There are a mind-boggling array of decentralised exchanges (DEXes) all over the crypto space nowadays. I remember, just 2 years ago, you could count the number of DEXes with one hand, at least the major ones. Gone are the days when all you need to pay attention to are Uniswap on Ethereum, PancakeSwap on BNB, and protocols like Aave or Compound Finance.

Nowadays, it seems like there is a DEX popping up every month on a blockchain that's nowhere near the top 100 on CoinGecko's list. If you regularly participate in DEXes as a liquidity provider, scouting for arbitrage opportunities, or simply looking for a platform to perform some permissionless swaps, I have the right tool for you.

Introduction to GeckoTerminal

GeckoTerminal is a DEX tracking tool that tracks real-time prices, trading, and transaction volume across more than 600 DEXes on 100+ networks. You can see liquidity for 1.7 million pools for 1.5 million tokens. All prices are updated in real-time and reflected on the platform as and when the action happens, saving you the hassle of hunting through numerous tabs and potentially missing out on some juicy opportunities.

What sets GeckoTerminal apart from its competitors is the sheer number of networks they track, which is more than any in the market. It has, hands down, the most extensive information on what's going on in the world of DEXes, along with what we feel is the most user-friendly UX/UI for easy navigation. In addition, the selection of languages available to choose from easily beats other competitors who often only have English as the default display with no options for a different language.

Without further ado, let's jump right in and check out all the goodies on offer in GeckoTerminal. This is a great consideration as one of the top go-to tools for any degen trader or anyone interested in analyzing the world of decentralized exchanges.

Getting Started with GeckoTerminal

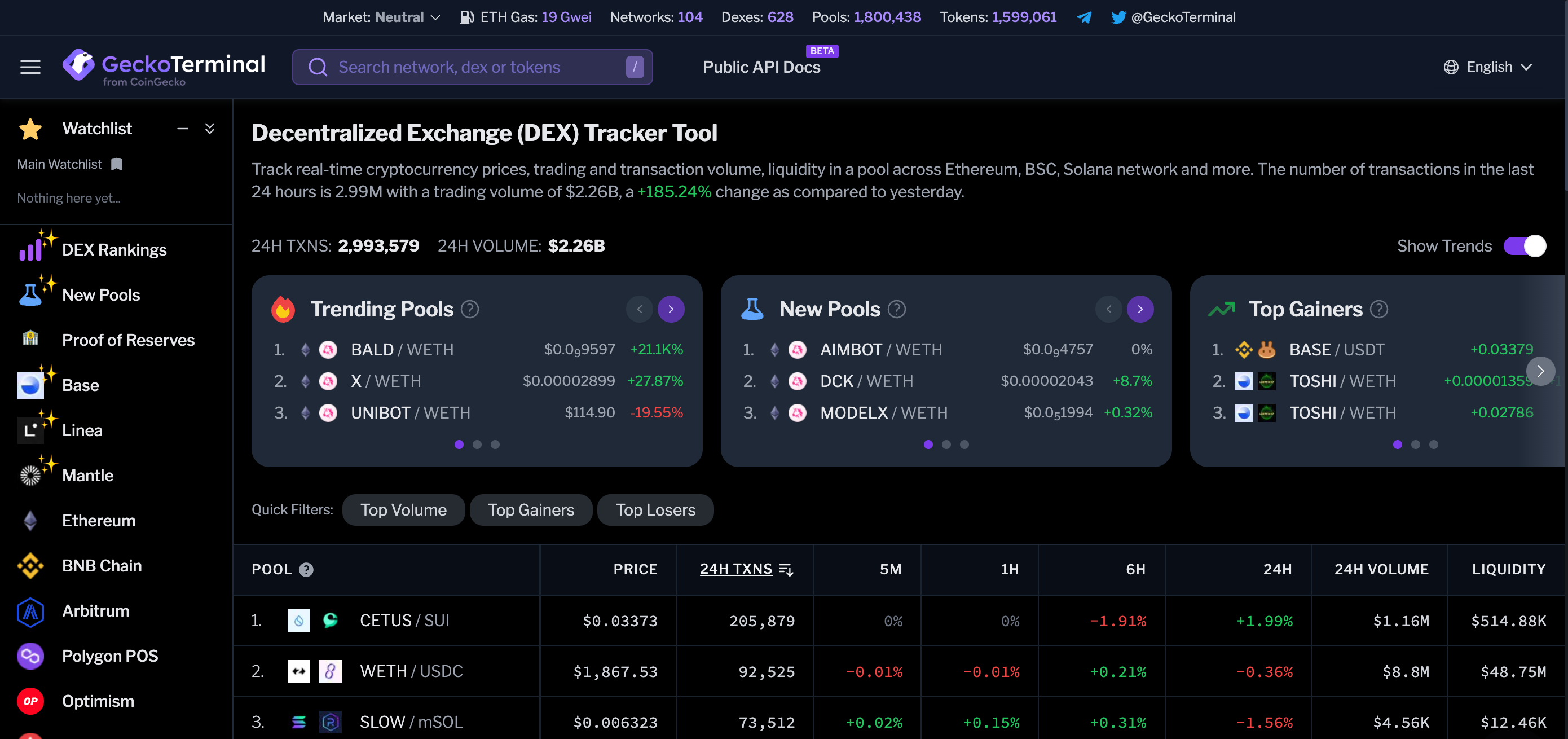

The first thing that hit me (and probably most users) is that there is A LOT of information on-screen. In the midst of the dazzling array of figures, my attention is drawn to the card-like slots near the top of the screen. These are the “Trends” that can be turned on and off by toggling the “Show Trend” button on the far right side of the screen.

Plenty of Information to Keep the Nerdiest Data Lovers Happy in GeckoTerminal

Plenty of Information to Keep the Nerdiest Data Lovers Happy in GeckoTerminalAll the way at the top are the overall metrics of GeckoTerminal showing what they track. If you have something specific in mind, the search bar is handily located at the top next to the logo, followed by the Public API documentation if that's what you're looking for.

On the left side of the screen is a list of blockchain networks supported by GeckoTerminal. You can see all the liquidity pools associated with that network by clicking on it. Other functionality of the platform is available here too. The rest of the page shows the list of liquidity pools across all the networks sorted by transactions in the last 24 hours by default. Clicking on any of the headings shows that column in ascending or descending order. If you'd like to hide the left-side panel, click on the three bars next to the logo.

Alright, enough of the main page, let's go exploring to find more cool stuff!

