The forex and CFD industry is forever changing, growing, and re-inventing itself. That gives traders the opportunity to continually experience new and innovative brokers.

One of those newer brokers is OInvest. They came online in 2018 and have been generating an increasing amount of buzz as an innovative broker with a solid offering of more than 350 CFD products, and leverage of up to 1:500 on a wide range of forex pairs.

This hidden gem has been growing its client base and adding to its accolades and awards, but is it safe for the average trader? That’s one of the things we’re going to investigate, on top of the trading conditions, and what you can expect as a client of this fairly new and innovative online forex and CFD broker.

OInvest Overview

Some online brokers have been around for a very long time and are well known, and then there are the gems that many haven’t heard of as they are recent additions. OInvest falls into that second category. Launched in 2018 the broker offers up access to over 350 CFDs on a wide variety of assets.

They are also a good broker for all levels of traders, with three account types to choose from. In the short time they’ve been online they’ve been able to rack up a number of awards, including Most Innovative Online Trading Broker for Southeast Asia 2020 from the Finance Derivative Awards and Best CFD Broker in Asia 2020 from A+OZ.

Just a small selection of the awards achieved by OInvest. Image via OInvest.com

Just a small selection of the awards achieved by OInvest. Image via OInvest.com The broker may be new, but that can be considered as a good thing as it often makes a broker more innovative and accommodating for its clients. In the case of OInvest many of those clients are located in the Middle East and Asia, which makes sense since the broker does not accept clients from the United States or from the European Union, although United Kingdom residents are accepted as clients. The broker itself is located and licensed in the Seychelles.

The platform of choice at OInvest is the award-winning MetaTrader 4, and users can choose from the desktop, mobile, or WebTrader. Plus there is a solid education center available to help every level of trader advance their knowledge and skills.

Is OInvest Safe?

Before you can start using a new broker, you will want to make certain that they are safe. Indeed, this is the question on the minds of most forex traders and it is one of the first criteria that we look at when reviewing a broker. There are a number safety considerations that we dig deeper into. These include regulation, fund security and communication security etc.

Regulation

OInvest is owned and operated globally by Aronex Corporation Ltd., which is a company located in Seychelles with registration number 8417765-1. It is further co-operated by Cyprus-based Habonix Solutions Ltd., a company with the registration number HE396742.

The license of OInvest. Image via OInvest.com

The license of OInvest. Image via OInvest.com And OInvest is regulated in the Seychelles by the Financial Services Authority (FSA) with license number SD014. This regulation and company location requires the broker to abide by all the laws of the Seychelles, and traders can feel more secure knowing there is a regulating body behind the broker.

Fund Safety

OInvest is clear in stating that they handle all client funds with the greatest of care. They acknowledge the importance of maintaining client funds, and their commitment to creating strong partnerships with all their clients. As a part of their commitment to fund safety all client funds are held in segregated accounts.

There is no co-mingling of the client funds and the operational capital of the business. Additionally, the segregated accounts are said to be held in tier-1 international banking institutions.

Risk Management

In terms of risk management OInvest has systems in place to continually monitor client positions to ensure that there are no excessive risks in terms of margin levels. This broker is very upfront in advising clients of the risks that are inherent in trading forex and CFDs and the potential for the loss of funds. Risky trades are flagged and warnings sent out to clients when these occur.

Data Security

There is more than just trading risks to consider when trading online. There are also cybersecurity threats to protect from, and OInvest is committed to using the most up-to-date technology to keep all client funds and data secure from hackers and other malicious actors. Here are some of the security measures they list on their website:

- Encryption of all transactions as well as the communications on our data servers

- Compliance with Level 1 PCI services

- Cutting-edge firewalls plus the most advanced Secure Sockets Layer (SSL) software to protect the information that is sent and received

The broker also maintains all data and trading systems in secure data centers, with access limited to a small team of employees. That limited access extends to client data, which is only accessible to a small number of OInvest employees.

OInvest SSL Certificate and secure padlock

OInvest SSL Certificate and secure padlock Any potential system downtime is protected against by fully redundant backup systems to ensure that all trades will go through, and all accounts will remain online at all times. Servers and systems are monitored 24/7 for all abnormalities, and backups are continually being made to secure and save client’s data.

Asset Coverage / Instruments

Asset coverage is one of the known strengths of OInvest as a broker. The wide range of assets being offered guarantees all traders will have access to the products they prefer to trade.

