Nexo has come a long way since entering the crypto space in 2018. What began as a straightforward lending platform now offers a wide range of services, including crypto-backed credits, high-yield crypto savings products, perpetual futures trading for over 100+ contracts, and more. The platform also offers tailored OTC (Over-the-Counter) solutions designed to meet the needs of HNW individuals, family offices, and institutions seeking to advance their investment goals.

Today, it serves millions of clients across 150+ jurisdictions as a leading digital asset platform. By combining cutting-edge technology with industry best practices, Nexo helps bridge the gap between traditional finance and the crypto ecosystem, delivering secure, innovative solutions that empower users worldwide.

Not bad for a company that started with just crypto-backed loans, right? But growth alone doesn’t guarantee trust.

In this review, we’ll examine Nexo’s operations in 2025, its regulatory framework, offerings, and market position. You’ll get a detailed breakdown of its features, including crypto-backed loans and recurring buys (for DCA investing).

What is Nexo?

Nexo is a digital assets wealth platform that empowers users to grow, manage, and preserve their crypto with a wide range of tools. Launched in 2018, it introduced the first crypto-backed Credit Line product, allowing people to borrow stablecoins using their digital assets like BTC, ETH, and XRP as collateral.

This solved the major crypto problem of offering liquidity while preserving crypto holdings. Instead of selling and potentially missing future gains, users can borrow against their crypto holdings while maintaining their market exposure.

Nexo began with lending and has since grown into a wealth platform for digital assets, serving over 7 million clients worldwide and managing more than $11 billion in assets. Today, it offers high-yield savings, crypto-backed borrowing, a trading interface, the Nexo Card with both a Credit and Debit mode, and tailored wealth solutions through Nexo Private.

The platform now focuses on serving individuals, businesses, and institutions with sophisticated solutions, expanding upon its original lending and crypto product suite to deliver a comprehensive digital asset experience.

Founding story and company background

Nexo operates globally in 150+ countries with multilingual support. Their goal with Nexo is to bring institutional-grade standards and financial discipline to crypto by treating digital assets with the same rigor as traditional ones. From the start, the focus has been on usability, trust, and long-term growth. And in a sector riddled with overnight experiments and failed promises, that long-term vision is refreshing.

Mission, vision, and compliance

Nexos’s mission is to offer a full range of digital asset services, from borrowing and earning, to spending, so clients can choose the tools that best fit their own strategies and goals, without compromising security.

Global reach and expansion

Nexo serves over 7 million clients across 150+ jurisdictions, supporting a diverse range of wealth-building needs. Its product expansion is fueled by innovation and strong partnerships.

Тhe Nexo Card allows users to spend digital assets or draw from a Credit Line at over 100 million merchants worldwide. For high-net-worth individuals, Nexo Private delivers tailored solutions across markets.

Nexo continues to monitor regulatory developments in key regions, including the U.S., to support future expansion.

Product Suite Overview

Nexo offers one of the most comprehensive product ecosystems in the digital asset space. Whether you are a retail client seeking high-yield savings with daily payouts, an investor looking to amplify exposure through Nexo Booster or futures, or an institution managing large portfolios, the platform provides a wide range of tools to help you interact with crypto effectively, with full control and institutional-grade infrastructure.

Nexo Ventures

Backing Ideas in The Digital Asset Economy. Image via Nexo Ventures

Backing Ideas in The Digital Asset Economy. Image via Nexo VenturesNexo Ventures serves as the company’s investment arm. It focuses on identifying and funding early-stage projects in blockchain and digital infrastructure.

These investments are not only strategic but also aligned with Nexo’s long-term vision for a more open and interoperable financial ecosystem.

The team behind Nexo Ventures provides innovative startups with funding, mentorship, technical expertise, and access to a global network to help them realize their potential. This allows Nexo to remain at the forefront of industry trends while also supporting the next generation of digital asset products and platforms.

