Quick Verdict

OKX is a pro-grade venue with deep perp liquidity, unified margin, and an integrated Web3 wallet. Base fees are low and fall fast with VIP tiers and OKB. PoR with zk-STARKs boosts transparency. Not ideal for U.S. users or total beginners, and fiat on-ramps can add third-party costs, but for serious traders, OKX is a first-string platform.

Who It’s For

- Active spot/derivatives traders who value unified margin and low latency

- API/algo users, copy-traders, and bot builders

- Web3 power users who want DEX, NFTs, and bridging in one ecosystem

Who Should Consider Alternatives

- U.S. users who need full, regulated access

- First-timers who prefer a hand-holding, fiat-first app

- Buyers relying on card rails who want the very lowest all-in costs

Top Alternatives to Consider

- Binance: Unmatched global liquidity and frequent fee promos.

- Kraken: Security-first, regulated access with conservative leverage.

- Coinbase: Best-in-class fiat on-ramps and beginner UX (higher fees).

OKX Quick Facts

| Fact | Details |

|---|---|

| Cryptocurrencies Supported | 300 coins and 688 trading pairs (CoinGecko) |

| Trading Fees (Maker/Taker Range) | Spot: 0.08% / 0.10% (base) · Derivatives: 0.02% / 0.05% (base); discounts via VIP tiers & OKB |

| Funding Methods | Bank transfers (SEPA/local rails where available), cards, P2P, and crypto deposits |

| Typical Withdrawal Fees | Network-only; varies by chain (e.g., BTC, ETH, USDT on ERC20/TRC20) |

| Products | Spot, Margin, Perpetuals, Futures, Options (region-dependent), Earn, Jumpstart, Copy Trading & Bots, Web3 Wallet, NFT Marketplace |

| Availability | Broad global coverage; limited features/availability for U.S.; product access varies by jurisdiction |

What Is OKX? Platform Overview & 2025 Updates

OKX started as a trading platform and has layered on Web3 services until it became an exchange + wallet + launchpad setup. Here’s how it got here and what it looks like now.

Brief History & Background

OKX launched in 2017 under Star Xu. Spot trading came first, then derivatives, futures, and options followed. More recently, the OKX Wallet rolled out with multi-chain support, DeFi aggregates, and NFT capabilities. They also added Jumpstart (for new projects), Earn, and Dual Investment products to attract long-term holders.

The platform publishes proof of reserves using zk-STARKs and Merkle tree data so users can verify holdings. That adds transparency. In February 2025, OKX admitted to U.S. AML violations and paid $505 million in penalties.

Global Presence & Access

OKX operates in Asia, Europe, the Middle East, and parts of Latin America. U.S. residents, however, don’t get full access. The OKX US entity has limited features compared to the global version of OKX. This is due to deposit restrictions and/or regulations that affect which tools (futures, options, Web3 wallet) work.

In January 2025, OKX secured its MiCA license, allowing it to roll out regulated products and services across Europe.

Who OKX Is Best Suited For

If you know your way around markets, like blurting orders, using bots, or want deep liquidity in derivatives, then OKX is strong. And if you enjoy experimenting with Web3, NFTs, bridging, or want to keep everything in one ecosystem, it makes sense.

But if you’re totally new, want an app that holds your hand, or are based in a restricted region like the U.S., then you may hit friction. This could mean that some features are locked, regulatory warnings, or confusing risk disclosure.

How We Reviewed and Tested OKX

This review is based on hands-on checks across both the web and mobile platforms, combined with a close review of OKX’s official documentation, public disclosures, and real-world user feedback.

We focused on practical trader outcomes such as features, costs, risk controls, and transparency, rather than marketing claims or promotional narratives. Regional restrictions were taken into account throughout the review to ensure that feature availability and limitations were assessed in context.

What We Tested

- Sign-up flow, email/phone verification, KYC tier requirements, and basic account security setup.

- Spot trading on major pairs: Order placement, execution, order types, charting, watchlists, and position tracking.

- Derivatives/margin where available: Perps/futures interfaces, leverage bands, funding mechanics, liquidation UI cues, and unified margin behavior.

- Fees and cost clarity: Base maker/taker rates, VIP tier logic, OKB discount mechanics, withdrawal fees across common networks, and visibility of third-party fiat on-ramp fees at checkout.

- Advanced tools: Copy trading dashboards/metrics, built-in bot setup (grid/DCA templates), and API feature review (permissions, rate limits, key controls like IP whitelisting).

- Web + mobile UX: Navigation, feature parity, alerts/push notifications, reliability during normal volatility, and friction points in trade/transfer flows.

- Web3 wallet features: Wallet setup, self-custody controls, DEX aggregation flow, bridging flow, and NFT/marketplace access where available.

- Security and transparency: Available account protections (2FA options, withdrawal allowlists), and Proof of Reserves verification flow (Merkle/zk files process as documented).

- User feedback scan: App Store/Google Play themes, especially around KYC delays, withdrawal holds, bugs, and support response consistency.

What We Didn't Test

- Institutional/OTC offerings, bespoke fee schedules, and enterprise arrangements that are not representative of retail users.

- Black-swan stress scenarios (exchange-wide outages, extreme liquidity cascades) beyond normal volatility periods.

- Third-party fiat on-ramp performance (approval rates, processing delays, bank-side issues), beyond confirming disclosed fees at checkout.

- Independent DeFi protocol risk/performance accessed via the wallet (smart contract outcomes, bridge security), beyond verifying the wallet pathways exist.

- Long-duration yield results across Earn/DeFi Earn products (multi-month tracking, realized APY), since rates and availability shift frequently.

Getting Started with OKX

Before you can trade or use its wallet, you need to sign up and configure your account. OKX provides a standard signup flow with layered security and identity checks, which differ slightly by region.

