The demise of FTX has caused many to question the safety of other centralised exchanges. In this review, we will compare two of these - Coinbase and Kucoin - to determine if they are worth using, and which one is better.

With many crypto investors now concerned about the soundness of centralized exchanges, there has been a flurry of withdrawals from these exchanges as the drumbeats of "not your keys, not your coins" echo loudly throughout the corridors of the crypto academy. Even so, the current system dictates that fiat-to-crypto currency can only be done through exchanges.

For those new to the crypto space, centralised exchanges offer a certain level of familiarity that they are comfortable with since most are used to dealing with traditional financial institutions that have the same requirements and infrastructure. At the very least, support is usually an email or even a phone call away.

Centralised exchanges have their role to play in the crypto sphere. They are part of the necessary equation to help the world get on the crypto bandwagon. The main functions of these exchanges are to allow onboarding, buying, and selling crypto assets. In some cases, one can also use their staking services to earn yield. This touches on the custodial vs. non-custodial issue, which we will discuss in more detail later. Note that storing crypto is NOT the key function of an exchange. That's best done with a cold wallet. Feel free to check out Guy's take on the Top Hardware Wallets for your long-term storage needs.

Now, on with our Coinbase vs. Kucoin review!

Note: Users located in the US and UK are not supported.

Coinbase vs Kucoin

Later in the review, we’ll take a closer look at each exchange individually. But first, we want to give you an overview of our findings by comparing Coinbase and Kucoin.

Coinbase vs. Kucoin: Products Offered

There are a few standard categories of products one can find at most exchanges. For both Coinbase and KuCoin in the top-ranking exchanges list, one must keep up with the Joneses and also one-up the competition where possible. In this section, we will do a brief comparison of the products on offer and highlight where they differentiate from each other. Both offer leverage trading.

Spot Trading

The key difference here is in the number of tokens available to trade. KuCoin, not being based in the US, has the upper hand in terms of token variety for trading. Coinbase, due to US regulations, can only offer what is likely to not offend regulators, which drastically shrinks what is available for customers.

Futures Trading

The playground that KuCoin operates in has many more exciting products in this space compared to Coinbase, which is essentially fighting with one hand tied behind its back. KuCoin's customers may be able to enjoy a most thrilling ride of up to 100x leverage for their futures.

Note: Leveraged trading is only for the most professional traders. If you can't consistently make a profit on your trades currently, this is not something to toy with as it could lead to disastrous consequences when things go wrong, especially in a volatile market.

Staking

A word on staking before we do our comparison: when one chooses to use the staking service of an exchange, one is essentially giving up custody of those assets to the exchange. Amidst the constant cry of "not your keys, not your coins", due consideration needs to be given to the amount of yield/profit you stand to gain vs. the risk of losing it all if the exchange were to go bankrupt or get hacked.

That being said, it's perfectly legit to choose a staking service with an exchange instead of doing your own staking via self-custody wallets. It simply boils down to choice and what people feel comfortable with. Those who choose this option should also be welcomed by the self-custody champions. The last thing we want is for people to feel that if they don't do self-custody, they're not worthy of being in crypto. That is absolutely not the case and such thinking does nothing to further the adoption of crypto by the masses.

Respectable exchanges like Coinbase and KuCoin take pains to provide staking services with a decent yield to customers should they choose to park their assets with them. While yield may be a deciding factor, others such as security, reputation, and longevity of the exchange are also worth looking into.

KuCoin runs its own Ethereum node prior to The Merge, collecting ETH on behalf of customers to help secure the Ethereum network. They also allow the staking of other tokens. Coinbase has a small staking program of a handful of tokens with rates that are not as competitive as KuCoin's. If you would like to find out more about crypto staking, please check out our article on this topic on which tokens to get to participate in the security of your favourite blockchain project.

NFT Marketplace

Coinbase has its own NFT marketplace and launchpad that carries well-known NFT projects and the chance to discover some up-and-coming artists. KuCoin, meanwhile, partnered with Windvane as its NFT marketplace. It even launched a 5th-anniversary collaboration project with Windvane, further cementing the partnership between the two entities. Wonderland, its own NFT launchpad, lets users purchase and trade gaming-related NFTs. Another NFT-related service offered by KuCoin and also available on Coinbase is fractional NFTs, where users can own a fraction of an expensive NFT that is also tradeable on its own.

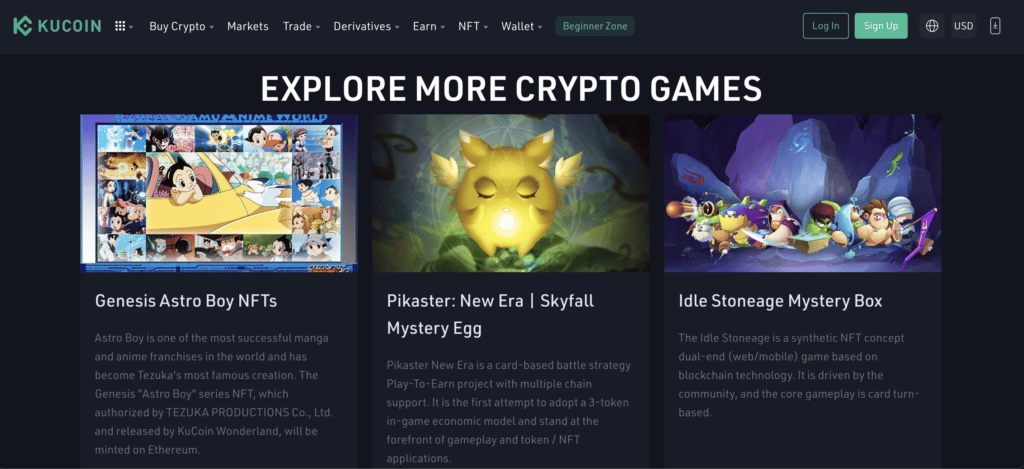

Discover anime-themed gaming NFTs in Wonderland.

Discover anime-themed gaming NFTs in Wonderland.Credit Card as a Payment Method

Coinbase successfully partnered with Visa to launch its own Coinbase card, accepted within the Visa network. Cardholders can spend USD and USDC freely or even crypto, although that's a taxable event in most countries. KuCoin has announced on their webpage that they will also be jumping in on this but more details are yet to be revealed. In this instance, Coinbase scored one over KuCoin.

For more details of the products offered by each exchange, read on to discover more or check out our full review on Coinbase and KuCoin.

Coinbase vs Kucoin: User Friendliness

Reviewing the exchanges in terms of user-friendliness, Coinbase offers two versions: simple and advanced. The Simple version, as the name says, is designed with newbies in mind. All one needs to do is select the asset you want to trade, click the Buy and Sell button, enter the amount and off you go. The Advanced version is similar to KuCoin's standard trading screen whereas KuCoin only offers one type of trading screen and it can be overwhelming/threatening for the less advanced traders.

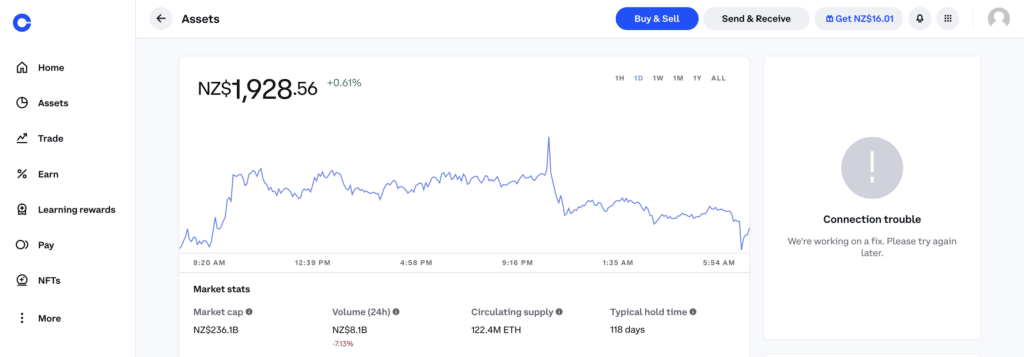

However, Coinbase is also known for its platform going down during peak congestion as I saw for myself when doing research for this article. Meanwhile, I've not known KuCoin to be unavailable any time I go to trade.

