When ICON was last covered here on CB back in 2020, it was colloquially referred to as The Ethereum of South Korea. From that name, you might already know that it was a long time ago when we covered this project, and a lot has happened since then. Nowadays, ICON is better known as a competitor to Cosmos while similarly not being anything close to Cosmos. Yes, a confusing sentence, I know. However, I’ll dive deeper into all of this, so no worries.

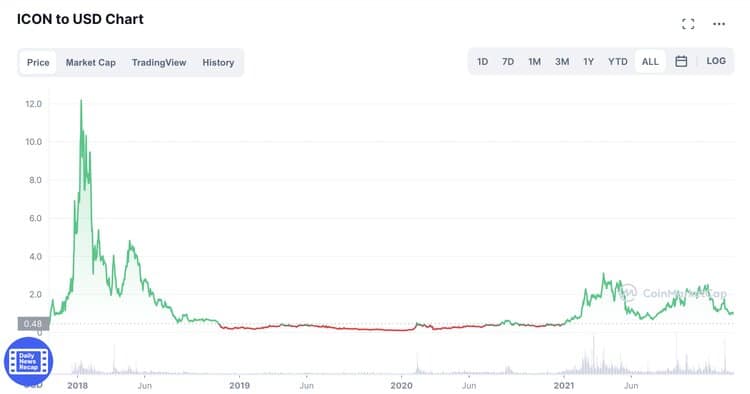

While the development of the network has been going forward like crazy, the price action of ICON’s native asset ICX has not been as good. The price has only risen by 2-3x from when the project was last covered here in July 2020. This is relatively poor compared to many other altcoins; Cosmos’ ATOM token is up 10x over the same time. This is perhaps one reason why this project has stayed under the radar for many people. However, all of this might change following the latest developments, including a whole new design with the ICON 2.0 upgrade.

ICON History

ICON was created by the South Korean DAYLI Financial Group, "built" by Korean-American Min Kim. However, the actual company to create the ICON network was ICONLOOP which is still active in its development. The project was incubated by DAYLI Financial Group. ICON had its ICO already back in 2017, raising a total of $43 million. The project launched in 2018, but in November of 2021, it transitioned to ICON 2.0, a whole new project.

ICON is a blockchain protocol powered by the open-source blockchain engine called "goLoop" (previously hyperLoop). GoLoop is the name given for ICON's loop-chain, and it comes from the new programming language used in the creation of ICON 2.0. ICON aims to be the blockchain of all blockchains by providing a bridge between different blockchains and traditional enterprises. ICON was more focused on the enterprise integration side in the early days. However, this had to change due to the slower than anticipated enterprise adoption. They saw that all the growth was in public blockchains, primarily among retail people, so they shifted to offering interoperability between different chains.

The ICON network uses a complicated consensus mechanism called Byzantine Fault Tolerance Delegated Proof-of-Stake (BFT-DPoS). For economic governance, they use a protocol called Delegated Proof-of-Contribution. The ICON network is operated and maintained by public validators called Public Representatives (P-Reps). Those 25 P-Reps that gain the most votes become Main P-Reps, and they’ll participate in on-chain governance. The rest become Sub P-Reps, and they’ll fill in for Main P-Reps if necessary. According to the ICON tracker, there are 150 validators (22 Main, 88 Sub, 50 candidates), of which the ICON Foundation itself is by far the biggest with a 15% share. The native currency is ICX, and it’s used to pay for network fees and validation and governance. ICONists (the name ICX holders are called) can delegate their stake to P-Reps and earn rewards for that. Currently, the reward sits at roughly 6-7%, but that can and does change over time.

The Future of ICON

You'll notice a lot of links in the following so that you can dive deeper if you want more information since, for the sake of brevity (and ease of reading), I'll try to stay away from the most technical aspects.

ICON 2.0

Let’s dive straight into the biggest news of them all, ICON 2.0. In September of 2020, ICON 2.0 was first introduced. This was introduced because the previous version was merely a test. It couldn’t support everything needed for the future development of the network. The Alpha version of 2.0 was launched in April of 2021, but the full version was launched in late 2021, so it hasn’t been active for long.

The most significant difference between the two versions can be found all the way at the ground level of everything, the programming language. The first version was built from the ground up using Python, and it did not support other languages. The ICON 2.0 version was built using a programming language called Go which is why the engine is called GoLoop. On top of using a new and advanced programming language like Go, the 2.0 version also has Python SCORE and Java SCORE features. It should also be noted that Python SCORE is being phased out in favor of Java SCORE. The ICON Foundation will provide financial and technical support for existing python DApps to migrate to Java.

