HitBTC is a relatively new exchange that claims to be the most advanced in the crypto space.

For the most part public sentiment favors HitBTC for their simple user interface and high volume trading. However, like any exchange, HitBTC has its positives and negatives that have been expressed by numerous traders.

One of the most important a trader would have is if HitBTC be trusted?

That is exactly what we will try and find out. In this in-depth HitBTC review we will dig into the exchange operations, platform, customer support, trading fees and security procedures. We will also give you some top tips to avoid being scammed.

Overview

HitBTC is a crypto currency exchange owned by HIT solutions Ltd, which is based in Hong Kong.

They are certainly one of the most established, operating since 2013 with over $6m in venture funding and a $300m trading volume. The team consists of software developers, finance professionals and experienced traders.

HitBTC brands itself as a highly advanced exchange for a variety of Altcoins including DASH, ZEC, EOS and BTS. Their core-matching engine includes superior order matching algorithms and real-time clearing.

They also have positive reviews for their high availability, uptime, and fault tolerance.

Key Features:

- Rebate system - attractive to the most powerful market makers, creating high liquidity

- No limits for deposit or withdrawal of digital assets

- Cutting-edge matching engine technologies

- Wide range of available instruments (more than 500)

- The most advanced API on the market (REST API and FIX API)

Is HitBTC Safe?

HitBTC did experience a hack in 2015, but have been mostly secure ever since.

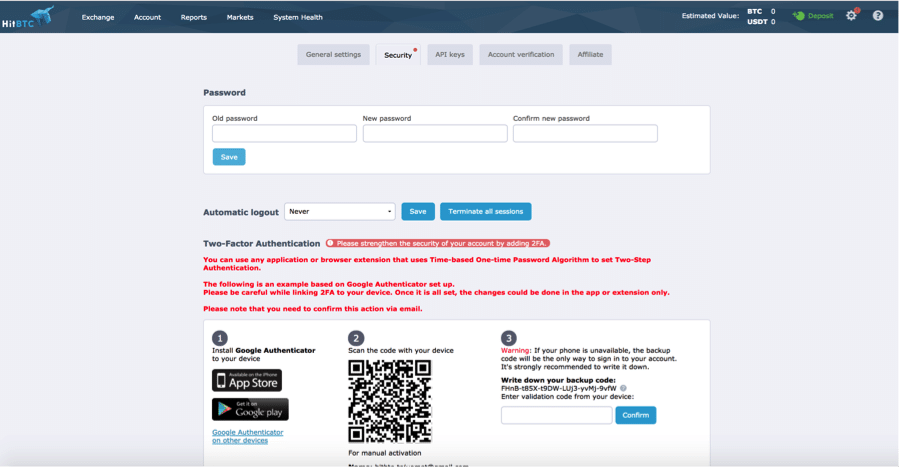

They recommend using 2-factor authentication when signing up to strengthen your account's security. You can activate it when logging in, withdrawing funds, and adjusting settings.

As a precaution, users can choose how long their account should remain active before automatically logging them out (30miutes, 1 hour, 8 hours, 1-7 days, or never).

HitBTC uses cold storage to secure the majority of its funds, and relies on advanced encryption technology to prevent important information from being hacked. Email notifications are also sent when your account is accessed from a different IP address.

Under the security tab, you can choose to ‘terminate all sessions’ if you believe there is someone else accessing your account. The site will automatically log out all your active sessions, except for the one you use to perform this action.

To confirm if there was a hack, you can view your latest activity, which records when you logged in/out, withdrew or deposited money or changed your password. All this can be viewed in the security tab.

An added security feature is the option to whitelist a range of addresses that you trust in order to prevent anyone else withdrawing to an address that is not in your control. Even if a hacker manages to breach your email and attempts the withdrawal, HitBTC will block it.

