Overall rating

Bottom line: Strong security/compliance vibe; Instant buys can cost more.

Strong security positioning with a public Trust Center and published certifications

Advanced trading available via ActiveTrader with a clear maker/taker fee model

Useful safety controls like hardware security keys and address allowlisting

Clear fee disclosures

Offers extra products like Gemini Staking and the Gemini Credit Card (availability depends on region/product)

Strong security positioning with a public Trust Center and published certifications

Advanced trading available via ActiveTrader with a clear maker/taker fee model

Useful safety controls like hardware security keys and address allowlisting

Clear fee disclosures

Offers extra products like Gemini Staking and the Gemini Credit Card (availability depends on region/product)

Instant/Recurring orders can be more expensive due to spread plus displayed fees

More limited listings compared with “everything exchanges”; supported assets can vary by region

Customer experience is mixed

Instant/Recurring orders can be more expensive due to spread plus displayed fees

More limited listings compared with “everything exchanges”; supported assets can vary by region

Customer experience is mixed

Picking a crypto exchange may feel like it is just about finding the lowest fee or the biggest coin list. What actually matters is deciding what you value most: strong security controls, clear regulation, easy-to-use apps, advanced trading tools, or simply having every token under the sun. Gemini is one of the most recognizable “compliance-first” exchanges, but that label comes with real tradeoffs; especially around costs on instant buys, regional availability, and how deep its product lineup goes.

In this review, we’ll break down Gemini’s fees, features, security model, and key limitations, so you can decide if it fits your goals and location.

Editor's note: We fully updated this Gemini review in February 2026 to reflect the platform’s latest fees and pricing structure, refreshed our coverage of security controls and certifications and revised key sections on product availability and regional restrictions. We also updated details on newer/expanded offerings, plus refreshed user-facing snapshots like app ratings and support experience.

Bottom line: Strong security/compliance vibe; Instant buys can cost more.

Gemini is a compliance-forward exchange with a strong security posture and clearer pricing on ActiveTrader. The tradeoff is higher all-in cost on Instant/Recurring (spread + fees) and a more curated coin list; availability varies by region.

Gemini is a centralized crypto exchange and custodian where you can buy, sell, trade, and store crypto. It’s similar to an online brokerage for digital assets: you fund an account, place trades, and withdraw coins when needed.

Gemini’s Core Differentiator is a “Compliance-First” Approach. Image via Gemini

Gemini’s Core Differentiator is a “Compliance-First” Approach. Image via GeminiGemini’s core differentiator is a “compliance-first” approach paired with a strong security posture. It positions itself as a regulated-style platform with customer funds described as held 1:1 under its stated policies in its Trust Center. In practice, that tends to appeal to people who value clearer controls and oversight, even if it can mean fewer features in some regions.

Gemini was founded in 2014 by Cameron and Tyler Winklevoss under Gemini Trust Company, LLC. In the U.S., its footprint is closely tied to New York oversight. The New York Department of Financial Services (NYDFS) describes Gemini as a chartered limited purpose trust company authorized to conduct virtual currency business in New York State. Over time, Gemini has become known for a regulated posture and an institutional-leaning product mindset.

Gemini’s availability and feature set vary by jurisdiction, so start with its areas of availability. Product restrictions can be feature-specific too. For example, Gemini says margin trading is only available to certain U.S. customers (and not in New York), subject to eligibility. Always verify eligibility in-app and in Gemini’s support docs before depositing.

If you just want the essentials, like how big Gemini feels, how you can fund it, and what the apps look like in the real world, this is the snapshot.

Coins listed: Gemini markets itself as supporting over 70 coins, with the full list changing over time and by region.

Fiat rails supported: Funding options vary by country, but can include bank transfers (ACH, wire, SEPA, FPS) plus debit cards, Apple Pay/Google Pay, and PayPal where available.

App ratings (as of February 2026): iOS: 4.8/5 (108K ratings). Android: 4.5/5 (54.4K reviews).

Gemini’s lineup splits into a simple “buy/sell” experience and a more advanced toolkit (plus a few institutional-style services). Feature availability can vary by country, so always double-check what’s enabled in your account.

Best for:

First-time spot buys/sells and smaller orders.

Simple portfolio tracking without learning an order book.

Where it’s often more expensive:

Gemini says Instant and Recurring orders include a spread in the quoted price, on top of any listed fees; so the convenience can cost more than placing a limit order on an order book.

Convenience tools include recurring buys and price alerts.

ActiveTrader is Gemini’s order-book interface, designed for people who care about execution control and clearer pricing.

Order types / time-in-force: Market, Limit, Stop-Limit, plus IOC (Immediate-or-Cancel), FOK (Fill-or-Kill), and MOC (Maker-or-Cancel), among others.

Why it matters for fees: Gemini publishes a maker/taker model for ActiveTrader, which is usually easier to optimize than one-tap “instant” pricing.