They instruments of choice here are Contracts for Difference, more commonly known as CFDs. The CFD has become the preferred method for trading in many markets as they provide a number of benefits to traders, which includes:

- The ability to easily trade both short and long.

- Trading with leverage. OInvest offers leverage from1:2 up to 1:500. More info about leverage can be found below.

- Easily trade a wide variety of markets and assets from one central account.

OInvest has five asset classes on offer and over 350 individual CFDs to trade on. More details follow below.

Forex

Forex is one of the most popular markets with the greatest global liquidity. At OInvest traders can get 24 hour access to the forex markets, with a choice of more than 45 different currency pairs that range from the majors like the EUR/USD and USD/JPY to the minors like the EUR/GBP, and even a selection of exotic pairs such as the GBP/TRY. In addition, OInvest offers leverage as high as 1:500 on their forex products.

Some of the forex pairs and trading conditions at OInvest. Image via OInvest.com

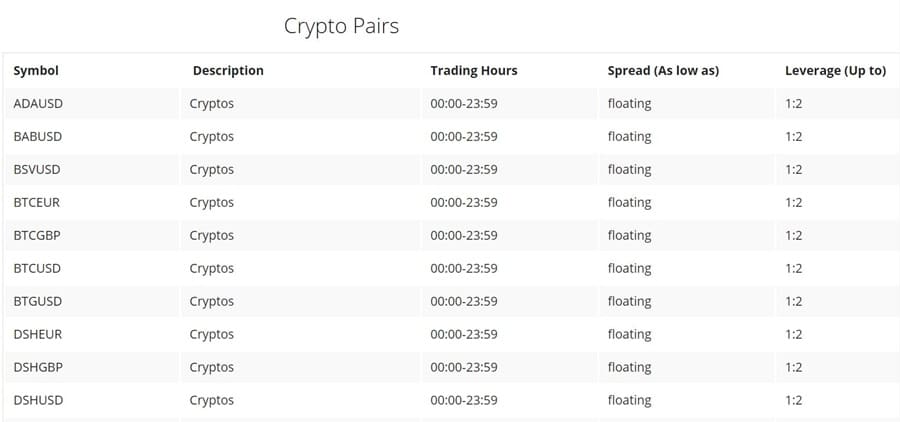

Some of the forex pairs and trading conditions at OInvest. Image via OInvest.com Crypto Pairs

Cryptocurrencies are the latest asset class and its popularity as a trading instrument has been growing massively. So of course OInvest has a selection of 33 crypto-crosses. These include majors like Bitcoin and Ethereum, as well as smaller altcoins such as Zcash, Verge, and Qtum. Cryptocurrency markets never close and can be traded 24 hours a day, and OInvest even offers 1:2 leverage on its crypto offerings.

Some of the crypto pairs available at OInvest. Image via OInvest.com

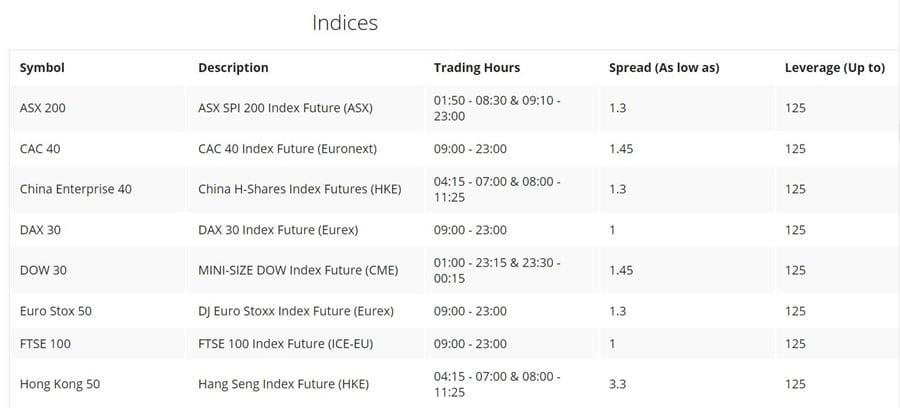

Some of the crypto pairs available at OInvest. Image via OInvest.com Indices

Indices take a broad view of major economies and stock markets and they are an excellent way to speculate on the movements in global stock markets. By using CFDs at OInvest traders are able to take the short side of the trade if they feel markets are weak, or the long side when they expect a bull run. At OInvest there are 15 major global indices offered, and many have extended trading hours. The broker also offers leverage of 1:125 on these index products.