HitBTC Fees

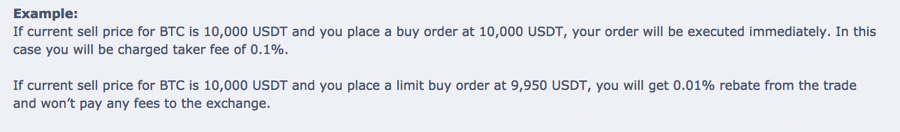

HitBTC uses a ‘Maker-taker’ model to maximize liquidity while narrowing the spread on their markets. When you place a market or stop order that is immediately filled, you are a “taker,” and you pay a “taker” fee for this.

This is because you are “taking” the price you want right now (removing the liquidity from the books) by buying or selling limit orders sitting on the books.

When you place an order that doesn’t fill immediately (like a limit order), you are a “maker,” who is providing liquidity to the order book, and you pay a reduced “maker” fee for this.

On HitBTC, "Takers" are charged with a 0.1% fee from the trade. "Makers" are not charged with a fee, and instead receive a 0.01% rebate from the trade.

Supported Assets

HitBTC’s provides access to over 300 crypto currencies, including Bitcoin, Ethereum, Lite coin, Doge coin, Monero, and USDT.

The platform offers a simple way to add new tokens to their exchange, you can simply select the ‘Add Token’ button at the bottom of their page, then enter your project website, Bitcoin talk and reddit links, email and a general description.

At this time it’s not clear how selective the process is, but it seems like they are trying to differentiate from other exchanges by offering the lowest barrier to entry to get listed.

ICO Coins

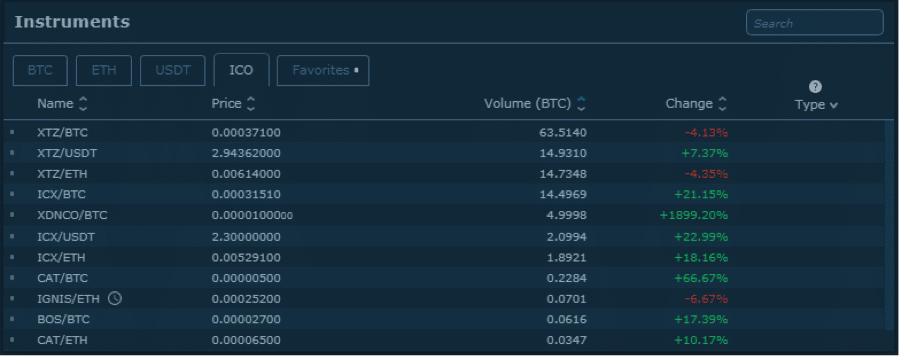

A really interesting feature of HitBTC is their trading of ICO coins.

Even before a company that does an ICO releases their tokens on exchanges, HitBTC allows users to buy the IOU’s of ICO coins and store them in their HitBTC account.

This is made possible because they purchase the ICO coins either at presale or during the actual ICO, enabling them to list IOU’s knowing that they can provide the real tokens to customers when the company eventually releases them to HitBTC.

This saves you the time of having to search for new ICO’s, and also allows you to participate in an ICO without the stress of sending money to a wallet address and not knowing if it was a confirmed purchase (or in the worse case, if the money went somewhere else).

This also provides a possible avenue for US investors, who are restricted by many ICO’s from participating, to finally get in early.

You cannot withdraw or deposit ICO coins before the company issues the real tokens. Once they are issued, the IOU’s are converted to real tokens that can be withdrawn or deposited.

Although details of this feature are shown on HitBTC’s support page, the same ‘ICO’ tab in the Instruments box is not shown on the trading screen:

This may be due to the feature temporarily being unavailable or perhaps discontinued.

On the surface, the ability to buy IOU’s or ICO tokens seems like a positive, but some users have speculated that HitBTC may be selling IOU’s at a higher price to make a profit.

In any case, users should be careful of this offering because an IOU made between a company that launched an ICO, and its token buyers is enforced by a smart contract, whereas a similar agreement made between the token buyer (in this case, HitBTC) and buyers on the exchange wanting the IOU is not.

HitBTC Customer Support

HitBTC offers a support center that features a variety of articles covering everything from ‘Account & Security’ to ‘Legacy & KYC’.