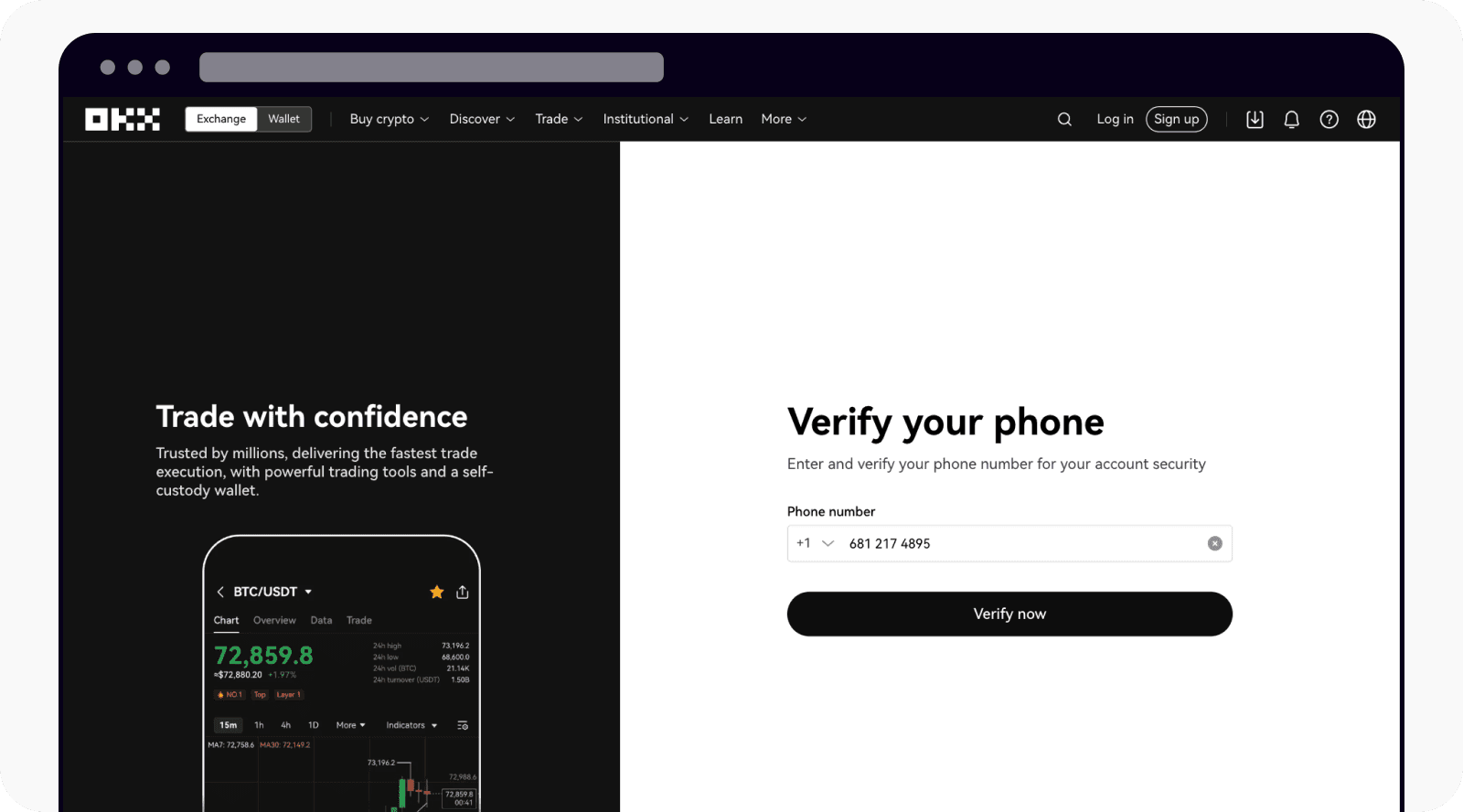

Account Creation Walkthrough

Creating an OKX Wallet account takes only a few minutes.

Step 1: Go to OKX and hit “Sign Up”

Open the OKX homepage and choose Sign Up to begin.

Step 2: Choose your country/region

Pick your place of residence, read and acknowledge the Terms of Service, then continue.

Step 3: Create your account with email

Enter your email address and proceed. Have a referral code? Add it on this screen before moving on.

Step 4: Verify your email (10-minute window)

OKX sends a 6-digit code to your inbox. Paste it into the email code field within 10 minutes, then continue.

Step 5: Add and verify your phone number

Easy Registration With Email Verification And Security Setup. Image via OKX

Easy Registration With Email Verification And Security Setup. Image via OKXEnter your phone number with country code and choose Verify now. You’ll receive another 6-digit code by SMS—enter it within 10 minutes to proceed.

Step 6: Set a strong password

Create a unique password using upper/lowercase letters, numbers, and symbols. Keep it private.

KYC & Limits

KYC1 (Basic) requires only a government-issued ID and facial recognition, unlocking limited deposits and P2P trading. According to OKX support, KYC1 users can trade up to $5,000 lifetime on P2P and Express.

KYC2 (Advanced) requires proof of address and allows much higher daily trading and withdrawal limits (often tens of thousands USD per day, depending on region). Higher levels unlock institutional accounts or fiat rails. Typical verification times range from a few minutes to 24 hours, depending on document checks.

Read more about the importance of KYC and AML regulations for crypto exchanges.

Making Your First Deposit

1. Open your dashboard

Once verification is done, head to your account Dashboard and choose Deposit.

2. Pick how you’ll fund the account

- Already have crypto? Select Crypto Deposit. Choose the asset and the network, then copy the address (or scan the QR).

- If the asset uses a memo/tag (e.g., XRP, XLM, BNB), include it or funds may not arrive.

- Send a small test transfer first, if it’s your first time.

- Network fees and confirmation times vary, so be patient.

No crypto yet? Choose Fiat Deposit. Select your currency and a funding method (bank transfer, card, or local rails where available), then follow the on-screen steps.

Your name must match your OKX account.

Fees and processing times depend on region and payment method.

3. Confirm the arrival of funds

You’ll see your balance update when the deposit settles. If prompted, transfer funds from your funding wallet to your trading wallet before placing orders.

4. Ready to trade or practice first?

Hover over Trade to pick Spot, Futures, or Options. First-time users may be asked a quick experience questionnaire. Prefer to warm up? Choose Demo trading to practice with test assets in a risk-free environment.

Trading Experience & Features

Advanced Tools Provide Seamless Spot And Derivatives Trading. Image via Shutterstock

Advanced Tools Provide Seamless Spot And Derivatives Trading. Image via ShutterstockTrading on OKX covers a lot of ground. From quick spot orders to complex derivatives, its feature set tries to serve both pros and people experimenting. We’ll break down the meat of what you’ll actually use.

Spot Trading

OKX supports a large number of trading pairs across many chains and coins. It offers deep liquidity on big pairs like BTC/USDT and ETH/USDT. For long-tail assets, liquidity often gets thinner, spreads widen, and slippage increases.

Order types include market, limit, and stop orders. OKX also supports OCO (one-cancels-other) and other conditional orders, though I could not find every order type for every region.

On top of this, you get multiple chart layouts, built-in indicators, a depth chart, and candlesticks. Watchlist functionality is present, and you can monitor both your open positions and your asset balances under the same umbrella.

Margin & Futures (Derivatives)

OKX’s derivatives suite includes USDT-margined perpetuals, inverse futures on select assets, and options where regulations allow. All of these tie into the unified account system, which lets collateral be shared across product types so traders don’t have to manage separate balances for each market. That structure simplifies margin calculations and makes capital use more efficient.

