If you are a CFD trader then you most likely will have heard of Plus500.

Plus500 is a leading provider of Contracts for Difference (CFDs). The platform offers a comprehensive product line which includes shares, Forex, commodities, ETFs, options and indices.

However, is Plus500 safe and can they be trusted?

In this review we will take a look at some of the most important aspects that you will want to consider before you open an account and start trading. We will also give you some top tips in order to make the most of your Plus500 trading experience.

Plus500 Overview

Based in the UK, Plus500 UK Ltd aims to provide its users with a secure and efficient multi-asset service that is on par with the top CFD providers operating in the sector.

Plus500 has been dealing with CFD’s since its launch in 2008. The Plus500 cryptocurrency trading platform is offered by Plus500UK Ltd which is a subsidiary of Plus500 Ltd; a company which is listed on the Main Market of the London Stock Exchange

The team behind Plus500 prides itself on professionalism and transparency and strives to provide a platform that is fully compliant with all the necessary financial regulations and procedures.

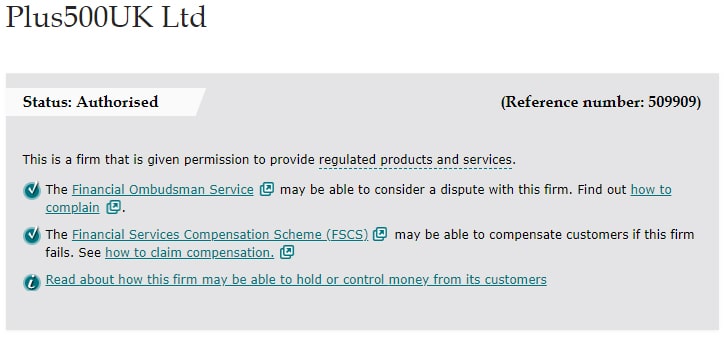

Plus500 UK Ltd is authorised and regulated by the British Financial Conduct Authority (FCA) with a licence number of 509909. This means that UK traders will have a number of client protections that we will go over below.

The company is a rapidly growing CFD provider and currently provides access to a portfolio of over 2000 instruments; Plus500 allows its users to trade in Forex, stock indices, individual equities, commodities, ETFs and cryptocurrencies.

Plus500 was also one of the first brokers to introduce a Bitcoin CFD in 2013. The Plus500 group has more than 2,000,000 monthly transactions and in 2014 the Plus500 Ltd listed on the AIM, a section of the London Stock Exchange.

Plus500 provides a comprehensive multi-asset platform that is aimed at traders around the world, the team behind Plus500 aim to attract users by building a reliable, secure and easy to use platform that is accessible to traders in a number of different locations.

Plus500 Regulation

As mentioned, Plus500 is regulated by the UK's Financial Conduct Authority. This means that the company had to comply with a number of requirements as outlined in UK law before they would be allowed to provide such services.

Plus500 UK Ltd FCA regulation. Source: FCA Register

Plus500 UK Ltd FCA regulation. Source: FCA RegisterThese rules are put in place by the FCA in order to protect traders and consumers should they want to trade with these instruments. Below are a few of the requirements that a CFD broker must comply with:

- Substantial Capital Reserves: Brokers will usually have to have a certain amount of funds in order to meet minimum capital reserve requirements. This is done in order to make sure that there is never a shortfall in a period of market stress

- Segregated Client Accounts: All client funds must be kept completely separate from those of the primary broker. This ties in with the point above around reserves.

- Extensive Broker KYC: The FCA will conduct an extensive review of the broker's operation which includes their employees and senior directors

What does this mean for the trader though?

It means that you have a number of protections in the case of broker liquidation or trouble. The Financial Services Compensation Scheme (FSCS) will cover traders in the event of broker bankruptcy up to GBP 50,000. This means it acts very much like deposit insurance in banks. Below is a list of some of the client money protections that are afforded by Plus500:

- All client money is held in segregated client bank accounts in accordance with the Financial Conduct Authority's client money rules

- Plus500UK Ltd uses its own money for hedging, it does not use client money for this purpose

- Plus500UK Ltd does not pass client money through to hedging counter-parties

- Plus500UK Ltd does not initiate speculative positions in the market

- Plus500UK Ltd has no exposure to corporate or sovereign debt

- Plus500UK Ltd does not invest the money of retail clients

This is indeed quite an advantage to using a CFD broker over a more traditional exchange. Traditional cryptocurrency exchanges do not have the client protecting regulations that you have from an FCA regulated CFD broker.