A selection of the indices you can trade at OInvest. Image via OInvest.com

A selection of the indices you can trade at OInvest. Image via OInvest.comCommodities

Commodities have long been a popular way to speculate on the price movements of some of the most demanded products. They can also be a good hedge against inflation or uncertainties, and at OInvest they can be traded with leverage as high as 1:125. OInvest also goes way beyond the typical crude oil and gold commodities. There are 17 different commodity CFDs to trade, including markets such as copper, soybeans, sugar, and coffee.

Choose one of the commodities for your trading pleasure. Image via OInvest.com

Choose one of the commodities for your trading pleasure. Image via OInvest.com Stocks

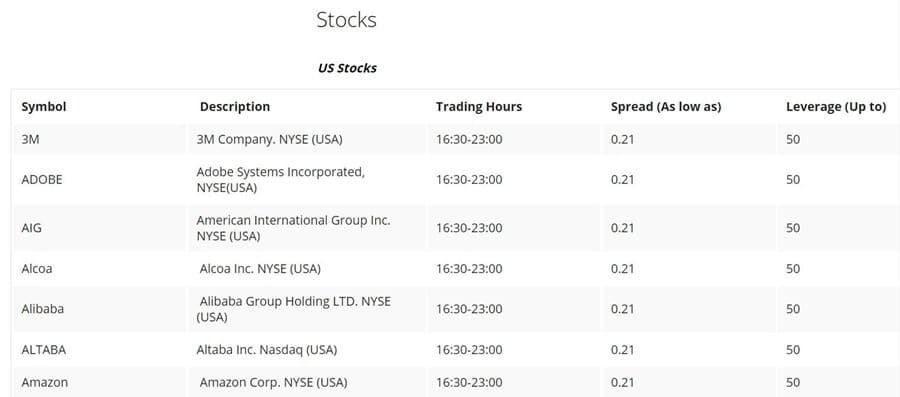

The largest number of CFD assets available at OInvest is the world of stocks. This is a flexible way to invest, and stocks are adaptable to any trading strategy or style. At OInvest traders can take advantage of CFD offerings on 194 different global stocks with leverage as high a 1:50. And since it is CFDs being traded it is a snap to take either a long or short position without any conditions.

OInvest has 194 individual stock CFDs to trade on. Image via OInvest.com

OInvest has 194 individual stock CFDs to trade on. Image via OInvest.com Leverage

In leverage traders are able to use money borrowed from their broker in order to take a larger position in an asset. Leverage is quite common in forex trading, but with the increasing popularity of CFD trading it has also been widely adopted in that industry. The benefit to leverage is that it can magnify a traders gains on a winning position.

However, leverage is a double-edged sword as any losses are magnified as well. Traders who plan to use leverage in their trading need to learn the proper ways to manage the risks that come along with its use if they wish to keep potential losses in check.

Increasing Your Leverage

Increasing Your Leverage At OInvest traders can take advantage of leverage on the various CFD products as follows:

- Forex - 1:500

- Cryptocurrencies - 1:2

- Indices – 1:125

- Commodities – 1:125

- Stocks – 1:50

Fees

Many traders will be happy to see OInvest does not charge commissions, relying instead on spreads in order to make their revenues. Deposits and withdrawals are free of any fees, however there is a large inactivity fee that could hit traders if they aren’t aware. Overall the fee structure of this broker is clear and transparent.

Oinvest Trading Fees

Because OInvest is making its revenue from the spreads charged you will find that they are a bit higher than at other brokers who use a commission and fee structure. The positive to this is it makes it easier to calculate potential profits on trades.

Spreads will differ based on the account type and the instrument being traded. For example, the popular EUR/USD currency pair has an average spread of 2.2 pips for silver account holders, 1.3 pips for gold account holders, and 0.7 pips for platinum account holders. Other currency pairs see a similar reduction in spread based on the account type.

Those interested in trading commodities will find the spread reduction is true here as well. For example, gold carries spreads of 0.59 pips, 0.48 pips, and 0.37 pips on silver, gold, and platinum accounts respectively. Crude oil spreads are 0.07 pips, 0.05 pips, and 0.03 pips. Coffee also has a low spread of 0.3 pips, and the spread on sugar is 0.23 pips.