Risk controls vary with position size. Leverage bands differ by asset and region, while maintenance margins, liquidation triggers, and ADL (auto-deleveraging) adjust based on how large your position is. Bigger positions face stricter margin requirements, and OKX publishes these tables directly on the platform for transparency.

And to stabilize the system during sharp swings, OKX operates an insurance fund. This pool absorbs losses when some positions cannot be closed cleanly in extreme volatility. At the same time, funding rates on perpetual contracts act as the balancing mechanism between long and short demand. These rates can turn positive or negative, and their movement directly shapes the cost of holding leveraged positions over time.

Advanced Trading Stack

The copy trading ecosystem on OKX lets users follow leaders’ strategies. Leaderboards show metrics like past performance, drawdown, win rate. Some users mention uneven transparency: some leader stats don’t capture risk fully.

For Advanced Traders:

- Trading bots are built in (grid, DCA, etc.), along with templates that exist.

- Backtesting is possible for some strategies via community tools or OKX’s bot sandbox.

- OKX’s API v5 also helps with algo trades.

API and algo users get REST and WebSocket endpoints, rate limiting per instrument and per account. For example, sub–accounts have rate limits (new orders, amendments, cancellations), each with its own rules. Exceeding them returns specific error codes. OKX also provides a test or demo environment. The key security practices are to use IP whitelists, keep secret keys safe, and limit permissions.

If you are interested in crypto trading, then take a look at our guide for basic crypto trading.