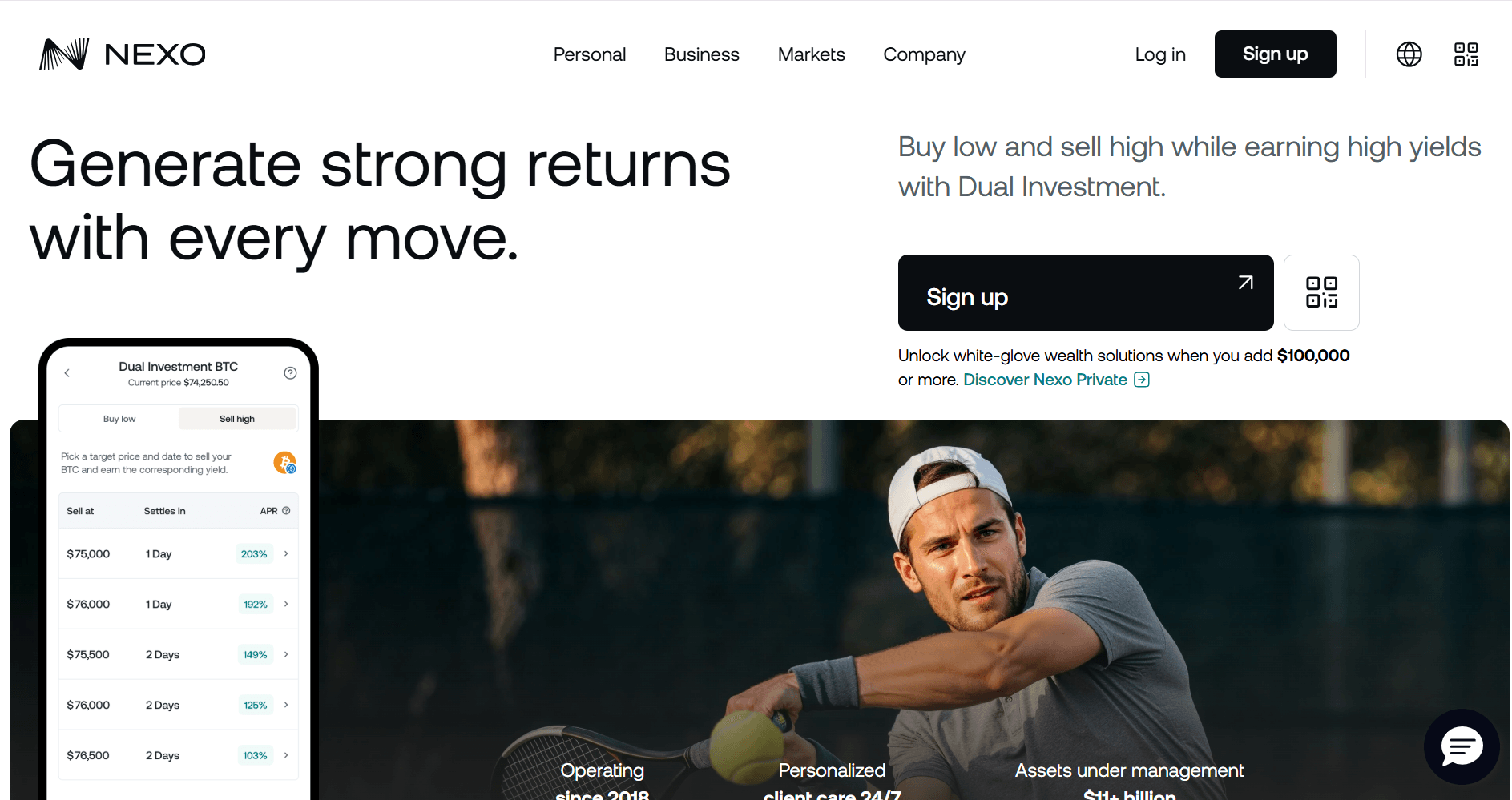

Dual Investment

Earn High Yields by Selling Bitcoin Smart. Image via Nexo Ventures

Earn High Yields by Selling Bitcoin Smart. Image via Nexo VenturesNexo’s Dual Investment product is aimed at clients seeking higher returns by using buy low or sell high strategies on assets such as BTC, ETH, and XRP. To participate, clients deposit a supported cryptocurrency, choose a target price, and select a settlement date.

If the market price reaches the chosen target on the settlement date, the asset used in the Dual Investment strategy is converted to the settlement currency, and the client receives the agreed enhanced yield in that output currency. If the target is not met, the original asset is returned with interest paid in kind.

While such strategies can deliver better returns than normal savings products, they come with market risk. As such, the Dual Investment product is suited for clients comfortable with volatility and looking to optimize passive income through short or long-term market exposure.

Translation? It’s not for the faint of heart, but for the risk-tolerant, it might just be a power move.

