On September 10, 2018, the New York-based blockchain company Paxos announced the release of a new stablecoin called Paxos Standard, (now Pax Dollar) with the ticker symbol USDP.

This is a fully USD-collateralized stablecoin that is being released by Paxos Trust Company. It is also regulated and approved by the New York State Department of Financial Services.

Within three months of being issued Pax Dollar achieved $5 billion in transactions, and as of 2023, it is the 54th largest cryptocurrency by market capitalization, with a market cap of $875 million.

What is Paxos?

Paxos describes itself as “the first regulated Trust company with blockchain expertise”, and it is using that expertise to create a modern settlement solution that can eliminate risk and simplify settlements.

Paxos Overview. Source: Paxos Website

Paxos Overview. Source: Paxos WebsiteWhat many people may not know about Paxos is that it was actually founded in 2012 as Paxos Trust Company, and that for most of its life it ran the cryptocurrency exchange itBit, which is still operates. The creation of Paxos was a pivot from an exchange platform to a company focused on creating a modern settlement platform using blockchain technology.

In the press release from Paxos, it says that

as a Trust company, Paxos is a fiduciary and qualified custodian of customer funds, and can therefore offer greater protections for customer assets than any other existing stablecoin

Here are some important facts you should know about the Paxos Standard:

- It is an ERC-20 token built on the Ethereum blockchain;

- After registering and becoming verified, users can purchase and redeem PAX tokens directly at Paxos.com on a 1:1 basis with the U.S. dollar;

- Paxos tokens only remain in circulation as long as there are corresponding U.S. dollars being held in reserve. When PAX are redeemed for USD the tokens are immediately burned, or destroyed;

- When trading on the itBit platform that is also owned by Paxos, investors will be able to withdraw other digital assets to PAX instantaneously and without fees;

- Paxos Standard will trade under the ticker symbol PAX, and while it remains a utility token it will also be available on other exchange platforms;

- Because Paxos Standard was created as an ERC-20 token it can be stored in any ERC-20 compatible wallet;

- The PAX smart contract has been audited by Nomic Labs, a respected smart contract auditor, and the account reserves will be audited by Withum, a nationally top-ranking auditing firm.

Paxos Adoption

Paxos has become a widely adopted cryptocurrency, with support from over 20 exchanges and OTC desks in the first five weeks of its existence.

It’s been picked up and listed by six of the top ten cryptocurrency exchanges, Binance, OKX, Gate.io, ZB, KuCoin and DigiFinex. And additional exchanges have plans to list PAX very soon, including OKCoin. These exchanges are offering PAX as an alternative to the controversial Tether (USDT).

Exchanges That have Listed Paxos. Source: Paxos Standard

Exchanges That have Listed Paxos. Source: Paxos StandardAdditionally, numerous Over-the-Counter (OTC) trading and market-making firms including SFOX, XBTO, Cumberland, Hudson River Trading, Galaxy Digital, FBG Capital, Two Rivers, OSL, DV Chain and QCP Capital are ready to support large trades from sophisticated investors.

Because PAX offers immediate settlement and verified reserves, it has rapidly become a trusted stablecoin among traders.

The rapid institutional adoption of the token shows how strong demand is for a regulated stablecoin backed by U.S. dollars, that can be trusted by traders. In the five weeks since its launch Paxos has already issued $50 million in PAX, and the demand has shown no signs of slowing.

However, even with all the news surrounding Paxos new stablecoin, Paxos is not just a USD-pegged cryptocurrency. Instead it is primarily a platform for payments.

With that being the case, what are the prospects for the future development of Paxos? And do we really need another stablecoin?

Paxos History

Remember that Paxos is not a new project. It has long existed and been known as a family of protocols that are designed to resolve consensus issues in a network of unreliable processors.

Paxos Trust Company has been registered in New York since 2012, and has long offered the cryptocurrency exchange itBit prior to morphing into a blockchain platform for settlements in 2018 and offering a stablecoin.

Paxos Team

Unlike the controversy surrounding the people who control Tether, there is no such obscurity when it comes to the people behind Paxos. The CEO and co-founder is Charles Cascarilla.

He has over 15 years in financial services and has co-founded Cedar Hill asset management back in 2005. He has also worked and Bank of America and Goldman Sachs prior to that.

Paxos Team. From Left: Charles Cascarilla (CEO), Andrew Chang (COO), Rachel Nelson (Compliance), Rajesh Nair (Engineering)

Paxos Team. From Left: Charles Cascarilla (CEO), Andrew Chang (COO), Rachel Nelson (Compliance), Rajesh Nair (Engineering)Joining him in the top team is Andrew Chang as the COO. He has over a decade of experience at a number of other technology companies and is a partner at Liberty city ventures.

