wealth. Prediction systems in financial markets have led to the use of robots and in the 21st century much of the trading volume in the world’s stock exchanges is controlled by trading robots.

These robots and prediction methods are so valuable that in 2015 $4 billion was spent on analytical systems and over $50 billion was spent on the financial data needed to make predictions. This amount is expected to balloon to $300 billion spent on data by 2020 as stated in their whitepaper.

The Cindicator solution not only provides predictions, it also generates vast amounts of data, and as we already know the financial sector is willing to pay huge amounts of money for good data. If Cindicator can capture just one quarter of this need for data it could be worth $75 billion. And that’s just in the financial industry. Cindicator can be used in many other arenas, such as elections, sports betting and anywhere predictions could be useful.

Cindicator Technology

In addition to the pool of analysts there are two additional elements that complete the Cindicator system. These are the artificial intelligence engine and the actual prediction product for end users. Let’s have a closer look at each.

The Analyst Pool

The Cindicator platform currently includes over 115,000 analysts, some of whom are professionals, but not all. The Cindicator platform gives anyone the chance to monetize their knowledge of financial markets and in return it receives valuable input for its prediction engine.

Cindicator has a very simple method for gathering data from these analysts. Each day a set of questions are sent to the analyst to answer. These questions are based on the analysts stated interests and fields of expertise.

Image via Cindicator Blog

Image via Cindicator BlogOne type of question commonly asked is a binary question that can only be answered with a yes or no. These binary questions are answered in a probability percentage range, with anything under 49% taken as a no and anything over 51% taken as a yes. Percentages are used to gauge the degree of confidence in the response.

The second type of question posed is a price related question. These types of questions give traders extremely useful data and are usually posed as a minimum/maximum type question. For example, Cindicator may pose the question: “Facebook shares closed at $163.53 on March 22, 2019. In your opinion what will the minimum and maximum price of Facebook stock be on March 25, 2019?”

Analysts don’t answer these questions from the goodness of their hearts. They have two types of motivation: personal and group.

The analyst gets their personal motivation through their public rating on the platform, which is based on the accuracy of their predictions. In addition there is a financial motivation since the analysts with the best prediction scores at the end of each month receive a reward that is paid in either CND or ETH. Each month scores are reset and a new competition begins.

Analyst prediction forecast accuracy of Bitcoin Price

Analyst prediction forecast accuracy of Bitcoin PriceAnalysts also receive a portion of the profits from Cindicator’s own portfolio at the end of each quarter. This gives the analysts a group incentive, since the better their predictions are, the larger the quarterly prize pool becomes.

Cindicator Artificial Intelligence

All of the data collected by Cindicator is analyzed by the artificial intelligence system in five main ways:

- Individual analysts are studied to determine patterns and common factors. Analysts are classified in a variety of ways such as bulls and bears, trend followers, wide versus narrow price predictions and many more factors.

- The AI will also study how often an analyst makes a mistake, what situations are most likely to cause a mistake, and how the analyst responds to changing market conditions.

- The AI uses a variety of predictive models to build complex algorithms that measure analyst performance.

- Data clusters and groups of analysts are also studied and experiments are conducted to determine the best possible groupings of data.

- Analysis of predictions compared with actual market performance provides valuable insights.

The Cindicator Products

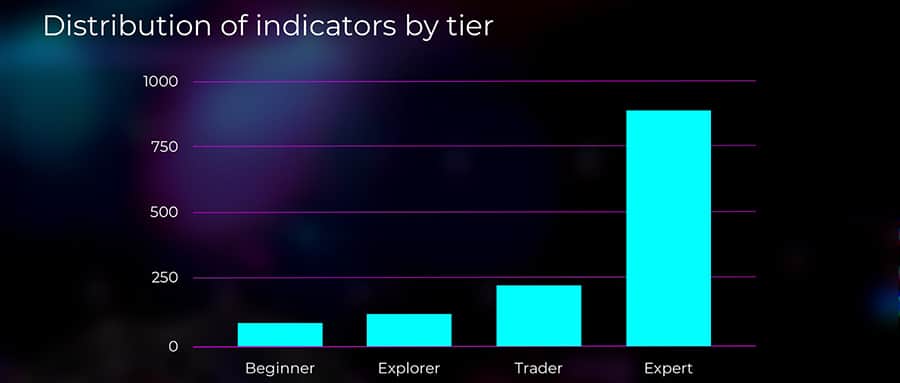

After all the data is collected and analyzed by the artificial intelligence system Cindicator makes it available to CND holders through two different products. The first is the Cindicator bot. It has four levels of access, with the beginner level requiring 5,000 CND tokens for access. The top Expert level requires 700,000 CND tokens.

