Blockchain technology has redefined finance with a digital native architecture. Novel, cryptocurrency-based income strategies like staking and yield farming are the new face of passive investment.

The blockchain world is home to several centralized and decentralized platforms offering passive income services on cryptocurrencies. This KuCoin Earn review will explore the ‘Earn’ passive investment products of the KuCoin crypto exchange, which features a suite of traditional and DeFi investment services.

If you want to learn more about KuCoin, feel free to check out our:

And see how KuCoin stacks up against the competition in our analysis articles:

Note: Users located in the US and UK are not supported.

KuCoin Earn Review Summary:

KuCoin Earn is a multi-faceted financial product on the KuCoin exchange that seeks to help users earn returns on their cryptocurrency holdings with a variety of cryptocurrency-based investment products. It offers traditional passive income services like fixed deposit savings products and lending. Earn also features DeFi investment products like crypto lending, staking, and Polkadot auctions, as well as several advanced products that leverage options to offer multiplied earrings for seasoned traders. It is essential users conduct the necessary due diligence to weigh KuCoin Earn’s associated risks against their preferences.

| Headquarters: | Seychelles |

| Year Established: | 2017 |

| Regulation: | Not regulated by any national licensing bodies. Is legally operating as a Digital Asset Exchange under Seychelles law |

| Spot Cryptocurrencies Listed: | 900+ |

| Native Token: | KuCoin Token (KCS) |

| Maker/Taker Fees: | Lowest: 0.00%/ 0.04% Highest: 0.08%/ 0.08% |

| Security: | High |

| Beginner-Friendly: | Some features are beginner-friendly, though KuCoin is best suited for experienced and advanced traders. |

| KYC/AML: | Required. Limits can be found on KuCoin’s Support Page. |

| Fiat Currency Support: | 50+ Currencies supported through integrations and various methods |

| Deposit/Withdrawal Methods: | SEPA Bank Transfer, Debit/Credit card, P2P, Apple Pay, Simplex, Banxa. Fast Buy supports 70+ payment methods through various third-party integrations Withdrawing fiat is not supported |

The Key Features of KuCoin Earn Are:

- Balanced products:

- Savings - Earn interest from crypto deposits.

- Staking - Participate in DeFi protocols to earn rewards.

- Promotions - Earn higher interest than Savings.

- ETH Staking - Ethereum liquid staking product.

- KCS Bonus Plan - Hodl KCS to earn a share of trading fee revenue.

- KuCoin Wealth products:

- Snowball - Predict market range to earn amplified returns.

- Twin-Win - KuCoin event-driven investment strategy.

- Covert Plus - Guaranteed asset conversion at a predetermined rate.

- Dual Investment - Volatility-driven investment product.

- Future Plus - Leverage with limited downside.

- Shark Fin - Principal preserving investment product.

- Specialized products:

- Crypto Lending 2.0 - Lend cryptocurrency with customizable APYs

- Polkadot Auction - Participate in the Polkadot and Kusama Slot auction via KuCoin.

- Burning Drop - Stake crypto to earn token distribution airdrops.

KuCoin Company Overview

KuCoin is a cryptocurrency exchange founded by Johnny Lyu and Michael Gan in September 2017. It is one of the most popular crypto exchanges known for its diverse crypto listings that are wider than well-known exchanges like Binance and OKX. The company is headquartered in Seychelles, although the crypto exchange serves a global customer base that is attracted to its user-friendly interface and competitive trading fee structure.

Key Features of KuCoin:

- Diverse listing - KuCoin offers hundreds of cryptocurrencies spanning popular tokens, stablecoins, DeFi tokens, meme coins, and several small-cap coins on its trading platform.

- User experience - The platform’s user-friendly interface is easy to navigate and ideal for average users.

- Low trading fees - KuCoin offers one of the most competitive fees among cryptocurrency exchanges.

- KuCoin Trading Bot - KuCoin offers trading bots for several well-known cryptocurrencies.

- Advanced features - Besides the spot market, Kucoin supports advanced trading strategies like margin trading, futures trading, and leverage.

- Passive income tools - KuCoin offers passive income opportunities on crypto fixed deposits.

- DeFi features - The platform also offers some DeFi-specific products like staking crypto on the blockchain.

- KuCoin token - As Kucoin's native token, KCS offers trading fee discounts and a share of KuCoin’s trading fee revenue.

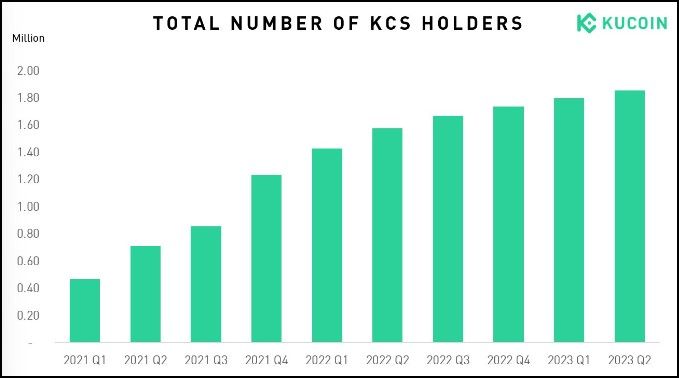

Despite the global economic downturn drying up VC faucets, fleeting interest in digital assets, and the detour of funding initiatives toward AI-driven startups, KuCoin has displayed resilience and growth in 2023.

Advantages of KuCoin:

- Steady growth - KuCoin users jumped by 26% halfway through 2023, signalling a growing user interest and trading volume in the crypto exchange.

- Strong customer support and security measures- KuCoin is committed to offering globally accessible customer support and launched anti-fraud measures earlier this year to improve platform security.

- Proof of Reserves - The platform consistently updates its Proof of Reserves (PoR) data and keeps the most traded assets like BTC and ETH over collateralized for additional security.

- KuCoin Community Chain (KCC) - KCC is a growing ecosystem of DeFi, GameFi, NFT, and other Web3 infrastructures with significant partnerships with security forms like Certik and PeckShield.

KuCoin user growth. Image via KuCoin Blog

KuCoin user growth. Image via KuCoin BlogThis review will focus on the ‘Earn’ section of KuCoin. If you wish to delve deeper into the specifics of the KuCoin platform, check out our KuCoin review.

What Earn Products Does KuCoin Offer?

To use the KuCoin exchange and its Earn products, users must first register with the exchange and create an account using their email. KuCoin mandates a KYC verification for all its users to ensure fund security and integrity of the user’s account.

Once registered, users can access the Earn section from the website homepage, where the products are categorized as balanced (including products like staking and savings), advanced (with products like dual investment), and some specialized products like lending and Polkadot auctions.

Let us dive deeper into each of these products, starting with the balanced Earn products:

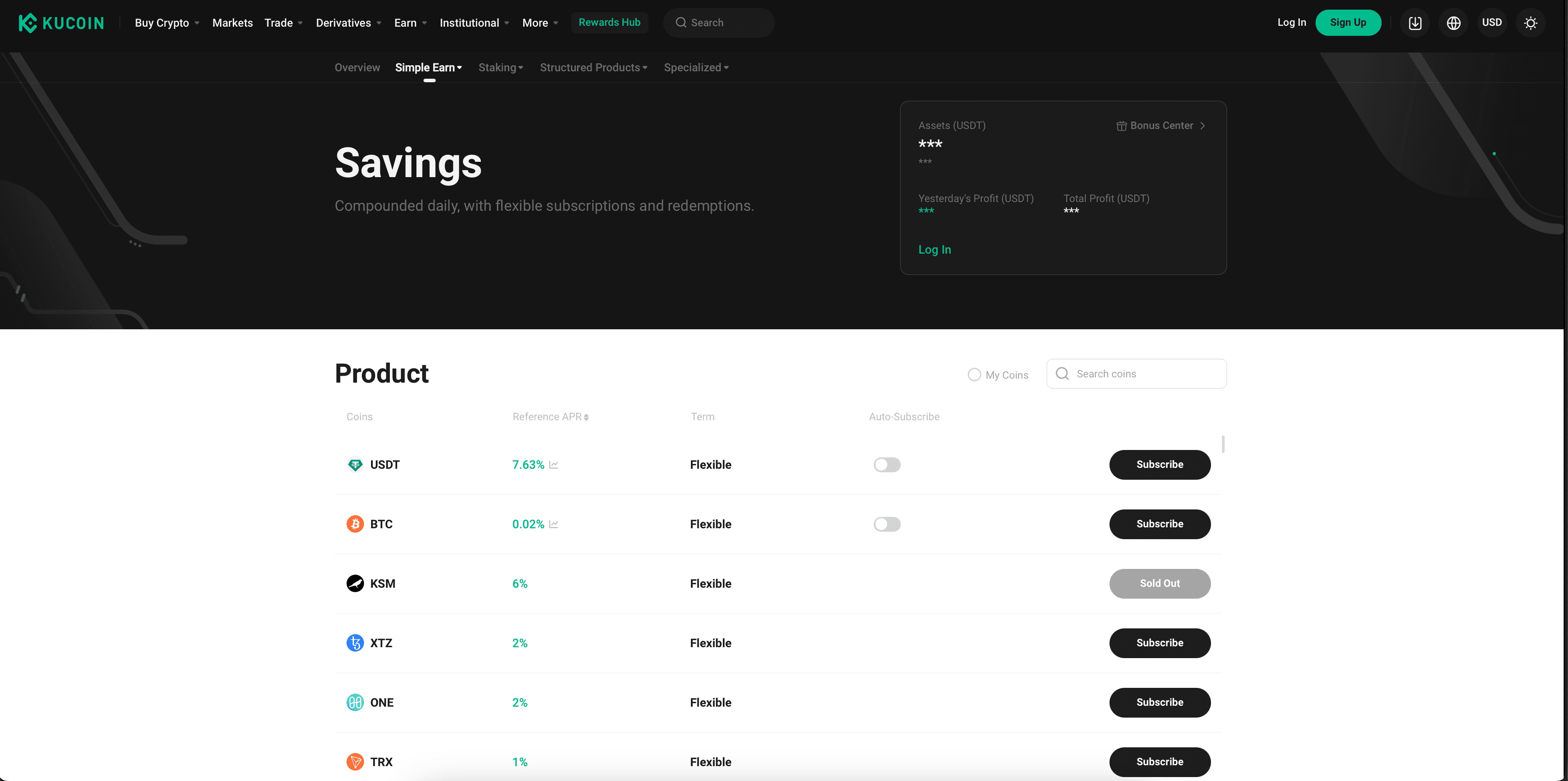

KuCoin Savings

Purchasing crypto from the Spot trading account opens access to the KuCoin Savings product. Subscribers earn compound interest on their crypto deposits, which are credited to their Financial account.

KuCoin Savings. Image via KuCoin

KuCoin Savings. Image via KuCoinBenefits of the Savings Product:

- Passive income - The Savings product stands out as a straightforward, easy-to-use stream of interest income.

- Flexible - KuCoin allows immediate withdrawal of the subscriber’s deposits.

- Compound interest - The earned interest is reinvested into the savings product for additional earnings, compounding the returns.

Risks of the Savings Product:

- Default risk - KuCoin does not explicitly guarantee the crypto asset deposits in the Savings product. Therefore, the deposits may run a risk of loss if the borrower defaults.

- Counterparty risk - As a centralized exchange, KuCoin does not possess a verifiable and decentralized security model. It could get hacked or go bankrupt.

- Interest rate fluctuations - The interest rate offered by the savings product may change with dynamic market conditions, making returns unpredictable.

- Regulatory risk - Kucoin is subject to regional regulations regarding offering cryptocurrency-based financial products, which are still immature.

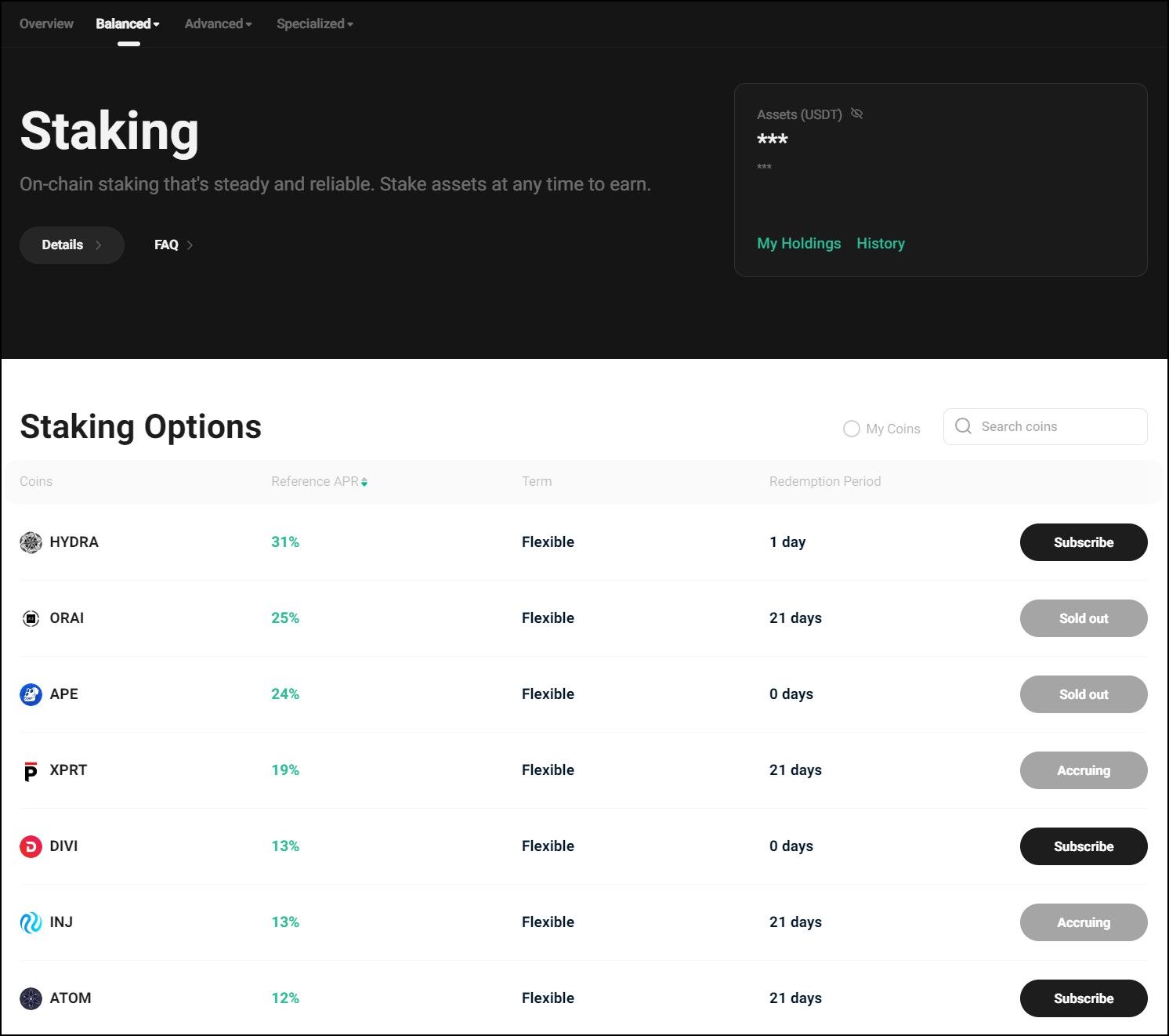

Kucoin Staking

Users can participate in several DeFi protocols with the help of the KuCoin Staking product. After the locking period of staked assets ends, KuCoin will automatically release the assets to the user’s Trading Account. During the staking period, users can trade their staked assets in the Liquidity Trading Market or choose to redeem their stake before the redemption period.