Web & Mobile UX

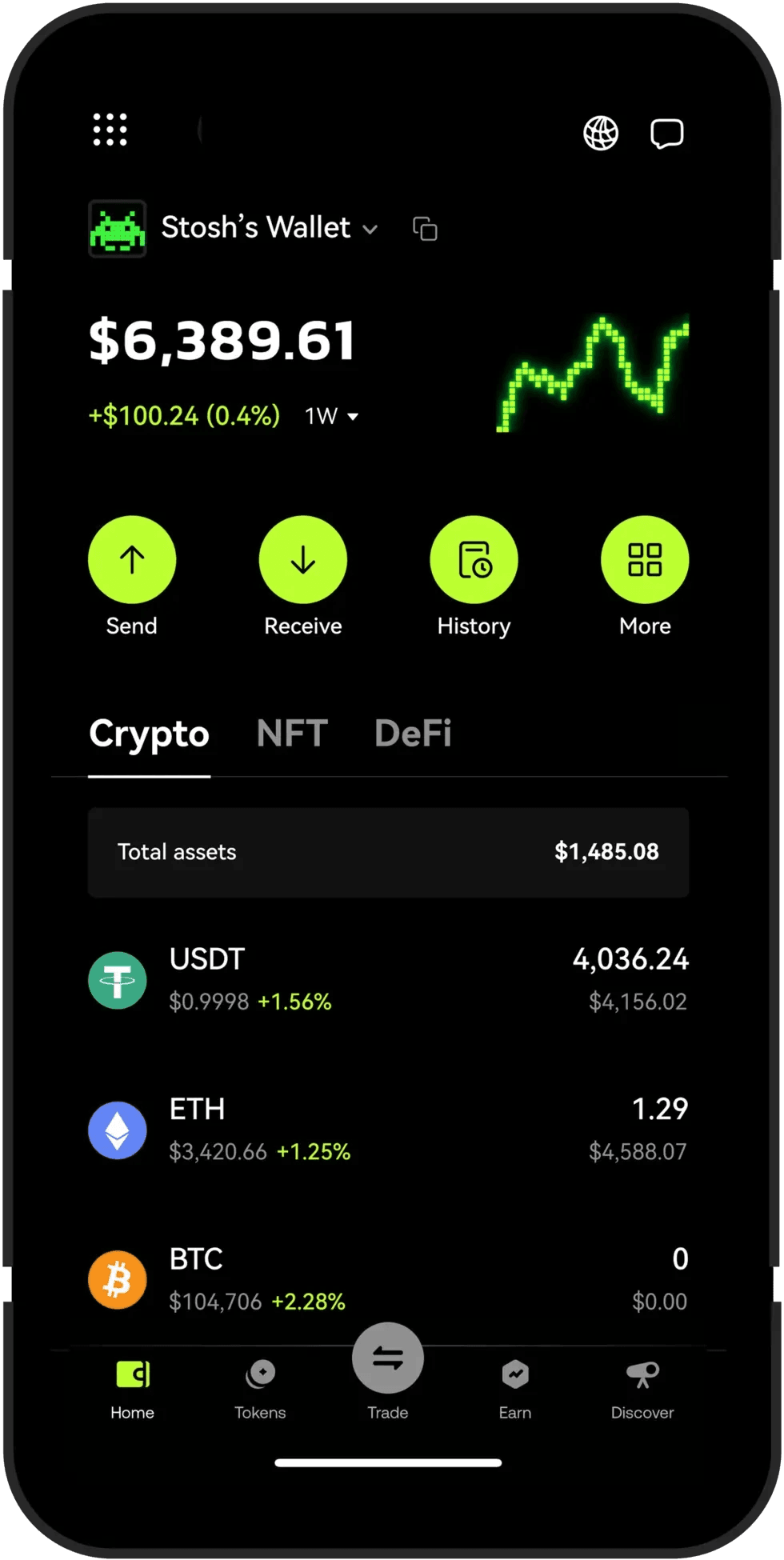

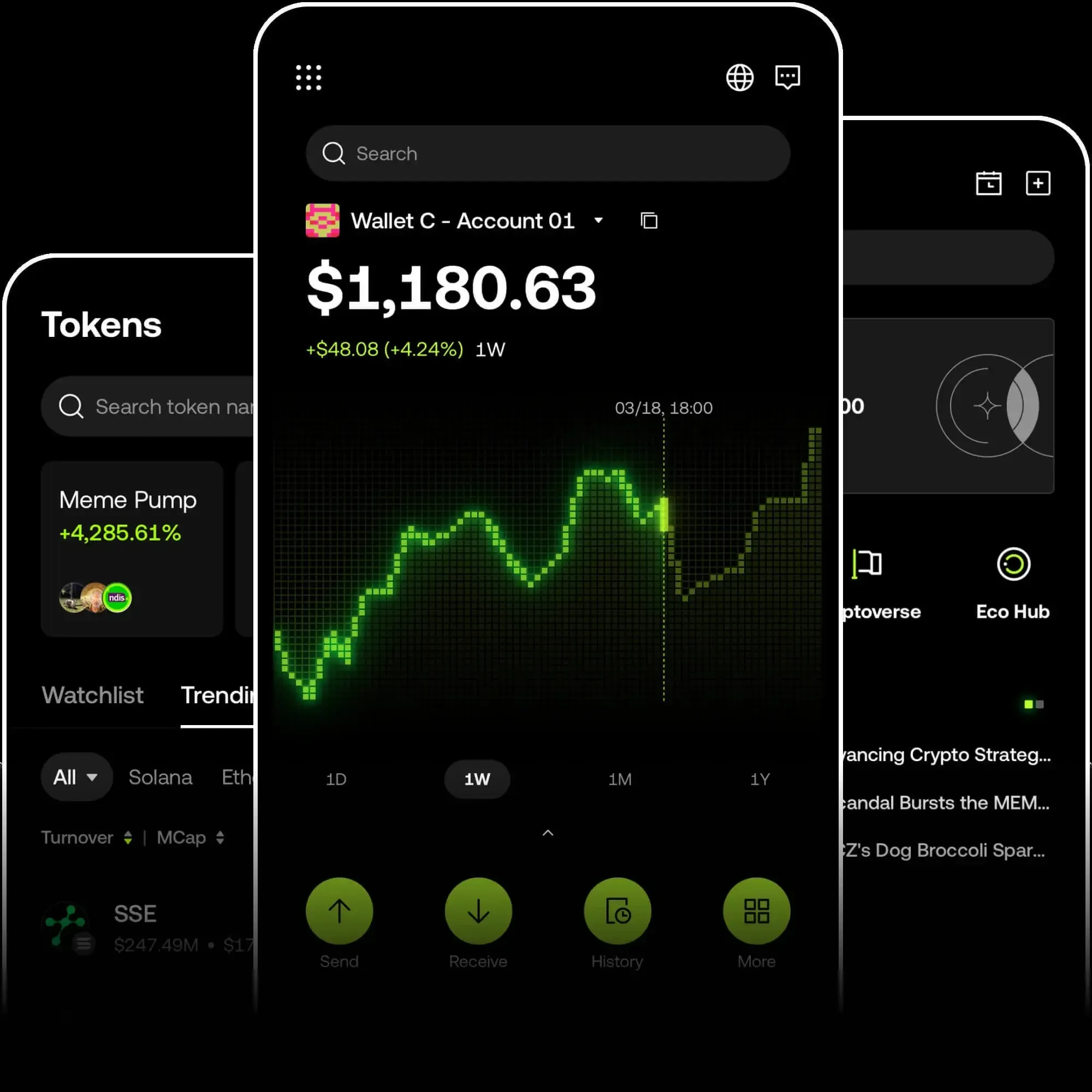

Consistent Interface Across Devices With Reliable Performance. Image via OKX Wallet

Consistent Interface Across Devices With Reliable Performance. Image via OKX WalletMost features on the OKX line up across desktop and mobile, though the desktop terminal benefits from extra screen space for charts and multiple windows. The mobile app streamlines most order flows, but confirm screens can take an extra tap or two.

Traders can set price alerts and push notifications to stay updated, while the combined Positions & Assets tab makes it easier to track exposure without switching views.

In terms of performance, OKX handles latency well on high-volume pairs, with execution generally reliable. During sharp volatility or scheduled maintenance, users may notice short delays, but these are exceptions rather than the norm. To keep markets orderly, OKX regularly updates tick sizes and minimum order amounts, publishing the changes so traders can adjust in advance.

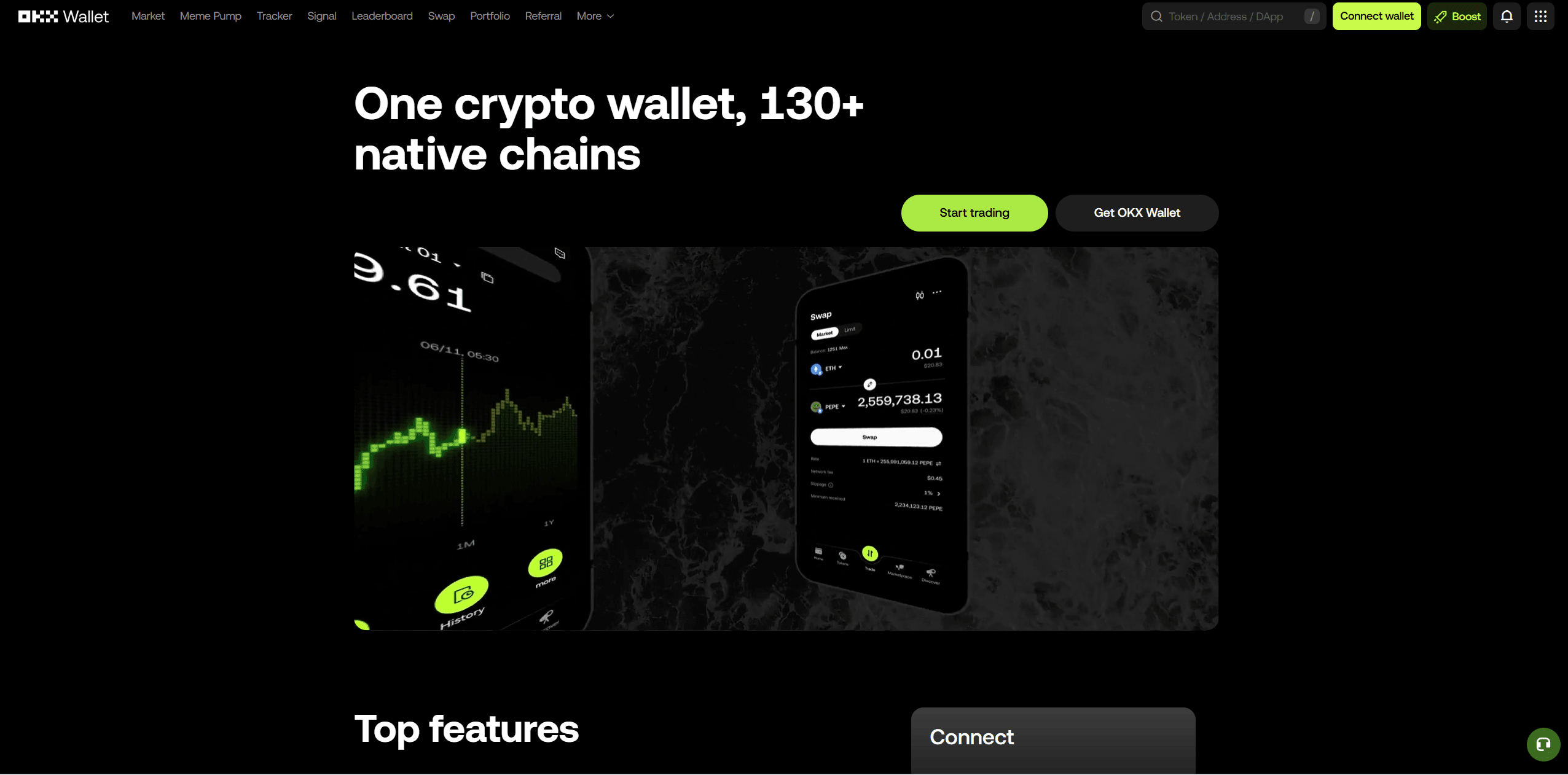

Web3, DeFi & Additional Services

OKX has layered in Web3 tools that bleed into the trading and wallet parts. These services are where it tries to feel “all-in-one”.