Go is extremely popular and it's a better suit for ICON. Image via Go.

Go is extremely popular and it's a better suit for ICON. Image via Go. Another big update with ICON 2.0 is that it has been open source from the beginning. This was great news since in the previous version, everything wasn’t open-source, and that was a major concern.

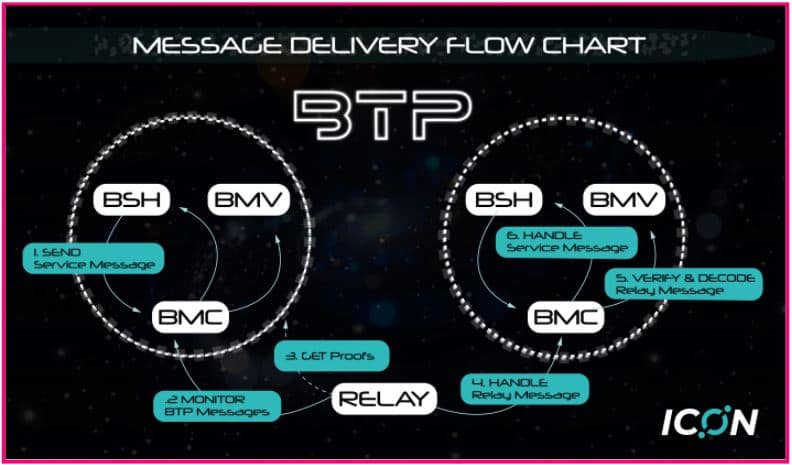

Blockchain Transmission Protocol (BTP)

The Blockchain Transmission Protocol is the bread and butter of ICON since it powers interoperability. BTP isn’t anything new, but it wasn’t fully operational in prior ICON iterations. The improved and fully functional BTP when launched is expected to be a game-changer. When reading about BTP, it became clear that not only is this big for ICON, but it could be huge for the whole blockchain industry. This is because it’s fundamentally different from what Cosmos and Polkadot are trying to do.

I found this and this article extremely helpful, so if you wish to learn more about how BTP works, I suggest you give them a look. The BTP is made up of four different components (covered below). To explain simply: if you send a transaction, you’ll be interacting with the Service Contract. This will be transferred into the Message Center Contract, where all transactions are gathered. After this, Relays (run like node operators by individuals) will take your transactions and submit them to the chain you want to send your coins to. Then to prevent any malicious transactions by Relays the Verifier Contract checks if that transaction can be found on the ICON blockchain, which is governed by its own consensus mechanism I linked to earlier.

How ICON itself describes the difference between their solution and others is that other systems connect blockchains within their own ecosystem rather than all blockchains together. On the other hand, ICON says it will be able to connect every blockchain that supports smart contracts. The first article linked to in this section does provide a more in-depth explanation of the differences, so I suggest you look at that too.

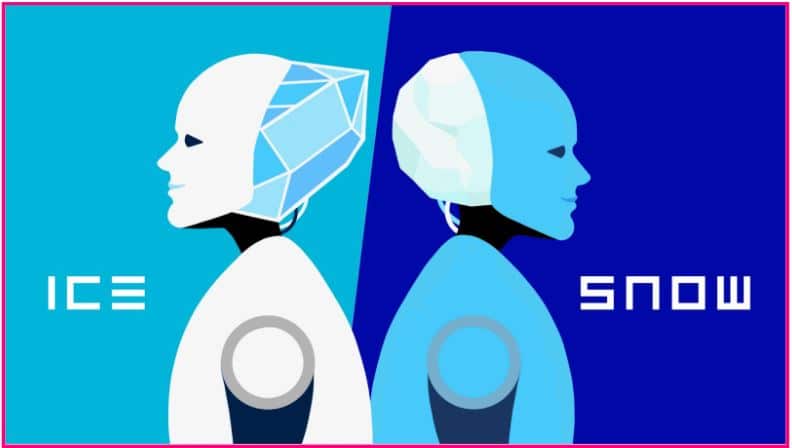

ICON ICE & SNOW Blockchains

In mid-July, ICON introduced a whole new blockchain for the ICON ecosystem called ICE. ICE is EVM and eWASM compatible, and it's meant to provide an entry to Ethereum and Polkadot. It was developed in partnership with Web3Labs, Mousebelt, and others. After the launch, the new structure for the whole ICON ecosystem is as follows: ICE will be focused on the application layer since it's easy for developers due to its EVM compatibility, and to explain what the ICON chain does, I'll use a quote from their Medium article:

“The ICON Network will continue to optimize for BTP, and begin focusing specifically on interoperability and low-latency cross-chain apps.”