See our in-depth guide on order types to understand them better.

Gemini’s daily auctions (on supported markets) collect orders, then match them at a single auction price; helping with price discovery and potentially reducing market impact for larger trades. Gemini’s has published auction explainers for Bitcoin and Ether.

How to participate: Use auction-only order types where available.

Who benefits: Larger orders and disciplined entries/exits.

Gemini Clearing is for pre-arranged trades that settle off the continuous order book.

What it solves: Confirms and settles a negotiated trade through Gemini, limiting visible order-book impact and helping manage counterparty risk.

Minimums/eligibility: Gemini states Clearing has no minimum trade size.

How it works: Orders can be submitted via web, REST, or FIX; a counterparty ID can restrict who is allowed to confirm.

Gemini markets Gemini Staking as its yield-style product.

Supported assets and rewards can change, and rewards are variable.

Gemini's staking page discloses a staking services fee of up to 25% of protocol rewards.

Staking isn’t “guaranteed interest.” It carries protocol risk and product/terms risk compared with staking from a self-custody wallet.

Gemini Dollar (GUSD) is a USD-pegged stablecoin issued by Gemini and implemented as an ERC-20 token.

Gemini says each GUSD is fully backed by cash or cash equivalents (bank accounts, money market funds, and U.S. Treasury bills) and redeemable 1:1 for USD on Gemini.

Gemini publishes monthly reserve attestations by an independent accounting firm (BPM).

The Gemini card is for U.S. users who want rewards paid in crypto.

Rewards: Gemini advertises 4% back on gas/EV charging/transit (capped), 3% dining, 2% groceries, 1% everything else.

Issuer / terms: Gemini’s rewards agreement says the card is issued by WebBank.

Tax note: The IRS treats digital assets as property, and taxable virtual-currency transactions generally must be reported.

Why this matters vs Coinbase’s “card”: Coinbase positions its main card product as a Visa debit card, and not a credit card.

Nifty Gateway was launched in 2020 with the vision of "revolutionizing" digital art. However, Gemini decided to focus on a one-stop super app for customers. Gemini thus announced that Nifty Gateway would close on Feb. 23, 2026 and moved to withdrawal-only mode ahead of closure.