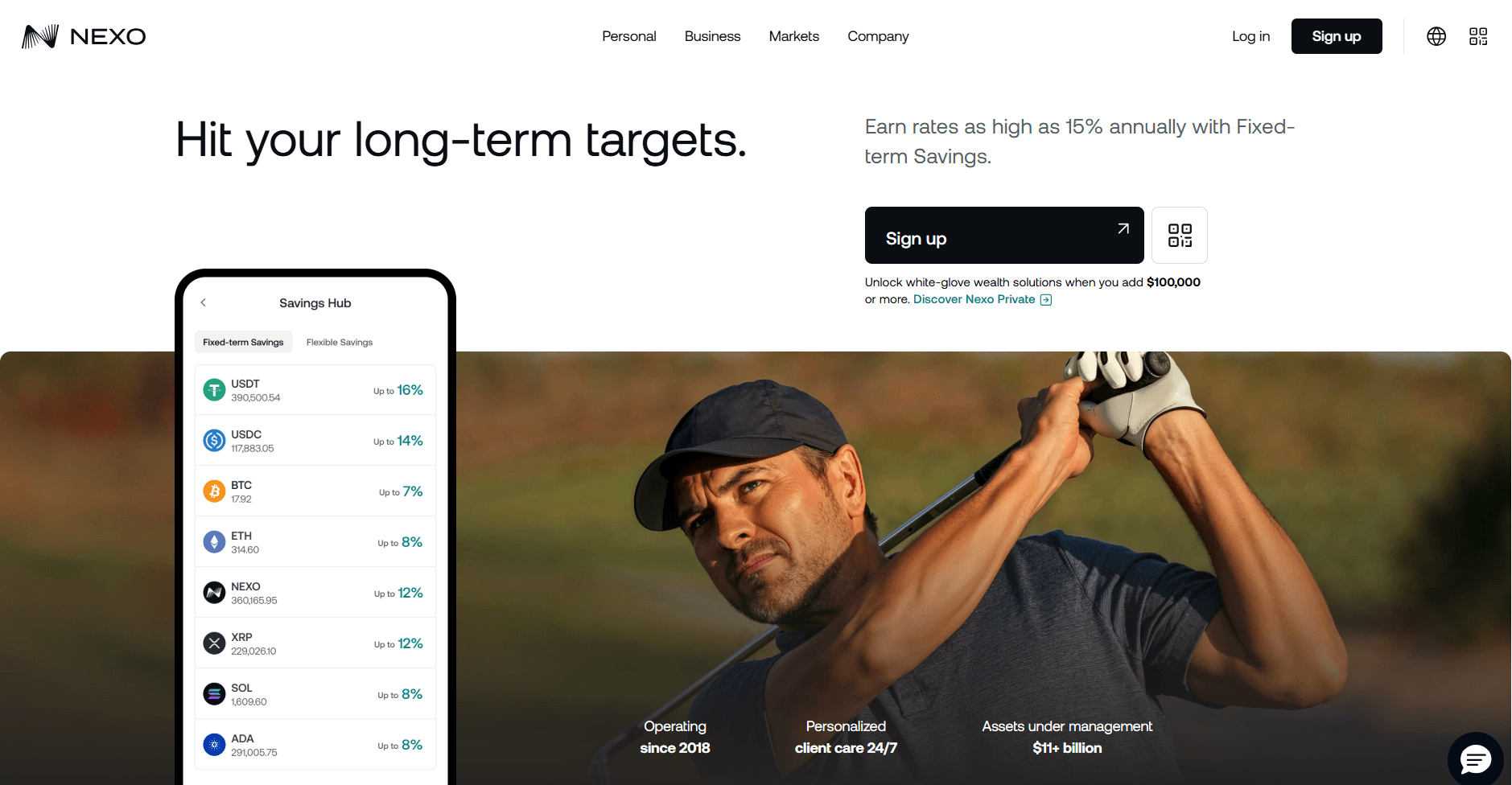

Savings

Earn Upto 15% With Fixed-Term Savings. Image via Nexo

Earn Upto 15% With Fixed-Term Savings. Image via NexoNexo’s interest-earning products are a flexible system for earning interest on digital assets, enabling you to earn returns of up to 15% annually. Clients can choose between two options: Flexible Savings and Fixed-term Savings.

Flexible Savings allows you to add or withdraw assets at any time while receiving daily payouts and variable interest rates based on your Loyalty Tier and the assets you hold.

Fixed-term Savings offers higher returns for clients who commit their assets for a set period.

Savings are managed through an intuitive dashboard that lets you monitor your assets, view interest payouts, and adjust your strategy over time. Interest rates are among the most competitive in the industry, especially when combined with Nexo’s loyalty incentives.

Crypto Borrowing

Instant Crypto Credit. Image via Nexo

Instant Crypto Credit. Image via NexoLet’s not forget that the platform’s original offering was the Crypto-backed Credit Line. This product enables clients to use digital assets like Bitcoin, Ethereum, or other supported altcoins as collateral to borrow. This way, clients can access liquidity, either directly in their

Nexo account or sent to a bank account, without having to sell their crypto holdings. That’s huge for long-term HODLers who don’t want to let go of their Bitcoin dreams just to pay a short-term bill.

Loans are approved automatically with no credit checks. Clients can borrow up to 50 percent of the digital assets’ value for major cryptocurrencies like BTC and ETH. Repayments are flexible and can be made in crypto, stablecoins, FIATx, or a mix of both.

Tip: Nexo converts the fiat assets you add to a digital equivalent called FIATx, which can be used on their platform for various activities, including loan repayments.