For issues that require users to email the support team, there have been complaints online about very slow response time (taking weeks and even months before an issue is resolved). Most common problems people have complained about are withdrawal delays and inexplicable loss of funds.

This was slightly disconcerting for us as customer support is often one of the biggest sticking points as slow customer often really hampers client satisfaction.

Verifications

While verification is not mandatory on HitBTC, unverified accounts do have certain withdrawal limits in a day. Hence, if you wanted to withdraw more than the limit that they have on the exchange then you will have to verify your account.

Verification means that HitBTC will complete KYC and AML procedures on you to make sure that they know who you are.

AML/KYC processes are also enforced. To verify, users have to email [email protected] with the following information:

- Name

- Address

- Bank account information (in case you want to deposit and withdraw fiat)

- Supporting documents (color copies)

- Identity Document (passport/ID card/driving license)

- Proof of residence

- Proof of bank account ownership

As more exchanges come under the scrutiny of regulators, verified accounts are slowly becoming mandatory. So it would perhaps be best to get verified now before they require mandatory verification.

Of course, this depends on how secure you feel about providing HitBTC with your personal documents. HitBTC claims that they keep all client material confidential and they have not suffered a hack as of yet.

HitBTC Trading Platform

Before we dig into the finer details of HitBTC, let's take a quick walk through the signup and registration with at the exchange as well as the steps required to begin your first trades.

Registration

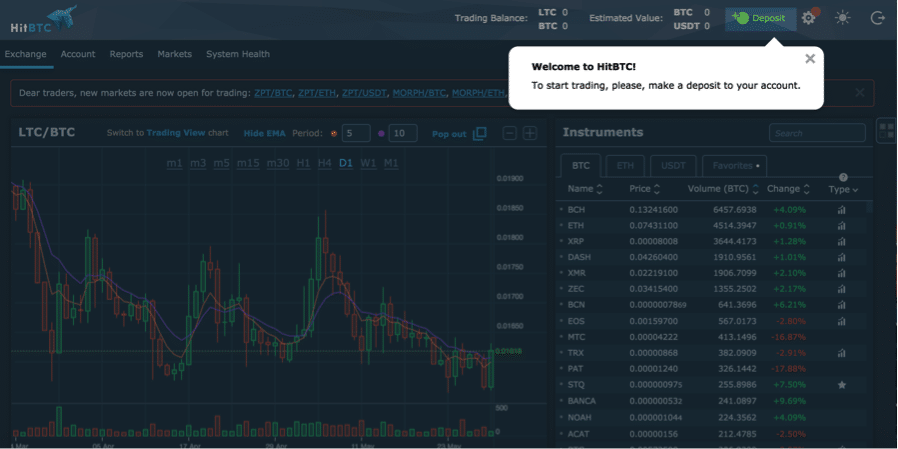

Signing up on HitBTC is a very simple and seamless process. First, you enter an email and password on the Sign-up page. HitBTC will then send you a confirmation email. Simply click to confirm your email address and you’re in.

To begin trading, you need to first make a deposit into your account.

