SnapEx is a relatively new crypto derivatives exchange that offers leveraged trading. They have recently been expanding to a number of new markets.

They offer leverage of up to 100x on a number of different cryptocurrencies. They have also developed a unique trading platform that does away with the notion of an order book. They hope that this simplified trading experience will speak to new traders.

However, are they really safe?

In this SnapEx review, we will attempt to answer just that. We will also give you some top tips when it comes to using the platform and securing those gains.

SnapEx Overview

SnapEx is owned and operated by Snap Technology Limited which is registered in Singapore. They have since expanded to a number of offices in Seychelles, South Korea, Japan & Malaysia.

Since their launch back in 2018, their user stats appear to have been growing quite nicely. For example, in 2019 they saw growth of over 900% in their daily active users as well as a 600% increase in their trading volume.

SnapEx is a derivatives exchange which means that you are trading price movements in the underlying cryptocurrency. This is unlike traditional physical crypto exchanges where you will hold the coin itself.

They have developed a platform that is relatively simple to use on both a web browser and a mobile device. There are also some unique features about this platform that we will go over in a bit.

Given that SnapEx is based in Asia, they have their biggest markets there. These include regions such as Indonesia, Vietnam, South Korea etc. Nevertheless, the site has been translated into 8 different languages.

Do take note though that there are some regions where they do not accept traders from and that includes the likes of Singapore, Hong Kong and the USA.

Is SnapEx Safe?

This is perhaps one of the most important questions that any trader will ask of an exchange. Given that they are trusting them with their cryptocurrency, it is something we actively look into.

So, how does SnapEx stack up?

Well, there are a number of areas that we regularly look into to assess this.

Wallet Security

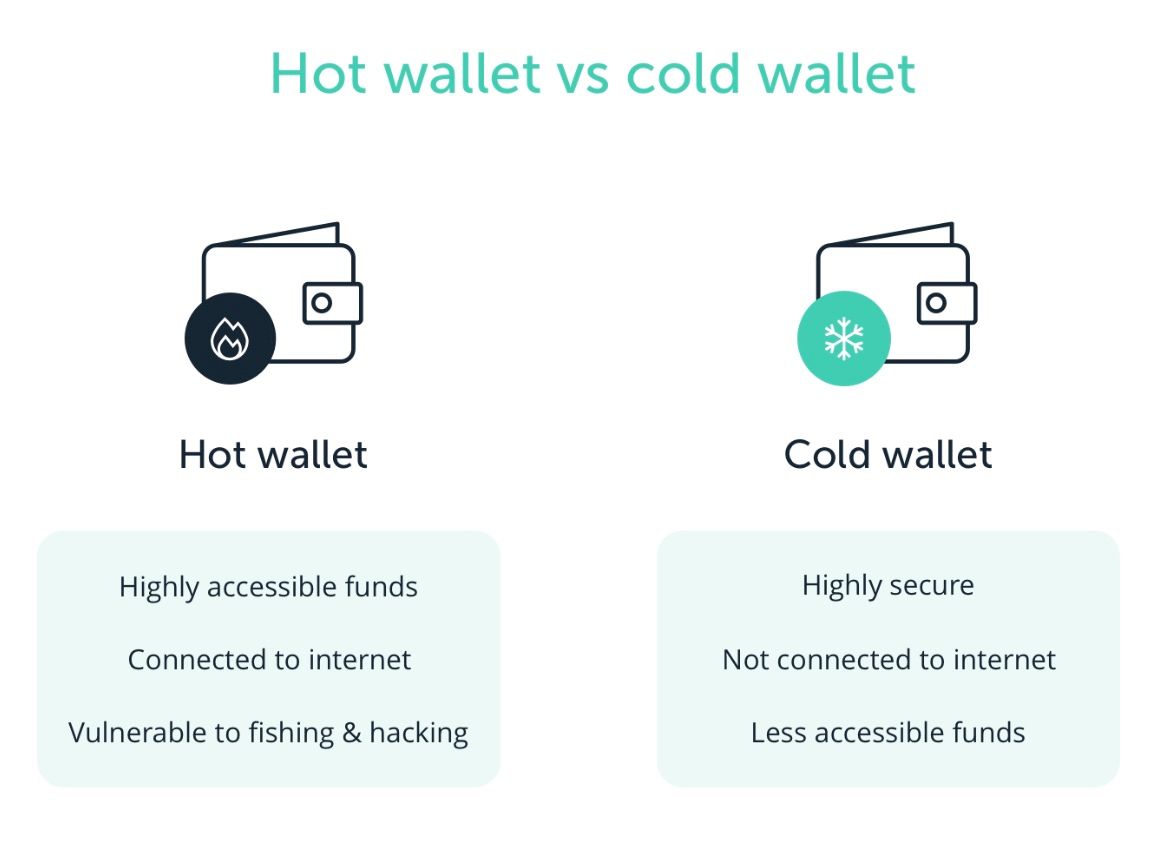

SnapEx operates a "cold" and "hot" wallet procedures. Basically, the bulk of the user funds are stored in a "cold" environment which is disconnected from the internet. This means that they cannot be accessed in any way by hackers.