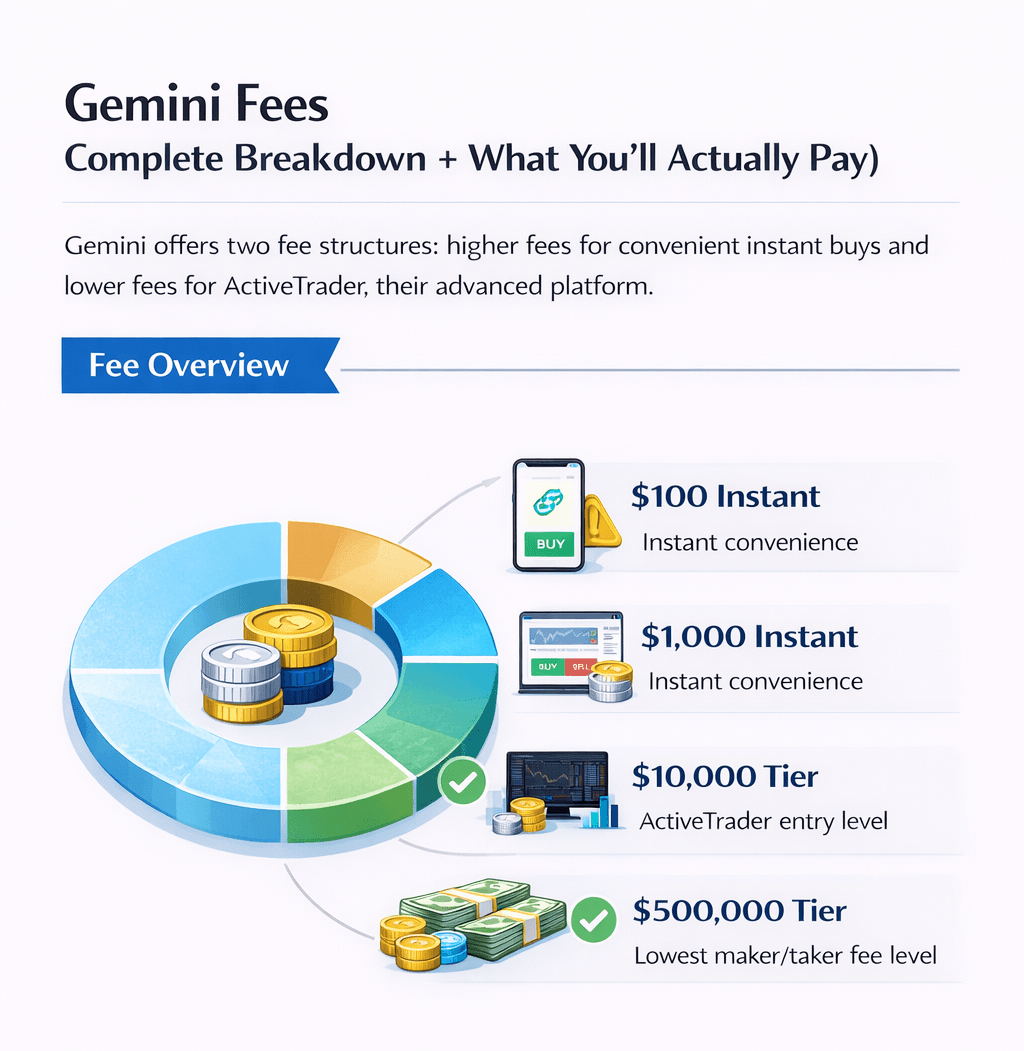

Gemini’s fees can feel confusing at first because the “simple” buy/sell flow bakes some cost into the quote, while the advanced interface charges a clearer maker/taker trading fee; more like the difference between exchanging cash at an airport kiosk (convenient, pricier) versus using a bank rate (more transparent).

Gemini’s Fees can Feel Confusing at First, where ActiveTrader Fees are more Straightforward

Gemini’s Fees can Feel Confusing at First, where ActiveTrader Fees are more StraightforwardOn Gemini’s standard web/app experience, you’ll typically see two cost layers:

A displayed fee that Gemini calculates at checkout and shows on the trade review screen (it can vary by factors like payment method, order size, market conditions, and jurisdiction.

A spread included in the quoted price for Instant and Recurring orders. Gemini explains this “locks” your quote briefly and notes the spread can vary between similar trades on the same product.

On ActiveTrader, fees are more straightforward: a published maker/taker schedule based on your trailing 30-day volume, starting from 0.20% for makers and 0.40% for takers (going lower with higher trading volume).

Tip: Before you hit Buy, open the trade review screen and check two things: the fee line item and whether the quote includes spread (Instant/Recurring). Your “all-in” cost is the combination of both.

Real-World Cost Examples (Scannable Scenarios)

$100 buy on mobile (Instant): You’ll pay the displayed fee plus spread. If you fund via debit card, Gemini’s Transfer Fee Schedule lists a 3.49% debit card deposit fee.

$1,000 buy on web (Instant): Same structure: displayed fee + spread. If you use PayPal where available, Gemini’s Transfer Fee Schedule lists a 2.50% PayPal deposit fee.

$10,000+ ActiveTrader month: If you’re in the ≥$10,000 tier, Gemini lists 0.15% maker / 0.30% taker on the ActiveTrader fee schedule. On a $10,000 trade, that’s $15 (maker) or $30 (taker), ignoring any market slippage.

Debit card purchase example (why it’s usually worst): Paying by debit card can stack costs. Gemini’s Transfer Fee Schedule lists a 3.49% card fee plus the trading fee and any spread for Instant/Recurring orders.