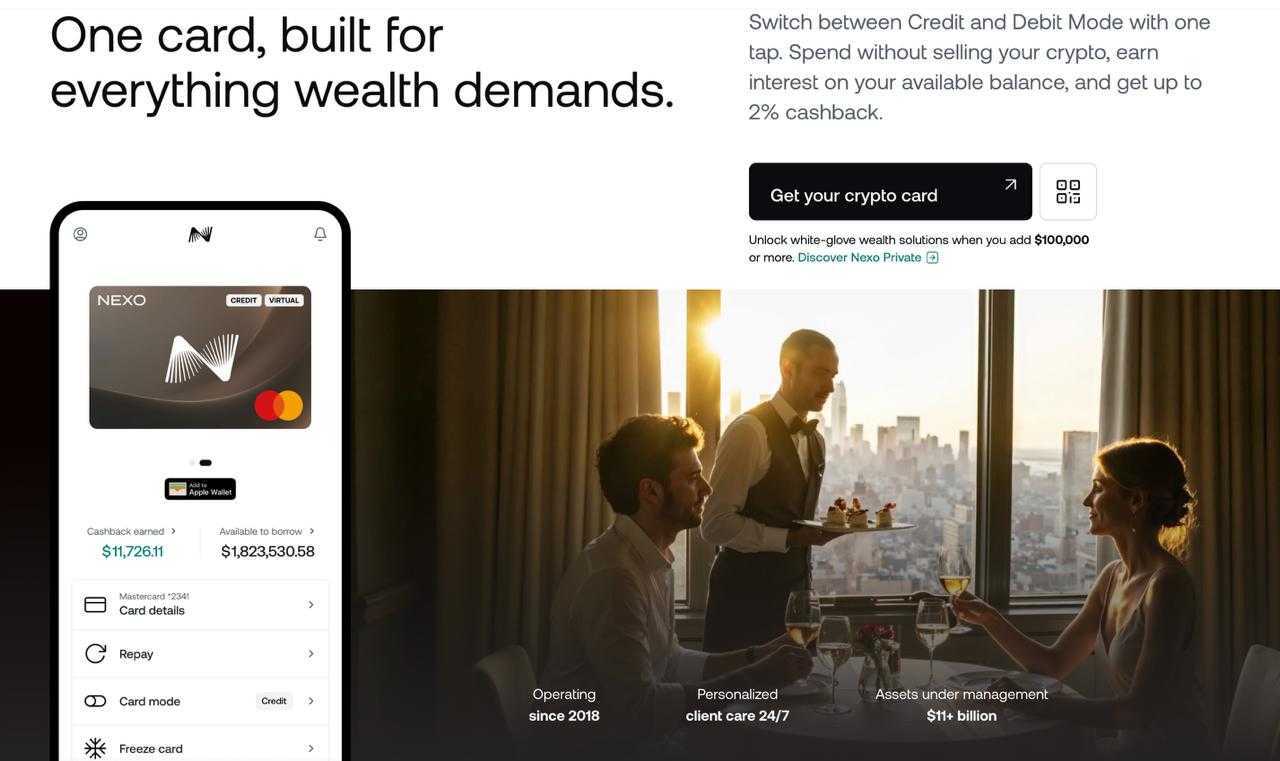

Nexo Card

The Nexo Card is a Mastercard-Branded Card. Image via Nexo

The Nexo Card is a Mastercard-Branded Card. Image via NexoThe Nexo Card lets clients spend their crypto or borrow against it at the point of purchase. It features two modes. In Debit Mode, the card directly sells the digital assets. In Credit Mode, the card issues a line of credit backed by the client’s collateral.

The card offers up to 2% cashback in either NEXO tokens, BTC, or other available cryptocurrencies in Debit Mode. It is accepted anywhere Mastercard is supported and is available in over 30 countries, with plans for a broader rollout.

Check out our top picks for the best crypto credit cards.

Nexo Booster

The Booster product lets clients use the full capacity of their collateral to borrow even more funds compared to the Credit Line product. This way, clients gain enhanced exposure to the same or another digital asset. The strategy can magnify returns in a bull market but also introduces a greater risk.

To manage that risk, the platform sets liquidation thresholds and uses real-time monitoring tools. Clients can also set “take profit” and “stop loss” exit conditions to manage their exposure.

This product appeals to those who are confident in their decisions or have trading experience in navigating products on other platforms that involve leverage.

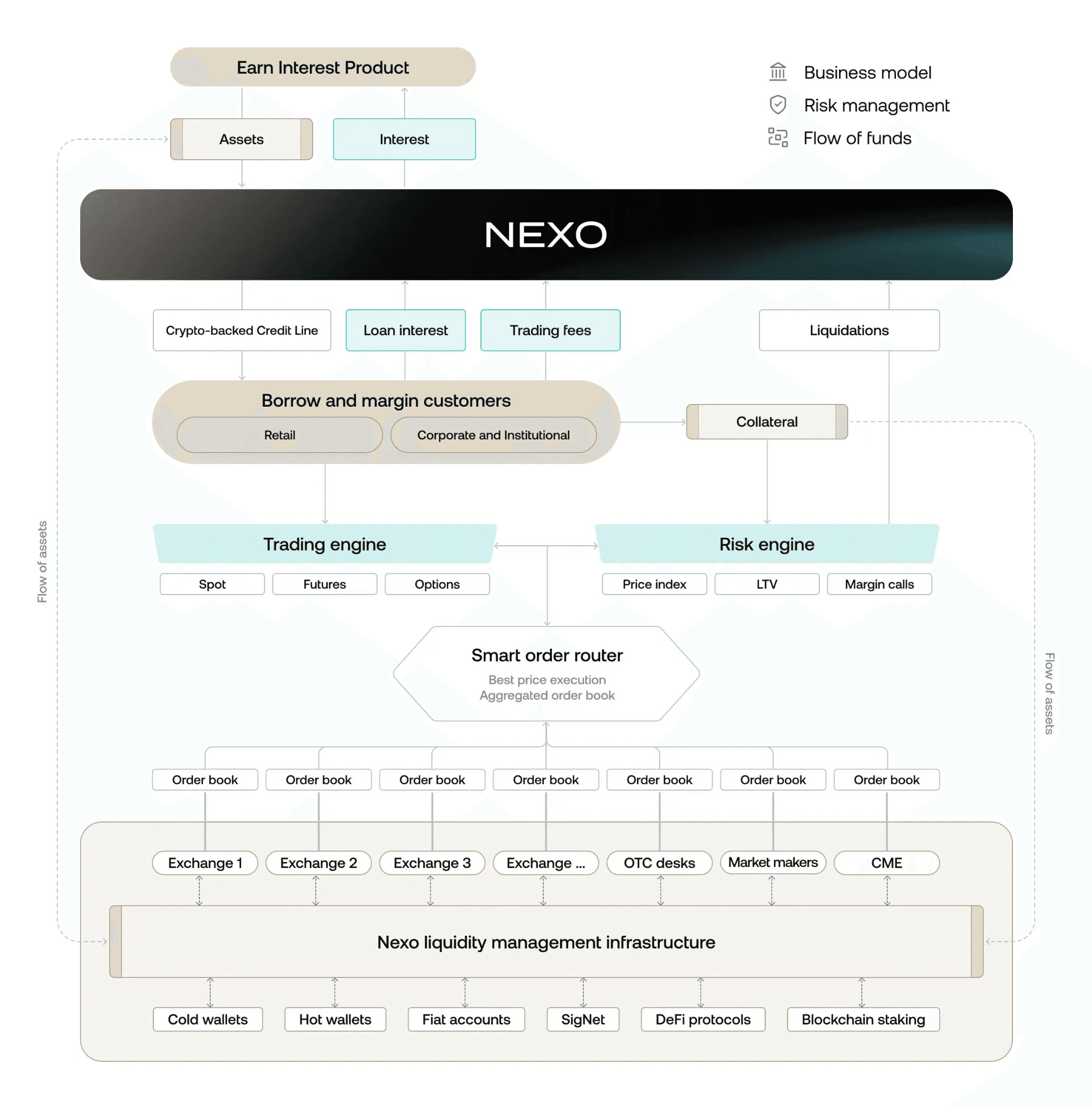

Smart Routing for Swaps

How Nexo Manages Risk And Liquidity For Smart Routing System. Image via Nexo

How Nexo Manages Risk And Liquidity For Smart Routing System. Image via NexoNexo’s Smart Routing system simultaneously connects to multiple exchanges to identify the best price available and split the orders depending on the price per volume. The system aggregates rates from several leading exchanges and selects the most favorable match in real-time.

