Editors Note- Investous is no longer an operating CFD Exchange. We recommend Pepperstone or AvaTrade if you are looking for a solid trading broker.

Investous is a new CFD broker that has just opened its books to traders of many different stripes.

They are fully regulated in Europe and offer over 270 different assets which you can trade. They also have a range of impressive technology from web-based trading platforms to MT4 and mobile app functionality.

However, can they really be trusted and should you use them?

In this comprehensive review of Investous we will give you everything that you need to know about the platform and the broker's operation. We will also give you some do's and dont's to consider when trading here.

Investous Overview

Investous is a new CFD brand which is owned and operated by FI Markets Limited. They are a Cyprus investment firm that is located at Kolonakiou Avenue 43, Shop No: 2B, Agios Athanasios, 4103 Limassol, Cyprus.

The company is authorised and regulated by the Cyprus Securities Exchange Commission (CySEC) with a CIF licence number of 267/15. This means that they are regulated in Europe and are allowed to offer their services to to traders in most European countries as well as a range of international countries.

They are a CFD broker which means that people can trade Contracts For Difference on their platform. These are derivative products that are leveraged and are traded on the margin. This means that traders can greatly enhance their potential returns (or losses).

The platform just launched in December of 2018 and is looking to expand their operations throughout Europe and beyond. They are trying to make technology and customer support the hallmark of their expansion goals.

Is Investous Safe?

This is probably one of the most important questions on your mind especially when it comes to using a new CFD broker.

For us, the most important criteria that we will want to look at include things like the regulatory protections / investor compensation, platform integrity and data security.

Let's take a look at each of these in depth.

Regulation

As mentioned, the parent company of Investous is regulated by CySEC. This means that it will have to continually meet a minimum standard when it comes to capital support and client protections. Here are some of the examples of protections that are afforded the traders:

- The broker should maintain at least €750,000 in operating capital in their accounts. This capital requirement can be a buffer for client protections.

- The Firms are obligated to keep regular financial statements and update the regulators about any potential changes.

- The brokerage firm should keep their funds in a top tier bank in an account that is segregated from the broker's business account (segregated accounts).

- Brokers should pool their funds into an investment compensation fund that will pay out traders suffered from any broker collapse. This is the Investor Compensation Fund (ICF) that Investous is party to. It will cover all traders for losses up to €20,000.

If you wanted more information about the financial position of FI Markets then you can read their Pillar III disclosure. This covers most of the important points that CySEC will have taken into account when they granted them the licence.

Best Execution

Best execution relates to the efforts that a broker will take when executing the order of their client. It stipulates that brokers took all "reasonable steps" when it came to routing a specific client order through their order books.

This is also a law that most financial regulators impose on their brokers. Given that FI Markets Limited is a CySec regulated firm, they also have to disclose to their clients their best execution practices. This is given in this document.

Why is this important?

Well, it shows that Investous is required, by law, to have your best interests at heart when meeting your order. When it comes to them choosing which liquidity provider to use, which pending orders to execute first and what prices they are allowed to quote.

Secure Communications

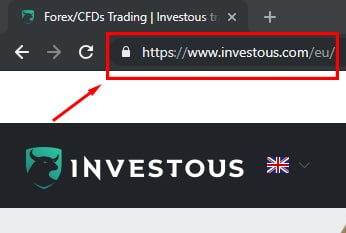

Investous SSL Certificate

Investous SSL CertificateAs is pretty standard these days, there is full SSL encryption on the Investous website and platform. This means that all documents you upload on their platform as well as all credit card information that you send them will be securely encrypted.

This is important because it can protect you from certain hacker attacks called man-in-the-middle where the hacker will infiltrate your connections and try and obtain sensitive information that they can use in later attacks.

If you always wanted to confirm that you were indeed on the Investous website then you can observe the browser padlock in the top left of the screen. If this is present it means that you are on Investous and the SSL certificate is valid.

Asset Coverage

Investous has hundreds of assets that you can trade on their platform. These are all CFDs which means that you can trade assets listed on different stock exchanges as well as physical assets like commodities without taking any sort of delivery.