KuCoin Earn Staking | Source: KuCoin

KuCoin Earn Staking | Source: KuCoinBenefits of KuCoin Staking:

- Easy to use - It does not involve complicated key management and offers easy redemption of investment.

- Variety - KuCoin offers several coins in its staking product and updates this list regularly.

- Flexible Terms Available- Staked assets do not need to be locked up

Risks of KuCoin Staking:

- Smart contract risk - The corresponding DeFi protocols run the risk of exploitation or programming errors.

- Platform risk - Users do not control the private keys used for staking their funds and must trust KuCoin’s integrity.

- Market risk - The returns from the staking products are estimates and may fluctuate when the market is extremely volatile.

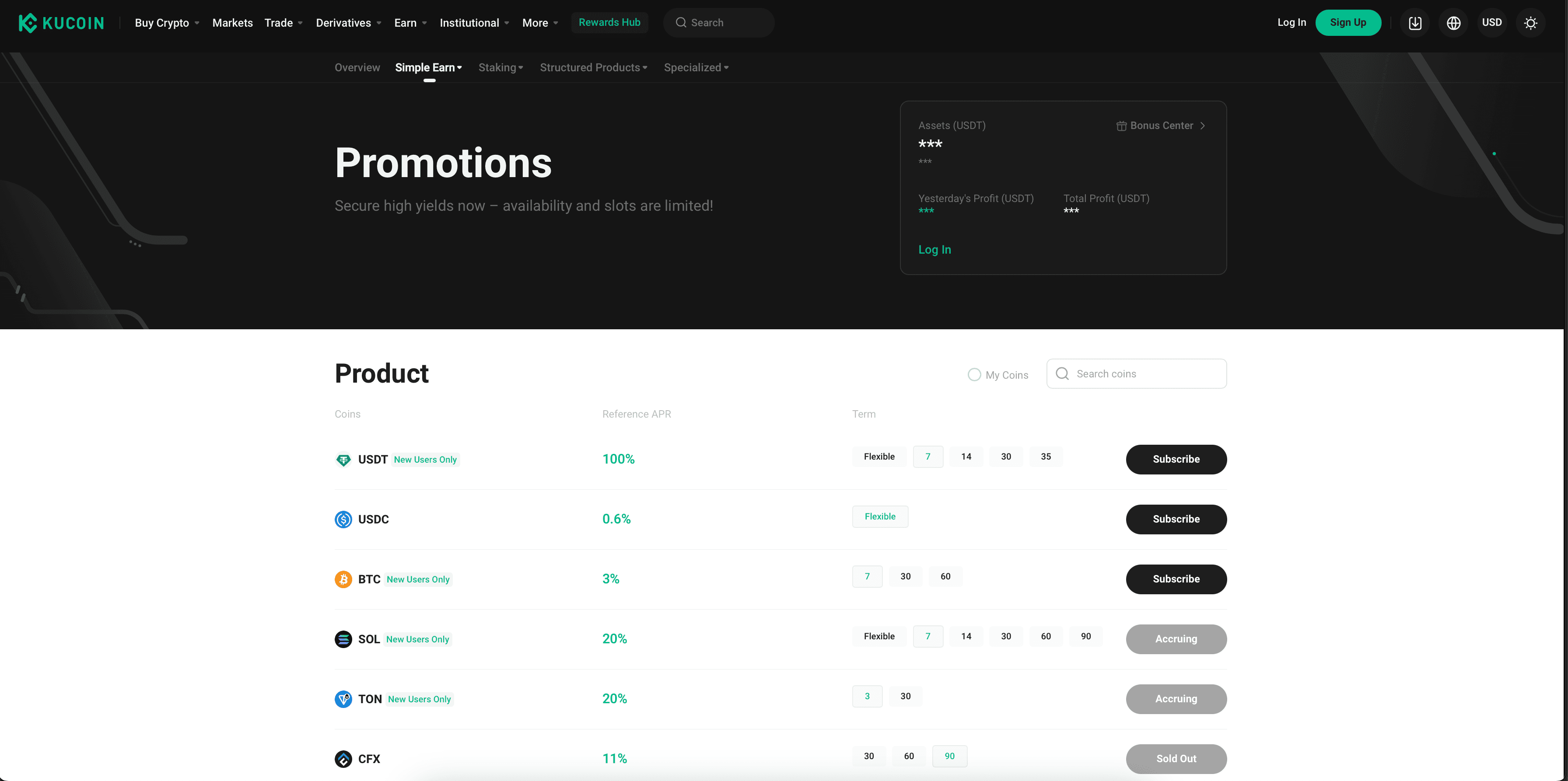

KuCoin Promotions

Like the KuCoin Savings product, Promotions is a fixed deposit product that accrues interest over time. However, in Promotions, the available liquidity is limited, and users can choose between a flexible or fixed investment scheme. It usually offers higher returns than what Savings and Staking products on KuCoin offer.

Flexible deposits are redeemable at any time, while Fixed deposits are locked for the selected term, and funds are automatically redeemed to the user’s account upon maturity. Fixed products tend to offer better returns than flexible products.

KuCoin Promotions Product. Image via KuCoin

KuCoin Promotions Product. Image via KuCoinRisks and Benefits of the KuCoin Promotions Product:

The KuCoin Promotions products run the same risks as the Savings product. Furthermore, users who opt for fixed deposits are more sensitive to market and platform risks. The Promotions product’s limited liquidity and better returns also subject this product to high demand.

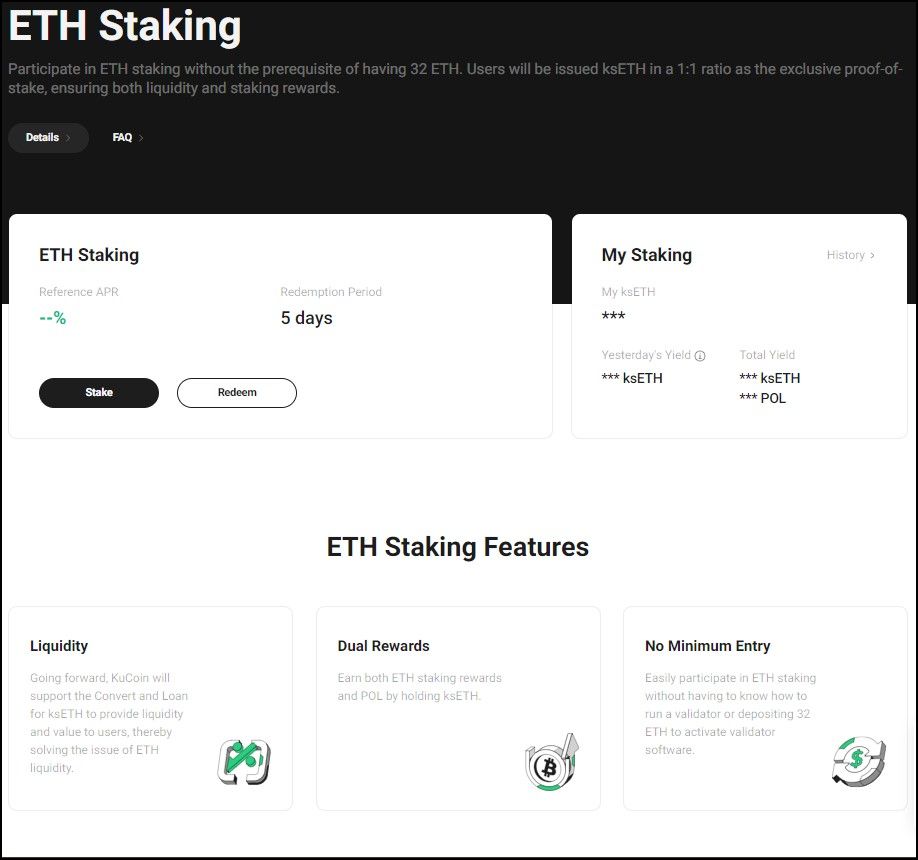

KuCoin ETH Staking

The Ethereum network migrated to Proof of Stake after the Merge. The intricately designed and financially demanding prerequisites for staking as a validator propelled the liquid staking industry in Ethereum.