Prior to Paxos he worked at Google in business development for their display products. The rest of the managerial team is similarly experienced with numerous industry veterans.

Another really compelling pitch behind Paxos is the advisors that they have through their board of directors. You can see the full list here but these include Sheila Bair, the former head of the FDIC and Bill Bradley who is a former senator from New Jersey who served as chairman of the Senate Finance Committee.

The Paxos Platform

Paxos has created a platform that combines distributed ledger technology with its status as a regulated trust in order to minimize settlement risk.

Paxos representatives characterize their platform using the formula:

Source: Paxos Website

Source: Paxos WebsiteThe rationale behind building such a platform is explained simply. By having a regulated trust, Paxos is legally able to transfer assets and monies. By combining that permission with blockchain technology those transactions can be done rapidly, securely, and without risk. This combination can be integrated into business and finance to solve the long standing problem of settlement risk.

Paxos made the decision to create its platform without a native blockchain, and has based itself on the Ethereum blockchain instead. As far as I can tell based on information from the company website, there are no current plans to transition from Ethereum to its own mainnet.

Paxos Use Cases

In looking at the working documents of Paxos and their whitepaper we can see that the project is looking to solve the following problems:

- The rapid transfer of currencies as well as the immediate exchange of physical assets into digital assets. The goal of this is to minimize counterfeiting risks.

- Reduce or completely eliminate operating costs in trade operations.

- Minimization of commission and fees in connection with the transfer of funds.

The PAX Token

The Paxos Dollar (USDP) is the first digital asset to be issued by a financial institution and to be fully secured by the U.S. dollar. While other similar stablecoins have existed, there has been no proof of full U.S. dollar reserves, nor have these earlier assets been issued by a financial institution. The Paxos team has been fairly clear in declaring the different base that PAX is working from.

In theory, 1 PAX will always be equal to 1 USD. It’s too early to see how well this holds up in reality, but given the strict auditing and destruction of tokens exchanged for USD it seems realistic.

Benefits of the PAX token. Source: Paxos Website

Benefits of the PAX token. Source: Paxos WebsiteThe PAX token is an ERC-20 token, and while it was initially released on the fairly unpopular itBit cryptocurrency exchange, it was rapidly adopted by a number of other exchanges, including the top 3 global cryptocurrency exchanges Binance, OKX and ZB.com.

Some have questioned whether another stablecoin is necessary in the cryptocurrency ecosystem, and the Paxos team has addressed the question by highlighting the following features of PAX:

- PAX allows user to convert digital assets to fiat currencies with no fees;

- Because of the peg to the USD there is very little volatility associated with PAX;

- Assets can be rapidly converted from physical to digital and vice versa very rapidly;

- Each PAX token is backed by the U.S. dollar, which is held in accounts in major U.S. banks and is insured by the Federal Deposit Insurance Corporation (FDIC).

In practice, PAX is not so different from other cryptocurrencies, and this is especially true when compared to other stablecoins such as Tether, TrueUSD, and Gemini dollars.

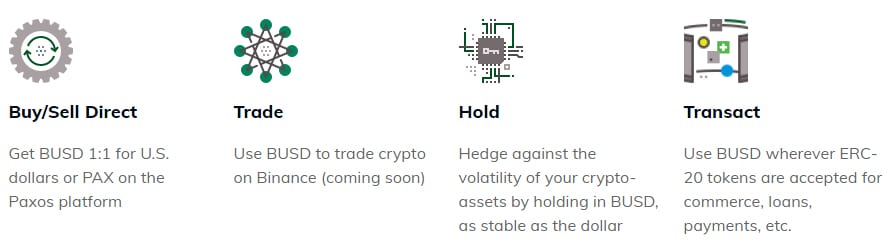

PAX Token Use Cases. Image via Paxos Website

PAX Token Use Cases. Image via Paxos WebsiteOne difference is the use as a utility coin, with PAX being primarily for use on the Paxos platforms. It was never created as a tradable asset, but certainly can (and already is) be traded on third-party exchanges.

It remains to be seen if PAX will become more popular than Tether, which has never enjoyed great trust from cryptocurrency users, but has a great head start as the very first stablecoin.

Since its release, PAX hasn’t even come close to the popularity of Tether, and one reason is likely the relative volatility of a stablecoin that is supposed to remain pegged at $1. PAX hasn’t been able to hold that level for most of its existence, and while it has seen good adoption, the varience from its peg has likely held it back from greater adoption.