Deposting Funds

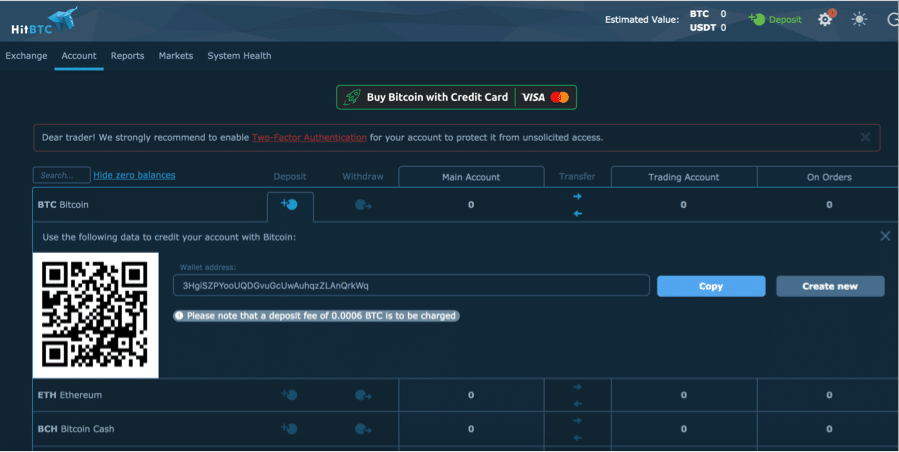

Making deposits on HitBTC is quite simple, the site integrates Changelly, which allows you to purchase Bitcoin directly with your credit card. You can then send your purchased Bitcoin to the specific address listed on HitBTC’s exchange.

HitBTC also allows you to deposit or withdraw on any of the available coins by clicking the icons displayed in the deposit and withdraw columns.

To withdraw funds, simply click on the icon in the withdraw row of any Coin you wish to withdraw.

Certain digital assets require more information be inputted when depositing or withdrawing. For example, Monero requires a payment ID when withdrawing, whereas Bitcoin and Ethereum only require the recipient’s wallet address.

HitBTC Trading

Once your Bitcoin is in your account you can transfer it from your ‘Main Account’ to your ‘Trading Account’ to begin making trades. You then go to the ‘exchange’ page to view your trading screen.

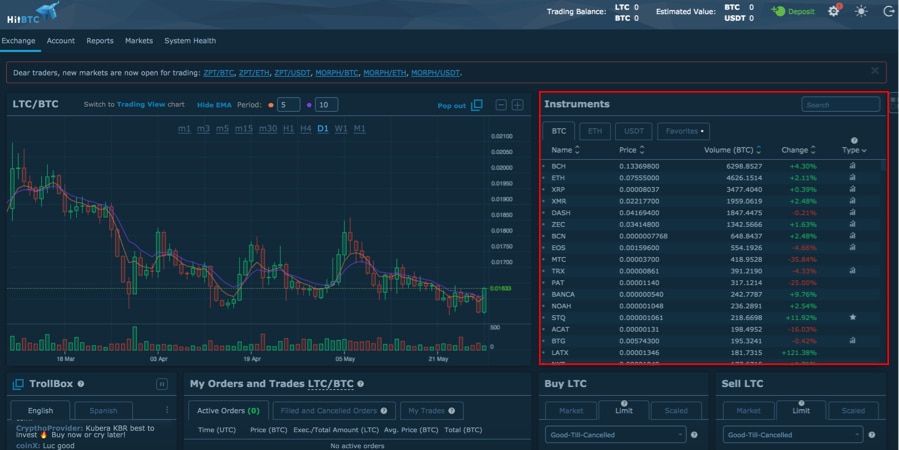

On the right side of the screen you can view different trading pairs under “Instruments”.

The graph on the left hand side displays the price changes over a period of days, weeks and months.

On the right (highlighted here) the 'Instruments' Box is the ‘buy and sell’ box. Here you can choose which type of order you want to make. Settings for market, limit, scaled and stop orders are all included:

- Market: A market order is an order to buy or sell a given instrument at the market price

- Limit: A Limit order is an order to execute a transaction only at a specified price (the limit) or better

- Scale: Scaled order is a set of multiple orders to buy or sell, automatically distributed among the user-determined price range (from minimum price to maximum)

- Stop: A Stop order is an order to buy or sell a currency once the price reaches a specified price, known as the stop price

A stop-limit order lets you make a limit order for a specific price. When it reaches this stop price, your stop-limit order turns into a limit order.