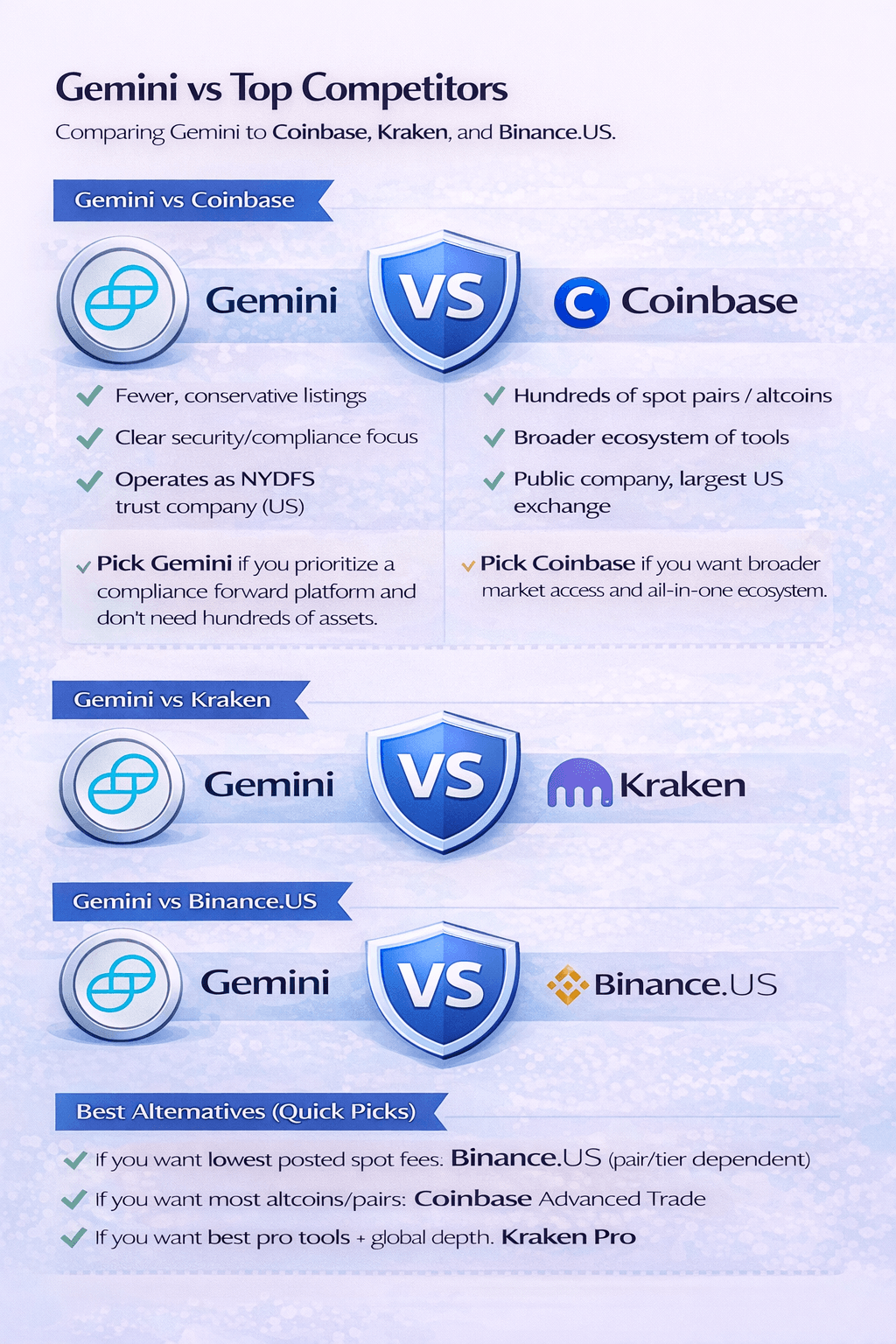

Now let's look at a quick comparison of Gemini vs Coinbase vs Kraken vs Binance US.

Fee area | Gemini | Coinbase | Kraken | Binance.US | Winner for… |

Instant/simple buys | Displayed fee + spread for Instant/Recurring | Displayed fee + spread on simple buys | Instant Buy includes spread + fees | Fees shown at preview + spread on buy/sell/convert | Transparency: always check preview. |

Advanced maker/taker (base tier) | 0.40% / 0.60% at $0–$10K | Kraken Pro (spot): 0.25% / 0.40% (base tier) | Tier 0 pairs: 0% / 0.01% | Lowest posted taker: Binance.US (Tier 0 pairs). | |

Staking “cut” | 30% commission on Auto Earn rewards | Lowest can be Binance.US, but varies by asset. |

Data as of February 2026. Always verify the latest schedules in the linked pages before trading.

Use ActiveTrader if you care about minimizing trading fees.

Avoid debit card funding when possible as Gemini’s Transfer Fee Schedule lists 3.49% for debit card deposits.

Batch withdrawals when practical, since Gemini uses dynamic crypto withdrawal fees shown before you confirm in its Transfer Fee Schedule.

Prefer limit orders in ActiveTrader so you can target maker fees (and avoid paying for convenience).

Watch spread vs fee: on Instant/Recurring orders, the quote can include spread even if the displayed fee looks small.

