A project that has been getting a great deal of buzz recently is that of the Request Network.

The Request Network (REQ) is developing a decentralized network for payment requests. It will allow users to quickly and easily send requests among each other that are secure and affordable. You can think of it as a decentralized and more affordable version of Venmo or PayPal.

However, can this project rise above the increasingly saturated decentralized payment sector?

In this review of the Request Network, we will take an in-depth look into the project. We will give you everything that you need to know about it including the technology, competitive landscape and broader use cases. We will also look at the underlying potential for adoption of the REQ token in the long term.

What is the Request Network?

The Request Network is a newer project, using the Ethereum network to create a decentralized payment system for requesting, sending and receiving money quickly and easily. It is meant to replace the current third-party solutions to give consumers a more secure payment solution that is inexpensive and compatible with all global currencies.

Overview of the Request Network

Overview of the Request NetworkThe Request Network will work globally by ensuring compliance with trade laws from each country in the world. Aside from just providing a payments solution, the use of blockchain technology means the Request Network can provide immutable accounting and auditing services.

If you think this use-case sounds familiar it’s because it is quite similar to the model used by Paypal, the world’s leading online payment system. But the Request Network is thinking even bigger and has plans to include invoicing, B2B, government uses, IoT, and the aforementioned accounting and auditing services.

Request Network Payments

The basic model for Request Network payments is simple:

- Jack sends an invoice to Jill via the blockchain.

- Jill receives the invoice and pays with one-click.

- Jack gets his money.

That’s the basic model, but it can be expanded upon too. Request Network payments can be used for online purchases, for B2B invoices, and eventually for smart contract payments in IoT systems.

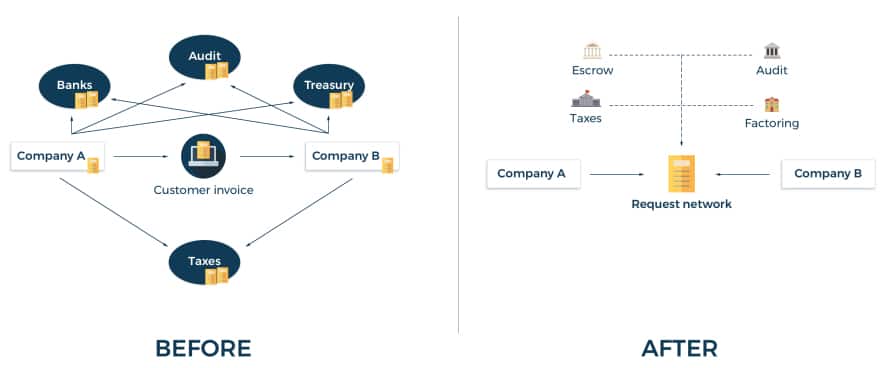

Current Payment Ecosystem vs. the Request Network. Source: Request Whitepaper

Current Payment Ecosystem vs. the Request Network. Source: Request WhitepaperThere are some distinct advantages from the Request Network push generated payments. One is there’s no need to share bank information. And the use of blockchain technology makes transactions more secure and inexpensive versus existing third-party payment processors.

Request Network Transparency

Because everything is recorded on a public blockchain the Request Network gives business and governments transparency in their transactions, easy accounting, and the ability to track invoices quickly and easily.

Any organization that can benefit from transparency in their budgets and expenditures (non-profits, governments and others) can also benefit from using the Request Network.