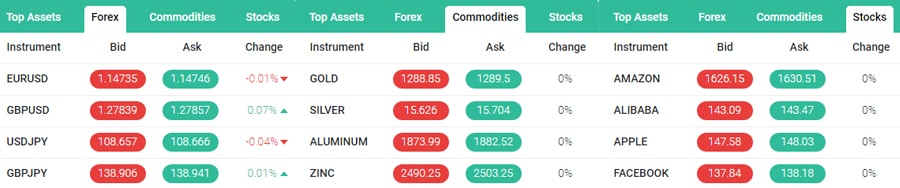

Some of the assets on offer at Investous

Some of the assets on offer at InvestousBelow are a summary of some of the assets that you can trade on Investous:

- Equities: Stocks on exchanges based in America, Europe and Asia. You can trade single stock names such as Tesla, Coca Cola, Amazon, Alibaba and Ferrari to name a few. These will be impacted by the market hours of the exchanges so take note

- Forex: They have most of the standard forex pairs including the most popular major and minor crosses. We would have liked to have seen a few more exotic options to trade with but this should satisfy most traders

- Commodities: Investous offers most of the commodity complex on their books including hard and soft. For example, they have gold, silver, copper as well as soft commodities such as Oranges, Soybeans and Coffee. This is actually quite an impressive mix for a CFD provider.

- Indexes: If you wanted to trade stock indexes then they have that too. They have indexes of markets from all around the world. Take note that because these are different markets, they will be open in their local trading times.

Lastly, for those of you who are avid cryptocurrency traders, Investous has a pretty sizable selection of crypto assets for you to choose from. All of these coins are crossed with three fiat currencies which are EUR, USD and GBP.

- Bitcoin (BTC)

- Litecoin (LTC)

- Ethereum (ETH)

- Ethereum Classic (ETC)

- Dash (DASH)

- Ripple (XRP)

Additionally, they have coins such as Monero and Bitcoin Gold that are just crossed with USD. It is also important to point out that they have two contract types when it comes to their cryptocurrency assets.

The standard contract has one lot which is equal to 100 of the coin. This may be a bit much for some traders so Investous has offered their "mini" contracts which are for one of the underlying coin.

Investous Fees

For those traders who have used a CFD broker before they will know that the broker makes money on the spreads that they charge the client. Some will also charge the client a flat commission per lot that they trade.

Investous does not charge a commission on the lots but they do have floating spreads in place for all of their assets. To give you an idea of some of the spreads, below is a snapshot of the spreads on a range of assets:

- EURUSD: 0.3 - 0.5 pips

- Coca Cola: 11 points on $47.50 ($0.11)

- Nasdaq: 180 points on 6,479.35 (c. 0.03%)

- Gold: 23 points on $1,248.26 ($0.23)

- Bitcoin: 7,200 points on $4,126 ($72)

All of the spreads seem reasonable expect for the spread on Bitcoin. This is quite a sizable spread especially when you are to compare it to the exchanges. If you were to have traded this on an exchange it would imply that the fee charged by the exchange is 1.8% which is indeed quite high.

Deposit and Withdrawal Fees

Taking a look at some of the other fees that you could incur on Investous, there are no fees that are charged for depositing funds. Of course, there may be fees that are applied by your bank related to the credit card transaction. Also, there may be international wiring fees that your bank charges if you are sending via Swift.

In terms of withdrawal fees, Investous will charge a flat rate of 35 EUR/USD/GBP and 2,500 RUB on wire transfers. If you are going to withdraw from a credit card this will cost 3.5% and if you are withdrawing through an electronic money service it will be 2%.

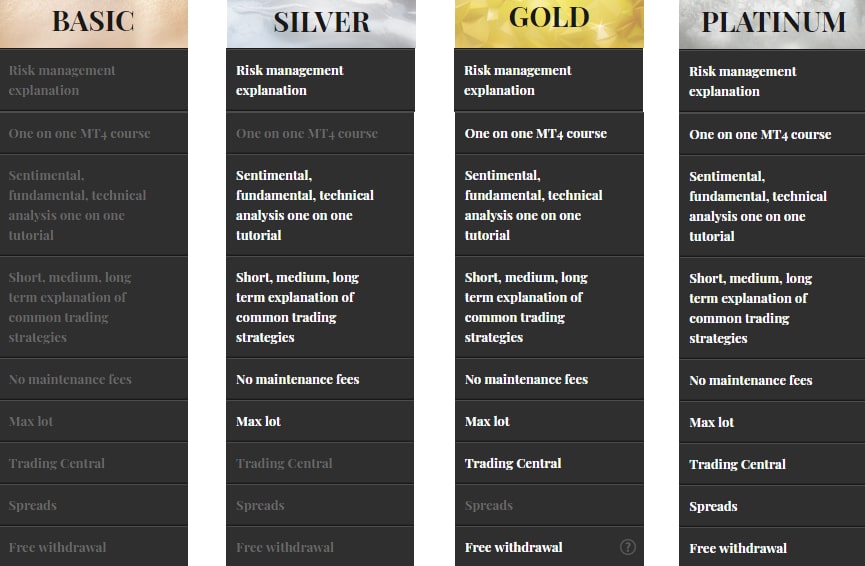

It is important to note that if you have a Platinum or Diamond account then these fees will be waived. We cover account types below in the live account section.

