The trading industry has always had one major downside. It doesn’t matter if you are trading forex, crypto, stocks, oil, ETFs, corn, cotton, or soybeans (yes, you can actually trade those last 3 and more!). That downside is that the platform where you trade is fully centralized and the company has full control and authority over your funds.

Once money is deposited on a centralized crypto exchange, or any centralized trading platform, all traders are at the mercy of the platform overlords, and there are countless stories of frozen funds, denied winnings, rug-pulls, scams, and bankruptcies. Bye-bye money.

That is one of the key reasons that DeFi has become so revolutionary and skyrocketed in adoption. Thanks to blockchain technology, for the first time, users could trade with no centralized authorities calling the shots. While DeFi is great for swapping assets and swing trading, due to the slow nature of network confirmations, high gas fees, and issues with matching engines and liquidity pools, DEXes, especially those built on Ethereum, are not suitable for active day traders, high-frequency trading, and cannot support advanced trading features in a cost-efficient manner.

That is where IDEX comes in. IDEX uses a unique hybrid approach, combining the best of both centralized and decentralized functions to build a high-performance exchange, without the need to hold onto user funds. Game changer! This IDEX review will cover everything you need to know about this trading haven.

IDEX TL; DR

IDEX is a professional grade high-performance exchange that allows users to retain control of their own funds through the use of smart contracts and a connection to crypto wallets such as Metamask. The trading interface is powered by Tradingview, similar to most major centralized exchanges, making IDEX suitable for all levels and styles of traders.

Using a hybrid approach between centralized and decentralized functions, IDEX has a unique model for how they constructed a matching engine and liquidity pools, which overcomes the limitations inherent in fully decentralized DEXes.

IDEX Key Takeaways

- Non-custodial crypto trading suitable for day traders and those simply looking to swap assets.

- Wyre integration allows for the purchasing of crypto directly on the platform.

- Polygon integration supports low-cost and efficient trading.

- Staking and Liquidity Providing can be done on the platform.

- Fantastic UI/UX trading experience.

| Headquarters: | Panama |

| Year Established: | 2012 under the previous name AuroraDAO |

| Regulation: | None |

| Spot Cryptocurrencies Listed: | 9 |

| Native Token: | IDEX |

| Maker/Taker Fees: | Maker: -0.005%% Taker: 0.03% |

| Security: | High |

| Beginner-Friendly | No - This platform provides features and a trading interface more suited for experienced crypto users and traders. |

| KYC/AML Verification: | Yes |

| Fiat Currency Support: | Yes, crypto purchases can be done via Wyre partnership |

| Deposit/Withdrawal Methods: | Crypto |

Review: What is IDEX

IDEX is a semi-decentralized exchange that provides a trustless, real-time, high-throughput trading platform that settles transactions on the blockchain.

A Look at the IDEX Homepage

A Look at the IDEX HomepageBy centrally controlling trade matching and Ethereum transaction dispatch, IDEX allows users to trade continuously without waiting for transactions to verify on the blockchain. This supports the instantaneous filling of multiple orders and allows for orders that can be cancelled immediately without gas costs. Pretty sweet!

IDEX is the first hybrid liquidity DEX that works in this capacity, combining centralized and decentralized functions. IDEX follows a similar Automated Market Maker (AMM) algorithm as other DEXes like Uniswap, but by combining the best parts of centralization and decentralization, IDEX provides the high performance and features of a traditional order book exchange, but with the security and liquidity of an AMM.

Traders on IDEX enjoy the following benefits:

- Low spreads

- High Liquidity

- High security as it is built on the Ethereum network

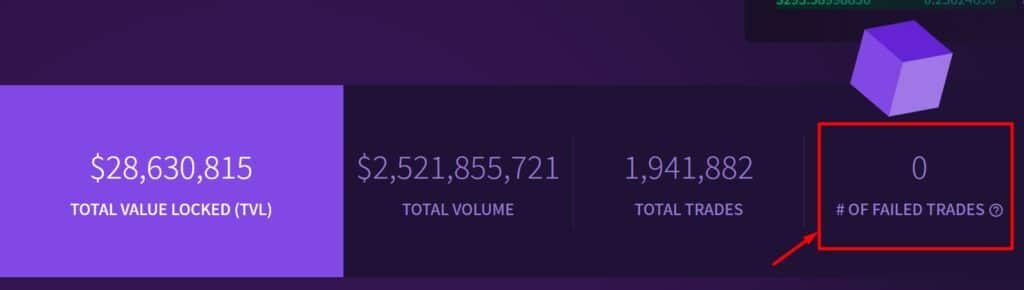

- No failed trades

- No gas wars as IDEX dispatches all trades for settlement in the same order they were executed at A Look at the IDEX Homepage

- The ability to cancel orders gas-free

- Ability to place advanced order types: Limit, stop-loss orders, market orders, post-only, fill-or-kill

- The ability to open multiple trades, with trades that are executed instantaneously

IDEX is not a decentralized exchange (DEX) in the traditional sense, it is best described as a non-custodial or “hybrid-decentralized” exchange.

IDEX has been around since 2012, originally formed under the name AuroraDAO then rebranded to IDEX in 2019. IDEX saw a lot of success in 2019, experiencing more than double the transaction volume of the popular Cryptokitties platform and surpassed Ether Delta for the most DEX trades of all time. To this day, IDEX remains a solid platform, known and respected for lightning-fast, secure, peer-to-peer trading.

When AuroraDAO rebranded to IDEX, users were able to swap their AURA tokens for the IDEX token and the platform received an entire facelift.

Aurora Rebrand to IDEX Announcement

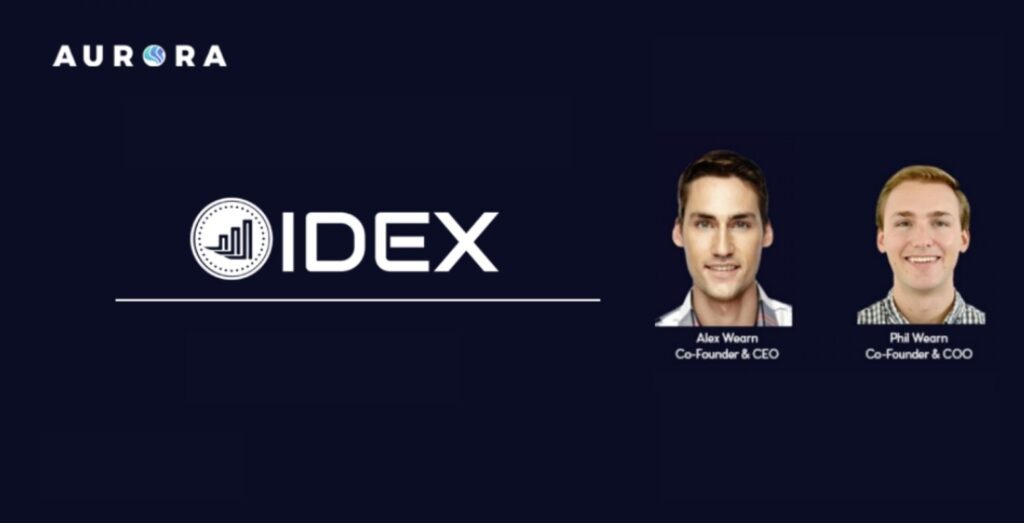

Aurora Rebrand to IDEX AnnouncementIDEX was founded and developed by Alex Wearn and Philip Wearn. Alex is the current CEO and has an impressive background working in software development, previously holding positions with the likes of Amazon, IBM, and Adobe.

Phil Wearn is the current COO and the former Co-founder of EtherEX. Phil has been building blockchain-based companies since the early days of Ethereum. While developing EtherEx, he identified a need for high-performance decentralized exchange protocols, which served as the bases for IDEX.

The Founders of IDEX

The Founders of IDEXThe Wearn brothers built IDEX with the mission of wanting to enable users to be able to access banking and financial tools and features for exchanging cryptocurrencies across multiple networks such as Ethereum, Binance’s BNB Chain, and more recently, Polkadot. Though it is important to note that the platform has decided to change direction, removing platform support on BNB and Polkadot, focusing primarily on perfecting the platform on Ethereum’s primary scaling solution Polygon.

That covers a bit about the background of the platform, now let’s take a look at what this platform has to offer.

IDEX Exchange Key Features

Before diving into the features, let’s look at what makes IDEX unique. I am sure you may have noticed that there are dozens of Uniswap clones out there that are essentially copy/paste platforms that fail to innovate in the space, so why does IDEX deserve your attention?

The majority of DEX platforms use an Automated Market Maker model to execute buy and sell orders. The IDEX exchange features order books with a centralized system for matching orders. Centralization within the IDEX system is achieved to ensure instant execution and fast processing for all off-chain transactions.

A Look at the Benefits of Combining Centralization and Decentralization. Image via IDEX

A Look at the Benefits of Combining Centralization and Decentralization. Image via IDEXOne of the biggest drawbacks likely noticed by anyone using a traditional DEX is the often slow trade settlement, highly volatile spreads, and frequent trade failures that waste gas fees.

IDEX boasts guaranteed execution of trades and the lowest latency of any DEX, thanks to the centralized counterpart. Due to its unique hybrid approach and the way exchange services are sourced, IDEX is the first decentralized exchange of this type with centralized systems in place that still offers full custodial ownership of assets for the user.

Zero Failed Trades. Impressive! Image via IDEX.

Zero Failed Trades. Impressive! Image via IDEX.Imagine if a centralized exchange (CEX) like Binance, which holds and has authority over all user funds, had a crypto baby with a decentralized exchange (DEX) like Uniswap that allows users to retain 100% control over their assets, that crypto baby would be IDEX.