In staking as a service, users leverage third-party service providers to participate in the Ethereum consensus without needing to run a validator node independently. A third-party validator node pools ETH deposits from several users and stakes them on the network on their behalf, distributing the rewards proportionately after charging compensation.

Liquid staking is a passive investment product that provides exposure to Ethereum staking rewards and lowers entry barriers by letting users stake an amount significantly less than the 32 ETH required traditionally. Furthermore, liquid staking providers mint a liquid, one-to-one representation of the user’s staked ETH that they may use for trading or in DeFi. KuCoin is one of the many centralized (Binance, Coinbase, Kraken, etc.) and decentralized (Lido Finance, RocketPool, etc.) liquid staking service providers.

KuCoin ETH Staking. Image via KuCoin

KuCoin ETH Staking. Image via KuCoinKuCoin ETH Staking Features:

- ksETH - KuCoin users who stake ETH on KuCoin obtain an equal amount of ksETH, which they may keep in their Funding or Trading Accounts. Holders of ksETH will receive the proportionate staking rewards distributed by KuCoin.

- Liquidity - KuCoin supports the ksETH/ETH pair on its trading platform to ensure their easy exchange and nearly equal value.

- Redemption - The ETH staked on KuCoin is redeemable anytime after a short waiting period.

- Rewards - KuCoin keeps 8% of the staking rewards to cover operating costs and distributes the rest among ksETH holders proportionately.

KuCoin ETH Staking Market Comparision:

| KuCoin | Binance | Coinbase | Kraken | RocketPool | Lido Finance | |

| Commission | 8% | 10% | 25% | 15% | Variable | 10% (variable) |

| Min. Staking Amount | 0.01 ETH | 0.0001 ETH | No min. amount | Unspecified | 0.01 ETH | No min. amount |

| Reward Distribution | Daily | Daily | Every Three Days | Weekly | 2-3 Days | Unspecified |

| Governance | CeFi | CeFi | CeFi | CeFi | DeFi | DeFi |

| Staking Risks | Not covered | Covered | Covered | Not Covered | Not Covered | Not Covered |

| Other | Additional Platform Rewards | Simple Earn Benefits | Retain Ownership | Additional Rewards | rETH Token Benefits | stETH Token Benefits |

KCS Bonus Plan

KCS Bonus is an incentive system to encourage users to hold KCS and earn passive income. It is a simple plan where users just need to hold at least 6 KCS in their KuCoin account, making them eligible to get a daily bonus coming from 50% of KuCoin’s daily trading fee revenue. The reward amount may vary depending on the trading volume and the amount of KCS the users hold. KuCoin claims the bonus plan has rewarded an APR of 3-30% in 2021.

KCS Bonus Plan. Image via KuCoin

KCS Bonus Plan. Image via KuCoinThe KCS Token

KCS is the native token for the KuCoin exchange. It is a utility token with which users can pay fees on KuCoin, fuel the Dapp ecosystem of the KCC chain, and share the growth benefit of the exchange. Originally an ERC-20 token, KSC has continued to migrate to the KCC chain since 2021.

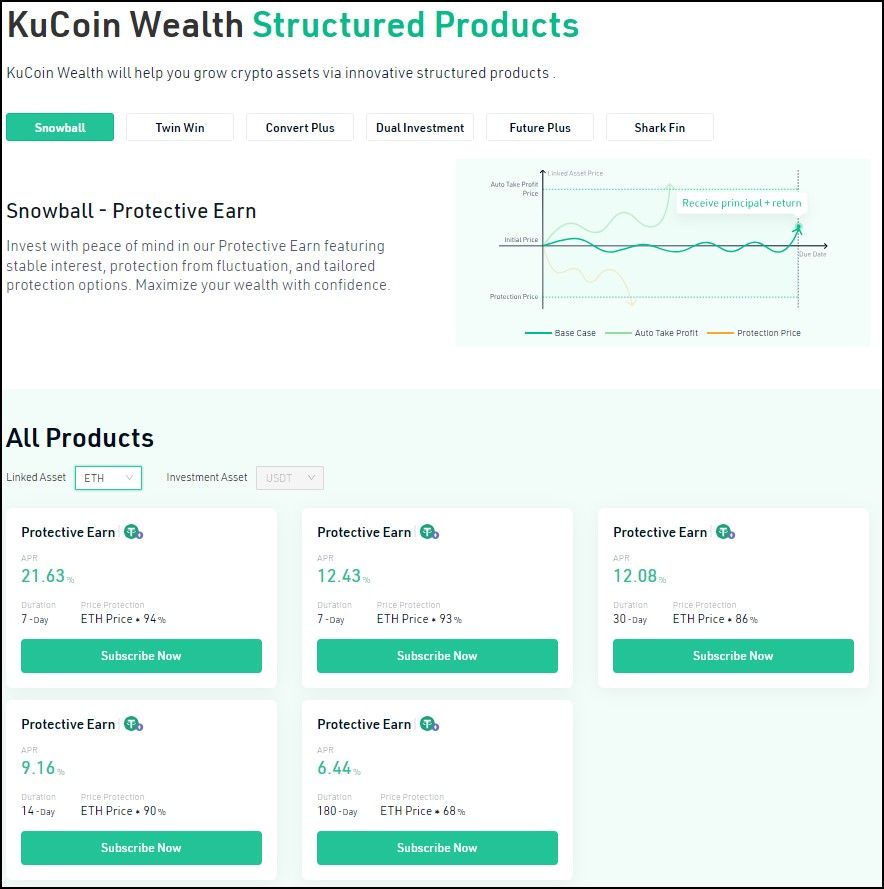

KuCoin Wealth Products

KuCoin Wealth is a collection of structured investment products that lets users profit from different market conditions. These products are financial instruments with varied risk-reward ratios that the investors may choose based on their needs.

Most KuCoin wealth products are constructed with a combination of options strategies. Users must have a view of the future movement in the market based on which they may subscribe to KuCoin Wealth offerings. These products are fairly intricate and at risk of negative returns if the market moves against the user’s bets.

KuCoin Wealth is meant for seasoned traders with a thorough knowledge of financial instruments and volatility risks and a fair idea about cryptocurrency markets. KuCoin offers a range of Wealth products. Some are principal-protected, while others are more aggressive. KuCoin offers the following Wealth products:

KuCoin Snowball - Protective Earn

KuCoin offers the Snowball strategy for USDT, ETH, and BTC. Snowball deploys options strategies where the user receives the designated returns as long as their position remains in the desired range.

Snowball Wealth Product. Image via KuCoin

Snowball Wealth Product. Image via KuCoinSubscribers are protected against sharp fluctuations as follows -

- The breach of the upper range closes the position and credits the user with the principal and accrued interest.

- The breach of the lower range closes the position and protects the user against further loss.