OKX Web3 Wallet Integration

Self-Custody Wallet Supports DeFi, NFTs, And Bridging. Image via OKX Wallet

Self-Custody Wallet Supports DeFi, NFTs, And Bridging. Image via OKX WalletThe OKX Wallet is fully self-custodial, giving users control through seed phrases or private keys. On top of that, it offers Smart Account features built on account abstraction, which allow gas fees to be paid in stablecoins like USDC or USDT instead of always needing the chain’s native token.

A further layer of convenience is coming through social recovery and guardianship. In supported regions, users can designate trusted contacts to help restore access if credentials are lost. These tools are still rolling out and aren’t yet available everywhere, but they point to a push toward more user-friendly security.

DeFi, Jumpstart & NFT

DeFi

OKX’s self-custody Web3 Wallet plugs into 130+ native chains, so you can swap and interact with DApps across major L1s/L2s from one place. The built-in OKX DEX is an aggregator that uses its X Routing algorithm to source prices across hundreds of DEXs and 20+ cross-chain bridges to reduce slippage and fees. If you prefer yield over swaps, DeFi Earn surfaces staking/liquidity opportunities (e.g., USDT, SOL and more) directly in the wallet.

Jumpstart (token launches)

Jumpstart runs two main formats: Mining (stake required assets like BTC/ETH or other specified coins for a period; rewards are distributed after the campaign), and On Sale (pay a discounted purchase price). Participation typically requires a verified OKX account and holding the required staking/participation assets in advance.

NFT (multi-chain marketplace)

The OKX NFT Marketplace spans 20+ chains (currently operates on 21), with support for major networks like Ethereum, Solana, OKTC, Polygon, BNB Chain, Avalanche, Immutable X, Aptos, Arbitrum, Optimism, Klaytn, Arbitrum Nova, and zkSync. OKX also provides an Ordinals hub for BRC-20/Bitcoin NFTs (listing, buying and inscription tools available in Wallet → Marketplace → Ordinals). Availability can vary by region.

Note: Some products/features are restricted by jurisdiction and require KYC. Always review the on-screen requirements before participating.

Fees Structure & Cost Analysis

Fees decide whether a platform makes sense for day-to-day trading or slowly eats into gains. OKX keeps its base rates competitive, but the picture changes once you factor in volume tiers, OKB token holdings, and product type.

Trading Fees & VIP Tiers

| Market | Maker | Taker | Notes |

|---|---|---|---|

| Spot | 0.080% | 0.100% | Starting tier |

| Derivatives | 0.020% | 0.050% | Perps/futures base |

| Item | Discount vs Base | Notes |

|---|---|---|

| Holding OKB | Up to ~40% | Scales with OKB balance; stacks with VIP |

| Tier | 30-Day Volume Qualification | Alt Qualification | Effect on Fees |

|---|---|---|---|

| VIP 1 | ≈ US$5,000,000 turnover | Six-figure account balance | Step-down from base; higher tiers reduce further |

Deposits, Withdrawals & Specifics

| Action | Fee (Typical) | Notes |

|---|---|---|

| Crypto deposit | Free | Standard across major exchanges |

| Withdraw BTC | ~0.00001 BTC | Network-linked; ≈ US$1 at current prices |

| Withdraw ETH | ~0.00003 ETH | Network-linked |

| Withdraw USDT | Chain-dependent | TRC-20 usually cheaper than ERC-20 |

| Method | Typical Fees | Notes |

|---|---|---|

| Card purchase | ~3.5%–5% | Varies by provider/region |

| Bank transfer | Varies | Depends on rails/provider |

| Third-party checkout | Provider-specific | Shown at checkout before confirm |

| Item | What to Know |

|---|---|

| Spreads (fiat→crypto) | Embedded in buy price; varies by asset/liquidity |

| Slippage | More likely on illiquid pairs or large orders |

| Borrow/funding rates | Ongoing costs when using margin or derivatives |

Figures are indicative, region-dependent, and subject to change. Confirm live fees in the OKX app before transacting.

Trading Fees & VIP Tiers

Spot traders start with maker fees at 0.080% and taker fees at 0.100%. Derivatives come in lower at 0.020% for makers and 0.050% for takers. From there, fees step down as you climb the VIP ladder. OKX calculates tiers based on your 30-day trading volume or account balances, with VIP 1 typically opening at around $5 million in turnover or a six-figure account balance.

Holding OKB, the exchange’s native token, unlocks further discounts. A trader with a meaningful OKB balance can cut fees by as much as 40% compared to base rates. This creates an incentive structure where both high volume and loyalty to OKX’s token ecosystem matter.

Worked example:

A user trading $50,000 in spot volume during a month at base rates would pay $40 if every trade were maker orders or $50 if they were all taker orders.

At $1 million monthly volume, a trader who qualifies for lower VIP fees and holds enough OKB might cut spot taker costs nearly in half. That means instead of paying roughly $1,000 at 0.10%, they might pay closer to $500 at 0.05%.

This is where OKX shines for high-frequency or institutional users: the higher the volume, the faster the effective fee rate drops.

Take a look at some of the best crypto exchanges with the lowest fees.

Deposits, Withdrawals & Specifics

Crypto deposits are free, which is standard across most large exchanges. Withdrawals carry network-linked fees that vary by chain. Pulling out Bitcoin usually costs about 0.00001 BTC, which is close to a dollar at current prices. Ethereum withdrawals hover around 0.00003 ETH, and USDT withdrawals depend on the chain, TRC-20 being cheaper than ERC-20.

Fiat rails come through cards, bank transfers, and third-party providers. These carry their own fixed or percentage fees, often between 3.5% and 5% for card buys. The exact number depends on the provider you pick at checkout. Hidden costs creep in through spreads when converting fiat into crypto, slippage on illiquid pairs, and ongoing borrowing or funding rates if you use leverage.

Worked example:

Depositing $1,000 with a card at a 3.5% fee costs $35 before you even make a trade. Withdrawing 0.5 BTC at a network fee of 0.00001 BTC only costs a dollar, but that assumes you move funds in chunks rather than micro-withdrawals, which can rack up costs over time.