Access to advanced order types, staking with automated rewards systems, and a fantastic user experience/user interface make IDEX a wonderful addition to the crypto industry, providing value to the ecosystem.

IDEX Trading Engine

The IDEX exchange utilizes an off-chain trading engine for trade execution. This benefit is two-fold:

- High-Performance- IDEX can process tens of thousands of orders per second with a latency of under 1 millisecond.

- Guaranteed Sequencing- Executing orders in the same order they are placed. This protects against front running and trade manipulations.

We can compare this to the issues experienced in typical DEXes such as:

- Low throughput- This is especially evident in Ethereum platforms that do not utilize layer 2 solutions.

- High Latency- Many layer 1 blockchains have slow settlement times for transactions, making them okay for swaps, but not suitable for high-frequency day trading.

- Non-deterministic ordering- Miners decide which transactions are included and in what order. This randomness and non-standardized unreliability also render many DEXes unsuitable for active traders.

After testing out the platform myself, it was quite evident that this is a high-performance exchange. Trading on IDEX feels more akin to trading on a high-performance centralized exchange such as Binance or OKX, but with the benefit of self-custody. 💪

For the Matching Engine, IDEX offers a central limit order book design that matches user orders based on price-time priority basis, similar to traditional and non-crypto trading exchanges. Limit orders are filled at the specified price, or better, with no risk of order collision or trade failures. The support for partial fills ensures seamless matching against multiple orders, making IDEX ideal for big money traders and those who are just throwing a few dollars worth of crypto around.

Here is an example from the IDEX API Docs that explains this:

- User A first places a limit buy order for 1 ETH at 210 USDC

- User B then places a limit sell order for 1 ETH at 200 USDC

If there are no other orders on the ETH-USDC order book, the matching engine fills user A’s and B’s orders for 1 ETH at 210 USDC. User A’s order was placed first and is waiting on the order book, while User B’s order crossed the spread and was able to be filled at a better price than what was selected.

Order Book

Combined with the trading engine is an off-chain order book. Another popular DeFi platform that uses an off-chain order book is dYdX.

Order books can be fully on-chain, like Solana’s Serum, fully off-chain, or a blend of both. The “chain” word is simply referring to what is being conducted on the blockchain network itself.

IDEX uses the combination to ensure minimized gas costs while maximizing the benefits of the trading engine. Orders on IDEX are represented by signed transactions from the user’s crypto wallet that include:

- The price

- Quantity

- Order-Type

- Originating wallet

- Nonce

- Traded assets

- Buy or sell information

These orders are passed through the trading engine where they are processed and orders are matched and executed as a trade when overlapping with existing liquidity.

Once orders match between parties, the trade is executed. Both traders’ balances update in real-time and subsequent trades can be placed immediately using the newly updated balances. The completed trade is sent to the network for settlement.

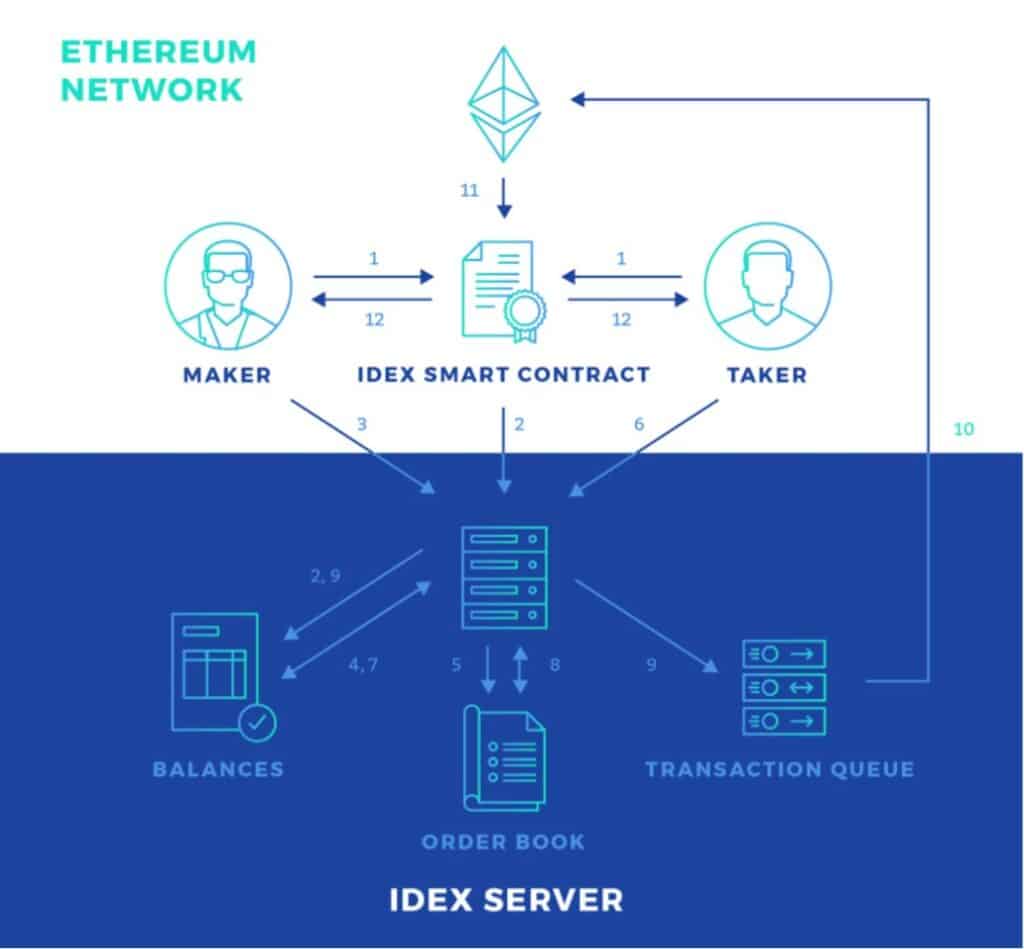

Here is an overview of IDEX’s on/off-chain architecture:

Image via medium/idex

Image via medium/idexOn-chain transactions only occur during settlement of a matched trade. Users are free to place and cancel orders as frequently as they like, without incurring additional network costs which is a real game-changer. This makes IDEX trading feel similar to trading on a centralized exchange, allowing traders to deploy more advanced market-making and trading strategies without having to waste unnecessary gas fees.

IDEX Hybrid Liquidity

IDEX Hybrid Liquidity (IDEX HL) is a next-generation method of combining a traditional order book and matching engine with the liquidity pools of an Automated Market Maker (AMM). Traders get matched against the best combination of limit orders and pool liquidity for the lowest-cost execution. This all happens on a seamless trading interface that works with lightning speed and high precision.

Some of the Benefits of IDEX.

Some of the Benefits of IDEX.IDEX HL is unique among the competition and provides one of the best places for active traders to trade in a non-custodial manner. This hybrid execution enables users to engage with liquidity pools in a way that has not been done before, leading to the following advantages:

- Tightest spreads in DeFi and sufficient liquidity at all times. This includes long-tail markets, all without the expense or complexity of a traditional market maker.

- Passive liquidity provision opportunities and returns for users. Traders can earn some passive income on the side of their trading activities.

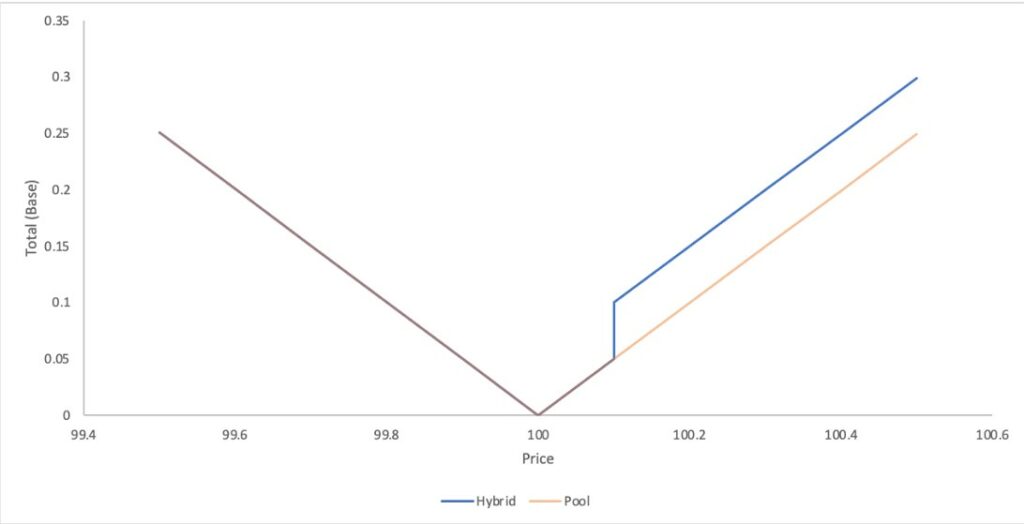

IDEX Pool Liquidity and Hybrid Liquidity Mechanics

Because IDEX isn’t your standard DEX, it is a good idea to take a look at how they approach pool liquidity. For pool liquidity to support central limit order book operations, IDEX needs to adhere to a constraint that ensures the pool is purely a liquidity supplier (maker) and never takes liquidity from the central limit order book (CLOB).

I am going to pull the following information directly from the IDEX Docs to make sure the information is accurate so we are all on the same page here.