GeckoTerminal Features and Functions

Trend Cards

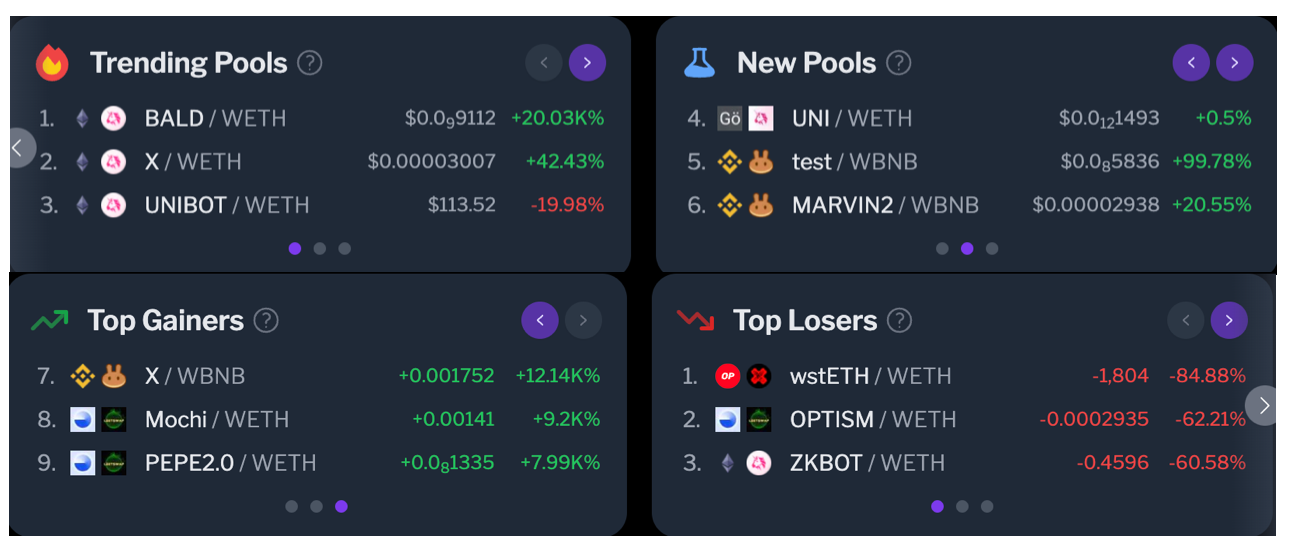

Trend cards are the ones that are at the top part of the page as mentioned earlier. I find these helpful because I can quickly assess all the most important information about the state of the market. Here's a closer look at these trends:

The Latest Trends in the World of DEXes. Image via GeckoTerminal

The Latest Trends in the World of DEXes. Image via GeckoTerminalEach card has 9 top assets listed that can be viewed by scrolling either to the left or right. The full list of Top Gainers and Losers is easily available on the main page. Clicking on the Trending Pools and New Pools will bring you to a new page for the complete list. These pools are sourced across all the networks tracked by GeckoTerminal.