How OKX Compares on Cost

When stacked against peers, OKX holds its ground. Binance posts similar base spot fees at 0.10% but leans on BNB for discounts. Coinbase is more expensive across the board, with fiat ramps carrying the highest cost. Kraken sits in the middle with moderate fees and fewer token-holding gimmicks.

Here are the fee details for OKX. Exact fees can vary by region and regulations.

| Exchange | Base Spot Fee (Maker/Taker) | Typical BTC WD | Typical ETH WD | ACH Deposit | Card Deposit |

|---|---|---|---|---|---|

| OKX | 0.08% / 0.10% (lower with OKB) | Network-only (~$15–20) | Network-only (~$5–8) | Free / region-dependent | ~3–5% (third-party providers) |

| Binance | 0.10% / 0.10% (lower with BNB) | Network-only (~$5–10) | Network-only (~$3–5) | Free | ~1–2% |

| Coinbase | 0.40% / 0.60% | $30 | $12.5 | Free | N/A (1–3% via card rails) |

| Kraken | 0.25% / 0.40% (<$10k vol.) | Network-only (~$20) | Network-only (~$8) | Free / ~$4 | N/A |

| Crypto.com | 0.25% / 0.50% | ~$36 | ~$10 | Free | ~2.99% |

Deposits, Withdrawals & Payment Options

The value of an exchange isn’t just in how trades clear, it’s also in how smoothly money moves in and out. OKX covers the main bases, but regional rules affect which rails you’ll actually see on your screen.

Multiple Funding Methods With Region-Specific Availability Options. Image via Shutterstock

Multiple Funding Methods With Region-Specific Availability Options. Image via ShutterstockSupported Methods

Crypto deposits work across the board and usually confirm within a block or two. Fiat options are more fragmented. Users in Europe can lean on SEPA, while Asian markets often see local payment rails integrated.

Cards and Google Pay are widely available, but they trigger the highest fees. Peer-to-peer fiat transfers are also supported, giving more flexibility in markets where direct bank rails are restricted.

Withdrawal Process & Timelines

Crypto withdrawals typically confirm within minutes once the blockchain settles the transaction. Large amounts, credential resets, or flagged behavior may trigger manual review, adding hours or even a day of delay.

OKX enforces daily withdrawal limits by KYC tier. Basic accounts withdraw less; fully verified accounts handle larger sums with fewer restrictions. Security holds can lock withdrawals temporarily after you change a password or disable 2FA.

Fiat Currencies & Stablecoin Strategy

OKX supports majors like USD, EUR, GBP, and selected local currencies. For traders who want predictability, stablecoins like USDT and USDC are often the cheaper route in and out. Depositing or withdrawing in stablecoins can reduce FX costs and bypass card fees, provided you already have them from another source.

Security Analysis: Is OKX Safe in 2026?

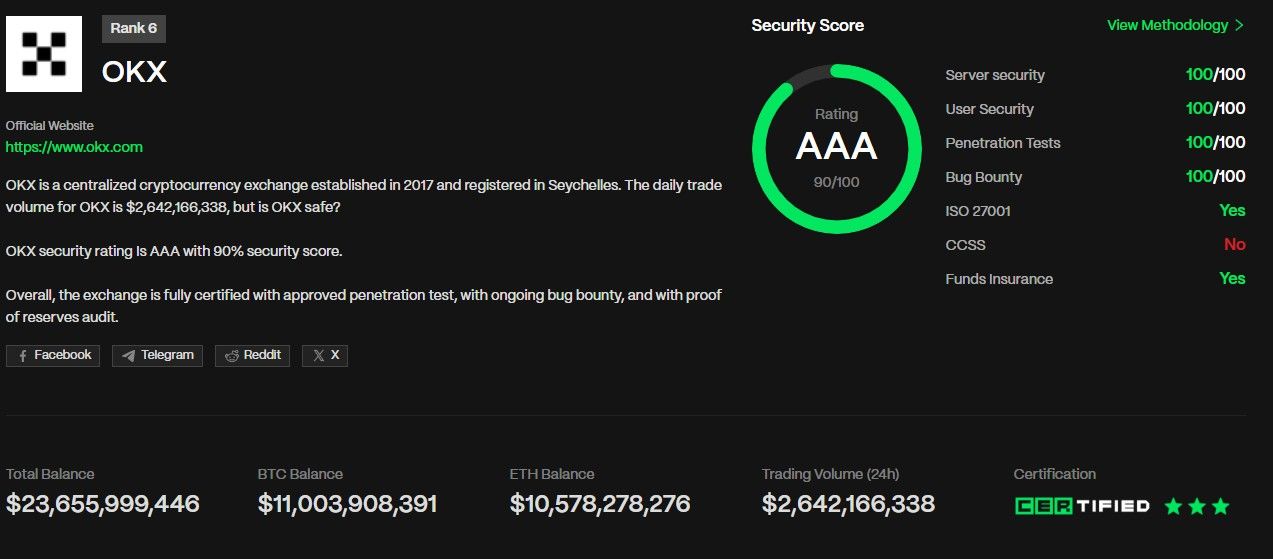

Security on OKX mixes user-side controls, infrastructure safeguards, and public balance reporting. According to CER.live, OKX is a top-10 safest crypto exchange, earning it the coveted AAA rating.

OKX Is One Of The Safest Crypto Exchanges Out There. Image via CER.live

OKX Is One Of The Safest Crypto Exchanges Out There. Image via CER.liveHere’s how the stack fits together and what it proves.

Core Protections

OKX layers multiple protections at the account level. Users can enable app-based or SMS-based two-factor authentication, U2F hardware keys, anti-phishing codes in official emails, withdrawal address allowlists with optional locks on new entries, and detailed device or session management.

For developers and algo traders, API keys can be limited to read, trade, or withdrawal permissions, and up to 20 IP addresses can be bound. Keys with sensitive permissions that aren’t IP-bound automatically expire after a period of inactivity.

On the infrastructure side, OKX relies on a mix of cold storage and multi-signature controls. Larger reserves are stored offline, while online wallets use semi-offline multi-sig to reduce exposure. Security guidance also points to standard safeguards such as strong encryption and biometric sign-ins on mobile devices, adding another layer of defense for everyday access.

Proof of Reserves & Transparency

OKX publishes regular Proof of Reserves (PoR) reports using zk-STARKs applied to a Merkle tree of user liabilities. This setup lets anyone check whether their balances are included and compare total reserves against on-chain wallet holdings.

The help center guides users through the process, with step-by-step instructions and downloadable zk files for deeper verification. What PoR does confirm is the existence of assets and the exchange’s solvency at the moment of the snapshot. What it cannot guarantee are future liabilities or any borrowings made off-exchange.