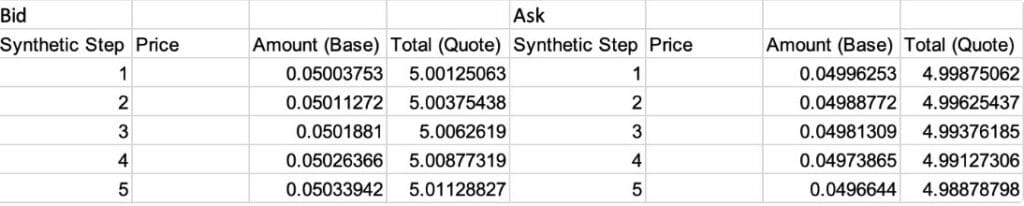

Representing an AMM pool on an order book comes with the following challenge: The pricing curve of the pool is continuous, while order books operate at discrete price levels. The only price for a liquidity pool is the nominal price (Quote/Base, or for an AMM: y/x), the starting price of the pool prior to any trades

Consider a liquidity pool with these parameters:

| Base Reserve | 100 |

| Quote Reserve | 10,000 |

| Pool (Nominal) Price | 100 |

| K | 1000000 |

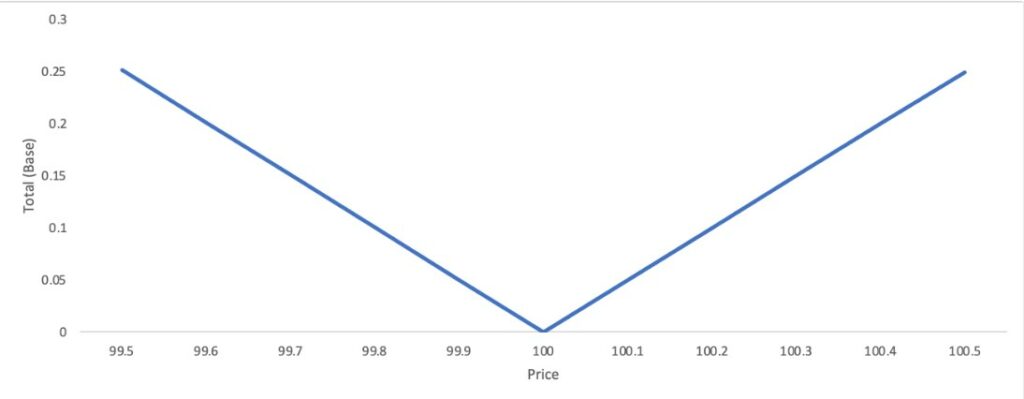

The liquidity in this pool is visualized on the following chart:

Image via docs.idex

Image via docs.idexNote that IDEX Hybrid Liquidity pool utilises the standard x*y=k AMM curve.

The amount of liquidity available from the pool, based on the reserves, can be calculated for any price level. IDEX HL selects synthetic price levels to display that are appropriate for the market and shows the available quantities.

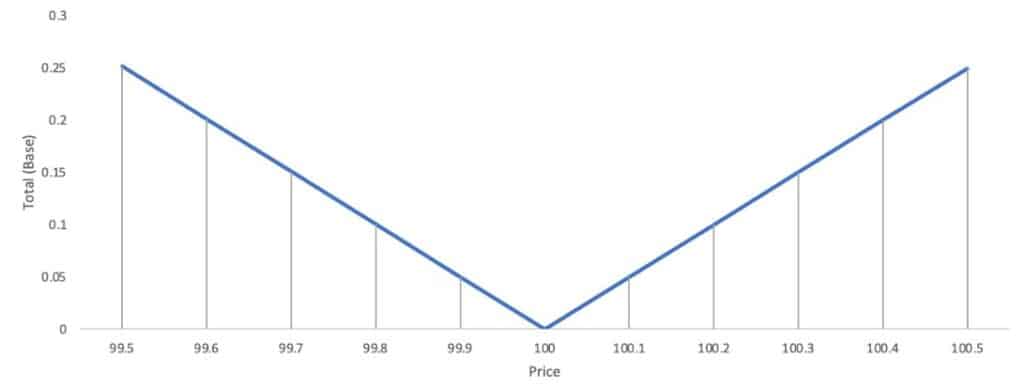

The graph below has synthetic price levels in increments of 10 basis points from the nominal price. It is important to note that these are not actual orders, as HL will fill taker orders with pool liquidity at any price.

Image via docs.idex

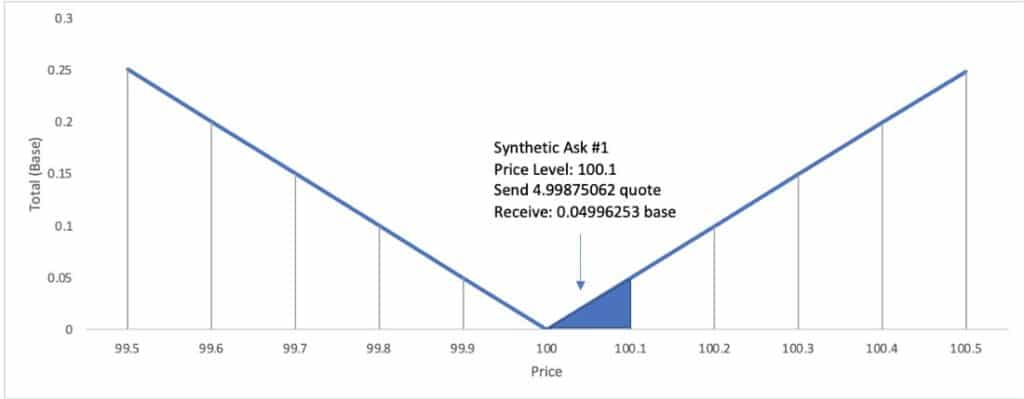

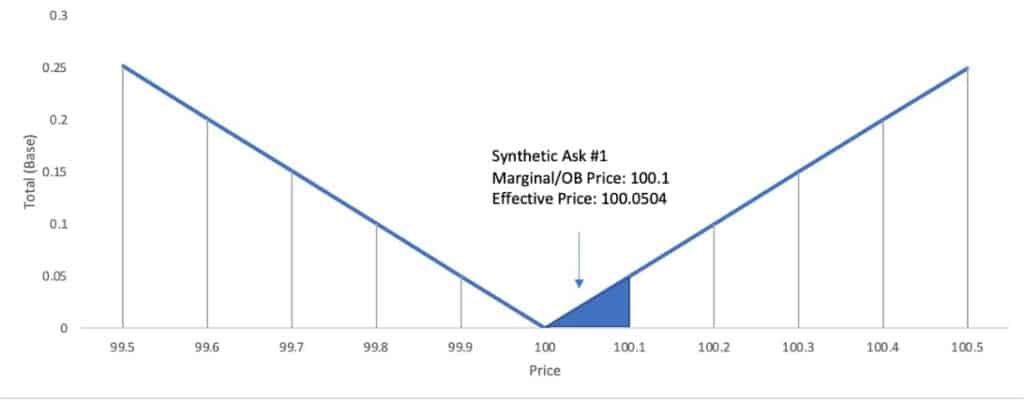

Image via docs.idexAs an order example, if a user exchanges 4.99875062 quote units, they will receive 0.04996253 base units in return, thus settling the pool price at 100.1.

Image via docs.idex

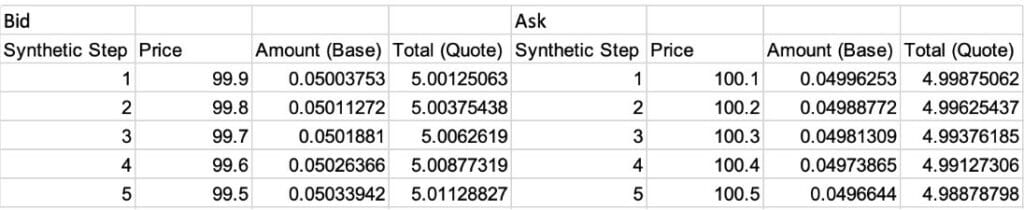

Image via docs.idexThe order book is always centred around the nominal price of the pool. On each side of the pool are both user-generated limit orders and synthetic price levels that represent the pooled liquidity as specific quantities. The chart shown above is displayed like this in table format as an example of how the trades would be understood by the trading engine in a way we can understand:

Image via docs.idex

Image via docs.idexSynthetic price levels used by IDEX HL are priced using the concept of “marginal pricing.” The marginal price of a pool is equal to the quote/base nominal price after a trade, aka once the pool “settles.”

This is the slippage-driven price of the last unit exchanged in the trade. In the example above, the marginal price is 100.1.

The marginal price is not the same as the effective price that the user pays for the liquidity. In this example, the liquidity between 100 and 100.1 has an effective price that is somewhere in the middle of the starting and ending nominal prices.

Here is a look at the marginal vs effective price in this scenario:

Image via docs.idex

Image via docs.idexThe orderbook for this scenario would appear as follows:

Image via docs.idex

Image via docs.idexNow we should explore how limit orders and pools are visualized.

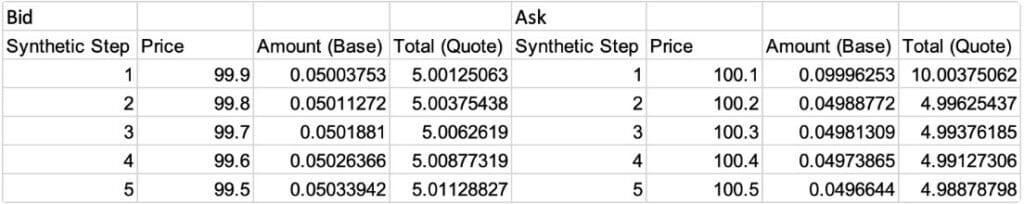

Order books contain additional limit orders that enhance the available liquidity. In this example, let's imagine a limit order ask for 0.05 base at a price of 100.1

Image via docs.idex

Image via docs.idexThe additional limit order is included in the quantity available at the synthetic price of 100.1

In the event that the limit order price is between synthetic price levels, the liquidity at the limit order price level includes both the limit order quantity and the pool liquidity from the previous synthetic price level to limit the order price.