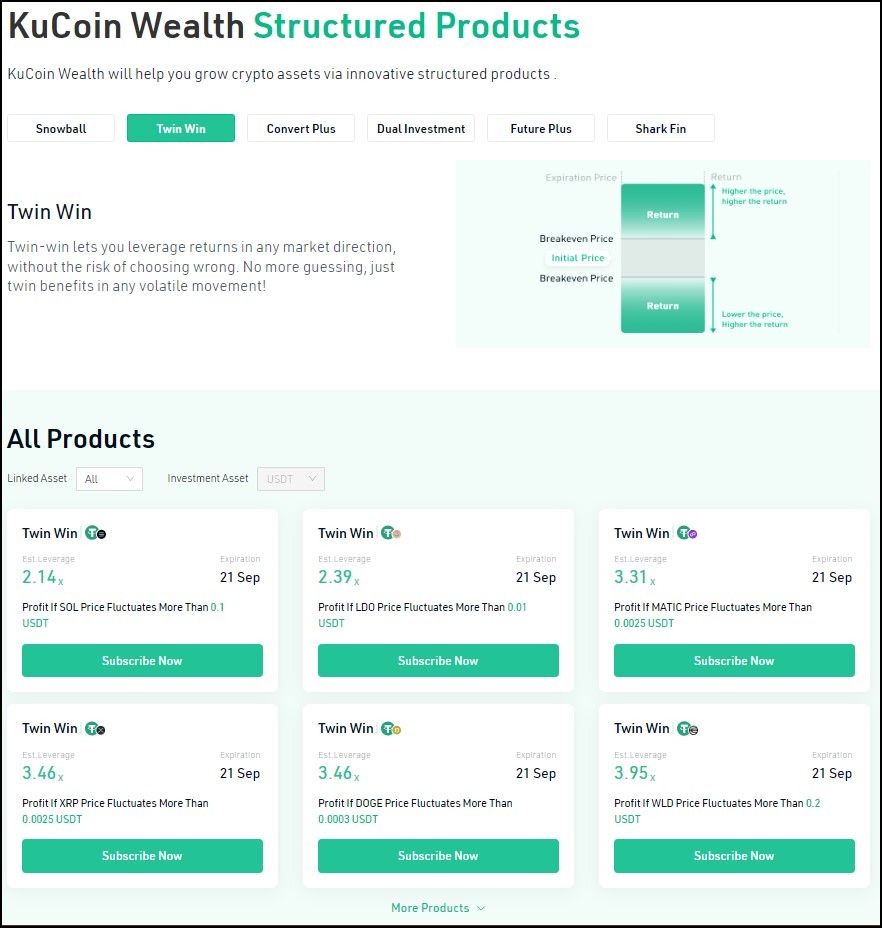

KuCoin Twin-Win

KuCoin Twin-Win is an event-driven trading strategy. It is a strategy where users can capitalize on market volatility driven by significant market events. The strategy bets on volatility, which means the more volatile the market, the higher the return, while they incur a loss if the event fails to achieve the target volatility.

Twin-Win Wealth Product. Image via KuCoin

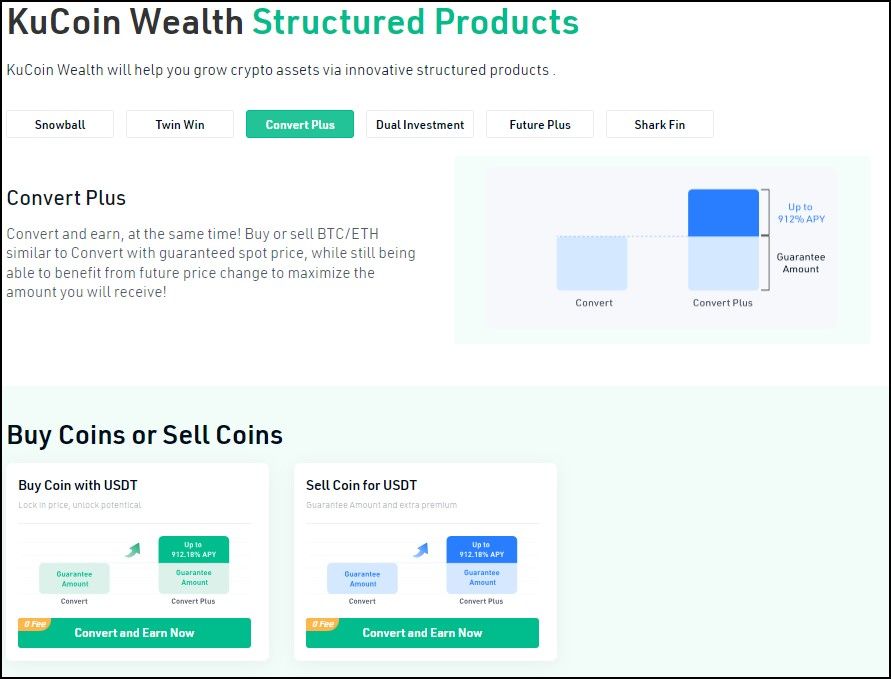

Twin-Win Wealth Product. Image via KuCoinKuCoin Convert Plus

Convert Plus is a trading strategy that deploys options to let users lock a conversion price for an asset they want to convert at a later date. The strategy guarantees the conversion price upon maturity and offers additional rewards if the underlying asset's price rises above the conversion price.

Convert Plus Wealth Strategy. Image via KuCoin

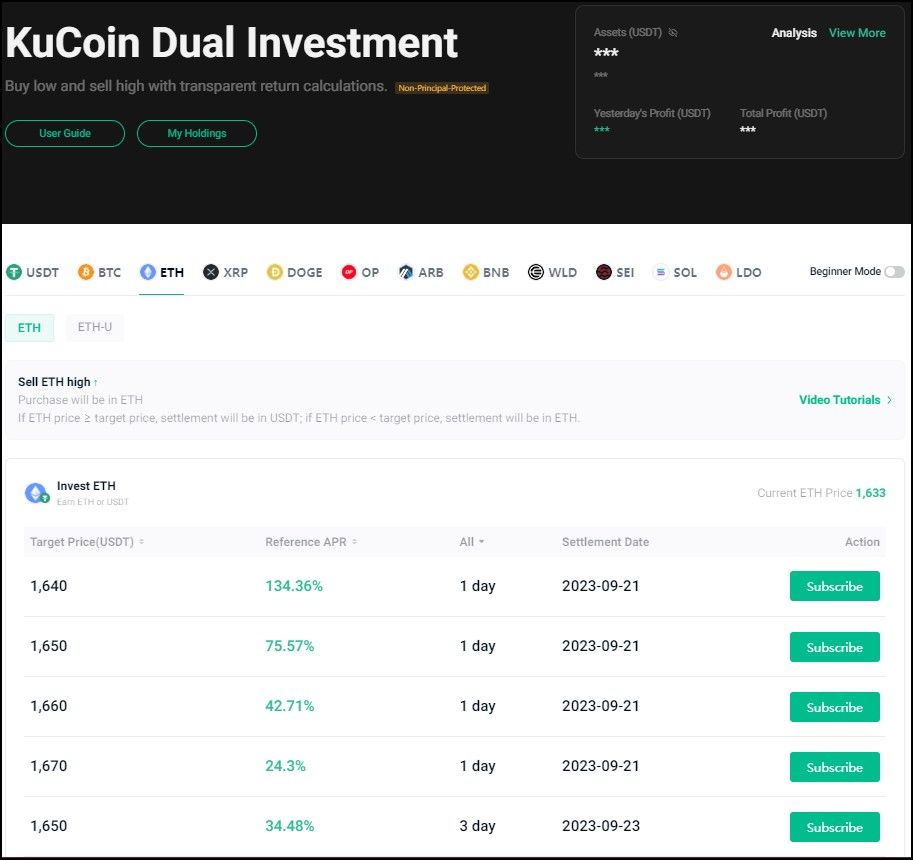

Convert Plus Wealth Strategy. Image via KuCoinKuCoin Dual Investment

The KuCoin Dual Investment is an advanced, non-principal-protected financial product that offers high yields. Here’s how it works:

- Select the pair: subscribers first choose a pair of assets to invest in. Usually, a cryptocurrency is paired with a stable asset like stablecoins.

- Select the terms: The user must choose a target price and settlement date they prefer for the cryptocurrency. They may bet on its price to go up or down and select the target price accordingly.

- Deposit the asset: Subscribers deposit the required assets into the investment product.

- There are two possible return scenarios.

- Price above the target price: In this case, the user gets their initial investment back in the stablecoin denomination on the maturity date with the accrues interest.

- Price below the target price: In this case, the user gets their initial investment back in cryptocurrency denominations, essentially allowing them to buy more of the asset at a “discount” compared to the target price.