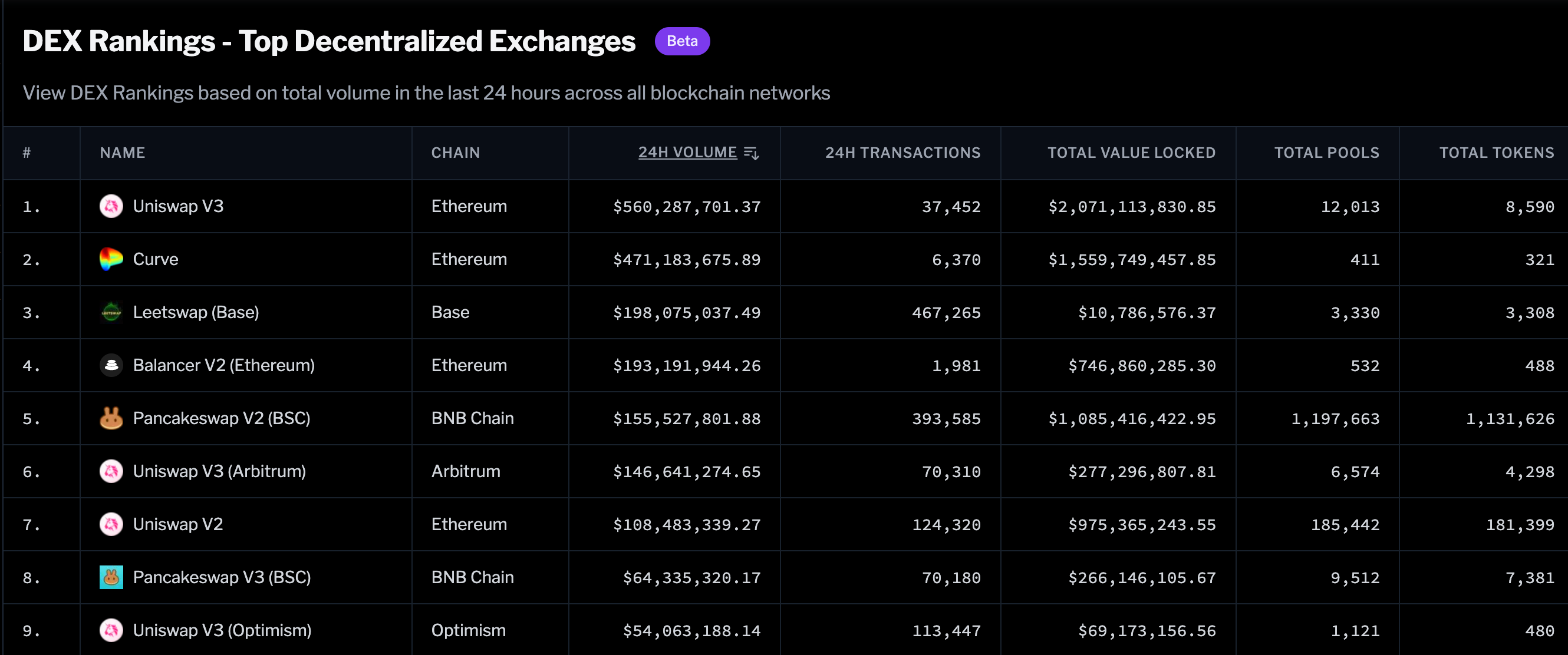

Get the Latest Scoop on the Hottest Liquidity Pools in DeFi from GeckoTerminal

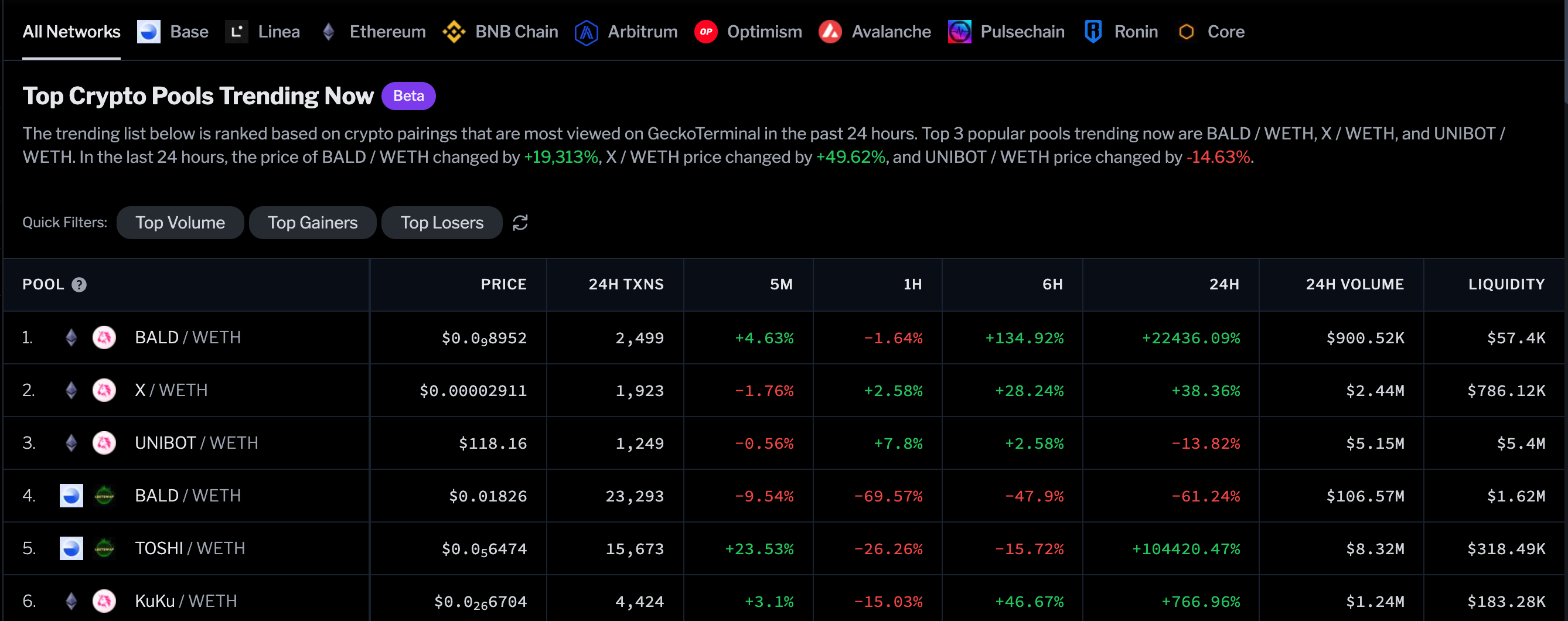

Get the Latest Scoop on the Hottest Liquidity Pools in DeFi from GeckoTerminalDEX Rankings

Here is where you can see how your favorite DEX stacks up against its competitors in the market. As always, click on each column heading to sort the data into either ascending or descending order. Doing this also changes the rankings displayed on the page. This information is updated every 24hours, as you can see from the timestamps in the page.

Bird's eye view of the top DEXes in the market brought to you by GeckoTerminal

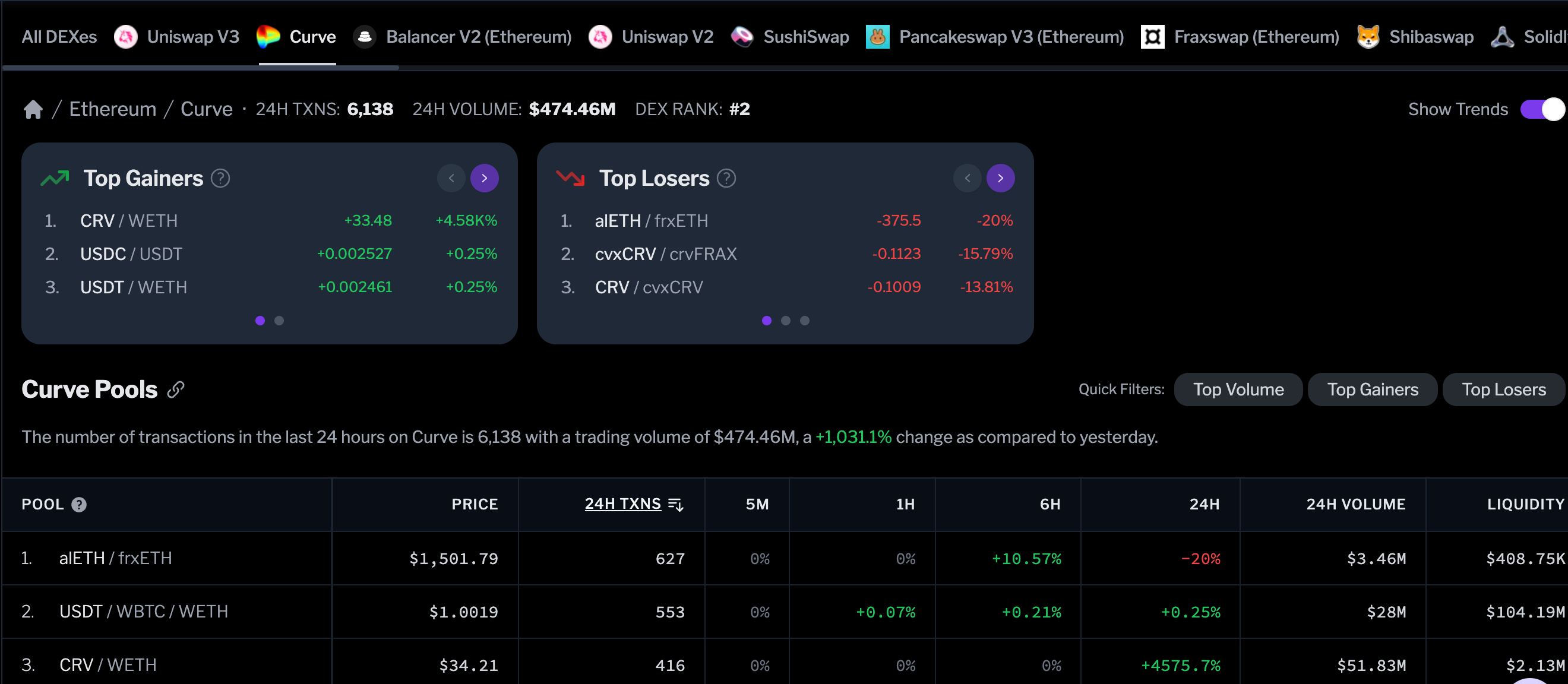

Bird's eye view of the top DEXes in the market brought to you by GeckoTerminalClick on the DEX you're interested in to find out more about the pools that are listed in it. The Top Gainers and Losers for that DEX are also listed and can be toggled off if needed. Note that not all DEXes will have these trend cards.