These cold wallet funds are also secured behind a multisignature wallet which means that a number of people at the SnapEx exchange will have to sign the transaction in order to release these funds. Here's a great image from the pros over at Ledger, simplifying the difference between hot and cold wallets:

Image via Ledger

Image via Ledger

Then, in order to meet withdrawal requests, SnapEx operates the "hot" wallet part of the infrastructure. A much smaller percentage of these funds are kept in the hot wallet in order to reduce the exposure to potential hacks.

Finally, in order to ensure that all withdrawal requests from users are legitimate, there are limits that were put in place in terms of amount per request and the number of times one can request a withdrawal.

Communication Security

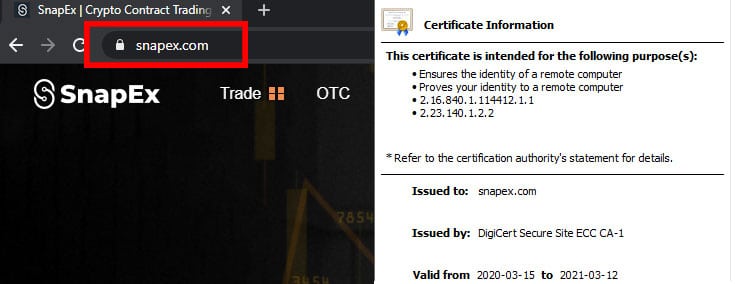

When you are accessing the SnapEx website you will notice that you are connected using 256 bit SSL encryption. This means that all communications that you send them will be fully hidden from hackers.

SSL Connection at SnapEx

SSL Connection at SnapExThis is also a great way for you to spot any potential phishing attempts. If you land on a website and it does not have the secure lock in the browser tab then you can be sure that you are on a phishing page and should leave immediately.

User Side Security

Often security starts with you - the user. That is why SnapEx also provides some user-side security tools in order to further protect your account.

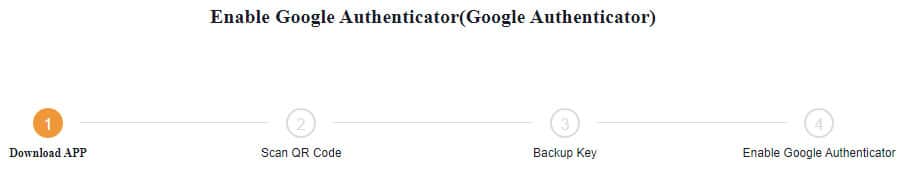

One of these is two-factor authentication. This means that whenever you are logging into your account they will ask you to confirm it on another device such as your mobile phone.

Setting up Google Authenticator at SnapEx

Setting up Google Authenticator at SnapExThis is done through the use of an authentication app such as the Google Authenticator. You can download this from either the Google Play Store or the Apple iTunes store. Once it is downloaded you will have to sync it with your SnapEx login.

Note ✍️: When you are setting up your authentication, be sure to save the backup key. This is your way to log back into your account if you lose your phone.

Assets & Instruments

As mentioned, at SnapEx you are trading leveraged instruments. This means that you are trading crypto on the margin and are only putting down a small percentage of the notional on the trade.

So, as a practical example. If you are trading with a 5% margin this means that you are only investing 5% of the total position size. It also means that your position has 20% leverage. A certain movement will be increased by a factor of 20. At SnapEx the max leverage is 100x.

The derivative instruments at SnapEx are also quite unique. While other exchanges offer their traders Futures instruments and perpetual swaps, SnapEx has developed an instrument akin to a CFD (contract for difference).

Benefits of the SnapEx instruments

Benefits of the SnapEx instrumentsWith the SnapEx trades, you will have no expiry rate and there are no funding rates. Your position will be marked-to-market on a daily basis based on the moves during the day. It can be held overnight but you will incur an "overnight" fee (more on that below).

When it comes to the assets that you can trade at SnapEx they include the following:

- Bitcoin (BTC)

- Cardano (ADA)

- Ethereum (ETH)

- Litecoin (LTC)

- Ripple (XRP)

- EOS

- Bitcoin Cash (BCH)

- Ethereum Classic (ETC)

All of these assets are crossed with Tether (USDT). You should also note that the minimum trade amount for each order is 5 USDT - easy for those starting out.

No Order Books

Something else that you will no doubt notice about the SnapEx platform is that they do not have orderbooks. This is because your counterparty to the trade is SnapEx themselves and they will match the trade for you.

There are a number of benefits to this the prime of which is that you don't incur any order price slippage. For those who don't know what this is, it is the impact that your order has on the price. Hence, with order slippage, there is the chance that the price you get is not what you had hoped for.

However, when you place an order at SnapEx, you are going to get the price that it was executed at. This could be the market order if you place this type of order or the exact limit order once the price reaches that.

