It's no exaggeration to say that 2022 has been a terrible year for the CeFi lending business. Despite all the losses posted though, there are still centralised exchanges that have their twinkie toes and likely a whole foot in the lending business. Sounds risky? Yeah, of course, but don't forget, exchanges need a certain amount of liquidity to succeed, especially during this crypto winter, when funds are few and far between. As risky as it may be, it's still worth it as long as the risk is managed well.

To that end, OKX, one of the current leading exchanges and are still actively offering crypto loans, keeping their doors open for borrowers and lenders. Let's jump into this OKX loans review and see what's on offer and whether it's worth joining.

Note: Users located in the US and UK are not supported.

OKX Loans Review Bottom Line:

The OKX exchange is a reputable and popular platform for anyone interested in cryptocurrency trading and crypto lending/borrowing. You can learn more about OKX in our OKX Deep Dive article.

In addition, we also have articles that dive into other aspects of the OKX Exchange:

- OKX Trading Bots: Automated Trading on OKX

- OKX Earn: Earn interest while Hodling at OKX

- OKX Mobile App: Mobile Trading on the Go

- OKX Wallet: The Portal to Web3

- OKX Security: Is OKX Safe?

- How to Sign-Up on OKX

- OKX NFT Marketplace

Flexible vs Fixed Loans

The two main types of loans available for OKX crypto exchange customers are Flexible and Fixed loans. Each of them has its own pros and cons. Let's check them out!

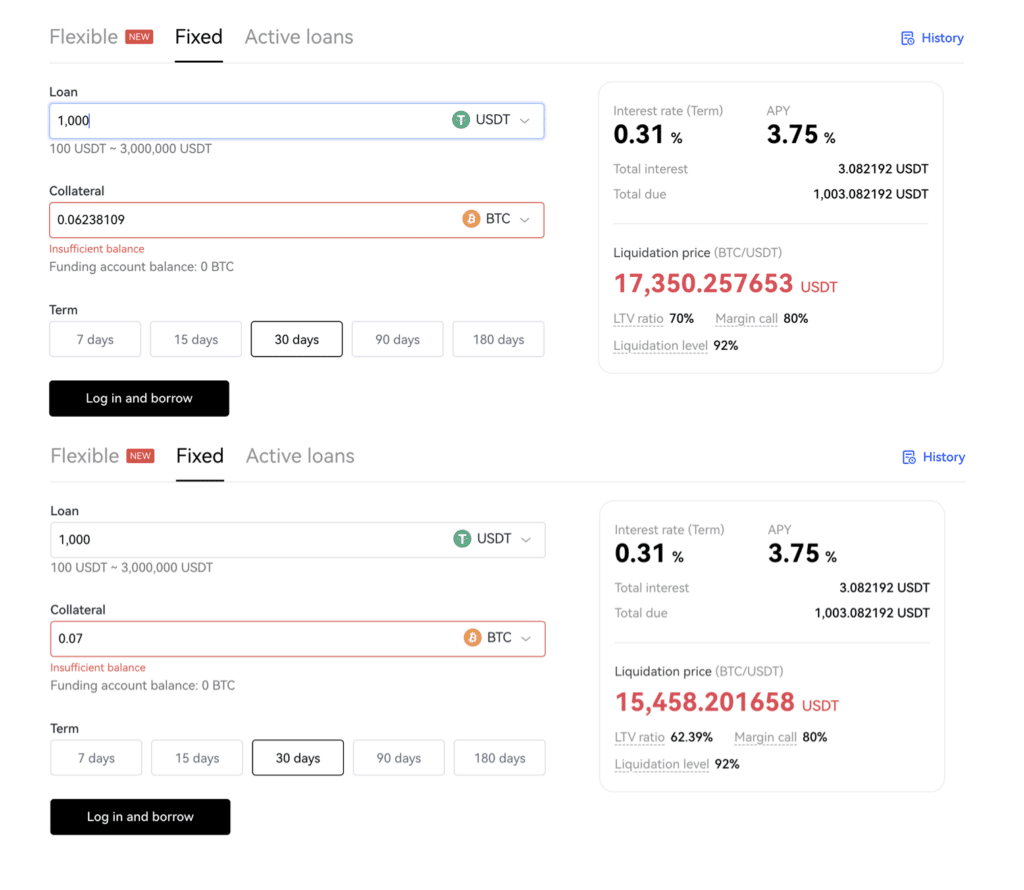

Fixed loan

This is the most basic type of loan available on the OKX exchange. The only thing you can borrow is USDT and 4 types of crypto collateral can be used to secure the loan: USDT, BTC, ETH and OKX's native token OKB. The interest rates are fixed based on the amount borrowed, collateral amount provided, and loan duration (7, 15, 30, 90, 180 days). The more collateral and longer duration, the lower the liquidation level.