The result of this additional limit order is visualized as a step function increase in the available liquidity at that price level.

Pool and Limit Order Liquidity. Image via docs. Idex

Pool and Limit Order Liquidity. Image via docs. IdexIt may be useful to provide some examples here of how IDEX’s Hybrid Liquidity model would settle trades compared to Pool and Limit only methods:

| Pool Only | Hybrid | Limit Only |

| Send 4.99875062 quote, receive 0.04996253 base | Send 10.0037506 quote, receive 0.09996253 base | The limit order liquidity at 100.1 consists of two limit orders of 0.025 base each |

| The order is filled entirely using AMM pool liquidity | Order is filled using the AMM pool liquidity up to the limit order at 100.1, and the full limit order at 100.1. Settlement happens on-chain in one transaction | Send 10.0037506, receive 0.09996253 base |

| The settlement occurs in two transactions, a hybrid settlement receiving 0.07496253 base, and a limit-only settlement receiving 0.025 base |

If you want to dive deeper into how this all works, I recommend checking out the IDEX docs. The team did an amazing job putting together their whitepaper and documentation, it was a great resource for this article.

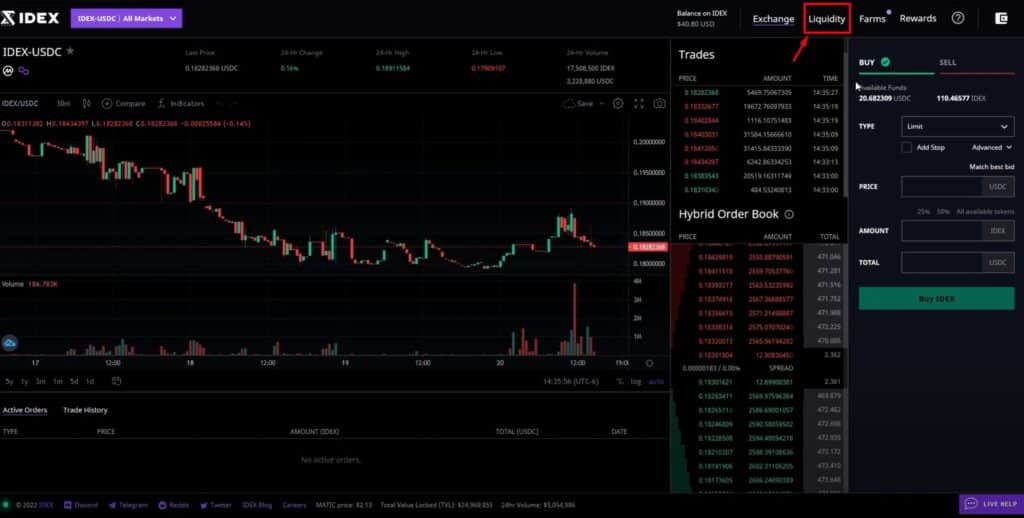

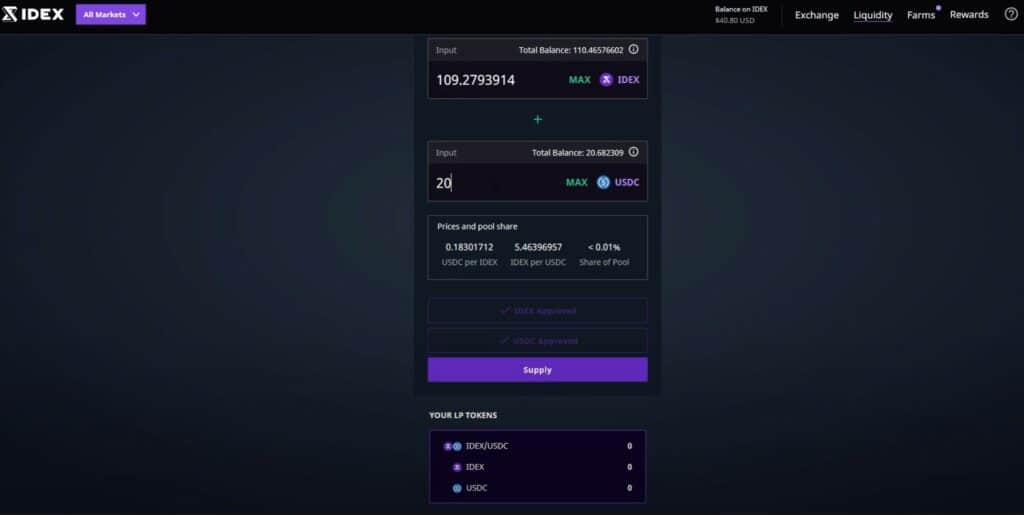

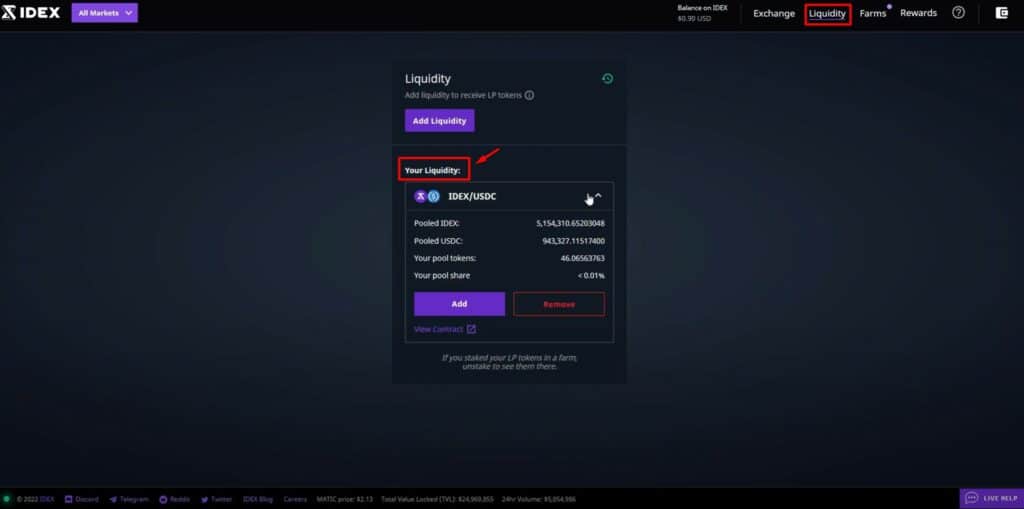

IDEX Liquidity Providers

Providing liquidity on IDEX is as standard as providing liquidity to any other AMM pool from a user perspective. LPs simply need to deposit equal amounts of each asset in the relevant pool and the smart contract pricing function does the rest in the back end.

How to access the Liquidity Provider Area

How to access the Liquidity Provider AreaIf you are new to the concept of smart contracts and why they are revolutionizing the world, we have a great article that answers the question: What is a Smart Contract?

Like other DEXes, liquidity providers on IDEX receive LP tokens that represent the tokens they used for providing liquidity to a pool. These tokens can be used throughout the ecosystem in liquidity mining programs, staked/farmed, or used as collateral.

A Look at Adding Liquidity to the IDEX/USDC Liquidity Pool.

A Look at Adding Liquidity to the IDEX/USDC Liquidity Pool.The IDEX Hybrid Liquidity design is unique from other AMMs in that instant, off-chain execution ensures that all arbitrage opportunities can be captured. The low settlement costs of Polygon reduce the fixed costs of arbitrage and enhances the volumes, capturing additional fees which profit the LPs.

Users who are familiar with the act of liquidity providing on platforms like Uniswap or QuickSwap will have no trouble doing the same here. Interestingly, if you are looking for a completely decentralized exchange that offers one-sided asset liquidity providing, I recommend checking out our DODO review.

Where IDEX outshines the traditional LP method that uses concentrated liquidity methods is that IDEX brings superior flexibility and functionality to both passive and active market makers in the following areas:

- Using concentrated liquidity to simulate limit order requires constant observation and monitoring as orders must be removed after execution in order to ultimately settle the trade.

- Placing and cancelling IDEX limit orders are free, management of concentrated liquidity position requires gas fees.

- Concentrated liquidity reveals a trader’s trading strategy to the public and is subject to all the mempool issues that affect platforms that use on-chain execution such as failed transactions and front running.