ICE is an extension network of an existing layer one blockchain (ICON) applying for a parachain slot on the Polkadot ecosystem. It is the first of its kind, as all Polkadot parachains so far have been built for the sole purpose of becoming parachains on the Polkadot network. This means that ICE will bridge technology and an entire community (ICON community) to the Polkadot ecosystem.

What gathered much attention with this announcement was the 1:1 airdrop of ICE's native token ICY.

I highly suggest you read the links I've left in this section to better understand this.

I highly suggest you read the links I've left in this section to better understand this. SNOW is another blockchain and relatively easy to explain. Do you know how Polkadot has an extensive “canary network” called Kusama? Well, SNOW is the same for ICE as Kusama is for Polkadot. The idea is to first get ICE a parachain slot to further integrate into the Polkadot ecosystem and allow applications to run there to take advantage of ICON’s BTP. However, as many other Polkadot parachain candidates have done, ICON will first launch the SNOW blockchain on the Kusama network to test things out. SNOW will also be a place for projects to launch before moving to ICE. And as with ICE, SNOW will have its own native token called ICZ, and it will be airdropped to ICX holders in a 1:1 ratio.

Now I know this may get a bit complicated to keep up with all the different blockchains and protocols, but if you understand that ICE and SNOW are built to make it easier for projects to leverage the ICON BTP that provides cross-chain interoperability, then you should be fine. And if you try to search for the two tokens mentioned above, you won’t find them since they are not yet running; however, the snapshots for these two airdrops have already been taken.

ICON Integrations

On top of the integrations mentioned above with both the Polkadot and Ethereum ecosystems, ICON will also be integrating with Moonriver, NEAR, Harmony, Algorand, and Binance Smart Chain, with some integrations possibly occurring by the end of March. ICON recently announced that following some gas fee issues that the team encountered while building their main bridging solution BTP, ICON will be launching an interim bridge called ICON bridge, while the team continues to develop BTP in the background. This happened only a couple of months ago, and the integrations went fast; therefore, we would expect further integration in the months to come. It’s still unclear how well these integrations will do and how many actual applications will be benefiting from ICON. However, at least in the Polkadot ecosystem, ICON has integrated successfully partnered with a few individual (and big) projects. These are Edgeware, Plasm Network, Moonbeam, and Acala.

Speaking of applications integrating with ICON, on top of those four, I did find several others. These are the Band Protocol integration in July 2020, Wintermute partnership, in September 2020, and Fandiem partnership in September 2021. Band Protocol is a cross-chain oracle, Wintermute is an algorithmic market maker, and Fandiem is a charity platform. These integrations are crucial to ICON since a network without any users is obviously useless.

ICON Incentive Fund

In January of 2021, ICON announced a cross-chain interoperability incentive fund. The fund consists of 200 million ICX tokens ($200 million at today's prices). The fund will be used to further incentivise the ICON community and every other community. The idea is to get other communities to develop cross-chain interoperable solutions. 40% of the fund will incentivise existing communities and applications working with the BTP system. In comparison, 60% will go towards further developing and broadening the whole BTP system. Incentive funds have been a huge deal lately, and at least looking at the price action of many tokens, they seem to be working. However, long-term success is what matters. The fund will use tokens from the reserves (look at tokenomics further down), and it'll be distributed over five years.

ICON Dapps

Although ICON is as old as many other chains, it hasn’t seen a particularly rosy growth in native projects. Currently, ICON has around twenty projects, and many are relatively unknown. For example, DeFi Llama lists Balanced and Omm, with a combined TVL of around $120 million. Balanced is the decentralized bank of ICON with all the standard features plus staking. Omm is a money market maker and includes the same features as Balanced except staking. Unfortunately, as with the rest of the crypto market, both of these have taken a beating recently, and they’ve both lost more than 50 % of their TVL. Other notable DApps include Craft, an NFT-marketplace that ranks among the Top 10 NFT marketplaces; Project Nebula, an NFT-based space exploration game, and GangstaBet, an NFT ecosystem.