Spreads on stocks begin as low as 0.21 pips, while index spreads begin as low as 1 pip for the FTSE and DAX.

Spreads are higher than average, but still very good. Image via OInvest.com

Spreads are higher than average, but still very good. Image via OInvest.com As you can see the spreads at OInvest are slightly higher than at some competing brokers, but typically those low spread brokers also charge commissions on their trades. Overall the spreads are not excessive, and traders should be able to overcome the slightly increased spreads to profit on their trades.

Oinvest Commissions

As we’ve mentioned, there are absolutely no commissions charged on any of the account types or assets at OInvest.

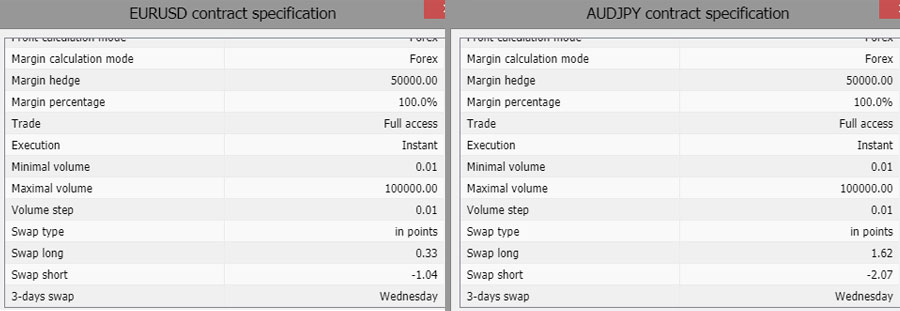

Swaps/Overnight Rates

Unfortunately OInvest does not list swap rates on their website, but they are easily accessible inside the trading platform. Because swap rates can change rapidly with interest rate changes it is understandable that the broker made the choice not to post them on their website.

Swap Rates of OInvest on the MT4 platform

Swap Rates of OInvest on the MT4 platform Note that traders can save on swaps by upgrading their account. Gold account holders receive a 25% discount on swaps and platinum account holders receive a 50% discount.

OInvest also offers swap-free accounts for those who follow the Islamic religion. These accounts have no swaps and are 100% Shariah compliant.

Non-trading Fees

OInvest does not charge any deposit or withdrawal fees, which makes them competitive versus brokers that will hit their clients with fees at every step. One unusual fee that the broker does impose though is a fee for “insignificant trading activity.” This is a €50 withdrawal fee if there has been no activity or only one trade taken in the account.

There are also inactivity fees to consider, which isn’t unusual for a CFD broker. These fees can be quite high, so prospective clients should be aware of them before opening and funding an account. OInvest considers an account inactive when there is a gap of 61 days in any account activity. At this point there is a monthly inactivity fee of €80. After 91 days of inactivity that monthly fee increases to €120. Further it increases to €200 after 181 days and maxes out at €500 after 271 days.

There are no inactivity fees for an account with no balance. These accounts are simply deactivated.

Inactivity fees are easy to avoid by trading once every 60 days, or by withdrawing all funds if you aren’t planning on trading that frequently.

Registration / KYC

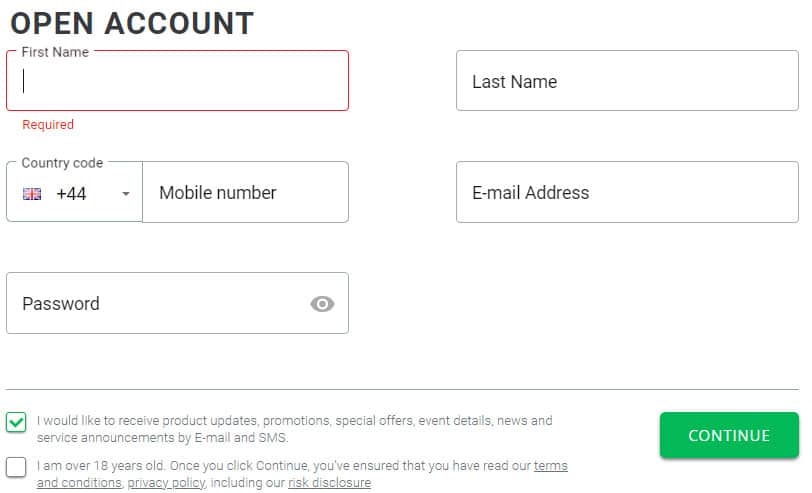

Opening an account is a very simple process. There are just 6 simple steps to follow. You can skip some of the steps initially to get access to the trading platform, but to trade you must complete all the steps. Generally this takes no longer than 2 business days.