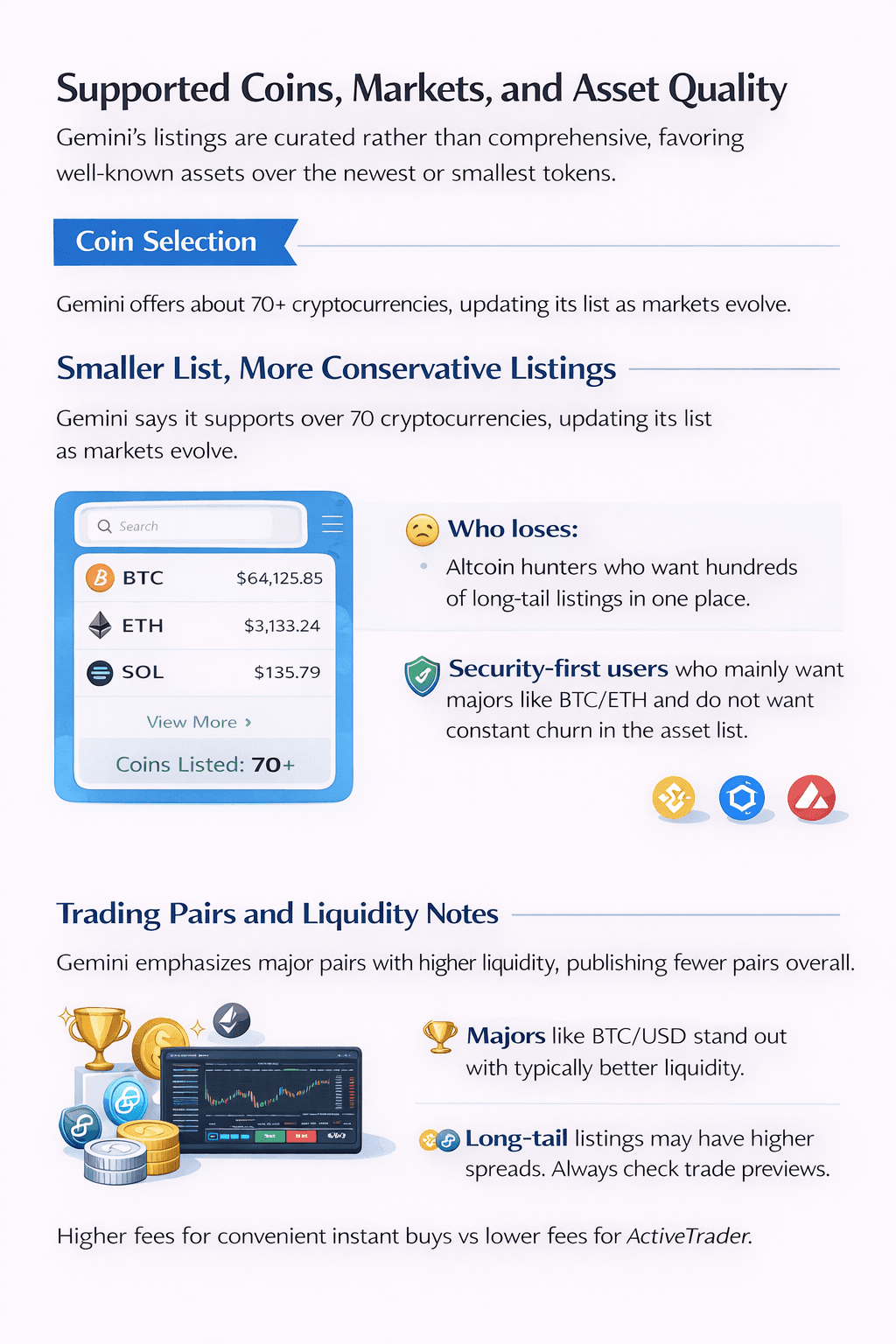

Gemini’s listings are best described as curated rather than comprehensive. That can be a plus if you prefer sticking to well-known assets, but a drawback if you’re hunting for the newest or smallest tokens.

Gemini’s Listings are Best Described as Curated rather than Comprehensive

Gemini’s Listings are Best Described as Curated rather than ComprehensiveGemini says it supports over 70 cryptocurrencies, with the exact lineup changing over time and sometimes by region. So the most accurate reference is its live list of supported cryptos.

Who loses: Altcoin hunters who want hundreds of long-tail listings in one place.

Who wins: Security-first users who mainly want majors like BTC/ETH and don’t want constant churn in the asset list.

Gemini publishes the trading pairs it supports, and liquidity typically concentrates in major pairs (more buyers/sellers, tighter pricing). In thinner long-tail markets, spreads can matter more than the headline fee, especially because Gemini notes that Instant and Recurring orders include a spread and that it can vary between similar transactions. When in doubt, compare the preview quote (or the order book on ActiveTrader) before you commit.

Funding and cashing out on Gemini is mostly straightforward, but the fine print matters because payment methods, fees, and holds can change by region, and some regions may have additional restrictions.

Gemini says available funding options vary by country, but commonly include bank transfers such as ACH (US), wire, and rails like SEPA/FPS/FAST, plus debit cards, Apple Pay/Google Pay, and PayPal where supported. You can also fund by sending crypto to a Gemini deposit address.

Important Note: As of February 2026, Gemini says it will close customer accounts in the UK, EEA, and Australia, with accounts moving to withdrawal-only in early March 2026. Gemini is partnering with eToro to help customers transfer assets ahead of this closure of services.

Gemini’s current Transfer Fee Schedule describes dynamic crypto withdrawal fees that track the “then-current” network/gas costs and are shown before you confirm. For ERC-20 withdrawals, Gemini notes the fee reflects Ethereum gas mechanics. In other words: “network fees” are what blockchains charge; Gemini shows what you’ll pay at the moment you withdraw.

You can read up on our detailed guide on Network Fees.

Gemini’s transfer limits include a $100,000/day ACH withdrawal limit for US customers and $1,000/day limits for debit card and PayPal purchases. If you buy using ACH, Gemini says withdrawals can be held until the transfer clears (typically 4–5 business days).