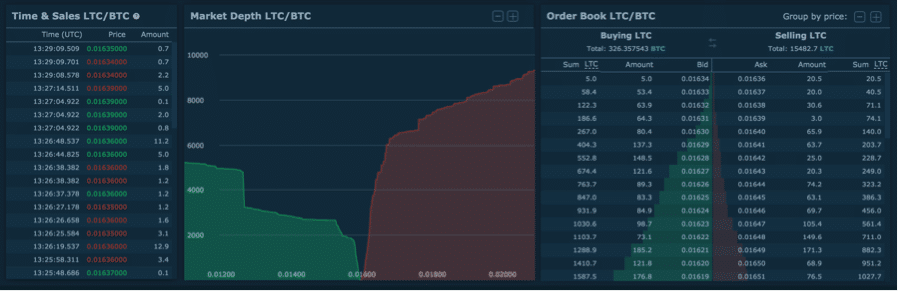

The bottom section of the trading screen features the ‘Time & Sales’ Box (which includes the 100 latest LTC/BTC trades, or trades of whatever order pair you have selected), the Market Depth Box, and the Order Book box (which shows the prices that people are buying and selling your selected crypto-currency ordering pair for).

Once you complete an order, you will be able to see it updated in the ‘My Orders and Trades box’ position in the center of your trading screen. You can also visit the “Reports” page, and click on ‘my orders’.

Another unique feature of HitBTC’s platform is the ‘Trollbox’, a live comments section where traders can engage in discussions and speculate prices.

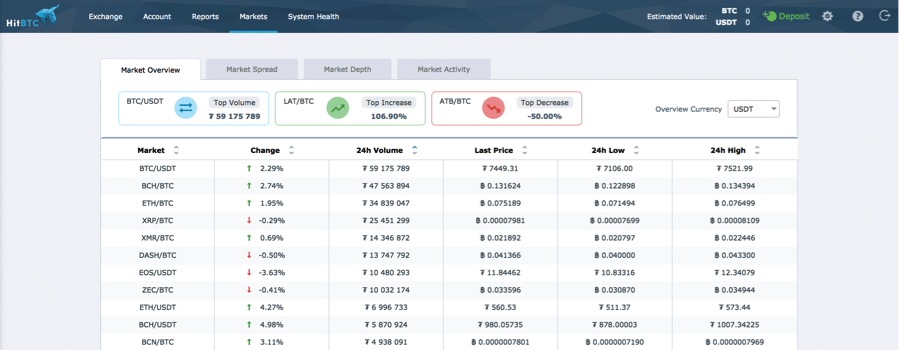

You can also go to the ‘Markets’ page to view all the latest prices and trading volumes of the last 24 hours for the crypto currencies available. HitBTC’s pairs each Altcoin with USDT (Tether), Bitcoin or Ethereum.

MetaTrader 4 Platform

For those cryptocurrency traders who used to trade Forex and stocks, they may have come across the MetaTrader4 software suite. This is some of the most advanced trading technology in the retail trader space. It is being used by over 100,000 clients in 18 countries.

HitBTC has teamed up with Weltrade to offer cryptocurrency traders an alternative to the HitBTC web platform. You would have to sign up and create a new account with Weltrade in order to start trading with the MT4 software.

The benefit of the MT4 platform over the web based one is that you can trade on leverage. In this case, you can trade on leverage from 1:3 up to 1:20 with larger volumes. You can also open short positions which is not something you can do on the normal HitBTC platform when buying the physical coins.

The MT4 platform provided by HitBTC and Weltrade can be run on a range of different devices. The MT4 software can be run on your desktop, on an iOS device or on a Google Android.

MT4 Software from Weltrade and HitBTC

MT4 Software from Weltrade and HitBTCFor those who have used the MT4 software will know just how advanced it is. There is a plethora of charting functionality, analysis tools as technical indicators. The MT4 platform is no doubt one for professional traders who do a great deal of technical analysis.

You can also use the MetaQuotes coding language to develop your own trading bots. In fact, you could probably code more effective bots with the MetaQuotes software as you have access to all of the indicators and market inputs right out of the box.

It’s important to note that when you trade with this MT4 platform, you are trading CFDs (Contracts For Difference). These are derivative instruments which means that you are not buying the underlying asset but merely trading on the price difference.

CFDs work in a similar fashion to futures contracts that you have on platforms such as Bitmex and the like. They are also margin instruments which means you must tread with caution as you can very quickly get liquidated and margin called.

OTC Trading

Another exciting feature on HitBTC’s platform is OTC (over the counter) trading.