Dual Investment Wealth Product. Image via KuCoin

Dual Investment Wealth Product. Image via KuCoinThe Dual Investment product offers potential gains from rising and falling markets while earning interest. However, subscribers must be cautious of this strategy during excessive volatility, where the opportunity cost of this strategy may outweigh its gains.

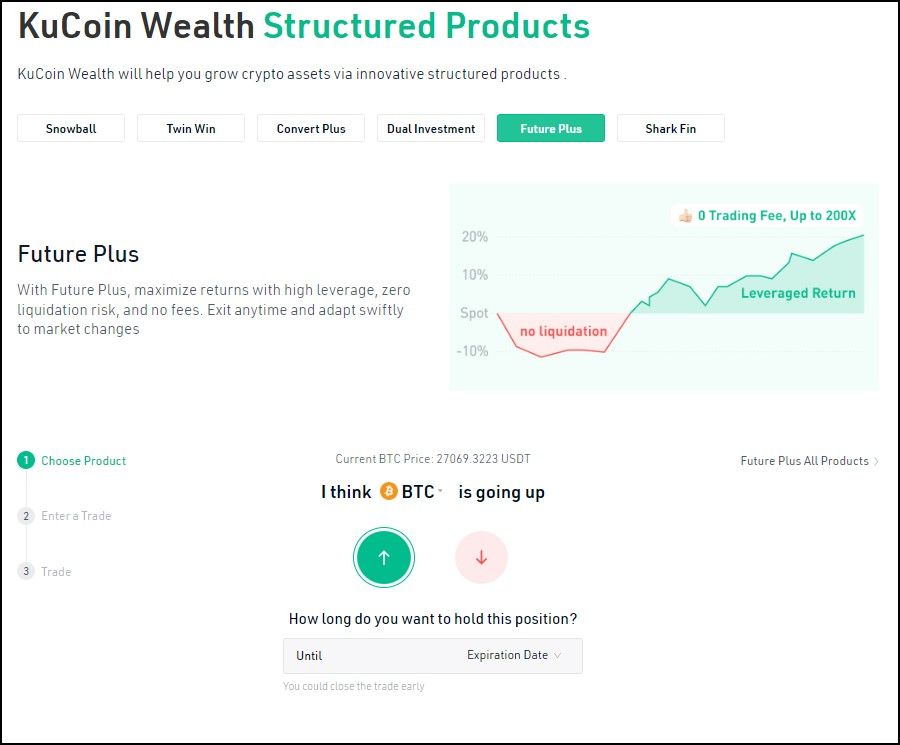

KuCoin Future Plus

The KuCoin Future Plus is a structured investment product that combines returns from directional market movement and leverage while limiting downside risk. Subscribers select a breakeven price, leverage amount, and market view.

If their view is correct, the upside profit is multiplied by their leverage, but the downside risk is mitigated by locking their loss to the initial capital invested into the product.

Future Plus Wealth Product. Image via KuCoin

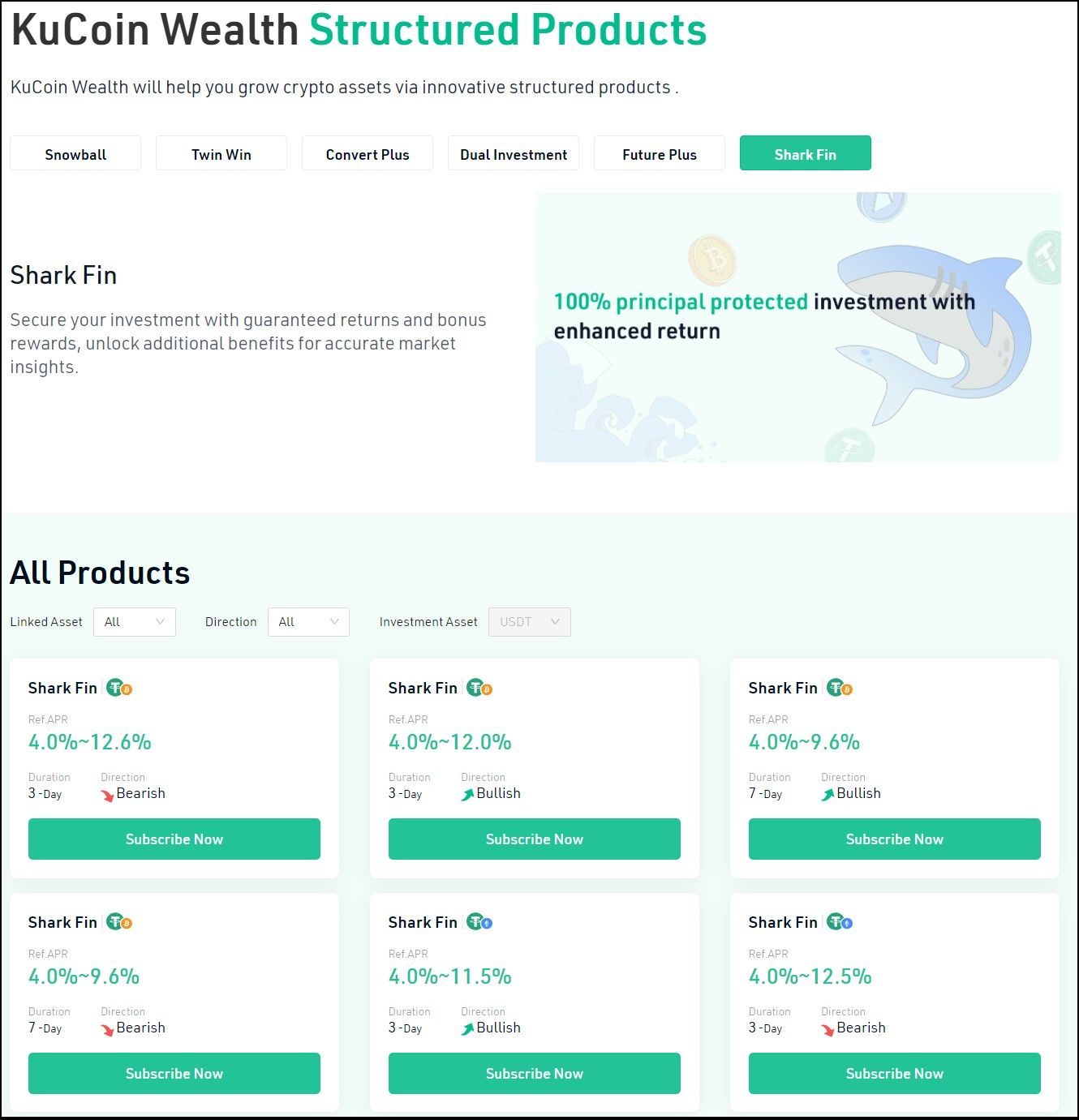

Future Plus Wealth Product. Image via KuCoinKuCoin Shark Fin

The KuCoin Shark Fin is a principal preserving passive investment product that uses options to generate guaranteed returns for its subscribers. This product guarantees a minimum return to subscribers and offers additional rewards if their directional view of the market turns out correct.