Customer Support

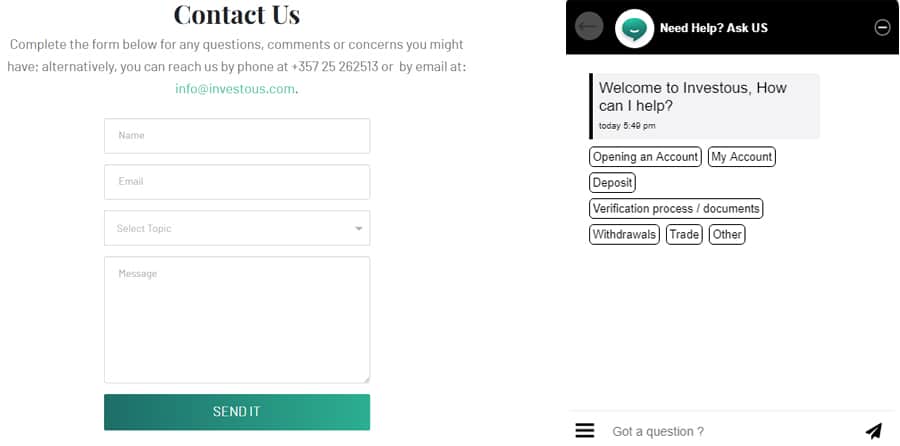

Customer support can be an important criterion for some traders. There is nothing that is more annoying than an unresponsive support team if you have pressing issues related to your account or any trading queries.

Investous seems to have this box ticked off as they have a range of support options for you to make use of. For example, on their platform they have the quick and easy live chat option. These chat agents can help you with most account related queries. We tested it out and they were quick to respond to our detailed questions on trading fees.

Investous Contact form and Live Chat Function

Investous Contact form and Live Chat FunctionIf you are the person who is more interested in reaching out to someone over the phone then Investous lists their Cyprus office number on +357 2526 2513. This may not be manned at all hours of the day so take care to call during Cyprus office hours.

Lastly, you can also reach out to them through an online contact form and ticket support system. If you are slightly more traditional and would prefer to email them then their agents can be reached on [email protected].

Of course, if the question was more routine in nature then someone else is likely to also have asked it. This means that you can find the answer to this in their FAQ section.

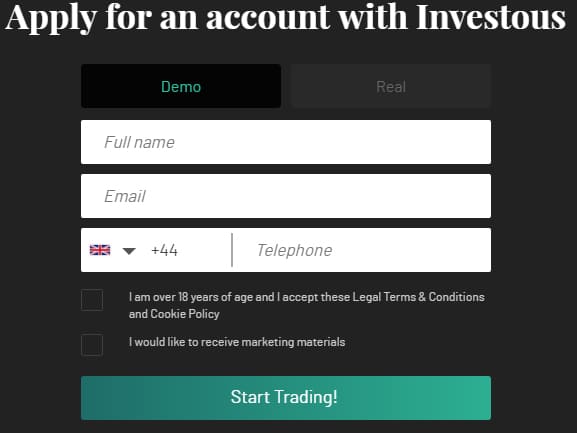

Investous Demo Account

This is something that could be quite useful for those who are new to trading or who are new to the platform in general. This will allow you to trade with $100,000 in demo funds in a non-threatening environment.

You will have access to the same prices and trading functionality as the live traders. This means that it could be a great way for you to practice before you invest any funds. It is also a great way for you to work your way through the platform to make sure that it is right for you.

You can create a demo account upon a registration. All they will require is an email address, full name and a phone number. Below is the registration form assuming that you are initially creating a demo account.

Demo Account Registrationg at Investuos

Demo Account Registrationg at InvestuosYou can also switch between a live account and a demo account if you have created a real account. Hence, you should not be too alarmed if you have already created a real account and would like to try on demo.