As each swap is performed on exchanges where order books govern the rate, larger orders may have less favorable rates compared to smaller trades.

Swapped assets generate cashback and are instantly credited to the clients’ Savings Wallet, where they begin earning interest immediately. This works for over 1,500 digital assets and operates continuously with no delays or manual steps.

For those interested in performing swaps above $250,000 and up to $3 million Nexo offers OTC Swap on select trading pairs, while continuing to offer competitive exchange rates. Such swaps, however, are not eligible for cashback.

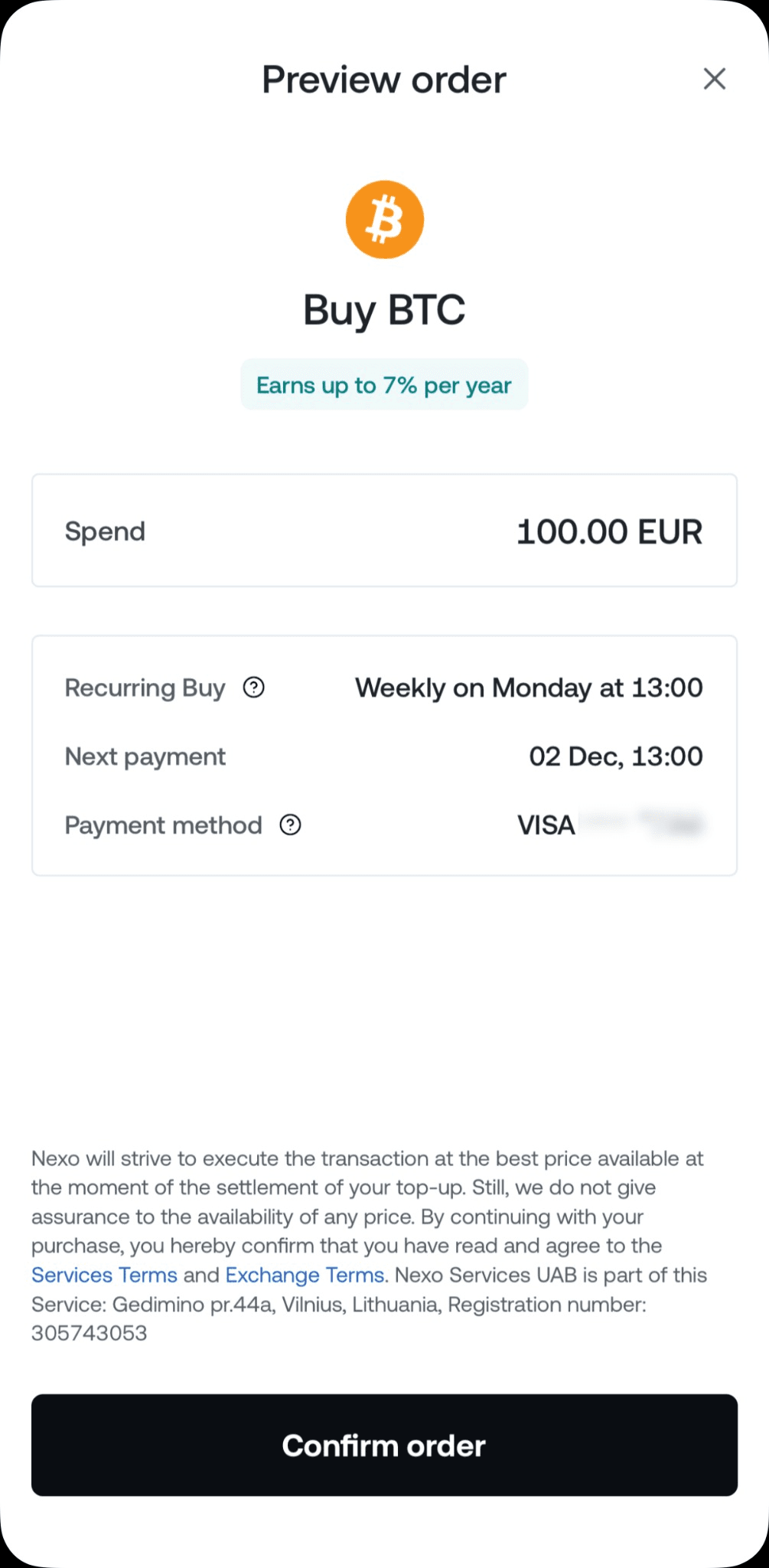

Recurring Buys and Automated Trading

Recurring Bitcoin Buy With Interest Yield. Image via Nexo Help Center

Recurring Bitcoin Buy With Interest Yield. Image via Nexo Help CenterNexo offers tools for clients who want to gradually build their portfolio or automate their strategies. With Recurring Buys, clients can schedule fixed purchases at set intervals, a method similar to dollar-cost averaging (DCA). This helps smooth out volatility and remove emotional decision-making from the process.

This tool supports long-term strategies without requiring constant market oversight.

More advanced clients can create custom trading strategies with target prices by using the Target Price Swap feature. That way, you can buy or sell assets at any time during the day when your awaited price is reached.