Request Network Ecosystem

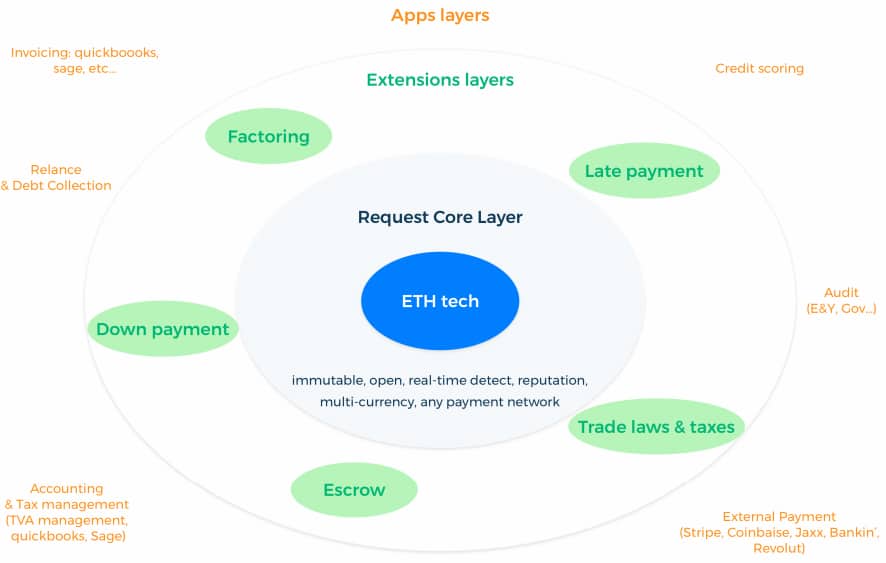

The Request Network was built on top of the Ethereum network and uses a three-tiered architecture to provide the necessary flexibility for the platform. Below is a visual representation of how the Request Network all comes together.

The Request Network Ecosystem. Source: Whitepaper

The Request Network Ecosystem. Source: WhitepaperAs you can see from the above graph, there are three separate tiers that make up the request network. These three tiers, or layers, are the Core Layer, the Extensions Layer, and the Applications Layer. Let's take a deeper look into each of them.

The Core Layer

Every good system needs a solid foundation and The Core Layer is the foundation of the Request Network. Because it is built on top of the Ethereum network it is able to detect any ERC-20 based invoices. It has also integrated other types of invoices through the use of oracles.

Basic payments are managed in the Core layer. Simple invoicing is done via smart contracts and tracked to payment. This is also free which is able to encourage most others to use it while simultaneously discouraging development of other paid-for systems.

The Extensions Layer

The Extensions Layer adds more complex functionality to the Request Network. By adding extensions to standard invoices from the Core layer this layer can include advanced payment terms to cover escrow, advances, taxes and other advanced accounting situations.

Some use cases might be to process unconventional payment terms such as rent payments made every 10 days. It could be used to divert 15% of any payment for tax purposes, or could be used to make daily salary payments.

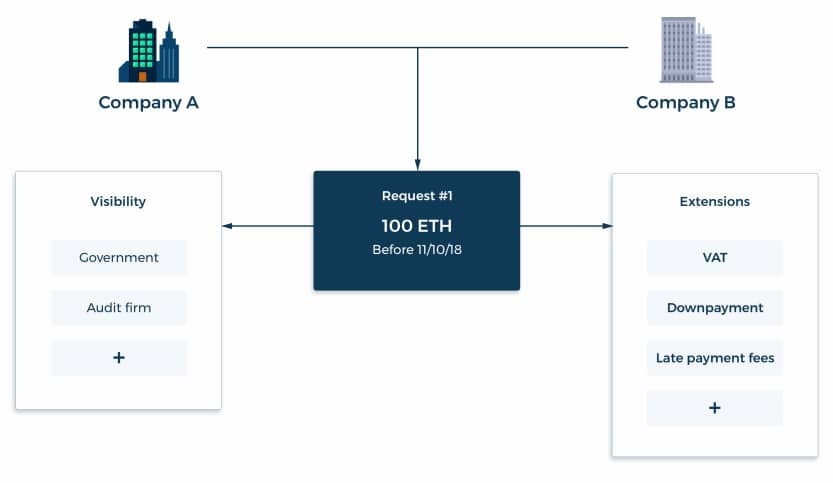

Adding Extensions to a standard request

Adding Extensions to a standard requestThe Extension layer does away with the requirement to make regular lump sum payments, giving users more flexibility. And the ability to process unconventional payments ensures you remain compliant for tax purposes.

It’s notable that third-party developers are also able to create on the Extensions layer. When using an extension there is a small fee charged in REQ, a portion of which is burned, with the remainder going to the extension developer.

The Applications Layer

The Applications Layer is off-chain and lets third-party applications plug in to interact with invoices or view information. There’s also a reputation system embedded in the Applications layer to stop malicious attacks and to censor those who don’t pay accepted invoices on time.

Application developers can tap into a $30 million fund that has been set aside by the Request Network team to incentivize app development. Accessing the fund requires submitting your project information and receiving approval from the Request Network team.