Live Account

You can either create a live account straight on your demo dashboard or you can do it the moment that you are registering your account. If you are going to be doing the latter then you will have a similar registration form to the demo account.

Unlike most other exchanges or brokerage houses, Investous has a range of different account live account types for you to choose from. These are offered to clients based on a number of different criteria. These could either be related to the skill level of the account holder or the amount that they have in their account.

Overview of the Different Investous Live Accounts

Overview of the Different Investous Live AccountsSo, which account is ideal for you?

This really depends on your own individual preferences and requirements. If you are uncertain exactly as to which account you should go for then it helps to reach out to their customer support team and bespoke account managers.

KYC and Verifications

Given that Investous is authorised and regulated by the CySEC, they have to complete all the regular Know Your Customer (KYC) and Anti Money Laundering (AML) regulations. This means that they will have to confirm your identity as a trader.

This is probably something that you will have probably come across at another broker or cryptocurrency exchange recently. There are very few trading outlets that will allow you to trade anonymously or without some form of basic identity verification.

While Investous does not require you to complete identity verification before you fund via credit card, you will have to be fully verified before you can withdraw any of your funds. Hence, it probably makes sense to do this before you start any trading.

Investous will require you to submit some form of government ID. This can include the likes of a passport, driver’s licence or ID card. They will also need to verify your place of residence with a proof of address. You can use a utility bill, bank statement or any government correspondence.

In terms of the time that is required for verification, assuming that all the documents you sent through are in a respectable state then you can expect verification within a few hours. However, it is perhaps most prudent to budget for between 1-3 days as these are the guidelines that Investous gives.

Deposits and Withdrawal

Much to the disappointment to those cryptocurrency users amoung us, Investous is a Fiat only brokerage. This means that you cannot fund your account with crypto of any kind.

When it comes to their funding options, you have wire, credit cards and an online money payment option such as Skrill. If you are looking for the fastest option then you are probably best to use a credit card or Skrill. Funding through wire could take 2-3 days.

In terms of the currency account options you have, you have EUR, GBP, USD and RUB. In order to fund your account, you will have to head on over to the "Banking" section in the header menu. Here you can select "deposit" and choose your funding option. Below are the maximum and minimum deposit limits on Investous.

| Minimum Deposit | Maximum Daily Deposit | Maximum Monthly Deposit | |

| Credit Card | $250/€250/£250/ руб 10,000 | $/€/£ 10,000 | $/€/£40,000 |

| Electronic Payment (Skrill) | $250/€250/£250/ руб 10,000 | $/€/£ 10,000 | $/€/£40,000 |

| Wire Transfer | $1000/€1000/£1000 | $/€/£ 10,000 | $/€/£40,000 |

When it comes to withdrawals, as mentioned you need to be fully verified before you can withdraw funds that you have gained from the trading. You are also only allowed to withdraw to the same method which you funded the account with.

The only withdrawal method that requires a unique approach is that of credit card. You can only withdraw as much as you have funded with the credit card. All funds that you have gained above this will have to taking out through another payment method such as wire or Skrill.

Withdrawing your funds from the account is just as simple as a deposit and you will access it from the banking section. Here you can select the amount that you would like to withdraw as well as your preferred withdrawal method. Investous will reach out to you if there is anything that they require.

Investous Trading Platform

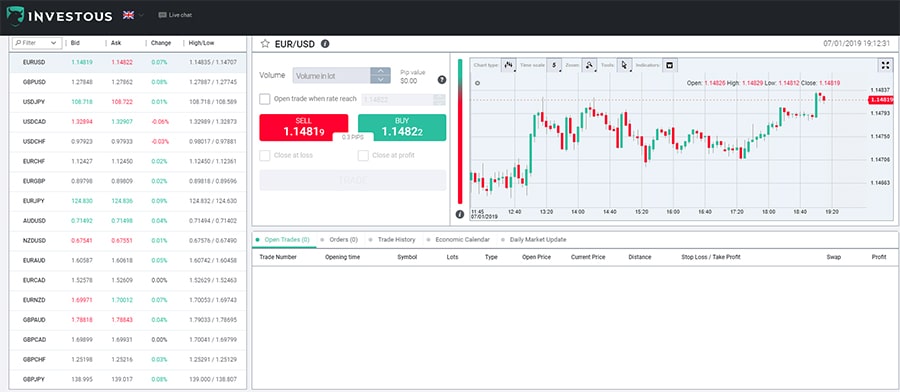

The online web trading platform of Investous is pretty typical and easy to use. For those who are familiar with other online CFD platforms then it will not be that hard to find your way around their platform.