It's a simple form for opening an OInvest account. Image via OInvest.com

It's a simple form for opening an OInvest account. Image via OInvest.com Follow these 6 steps to open an account at OInvest:

- Click the 'Open Account' button on the top right corner of the website.

- Enter your first and last name, cell phone number, email address, and chosen password. Agree to the terms and conditions, risk disclosure, and privacy policy by checking the box and then click the 'Continue' button.

- Deposit funds or click the 'Not Now' button to do this later.

- Submit your verification documents or click the 'Not Now' button to do this later.

- Confirm your cell phone number and email address via the codes and links sent to each.

- Fund your account and begin trading.

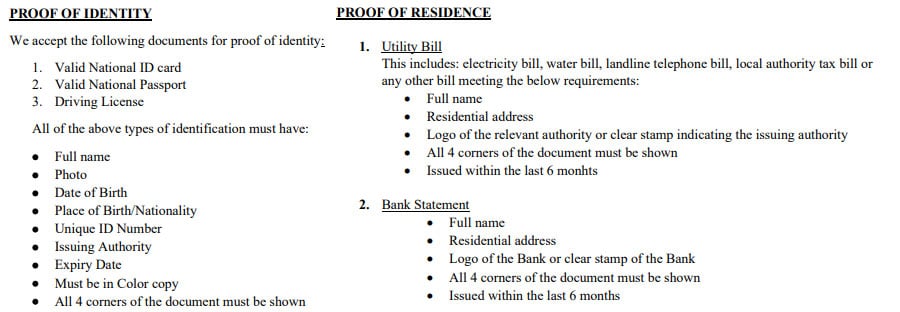

In order to fully open an account and comply with the brokers KYC requirements you’ll need a few pieces of information in addition to your name, email address, and phone number. You’ll also need an address, a birth date, and some form of national ID number, usually a tax ID number.

KYC Requirements of OInvest

KYC Requirements of OInvest In addition to that to fully confirm the account and begin trading you will have to submit clear images of several documents that are used as proof of identity and address. These could be documents such as driver’s license and passport for identity verification and a utility bill or similar for address verification.

Deposits / Withdrawals

There are quite a few deposit and withdrawal options available from OInvest, so everyone should be able to find something that matches their needs. One thing to keep in mind is that OInvest does have a minimum initial deposit of $250.

After that the minimum deposit and withdrawal amounts, regardless of which method you choose, are $100. Below are the deposit/withdrawal methods and deposit time frames. Note that all withdrawals are processed within 7 business days.

A good selection of payment processors. Image via OInvest.com

A good selection of payment processors. Image via OInvest.com - Visa and MasterCard - Processed within 7 business days, usually instant

- PayTrust88 - Processed within 7 business days, usually within 24 hours

- Rave by Flutterwave - Processed within 7 business days, usually within 24 hours

- Skrill - Processed within 7 business days, usually within 24 hours

- Neteller - Processed within 7 business days, usually within 24 hours

- V Pay - Processed within 7 business days

- Bank wire transfer - Processed within 7 business days, usually within 5 business days

Trading Platform

OInvest offers just one trading platform, but it is the award-winning MetaTrader 4 platform and clients can choose between the WebTrader, desktop version, and mobile version. The versions synch so you’ll see the same information no matter which instance you are currently using. Place a trade on your desktop and close it later from the mobile platform.

WebTrader (MT4)

OInvest uses the WebTrader platform offered by MetaTrader 4, giving their client’s access to one of the top charting platforms available right within their browser. No need to download anything, and use it from any internet connected device with a web browser.

The MT4 WebTrader. Image via OInvest.com

The MT4 WebTrader. Image via OInvest.com Just like the desktop version of MT4, the WebTrader offers detailed charting and analysis capabilities, a variety of advanced market orders, and the ability to manage open trades. Most everything is customizable, so traders can set the platform up to match their own trading style and preferences.