Other Jurisdictions

Plus500 Website Languages

Plus500 Website LanguagesThe website is available in a wide variety of different languages (32 to be exact). We have already gone over the UK operations of Plus500 but they also have numerous local companies in other jurisdictions around the world.

These authorisations help open up the platform to traders in a number of different locations including, Europe, Asia, Africa, and Australasia. Plus500 is authorised to offer their services in other countries through the following subsidiaries:

- In Europe through Plus500CY Ltd which is authorized & regulated by CySEC (#250/14)

- In Singapore through Plus500SG Pte Ltd, licensed by the MAS (#CMS100648-1) and IE Singapore (#PLUS/CBL/2018)

- In Australia through Plus500AU Pty Ltd (ACN 153301681), licensed by ASIC in Australia, AFSL #417727

- In New Zealand by the FMA with FSP #486026

- In South Africa by the FSP with FSP #47546

Available Assets

Plus500 is a popular destination for CFD traders as it offers a range of products that cover Forex, ETFs, indices, commodities, and shares.

Tradable instruments available on the platform include popular indices such as the S&P 500, DAX 30, and FTSE 100, and stocks and shares from some of the world’s top companies like Google, Barclays, and Vodafone.

Asset classes available to trade on Plus500

Asset classes available to trade on Plus500Forex trading pairs involving EUR/GBP and EUR/USD are also available, while established commodities like Gold, Silver and Crude Oil can also be traded on the site by speculating on the Buy and Sell price movements.

In addition, the following cryptocurrencies are also available to traders:

- Bitcoin (BTC)

- Ethereum (ETH)

- Litecoin (LTC)

- Bitcoin Cash (BCH)

- Ripple (XRP)

- IOTA (MIOTA)

- Monero (XMR)

- Neo (NEO)

- Eos (EOS)

Cryptocurrencies are almost available for trading 24/7 as there is a small window on Sundays between 13:00-14:00 GMT when they are not available.

By using the Plus500 cryptocurrency platform, traders have access to BTC/USD, ETH/BTC, BCH/USD, ETH/USD, LTC/USD, XRP/USD, IOT/USD, XMR/USD, EOS/USD and NEOUSD trading pairs.

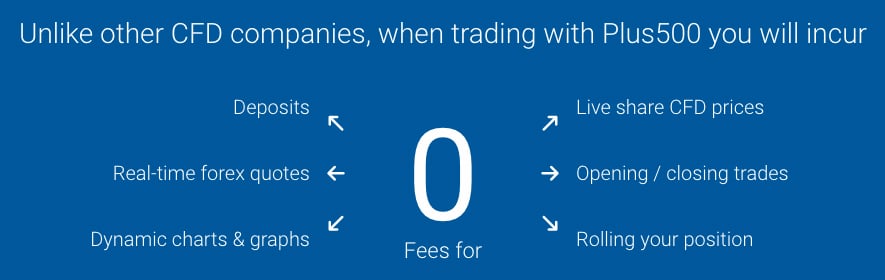

Plus500 Fees

Plus500 strives to limit its fess as much as possible and does not charge commissions on any of its trades; the platform seeks to benefit from the spread of each of the various trading instruments available.

The spread is the difference between the amount paid for an asset like Bitcoin (BTC) and the amount you receive when you sell it back.

For buying and shorting there is a different set of metrics, for example when buying using BTC/USD, the spread per unit is $65, and the premium buy is -0.048%.

Unlike other CFD brokers and exchanges, they will not charge you based on any commissions. However, there are other fees that may apply.