Once you have gone through the adding liquidity sequence, and approved the MetaMask transaction (or wallet of choice), you will be able to see all the pools that you have provided liquidity for under that same liquidity tab:

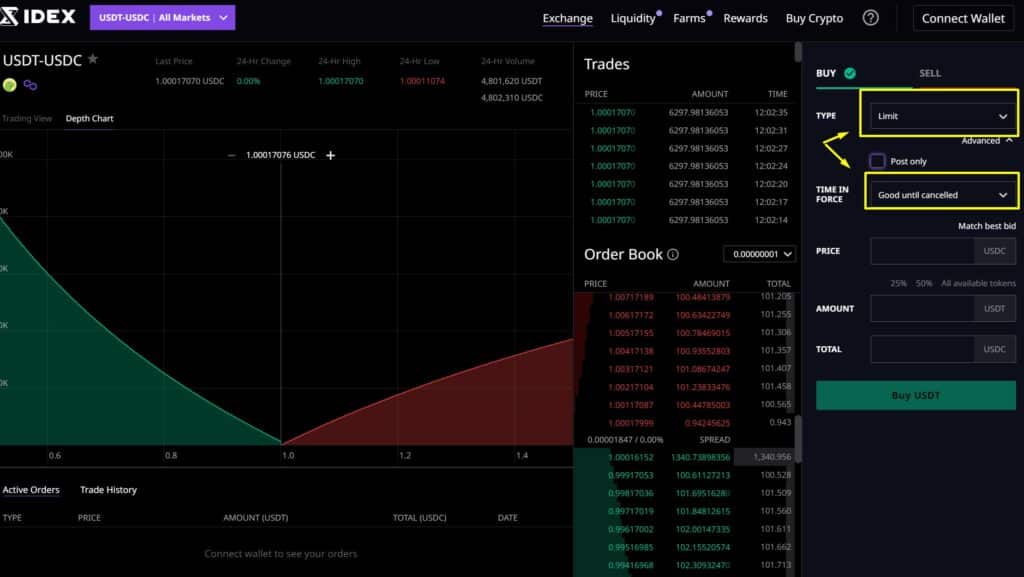

Order Types

Thanks to the high-performance trading engine and professional-grade order book execution, the IDEX exchange offers advanced order types that are typically only found on centralized exchanges.

IDEX trading supports the following order types:

- Market- A market order is a buy or sell order placed at the current price for a quantity selected by the trader

- Limit- A limit order is an order to buy or sell a quantity of an asset at or better than a specified price

- LimitMaker- a limit order that can only add liquidity to the order book. If a LimitMaker order price crosses the spread and matches with an existing order on the books, the order is rejected by the matching engine without generating any fills. LimitMaker orders are sometimes referred to as "post-only" orders in other systems.

- Stop-loss- A market order that is only processed by the matching engine when the most recent fill in a market crosses the specified stop price. This is used to close out a trade automatically in a loss and is set to protect the account balance from large losses.

- Take-profit- A market order that is only processed by the matching engine with the most recent fill in a market crosses the specified stop price. This is used to close out a trade automatically when a certain profit point is reached on a trade.

As for Time in Force rules, IDEX supports the following Time in Force policies:

- Good-Till-Cancelled (GTC)- Under GTC rules, a limit order that is set by a trader will remain until it is filled or cancelled.

- Immediate-Or-Cancel (IOC)- Limit orders with an IOC time in force only take liquidity from the order book, and never become a resting order. On execution, any portion of an IOC limit order that matches resting orders is filled, with the rest of the order being cancelled.

- Fill-Or-Kill (FOK)- FOK limit orders only take liquidity from an order book. The entire quantity must be matched immediately, or the order is rejected without being filled.

All these options can be located on the right-hand side of the trading interface:

IDEX Stake & Earn

What is better than earning passive income?

Trick question, nothing beats that!

IDEX staking enables traders, market makers, and users of IDEX to contribute to the ecosystem and contribute to the decentralization of the platform.

The 3 Staking Tiers on IDEX.

The 3 Staking Tiers on IDEX.Stakers can use IDEX tokens and run IDEXd staking software to operate a node. This can be quite lucrative for node operators and delegators. Staking provides the following benefits:

- Stakers earn 50% of all fees collected by the network for compensation for their work.

- Running a node contributes to the infrastructure, decentralization, security, and robustness of the platform.

Staking node operators maintain a real-time copy of the IDEX order book and other system data, providing compatible REST API endpoints to the public. This reduces the IDEX operational costs by offloading popular API operations, spreading the workload across anyone who is operating a node.

Maintaining a staking node does not require the use of bonds and offers stakers a riskless staking experience with no possibility of slashing. Of course, when I say “riskless,” I am only talking about slashing risks, as this is crypto, there are risks aplenty in this industry.

If all this talk about running a node is above your head and operating staking nodes isn’t your thing, not to worry. Users can also delegate their IDEX tokens to an existing node and still enjoy passive income from the trading fees generated on the platform.

Hummingbot

Trading bots can be an incredibly powerful tool used in the hands of a trader who knows how to use them, and are a must-have for arbitrage traders. But anytime I talk about trading bots I always feel the need to throw in this disclaimer:

Warning ⚠️: Over 90% of inexperienced traders who use automated trading bots lose money. It is important to understand that no automated trading strategy can be successfully deployed in all market conditions. Trading bots are static and rule-based, while markets are dynamic, volatile and unpredictable. Professional traders have different strategies to deploy in different market conditions, no one strategy, like the one followed by a trading bot, can be consistently profitable in all market conditions.

Similar to using leverage, trading bots are tools best used by experienced traders who know the appropriate market conditions in which to run a bot and have already developed profitable trading strategies.

You can learn more about crypto trading bots in our article: Top Crypto Bots?

IDEX has integrated with Hummingbot, an open-source toolbox for professional liquidity providers that helps them build market-making and arbitrage bots that can run on IDEX.

Image via hummingbot.io

Image via hummingbot.ioRunning the Hummingbot API on IDEX makes it easy to run a trading bot and capitalize on AMM arbitrage opportunities. The platform allows users to build and run customizable trading strategies and includes built-in strategies that are fully customizable to fit the needs of even the most advanced traders.

Arbitrage trading strategies are one of the standard configurations. Users can take advantage of this by running the bot on both IDEX and a secondary exchange like Binance. When the price changes on the secondary exchange, Hummingbot identifies the price change and executes an arbitrage strategy by buying on one exchange then selling on the other.

If you are interested in exploring trading bots further, I recommend checking out 3Commas, you can learn about them in our Top Trading Bots article.

IDEX Launches on Polygon

In July 2021, IDEX announced that they would be expanding to Ethereum’s most prominent layer 2 scaling solution Polygon.

Image via Twitter

Image via TwitterBy bringing IDEX to Polygon, settlement costs were 10,000-100,000x cheaper than on Ethereum, eliminating the cost trade-off that exists on Ethereum-based DEX protocols.

IDEX Fees

IDEX trading fees are straightforward and designed to keep things simple. Taker fees are set at a flat 0.25%, regardless of the type of liquidity being matched. Meanwhile, maker fees are currently at -0.005%, which means traders adding liquidity to the market by placing limit orders that don’t execute immediately receive a rebate as an incentive. Instead of paying a fee, these "makers" earn a small payment—0.005% of the trade value—when their order is filled.

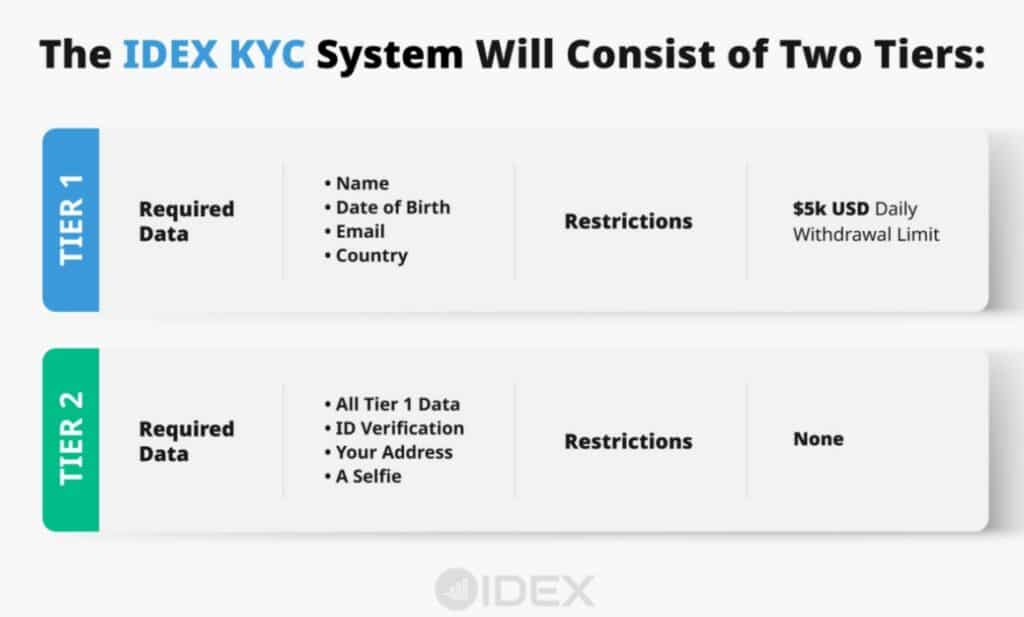

IDEX KYC and Account Verification

In 2019, IDEX announced that they would be introducing KYC and AML requirements for users, as well as blocking IP addresses from sanctioned countries and IP addresses from New York. This move caused quite the uproar in the crypto community as it was one of the first exchanges with decentralized aspects to start censoring what many felt should be a censorship-resistant industry.

Image via news.bitcoin.com

Image via news.bitcoin.comDue to the centralized aspect of IDEX, the need to play friendly and comply with rules and regulations was needed, as is the case with many centralized crypto platforms.

The team admitted in their KYC announcement that the platform had not yet met its full vision of creating an open and transparent, completely decentralized financial system. They went on to explain that regulation was a necessary requirement that IDEX needed to fulfil to achieve its goal.

IDEX has a two-tier verification system designed to keep things simple:

Image via medium/idex

Image via medium/idexThough KYC is required, IDEX still has the following benefits over fully centralized exchanges:

Non-custodial - The exchange does not hold or manage customer funds

Censorship Resistant - No single person or entity can shut down the exchange or prevent others from using it

Transparent - Open source and verifiable code

Auditable - All trades are written into the blockchain, and history is retained.