OTC trading allows users to perform high-volume trades without going through the public order books. It means that you make your deal directly with the counterparty without affecting the market price of the coin or token.

This feature is offered via HitBTC’s partnership with Trustedvolumes.com

Terms and conditions:

- Each trade must exceed the equivalent of $100K USDT by volume

- Commission is only 0.1% for OTC trades

HitBTC Referral Program

Something that many exchanges offer is an affiliate program where you can refer other traders and earn a commission off of their trading. Once you choose to sign up to the affiliate program you will receive a custom link that will be used to track your referrals.

What sets HitBTC aside from many of the other exchanges is that they offer a pretty generous 75% of the trading fees that your referral generates on the platform. The most that we have seen on other exchanges is about 50%.

They also have an advanced tracking and link creation system where you can create different links and monitor their relative performance in your affiliate dashboard. There is a minimum requirement for a withdrawal of your affiliate commissions and that is 0.1BTC.

HitBTC API

For those traders who like to code their own trading bots, HitBTC offers a pretty robust and efficient API. For example, the API has low latency which means that your trading orders are executed much faster than other exchange APIs.

There is also a pretty high limit for API requests. They allow you to send a maximum of 100 API requests per second per IP address. One can compare this to the likes of Poloniex which has a limit of 6 p/s and Kraken which has tiered rate limits.

Market Making

As mentioned, as an exchange, HitBTC will get benefits if their traders are able to provide some liquidity to their order books in the form of a market maker.

If you are one of these traders that would like to participate in the market making on the HitBTC platform then there are a number of Market Making contracts that you can enter into with them. These contracts have cash incentives as well as rebate bonuses.

For those traders of you that would like to use their advanced API, then the market making functionality could be an attractive addition. Below is a table of the market maker contracts that are available at HitBTC.

| Contract Category | Admissible Size | Maximum Spread | Rebate Bonus | Benefits |

| Contract XS | ≤ 1 BTC | ≤ 0.3% | 0.01% | 1,000 USDT |

| Contract S | ≤ 5 BTC | ≤ 0.8% | 0.015% | 2,000 USDT |

| Contract M | ≤ 50 BTC | ≤ 2% | 0.05% | 3,000 USDT |

| Contract L | ≤ 200 BTC | ≤ 3% | 0.02% | 5,000 USDT |

| Contract XL | ≤ 1,000 BTC | ≤ 3.5% | 0.04% | 10,000 USDT |

| Total Potential Benefits | 0.1% | 21,000 USDT |

These contracts are available for the following cryptocurrencies: BTC, BCH, USDT, ETH, DASH, XRP and a few other coins. HitBTC will also provide daily reports on to the market maker in order to help them build the most efficient trading strategy.

If you would like more information on how the Market Making contracts work you can consult the HitBTC market making page.

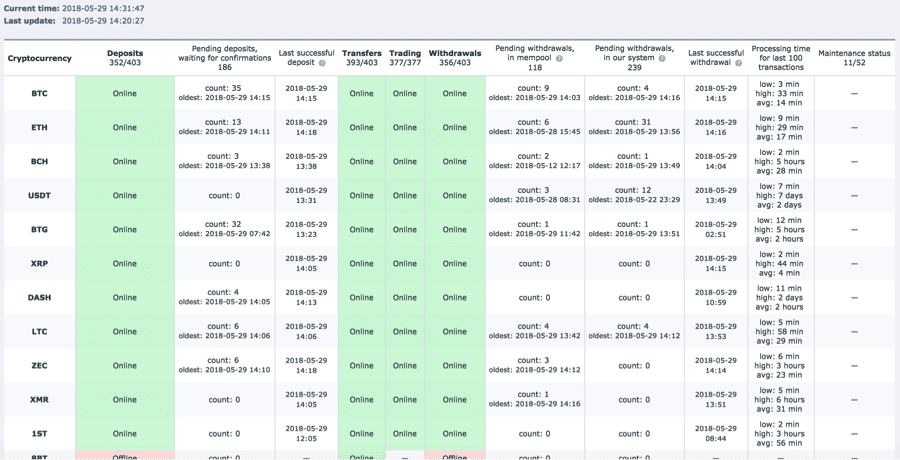

System Health

With System Health, HitBTC attempts to be as transparent as possible about how well their systems are functioning.