For a quick self-check, users can open the PoR page, choose the latest audit, and match their Merkle data against the reserve ratio published with wallet totals. Advanced users can go further by downloading the zk files to locally verify that balances are non-negative and sums reconcile correctly.

Mobile App Review

OKX’s app aims to cover pro trading and Web3 on the same screen. The layout stays consistent on iOS and Android, with a few mobile-only helpers for quick edits and tracking.

UI & Navigation

OKX Wallet's Intuitive User Interface Design. Image via OKX Wallet

OKX Wallet's Intuitive User Interface Design. Image via OKX Wallet The home screen tiles surface key information at a glance, showing balances, favorite pairs, and quick actions. From there, the Markets tab leads into TradingView-powered charts, complete with multi-indicator overlays, order book depth, and full-screen mode.

The trading ticket supports limit, market, and conditional orders, with take-profit and stop-loss lines that can be dragged directly on the chart. Positions and asset balances sit just one tap away, making it easy to adjust risk without leaving the trading view.

Watchlists sync seamlessly across devices, and alerts trigger push notifications when prices hit set levels. For quick monitoring, the floating Market Tracker widget can pin chosen pairs over other apps. iOS and Android versions are nearly identical, offering the same experience for charts, order tickets, and positions regardless of platform.

On-the-Go Features

You can open, scale, reverse, or close derivatives directly from the chart. Copy trading and bot templates live under Trade → Bots and Copy, with leaderboards and strategy settings accessible on mobile. Earn, Jumpstart, P2P, and the Web3 wallet are reachable from the tab bar or the More menu, so funding or on-chain actions sit close to trading. Notifications cover fills, liquidations, funding, and price levels.

Reliability note: Latency on majors is solid; bursts of volatility or chain incidents can still slow confirms. Keep alerts on and consider withdrawal allowlists and 2FA resets as triggers for temporary withdrawal holds. OKX

Customer Support & Real-World User Experience

Support matters when funds are on the line. OKX offers always-on help, but the quality users feel varies by channel and region.

Support Channels & SLAs

The help center runs 24/7 with live chat as the primary route. Users can submit tickets and use a toll-free voicemail, where responses arrive by email. Contact pages show chat as “recommended,” plus the voicemail number and support email. Coverage includes a multilingual help center.

Incident notices and product changes are published in the help hub. And here you can also check your system status, reset credentials, freeze an account, or verify official channels from the same portal. These self-serve flows reduce back-and-forth when time matters.

User Review Synthesis

A review is incomplete without a real review, right? So we dug into the App Store and Google Play reviews of the OKX app. Here is what we found:

Positives

Users highlight smooth transfers to banks and wallets, along with a clean, beginner-friendly interface. Some call it a top-tier exchange with quick setup for simple trading.

Security & Verification

Frequent complaints about account closures after KYC, verification headaches when switching devices or countries, and failed biometric/password setups create trust concerns.

Scam & Fraud Worries

Several reviews warn about scams tied to third-party communication like WhatsApp or suspicious account activity, leaving some users wary of the platform.

App Experience & Bugs

While many find the interface easy to navigate, others report clunky navigation, demo frustrations, blocked withdrawals, and transaction failures that undermine reliability.

Support

Mixed responses: some users receive prompt reassurance, but others describe unhelpful replies or difficulty reaching responsive support for case-specific issues.

Crowd Split

App Store ratings of OKX skew very positive (4.6/5) with emphasis on usability, while Google Play (3.9/5) reveals deeper issues around bugs, security, and reliability.

Bottom Line

App Store reviews show a split view. Some users praise fast transfers and an easy flow. Others report KYC delays and slow escalations in certain regions. Examples include positive transfer feedback in the UK store and complaints about week-long verification in the U.S. store.

On Google Play, the listing highlights broad adoption and TradingView’s reliability award, while wallet-specific reviews note security setting friction for a subset of users. Net sentiment trends positive on features and markets, with persistent gripes around verification pace and ticket turnaround.

OKX vs Top Competitors

A head-to-head view clarifies where OKX fits. Fees and liquidity tell one story, compliance reach and product depth tell another.

| Category | OKX | Binance | Coinbase | Kraken |

|---|---|---|---|---|

| Fees (spot/deriv) | 0.08/0.10; 0.02/0.05 | 0.10/0.02-0.05 with promos | higher on fiat and basic spot | moderate, clear tiers |

| VIP thresholds | volume and asset balance ladders | volume plus BNB | limited VIP effect | volume tiers |

| Assets and pairs | broad majors, wide perps | very broad across EVM and bey Sond | tighter, compliance-led | curated, fewer alts |

| Max leverage | product-specific bands | similar bands with promos | limited | conservative |

| PoR cadence | ongoing PoR with zk-STARKs | regular reserves posts | public financials and disclosures | public status and audits |

| Web3 wallet | built-in self-custody wallet | external or separate apps | separate wallet | none native |

| Copy/bots | copy trading and grid/DCA bots | copy and bot marketplace | limited | limited |

| Availability (US/EU) | limited in US; active in EU | restricted products in some regions | strong US/EU presence | strong US/EU presence |

| Support | 24/7 chat, ticket, help hub | chat, tickets, large KB | regulated support paths | tickets, KB, slower phone routes |

Quick Takeaways from our table:

- OKX is cost-efficient at base and improves with volume or OKB.

- Binance pushes fees lower with BNB and promos.

- Coinbase wins fiat simplicity at a higher price.

- Kraken wins on conservative posture and clarity.

OKX vs Binance

Binance is the largest global exchange by trading volume, known for unmatched liquidity, regular promotions, and a wide catalog of listed tokens.

Fees and VIP: Both exchanges start at a similar base, with spot taker fees around 0.10%. OKX edges slightly lower on the maker side at 0.08%. Binance offers fee reductions when you hold and use BNB, while OKX uses its OKB token for similar discounts.

Where they differ is in promotions. Binance frequently runs zero-maker or rebate campaigns on select contracts, giving short-term boosts for active traders. OKX relies more on its volume-based VIP ladder and OKB balance for long-term discounts.

Liquidity and derivatives: Binance consistently posts the highest spot and derivatives liquidity, especially on major pairs like BTC/USDT and ETH/USDT. OKX is close behind, particularly in perpetual futures markets, where its unified margin system allows traders to manage collateral across positions more efficiently. For traders running cross-product strategies, this unified margin and portfolio cross-feature can be more capital-efficient compared to Binance’s segmented margin accounts.

Web3 stack: Binance splits its services: its main app handles trading, while Binance Wallet and other companion apps cover DeFi and NFTs. OKX takes a different approach with an integrated Web3 wallet built directly into the main suite, offering DEX aggregation, NFT trading, and cross-chain bridging without leaving the platform. For users who want exchange and Web3 access in one place, OKX feels more seamless.