IDEX Security

The primary security behind the IDEX platform is the fact that users’ funds are secured via smart contracts on the Ethereum network, as opposed to relying on the fallible security of centralized exchange servers and procedures. Funds are never held by the platform, and therefore, there is no single wallet for hackers to exploit and drain the exchange, an issue we have seen with many centralized exchange hacks that resulted in millions in losses.

Smart Contracts Help Secure User Funds in a Trustless Manner. Image via Shutterstock

Smart Contracts Help Secure User Funds in a Trustless Manner. Image via ShutterstockUsers on IDEX retain full control over their private keys and the decentralized nature eliminates counterparty risk. The fact that trading occurs via Ethereum nodes provides an extra layer of encryption for users as well. These nodes are spread out across the world, decreasing the risk of attackers being able to bring down servers, or attack one central vector, making the IDEX exchange nearly impervious to attacks.

IDEX also connects to networks through the use of oracles, providing another layer of security. The network uses an automated system for incentivizing node operators. These node operators validate transactions and other operations on the network, and in return, are rewarded as they contribute to the network in integral ways. The IDEX utility token is used for securing the protocol through staking as node operators need to stake IDEX to operate the network.

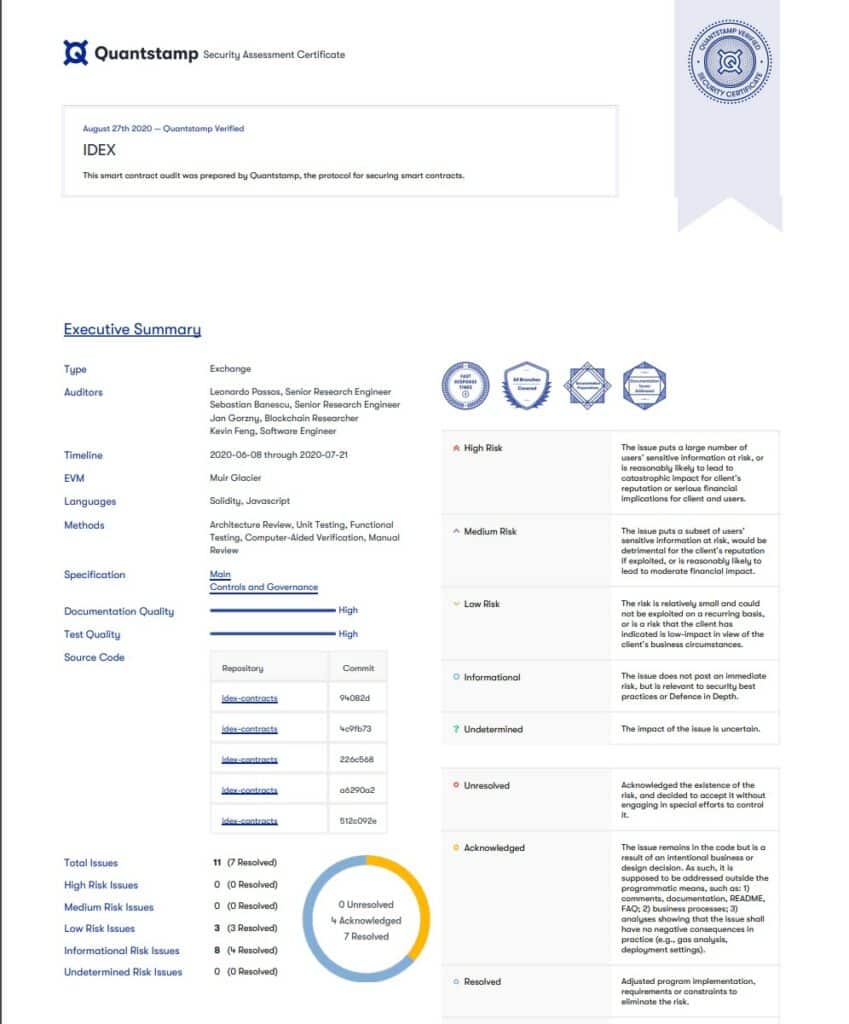

The IDEX platform has been audited by Quantstamp and Callisto, receiving passing security certificates. You can find those results on the IDEX Audit report.

Here is the summary page of the audit results:

Image via certificate.quantstamp

Image via certificate.quantstampBecause this is a non-custodial platform, it is important to understand that much of the safe use and security of this platform is the ultimate responsibility of the user. Good cyber security hygiene and responsible crypto use is important. You can learn more about that in the Security section of our DODO review where I cover some of the measures crypto users can take to interact with DeFi securely and link to some good resources.

One area for improvement here is that I would like to see more frequent audits by more companies. The Callisto audit is from 2019, the Quantstamp audit is from 2020, I could not find any recently completed audits. IDEX will be launching the version 4 upgrade in the near future, I personally would not be using the v4 iteration until I see that an audit has been performed on the updated platform.

For users who want to enhance the security of IDEX, Ledger hardware wallets integrate into the platform, increasing overall security and safety. Ledger is one of the world’s leading hardware wallets, you can learn more about Ledger wallets and even grab a discount code in our Ledger Nano X review.

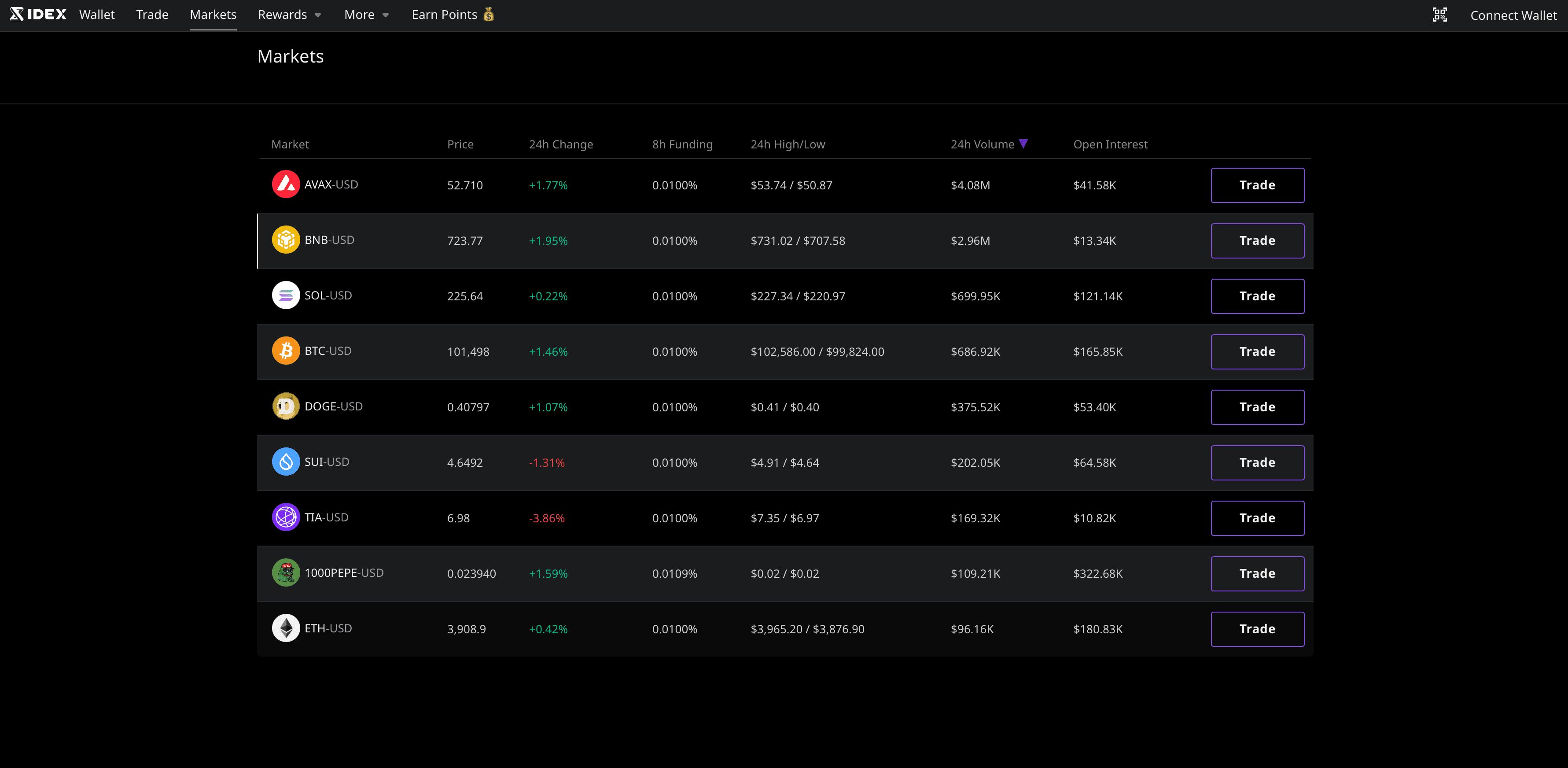

Cryptocurrencies Available on IDEX

IDEX currently offers 9 different trading pairs:

Image via Idex

Image via IdexAs you can see, IDEX’s offerings are mostly limited to large-cap cryptocurrencies. So, if you're looking to trade mid or small-cap altcoins, you’d be better off using exchanges like KuCoin, Bybit, or Binance.