All the Liquidity Pools for This DEX are Listed Here for Easy Reference. Image via GeckoTerminal.

All the Liquidity Pools for This DEX are Listed Here for Easy Reference. Image via GeckoTerminal.Liquidity Pool

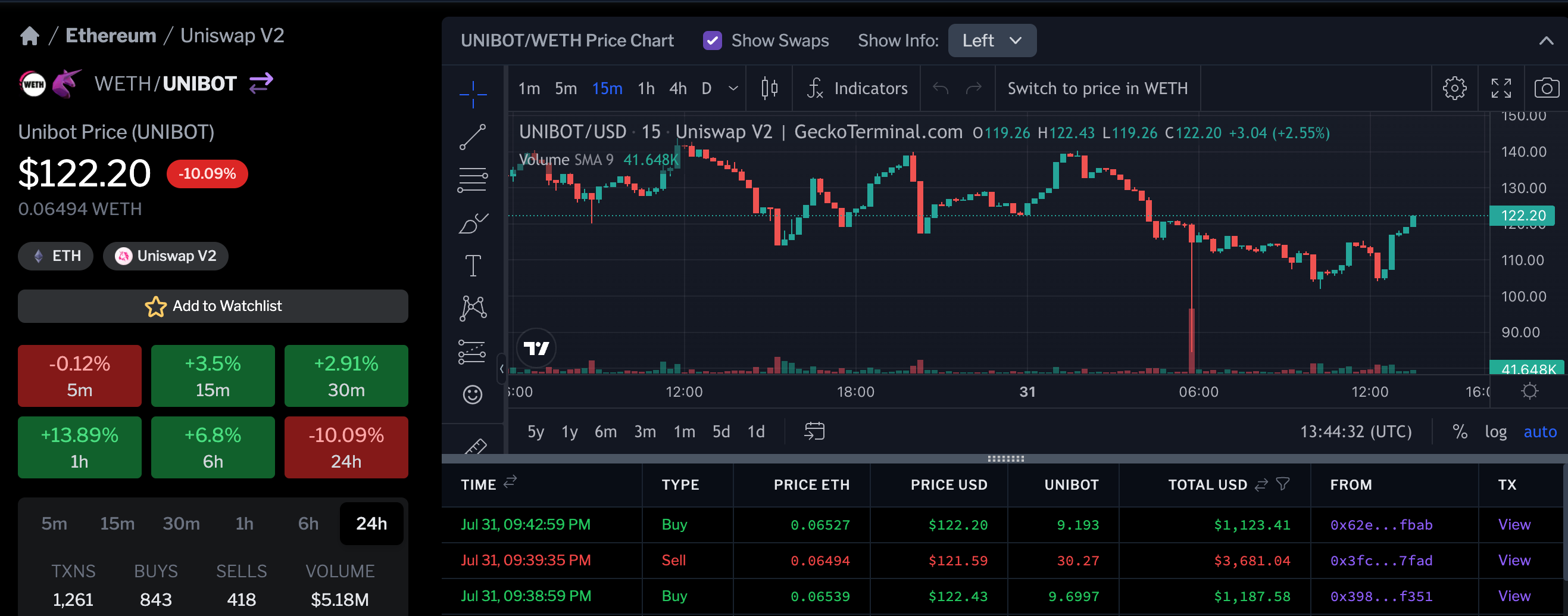

It's all well and good that we can have macro data on our hands. However, the devil is in the details and it's time to take a hard look at the information available for a single pool. This is the single smallest block of information unit. GeckoTerminal does not disappoint as all the relevant information you might want to know about a liquidity pool is right here. We'll look at it section by section.

The price of the token, the candlestick chart (embedded from TradingView), and the pool's performance are the first pieces of information to greet you. Within the chart, you can switch denominations and timeframes. Further up, you can toggle the Show Info button for placement of the performance info (or to hide it completely).

Feel Free to Customise This Section According to Your Preference. Image via GeckoTerminal.