Collateral amount affects liquidation level, but not rates. Image via OKX

Collateral amount affects liquidation level, but not rates. Image via OKXThe interest rate shown above is accrued on a daily basis. One thing to watch out for is that you can't repay your loan early because you will incur a penalty for doing so. On the other hand, if you are overdue with your repayment for more than 3 calendar days, the system will auto-liquidate to pay back the lender with the remaining balance returned to you, the borrower.

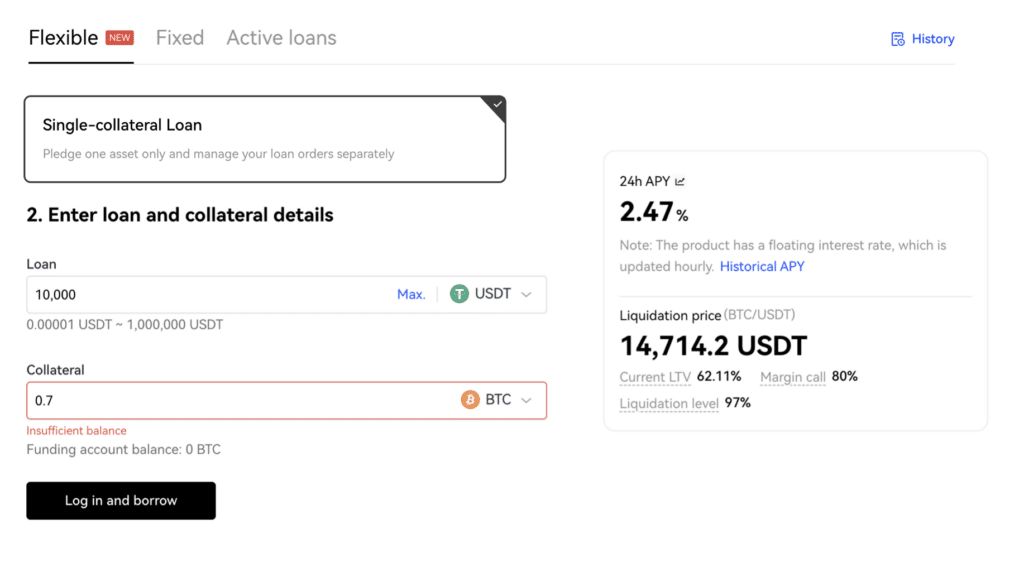

Flexible Loan

The other type of loan available is known as Flexible Loan. As the name implies, there's flexibility with this option, and it is seen in 4 places.

- Choice of collateral types:

- Single-collateral is similar to a Fixed loan, whereby you can only take out a loan with one type of crypto collateral at a time. If you want to have more than one loan going on at the same time, you will need to put up collateral twice and get two separate loans.

- Multi-collateral allows you to stack up loans one on top of another. Say you use both BTC and ETH worth a combined value of $100,000 to secure a loan for 50,000 USDT. If you decide to take out another loan of 10,000 USDT, this gets added to the previous loan, hence you have a 60,000 USDT loan without having to add more collateral.

- Interest accrued on an hourly basis, calculation as below:

- Hourly Interest = (sum of principal borrowed + interest accrued) * current interest rate

- Can repay the loan partially or in full anytime without incurring any kind of penalty charges.

- Support up to 10 crypto assets

Choose from a variety of crypto to borrow with variable loan duration. Image via OKX

Choose from a variety of crypto to borrow with variable loan duration. Image via OKXNotes on Borrowing

Alert-level reminders are sent out to borrowers, reminding them to top up their collateral if prices fluctuate. If no collateral is added and the price hits the number above, the position will be closed automatically, resulting in a forced liquidation.

One interesting point to note is that whether flexible or fixed, these loan requests listed on the market can have multiple lenders attached. This is because lenders are not obligated to lend the entire amount requested, but what they wish. For example, a 10,000 USD loan request can be made up of various lending amounts totalling the full amount. The loan will only take effect after the entire amount has been fulfilled.