Always verify your current holds and limits in-app before initiating large transfers.

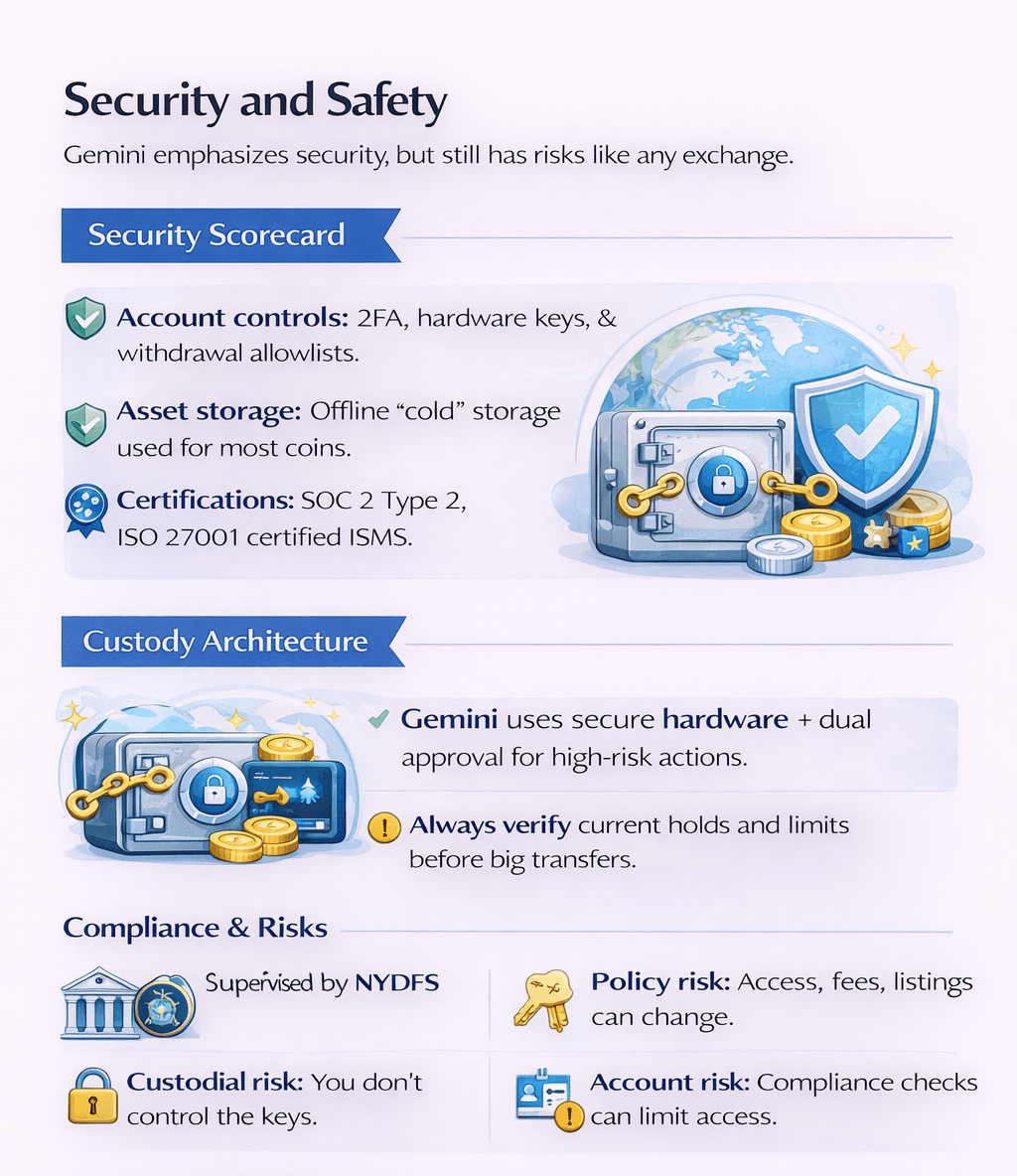

Gemini emphasizes security: it maintains a public Trust Center, requires strong account controls, and publishes third-party certifications. Still, it’s a centralized custodian, so “safe” means “well controlled,” not “risk-free.”

Gemini Maintains a Public Trust Center, Requires Strong Account Controls, and Publishes Third-Party Certifications

Gemini Maintains a Public Trust Center, Requires Strong Account Controls, and Publishes Third-Party CertificationsAccount controls: Mandatory two-factor authentication (2FA), support for hardware security keys, and address allowlisting to restrict withdrawals to pre-approved addresses.

Asset storage: Gemini Custody says most exchange wallet assets and all segregated custody assets sit in offline, air-gapped storage systems.

Certifications: As mentioned in the trust center page referenced above, Gemini lists SOC 1 Type 2 and SOC 2 Type 2 exams and an ISO/IEC 27001:2022 certified ISMS.