Regions and compliance: Binance enjoys the broadest brand reach globally, but has had to adapt its offerings constantly due to regional restrictions and regulator pushback. OKX also restricts U.S. users from its full platform, though it publishes ongoing Proof of Reserves and has been forced to increase compliance transparency after its 2025 AML plea. Traders outside the U.S. will generally find both accessible, but both exchanges may differ in what specific services they can provide, depending on jurisdiction.

Who each suits: Advanced derivatives and Web3 users who want integrated wallets often prefer OKX. High-volume spot and futures traders who maximize BNB discounts or take advantage of frequent promos may find Binance more cost-effective.

Comparing Fees, Liquidity, Web3 Features, And Global Access. Image via Shutterstock

Comparing Fees, Liquidity, Web3 Features, And Global Access. Image via ShutterstockOKX vs Coinbase

Coinbase is a U.S.-based, heavily regulated exchange that prioritizes a simple user experience and fiat accessibility.

Beginner UX and fiat ramps: Coinbase is widely seen as the easiest on-ramp into crypto, with smooth bank integrations, card payments, and PayPal support in many regions. OKX also offers cards, bank rails, and peer-to-peer fiat trading, but in many markets it leans on third-party providers that charge higher spreads and fees. The difference shows when onboarding: Coinbase’s flows are cleaner for first-time buyers, while OKX may involve additional steps or provider-specific checks.

Fees reality: Coinbase is consistently more expensive on fiat buys. Its “simple buy” feature often charges several percent in spread and fees. OKX’s base trading fees are lower (0.08% maker, 0.10% taker), but when using fiat ramps, costs depend on the third-party processor selected at checkout. Heavy fiat users often reduce costs on Coinbase by using Coinbase Advanced, where fees are closer to market norms, while OKX users can avoid extra fees by depositing stablecoins or crypto directly instead of paying card spreads.

Product depth: This is where OKX outpaces Coinbase. Beyond spot, it offers perpetuals, futures, options, staking, copy trading, bots, and an integrated Web3 wallet with NFT and DeFi access. Coinbase, by design, keeps things lean: its Advanced platform supports spot and some derivatives in select regions, but its main selling point is regulatory compliance and simplicity rather than breadth.

Who each suits: Coinbase is the better fit for first-timers and fiat-first users who want a highly regulated, beginner-friendly experience. OKX fits cross-margin traders, derivatives users, and Web3 power users who want all those advanced tools in one place.

OKX vs Kraken, KuCoin, and MEXC

When comparing OKX to this trio of competitors, it helps to see them as points on a spectrum. Kraken represents the most regulated and conservative option, KuCoin and MEXC push for aggressive altcoin coverage and leverage, and OKX sits in between, balancing advanced derivatives with on-chain tools.

Security reputation: Kraken has built its brand on trust, with a clean track record and external proof-of-reserves audits. OKX also publishes zk-STARK-based PoR, though its 2025 AML settlement brought new compliance oversight. KuCoin and MEXC are quicker to list new assets but face ongoing concerns about regulatory footing and long-term accountability.

Market coverage: KuCoin and MEXC dominate the altcoin scene, offering hundreds of tokens often absent from larger regulated platforms. Kraken keeps listings curated and safe, but limited. OKX takes a middle path: it supports all major pairs and a broad range of derivatives while being more selective than KuCoin or MEXC on fringe coins.

Derivatives and leverage: OKX’s unified margin and deep perpetual liquidity give it an edge in professional derivatives trading. MEXC offers the highest leverage limits of up to 200x, but that also comes with higher risk. KuCoin provides a decent range of perps and futures, but lacks unified margin efficiency. Kraken remains conservative, limiting leverage and focusing on compliance-first futures.

APIs and algo trading: Institutions tend to prefer OKX and Kraken for their stable, well-documented APIs. KuCoin and MEXC are widely used by retail bot traders, but uptime and execution can be inconsistent compared to OKX’s enterprise-grade stack.

Regional access: Kraken dominates in the U.S. and Europe with full licenses. KuCoin and MEXC attract users in less-regulated regions but remain off-limits in many Western markets. OKX spans most regions globally, excluding the U.S., and is aligning with MiCA for European access.

Who each suits:

- Kraken: Best for traders who want regulated access with strong security.

- KuCoin: Fits altcoin hunters and casual retail users in flexible regions.

- MEXC: Attracts high-leverage traders chasing promotions.

- OKX: Appeals to users who want advanced derivatives and integrated Web3 without going all-in on risky alt markets.

Legality & Regional Considerations

Regulation shapes how accessible OKX is around the world. The exchange operates widely across Asia, Europe, and the Middle East, but the experience looks very different depending on where you log in from.

Is OKX Legal in the United States?

For U.S. residents, the global OKX platform is not legally available. Instead, there is a smaller spin-off called OKX US. It strips out core features like derivatives, most margin products, and Web3 integrations. U.S.-based traders who want a regulated option often turn to Coinbase or Kraken, which have clearer licensing footprints.

Restrictions & Licensing Snapshot

OKX maintains an updated list of supported and restricted countries in its help center, and that should be the first stop before creating an account. Even if your country is supported, specific features such as futures or high-leverage products may be disabled under local law.

Final Verdict: Who Should Use OKX?

OKX is at its strongest when it serves people who want depth and tools rather than just a buy button.

Best Fit Profiles

Advanced and derivatives traders find plenty here: low fees, deep liquidity, and unified margin for efficient capital use. API and algo users can lean on the rich endpoints and WebSocket support. Copy trading and trading bots appeal to semi-active traders who want more automation. And the integrated Web3 wallet makes OKX a natural fit for power users who move between exchange trading, DeFi, and NFTs.

Not Ideal For

U.S. users won’t get full access, and compliance restrictions mean OKX US is a pared-down version. Total beginners may feel overwhelmed by the complexity of the interface and products. Investors who prefer a “set-and-forget” approach with simple fiat ramps and easy custody often find Coinbase or regulated brokerages more comfortable.

Alternatives

- Binance: Best for global users chasing the deepest liquidity and willing to manage shifting regional rules.

- Kraken: Strong choice for U.S. and EU traders who prioritize security, conservative leverage, and regulatory clarity.

- Coinbase: Easiest for beginners and fiat-first users in the U.S. or other regulated regions.

- KuCoin: Good fit for altcoin hunters who want exposure to a wide variety of smaller-cap tokens.

- MEXC: Appeals to high-frequency traders and retail users drawn to aggressive promotions and deep leverage options.

In short, OKX suits traders who want one platform for both advanced markets and Web3 access. If you fall outside that profile, one of the competitors above may serve you better.