The system is set up to be more lender-friendly so that there's more available to borrow from. This is reflected in the liquidation order below:

i) auto-liquidate available collateral;

ii) If the amount is not enough to cover, use insurance funds from the OKX platform;

iii) if still not enough, OKX reserves the right to ask for more money from the borrower.

Therefore, it's possible for the borrower to lose more than their collateral to cover the lender's losses.

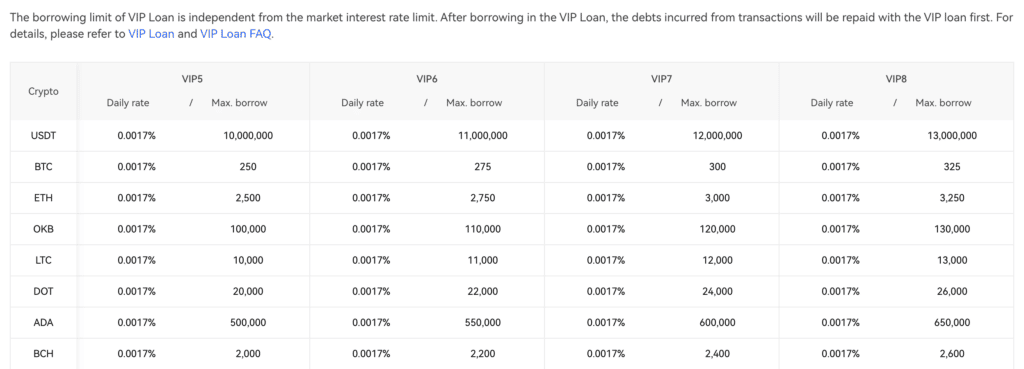

VIP Loans

There's another type of loan that can be made on the OKX platform. However, this is reserved for those who are in the VIP5 tier and above. Not only are the interest rates more favorable, but they also have two lending pools to choose from. These are known as the Market Borrow Savings pool and VIP Loans pool. Interest rates for these kinds of loans are based on the number of pools involved and split accordingly.

The difference between these two pools is in the limits available for borrowing. Perhaps an example might be better used to explain how these two pools work.

Say you would like to do a leveraged trade of 10x. You use 1 BTC as collateral to borrow 1000 USD to buy 10 BTC. You'll end up with 11 BTC and a 1000 USDT loan. With the Market Borrow pool, there's a minimum amount that needs to remain in the pool. The safety number is 500 USDT. If, at the time you want to make the loan, the pool has less than 500 USDT left, you can only borrow up to that amount. At this point, you might not be able to complete the trade.

What you can then do is get the rest from the VIP Loans pool. This way, you end up with 500 USDT from each pool. This will affect how interest is calculated. There's a fair bit of intricacy involved in the rates' calculation, so if you're interested, the details can be found on the OKX Loans page.

A plethora of crypto to choose from with ultra-low rates. Image via OKX

A plethora of crypto to choose from with ultra-low rates. Image via OKXHow to borrow on OKX

Borrowing on the OKX platform is fairly straightforward. They offer the convenience of both mobile and desktop versions to suit users' habits. The general flow is:

- Log into the website and browse to the Finance page. Head over to the Loan section.

- Select whether to get a Fixed or Flexible loan.

- If you choose the latter, continue to select from a choice of single or multi-collateral loan type.

- If you choose the former, you get to set the loan duration so pick one that you're confident of making a repayment.

- Agreement to the terms and conditions listed.

- In the "Risk Management" section, check that all the details are correct, especially the liquidation price and levels. Don't wanna get rekt for no good reason!

- Once you're ok with the details, go ahead and confirm the loan.

- Wait for the loan to be fulfilled.

Conclusion

Given how much effort has been put in to make the act of lending and borrowing as easy and safe (for borrowers) as possible, OKX is determined to grab as much of the pie as possible in this current-shrinking market. Whether it manages to or not, will depend on how easily lenders can obtain liquidity and the willingness of borrowers to participate. In this competitive landscape, OKX can monitor their results and where necessary, come up with promotions such as Interest-Free Loans to entice more business.

I hope you found this overview of OKX Loans helpful. OKX is a very forward-thinking and innovative exchange, one of the real pioneering trailblazers in the space. You can find out more about what is on offer on this robust, all-in-one exchange in our dedicated OKX review.

👉 Sign up to OKX for an exclusive 40% off discount fees for life!