Gold has been a popular commodity as a store of value since the dawn of time, but it has several issues.

Even though it’s beautiful when used for jewellery, and super shiny even as a rock, it isn’t easy to move or store in any quantity, and it’s very difficult to divide into smaller units. In fact, most of the gold trading being done on exchanges is trading in derivatives without any actual physical gold ever changing hands.

With the development of blockchain technology some forward thinking folks decided that making gold a digital asset would be a good idea. Paxos was one of the companies which digitized gold on the blockchain. Let’s see how they did it and how their Paxos Gold (PAXG) token functions as a blockchain asset.

What is Paxos?

Paxos was founded in 2012 as a privately held company that’s working on rebuilding the infrastructure of finance in a decentralized manner. As their website proclaims, they want to “make it possible to move any assets anywhere, instantly – and therefore democratize access to a new, global, frictionless economy.” And they’re accomplishing this by digitizing assets, including gold.

Paxos is making it possible "to move any assets anywhere, instantly." Image via Paxos.com

Paxos is making it possible "to move any assets anywhere, instantly." Image via Paxos.com After launching the itBit cryptocurrency exchange in Singapore soon after the creation of the company they were awarded a limited purpose trust charter by the New York State Department of Financial Services, making them the first company approved and regulated to offer crypto products and services. Soon after that they became regulated qualified custodians, enabling them to branch out from stablecoins to digital gold.

What is Paxos Gold (PAXG)?

Paxos Gold was created as an ERC-20 token on the Ethereum blockchain and with it Paxos is looking to solve the fundamental problems with physical gold and the traditional gold markets. Namely, that in the traditional market, investors have no access to a high-quality gold product that easy to purchase, transport, store, and trade.

In the traditional markets investors can certainly buy as much physical or allocated gold as they like, but along with the purchase comes the high risk of physical gold. This risk is due to the size and weight or larger gold bars, the expense of storing it safely, the inability to divide it into smaller units easily, and the fact that because it can be difficult to transport it can also be difficult to sell, trade, or use.

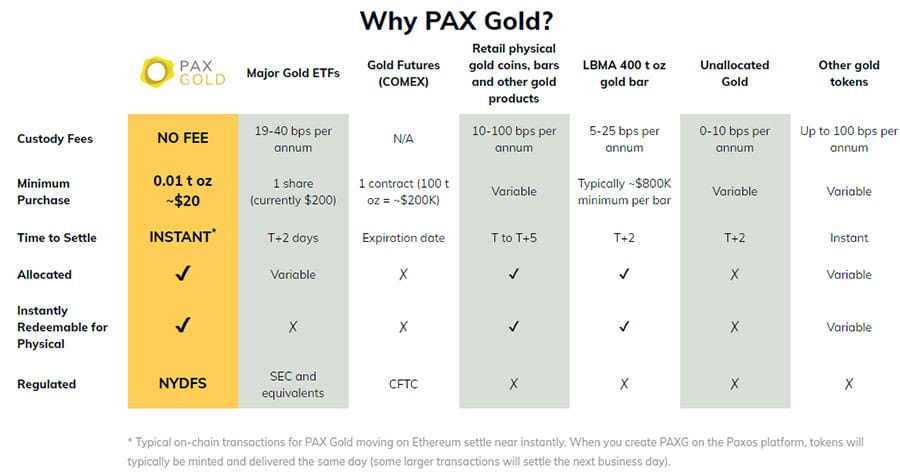

Pax Gold has many benefits vs alternatives. Image via Paxos.com

Pax Gold has many benefits vs alternatives. Image via Paxos.com The alternative is to trade on unallocated gold futures, CFDs, or ETFs. These are just derivatives, without the backing of any physical gold at all. None of them involve actual ownership of gold. Rather it is little more than speculation of the changing price of gold without any physical gold to back up any of the assets. It makes trading easy, but there is no store of value involved.

How Does Paxos Gold work?

Paxos is using blockchain technology to improve the distribution, storage, and ownership of gold. Because PAXG is a blockchain asset it is decentralized, immutable, and highly resistant to malicious attacks or theft. Paxos Gold is as good as gold, but without the problems of storage, transportation, and the risk of theft.

The PAXG token is an ERC-20 token at the time of writing, but the whitepaper does not specify that this platform is necessary, and Paxos could reissue PAXG on a different platform in the future.

The PAX Gold asset is fully regulated by the New York State Department of Financial Services (NYSDFS). There is no unallocated gold included in the PAXG backing, instead it is fully-collateralized by physical gold at the ratio of one troy ounce (roughly 31 grams) of a gold bar complying with the London Good Delivery standard, to one PAXG token.