Perpetual Futures Trading

For sophisticated traders, Nexo offers access to perpetual futures contracts. Imagine you want to gain exposure to an asset without actually owning it. Crypto futures allow for just that, as clients can speculate on price movements of Bitcoin, Ethereum, Solana, and 100+ other contracts while using other assets as collateral.

The platform provides futures trading with up to 100x leverage on select contracts, multi-asset collateral support including Bitcoin and Ethereum, and hedge strategies. Nexo also gives its clients access to risk management tools such as stop loss, take profit, and trigger-based entry orders. This is intended for clients who understand leverage and are looking for advanced trading flexibility.

AI-Powered Tools and Analytics

Nexo integrates AI-powered tools to enhance user insights and support their experience. Currently, AI-generated market insights help clients monitor trends and better understand market sentiment.

Fees and Costs

Understanding what you pay and why is essential in crypto. Nexo has built its reputation on offering transparent, competitive fees without burying costs in fine print. As of 2025, that commitment to transparency remains a core part of the platform experience. Clients benefit from loyalty-based discounts, zero account maintenance fees, and clearly disclosed costs across every transaction type.

Trading, Lending, and Withdrawals

Borrowing rates start at 2.9% annually, depending on the client’s Loyalty Tier and loan-to-value ratio. There are no origination fees, and clients can repay at any time, at their convenience. However, there are early repayment costs if the loan is repaid in less than 45 days.

Nexo also offers free crypto withdrawals every month. Access to free withdrawals depends on your loyalty tier. For example, clients in the Platinum tier may receive one free withdrawal each month for certain networks like Bitcoin and Ethereum, and unlimited free withdrawals on many other networks. Once the free limit is reached, only a small network fee applies, which reflects blockchain transaction costs and not any additional charge from Nexo.

Moreover, Nexo charges fees for incoming bank transfers and withdrawals. That said, the free monthly withdrawal for Platinum tier clients can also be used for bank transfers.

Updated Fee Model for 2025

Nexo refined its fee structure. Loyalty tiers now offer more detailed perks, including lower borrowing rates, higher earn rates, and increased crypto cashback.

Depending on the loyalty tier, clients enjoy free withdrawals to an external wallet or bank account. All fees are documented in the platform, making it easy to track and manage them in one place.

User Experience

Nexo’s commitment to user experience is evident across every touchpoint of its platform. Whether you’re a first-time crypto user or a seasoned trader, Nexo’s intuitive design, always-on Client Care, and unified product suite ensure a smooth and focused experience at every touchpoint.

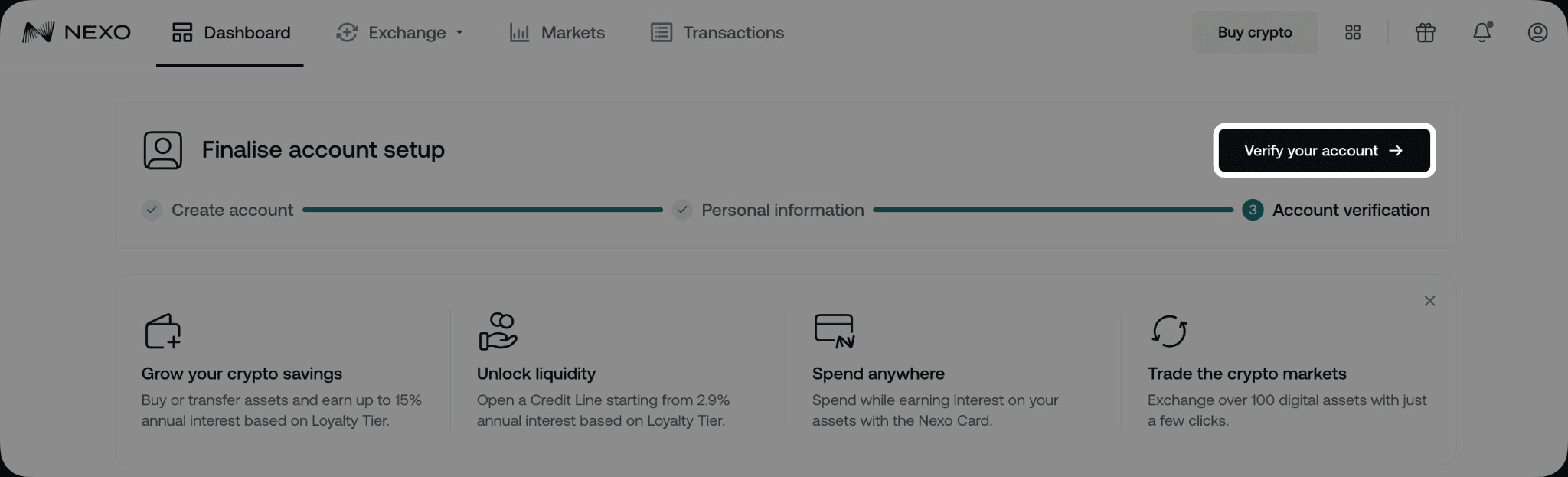

Account Setup and Instant Approval for Credit Lines

Complete Verification To Unlock Full Features. Image via Nexo

Complete Verification To Unlock Full Features. Image via NexoGetting started with Nexo is a streamlined process. Clients can register with just an email address and password, and the onboarding flow guides them through KYC (Know Your Customer) verification. The process is efficient, and most clients complete verification in under 10 minutes, thanks to automated ID checks and a user-friendly interface.

One of Nexo’s standout features is fast access to a crypto-backed Credit Line. Once your account is verified and assets are deposited, you can immediately borrow against your crypto, with no credit checks or lengthy approval processes. This instant access to liquidity is a major advantage for clients who need funds quickly without selling their holdings.