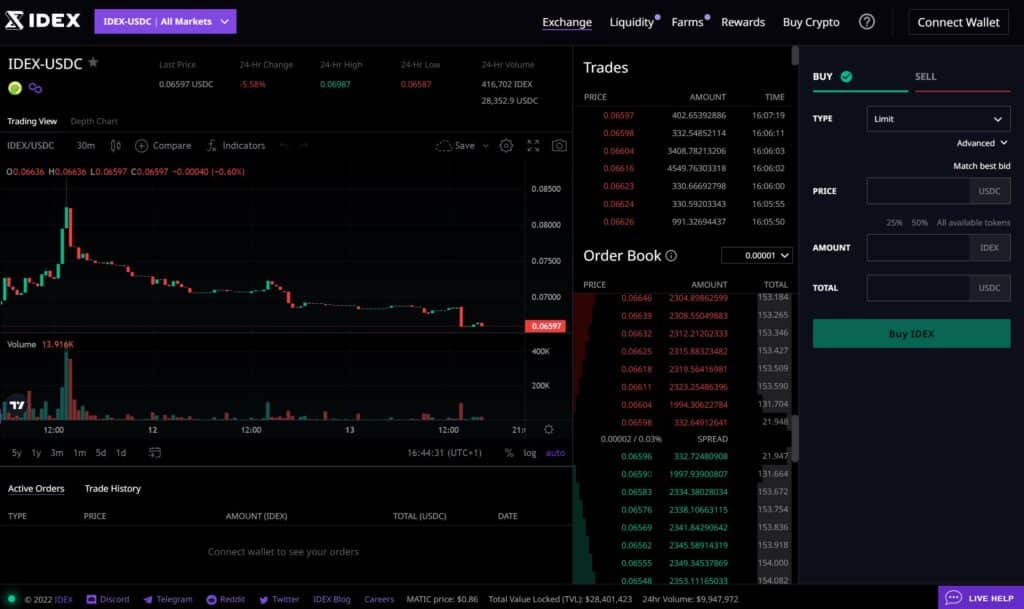

IDEX Exchange Platform Design and Usability

IDEX is a very well-designed and well-built platform. The UX/UI is a breeze to use and offers a good balance between functionality and simplicity.

A Look at the IDEX Trading Interface

A Look at the IDEX Trading InterfaceUsing IDEX feels a bit strange at first (in a good way) if you are used to only using pure DEXes and CEXes like I am. I found it interesting that IDEX is a hybrid with regards to centralized and non-centralized aspects on the back end, but also felt like a hybrid mix between a CEX and a DEX on the front end as well when trading.

The trading interface itself and platform navigation feel cleaner and more intuitive than most decentralized exchanges I’ve used. It felt just as high-grade and responsive, familiar in experience as to when I trade on Binance, and was not the clunky, slow interface that lacks advanced features that I have become used to when I access DEXes, creating a good blend between the two.

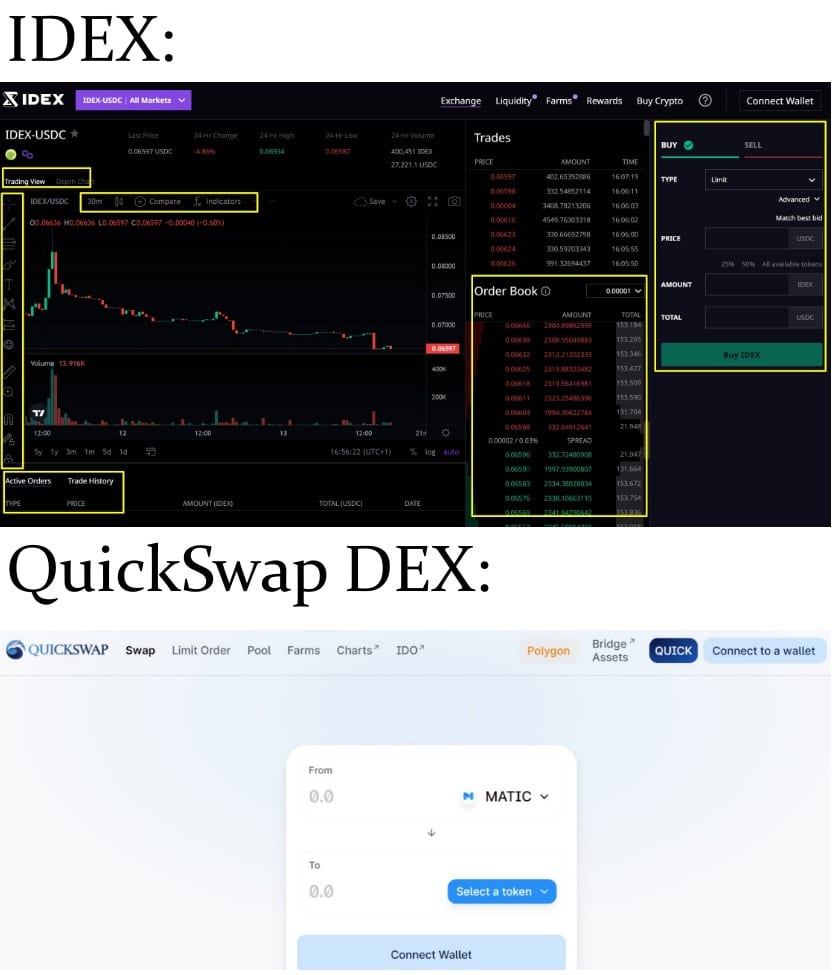

Of course, most DEXes are not suitable for active trading, as I’ve alluded to, so it is sort of like comparing apples to oranges as IDEX is not your standard DEX. IDEX features an order book, trading types, trade history, full charting functionality, and depth chart, vs the standard DEX, which is traditionally only used for swaps.

Here is a visual highlighting what I mean. All the options available on IDEX are highlighted in yellow, comparing the IDEX interface to a traditional DEX QuickSwap:

A Look at IDEX vs Traditional DEX QuickSwap

A Look at IDEX vs Traditional DEX QuickSwapThis is not to say that I am bashing QuickSwap or traditional DEXes at all, I love a good DEX and use them frequently. Most crypto users simply want to swap asset “X” for asset “Y” and have no need for a trading platform like IDEX. Traditional DEXes are perfect for that. They are beautifully simple in that regard.

Trading execution is flawless on IDEX, it is an absolute pleasure to trade on. Though IDEX feels similar to trading on a CEX, what felt a bit empty for me was that it lacks many of the features and products offered on centralized exchanges. This isn’t a knock on IDEX as they are not trying to compete in the CEX market.

So basically, you have trading that feels the same as a CEX in terms of functions and performance, but without the vast number of earn products and other features offered on platforms like Binance or OKX, but you can actually trade, making IDEX more suitable for traders than the majority of DEXes.

Overall, this platform is incredibly well designed. I like that the trading interface is powered by TradingView, the highest quality industry standard when it comes to charting platforms. Thanks to TradingView, IDEX is suitable for even the most hardcore technical analysis traders. IDEX traders can also swap to a Depth Chart if they find that useful:

If you are in the mood to enhance your trading and technical analysis skills, be sure to check out our article on how to perform TA.

If I am going to be really picky and just because I don’t want to give the platform too much praise, being able to switch between a light and dark mode would be nice. The trading interface modules are also not customizable, which is something that is supported on many trading platforms, so there is slight room for improvement.

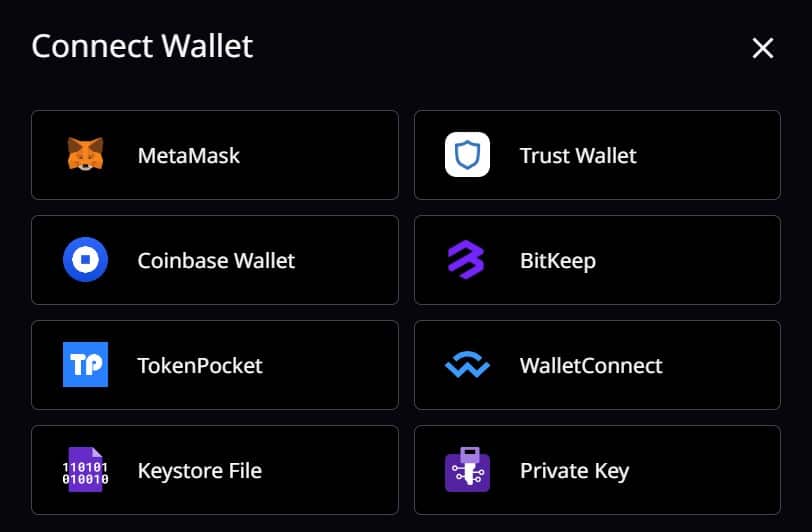

Deposits and Withdrawals at IDEX

Thanks to the partnership with Wyre, users can purchase crypto directly on the platform. The other method would be to deposit crypto from a wallet such as MetaMask. A Crypto wallet will need to be connected to the platform to trade.

MetaMask is the most common wallet used, but Trust Wallet and Coinbase Wallet, among others, are also supported. Users can also use the Wallet Connect function or create a new wallet on the platform.

Supported Wallets on IDEX.

Supported Wallets on IDEX.Withdrawals can only be done in crypto.

IDEX Token (IDEX)

IDEX is the primary utility token of the IDEX platform. IDEX can be staked and used by node operators and delegators to help secure and decentralize the IDEX platform.

IDEX token also incentivizes platform adoption and trading volume through IDEX trading rewards which are automatically distributed to users’ wallets based on their monthly trading volume.

Note that there is also the IDXM token which is a “membership” token, granting holders the ability to reduce their trading fees and/or increase trading rewards.