The Simple screen for trades, good for newbies but only when it works. Image via Coinbase

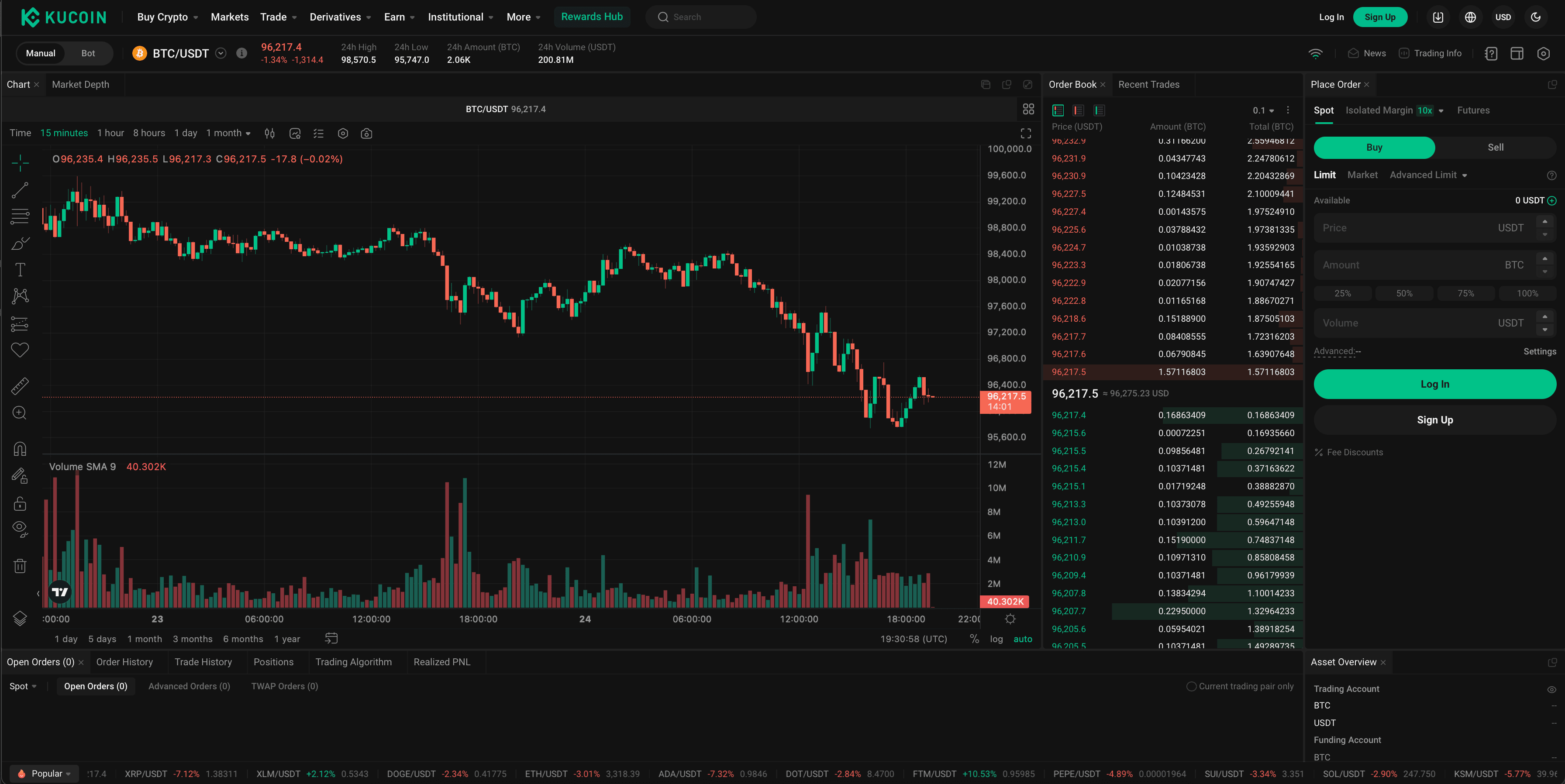

The Simple screen for trades, good for newbies but only when it works. Image via CoinbaseKuCoin's screen, on the other hand, takes a bit of getting used to, complete with trading charts and order books. Designed for those who know what they're doing and what they want, it comes with analytical tools and the usual bells and whistles you'd see in TradingView minus some functionality. Not recommended for those new to trading.

Good for advanced traders. Image via KuCoin

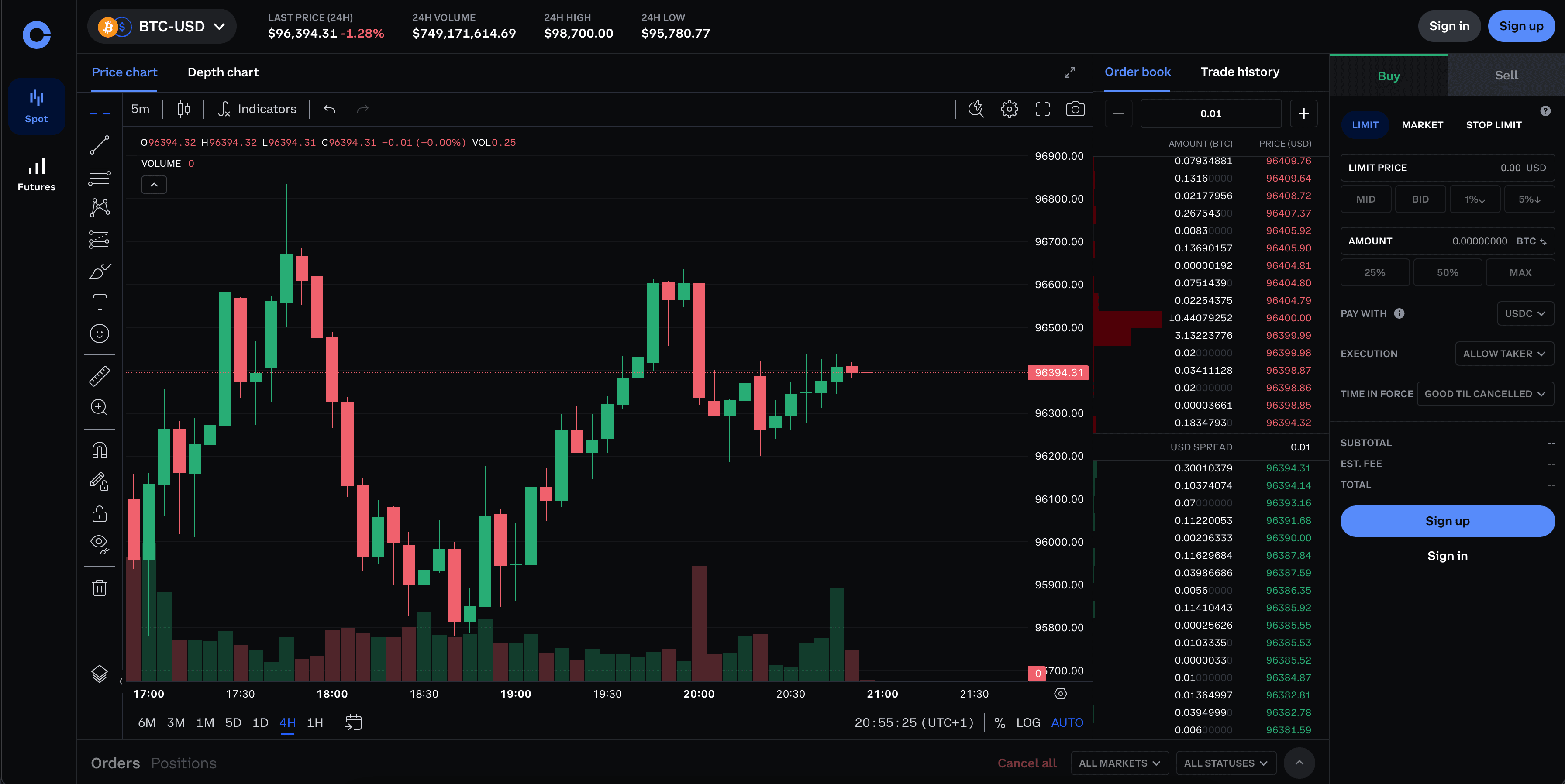

Good for advanced traders. Image via KuCoinIn the interest of comparing apples with apples, I also checked out the Coinbase Advanced trading screen which bears some similarity to KuCoin's but has a lot fewer indicators than one would normally expect for advanced trading. Despite the similarities, Coinbase manages to make its screen less cluttered than KuCoin's, making it easy on the eyes.

Looks more complicated than Simple but still easy on the eyes. Image via Coinbase

Looks more complicated than Simple but still easy on the eyes. Image via CoinbaseTrading action aside, the other important factor to consider is customer support. How easy is it to get help when it's needed?

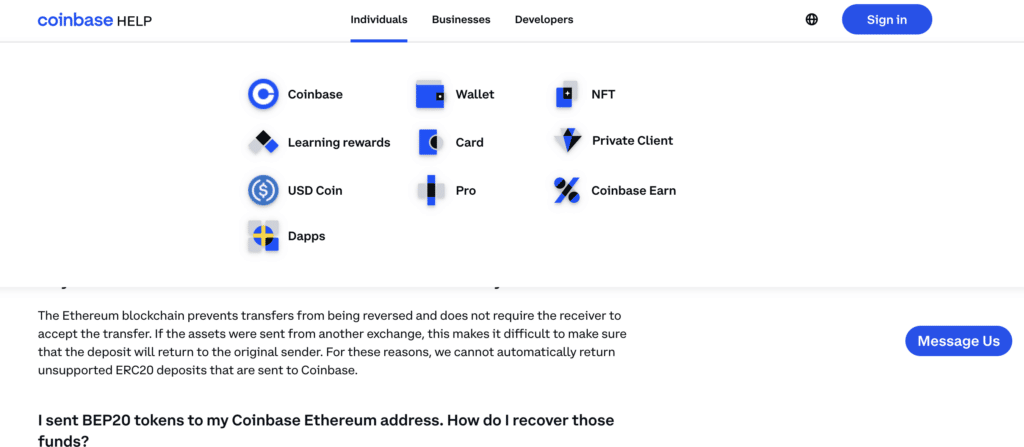

The Coinbase Help section allows users to search either by topic or customer type (Individual, Business, Developer). This caters for a few search habits for customers, which shows good UI. I also like that they have a Tax section for FAQs relating to this complicated issue. While tax advice is not provided, general ways on how to handle taxes for crypto are clearly outlined, which is still very helpful in its own way. The articles are also clearly written and easy to understand. For all other queries not found on the support page, customers can also contact them via a chat program or live phone support. Questions are streamlined into categories.