If you’re interested in using these platforms, you’re going to need a wallet that supports ICON and ICX. The most commonly used wallets are the Hana Wallet – the primary and Ledger-compatible wallet of the ICON ecosystem – and MyICONWallet, a mobile-based wallet. The original wallet, ICONex, also exists but is being phased out. Personally, I don’t have any experience interacting with the ICON network, so I can’t give any tips on that.

ICON Tokenomics & ICX Price

ICX was launched back in 2017 with the following allocation: 50% token sale, 17% reserve, 13% Foundation, 10% community group & strategy partners, 10% team, advisors, and early contributors. The allocation seems to be fairly decent but something worth pointing out is that ICX doesn't have a max supply. Currently ICON has a circulating supply of just under 700 million. However, the protocol does have a set inflation rate which was recently changed. Previously ICON didn't have a set inflation rate but rather it fluctuated based on a set of variables. The trouble with that was that although it was meant to maintain an appropriate amount of stakers the inflation didn't have a hard cap and could sometimes reach over 20%. Now with the new network proposal this inflation rate is set at 3.99% annually. From the annual inflation rate the majority of ICX, 77%, goes to voters. Then the rest is divided between block producers and CPS (Contribution Proposal System) a decentralized grant fund controlled by P-reps. The allocation is 13% for block producers and 10% for CPS.

ICX can be staked on multiple platforms and currently the rewards are around 10-12%, which is not bad, at least now when the inflation is at a predetermined rate. The un-lock period depends on how much you stake, and it can be anywhere from 5 to 20 days. The staking works such that you’ll be delegating you ICX to a P-Rep (voting on a P-Rep. Historically, ICX staking has been quite popular due to the relatively stable to price of ICX. At these price levels it could be compared to stablecoin lending with the additional upside potential from the projects growth. However, it’s good to note that it does include the downside of a potential failure too.

Here's a look at the price action of ICX. Image via CoinMarketCap

Here's a look at the price action of ICX. Image via CoinMarketCap When it comes to price action it has been a few quite miserable years for the holders of ICX. Not much has happened and from a technical point there aren’t many catalysts for any huge growth. The poor price action seems kind of odd considering how much has happened in the ICON ecosystem, but my guess would be that the already quite high market cap has kept the price low. The market cap is currently around $800 million, which maybe doesn’t sound that much, but considering ICON hasn’t been delivering much in its relatively long history it does make you wonder. On the positive side though, the new ICON does take on the competition in the interoperability niche and if you compare it to Cosmos’ market cap of almost $10 billion then ICON has a lot of room to grow.

ICON Roadmap

ICON is moving full steam ahead now, looking for further integrations to become the leading interoperability solution. A lack of clarity and information was highlighted in the previous CB article. This has luckily been resolved since ICON does post almost monthly development updates (here's the most recent one) and keeps the progress open-source. However, the whitepaper is old and, in my opinion, does not highlight the possibilities of ICON 2.0 and also, the token economics are not clear.

Currently, there aren't any concrete milestones coming since both ICE and SNOW are in development with unknown release dates, and there were significant upgrades just a few months ago. The ICON 2.0 upgrade was a lot of work, making it understandable that anything that big won't be seen just yet. But as I mentioned earlier, it is expected that we see many more integrations with both applications and different blockchains. To keep up with the project's development, you'll be best off reading the monthly updates from the ICON team.

Conclusion

Hopefully, this article provides you with some kind of clarity about what ICON is and how it's trying to find its way to the leading cryptocurrency projects. I also again encourage you to look at the multiple links I left if something feels unclear or if you wish to learn more about ICON.

Finally, I want to quickly speak about researching this project. To me, it seems like there are two kinds of ICON networks. One is the old ICON with a centralized structure, lack of clarity (old whitepaper), slow growth. The other ICON is the new one with interoperability, growth, and clarity. However, these are the same project which does provide some uncertainty. ICON 2.0 with a new name, a fresh look and a new token would have made me see this project as a good one (although I'm not a technical genius, I'm not entirely sure if their interoperability approach is the best). However, now when these two are mixed, I can't decide what to think.

But, regardless of what I think, it will be interesting to see where ICON is heading since interoperability is certainly something we'll need. Looking at Cosmos' ATOM token, it's clear that the trend is up for these solutions. Now it's just up to ICON and its community to prove that their solution is viable and potentially the best one.