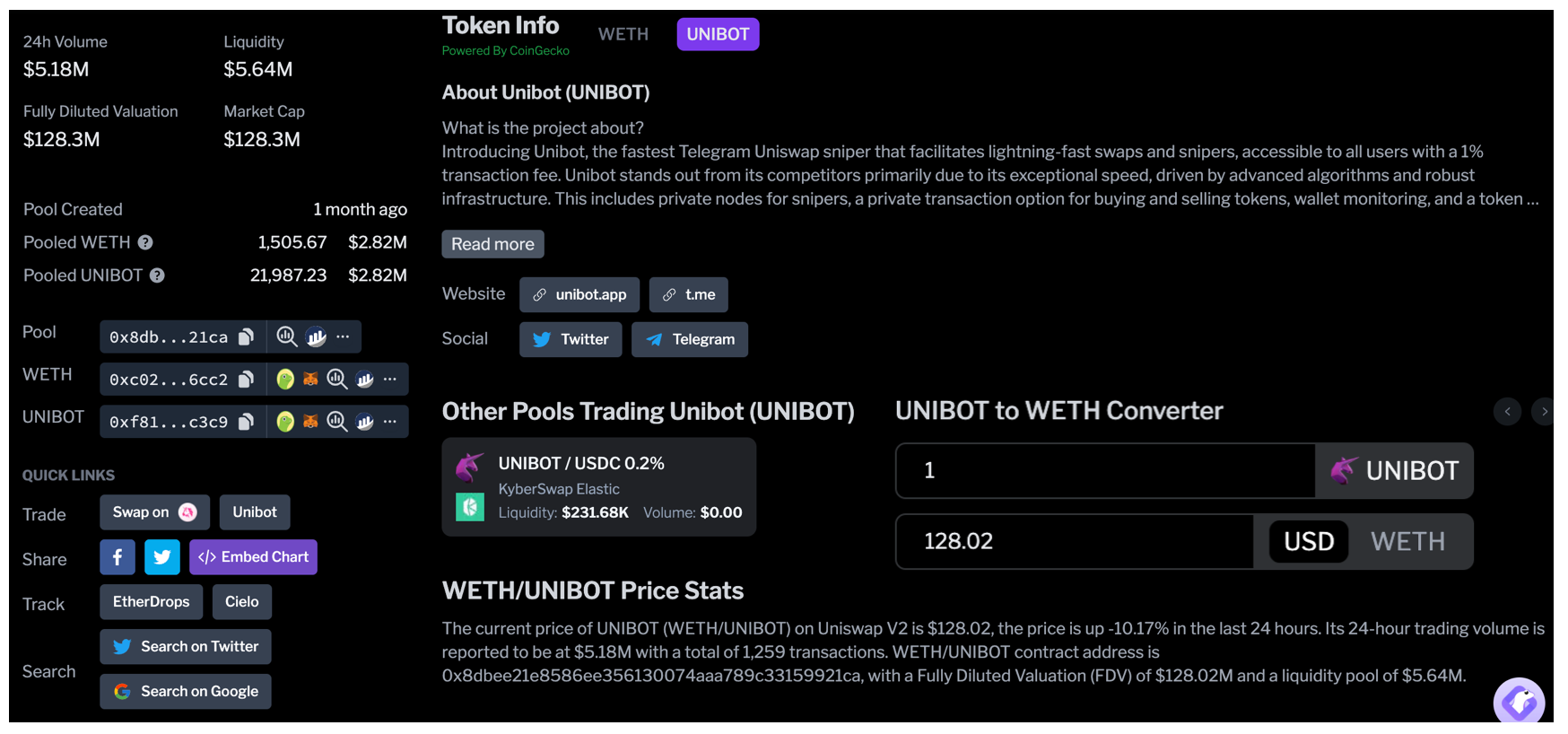

Feel Free to Customise This Section According to Your Preference. Image via GeckoTerminal.Scrolling down further, there's a unit converter handy for making quick calculations between the liquidity pair or with USD. Switch between the token pair to see info pertinent to each token. Information about the pool is on the left side of the page. There is also an opportunity to do some DYOR by clicking on the Search links to search on Twitter and Google to find out more or get the latest news. Continue scrolling to get some FAQ type of questions related to the pool. These questions are applicable to all pools but the answers vary according to the pool selected.

The First Port-of-Call for the Lowdown on a Liquidity Pool. Image via GeckoTerminal