Request Network Team

Most of the team at the Request Network were the creators of Moneytis, a global money transfer platform. So, they do have extensive experience in money transfer. And Moneytis was quite successful, with a 20% growth rate, but the team wanted to take advantage of the benefits offered by blockchain technology.

One thing they noted at Moneytis was the prevalence of invoices, so they chose to focus on that first at the Request Network. The co-founders of the Request Network are Christopher Lassuyt and Etienne Tatur, who serve as the CFO and CTO of the team respectively.

Request Network co-founders: Christophe Lassuyt (CFO) and Etienne Tatur (CTO)

Request Network co-founders: Christophe Lassuyt (CFO) and Etienne Tatur (CTO)The team is quite transparent, even in an industry that prides itself on transparency. They remain active on Reddit and other social channels, and provide bi-weekly progress reports. The launch of the mainnet in March 2018 was a major milestone for the team.

The team was selected by YCombinator as a project worth supporting. YCombinator also supported Coinbase in the past, and has an acceptance rate of just 1-2% of all projects. Acceptance by YCombinator gives credibility to the team and the project.

The team has also created several important partnerships, including one with the Kyber Network to enable cross-currency payments. It also has a notable partnership with PwC France to provide blockchain solutions for its business clients.

Competition

The payments space is pretty crowded, so the Request Network has quite a bit of competition.

The traditional payments space already has massive companies like Paypal, Stripe and Venmo, but the Request Network hopes to overcome the traditional companies with its more efficient, secure and cheaper solution.

Blockchain competition is growing as well, with OmiseGo (OMG) the most similar blockchain product. The Request Network team feels that OmiseGo is complementary with their product offering rather than being predatory.

Competition and synergies in the Blockchain space: REQ, OMG, PPT, MCO

Competition and synergies in the Blockchain space: REQ, OMG, PPT, MCOIn the payments space there will be competition from the likes of Crypto.com (previously Monaco) and TenX, while the invoicing space will be competing with Populous (PPT), even though the two projects are approaching invoicing from a different direction.

There are also some blockchain projects tackling accounting and auditing, but none of those include the complete payments and invoicing package like the Request Network does.

The REQ Token

REQ is the ticker symbol for the Request token, which is an ERC-20 token. The REQ is used to pay fees on the Request Network, and for creating advanced invoices and using extensions.

Initially fees on the network were set between 0.05% to 0.5%, with decreases expected as the network grows larger. However the v2 release of the Request Network will change the fee structure. The new fees will be charged based on the size of the data in each request. That fee will be $0.10 for the first 10kB of data and then $0.03 for each additional 10kB of data. The expected release of v2 is the first quarter of 2019.

It hasn’t been confirmed yet, but there has been talk of the Request Network using a Proof-of-Stake mechanism, which means REQ holders would be able to receive staking rewards for holding REQ tokens.

Other purposes of the REQ token include acting as an intermediary for cross-currency exchanges and forming governance in community voting.

Register at Binance and Buy REQ Tokens

Register at Binance and Buy REQ TokensThe Request Network held their ICO is October 2017, raising $33.6 million and selling tokens at $0.0672. Price remained flat until December, where it began rising with the broader market, finally skyrocketing to an all-time high of $1.03 on January 6, 2018. Since then it has fallen steadily and as of November 28, 2018 the token is buried at $0.027108.

The primary exchange for REQ is Binance, but there is some volume trading on Huobi as well. It’s also offered on roughly a dozen other exchanges, but trade volumes are well under $10k on all of them.

Because REQ is an ERC-20 token it can be stored in any compatible wallet. Popular choices include MetaMask and MyEtherWallet / MyCrypto. To ensure security a hardware wallet is the best choice.

Conclusion

Rather than creating a simple payments network, the Request Network is attempting to bring blockchain technology yo every aspect of payments, invoicing, accounting and auditing. The platform will be more than a stand-alone product. It will be an ecosystem where developers can expand upon existing offerings, creating their own services and apps as needed.

While the roadmap laid out by the team looks extremely ambitious, with hard work and dedication the team expects to deliver on time.

This is a team that has years of experience working together in the payments industry, which gives them a huge advantage. They also have the support of YCombinator, the most successful start-up accelerator in the world. And despite the aggressive ambition of their roadmap they’ve so far hit every milestone.

The value of their token may be depressed now, but if the team continues to meet their goals and milestones they are certain to have an outstanding platform. And that will give them what they need to unseat the current leaders in the payments platform industry.