On the left you have all of the assets that you can trade. Here you can easily filter the types of assets based on the asset class. Alternatively, you can select to view all of the most popular assets.

Investous Web Trading Platform

Investous Web Trading PlatformYou have your order forms in the middle of the platform with your order history and open trades. You can also toggle between the Daily market update as well as the Economic calendar (we will cover this in education).

On the right you have your trading charts. The chart is pretty intuitive and has quite a bit of functionality and trading tools. For example, you have a sentiment indicator on the left of the chart that will give you an overview of where the other traders are positioned.

We are actually quite surprised at the range of indicators and technical analysis tools that you have on the standard Investous web-based platform. For example, you have a number of charting tools that allow you to map out your strategy and decompose important levels on the chart.

There are also a host of indicators that you can overlay onto the chart. These include over 30 different trend indicators as well as up to 15 different oscillators. If you have any difficulty charting on the smaller sized charts then you could always expand the chart to full screen for easier functionality.

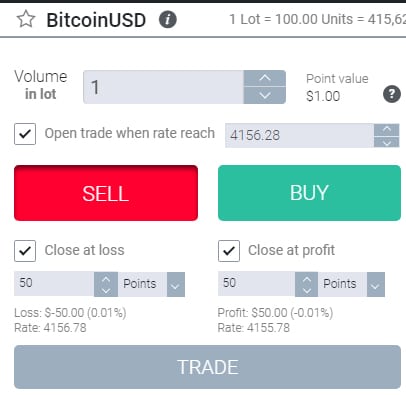

Order Functionality

While the charting package itself is quite advanced, the order functionality is a bit lacking. There are no options when it comes to order life as well as more bespoke stop losses / take profit orders.

Standard order form on Investous

Standard order form on InvestousYou have pretty standard order options. You can place a limit order to buy / sell the asset at a certain price. When you are placing this order then you can select your stop loss levels as well as your "close at profit". These can be placed based on pips away from market value or as a defined level.

Before you place your order, make sure that you observe the "pip value" of the trade. This will give you an indication of how much your position is likely to change based on the underlying move in the asset price.

MT4 Platform

For those more seasoned CFD traders you will be happy to know that Investous also offers MT4 functionality and connections.

MT4 is third party trading software that is developed by a company called Metaquotes. This software is interoperable between different brokers and allows for a plethora of trading tools and functionality.

Not only do you have the most advanced technical analysis tools and charting software but you can also code your own "Expert Advisors". These are basically trading bots and software scripts that will trade the markets automatically for you. These trading algorithms are developed in MQL which is the proprietary coding language used by Metaquotes.

The Investous MT4 platform being traded on a MacBook

The Investous MT4 platform being traded on a MacBookThe other advantage of using MT4 is that it is a computer program that is directly connected to the Investous trading servers. There is much less latency between order execution than there would be on the likes of the web-based platform. You can also set this up on a VPS server to run 24/7 should you be trading with bots and software.

Although the MT4 software may be slightly complicated for the beginner traders, it helps to get your head around it and hone your trading skills. This is because of the fact that it is standardised trading software that is offered by hundreds of brokers. Once you know how to use an MT4 platform, you can trade on it with any supporting broker.

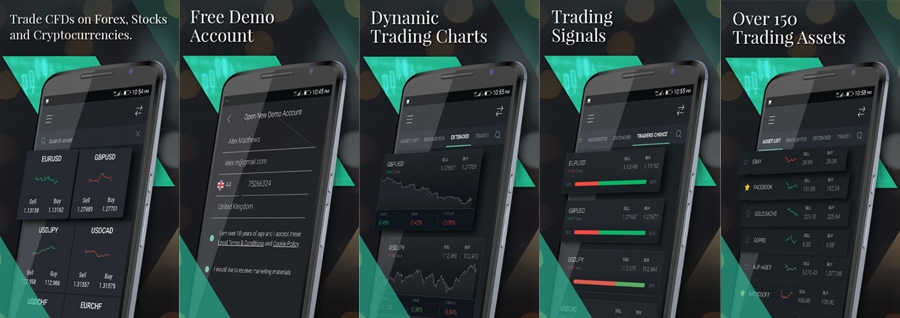

Investous Mobile App

While trading on a PC is always an optimal solution, there may be those individuals who often find themselves away from their desk. Hence, Investous has a mobile trading app which will allow you to monitor your positions on the go.