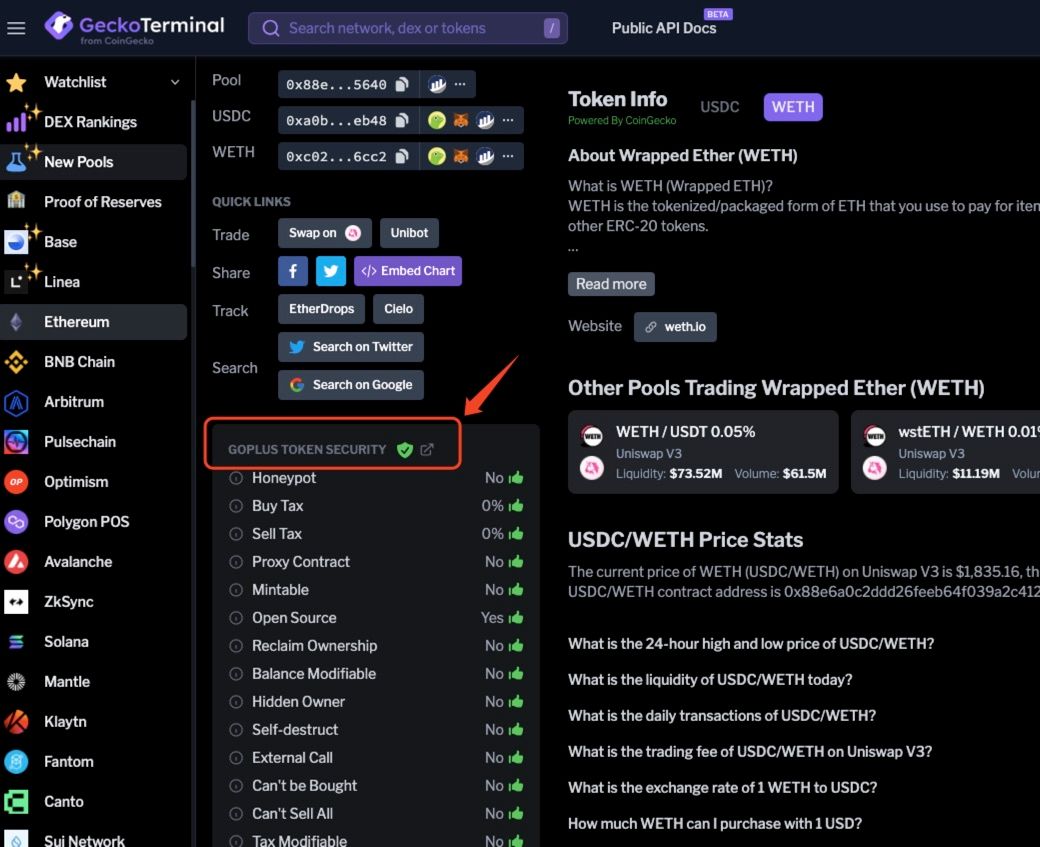

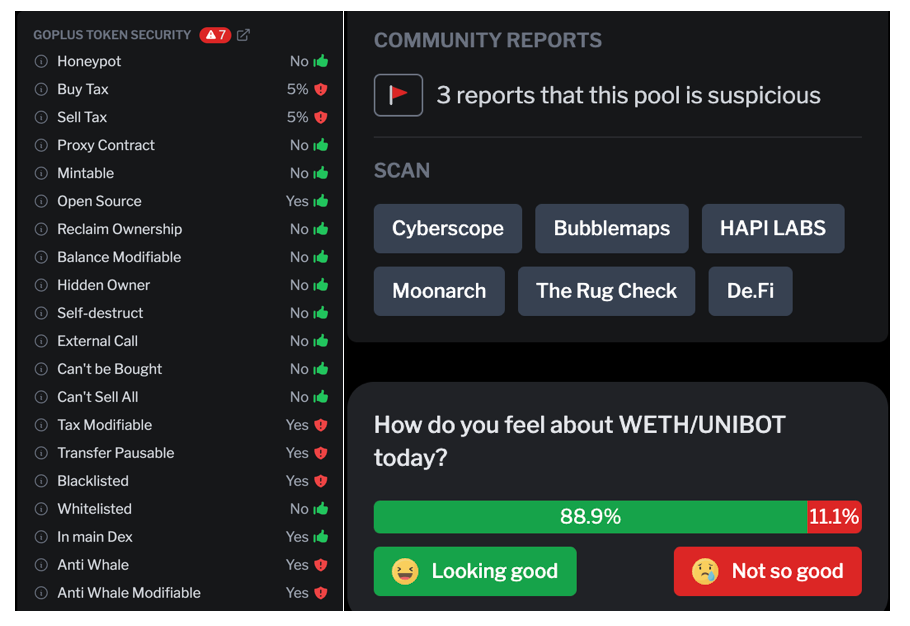

The First Port-of-Call for the Lowdown on a Liquidity Pool. Image via GeckoTerminalOne main concern for providers is the safety of the pool. Security is a dominant concern as we have all heard of pools getting rugged. Saving the best for last, the GeckoTerminal team established a partnership with GoPlus Security to offer an amazing checklist and rate them as good (green) or a red flag (red). Hover over the info icon next to each item and see a brief description to help you understand what you're looking at. This list is a great starting point to evaluate whether the pool is reliable enough for you to put some funds in or borrow from.

Go Plus Token Security Rating. Image via GeckoTerminal

Go Plus Token Security Rating. Image via GeckoTerminalWe also recommend that you do some research on the GoPlus project to assure yourself the integrity of the data they provide prior to giving them your trust.

Users can also file a report if they think there is something suspicious about the pool. Further security checks can be found by clicking on the links in the Scan section which will bring you to other partners that provide their own assessment of the pool's safety. Just for interest's sake, you can also click on the impromptu survey on your feelings about the pool today.

Verify the Security of a Liquidity Pool by Doing all the Necessary Checks. Image via GeckoTerminal

Verify the Security of a Liquidity Pool by Doing all the Necessary Checks. Image via GeckoTerminalProof of Reserves

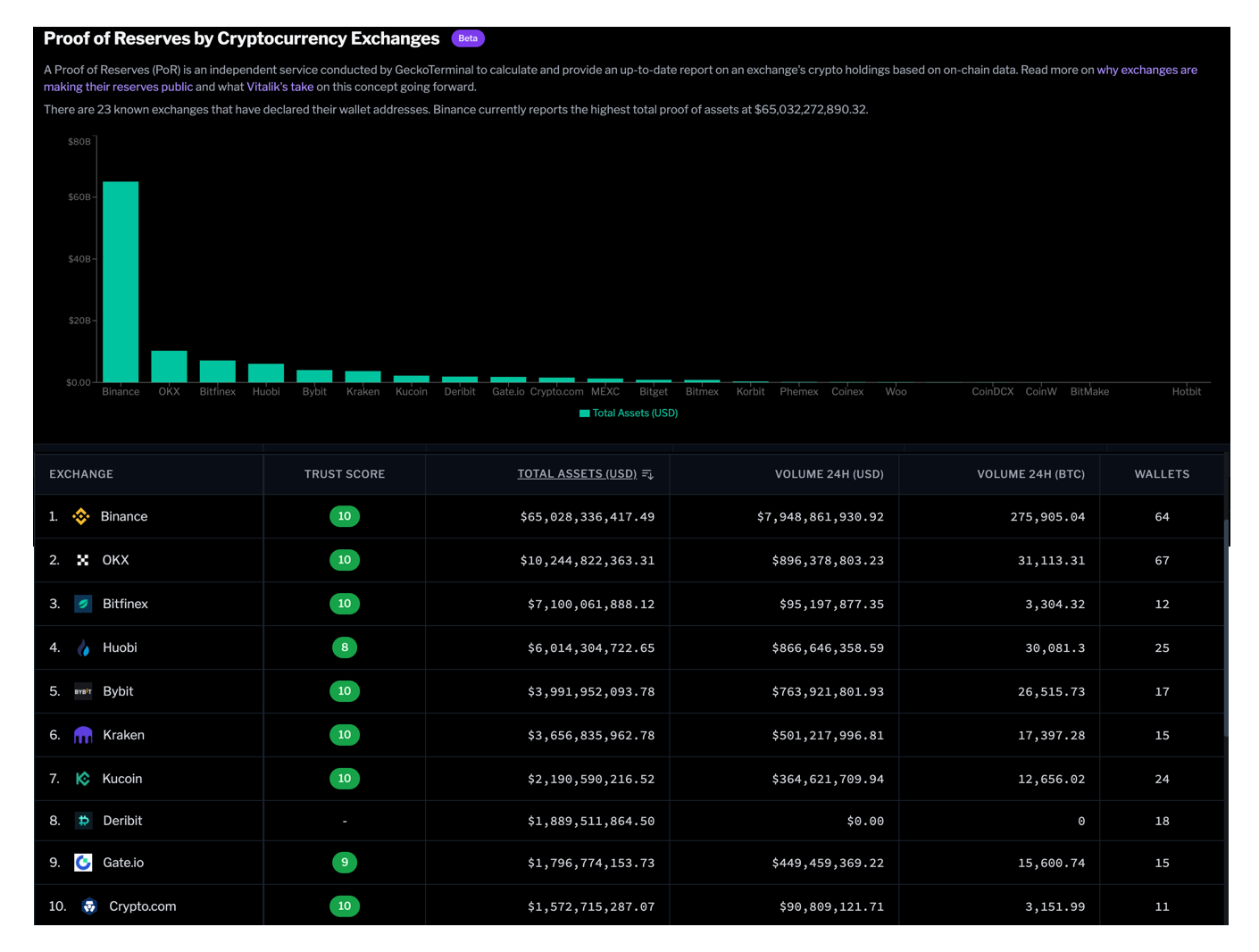

Despite being a tracker tool for DEXes, CEXes aren't left behind either as shown with the Proof of Reserves section. Top CEXes are displayed with their Trust Scores, total assets (USD) 24H trading volume in USD and BTC plus all known public wallets. Trust Score is a metric used by CoinGecko to rate the trustworthiness of a CEX. If you'd like to find out more about this, be sure to check out our CoinGecko article for the methodology behind the calculation.

One point of interest is that the 24H volume refers to the spot trading volume of all users within that exchange, displayed in both USD and BTC for easy reference. This is calculated as: total spot trading volume / price of BTC.