Big icons sorted into appropriate categories for easy navigation. Image via Coinbase

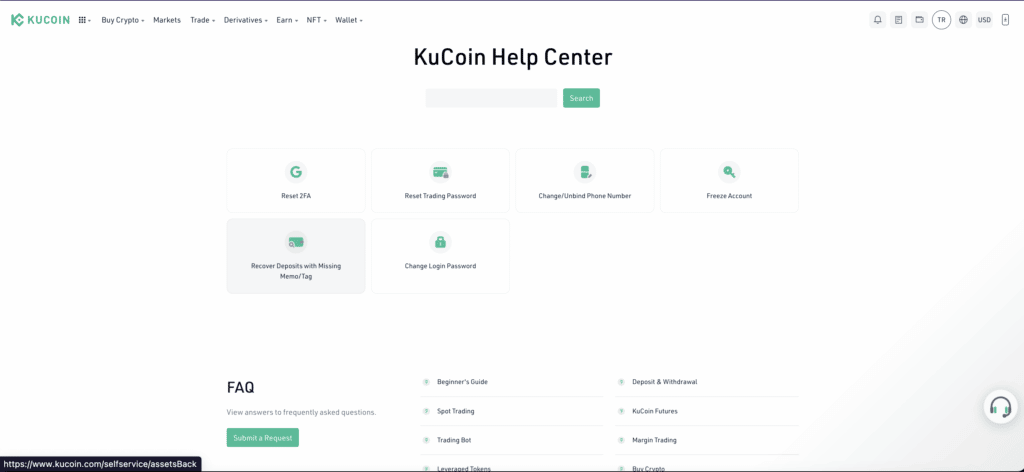

Big icons sorted into appropriate categories for easy navigation. Image via CoinbaseIn comparison, KuCoin only has a chat function but no live phone support. The layout of the page, which basic and functional, could make better use of the white space, perhaps slightly bigger fonts for the category headings for easy reading. I've used KuCoin's chat function previously and find them to be relatively helpful. Where there is an issue that needs more expert help, the conversion from chat to a ticket is a smooth one and the issue is resolved in a relatively acceptable timeframe.

There is also a search field for topics not covered on the support page. Customers would do well to select the type of query in addition to posing the question in the relevant fields. This ensures that the query is directed to the right team for more prompt resolution.

Better use of white space to cover more topics? Image via KuCoin

Better use of white space to cover more topics? Image via KuCoinIn conclusion, both platforms offer comparable ease of support for customers which, these days, is what gives centralised exchanges additional value and a one-up over DeXes. For the latter, the level of support one can get is wholly reliant on the strength of the community, which varies from one Dex to another - sometimes significantly.

Coinbase vs KuCoin: Fees

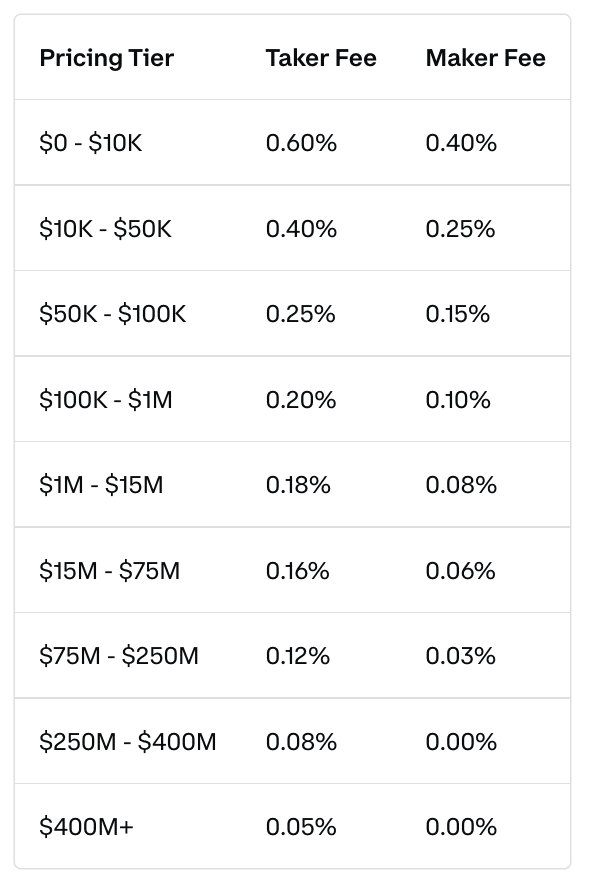

When comparing the fees charged by both Coinbase and KuCoin, it is very obvious that the former is more expensive than the latter. Coinbase's Taker and Maker fees for the lowest tier are at 0.60% and 0.40% respectively. In KuCoin's case, at a similar tier, it's at 0.09% and 0.1%.

Coinbase trading fees:

What you can expect to pay in fees using Coinbase. Image via Coinbase

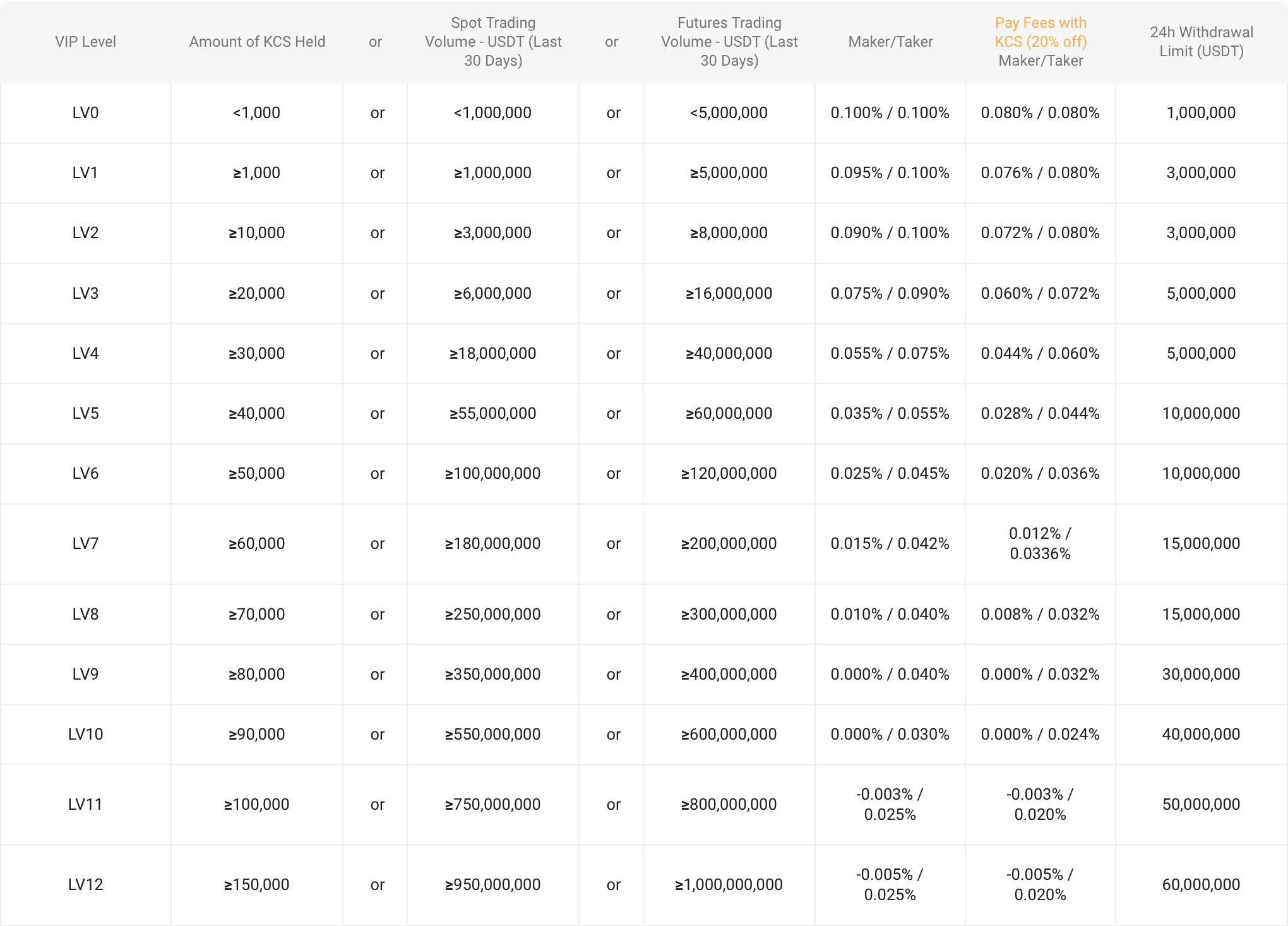

What you can expect to pay in fees using Coinbase. Image via CoinbaseKuCoin trading fees:

Image via KuCoin

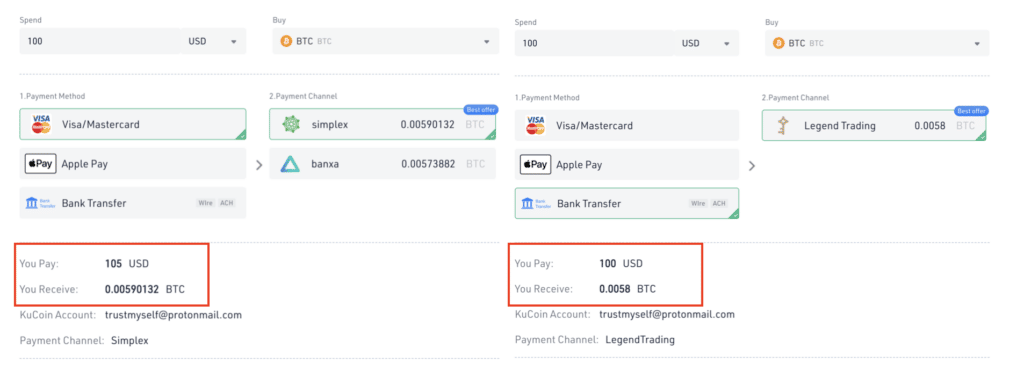

Image via KuCoinAside from trading fees, another type of fees that we need to consider are deposit and withdrawal fees. KuCoin does not charge any fees for deposits but the fees paid for buying crypto are not cheap. The following screenshot shows why:

A comparison of what you get via the different methods on KuCoin. Image via KuCoin

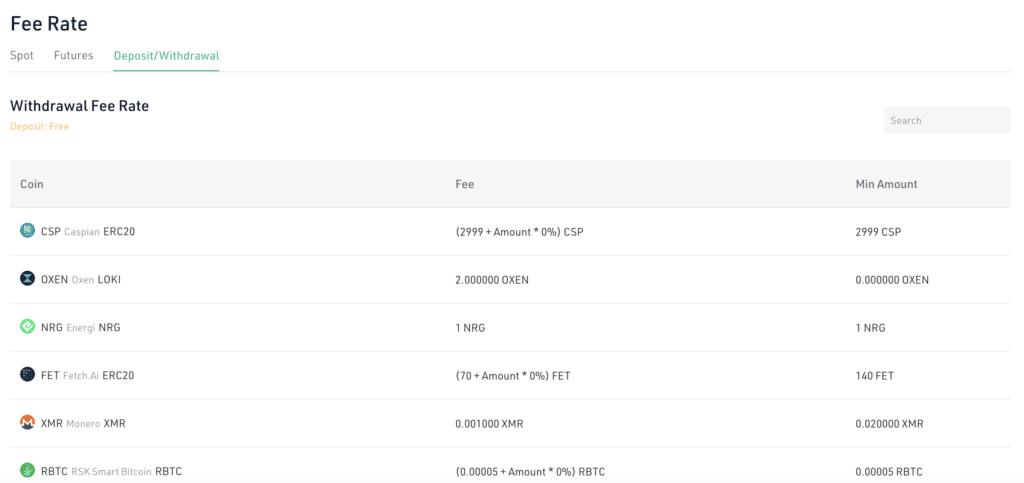

A comparison of what you get via the different methods on KuCoin. Image via KuCoinCrypto withdrawals at KuCoin are highly dependent on what crypto is being withdrawn including a minimum withdrawal amount stipulated by the exchange. It's worth noting that KuCoin doesn't allow for fiat withdrawals, only crypto withdrawals are allowed. By that same token, it is assumed that deposits are also mainly crypto and no direct deposit of fiat is possible.

Withdrawal fees are based on crypto. Image via KuCoin

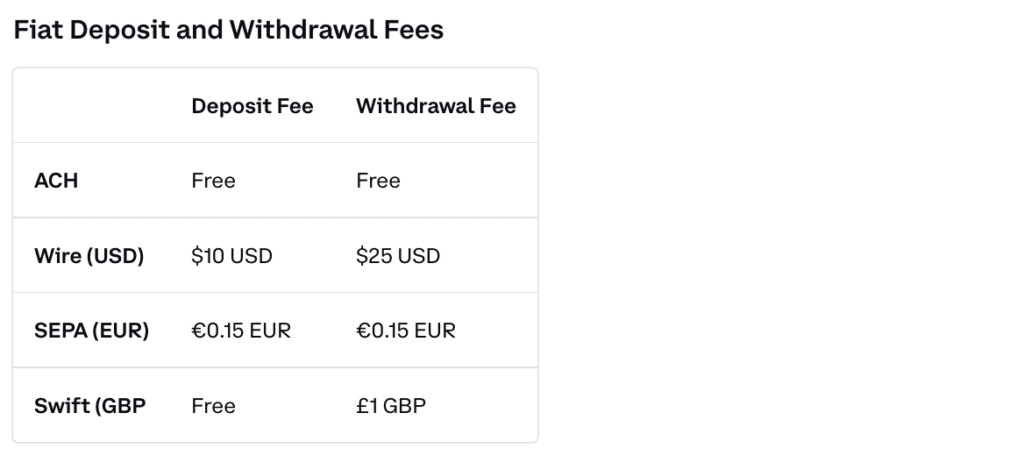

Withdrawal fees are based on crypto. Image via KuCoinOn the other hand, Coinbase charges deposit and withdrawal fees based on the type of merchant processing the transaction. While ACH transfers are free (and only applicable to US customers), other kinds of transfers are even more expensive than what KuCoin charges. Still, we're not exactly comparing apples with apples here as KuCoin doesn't allow fiat deposits.

Deposit and Withdrawal fees are even more expensive with Coinbase.

Deposit and Withdrawal fees are even more expensive with Coinbase.Based on the information provided, customers have a few decisions to make before deciding which platform to go with. The location of customers, fiat vs. crypto deposits, and how often do they trade are just some of the bare considerations to be given.

Coinbase vs Kucoin: Security

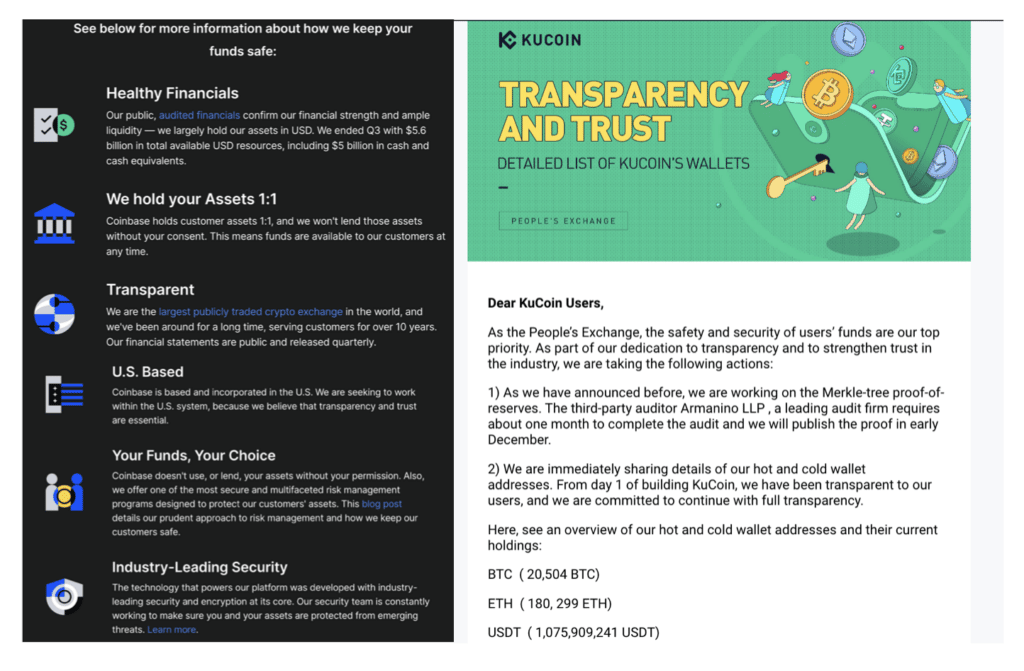

Security is topmost in people's minds these days given the amount of hacks on DeFi platforms, and what happened to FTX. To be fair, the FTX debacle was caused by a lack of internal security and controls, different from external hacks, despite the drainage of funds after the FTX story broke. One of the first things both Coinbase and KuCoin did in the wake of the incident was to issue an email to customers, reassuring them of the safety of their funds. I think any exchange worth its salt did something similar.

Emails sent to customers immediately after FTX happened.

Emails sent to customers immediately after FTX happened.Proof-of-reserves is a hot topic these days, one which KuCoin has indicated its eagerness to join, as indicated in the letter above. The amount of ETH staked in participation of KuCoin's Ethereum node is also of special note.