Margin

When it comes to the margin on the positions, this is all calculated in Tether USDT. The benefit of this is that your margin will not fluctuate with the movement of the underlying asset. So, for example, if you were margined in Bitcoin the margin requirements may change.

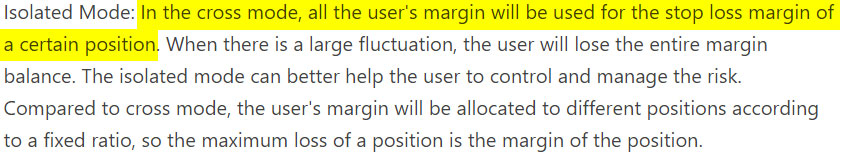

You also need to note that SnapEx only has one type of margin method. While most other exchanges use cross margin, SnapEx margins positions using an isolated approach.

So, what are these exactly then?

When it comes to the "Cross" mode, all of the user's margin will be used for a stop loss margin for a particular position. So, if you have a certain amount of margin in your account and a trade goes against you then that margin can be used.

Isolated Margin at SnapEx

Isolated Margin at SnapExHowever, SnapEx uses the isolated margin. This basically means that only a certain portion of the trade will be up for liquidation if the markets were to move against you. In this way, you can kind of think about it as the premium on a crypto option.

SnapEx Fees

Fees are no doubt one of the most important considerations for any trader just before they use a platform. They are, after all, the factor that will determine your long-term profitability.

At SnapEx, they operate a pretty simple fee system. Unlike on an exchange that has order books, you don't have maker / taker commissions on the orders that you place. You have a simple flat percentage fee of 0.15% that is charged when you enter each trade.

Pro Tip 💯: You can reduce your fees using the Snap Points that you earn. We cover snap points further below.

Once you have entered this trade and the 0.15% has been deducted, you will not have to pay the same fee on the way out. This is not the case at other exchanges that have fees on all transactions be it when opening a trade or closing it.

The SnapEx Trading Fees in Support Centre

The SnapEx Trading Fees in Support CentreIf we were to compare this fee to some other exchanges, it is about the same as exchanges such as Bybit etc. For example, at Bybit your taker fee is 0.075%. So, if we were to add these two up they are 0.15% when opening and closing a trade.

However, given that there are no order books you don't have the opportunity to place what are called "maker" orders where you are creating liquidity in the books. So, you do lose out on potential maker rebates that you get on other exchanges.

In terms of other trading fees, you also have what are called "overnight" fees. These are basically just fees that are charged for holding a position overnight. The Overnight Fee will be charged at 6:00am GMT+8 daily. The fee will be equivalent to:

Margin x (Leverage - 1) x 0.045%.

Deposit / Withdrawal

When it comes to crypto deposits, these are completely free. However, when you are withdrawing you will be charged the following rates:

- USDT Omni: 10 USDT

- USDT ERC20: 5 USDT

- BTC: 10 USDT

These are actually quite high and are more than we have seen on other exchanges. Even if they are taking a portion of the fees in order to cover miner costs then it is much more than is required.

If you are going to be using their OTC service in order to buy the cryptocurrency then you are also likely to have pretty high fees here. When we checked they were about 5%. However, these fees are not charged by SnapEx but by the payment processors that they use.

Average Price Line

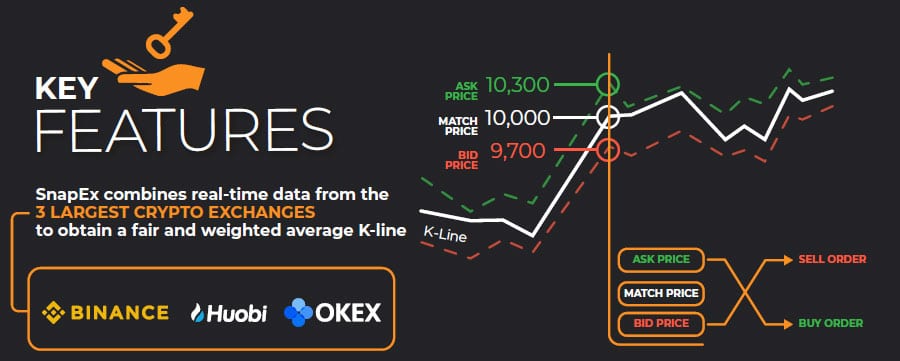

Something else that is unique at SnapEx is what they call their "K Line". This is basically the internal price that SnapEx uses to reference all contracts on the platform.

Overview of the SnapEx Price Line Charts

Overview of the SnapEx Price Line ChartsThis is basically a price line that is the average of the prices on 3 other exchanges. These exchanges are Okex, Binance and Huobi. They determine the weighting based on the total volume of said exchange.

The benefit of this is that you are getting the full transparency and there is no possibility that SnapEx is shifting their prices in order to liquidate traders. This is a tactic that many other exchanges have been accused of.