A One-Page Overview of Reputable CEXes in One Place, Courtesy of GeckoTerminal

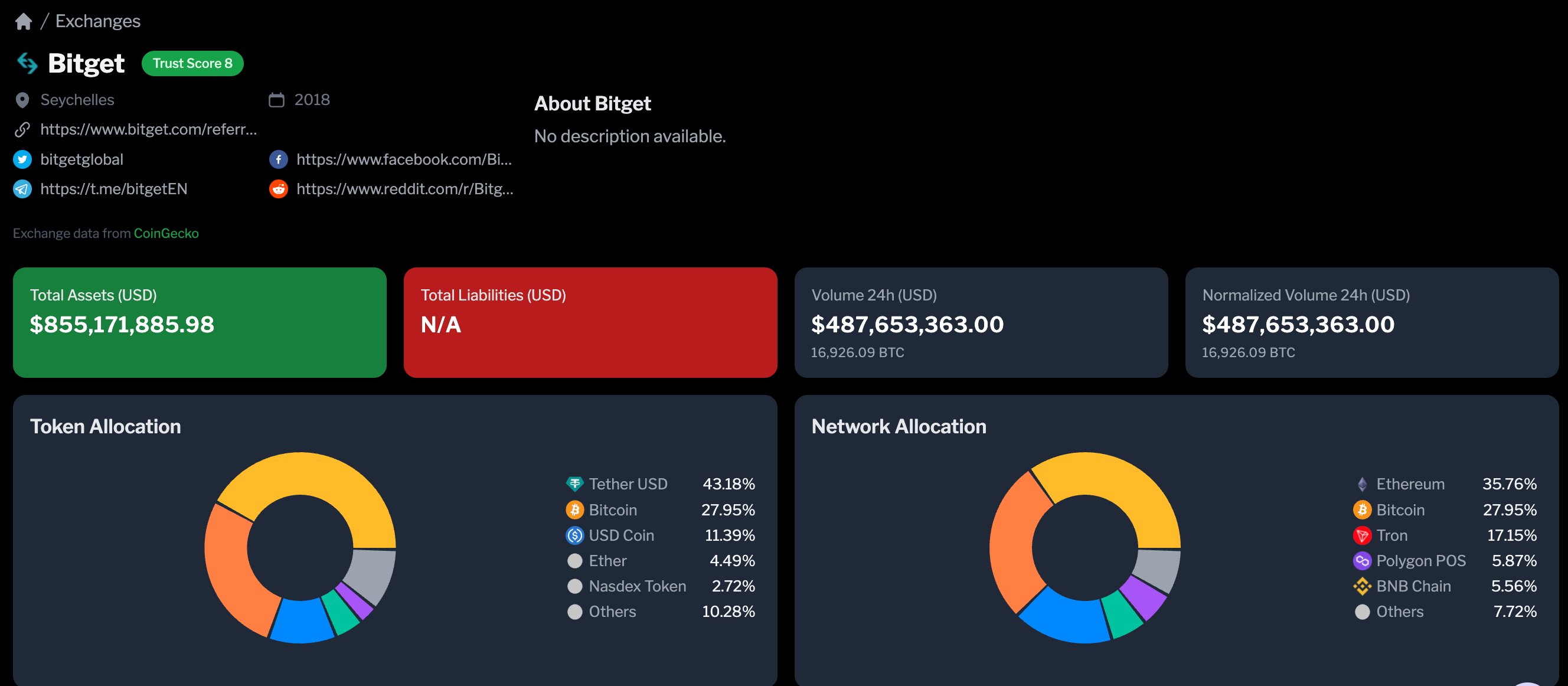

A One-Page Overview of Reputable CEXes in One Place, Courtesy of GeckoTerminalSelecting any CEX allows you to drill down further for a closer look. The key information that pops up at you is total assets and liabilities (if available), followed by the token and network allocation. Note that these figures pertain to the reserves held by the exchange, not all the tokens. Taking Bitget as an example, their reserves are mainly in USDT followed by Bitcoin and USDC. A sizeable chunk of the tokens are on the Ethereum network, followed by Bitcoin and Tron. The rest are in single digits.