Plus500 also utilizes a “Premium” or overnight fee, which is either added or subtracted to/from your account whenever a position is left open after a certain time (the “Premium Time”). This is standard practice amoung CFD providers.

However, there is a non-standard charge in their inactivity fee. This is essentially a fee that is levied on the trader if they do not use the platform for a period of 3 months. The charge is rather small at only $10 but you merely have to trade at least once in the three month period to avoid it.

Lastly, there may be additional fees that may apply for guaranteed stop orders. These are essentially order levels that Plus500 guarantees will get executed at once the price reaches that level. In order to compensate for the broker risk with these orders, the spreads may be slightly larger.

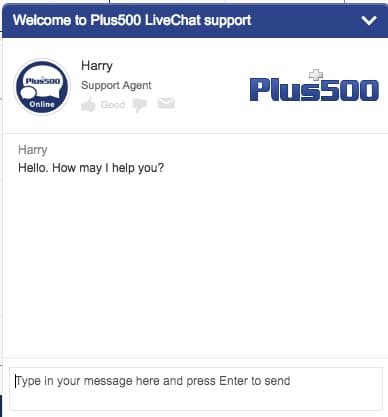

Plus500 Customer Support

When you are using a company the size and scope of Plus500 you can be certain that you will be getting professional standards of support from the team.

Plus500 Dedicated Chat

Plus500 Dedicated ChatA dedicated customer support team is available 24/7 and clients can contact Plus500 support representatives via an email-based ticketing system, or engage in an online chat session that is available on the platform.

In addition, there is a comprehensive FAQ section to help deal with the most common customer queries.

Customer support is available in 16 languages and agents aim to respond to customer queries as quickly as possible, response times can vary greatly depending on how busy the platform is.

There does not seem to be any direct telephone number into their support team which may be a disadvantage for some traders. However, we found that they are really responsive to their online tickets as well as emails.

Plus500 will also generally cover all of the fees that are applicable to processing the payment. There are rare occasions where an additional charge by your bank or an intermediary financial institution will charge a fee.

Payment & Withdrawals

The Plus500 platform offers a number of different methods of depositing funds and payment processing options such as Visa, MasterCard, Wire Transfer, PayPal and Skrill are all supported. In order to make a deposit, users must navigate to funds management, deposit, select the desired deposit option, and then click submit.

Deposit and withdrawal facilities are easily accessible to users in regulated jurisdictions and it’s necessary to make withdrawals by using the same payment processing option that was selected when depositing funds. It is also necessary to provide ID when processing payments.

In terms of payment times, this will usually depend on where your bank is located. If it is in Europe then a SEPA payment should clear within a few hours. The same can be said for a bank that is located in the UK.

However, if your bank is outside of the UK or Europe, then the wire will be sent as a SWIFT payment. These usually take between 3-5 business days and can be quite frustrating.

Security

Given that Plus500 is a CFD broker and does not hold physical cryptocurrency, they are not targets of hackers. In terms of personal funds on the exchange, you should feel comfortable with the protections afforded by the FCA.

However, there are some other client protections which you may take comfort in. One of those is negative balance protection. This will ensure that your account can never be margined into negative territory. Hence, you will never be held liable for a negative balance.

If you were worried about personal security procedures, Plus500 employs Secure Sockets Layer (SSL) encryption to ensure that user connections remain stable and secure. They also have two factor authentication when you are logging into your account.

Plus500 Demo Account

If you are a new trader and you wanted to get a sense of how to trade CFDs on Plus500 then it would make sense to give their demo account a try. This is available to all new traders who have created an account with the broker and would like to practice in a non-threatening way.

In order to use the Plus500 demo all you have to do is register a trading account with a valid email and password. Once you have confirmed the email then you are ready to start trading. A demo account will give you access to all of the same functionality that you will have on a live account.

Plus500 will also give you demo funds to trade with. These allow you to get a sense of how to size your trades and manage your risk without having to lose actual money. Once you are confident of your ability on the demo and would like to trade for real then you can move onto a live account.

Live Account

In order to create a live account you will need to make a minimum deposit of $100. This minimum deposit is broadly in line with most of the regulated CFD providers and it should give you a reasonable idea of how live trading works. If you are only funding $100 then you may want to make minimal trade sizes in order to protect avoid margin calls.