A quick peek at a list compiled by Nic Carter, a well-known figure in the crypto community, shows which exchanges have put their money in their mouth. Neither Coinbase nor KuCoin are on it. Still, that may not mean much as they could be in the process of doing so.

When it comes to safeguarding funds from external attacks, both exchanges have thrown in considerable resources. Further details of each exchange's efforts can be seen in the relevant sections below.

Coinbase Overview

What is Coinbase

Coinbase is a US-based, full KYC-AML exchange operating in more than 100 countries around the world. It is one of the most well-known cryptocurrency exchanges. There's even a book out about the exchange called Kings of Crypto. As a publicly listed company on Nasdaq, Coinbase is heavily regulated, which may represent a measure of safety in the eyes of some customers. Due to its pole position in the crypto industry from the point of view of the regulators, especially now that FTX has gone under, its every move is practically scrutinized, which not only makes it difficult to play any funny tricks but also limits what they are able to offer to their customers.

A Look at the Coinbase Homepage Image via Coinbase

A Look at the Coinbase Homepage Image via CoinbaseWhen it comes to marketing, Coinbase has done its fair share of horn-tooting to the public. The Superbowl ad, featuring a QR code in the middle of the screen, has been the most eye-catching one of all. While there has been criticism regarding security concerns, it has been a successful marketing venture for the company. The number of app downloads due to the ad caused a crash in the Coinbase system. To find out more about the exchange, check out Guy's take on it.

Cryptocurrencies Offered

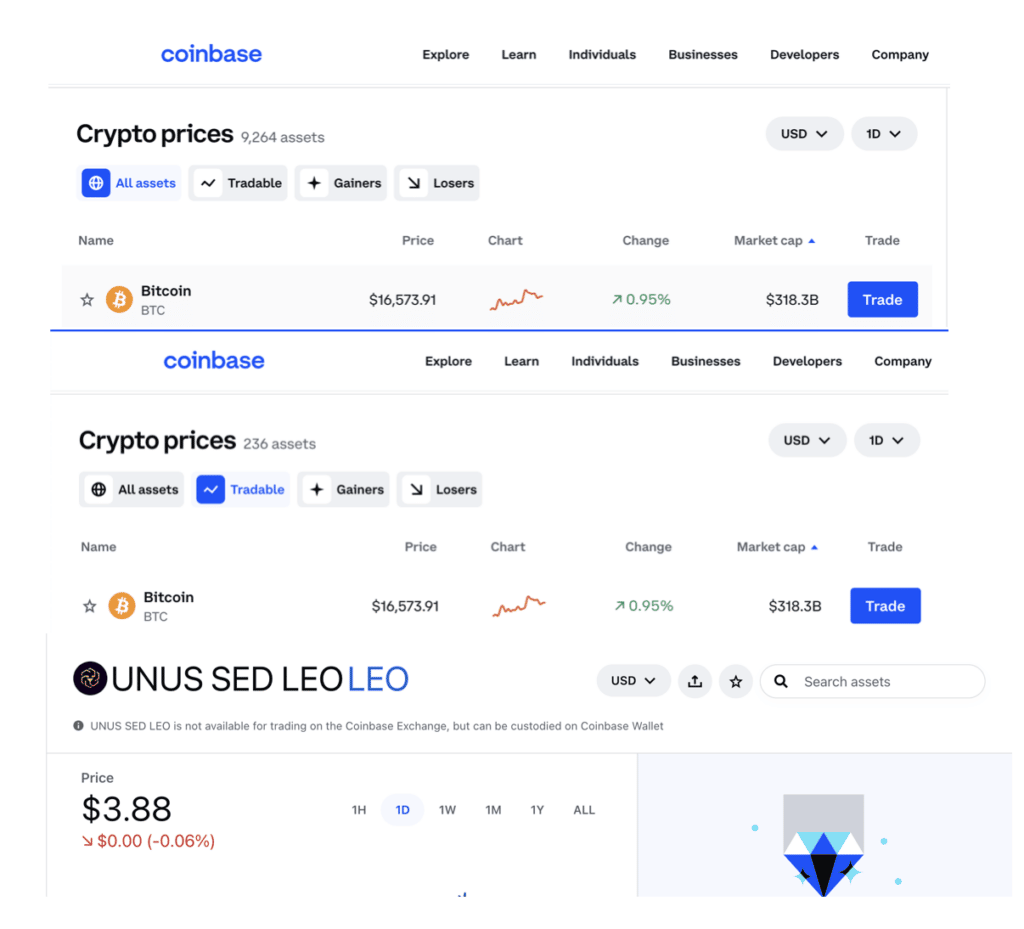

Many of the tokens currently available in the market are deemed to be potential securities by the SEC in the US. Even though there are more than 9,000+ tokens listed on the Coinbase page as supported tokens, a large number of these are mainly available to be stored in the Coinbase wallet. Actual tradeable tokens are over 500. Some of them are flat-out not supported on the exchange but are still listed for their price and stats.

Check Tradeable for tokens that can be traded on the exchange. Image via Coinbase

Check Tradeable for tokens that can be traded on the exchange. Image via CoinbaseCoinbase Products

Despite the regulatory restrictions, Coinbase does its best to offer a selection of products that is enough to satisfy crypto newbies and the occasional swing trader.

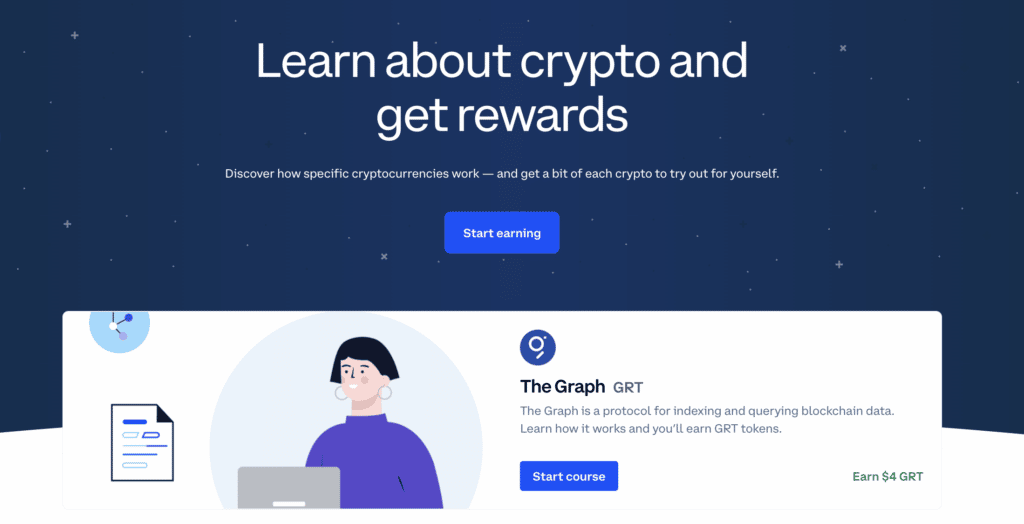

Learn

One of the things that first attracted me to Coinbase was the learning tutorials. Basically, Coinbase is paying you to learn about blockchain projects and at the completion of the short tutorial, a few dollars' worth of the tokens are deposited into your Coinbase wallet. It's the safest and best kind of free money out there. Not only do you get a bit of education, but you also get some tokens to get started. This is a great way to learn about new projects and get some capital to start your crypto journey.

Learn and Earn tokens for new crypto projects. Image via Coinbase

Learn and Earn tokens for new crypto projects. Image via CoinbaseWallet

The Coinbase Wallet is a Web3 wallet fully integrated with the exchange. There is a mobile and desktop version, allowing the storage of both tokens and NFTs. You can get on the crypto train using the fiat onramp options available in the wallet to buy crypto using debit or credit cards supported in your country of residence.

A note of caution: The wallet has been known to have been involved in scams, mainly from users linking their wallets to scammy DApps. One of the more well-known ones is a mining pool scam. Take extra care when adding DApps to your Coinbase wallet. Check and verify that the DApp is legit before giving it access to your wallet to ensure the safety of your funds.

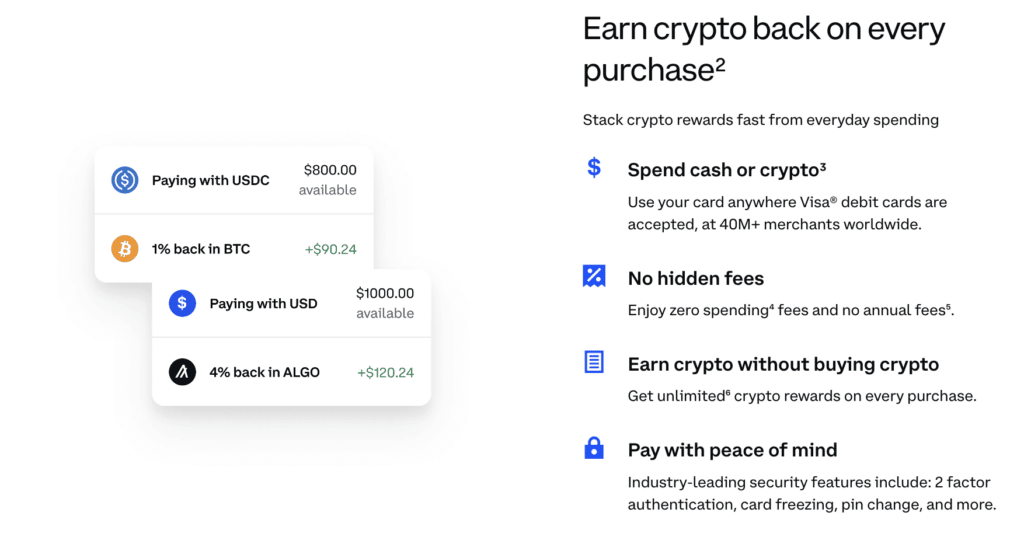

Coinbase Card

US customers (except Hawaii) are eligible to apply for the Coinbase Card where you can earn rewards when spending your crypto. Funding the card is done by either linking your bank account or having part of your salary deposited directly into the card. The partnership with Visa gives it access to merchants worldwide that accept the card as payment.