On this page, users can view key metrics for the system's performance and availability, including live statistics of incoming/outgoing transactions.

Below are a collection of all of the Metrics that are important for the HitBTC system health (which is in alpha mode).

- Deposits: Check on the number of users' deposits in the queue and the pay-in status before you make one.

- Online/Offline for Transfers displays whether the funds can be transferred between Main and Trading accounts.

- Online/Offline for Trading indicates the availability to make orders in the system.

- Withdrawals: Helps to track the pay-out online/offline status, number of withdrawals in the mempool, number of withdrawals in the system, when the last pay-out was done and the average time required to process 100 transactions for each of the currencies.

- Maintenance status indicates when any maintenance operation is being performed.

System Health is one of the more impressive features of the platform because it allows traders to decide when to deposit funds or make a trade based on real-time analytics about the site's performance. This gives HitBTC a competitive edge over exchanges that keep their users in the dark about real time performance issues.

The system provides an online/offline status for every single coin that is tradable on their platform, which for traders is a huge relief as it allows them to plan their trades accordingly, and perhaps trade a specific coin on a different exchange if HitBTC’s system is experiencing issues with it at the moment.

What We Didn't Like

While it seems that HitBTC has all the features that make it look impressive from the outside, there were a number of things that we were less than impressed with.

Firstly, we have to take issue take issue with their customer support. You do not have to go far to find numerous complaints online about their slow response to customers. This is probably compounded by other accusations that they traders have been unable to withdraw coins or having funds missing when making transfers.

This slow customer support is also not ideal when it comes to verifying your KYC documents. Given that they request so many documents, not only do you have to spend the time properly scanning everything but you may have to wait a number of days before the HitBTC team can properly verify them.

There have also been reported inconsistencies between the fees that some users are paying for transfers. Some users claim they have been charged high fees whereas others have had no issues.

Lastly, you can only buy and sell coins that are divisible by 100, 1,000 or 10,000. This is not ideal especially for those smaller traders who want to trade the more expensive coins.

HitBTC Criticism

Although on the face of it, HitBTC seems to be a reasonable exchange, there have been a number of criticisms that have been levelled at them in recent months from high profile cryptocurrency users. For one, there was the ire that they have attracted from cryptocurrency trader "Sicarious".

The trader claimed that HitBTC has locked his mother's account and was not allowing her to withdraw her funds. This was after repeated attempts by the trader's mother to get her account unfrozen. However, it seems that in a follow up to the tweet HitBTC unfroze the account and allowed his mother to continue trading.

Another high profile cryptocurrency user who has taken issue with HitBTC is John McAfee. However, his criticisms were more to do with the large minimum buy in which could restrict the ability for poor investors to place funds on the exchange and buy coins.

Whether these comments and criticisms are warranted is hard to determine. However, our HitBTC review would not be complete if we did not cover these points. In any event, you should never leave a large amount of coins on an exchange irrespective of its reputation.

Conclusion

HitBTC is an established crypto exchange that has provided quality trading services since the early days of cryptocurrencies.

The exchange has developed over the years to provide high volume trades on a secure platform that monitors and constantly updates users on the status of the system's health. As a result, the platform now has over $300m in trading volume.

However, they still need to improve their customer support, ID verification, and withdrawal processes if they wish to stay competitive with other exchanges like Binance and Coinbase, who have trading volumes of $1.6Billion and $250million respectively.

HitBTC primarily needs to focus on resolving these issues, then repairing their public reputation so as to reflect those improvements and restore trust amongst traders who may have lost money on their platform.

Only then could we see HitBTC strengthening its position amongst other major exchanges in the space.

Disclaimer: These are the writer’s opinions and should not be considered investment advice. Readers should do their own research.