Shark Fin Wealth Product. Image via KuCoin

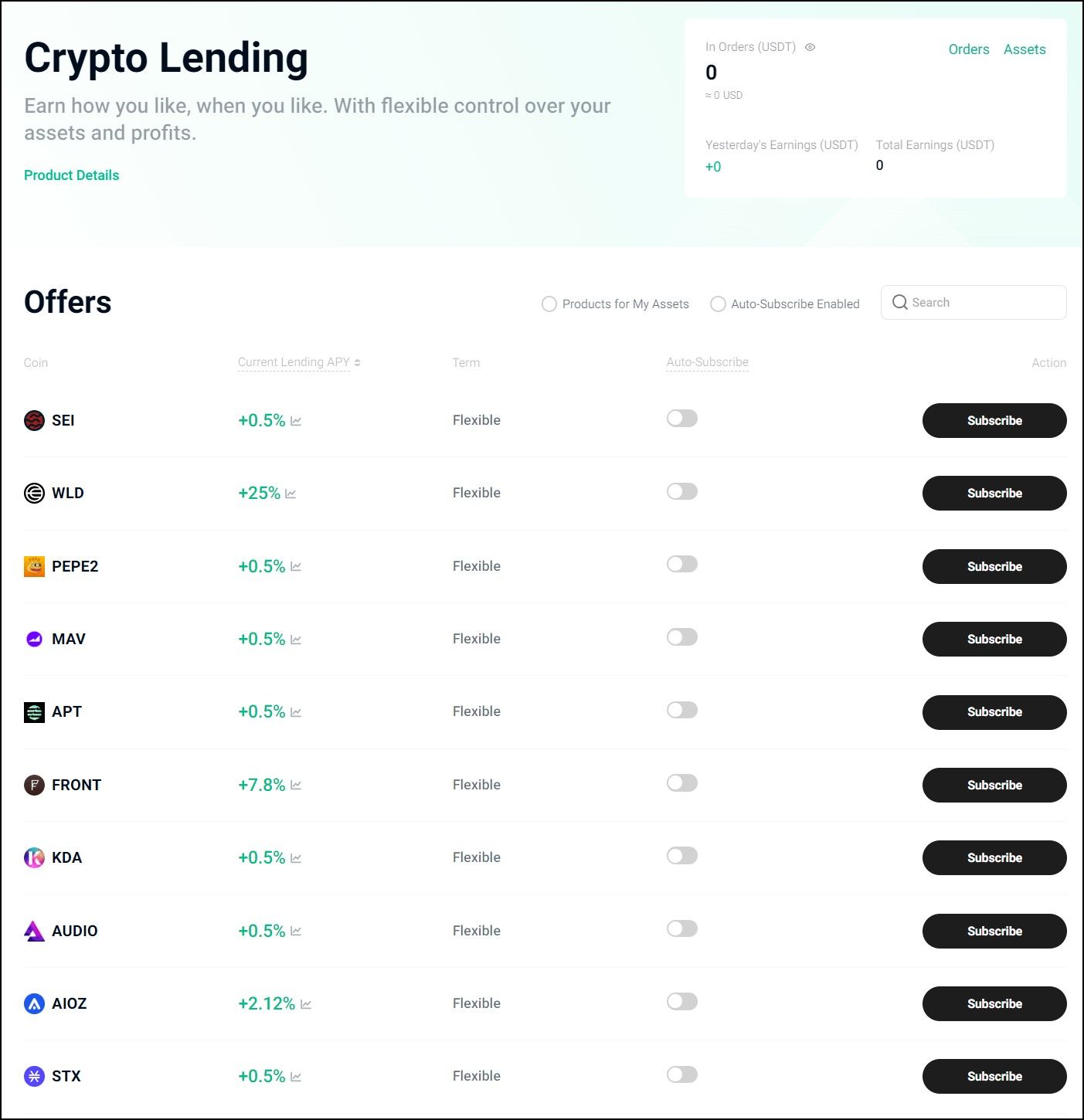

Shark Fin Wealth Product. Image via KuCoinKuCoin Crypto Lending 2.0

Crypto Lending 2.0 is a passive investment product where KuCoin mediates capital flow between lenders and borrowers. It allows subscribers to lend their crypto assets and earn interest on them. Here is how it works -

- Subscription - Users can subscribe to lend several supported assets and set a minimum lending APY.

- Matching - The user’s subscription is matched with a borrower who agrees to pay the interest the lender demands.

- Interest distribution - Subscribers receive an interest based on the amount lent out and the lending interest rate, which is distributed every hour.

- Redemption - Lenders can redeem their assets at any time but with a one-hour delay. The redemption may get further delayed if the funds in the asset pool that cover the lender’s loan are insufficient.

- Auto-Subscribe - KuCoin also provides an Auto-Subscribe feature, which lets users automate the lending process.

Crypto Lending Staking Product. Image via KuCoin

Crypto Lending Staking Product. Image via KuCoinBenefits of crypto lending on KuCoin:

- Passive income - Lending your crypto assets allows you to earn interest, providing a passive income source.

- Flexibility - KuCoin Crypto Lending 2.0 offers a more flexible lending experience, with hourly interest distribution and the ability to redeem lent assets with a minimum of T+1 hour after matching.

- Diversification - Crypto lending can be a part of your investment strategy, helping to diversify your portfolio and manage risk.

- User-friendly - The platform is designed to be easy to use, making it accessible for both experienced and new crypto investors.

Risks of crypto lending on KuCoin:

- Counterparty risk - When lending your assets, there is a risk that the borrower may default on their loan. However, KuCoin requires borrowers to maintain a certain amount of collateral to minimize this risk.

- Platform risk - There is a risk associated with using any online platform, including potential security breaches or technical issues. KuCoin has implemented security measures to protect users' assets, but staying informed about the platform's security practices is essential.

- Market volatility - Crypto markets are known for their volatility, impacting the value of your lent assets and the interest you earn.

- Regulatory risk - Crypto lending is subject to regulatory changes, which could impact the platform's operations and your ability to lend or redeem your assets.