While spending USD, including USDC, is not a taxable event, other kinds of crypto may incur taxes due to it being seen as a sale. Do check with your accountant or the tax officers for further clarification before you spend your crypto like cash.

Spend your USDC or crypto using the Coinbase Card worldwide. Image via Coinbase

Spend your USDC or crypto using the Coinbase Card worldwide. Image via CoinbaseEarn

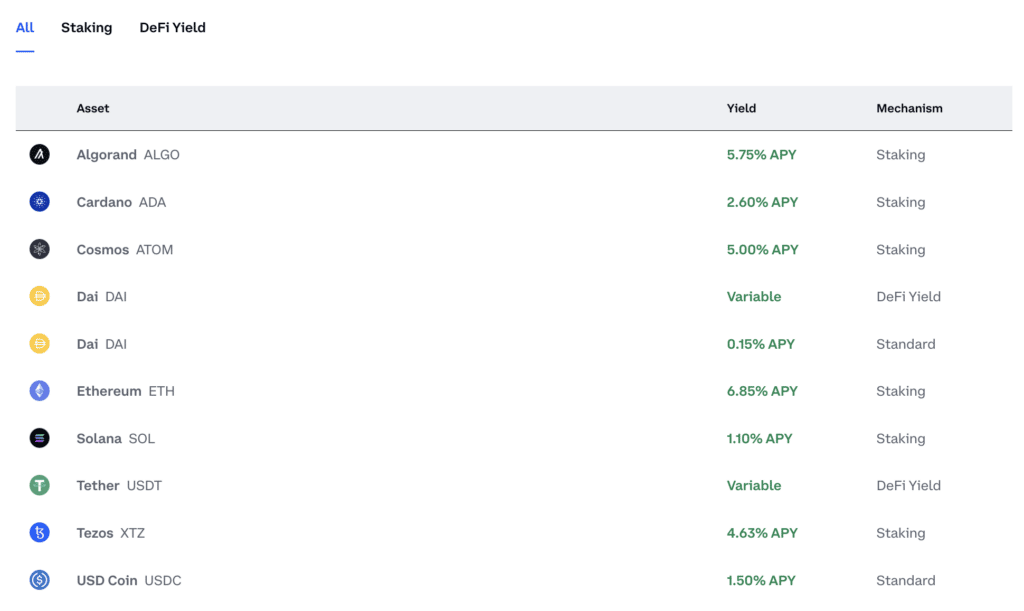

Just like other exchanges, Coinbase provides crypto users two ways to stretch their crypto a bit further on their platform. One of them is a staking program whilst another is earning DeFi yield. The interest to be gained by these two are decent enough to be considered, given the strength of Coinbase's brand. From the chart below, it's easy to find which ones are worth staking on this platform. Still, it's worth making a comparison with other exchanges to find the yield that you're most comfortable with, all things considered.

Earn some decent yield at Coinbase.

Earn some decent yield at Coinbase.Derivatives

The derivatives products offered by Coinbase are pretty middling, especially considering the aforementioned scrutiny by US regulators. Erring on the side of caution, they are limited in this aspect. Currently, you can do futures trading on the following products: ETH, Bitcoin, nano Ether, nano Bitcoin, Bloomberg US Large Cap Index, and Crude Oil.

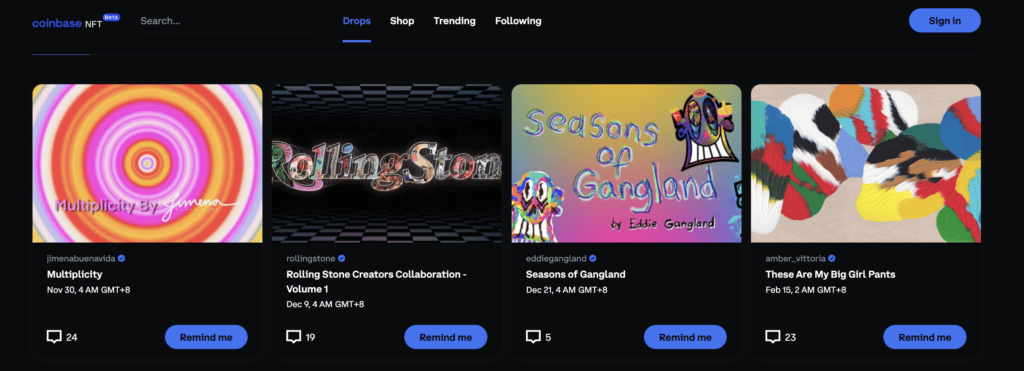

NFT

Coinbase first announced its NFT marketplace in beta in Oct 2021. Since then, the marketplace has had its ups and downs. Reception initially was enthusiastic but with the bear market, NFT activity has dropped considerably.

The marketplace itself features 4 sections: Drops, Shop, Trending and Following. Most of the NFTs listed are on the Ethereum blockchain so expect to pay a bit of gas to purchase any of them.

- Drops is where new collections are unveiled and you can have a reminder sent to you to view them when they're ready.

- Shop and browse all current NFTs available for sale.

- Trending shows the most talked-about NFTs in the crypto space together with some stats for reference.

- Following displays the on-chain activities of the accounts you follow including popular NFT collections you might be interested in.

Check out the latest NFT collections at Coinbase

Check out the latest NFT collections at CoinbaseAll the products highlighted above are tailored for individual investors. Business and institutional investors would do well to check out their offerings in this department.

Types of Accounts and Fees

Coinbase has two types of accounts. The most common type is the regular trading account which anyone can sign up for. KYC is required for making fiat deposits and withdrawals. The fees for this type of account were displayed in all their glory in the previous section. Coinbase One, the pro trading account is designed for the more ambitious trader in mind. It requires a premium subscription but you can try it out for free for 30 days. Benefits include:

- Zero trading fees

- 24/7 Priority Support

- Access to Messari Pro with a 90-day free trial for crypto analytics, and other market intelligence platforms.

- Staking rewards for members

One thing Coinbase isn't known for is competitive fees as compared to other exchanges. However, being a regulated exchange does bring a certain level of peace of mind. This is probably first and foremost for some after seeing what happened to FTX.

Coinbase Security

When you're as well-known as Coinbase, you practically have a big bullseye painted on your back, indirectly enticing hackers to give you a go in exchange for bragging rights. To that end, Coinbase had previously fallen foul in May 2021 when over 6000 accounts were drained. Thankfully, funds were reimbursed as investigations revealed a breach in their 2FA mechanism on the platform. Since then, Coinbase has seriously beefed up its security measures and even offered insurance protection for those who want more peace of mind for their funds. These include (but are not limited to):

- 2FA Verification

- Passwords stored in encrypted form using bcrypt algorithm

- Active monitoring of third-party breaches and darknet activity

- Set up your own crypto vault with Coinbase using the help article provided

- Receive security notifications for all major security changes to your account with the option to lock your account if you choose to do so.

In combination with Coinbase's security measures and being a regulated exchange at least provides enough reassurance to customers that doing any kind of funny business relating to customer funds or the risk of being compromised has been greatly reduced. It's not enough to not be the lowest-hanging fruit but that security needs to be top-notch. To that end, Coinbase seems to have made a considerable investment in this area.

Kucoin Review

What is Kucoin

KuCoin is a centralised exchange with a huge variety of trading products on offer. Advanced traders will probably be quite pleased with the derivatives and future products, not to mention the constant promotions and airdrops of USDT to entice new users to sign up. I honestly think their marketing department works on overdrive to come up with one novelty idea after another to keep people glued to their platform.

As far as user-friendliness is concerned, KuCoin might not be the best platform for a complete newbie as it can be quite confusing. As a customer, my mailbox has been inundated with all sorts of trading promotions on a regular basis, giving me the impression of a very noisy video game arcade. Still, it's quite a lot of fun if you have time to explore.

If you'd like to check out the madness for yourself, Coin Bureau readers can take advantage of KuCoin’s selection of features, insane catalogue of hard-to-find altcoins, and low fees while enjoying an exclusive up to 60% fee discount and free trading bot by using our KuCoin Sign-up Link. A full review of the exchange is also available for you to check out before you sign up.