SnapEx Registration

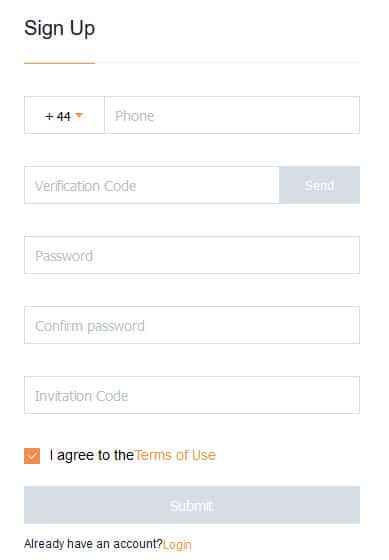

If you have decided that you would like to give SnapEx a try then you have to first register an account. This is pretty straightforward and can be done with a phone number. They will send you a text message with a verification code.

Signup Form at Snapex

Signup Form at SnapexMake sure to use the code within 60 seconds though as it may expire. Once you have confirmed your registration then your account is good to go. It is at this point that you should set up your two-factor authentication to secure your account.

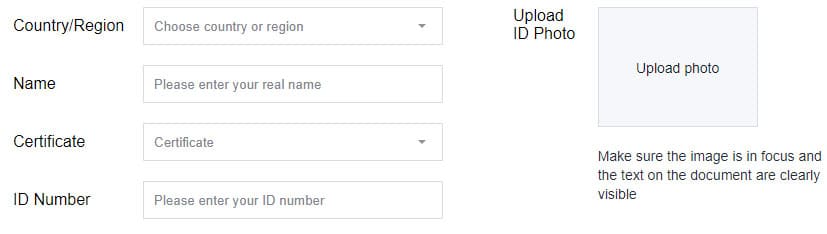

KYC

Something that you need to know about SnapEx is that it is a full KYC exchange. This means that you have to complete identification on the account before you can deposit or withdraw your funds.

Privacy Hawks 💯: If you would prefer to use a non-KYC exchange there are a number of them including Prime XBT & Binance

Although this may be frustrating to some, it is clear that SnapEx is trying to be above board when it comes to government-mandated KYC checks and AML regulations.

KYC Process at SnapEx

KYC Process at SnapExWhen you are completing the verification they will first need your personal information such as your name, country and document ID number. Once you have given that over then you can upload a photo of the ID document itself. Unlike with other exchanges, you are not required to submit a selfie.

Demo Account

Before we move onto the trading platform it is worth mentioning that SnapEx has a really handy demo account. This is a practice account that has been funded with 10,000 USDT of practice funds.

A demo account is a great way for you to try out the platform in a non-threatening manner to make sure that you are comfortable with it before depositing. It is also a useful tool to practice your trading and make sure that you have your trading strategies down pat before diving full in.

When you create an account at SnapEx you are creating both a demo fund and your real account. Although you are only funded with this 10k demo USDT, you can always get this replenished by reaching out to the folks in the SnapEx telegram (covered below).

SnapEx Platform

A tradesman is only ever as good as the tools at his disposal. This is why the type of trading platform that an exchange has on offer is so important.

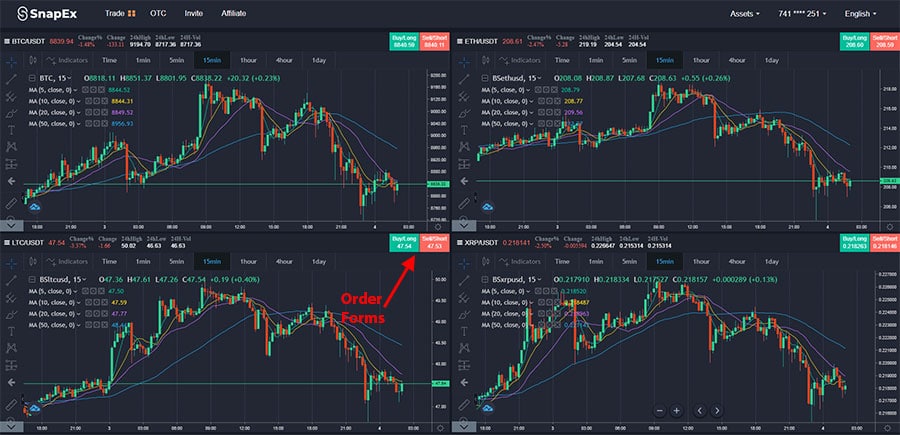

At SnapEx, they have a pretty unique trading platform. As mentioned above, there is no order books so this frees up a lot of space when it comes to the user interface. The UI is quite well laid out and relatively intuitive.

The first thing that you will note is that you can choose how many charts you want on a single screen. You can set it to have up to 6 different charts on a single screen - great if you want to monitor different markets.

Below is the layout of how it looks when a singular chart is chosen. On the left, you have all of your market selectors where you can switch between the different cryptocurrencies. Below that, you have a snapshot of your margin as well as the option to switch between demo and real accounts.

User Interface of Single Chart

User Interface of Single ChartThen in the middle of the platform, you have the trading charts. For those who know a lot about trading they will notice that these are tradingview charts. These are highly effective tools for those who conduct technical analysis with a plethora of indicators and studies.