Mobile App and Web Usability with Real-Time Portfolio Insights

Nexo’s platform is accessible via both a web dashboard and a highly rated mobile app (available on iOS, Android, and Huawei). The user interface is clean, modern, and logically organized, making it easy to navigate between savings, trading, borrowing, and card management.

- Portfolio Overview: Real-time analytics show your total balance, asset allocation, interest earned, and loan status at a glance.

- Interactive Tools: Clients can track performance, set up Recurring Buys, and monitor loan-to-value (LTV) ratios with intuitive control

- Customization: Dashboards can be personalized, and notifications are configurable for price alerts, interest payments, and security events.

24/7 Multilingual Client Support and Dedicated Onboarding for Premium Clients

Customer support is available around the clock, with live chat, email, and an extensive help center covering frequently asked questions. Nexo’s Client Care team is multilingual, ensuring clients from around the world can get assistance in their preferred language.

For institutional and high-net-worth clients, Nexo offers dedicated onboarding specialists and relationship managers. These professionals provide personalized support, from platform walkthroughs to tailored solutions for complex needs.

Additional User-Centric Features

- Educational Resources: Nexo’s blog and Help Center help clients stay informed about security best practices and platform updates.

- Accessibility: The platform is optimized for clients with varying levels of technical expertise.

- Continuous Improvement: Nexo regularly updates its interface and adds new features based on client feedback, ensuring the platform evolves with the needs of its community.

- Free Withdrawals Up to Loyalty-Based Limits: Clients in the Platinum loyalty tier enjoy the most free withdrawals per month, depending on the asset, and all withdrawals are processed quickly, often within minutes.

Nexo’s interface is designed for simplicity, speed, and support. This makes the platform accessible for newcomers while providing the depth and flexibility demanded by advanced clients and institutions.

And this is not all, its user experience is integrated into its reward system as well.

Loyalty Program and Referral Bonuses

Nexo’s loyalty program is a central part of how the platform incentivizes long-term engagement and gives clients greater value for holding and using NEXO tokens.

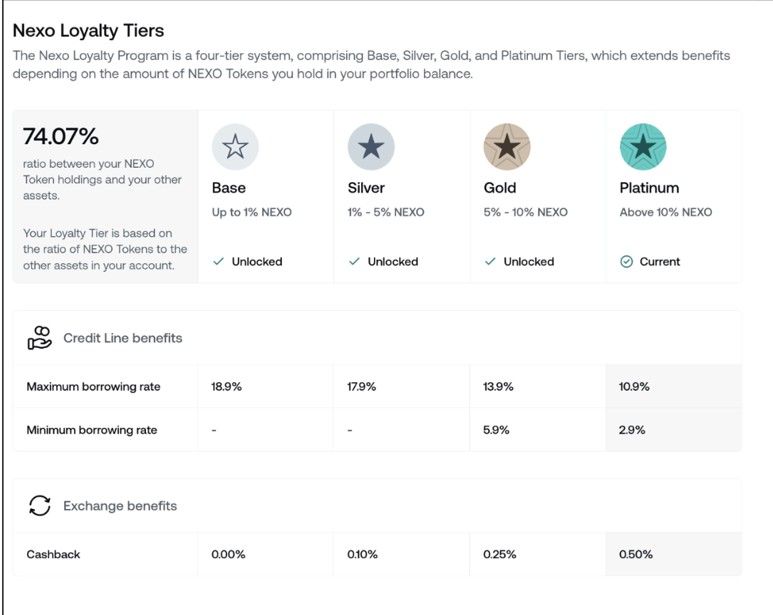

Nexo Loyalty Tiers and Interest Breakdown. Image via Nexo

Nexo Loyalty Tiers and Interest Breakdown. Image via NexoTiered Rewards Based on Token Holding

The Nexo Loyalty Program is built on a four-tier structure, and your tier depends on how much of your portfolio is held in NEXO tokens, measured as a percentage against the rest of your portfolio balance.

- The Base tier requires no NEXO holdings and provides standard platform rates.

- The Silver tier starts at just one percent of your portfolio in NEXO against the rest of your portfolio.

- The Gold tier begins at five percent of your portfolio in NEXO against the rest of your portfolio.

- The Platinum tier is unlocked when you hold ten percent or more in NEXO against the rest of your portfolio.

As you move up the tiers, the benefits become more meaningful. These include increased earnings on savings, reduced borrowing rates, and higher crypto cashback on swap and card transactions.

For Nexo Cardholders, loyalty tiers translate into real-world savings. Clients earn up to two percent cashback, paid in either BTC or NEXO tokens, on every purchase when using the Nexo Card in credit mode. This turns everyday spending into a passive way to accumulate more crypto.

Referral Program and Promotional Rewards

Nexo’s referral program gives clients an easy way to earn additional crypto by bringing others to the platform. When you invite a friend and they complete one or more qualifying transactions, both you and the new client receive a referral bonus. The current referral offer provides up to $5,000, paid out exclusively in BTC, far exceeding the typical crypto bonuses.

The company also runs frequent promotions that temporarily increase referral bonuses, reduce borrowing rates, or boost savings yields. These campaigns are announced through the app and newsletter, providing short-term incentives on top of the loyalty program’s long-term structure.

NEXO Token Utility Beyond Rewards

The NEXO token plays a key role in determining loyalty status, but its utility goes beyond that. Clients can choose to receive interest payments in NEXO to earn even more on their holdings.