Cryptocurrencies Offered

With more than 700 tokens available to trade in regions, it can satisfy most traders except for maybe the most hardcore degen ones. Aside from the top 100 tokens in the market, there are also some slightly off-the-beaten-rails ones with new coins listed almost on a weekly basis. This was my go-to trading platform for all sorts of alternative tokens, including the slightly dodgy ones. I've yet to come across a token they don't have, but then, I'm hardly trading these days, much less at a degen level.

Products

As this is not the full review, we'll briefly cover each of the major types of products, enough to give you a glimpse to whet your appetite. For more in-depth information, please check out the review.

Trading

Aside from the standard spot and margin trading, KuCoin also offers Trading Bots. These bots are a way to make some passive income but be warned: it's best to have a somewhat solid strategy set up before using the bots as it can be a pricey affair. I've heard of people getting rekt'ed using bots so use at your own discretion. Also, it's worth checking out KuCoin’s article on trading bots to learn more.

If you are interested in exploring trading bots and automated trading further, feel free to give our Top Trading Bots article a read, which also features 3Commas. Curious to give bots a try?

Derivatives

This section has the riskiest products which are probably also the most fun. Futures Classic offers 100x leverage for super-advanced traders, while Futures Lite is an easy dip for beginners new to the Futures trade. Futures Brawl is almost no different from gambling where traders bet on the direction of Bitcoin going up or down over the next 24 hours. The system matches you with an opponent who bets the opposite way. The winner gets tokens as a reward. The number of points you can win increases for larger wagers. Win streaks yield higher rewards.

Another interesting product is Leveraged Tokens. Instead of doing margin trading on your own, you can buy these tokens that have leverage built-in. These tokens never expire and the price won't go negative, thus no risk of liquidation. The name of the token tells you which direction it goes. ETH3L means 3 times leverage for longs while ETH3S is the opposite for shorts. When the price of ETH increases by 1%, the net value of ETH3L will increase by 3%. Conversely, ETH3S will drop by 3%. KuCoin has a detailed page on this if you're interested.

Earn

KuCoin provides a few ways to earn for yield-seeking users. KuCoin Earn is basic stake-and-earn for most staking tokens including ETH and also parachain auctions on the Polkadot blockchain. KuCoin Pool allows users the opportunity to participate in PoW mining for Bitcoin and Bitcoin Cash. While the age of ICOs might have been over, it's not too late to participate in some of them through KuCoin Spotlight. This service allows users to acquire token rewards from new projects listed in the Spotlight section. Users need to stake KuCoin's KCS tokens for the projects they are keen to invest in.

NFT

KuCoin has its own NFT marketplace with Windvane, a platform for NFT trading. Those who are keen to get the scoop on the latest NFT collections might want to visit Wonderland, KuCoin's NFT launch platform. If FOMO bit you hard on famed NFT collections such as Cyberpunks and BAYC, fear not as you now have the chance to get a fraction of these NFTs through the Fractional NFTs section.

Card and Wallet

Users who want to spend their crypto and earn cashback rewards can look forward to KuCard, a new offering coming soon. Styled in the vein of crypto.com's credit card, KuCard can be used with Visa merchants worldwide. It also supports Apple and Google Pay, expanding its coverage acceptance. KuCoin wallet is their foray into the wallet space with a Web3-based wallet to store your crypto and NFTs. Blockchains supported include Ethereum, BSC, and Polygon to name a few, with more unveiling in the near future.

KCC Blockchain

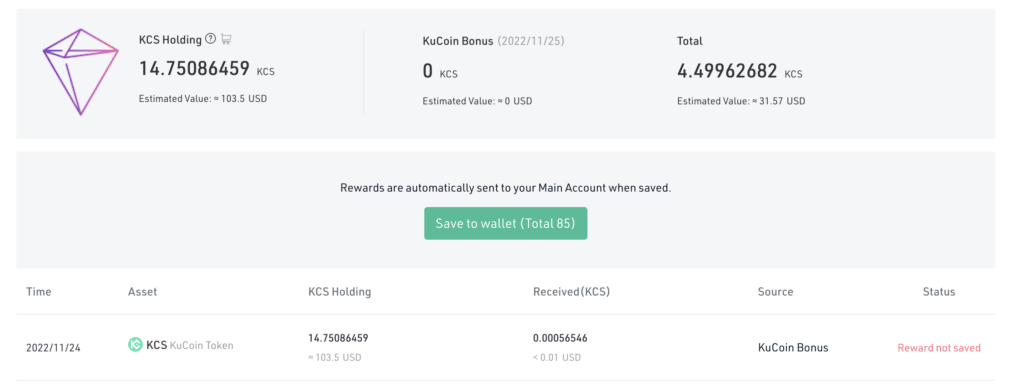

KCC, an EVM-compatible blockchain, is KuCoin's own blockchain. Blocks are produced every 3 seconds and the Proof of Staked Authority (PoSA) is used as their consensus mechanism. Gas fees are paid using KCS, KuCoin's native token. Just by holding KCS tokens grants you eligibility to receive more KCS tokens as rewards. The more you hold, the more rewards you will get. KuCoin will notify you when your rewards are ready to be claimed.

KCS holders are incentivised to hold more with rewards. Image via KuCoin

KCS holders are incentivised to hold more with rewards. Image via KuCoinTypes of Accounts and Fees

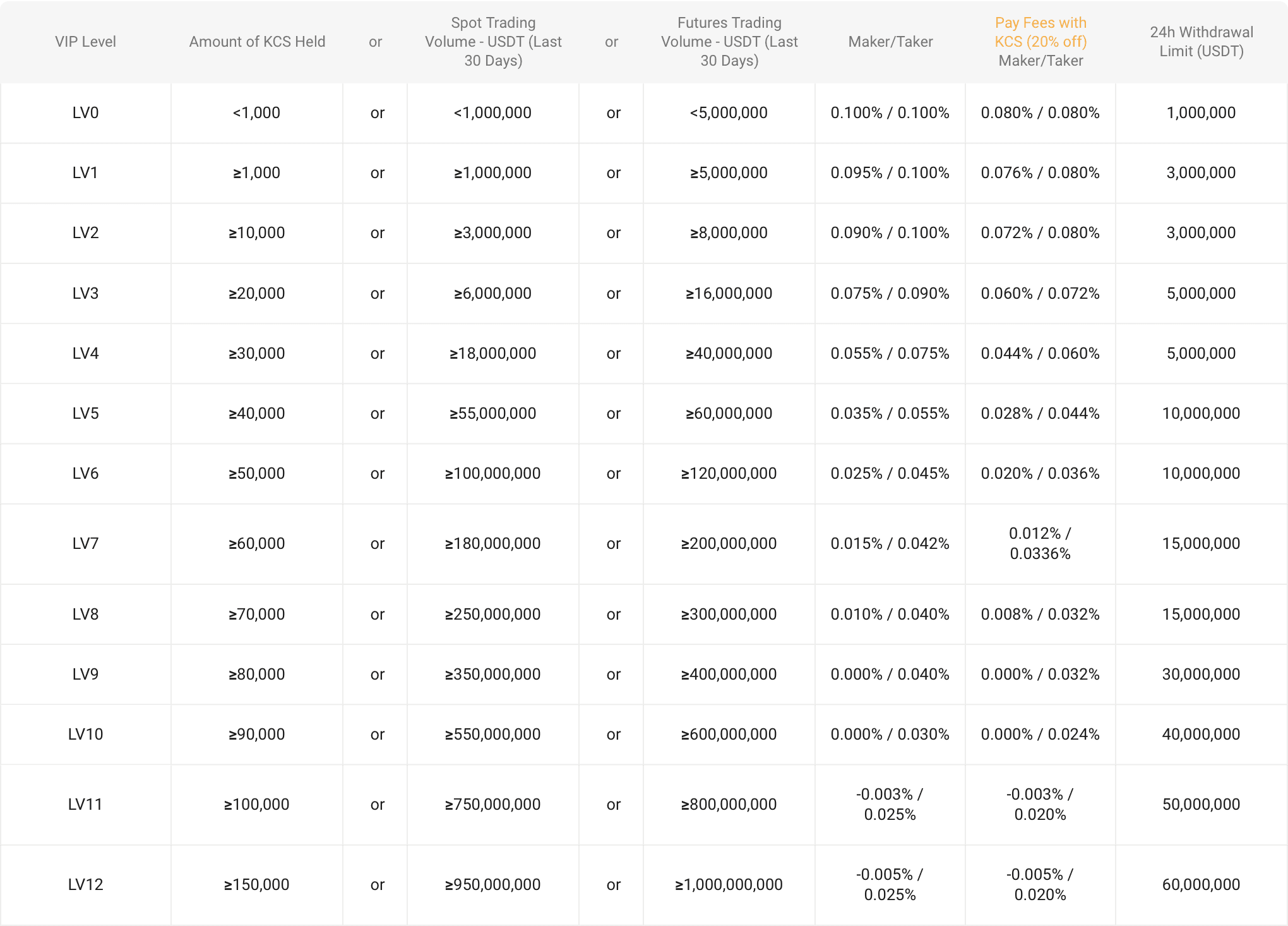

Unlike Coinbase, KuCoin has only one type of trading account. KCS holders get an extra discount if they pay the fees using KCS. The Spot Trading fee schedule is as below:

Image via KuCoin

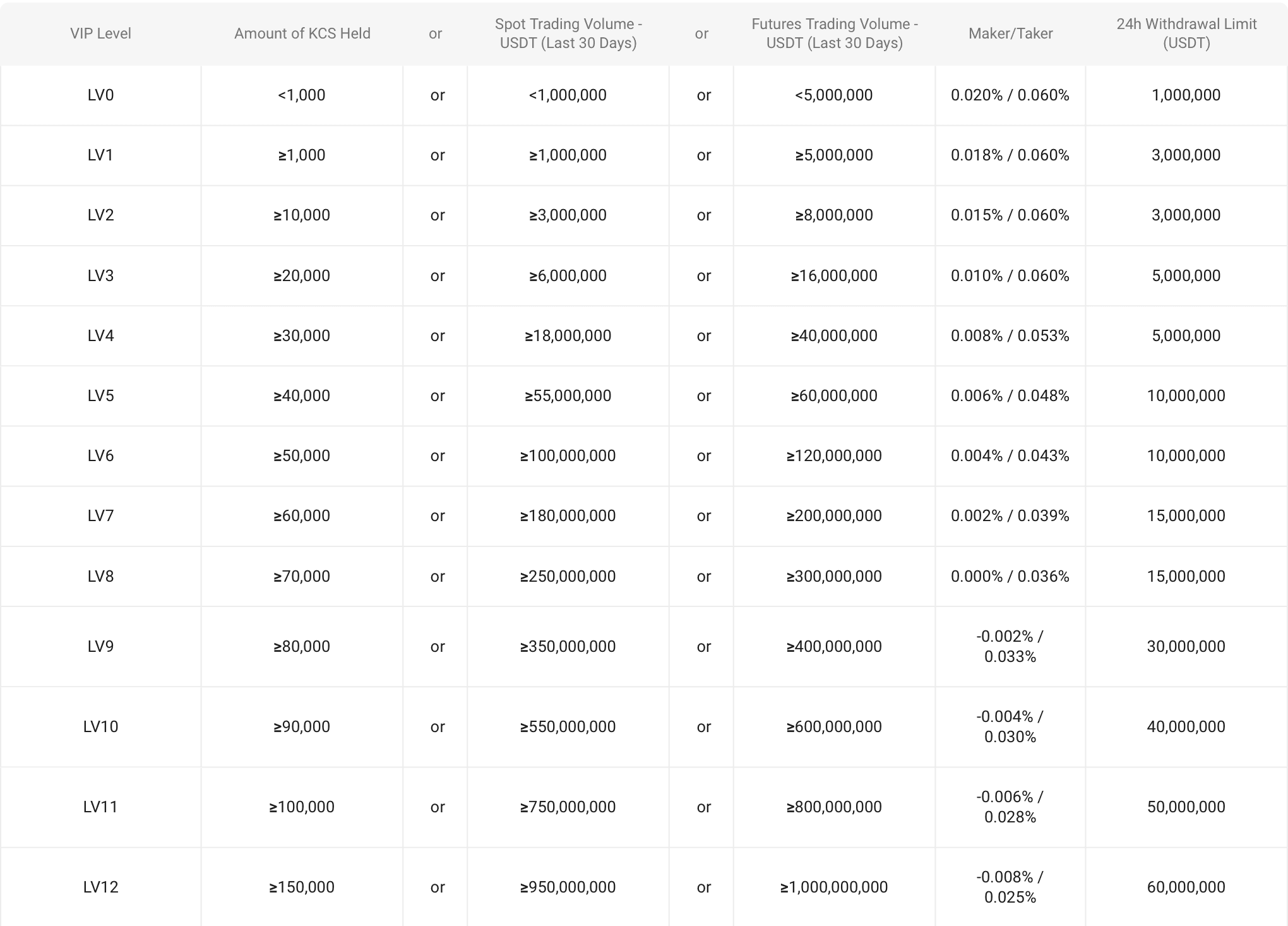

Image via KuCoinFuture traders have their own fee schedule, outlined below:

Image via KuCoin

Image via KuCoinSharp-eyed readers might have noticed that past a certain level, i.e. Level 8 and above, fees actually head into negative territory. This is not an error but it's actually KuCoin's way to incentivize those with big money to trade on their platform. Please refer to the KuCoin Fees Page for the most up-to-date fee information.

Overall, fees are fairly low by industry standards as they are looking for volume. This strategy is supported by the large range of tokens and trading pairs plus the almost non-stop promotional pushes. It's been a success thus far. Only time will tell if they will deviate from it.

KuCoin Security

KuCoin was also one of the exchanges that issued an email to customers, reassuring them of the safety of their funds, after what happened to FTX. As stated in the open letter, KuCoin is working on a Proof-of-Reserves measure to further safeguard customer funds.

When it comes to external safeguards for the prevention of hacks and attacks, the majority of tokens are stored in offline cold wallets, making it difficult for hackers to gain access. In addition, KuCoin has the following in place:

- Two-factor authentication

- Security questions

- Anti-phishing safety phrase

- Login safety phrase

- Trading password

- Phone verification

- Email notifications

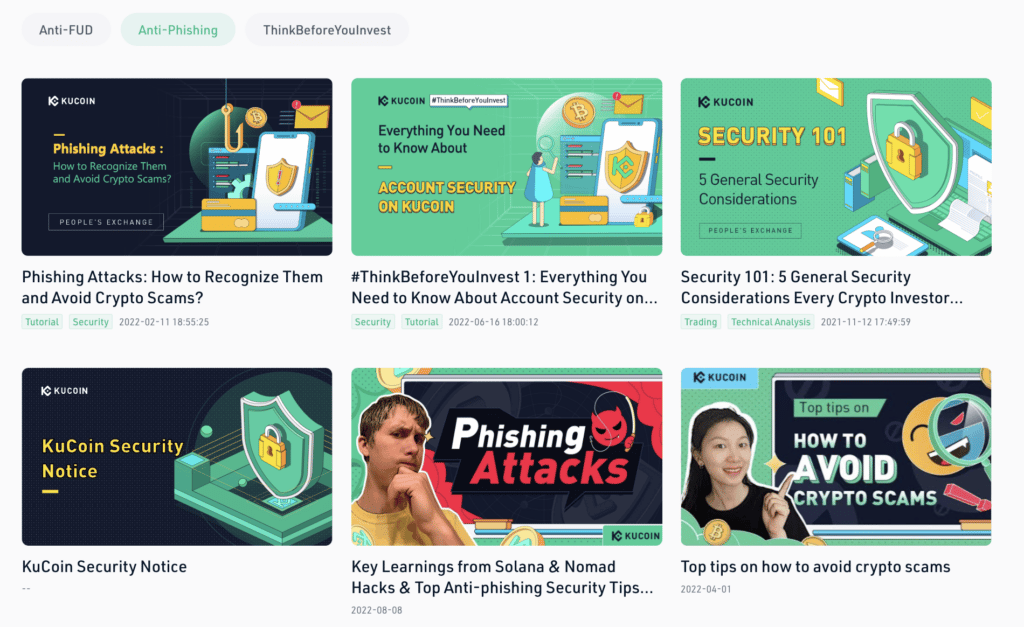

- Restrict login IP address

To be honest, there's only so much an exchange can do to safeguard customers' funds. The measures above can't prevent users from getting scammed themselves. Taking the concept of exchange security one step further, KuCoin offers tutorials to customers on how they can prevent themselves from falling for all sorts of schemes. This is something praiseworthy and merits a thumbs-up in my books.

Tutorials to help you spot scams and phishes, brought to you by KuCoin.

Tutorials to help you spot scams and phishes, brought to you by KuCoin.Coinbase or KuCoin: Conclusion

Those with very low-risk tolerance or just want to dip their pinkie toes into the water would do well to go with Coinbase. The KYC part can be a bit of a pain but it's no different from opening an account at the local bank. This veneer lends it an air of respectability and the feeling that all is taken care of to some degree. Easy way to get on board with fiat-to-crypto conversion, simple buy-and-sell interface in a controlled environment with little distraction as you slowly make your way. Pick up some free crypto as you learn about some of the blockchain projects currently trending in the crypto space.

The more adventurous-minded ones might want to give KuCoin a try with its Wild-West kind of atmosphere. It's up to you to figure out how to get some crypto to deposit into the exchange if you want to skip their expensive buying options. Once you're in, be prepared to be blasted by all sorts of promotions pulling your attention to all corners. Take your time exploring each of them and there is plenty to keep you occupied. Once you've gotten a taste of each offering in the platform, you might find you've made more progress than previously imagined.

In summary, Coinbase is like a well-lit and well-designed department store, offering a decent selection of the basics with some alternative choices but nothing too wild. KuCoin is like the night market in Asia: slightly chaotic at first glance (but there is order amidst the mess) with a huge variety of stalls complete with hollering vendors coupled with a noisy atmosphere. Lucky ones might discover a gem or two and contribute to the noise with shouts of hurrah.

Whichever one you decide to give it a try, good luck, have fun, and be sure to only invest what you can afford to lose!

Disclaimer: These are the writer’s opinions and should not be considered investment advice. Readers should do their own research.