Then, just to the right of the chart you have your order form where you will be managing all your live and pending orders. Below that, you have a small description of the asset being traded as well as some key market stats. Finally, just below the chart, you have an overview of your open positions, pending orders and order history.

For Night Owls 🦉: You can switch the color of the interface to the dark theme in the top right of the chart. This moves over to "dark" which is easier to use at night.

Something that you will no doubt note is that these panels cannot really be adjusted around to your own layout. This is unfortunate as it means that you cannot customise it to suit your trading needs. Having said that, you can move the order form and market data around.

Taking a look at a multi-chart layout, below we have a four-chart layout. As you can see, the order forms have been sidelined. These can now be accessed from when you hit either the "buy" or "sell" just above the chart. This will pull up the standard order form that you have on the singular layout.

Multiple Charts on SnapEx

Multiple Charts on SnapExIf you wanted to monitor your broader position on the market then you can hit the position tab right at the bottom. This will pull it up and you can see all of the orders that have either been placed or are still pending across all of the markets.

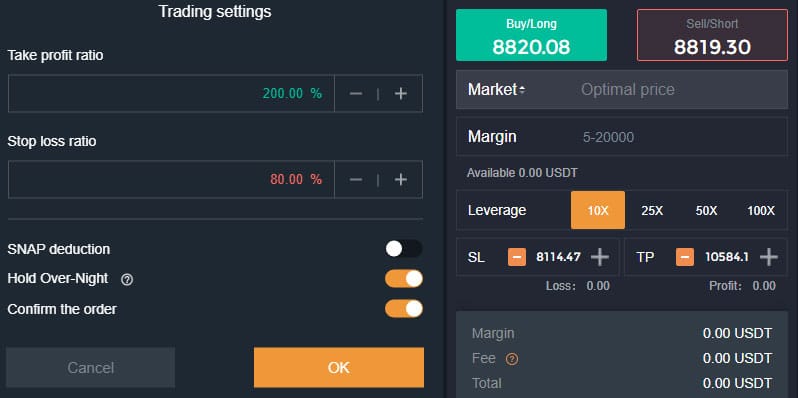

Order Form

This then brings us onto the order form on the platform. You have a fair amount of order functionality here although it is not as comprehensive as some of the other futures platforms.

SnapEx Trading Settings & Order Form

SnapEx Trading Settings & Order FormThe first thing you will notice above the order form is a standard setting tab. This will allow you to adjust the default order parameters you have when you open an order. These are the following:

- Take Profit Ratio: The Percentage above your entry point that you would like to take a profit.

- Stop Loss Ratio: You can set a default percentage stop loss from your entry which will be applied when you enter a trade

- SNAP Reduction: When this is enabled then your SNAP points will be used to reduce the fees on the trade. We cover SNAP points and how they work a bit more below.

- Hold over Night: This is set by default but you can disable it. This will keep your position on overnight. Note that once a position rolls overnight you will have that overnight fee that we talked about above.

- Confirm Order: This is a setting that will pop up when you have placed the order and ask you to confirm that you are ok with the parameters. Of course, you can remove this and it will function much like a one touch order.

Then, once you have set your order parameters for the default then you have the rest of the main order parameters below that. Firstly, you will have to select the direction of your trade.

Then you will have to select what type of order you would like to place. There are only two order types available at SnapEx. They are:

- Market Order: This is an order that is placed at the market level. In the case of SnapEx, that will be the prevailing rate determined by their K price line. Remember that there are no order books so there are no "bids" or "asks" from the other market participants.

- Limit Order: This is an order that is placed away from the current price and will only be executed once the price reaches this level. This could be above for a sell order and below for a buy order

Just below these order options, you will select the amount of margin that you would like to place on the trade as well as the leverage that you will take on (unfortunately only 4 levels). This will determine your actual position in the market.

Note ✍️: Unlike at exchanges that have order books, you don't select the order size but rather the amount that you would like to risk on the trade (margin). This will then scale the order based on your desired leverage / margin.

Then the final thing that you will have to set is the Stop Loss and the Take Profit. If you had set these at the beginning with the default order form it will already be presented to you. It is advised that you always set a stop loss and take profit as it's just the best for risk management.

Your final order parameters are just below that (including the fee) and you either hit "buy" or "sell". If you have not selected to avoid confirmation, you will have one more confirmation screen come through.

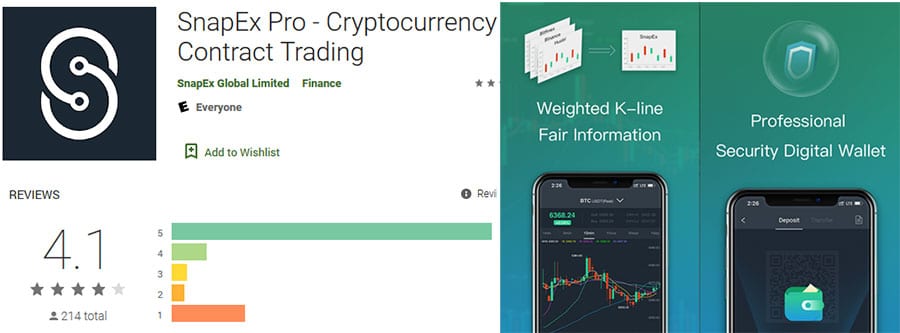

Mobile App

Sometimes you may be away from your desk and you can't place those trades or monitor your open orders. Thankfully, SnapEx has developed a pretty functional mobile app.