One very convenient feature of the WebTrader are the Trading Cubes, which allows all the information about a given asset to be viewed at the same time. This is a great time-saver when making trades, as is the one-click trading feature.

A further benefit of the WebTrader is the ability to view a limited version that will show you market conditions without logging into your OInvest account. If you want to get a true feel for the trading conditions at OInvest you can also create a demo account here and use it for 14 days to test the platform.

MetaTrader 4 Desktop

MetaTrader 4 desktop platform is the industry standard when it comes to charting, technical analysis, and trading both forex and CFDs. Anyone with any experience trading forex or CFDs is likely familiar with MT4 and its capabilities.

Those who aren’t familiar with MT4 have likely just started trading. You can start with the knowledge that this trading platform has one of the strongest reputations in the forex and CFD industry thanks to its ability to manage open positions, analyze price trends, and chart nearly any asset effortlessly.

Trading via the MT4 desktop platform.

Trading via the MT4 desktop platform. MetaTrader 4 comes with thirty different indicators, and the ability to switch between 9 different price frames. It also gives you the option of using two market orders, four pending orders, and two stop orders, plus it has a trailing stop feature. Open trades right from the chart, or take advantage of one-click trading.

You’ll also get access to the huge library of custom built indicators and robots that have been created by the MetaTrader community. Some do have a cost, but many are free, and you’re sure to find something useful.

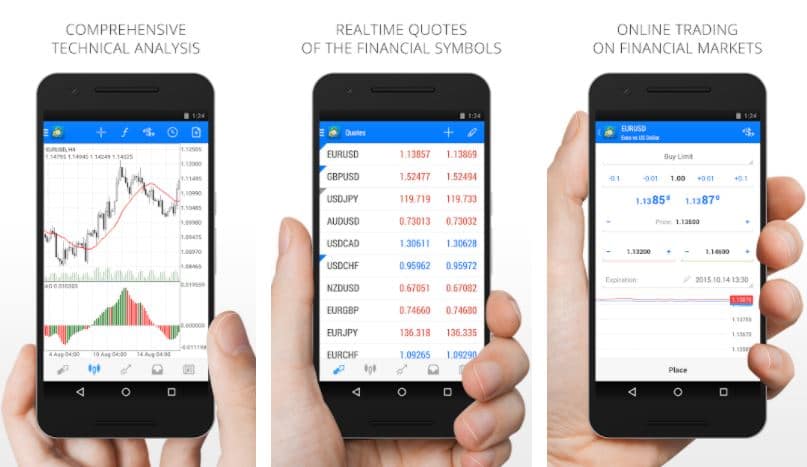

Oinvest Mobile (MT4)

OInvest calls the mobile trading app it offers the “OInvest Application” and the “OInvest Trading App” on its website, but that doesn’t change the fact that this is actually the MetaTrader 4 mobile version. And that’s a good thing since it ensures compatibility between the mobile app and the desktop and WebTrader versions.

The power of MT4 trading in the palm of your hand. Image via Google Play store.

The power of MT4 trading in the palm of your hand. Image via Google Play store. Just like the other MT4 versions the mobile app connects easily to your account, and seamlessly synchs with the other platform versions. The mobile version is also very rich in the same features that make the other versions so popular with traders. Customize your charts how you like and take full advantage of the 30 indicators and 9 timeframes available.

You also get 24 analytical objects. Instant execution and pending orders help you further customize your strategies. Orders are executed even if you close the application, so you do not need to drain your smartphone’s battery.

Customer Support

The customer support team at OInvest has been highly rated by online customer reviews, which should tell you that they are really doing a good job.

They can be contacted via live chat, telephone, email, or on their web-based forms. They can also be contacted via their social media channels, but we weren’t able to verify how response they are through those channels.

They are extremely responsive when contacting them via online chat, and you should get connected in under a minute. The downside to the customer service team is that they are not available 24/7 or even 24/5. Instead you can reach them from 06:00AM to 03:00PM GMT on Monday through Friday. You can even reach out directly to the management team via a Contact management webform.

Email: [email protected]

Phone: +44 2035196460

Education & Additional Resources

Too many new brokers overlook the need to provide their traders with a solid source of educational materials and training, but not OInvest. You’ll find a fully loaded educational center, and while they don’t provide any proprietary research, traders will have access to the research available within the MT4 platform

Oinvest Research Tools

Most of the research tools offered by OInvest can be found within the trading platform. While these aren’t proprietary research, which could be disappointing to some, you can rest assured that the research being provided through the MetaTrader 4 platform is top-notch. And those who upgrade to a platinum account will get access to news alerts as well.