In the Gemini Dollar (GUSD) whitepaper, Gemini describes storing keys in hardware security modules (HSMs) that meet FIPS 140-2 Level 3 or higher and using multi-signature dual control (two independent approvals for high-risk actions). Think “vault + two keys,” rather than one person holding a single master key.

In the U.S., Gemini operates through a New York trust company supervised by NYDFS, with AML expectations shaped by FinCEN.

Custodial risk: You don’t control the private keys.

Policy risk: Fees, listings, and product access can change.

Account risk: Identity checks or compliance reviews can temporarily restrict access.

Market/liquidity risk: Thin markets can widen spreads and slippage.

Gemini’s mobile app is built for checking prices, placing trades, and managing your account on the go. The key is separating what works well on a small screen (quick actions) from what’s usually better on desktop (deep analysis).

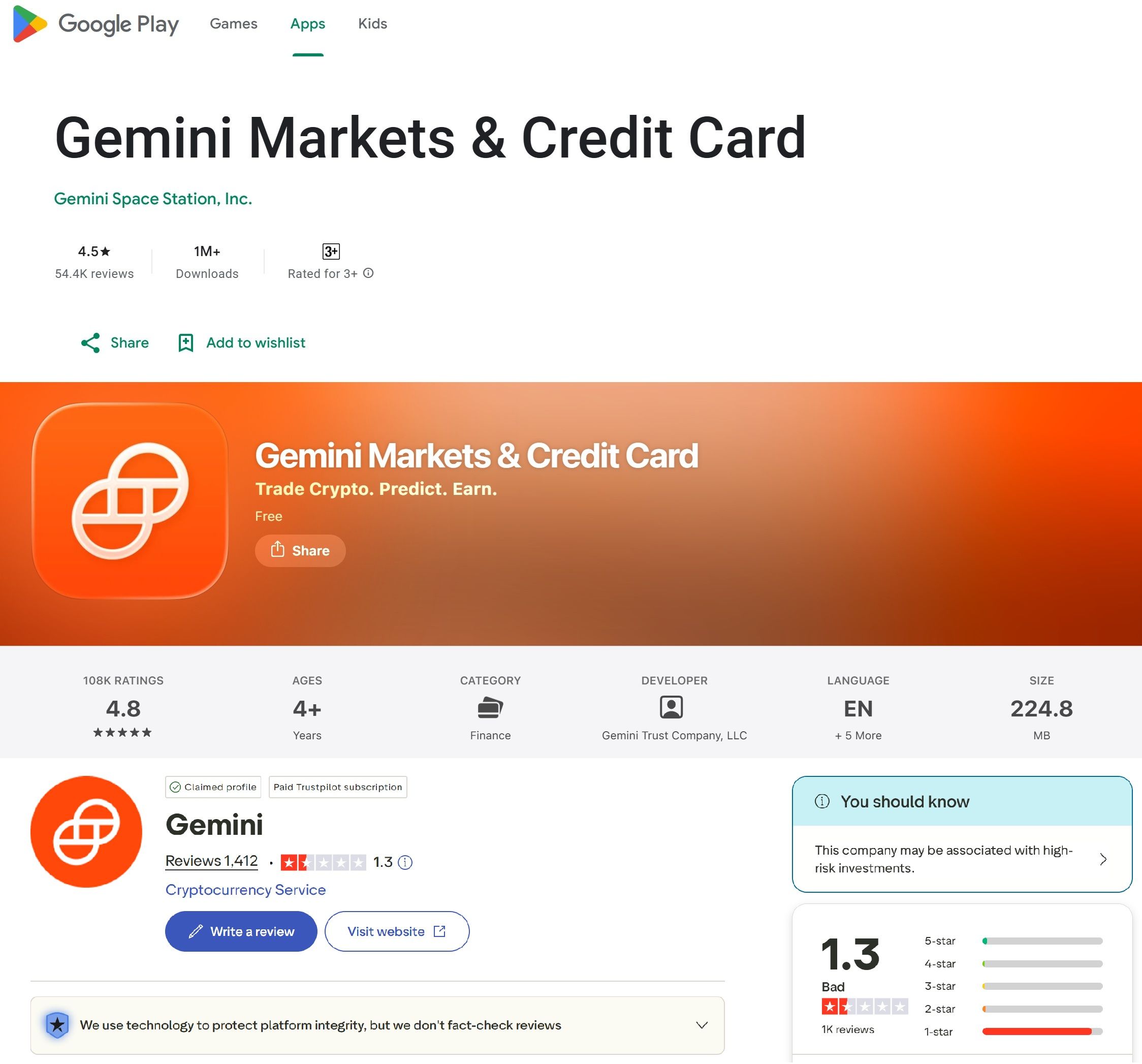

As of February 2026, here’s the public rating snapshot:

Gemini is Rated Higher on Google Play and Apple Store, But Have a Very Low Score on Trustpilot

Gemini is Rated Higher on Google Play and Apple Store, But Have a Very Low Score on Trustpilot

iOS: The Gemini iOS app shows 4.8/5 from 108K ratings.