Before you can fund your account you need to make sure that it has been verified (more below). Once verified you can deposit into the account using one of the methods that we have mentioned above. For such a small amount it probably makes sense to use a payment card.

It is also important to note that moving onto the live account does not mean that you cannot access your demo account anymore. You can easily switch between your live and demo account on the main trading dashboard.

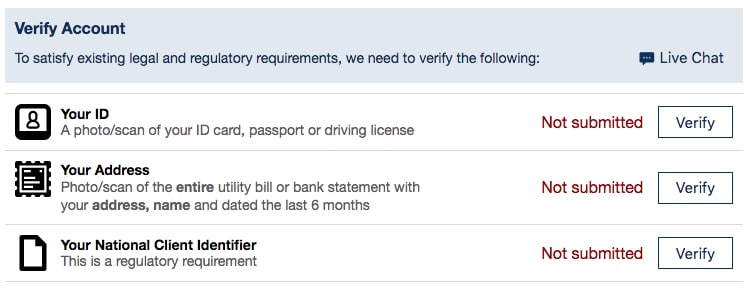

Identity Verification

Given that Plus500 is a broker that is regulated by the UK FCA as well as a number of other regulatory bodies, they are required by law to conduct Know Your Client (KYC) on their potential traders.

Hence, when you create live account at Plus500 you are required to submit documentation to confirm your identity as well as your place of residence. These can be accessed through the "Upload documents" section in your account.

Plus500 Verification Documents

Plus500 Verification DocumentsThere are a number of documents that they will accept for these purposes. For identity documentation they will accept a government issued ID document that shows your picture, ID number, date of birth, full name and expiry.

There are also a range of different documents that they will accept as proof of address. These include banking statements, utility bills, tax correspondence or a phone / internet bill.

Plus500 will also ask you some general questions on your source of funds, income and trading history as is required by the FCA.

Plus500 Trading Platform

Let’s take a look at some of the most important features that have been touted by them. We took the time to individually verify all of these claims on the website. We also delved into the important terms and conditions to make sure that traders were protected.

Functionality

Plus500 utilizes proprietary software that provides its users with a clean and intuitive interface and trades across multiple markets can be initiated from one screen.

Users can easily switch between different trading positions and Plus500 also provides live streaming quotes of financial assets. In addition, up-to-date charts and educational resources help enhance the trading experience.

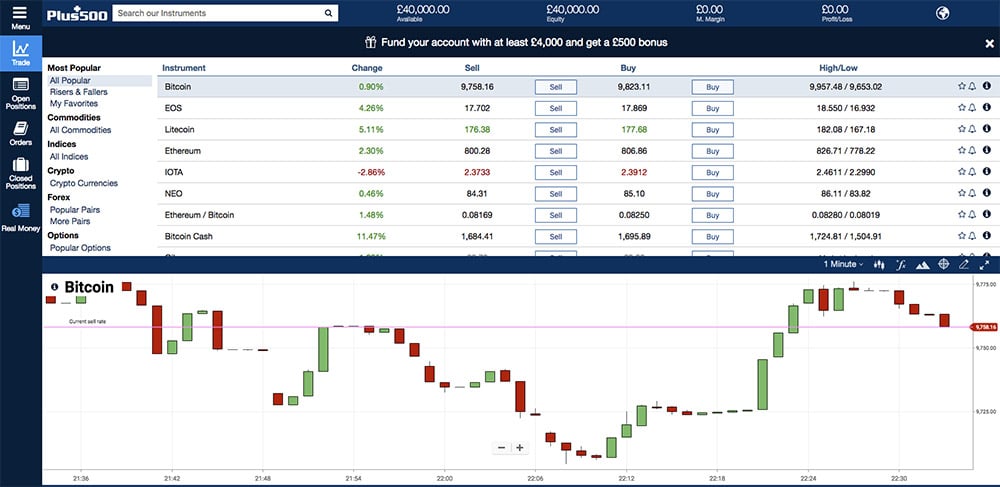

Below is a screenshot of the Plus500 web trading platform. As you can see, it is quite intuitive and relatively easy to operate. All of the most important information is immediately available without having to switch between different menus.