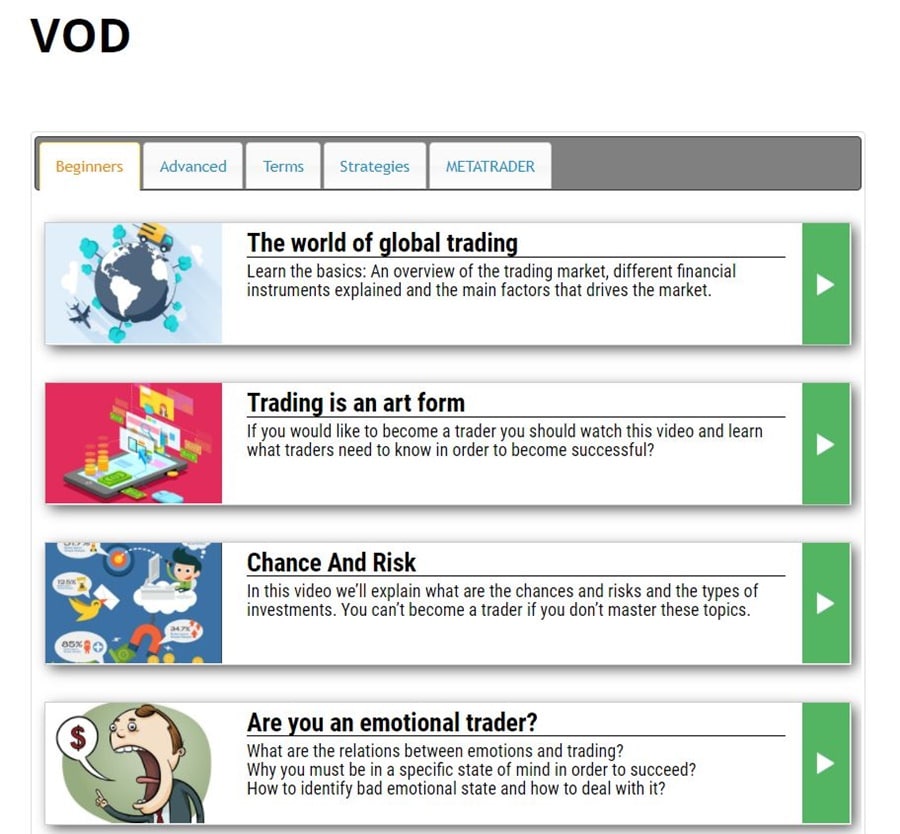

Oinvest Education and Training

While the research isn’t proprietary, the educational offerings from OInvest are superb. They cover all levels of traders and a myriad of concepts. Beginners can build a solid foundation here, and more advanced traders can develop some new strategies and skills. Note that videos and webinars are only available with the gold and platinum level accounts.

All the videos you need to get started. Image via OInvest.com

All the videos you need to get started. Image via OInvest.com Platform tutorial videos

The platform tutorial videos are there to help familiarize traders with the MetaTrader and MetaTrader mobile platforms and they do an excellent job. Definitely worth while, even if you’ve used MT4 before.