The finest physical gold on blockchain - PAX Gold (PAXG). Image via Paxos.com

The finest physical gold on blockchain - PAX Gold (PAXG). Image via Paxos.com This conveys several benefits, such as the ability to easily divide the token into smaller units. It also avoids the storage fees normally associated with physical gold, as well as the problems with transport, delivery, and trading.

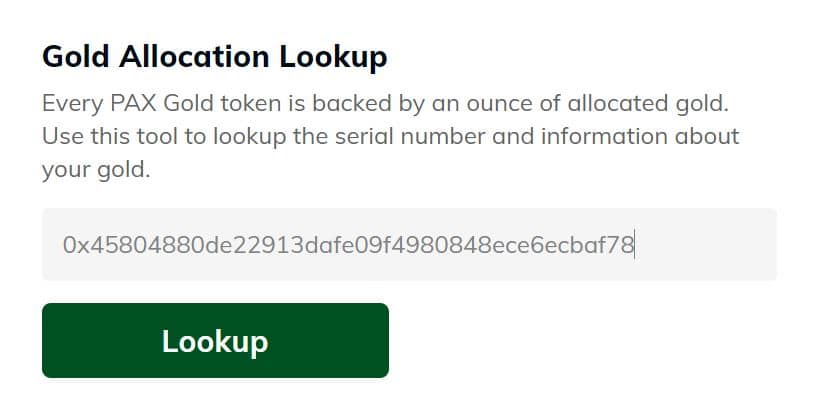

Registration of the gold that is backing the token is transferred to the token holder, and it is possible to visit the Paxos website, enter the Ethereum address holding the PAXG token, and see the serial number, weighting, and purity of the bar associated with the token.

View the serial number, weighting, and purity of the bar associated with the PAXG token. Image via Paxos.com

View the serial number, weighting, and purity of the bar associated with the PAXG token. Image via Paxos.com The lookup tool only works for PAXG held on-chain in private wallets, not for tokens held in exchange wallets. Users who hold their PAXG in a Paxos account can always log in to view their allocation report and see all the same details and more.

Why use Paxos Gold?

Paxos is best known for its stablecoin called Paxos Standard, which is a fully-collateralized U.S. dollar stablecoin. That was launched in September 2018. Just one year later in September 2019 Paxos launched Paxos Gold (PAXG) a fully-collateralized digital asset that represents one fine troy ounce of a London Good Delivery gold bar.

These bars are securely stored in professional vaults, and anyone who owns PAXG has rights to a corresponding amount of the physical gold. Because PAXG is a direct representation of physical gold its value is also tied to the actual price of gold in real-time on the spot markets.

Look at all the benefits to digital gold. Image via Paxos.com

Look at all the benefits to digital gold. Image via Paxos.com By using Paxos Gold users get the benefit of physical gold ownership, without the downsides of storage and transport. Instead they can take advantage of the mobility and speed of transfer that comes with digital assets. The PAXG tokens have been made extremely flexible, and users are able to convert tokens to fiat currency quickly and easily, or they can opt to convert the tokens to allocated and unallocated gold if they wish, just as quickly and easily. Unlike the futures gold market, Paxos Gold digital tokens carry no settlement risk.