Screenshot of Plus500 Platform. Prices are illustrative

Screenshot of Plus500 Platform. Prices are illustrativeThere is also the option to expand the chart should you wish to crack out the technical analysis tools. On that point, the platform has the basic charting package with a number of typical indicators and studies.

There is also the option to place the pairs on a watch list that will alert you of particular price points being reached. These will either be emailed to you or pushed via the mobile application. There are also a number of different order types such as stop losses and limit orders.

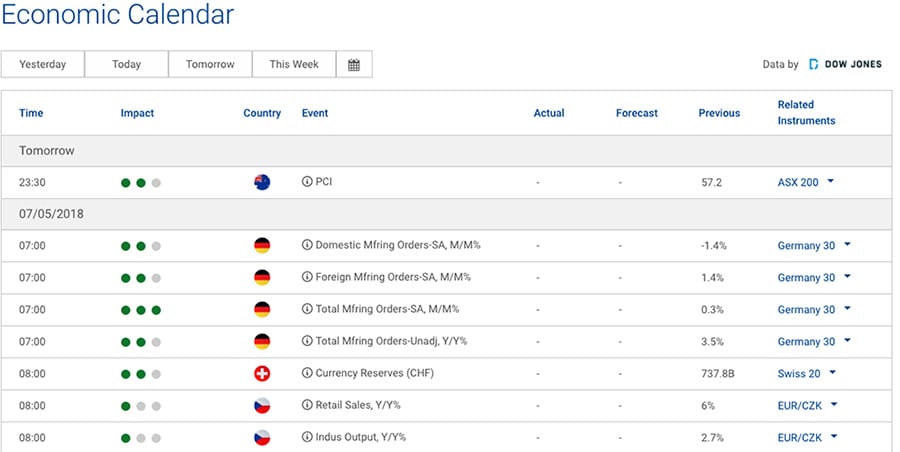

For those individuals who would like to trade assets other than cryptocurrencies, then they can make use of the handy economic calendar. This is presented below and gives an overview of the most important Macro announcements coming for the week.

Trading Engine

When trading CFDs on leverage, it is really important that you are using a trading platform that is able to respond quickly to orders. This is because botched orders can severely impact your profitability in the long run.

Given that Plus500 is a CFD broker, they do not operate order books like traditional cryptocurrency exchanges. When you place an order it will be met by the broker on the opposite side as the market maker. This will be driven by the Plus500 server architecture and trading engine.

We ran some test on the speed of the engine and how quickly orders were executed. There was no issue at all as the orders were executed in a mere matter of seconds. The fastest order execution time happened when we were trading on the desktop client.

Margin Trading

Given that Plus500 is a CFD broker, you will be trading Contracts for Differences. These are derivative instruments that get their value off of the value off an underlying asset (eg Bitcoin).

The profit or loss for the trader is calculated according to the difference between the spreads in the price of an asset between the open and close of the day.

CFDs are also leveraged instruments. This means that your position will usually be much larger than the amount of money that you have to contribute to the trade. This is called the "margin" that you will have to fund your account with.

For example, if the margin requirement at a broker is 5%, this means that you will only have to place 5% of the value of the trade initially. This also means that the leverage on your account is 20:1. In other words, if there is a 1 point move in the price of Bitcoin, your position will move by 20x that.

This leverage is what makes CFDs attractive to traders. However, leverage is a double edged sword as it can also magnify your losses. It is important to make sure that you have adequate risk management in place in order to avoid downside loss if a trade moves against you.

In terms of the leverage levels and margin requirements at Plus500, the maximum leverage is 1:30.

Risk Management Tools

While Plus500 will call these "Risk Management Tools" these are really just a collection of order types. They are orders that when placed will help reduce the risk of open orders and help you take profit or reduce loss.

These are available to you when you are placing your typical orders on the platform. Let us take a closer look at some of these order types or risk management tools.