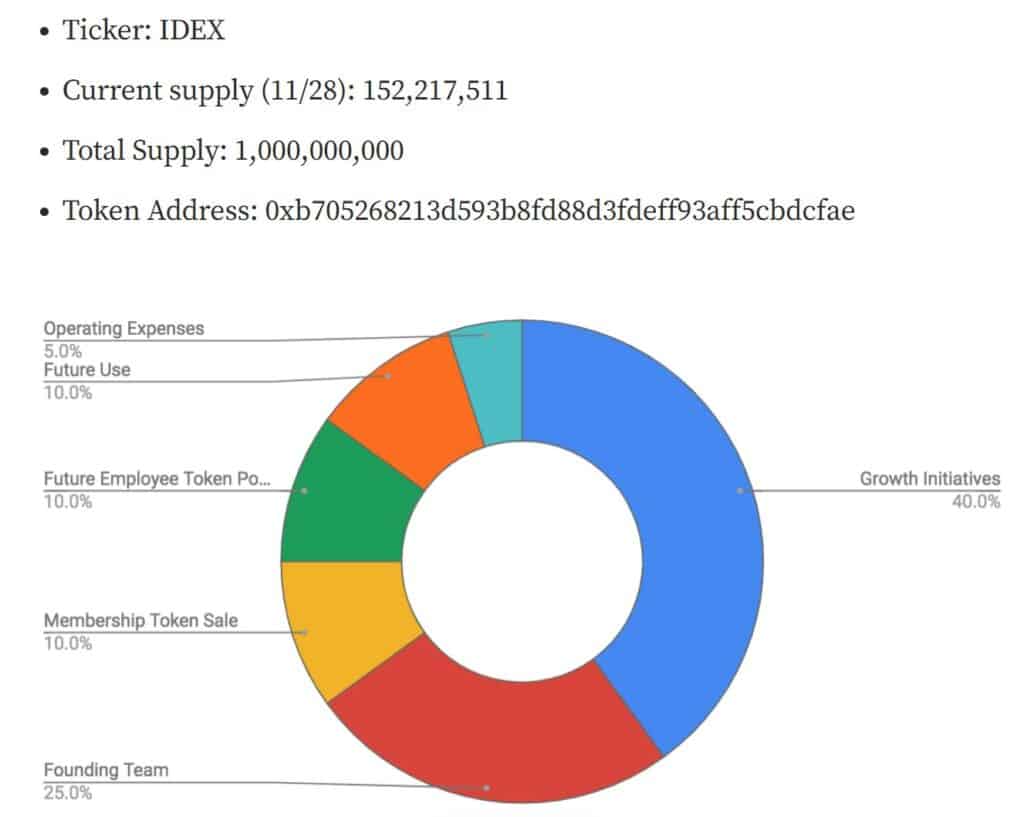

Here is a look at the IDEX token details and distribution:

Image via IDEX

Image via IDEXIDEX Customer Support

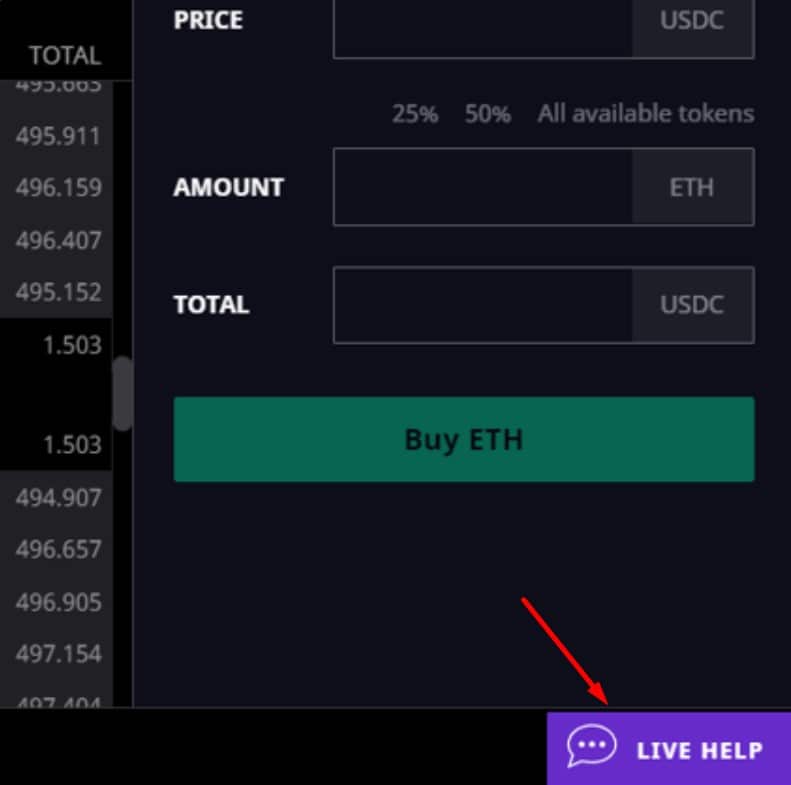

IDEX offers users live chat support directly within the platform via a live chat box in the bottom corner.

This is nice to see and a rarity within the DEX space, as these types of protocols aren’t typically known for live (or any) support. Many of the more popular DeFi platforms make up for the lack of support by having great communities on Discord or Telegram where users can ask questions and receive answers from fellow users or moderators.

I took a crack at testing the quality of support and the response times and was quite pleased. Over the span of a few days, I reached out using an alias and different IP addresses and was impressed that each question was responded to in under three minutes, and the support staff were knowledgeable and friendly. You can tell that the support team is not outsourced as they were well versed about crypto and understood the ins and outs of the platform.

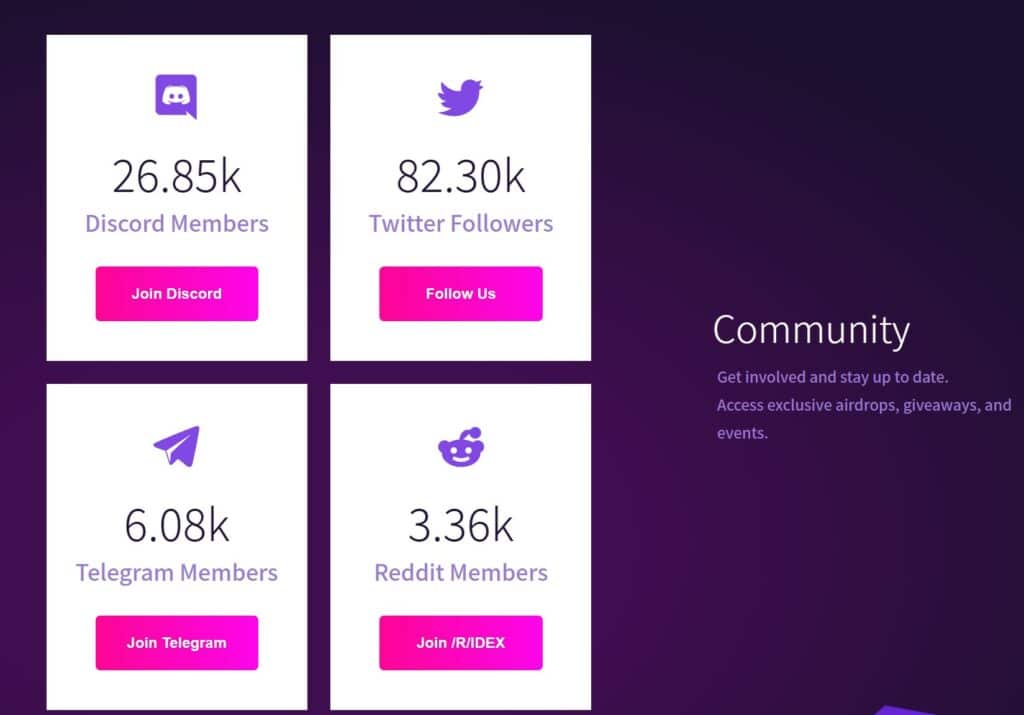

Here's a snapshot of the community metrics:

Image via IDEX

Image via IDEXHere are the socials handles if you want to follow the team or connect with the community:

IDEX also has a very well-populated help section and FAQ site with fantastic user guides which should be able to help address the majority of user questions and issues.

IDEX Top Benefits Reviewed

IDEX is one of the best platforms available for users who are looking for a non-custodial, secure platform for advanced crypto trading. This high-performance exchange delivers on what it promises and offers a low fee/gas-free place where traders can conduct advanced trading strategies and techniques.

The IDEX exchange is also a solid place for liquidity providers and arbitrage traders thanks to the friendly API integration with Hummingbot.

What can be Improved

It would be nice to see a more recent blockchain audit conducted for the protocol, I am hoping this will be done once v4 launches. It would also be nice to see IDEX expand outside of the Ethereum ecosystem and support more assets for trading.

It seems counter-intuitive to me that IDEX used to support operations on the Binance Chain and announced plans to launch on the Polkadot network, only to backtrack on those plans. Also, their decision to enforce KYC damaged the reputation of the platform and drove many users to find alternatives.

I am not saying this was a right or wrong decision, but to do a 180-degree turn after offering a KYC-free DeFi trading oasis, and then flip and go against DeFi ethos must have been a tough choice for the team to make. It would be nice to see the platform move towards being able to deliver on their original offering and hopefully someday create a fully decentralized platform without compromising performance, ditching the KYC and becoming a true DeFi gem.

IDEX Review Conclusion

IDEX is an impressive platform with a large and loyal user base. There are very few options out there for traders who want to actively trade in a self-custodial manner, I wouldn’t hesitate to recommend IDEX to any traders out there.

IDEX isn't resting on its laurels either and is only building and getting better. The project plans on launching perpetual swaps trading in the v4 iteration, an addition that is much needed in the crypto space. With its stellar performance, instantaneous trade executions, and access to all the advanced trading tools a trader needs, IDEX is likely to continue to be a real powerhouse in the crypto space.