The app is available in both the Google Play store as well as the Apple iTunes store. The app seems to be pretty advanced for a CFD platform and will give you access to most of the web-based trading platform's features.

Investous Mobile Mobile Application. Source: Google Play

Investous Mobile Mobile Application. Source: Google PlayFor example, you can do mobile charting, administer your account and orders, reach out to customer service as well as the live chat function. Given that this is a mobile app, you also have one-click trading which can slow down the time that it takes to execute an order.

The app is still pretty new in both of the stores so it has not had enough time to gather a sizable amount of reviews. However, if we were to take a look at the Google play store, there is already a 4.2 average rating for the app.

So, should you use the app?

Well, mobile trading can be an ideal method to trade for those that do not have access to a computer at the time. The Investous app also has a range of features that other CFD apps have. However, you cannot beat the speed and functionality that will come with a web based or MT4 trading solution.

Education Centre

It is always helpful when a broker includes educational and training material with their package as they are providing value beyond just a trading platform. Investous also has some helpful resources which you can access from the header through the "Education Centre" tab.

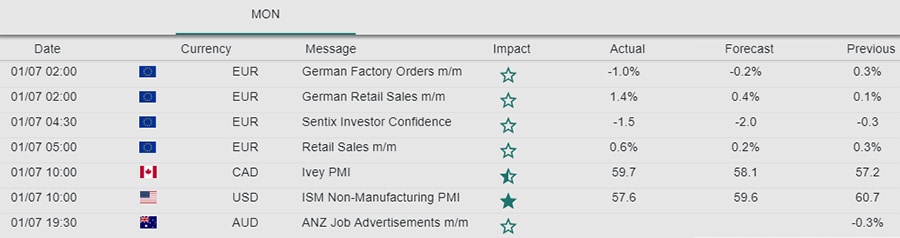

For example, something that we have mentioned above is the economic calendar. This is basically a timeline of all the most important economic news that will be breaking over the upcoming days.

The economic calendar is helpful for you to keep an eye on potential economic events that could create severe volatility. It allows you position yourself beforehand and hedge out the market risk that comes with it.

Economic Calendar with analyst forecasts

Economic Calendar with analyst forecastsThis also has a run down of what is expected (forecast) and the actual number. If expectations have been exceeded or if there was a miss, the markets will react in a much more forceful way. This could give traders an opportunity to profit from severe price action.

There are also a host of educational videos which can give you an overview of the general principles of Forex and CFD trading. These videos are helpful for most types of traders from complete beginners to those who have a bit more knowledge of the subject and would like to augment it.

Investous also has daily market update videos that are published at the beginning of the trading day. These will give you a run down of what to expect from the markets for the coming day / week. These videos will either be presented on the homepage as well as on the trading platform below the charts.

What We Didn't Like

While our review has been generally quite positive, there are a number of things that we were not too fond of that we think need mentioning.

Firstly, we found the spreads that they are charging on some of their cryptocurrency pairs to be quite exorbitant. If you were to price these spreads on the basis of a normal exchange then it would be one of the most expensive. Moreover, this is just a financial product and not the underlying asset.

We also found the 3.5% withdrawal fee to be quite hefty. This is not something that one would traditionally expect from larger brokers or exchanges. Perhaps this could be lowered as Investous expands their payment processing solutions.

Taking a look at the platform, when it comes to the order functionality, these are quite basic. You only have two types of orders and have no options around order life or more advanced stop orders. This could be frustrating to those traders who have experience with more involved order options.

Lastly, the brokerage is still new which means that there is not that much in the way of previous trader experience. This is probably a catch 22 as new brokers have to start somewhere. We are encouraged with their regulatory licences however.

Conclusion

In summary, Investous seems to be quite an attractive broker. We like the fact that they are a fully regulated CFD brand which implies numerous investor protections that you are not afforded on other brokers and exchange.

We were also quite impressed with the technology on the platform as well as the fact that they have MT4 functionality. This means that traders who are familiar with this software can make the most of Investous.

While there were certain things that we thought warranted improvement, these should not be a deal breaker. They are all points that can be worked on by Investous and improved as the broker expands their product and gets feedback from clients.

So, is Investous the broker for you?

Well, if you are looking for a well regulated and technologically advanced platform with reasonably extensive asset coverage then it could be worth checking out.

Disclaimer: These are the writer’s opinions and should not be considered investment advice. Readers should do their own research.