In fact, given that their major markets are in Asia, the bulk of their users trade with mobile devices so they have developed quite a functional app. This is available on both iOS and Android.

Taking a look at the User Interface, it is quite well laid out and easy to use. You have functions such as instant order execution as well as the ability to monitor a number of different markets. You can also do some account management things here including deposits / withdrawals.

SnapEx Mobile app in the Google Play Store

SnapEx Mobile app in the Google Play StoreCurrently, the app is only available in English in the Google Play store whereas it is still in Chinese in the iTunes store. Looking a bit closer into the ratings on Google play it seems as if the app is reasonably profitable. They have 4.1 stars from all of those who have reviewed.

So, should you use the app?

Well, we always prefer trading with a browser on the PC. This is just because you can't really replicate the trading conditions you get on the mobile device. Despite having an enhanced charting package, it is still quite hard to properly monitor all your levels.

We would rather suggest that you use the Desktop or Web version as a default. However, if you need to leave the desk the SnapEx mobile app is perhaps your best bet and appears to be better than most of the others.

Deposits & Withdrawals

If you want to start trading with actual funds at SnapEx then you will first have to deposit them. Perhaps the quickest way to do this is through the use of cryptocurrency.

At SnapEx, there are currently only two methods that you can deposit crypto on the platform. These are through either Bitcoin, Tether (USDT) or Ethereum. If you want to do this then you will have to head on over to the "Assets" section and then hit the "Deposit" option.

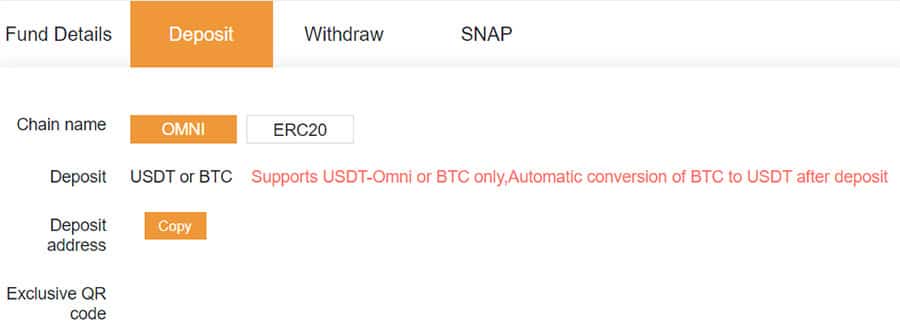

Generating a SnapEx Deposit Address

Generating a SnapEx Deposit AddressHere you will either select "OMNI" or "ERC20". Take note that if you are depositing Bitcoin or Tether OMNI then you will select the "OMNI" option. If, however, you are depositing a newer ERC20 Tether variant then you will have to select that.

You will then need to select "copy" where that will give you the address required to fund the account. You will then also have a QR code that will be generated. You can use this to fund your account if you have a mobile wallet that can read these codes.

Note ✍️: Once you have made the deposit, you should be aware that it will take 6 confirmations before it is credited. You can view this on a blockchain explorer.

If, however, you do not have Bitcoin available then you can always use fiat to buy Bitcoin to fund the account. This is through their OTC platform. Here you can make purchases in a number of currencies including CNY, KRW, TRY, THB, VND, MYR, INR, USD, EUR.

Perhaps the simplest way for you to do this is through the use of a credit or debit card. You should take note though that this is quite an expensive process and fees can be as high as 5%. This is because of the payment processor fees (simplex).

If you find these fees to high then you can use a number of other options that they provide. These are all given below along with the currency that you can buy Bitcoin with.

Withdrawals

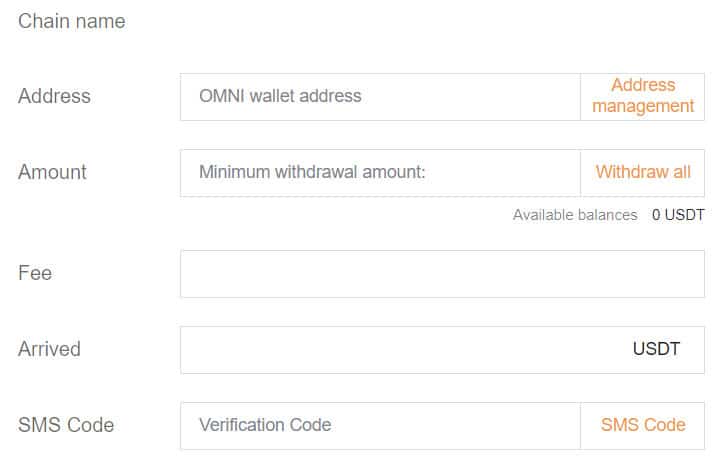

If you are going to be withdrawing in crypto then it is also pretty simple. All you need to do is head on over to "Withdraw" and this will pull up the withdrawal form. You can withdraw in Bitcoin, Ethereum or Tether USDT.