There is also the Cryptometer, which gives cryptocurrency arbitrage opportunities, and automatically monitors 5 crypto exchanges and 18 cryptocurrency pairs. The Cryptometer is only available to those with a CND balance of 1 million CND or greater.

Cindicator Team & Advisors

Since its beginnings in 2015 the Cindicator team has done an excellent job in creating a useful product and positioning it in the financial services industry. The team has grown to more than 60 members across nine countries. It includes specialists in data science, trading, platform development, marketing and customer support.

The co-founders of the Cindicator Project

The co-founders of the Cindicator ProjectThe leaders of the Cindicator project are the three co-founders.

- Mike Brusov – The CEO of Cindicator and a co-founder, Mike brings 8 years of experience as a tech entrepreneur, with most of that experience in big data and predictive analysis.

- Yuri Lobyntsev – The CTO of Cindicator and co-founder, Yuri begin in technology as a 10 year-old software coder. He has extensive experience as an application developer and is passionate about merging artificial and human intelligence.

- Artam Baranov – The COO and a co-founder of Cindicator, Artem is a serial entrepreneur with experience founding several different companies prior to his involvement at Cindicator, where his involvement includes pulling the team together to function as a single force.

Cindicator also has a pretty strong advisor pool to tap. Some of the prominent names that are lending advice to the project include the like of Charlie Shrem, Anthony Diiorio and Evan Cheng. For those who do not know, Charlie is an early Bitcoin proponent and a founder at the Bitcoin foundation. Anthony is a founder of Ethereum and the founder of Decentral and Evan is the director of Facebook engineering.

The Cindicator Community

Cindicator has been growing their community, and while it isn’t huge, it isn’t too small either. They have nearly 40,000 Twitter followers and over 6,200 followers on their sub-Reddit. They are also approaching 1,000 subscribers to their YouTube channel and have over 5,800 likes on their Facebook page. As I said, not huge, but not small either.

Cindicator needs to keep developing new products and attracting new fans to keep their momentum moving forward. Otherwise they could have the best prediction tool on the planet and still get outpaced by a more popular project. Growing the community will also help support the value of the CND token.

In order to help foster this growing community, the Cindicator team tries to keep their members up do date with the project developments. The most important of these are posted through their official blog.

The CND Token

Cindicator held their ICO back in September 2017 and it concluded on the 24th, with the project raising $15 million. They sold 1.5 billion CND tokens, which is 75% of the total supply, for $0.01 per CND.

CND Price Performance. Image via CoinMarketCap

CND Price Performance. Image via CoinMarketCapUnlike many projects, the token remains above its ICO price even after the brutal bear market of 2018 and as of late March 2019 one CND is selling for $0.016253. The price has also been gaining in 2019 as it began the year right around the ICO price of $0.01 per token.

If you’re interested in buying CND, perhaps so you can gain access to the Cindicator bot, then there are a number of exchanges that you can use. However, over 96% of the volume is currently being traded on the Binance Exchange. It is listed on HitBTC but volumes are non-existent.

Despite so much trading taking place on only one exchange, there remains healthy levels of liquidity on the order books. Despite this though, CDN remains quite volatile in comparison to similar sized altcoins so you should trade them with caution.

Register at Binance and Buy CND Tokens

Register at Binance and Buy CND TokensOnce you have your hands on the CND token then you will probably want to move them off of the exchange and store them in an offline wallet. Keeping large amounts of tokens on an exchange is always a risky practice and should be avoided.

The CND token is an ERC-20 token, so it can be stored in any ERC-20 compatible wallet. If you’re using it to access the Cindicator platform it must be held in a stand-alone ERC-20 wallet, not in an exchange wallet.

Conclusion

The Cindicator project hasn’t gotten as much recognition as some other crypto prediction markets such as Augur, but it is doing better than others like Gnosis. It remains a unique project and th fact that it already has a function platform with paying customers puts it ahead of the majority of blockchain projects.

And while the outcome its seeking to achieve may be complex, blending human and artificial intelligence to predict financial markets, the use case is actually easy to understand and grasp.

The fact that the token price held up during the 2018 bear market is also encouraging for the future of the Cindicator project and for investors in the CND token. With tens of billions of dollars in customer funds available in the finance sector alone Cindicator has a bright future if they can keep performing and moving forward.