For clients looking to optimize their benefits, reaching the Gold tier is often the most efficient strategy. It unlocks strong savings, borrowing, and cashback perks with a relatively modest NEXO Token allocation. For those aiming to access the platform’s full suite of premium benefits, including the highest earn rates and lowest borrowing costs, the Platinum tier offers even greater value in exchange for a higher token commitment.

Business and Institutional Services

Nexo has made large strides in catering to the needs of businesses, institutions, and high-net-worth individuals. Its business and institutional suite is designed to deliver the same seamless experience that retail clients enjoy, but with the scale, flexibility, and personalized service required by professional clients.

White Label Services

For companies seeking a ready-made digital asset solution, Nexo’s White Label offering allows businesses to operate under their own brand while leveraging Nexo’s full infrastructure. The product includes built-in lending, savings, and trading functionalities, all backed by Nexo’s security and compliance standards. Branding and distribution remain entirely in the partner’s hands.

Corporate Accounts: Institutional-Grade Custody, Advanced OTC Trading, and 24/7 Support

Corporate clients benefit from institutional-grade custody provided through partnerships with industry leaders and insurance providers like Ledger Vault and Fireblocks. Assets are stored securely, with multi-signature wallets.

Nexo’s OTC trading desk offers deep liquidity for large trades, competitive pricing, and personalized execution strategies. This service is especially valuable for funds, family offices, and enterprises managing significant digital assets.

24/7 dedicated support ensures that institutional clients can execute transactions, resolve issues, and access relationship management services at any time, regardless of their location or time zone.

Nexo Private: tailored services for high-net-worth clients

Nexo Private is a dedicated service suite designed for individuals and institutions with $100,000 or more in digital assets on the platform who seek to advance their investment goals.

Key benefits include:

- Tailored onboarding: One-on-one guidance through account setup and overview of platform features.

- Bespoke OTC execution: High-volume trades with minimal slippage and competitive pricing through Nexo’s OTC desk.

- Exclusive borrowing terms: Access to preferential borrowing rates, including zero-interest credit lines for eligible clients.

- Dedicated relationship manager: A single point of contact for personalized support, service coordination, and priority response.

The Private Hub inside the Nexo app allows clients to easily schedule meetings with their relationship manager and explore the platform's OTC services.

Nexo Private is built to support the complex needs of high-net-worth individuals, family offices, and corporate clients — combining personalized attention with institutional-grade execution.

Seamless Global Transfers with Instant, Multi-Currency Support

Nexo enables global access to digital finance by bridging crypto and traditional payment systems. Easily add or transfer both crypto and supported fiat currencies (USD, EUR, GBP) between your Nexo account and your bank account. Transfers are processed through trusted third-party providers and vary in processing speed, depending on the payment method.

Tip: Nexo converts the fiat assets you add to a digital equivalent called FIATx, which can be used on their platform for various activities, including swaps to cryptocurrencies and loan repayments.

Withdrawals from the Nexo platform to a card are also available in supported regions. This setup is particularly useful for freelancers, remote workers, and international clients who need reliable access to digital funds without switching between multiple platforms.

Who Should Use Nexo?

Nexo supports a wide range of clients, from crypto beginners to institutional clients. It's an all-in-one platform that combines savings, lending, trading, and payment tools in a secure environment. Below are the client profiles that benefit most from Nexo’s offerings.

- Investors Seeking Passive Income

- Active Crypto Traders

- Yield Seekers and Strategic Investors

- Borrowers Who Need Instant Liquidity

- Institutional and High-Net-Worth Clients

- Beginners Exploring Crypto for the First Time

How Nexo Compares to Other Platforms

Nexo continues to stand out in a competitive field by combining high-yield savings, crypto lending, institutional-grade security, and a wide suite of features all within a single platform.

When compared to major platforms such as Binance, Coinbase, and Crypto.com, Nexo holds its ground across core performance areas, including savings, trading, borrowing, and overall user experience.

Borrowing Rates

Nexo’s borrowing rates begin at 2.9% per year at the highest loyalty tier. This gives clients more flexibility than most competitors, especially for instant crypto-backed loans.

Security, Custody and Compliance

Nexo’s security model includes partnering with top-tier custody and insurance providers like Ledger and Fireblocks, whose facilities are insured via Lloyd’s of London and Arch Insurance (UK) Limited.

This is comparable to Binance and Crypto.com, while Coinbase is widely recognized for its regulatory posture and insurance protections in the United States.

Where Nexo Offers Unique Value

Nexo is among the only platforms providing AI-powered portfolio insights and a loyalty program that directly impacts yield and borrowing rates, and withdrawal benefits. These features are either limited or absent on platforms like Coinbase or Crypto.com.

Moreover, the loyalty program creates real incentives for clients to stay engaged and rewards long-term participation in the ecosystem.

Conclusion

In 2025, Nexo solidified its role as a leading all-in-one platform for digital wealth. With high-yield savings, crypto-backed borrowing, advanced trading tools, and private and institutional services, it delivers the best and most user-friendly experience that serves both individuals and businesses.

The platform’s expansion into new markets, focus on regulatory compliance, and steady rollout of features like card rebates, which are part of its growth plan, show a commitment to innovation and long-term sustainability.

While some products depend on NEXO token holdings and availability varies by region, the overall value proposition remains strong. For clients seeking a secure, transparent, and versatile way to engage with crypto, Nexo continues to stand out as a top-tier option.

Disclaimer: This is a paid review, yet the opinions and viewpoints expressed by the writer are their own and were not influenced by the project team. The inclusion of this content on the Coin Bureau platform should not be interpreted as an endorsement or recommendation of the project or product being discussed. The Coin Bureau assumes no responsibility for any actions taken by readers based on the information provided within this article.