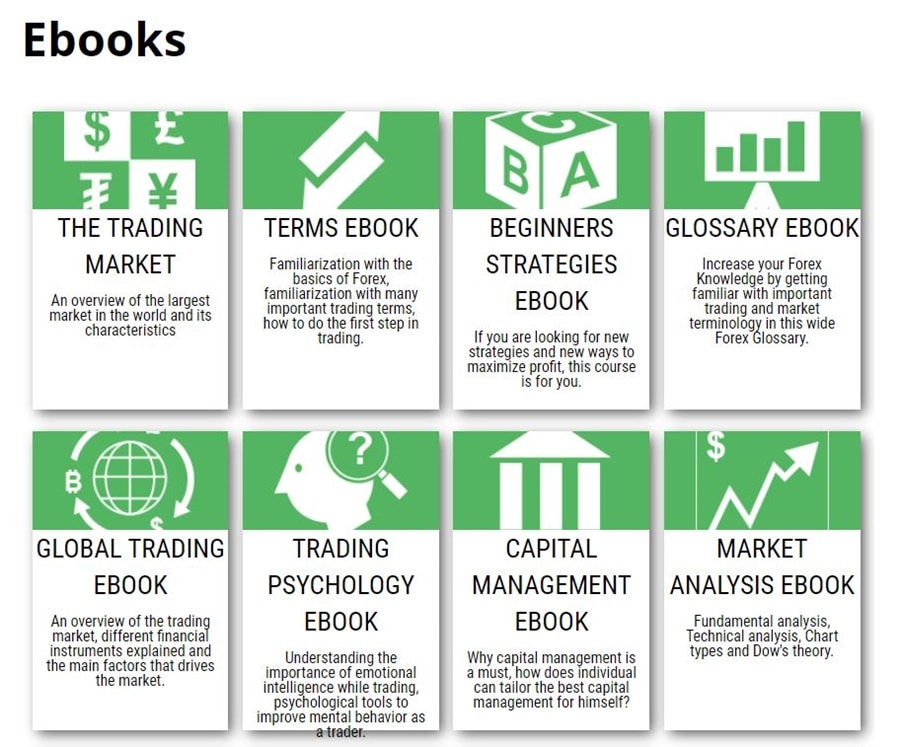

Educational PDFs

This section of the educational portal will keep you busy for some time as it contains 11 different e-books for you to download and read. Plus there’s material here for all skill levels, from the Beginners Strategies e-book to the Advanced Trading Strategies e-book. Other topics include global trading, trading market, technical analysis (basic and advanced), market analysis, and capital management.

You'll be busy reading for weeks with this selection of ebooks. Image via OInvest.com

You'll be busy reading for weeks with this selection of ebooks. Image via OInvest.com Live webinars

OInvest hosts webinars roughly once a week and if you’re a gold or platinum account holder you are able to attend. These cover a wide range of subjects, but there’s sure to be something for everyone at one time or another.

YouTube videos (VOD)

The video section of the educational portal is huge, but like the webinars you need to be a gold or platinum account holder to access them. The videos are divided into various categories, with at least several in each, and up to a dozen in some. A few of the categories include Strategies, Beginners, MetaTrader, and Advanced.

Trading academy

There are two trading courses available (The Trading Market and Social Trading) in the trading academy and anyone can access them, even if you haven’t registered for an account. They include both written and video materials.

Areas for improvement

Of course no broker is perfect, and the same is true for OInvest. If you’ve made it this far you’ve probably already hit on some of the areas we think the broker could improve upon. We’ll re-iterate them here.

While OInvest is regulated by the FSA in Seychelles we think it would benefit them to obtain more reputable regulatory status. One of the holding companies is located in Cyprus, so CySEC regulation should be possible.

We were pretty impressed by the broad asset offerings, particularly the crypto and commodity categories. That said, increasing the leverage for the cryptocurrencies wouldn’t go amiss in our opinion. Even just 1:5 or 1:10 would be a huge improvement. Sure cryptocuyrrenies are volatile, but that’s improved somewhat since 2017/2018 and a bit more leverage should be fine.

We understand that OInvest has no fees and commissions, but we’re not sure that increasing spreads is the best way to offset that. After all, many traders put a lot of weight on the spreads when making their decision on what broker to trade with. Decreasing spreads somewhat could attract more investors.

While we have no complaints with the customer service team, we believe expanded hours would be more than fair. In fact, we think customer service should be available 24/7 and have been quite troubled by the recent trend towards offering support on a 24/5 basis, or like OInvest even less. They need more customer service coverage, not less.

Conclusion

There are many reasons to recommend OInvest, from the regulation to the broad asset offerings to the huge educational portal. Spreads are good if not great, customer service is also good, even though we’d like expanded hours of coverage. The broker has one of the best trading platforms in MetaTrader 4, and banking is both easy and quick.

Taken all together there’s little reason not to recommend this broker, and we think that given the excellent education and support offered beginning traders would be quite happy here.

There’s no need to take our word for it though, because you can easily go and register a demo account with the broker to try their platform and offerings yourself.

Warning ⚡️: Trading CFDs is very risky and you could lose your entire investment. Make sure that you practice adequate risk management

Disclaimer: These are the writer’s opinions and should not be considered investment advice. Readers should do their own research.