Android: The Gemini Android app shows 4.5 stars from 54.4K reviews.

Trustpilot: Gemini’s Trustpilot profile shows a 1.3/5 TrustScore (about 1.4K total reviews).

On Trustpilot, the most common negative themes revolve around accounts being restricted (often during withdrawals or verification) and slow or unresponsive customer support, with some complaints also focused on credit card-related issues.

Biometric login: Gemini recommends enabling biometric authentication.

Alerts: You can set price alerts to stay on top of moves.

Recurring buys: The app supports recurring buys for “set-and-forget” investing.

Charting and order-book analysis can feel cramped compared with desktop.

Advanced trading can be harder to manage quickly on mobile (especially during volatility).

The low Trustpilot score is a reminder to be cautious about customer experience signals and to do extra diligence before committing large sums.

Choosing an exchange is mostly about tradeoffs: fees vs features, asset variety vs tighter listings, and how much you value a compliance-led setup. Here’s a simple “choose-your-path” view.

Gemini’s Edge is Typically the Security/Compliance Framing

Gemini’s Edge is Typically the Security/Compliance FramingDecision factor | Gemini | Coinbase |

| NYDFS trust-company footprint (US) | ✓ | ✗ |

| Asset/pair breadth (where Coinbase highlights 500+ spot pairs) | ✗ | ✓ |

| Advanced trading with maker/taker tiers (Gemini's ActiveTrader vs Coinbase Advanced) | ✓ | ✓ |

| Clear “security-first” positioning | ✓ | ✓ |

| Best if you want “one app for everything” (Coinbase’s Advanced Trade + broad lineup) | ✗ | ✓ |

Pick Gemini if you prioritize a compliance-forward platform and don’t need hundreds of assets.

Pick Coinbase if you want broader market access and an all-in-one ecosystem.

If you want global trading depth and a long-standing pro interface, Kraken (and Kraken Pro) tends to be the more natural fit for frequent traders.

Gemini can feel more “rules-first,” but we have already noted that it has announced it will close customer accounts in the UK/EEA/Australia (moving to withdrawal-only in early March 2026).

If your priority is low posted spot fees, Binance.US advertises 0% maker and 0.01% taker on Tier 0 pairs as noted earlier.

Gemini’s edge is typically the security/compliance framing, while Binance.US may appeal more to fee-sensitive spot traders.

If you want lowest posted spot fees: Binance.US (pair/tier dependent).

If you want most altcoins/pairs: Coinbase Advanced Trade.

If you want best pro tools + global depth: Kraken Pro.

If you want strongest “US compliance vibe”: Gemini’s NYDFS-linked trust-company setup.

Remember that these comparisons barely scratch the surface. For a more in-depth analysis, check out our detailed reviews of Kraken, Coinbase, and Binance US.

Gemini routes most issues through its Help Center, where you can search self-serve articles and submit a request if you need a human. Gemini also states its primary support channel is email, and that it will never call or text customers (calls only happen in special cases after scheduling by email). If your case isn’t resolved, Gemini documents an escalation path via a formal complaints process, including a regulatory complaint option in the app.

Gemini's Primary Support Channel is Email, and it will Never Call or Text Customers

Gemini's Primary Support Channel is Email, and it will Never Call or Text Customers

For the Gemini Credit Card, Gemini says support inquiries can go through its request form, and a 24/7 phone number is available inside the card account’s Help Center settings.

If you hit platform issues, Gemini’s status page is the fastest way to confirm whether delays are system-wide.

Gemini is best understood as a “compliance-and-controls first” exchange. If you’re happy to trade a bit of convenience (and sometimes higher costs) for a platform that leans heavily into security posture and regulatory alignment, it can be a strong fit. If you want the widest asset menu and the cheapest one-tap buys, you’ll likely feel constrained.

The core tradeoff is simple: Gemini prioritizes a security-forward, compliance-led setup, but that can come with higher all-in costs on Instant/Recurring orders due to the spread and a more curated list of supported assets.

You mainly buy and hold major assets and want a platform that emphasizes controls and oversight.

You’re comfortable using ActiveTrader to reduce trading fees and get more execution control.

You’re eligible in your region and have confirmed access via areas of availability.

You want frequent “instant” buys at the lowest possible all-in cost (Gemini notes Instant/Recurring include spread).

You want maximum altcoin variety and constant new listings (compare Gemini’s supported cryptos with broader exchanges).

You may be affected by region/product restrictions or closures. Always check Gemini’s latest notices and availability first.

Get exclusive access to premium content, member-only tools, and the inside track on everything crypto.