Process to Withdraw Crypto from SnapEx

Process to Withdraw Crypto from SnapExYou will insert your offline address as well as how much you would like to withdraw. Before you can confirm the withdrawal, they will have to confirm the request on your phone. This will either be through the Google Authenticator or an SMS code.

When it comes to fiat OTC withdrawals, this can only be done through one of their payment providers and cannot unfortunately be sent to your card.

Customer Support

We have had to deal with a number of exchanges over the past 4 years and one of the most frustrating things that we can find is when they have a slow or ineffective customer support function.

So, it is a really important criterion for us. This is why we took the time to look over and test the customer support options at SnapEx.

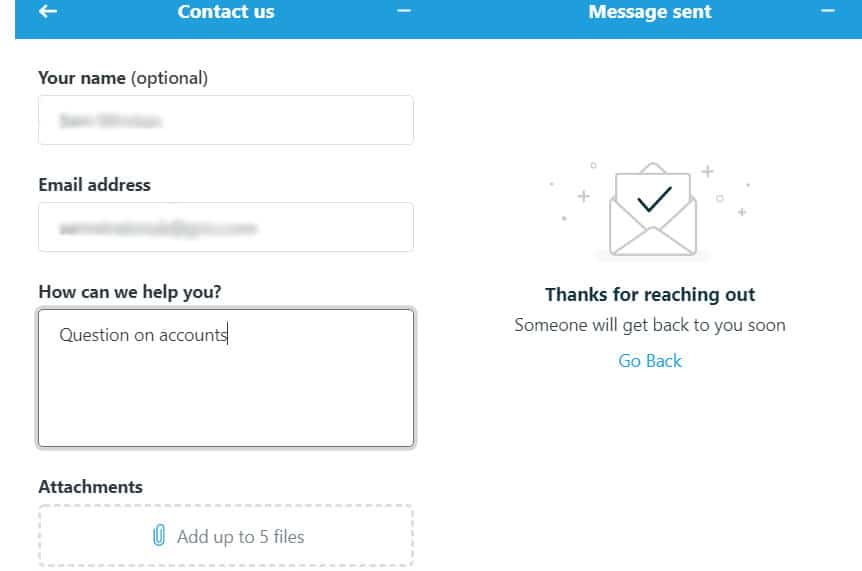

We tried out the live chat function however we were not able to get through to an agent. We were asked for an email address and more information on our type of request but we were not able to get through to an actual agent.

Reaching out to Live Chat at SnapEx

Reaching out to Live Chat at SnapExHowever, after submitting the chat request our query was sent on to their customer support team as an email. When dealing with them on email we were helped timeously which is no doubt a plus.

While the live chat was not as responsive as we would have liked, you could easily jump into their sizable telegram channel and reach out to their support team there. The team there was quite helpful and was able to chase up a ticket that we had lodged a day earlier.

Unfortunately, there are no phone numbers so you cannot reach them through traditional communication channels. However, these are less of a concern for exchanges these days and the vast majority of exchanges don't offer this anymore.

SNAP Points

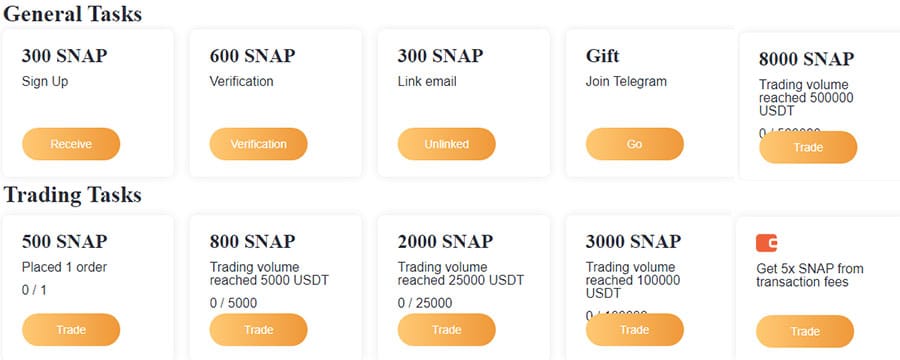

I have mentioned the SNAP points before but these are perhaps one of the most interesting ways for you to not only reduce your fees but earn a host of other goodies.

You can think of SNAP Points as VIP points that are earned for completing a number of tasks on the SnapEx platform. These include the likes of signing up, and verification of an email address. You can also earn some SNAP just from simple trading tasks like placing your first order, trading over 5,000 USDT, 25,000 USDT etc.