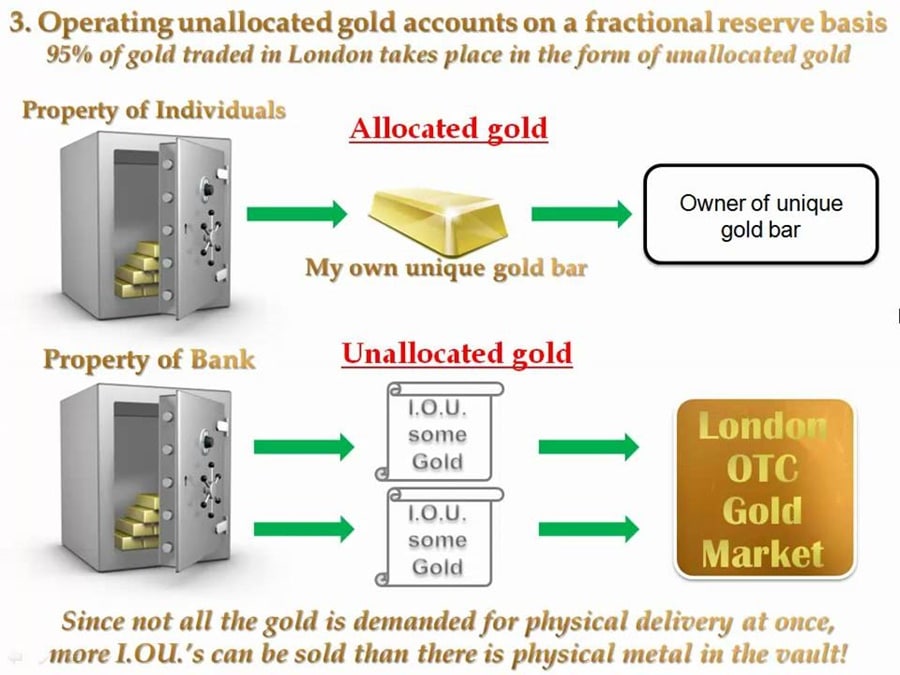

Allocated Gold Vs. Unallocated Gold

We’ve mentioned allocated gold and unallocated gold several times in this piece so I thought it would make sense to take a moment to explain what these concepts refer to in gold trading.

From an ownership perspective it is probably best to have actual physical possession of any gold you buy. That way you know it is yours and where it is located at all times. You can touch it, move it about, and sell it as you like. But gold is bulky, and storing it yourself carries the risk of theft.

Allocated gold in storage. Image via Goldiraguide.org

Allocated gold in storage. Image via Goldiraguide.org Because of the issues tied to the physical storage of gold most investors are glad to pay someone else to store their gold, and they do this through either allocated or unallocated accounts.

In an allocated account the firm you purchase the gold from will use your investment to buy and store physical gold. The buyer is still legally the owner of this gold. This is the method Paxos uses in backing the Paxos Gold token.

Unallocated gold is different in that the company you purchase the gold from doesn’t use your money to buy physical gold. Instead they often use the capital for other investments, but they do promise to deliver gold to you if you request that, or to return fiat currency to you when you’re ready to sell. Unallocated accounts are typically less expensive in terms of fees because they aren’t paying for the transport or storage of physical gold.

The difference is clear. Image via Youtube.com

The difference is clear. Image via Youtube.com The downside is that unallocated gold is more risky as an investment. If your gold provider goes bankrupt there’s no gold waiting to be delivered to you. All you’ll have is an IOU for the gold or equivalent cash, and you’ll be lucky to ever see either.

When you purchase allocated gold, or Paxos Gold tokens, you are the legal owner of the gold, and the company is holding your gold for you in a secure location. Even if the company goes bankrupt you’ll be able to claim your gold. This makes allocated gold safer than either unallocated gold or even physically owning the gold yourself.

Where to Buy Paxos Gold

When Paxos Gold was first launched the only place to purchase PAXG tokens was through the portal on the Paxos website by creating an account, or through the itBit exchange that is owned by Paxos. Since that time Paxos Gold has grown tremendously, and it is now the 78th largest altcoin by market cap, with a market cap of over $455 million and daily trading volumes well in excess of $10 million.

Image via CoinGecko

Image via CoinGeckoBecause of that growth, you can now purchase PAXG on a number of exchanges, including Swissborg, Kraken, HitBTC, and Binance.