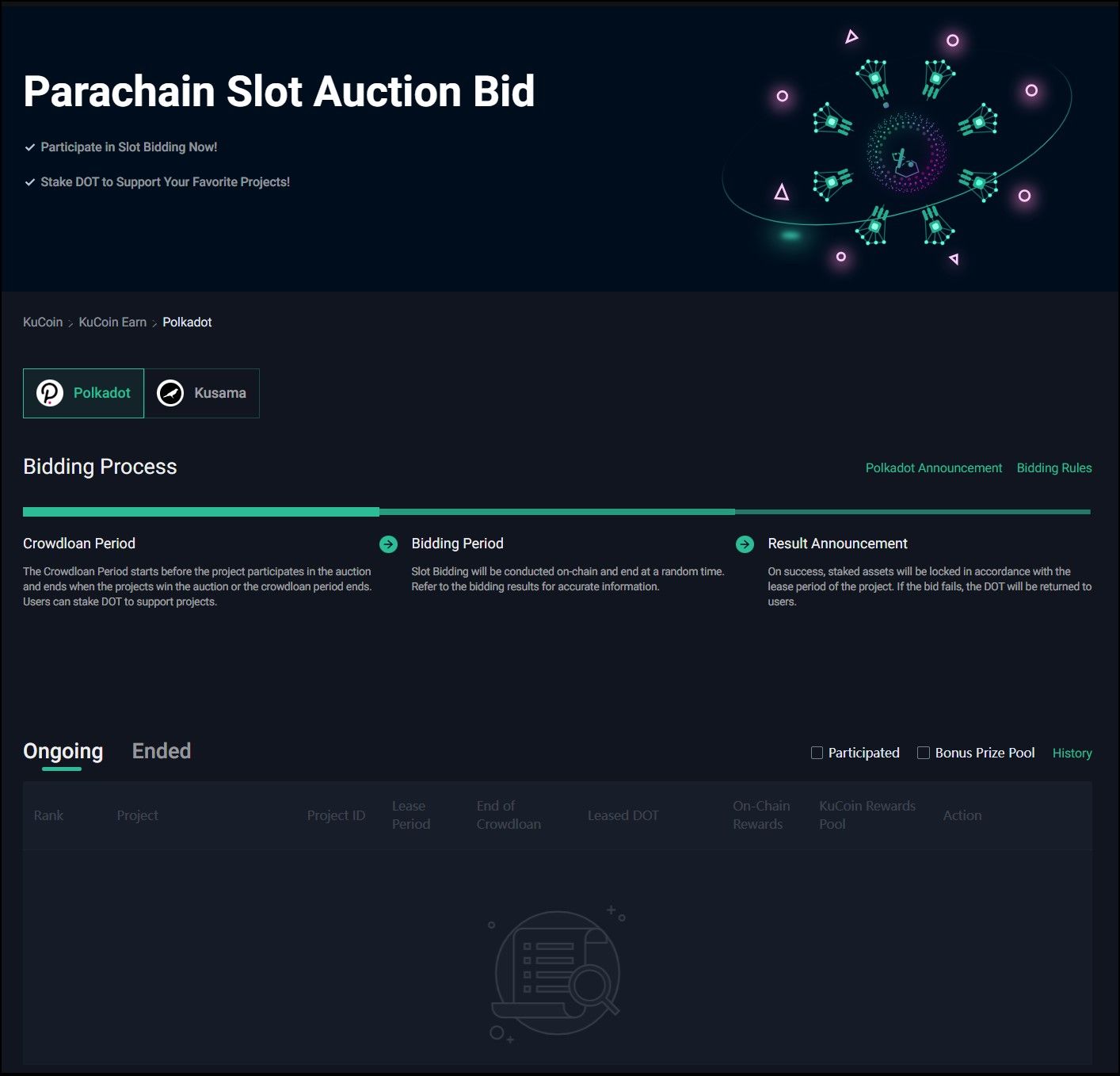

KuCoin Polkadot Auction

Polkadot auctions parachain slots, a layer-2 on the Polkadot network where supports bid for their favorite projects with DOT. The bids are locked on-chain and returned after the auction is complete. The bidders of the winning slot receive additional rewards as token allocation on the Polkadot network.

DOT Slot Auctions Earn Product. Image via KuCoin

DOT Slot Auctions Earn Product. Image via KuCoinA KuCoin account with DOT holdings can also participate in the Polkadot Slot Auctions. Here are some benefits of participating in the auction via KuCoin:

- Simple - An auction participant on KuCoin does not have to deal with smart contracts and complicated blockchain applications, making the auction experience simple and straightforward.

- Kusama auctions - Kucoin also lets users participate in Kusama Slot Auctions, another Polkadot blockchain network from the same account and DOT holdings.

- Additional rewards - KuCoin rewards auction winners with a share of the KuCoin Rewards Pool as an additional incentive, amplifying returns.

If you want to learn more about Polkadot Slot Auctions, Guys covers that in the video below:

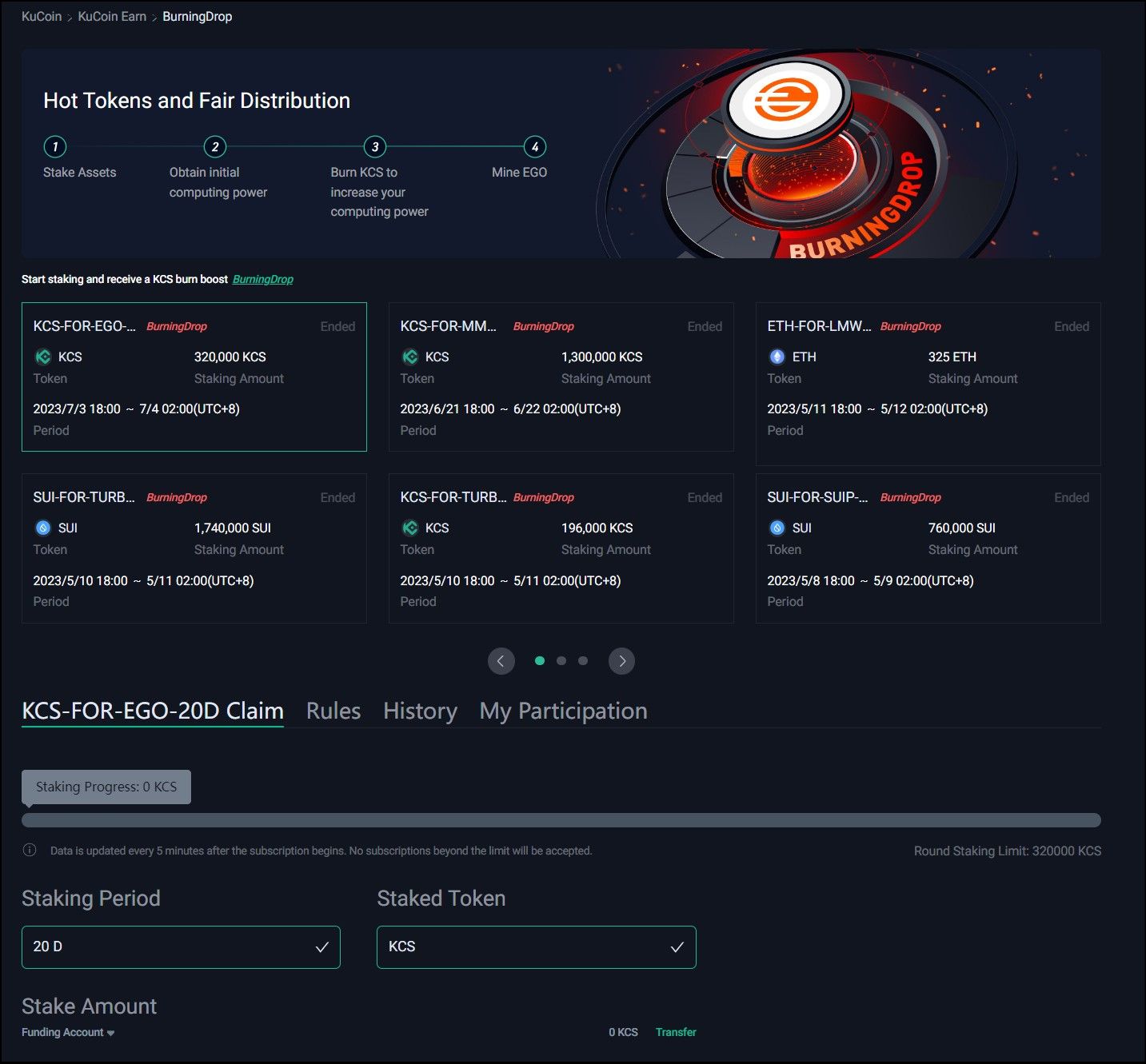

KuCoin Burning Drop

KuCoin Burning Drop allows users to participate in token distribution schemes of new projects by staking supported assets like KCS, ETH, and USDT in their KuCoin account.

Burning Drop Earn Product. Image via KuCoin

Burning Drop Earn Product. Image via KuCoinHere is how the Burning Drop process works:

- Staking - Users stake the required tokens for a specified period, usually 20 days.

- Burning Acceleration Period - This is a period when users who previously staked in the Burning Drop can burn their POL (a reward received for subscribing to KuCoin Earn products) to earn more tokens rewards.

- Token distribution - Participants receive their share of new tokens at the end of the staking period.

Is KuCoin Safe?

KuCoin is a well-known cryptocurrency exchange that has been in operation since 2017. The platform employs security measures like encryption protocol and two-factor authentication for additional account security.

However, the safety of KuCoin, like any centralized financial service, is not completely transparent and verifiable. KuCoin emphasizes the importance of knowledge of inherent risks associated with staking cryptocurrencies. Users must understand the importance of possessing private keys and if giving up that privilege is a viable trade-off in their personal investment context.

KuCoin is also subject to operational and maintenance downtimes and prone to blackswan events like exploits. On September 25, 2020, KuCoin underwent a security incident where hackers obtained private keys to the exchange's hot wallets and drained over $280 million in various crypto assets traded on the platform.

As with any financial service, due diligence and a clear understanding of the associated risks are essential for users considering staking assets on KuCoin Earn.

KuCoin Earn Review: Closing Thoughts

KuCoin Earn is a strong player in the fast-paced world of cryptocurrency finance, offering a broad range of products and a user-friendly experience that appeals to both newcomers and seasoned investors looking to expand their portfolios.

Yet, like any investment venture, it's crucial to proceed with caution and fully understand the associated risks and intricacies. As the cryptocurrency market continues to evolve, KuCoin Earn is well-positioned to leverage this growth, providing a comprehensive platform for managing crypto assets that distinguishes it from other competitors.