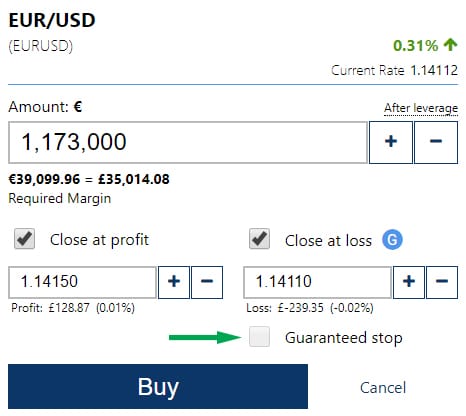

Close at Profit / Loss

These are your typical Limit / Stop Loss orders. You will place them if you want to lock in a guaranteed profit or if you would like to limit your loss with a losing position. These are available free of charge on Plus500 with all trading accounts.

When you are setting these in the order form, you will need to select the rate at which you would like to take profit / stop loss. While you are adjusting these prices, Plus500 will give you a handy indication of how what percentage that is on your entire position (for relative profit).

Setting your take profit / stop loss on Plus500

Setting your take profit / stop loss on Plus500It is important to note, however, that these levels are not gauranteed. If there is a situation where the market price were to gap passed your levels then it is possible that it would either execute above or below your desired level. This is a well know phenomenon in trading and is called "slippage". You can avoid this by placing the next type of order.

Guaranteed Stop

If you wanted more certainty around your stops then you could place what is called a "guaranteed stop". As the name may suggest, this order will guarantee you the level that you have placed the order at. Even if the market were to gap you would get executed at this level.

There are trade-offs however…

You will have to pay extra in terms of spreads over a standard stop loss order. It can also only be used for stop losses (no take profit). It is only available on certain instruments and it can only be used on new orders and not added to existing orders.

Setting a guaranteed stop is quite similar to setting a standard stop. When you are placing the order you will set it a certain percentage away from the market price. There is a certain minimum predefined percentage that you can place these stops at.

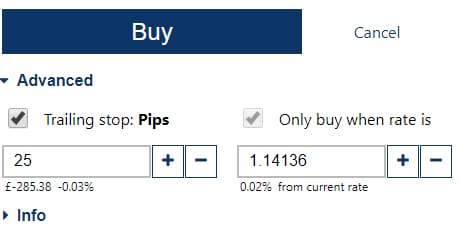

Trailing Stop

Trailing stops are great risk management tools. This is because they are dynamic and will change according to the current market price. They will effectively follow the price of the asset or "trail" it. The advantage of this is that you can participate in as much upside as you like while still having a certain level away from the price that you can lock in a profit.

So, for example, if you have a trade on the EURUSD and you set a trailing stop of 5 pips this means that as EURUSD moves up by 10 pips then the stop will as well. The stop will still be 5 pips away from the actual level but it will have moved. If the price falls you will have locked in a profit above your entry point.

Trailing stop settings on the Plus500 order form

Trailing stop settings on the Plus500 order formSetting a trailing stop is free of charge and can be selected in the standard order form. It is important to point out that this is not a guaranteed stop and if their is a significant gap in the price of the asset it may not get filled. It maybe makes sense to also set a guaranteed stop somewhere below this.

Windows Client

While the Plus500 trading platform is quite an advanced piece of technology, they also have programs which you can download and run on your PC. These tend to have much more functionality than the simple web based traders when it comes to charting and technical analysis tools.

This is available on Windows 10 and Windows 8.1. There are a number of advantages that come with using a trading program directly on your PC. These are mainly related to the speed with which it operates and orders are executed.

When you launch a PC trading application you are running directly on your computer and not through your browser. Hence, the PC resources are used more effectively and it can increase your user experience.

Unfortunately for those Mac users, Plus500 does not have a MacOS version of their computer client.

Plus500 App

For those traders who are on the go, there is the option to download and use the mobile application. This is available on both iOs and Android versions.

Mobile trading is not for everyone as you tend to forego a great deal of the trading and analysis functionality that you have on the web and PC based trading platform. They are more useful for you to monitor your positions or execute emergency trades.