Paxos Gold-backed Cryptocurrency

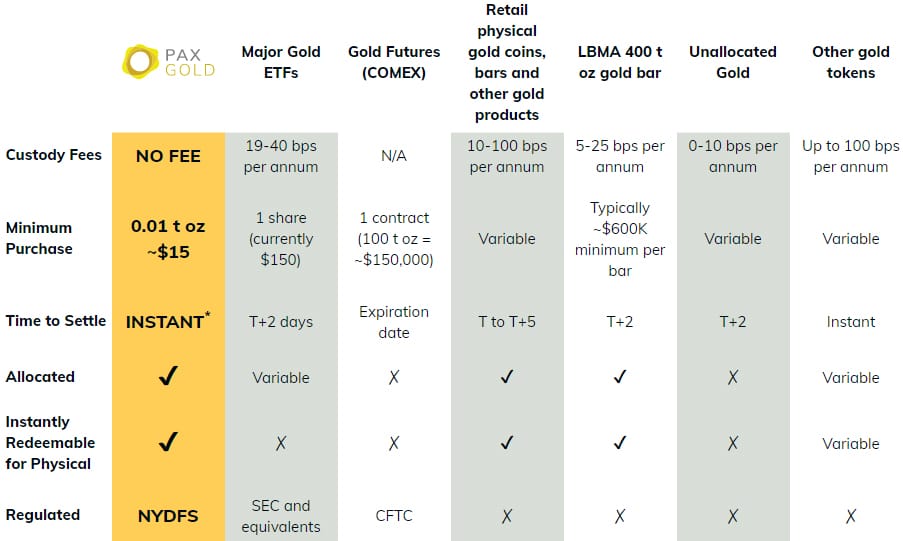

Most recently Paxos announced on September 4, 2019 they are releasing PAX Gold (PAXG), a product that will allow people to buy a digital asset backed by one troy-ounce of gold held in vaults located in London. It is the very first cryptocurrency backed by gold.

Paxos claims that ownership of the token confers ownership of the actual physical gold, and will provide users with the serial number of the gold bar in the London vault. The PAX Gold tokens will also be available in amounts as small as 0.01 PAXG, meaning investors can get exposure to extremely small amounts of gold easily.

The PAXG token is available on the itBit exchange which is also owned by Paxos, and can also be bought directly from Paxos by creating an account at their website.

The PAX Gold token compared to other options. Image via PAX GOLD

The PAX Gold token compared to other options. Image via PAX GOLDAs of 2023, the circulating supply of PAXG is 271,239, which is the total supply of PAXG available at the moment.

PAXG is an ERC-20 token, just as PAX is, making it flexible and able to be used wherever ERC-20 tokens are supported.

Paxos claims the PXG token is preferable to physical gold because it will have lower holding costs, and holders of PAXG tokens will find them to be more flexible than the physical gold it represents.

The Binance BUSD Stablecoin

Just two weeks after announcing the release of the very first gold-backed cryptocurrency Paxos announced the release of the Binance USD (BUSD), a stablecoin for use primarily on the Binance cryptocurrency exchange.

Binance chose to work with Paxos on the new stablecoin because they feel a stablecoin approved and regulated by the New York State Department of Financial Services, ensuring the utmost of consumer protections, will help them provide on-chain financial solutions for users across the world.

How to Use the BUSD Tokens. Image via Paxos BUSD

How to Use the BUSD Tokens. Image via Paxos BUSDIn the two months since the BUSD was released, it has grown to a market capitalization of $18 million and is the 173rd largest cryptocurrency by market cap. That leaves it far behind its sibling PAX, however, PAX has had an additional year of growth.

Conclusion

Even though the Paxos Trust has been active in the financial services industry for six years, the new Paxos platform that is tied to blockchain technology is very new. This makes it difficult to say how successful it will be over time, although it does seem to have a solid value proposition. As of 2023, the token is holding up well, remaining the 54th largest cryptocurrency by market cap.

Even though PAX is intended primarily for use on the Paxos platform and has been picked up by many dominant exchanges, there seems to be a very slim chance that it will replace Tether as the most popular stablecoin. The stablecoin competition is fierce, not only due to the dominant Tether (USDT), but also the USD-collateralized stablecoin USDC, which is quickly becoming a prominent player, has also surpassed USDP in market cap.

The Paxos team has been very vocal and positive regarding their project and the PAX token, and this is to be expected, but in reality, the PAX token offers little that is innovative in the blockchain space.

Its real strength lies in the full USD backing and the backing of traditional financial institutions. That alone has been enough to keep it from getting lost among other projects, especially given the auditing and additional trust it will gain versus competing stablecoins.

Now the team has taken on a new realm with the release of the first gold-backed cryptocurrency. This Paxos Gold is off to a fairly slow start, raising just $5.7 million more than two months after its release. Whether or not a gold-backed cryptocurrency will catch on remains questionable, but if it does Paxos has the first mover advantage.

Disclaimer: These are the writer’s opinions and should not be considered investment advice. Readers should do their own research.