Earning with Paxos Gold

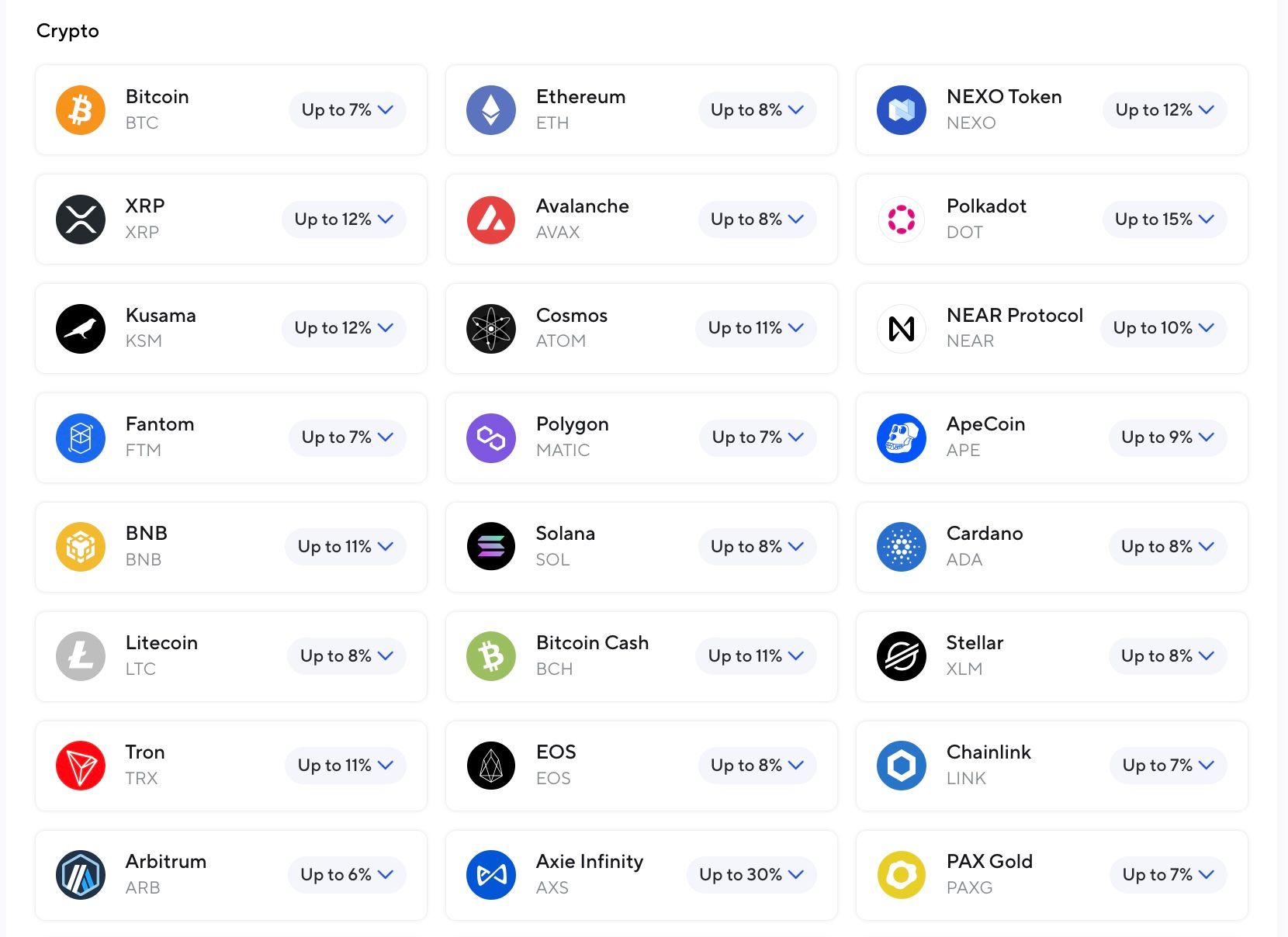

With decentralized finance growing so rapidly Paxos Gold now gives gold investors the opportunity to do something they could never do with physical gold – earn interest. Gold as an asset has long been considered a yield-less asset class, which is why it is so sensitive to interest rate changes. With Paxos Gold it is now possible to earn interest on gold holdings.

There are already several DeFi platforms that will pay interest on your PAXG holdings. One of the first was Nexo, a leading regulated financial institution for digital assets. Nexo purchased $5 million worth of PAXG just after the token was launched, and has been offering lending and interest payments on saved PAXG since.

As of October 2023, users can deposit PAXG at Nexo and earn up to 7% APY. They also allow PAXG holders to use the tokens as collateral for a line of credit.

A Look at the Interest Rates Available on Nexo

A Look at the Interest Rates Available on NexoAnother option for earning with Paxos Gold is with Crypto.com. This platform is offering up to 6.5% APY on deposited PAXG. In addition, Crypto.com offers a debit card that can be loaded with U.S. dollars converted from the PAXG held with them. That might be the easiest way to spend gold you’ll find.

The Future of PAXG

In the beginning of November 2020, Paxos announced that they would be integrating with payments provider Paypal to offer cryptocurrency and cryptocurrency payments to the payment providers clients. So far Paxos Gold is not in the list of supported coins, but Paxos founder and CEO Charles Cascarilla has hinted that PAXG could be supported in the future.

Paxos and Paypal have joined forces. Image via Paxos.com

Paxos and Paypal have joined forces. Image via Paxos.com Paypal has a user base of over 500 million people worldwide, and giving them access to digital gold could create an explosion in demand for Paxos Gold and was recently given a license from Singapore's Monetary Authority to offer digital payment token services in the area.

Conclusion

Digital gold is an idea that makes a lot of sense. It avoids the problems that have been associated with purchasing, holding, and trading physical gold. It even creates the opportunity to generate interest on what has always been a yield-less asset. With Paxos Gold, the team at Paxos has brought timeless gold into the 21st century.

The real hurdle at this point is blockchain adoption. Once people become more comfortable using blockchain assets in general, it will be a logical leap for them to use digital gold rather than physical gold. After all, digital gold is far more portable, liquid, convenient, and it can even be used to generate interest payments.

The integration with Paypal should give Paxos a boost, and could significantly advance the movement towards digital assets being used by everyday people for all sorts of purposes – including investing in gold.