Plus500 Mobile Application for iOS

Plus500 Mobile Application for iOSTaking a look at some of the Plus500 reviews on the Google play store as well as on the iTunes store, there are a wide range of opinions.

Many traders had suggestions for improvement such as increasing the range of the charts as well as the excessive memory usage of the app. This could reduce instances of the app freezing or crashing.

To the credit of the Plus500 support staff, they responded to every single review and tried to assist those traders that had specific questions or concerns. They had also forwarded the development requests to their technology teams so one can hope that these will be attended to soon.

Plus500 Affiliate Program

If you are one of those traders who has your own website or blog then there is an opportunity for you to refer some of your readers to Plus500. This is through well known affiliate program at Plus500 where they will partner with you and offer commissions based on your referrals.

These commissions are fixed per trader that you recommend and are some of the highest in the industry. For example, they have commissions per trader of up to $700. These of course will depend on where the trader is located and what sort of products that they will be trading.

Source: 500affiliates

Source: 500affiliatesHowever, unlike the referral fees that you will earn at other brokers and exchange, the Plus500 affiliate commissions are paid irrespective of the amount that the trader is trading. They are earned the moment that one of your referrals makes a deposit of any amount.

In fact, Plus500 has earned the award of having the best Forex affiliate program in 2015, 2016 and 2018. You can read all of their testimonials on their affiliate website.

So, how do you go about being a Plus500 Affiliate?

Getting Approved

Given that Plus500 is a fully regulated broker, they require all of their affiliates to abide by the relevant CFD marketing laws. Unlike other exchanges and brokers they have to make sure that you are promoting their brand in an ethical and legal way.

They also will want to complete KYC on yourself as well as the site before they will accept your referrals. They will ask you to send them a list of websites and blogs that you would like to promote.

First, you will complete a registration form on their affiliate website. You will then get contacted by an affiliate manager as well as the compliance department. Once you have completed the relevant KYC checks and they are satisfied, you will be cleared for promotion.

Promotional Materials & Monitoring

Unlike many exchanges and brokers that merely accept your referrals, the Plus500 affiliate program has a range of materials and resources that you can use to best promote their brand. These include numerous pre-approved banners, videos and widgets that you can insert on a website.

Promotional Material on offer from Plus500

Promotional Material on offer from Plus500Plus500 also has a pretty advanced backend affiliate system where you can monitor your traffic as well as who has signed up and funded an account. This will allow you to best tailor your marketing effort and refine your approach.

Plus500 Affiliate Payments

Given that Plus500 is a regulated broker that is listed on the LSE, you can be pretty certain that they will pay their affiliate commissions. These are paid out to the affiliates of Plus500 on a regular basis and can be paid via either wire payments, Skrill or even PayPal.

We have not seen a broker that has paid affiliate commissions via PayPal which no doubt is one of the easiest options. Unfortunately, they do not offer payments for commissions in crypto.

They also offer you the chance to promote the Plus500 affiliate program to others. If you do this you will get 10% of the commissions that your referral pulls in. Unlike some exchange affiliate programs, you are only entitle to the commissions of the referral directly below you.

Conclusion

There are a number of advantages when trading cryptocurrencies on the Plus500 platform. Members can be confident when using the secure and efficient interface that allows for rapid trade execution and also offers a host of options related to margins and leverages.

The site employs to notch security, with fraudulent transactions and hacks being extremely infrequent. Moreover, the protections that are provided to the trader through the FCA regulations cannot be discounted.

However, there is a lack of resources for new traders and there is also no telephone support available. It is also important to note that plus500 is a CFD broker which means that you will not own the underlying cryptocurrency but a derivative on it.

Hence, the people who wanted to buy cryptocurrency and then withdraw it from the exchange may be disappointed to learn that they cannot do this with Plus500.

However, for those traders who wanted to trade cryptocurrencies and numerous other assets on leverage, then the Plus500 CFD platform would meet their needs.

We would encourage traders to do their own research but based on the available information, it seems you can't go wrong with Plus500.