The Type and Location of Reserves are Clearly Outlined. Image via GeckoTerminal

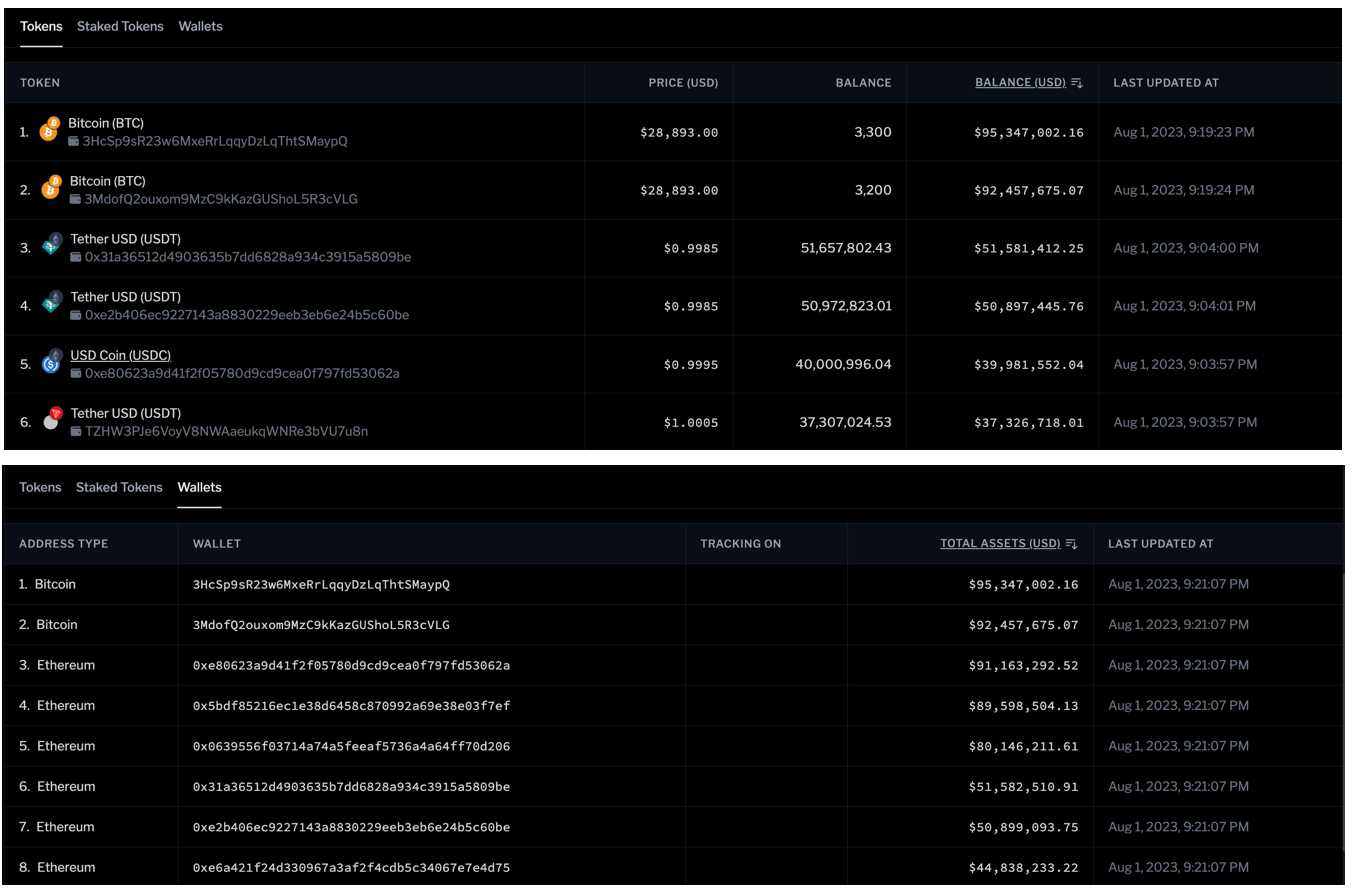

The Type and Location of Reserves are Clearly Outlined. Image via GeckoTerminalThe next section shows the tokens themselves and the wallets associated with the exchange's reserves plus any staked tokens that are part of the reserve.

More Data for Data Lovers to Feast Their Eyes On. Image via GeckoTerminal

More Data for Data Lovers to Feast Their Eyes On. Image via GeckoTerminalUsing GeckoTerminal has become a part of our analysis when conducting our research in determining the safety and solvency of the Top Centralized Crypto Exchanges.

Customizing GeckoTerminal

Make the platform more personable for you with the Watchlist. All you have to do is click on the star icon next to a liquidity pool to add them to your list. You can create multiple watchlists to keep track of the different pools you may have your eye on.

One other neat feature of this page is the ability to change the display language to a non-English one. Currently, GeckoTerminal offers a total of 17 languages as options such as English, Chinese (both Simplified and Traditional), Indonesian, Turkish, and Dutch to name a few. Compared to other DEX tracking tools that only support English, this is the most user-friendly feature for non-English users. It also sends out a strong signal about the user base of the platform and/or the regions it plans to conquer.

Multi-Protocol Support

We've mentioned earlier how to drill down to a DEX for a closer look at the exchange. Let's turn our focus to just a few of the networks themselves that the DEXes run on and see what else we can discover. This is just a small sample of networks that are tracked by GeckoTerminal.

Ethereum

As the grandfather of smart-contract networks, Ethereum features the most DEXes of any blockchain. Most well-known DEXes in crypto land probably started off on Ethereum before branching out to other networks. When it comes to DeFi, Ethereum is still the premium network to be on. L2s like Arbitrum and Optimism may be catching up, but the prestige and network effects of being on Ethereum are still worth quite a lot, even if the high gas fees, relative to the rest, increase the cost of transactions on it. The 24H trading volume of around $1 billion says it all.

Solana

Long touted as an “ETH Killer” when it first came into being, it's jostling to be one of Ethereum's main competitors in the DeFi field. Criticisms of centralisation aside, Solana has seen some decent volume through Orca and Raydium until the FTX scandal came along. Since then, things have been a lot quieter with a 24H volume of $16.77 million, a far cry from Ethereum's. So far, it seems to have gotten its network outage problem under control. The next step is to see how further development in the DEX space shapes up in the future.

Fantom

Despite having more DEXes than Solana, the 24H volume of $2.58 million shows that DEX quantity is less important. Of all the Layer 1 alternatives, this one is slightly on the fringe, just edging in but not quite. Yet it's interesting to see that Curve Finance, one of the top DeFi dApps, has set up a presence on this network. Spookyswap is Fantom's most popular offering, with a 24H volume of half of the total volume on Fantom.

Below are some of the lesser-known chains so you have an idea of the variety of networks that GeckoTerminal tracks.

Oasis Emerald - with 5 DEXes and a 24H volume of $26.2k, this is definitely one of the smaller fishes in the sea. The highest-ranked DEX in this network is Yuzuswap at position 200.

Tomochain - only 1 DEX exists on this network, which is Luauswap. It still managed to get $12.87k for its 24H volume with 374 transactions in the same period.

Milkomeda Cardano - even with the Cardano flag waving high above its head, this network manages even less volume than Tomochain at $3,736.42 with 3 DEXes in its network

Wemix - this is another blockchain I've not heard of but it manages to pull in $128.4k which is probably not too bad, considering how crowded the marketplace already is and with only one DEX called WeMix.Fi

GeckoTerminal API and Dev Tools

In line with CoinGecko's practice of offering free public API keys, GeckoTerminal also has its own API documentation that's free to try. The API endpoints allow you to:

- Get the price, volume, and historical chart for any token as long as you have the token or pool address.

- Track all pools that carry a specific token

- Use OHLCV to plot a candlestick chart for a singular pool address.

Currently, the API is in Beta mode and is subject to frequent changes. Anyone with a working knowledge of API is welcome to give the documentation a read. All endpoints are in RESTFUL JSON format which is a standard for API connectivity.

Please note that no authentication is required for now but users are subject to a universal rate limit. More information can be found on their FAQ page.

Security Features

GeckoTerminal is CoinGecko's DEX tracking offering to the crypto world. They are the main data source for powering all the metrics you see on the platform. This is a mostly view-only platform that allows limited interaction with users. Unlike CoinGecko which has a log-in function to use its portfolio tool and other services, GeckoTerminal holds no personal data in their databases. What they've done is basically cobbled together on-chain data that is readily available to the public and put on a user-friendly cover over it.

They use encrypted connections for data retrieval and routinely perform security audits as one of their numerous security measures. Strict access control is also in place to protect any transient data. Once retrieved, the data is stored in GeckoTerminal's cloud-based systems using best practices in the industry for data management.

GeckoTerminal Review: Conclusion

The proliferation of networks and DEXes has evolved to the point where it necessitates a tracking tool of sorts to make sense of what's going on. The team at CoinGecko sees this opportunity and released GeckoTerminal to the world. The platform still has lots of room to grow, whether it's adding more customisation abilities or increasing user engagement with the platform. Perhaps a tie-in with CandyRewards by bringing over CoinGecko's loyalty users, a Connect Wallet feature that lets users perform swaps on their favorite DEX, or a mobile app version of the platform.

Whatever they choose to put on their roadmap, GeckoTerminal as it stands now has plenty to offer and is a great tool for learning about DEXes from a numbers point of view. In the meantime, I look forward to any new features they might release down the road.