Earning Snap Points at SnapEx

Earning Snap Points at SnapExThese SNAP points actually have a monetary value and can be exchanged for USDT. 100 SNAP points is the equivalent of 1 USDT. Once you have generated 10,000 SNAP points then you can exchange these for $100.

If you have not generated the 10,000 SNAP points yet then you can still use some of these SNAP points to offset the cost of transaction fees. As mentioned in the order form section above, you will just need to select the "SNAP deduction" and that should work to bring down your fees.

Refer & Affiliate Program

If you have enjoyed your trading experience then you can make money by referring others to the platform. The first way of doing this is through the simple invite link or code. Using this will earn you up to 35% of lifetime revenue on that referral.

If this is something that you would like to do then you have to head on over to "Invite" in your main menu. There you will see information about the referral program as well as a link below that. This is the link that you can send to your friends. Alternatively, you can just ask them to copy your invitation code.

If you are more of an influencer and you have a pretty big network of traders then you can join their affiliate program. This is one of the most lucrative in the space and pays up to 50% commission on tier-one traders.

And, it's not just what you can earn on the platform. There are a number of benefits that they have included for their affiliates. This includes some of the following:

- Commission Levels: Based on the amount of trading volume that you refer, your commission structure will adjust. They have three levels that give you 40%, 45% and 50%.

- Indirect Commission: You will earn 10% on the commission generated by traders of your own referrals.

- Signup Bonuses: SnapEx will also provide your traders with signup bonuses that could help augment their trading capital.

- Marketing Support: They will provide you with a whole host of custom marketing materials that could help increase your promotional efforts. This includes banners, landing pages and unique links.

- Instant Payment: You can get your marketing rebates instantly and the moment that your referral makes a trade.

If you wanted to become an affiliate then you will have to apply. Unlike with other affiliate programs that have a simple registration form, here you will have to complete a google form to apply.

SnapEx Offline

It can sometimes be quite isolating as a trader. You often trade from home and don't have the same social exposure that you get with your standard office jobs.

That is why we were quite impressed to see that SnapEx offers their traders an opportunity to get together at their numerous meetups. These have been held in a number of countries around the world.

For example, in October of last year, they held their first-ever SnapEx event in Vietnam. There were over 180 people that attended and it was well oversubscribed. There were a host of interesting talks by people in the Vietnamese crypto community.

People Attending the SnapEx Vietnam Event. Image via SnapEx Blog

People Attending the SnapEx Vietnam Event. Image via SnapEx BlogAfter the success of this event, they decided to hold other events in cities such as Istanbul where they met local traders there. Similar to the Vietnamese meetup, it was just an overview of how to trade the crypto markets and use trading strategies there.

Finally, in November of last year they held a talk in Manilla that went over security and risk management. This was attended by some pretty well-known speakers that went through some of the most important things that you have to know when starting out.

So, all in all, this shows that SnapEx is not just an exchange that is looking to increase its user numbers but they are trying to actively build a community that is engaged around the platform.

Areas for Improvement

While there was a lot that we liked about SnapEx, there were a few things that we thought needed to be improved upon if they really wanted to provide the best trading experience.

Firstly, when it comes to the platform itself, it would be great if traders had the ability to move the charting panels around and place them in a place they are most comfortable with. While the standard layout is great for now, some of the more professional traders would like to customize this.

It would also be great to see more order functionality. You cannot place conditional orders or more advanced trailing orders. These are standard on other exchanges and help traders better manage their risk.

Onto other aspects of the exchange, we think that the mandatory withdrawal fees are really quite high. We have not seen withdrawal fees of $10 at any other exchanges that we have covered and these are likely to drive those smaller traders away.

It is also quite unfortunate that they require full KYC before you are allowed to deposit on the platform. Unlike with other exchanges, you cannot trade up to a certain limit before they request this information. It could be a deterrent for those privacy hawks out there.

Finally, the exchange needs to increase its online awareness amoung traders. It is still relatively new and there are a lot of people who have not heard of it. However, this is the same position many other new exchanges have been in so its just a matter of staying the course to greater awareness.

Conclusion

Overall, we were pretty impressed with SnapEx. Their unique offering gives traders another choice when it comes to leveraged trading platforms. By not relying on order books, they can offer a more seamless execution environment.

We also liked the fact that they have made it easier for new traders to get involved in crypto. This includes such things as their low trade & deposit requirements as well as their K-line price charts (great for transparency).

We also really did appreciate the amount of development work that went into building that mobile app. This will no doubt go a long way to properly cementing their market share in the Asia region.

While there were a few areas that we thought warranted improvement, they are by no means a deal-breaker and can easily be worked on in order to best refine the SnapEx offer.

So, should you consider SnapEx?

Well, if you want a relatively user-friendly exchange that is transparent and quite functional then you should most definitely give SnapEx a try.

Warning ⚡️: Trading leveraged futures products is incredibly risky. Make sure that you practice adequate risk management

Disclaimer: These are the writer’s opinions and should not be considered investment advice. Readers should do their own research.