In today’s crypto sphere, DeFi and NFTs have absolutely stolen the show and have been the talk of the town for quite some time now. In the trendy world that is cryptocurrency, however, the greatest levels of anticipation and hype have been reserved for Initial Coin Offerings (ICOs). This is primarily due to the fact that ICOs offer an open, democratic approach to investing into the inherently dynamic, ever-changing digital asset space and have consequently fueled high interest levels across the ecosystem.

ICOs were particularly popular back in 2017 and 2018, when many crypto investors saw an opportunity to make a quick flip and some easy money. Indeed, many of them were successful in doing so as they invested in the right projects at the right time, making some pretty decent profit along the way. However, on the flip side, many ideas crowdfunded via ICOs were doomed from the get-go, but investors were perhaps still too inexperienced to realise that.

ICOs Were The Trend Of 2017 Bull Market - Image via Forbes

ICOs Were The Trend Of 2017 Bull Market - Image via ForbesMany ICOs went to zero but, a number of incredibly successful Initial Coin Offerings have also come to life, with some returning early-stage investors over 1,000,000% in gains! To this day, ICOs arguably still offer huge opportunities to their investors and the challenge ultimately resides in spotting the right ones.

Before diving into the Top 10 most performant ICOs of all time, let us discuss the main characteristics of Initial Coin Offerings and shed light on how they work.

About ICOs

In crypto, Initial Coin Offerings (ICOs) have many parallels to Initial Public Offerings (IPOs) for stocks. Thus, an ICO is essentially a type of crowdfunding. A company or blockchain-based project looking to raise capital to create a new coin, crypto asset, dApp or service can launch an Initial Coin Offering as a medium to raise funds.

ICOs are a blockchain based fundraising method

ICOs are a blockchain based fundraising method Interested investors can buy into the offering and receive a new cryptocurrency token issued by the blockchain project. This token may have some utility in using the product or service the company is offering, or it may simply represent a stake in the company or project itself. In order to participate in the Initial Coin Offering, interested investors will usually need to purchase a pre-existing cryptocurrency first, in most cases Ethereum’s ETH, that will be used as the funding asset in the project.

During ICOs Investors Send Their Contributions To The Project With Pre-Existing Cryptos Such As ETH

During ICOs Investors Send Their Contributions To The Project With Pre-Existing Cryptos Such As ETH Of course, this entails a requirement for investors to be somewhat familiar with the concept of digital assets, digital wallets and their functionalities, and they must also have a basic understanding of how to engage with crypto exchanges.

Furthermore, while ICOs share similarities with traditional market IPOs, Initial Coin Offerings are for the most part completely unregulated, which means investors must indeed exercise a high degree of caution and extensive due diligence when researching and investing in specific ICOs.

That being said, while ICOs are in fact unregulated, the Securities and Exchange Commission (SEC) can intervene in the ICO process if there is any suspicion of on-going illegal activities. For instance, in 2018 and 2019, the maker of Telegram raised $1.7 billion in an Initial Coin Offering but the SEC filed an emergency action and obtained a temporary restraining order due to alleged illegal activity on behalf of the development team.

The SEC Filed An Emergency Action Against Telegram On Suspicion Of Illegal Activities

The SEC Filed An Emergency Action Against Telegram On Suspicion Of Illegal Activities In March 2020, the U.S. District Court for the Southern District of New York issued a preliminary injunction, which resulted in Telegram having to return $1.2 billion to investors and pay a civil penalty of $18.5 million.

How ICOs Work

When a tech-start up or blockchain-based project wants to raise capital through an ICO, it will usually compose a Whitepaper outlining the primary, fundamental elements of the project, its technical applications, token economics, the duration of the ICO and the accepted assets to be exchanged for the project’s new tokens.

Throughout the ICO campaign, crypto investors, supporters and enthusiasts can purchase some of the project’s tokens with pre-existing digital assets such as Ethereum, BNB, USDC and BUSD and, on rare occasions, even fiat currencies.

If the digital capital raised during the campaign is insufficient, funds may be returned to the backers and the ICO will be consequently deemed unsuccessful. However, if the funding requirements are met within the specified timeframe, the capital raised will be redeployed by the project to pursue infrastructure development and its future goals.

Once A Project Is Fully Funded Via Its ICO, It Can Distribute Tokens And Focus On Development

Once A Project Is Fully Funded Via Its ICO, It Can Distribute Tokens And Focus On Development In order to participate in Initial Coin Offerings, and its sisters Initial Dex Offerings (IDOs) and Initial Exchange Offerings (IEOs), users will most likely have to interface the platform holding the ICO with a decentralised wallet such as Metamask. While some ICOs do happen on centralised exchanges and require users to have the exchange-specific wallet, a decentralised wallet allows participants to have full control over their new ICO tokens, enabling further trading and asset swaps.

When, for instance, a project launches its tokens on a launchpad such as Polkastarter, whitelisted participants can exchange their Ethereum or USDC assets for newly minted ICO-IDO tokens and receive those tokens directly to their Metamask wallet. On the other hand, for ICOs launching on more centralised platforms such as CoinList, for instance, selected users can send in their contributions in USDC, ETH, Bitcoin, and even fiat, and receive their tokens in their CoinList exchange wallets.

Top 10 Most Performant ICOs

The year 2017 produced a wide array of ICOs in the crypto space. Some were an ultimate success, whereas others became nothing more than a digital graveyard. In fact, according to a Bitcoin.com report, 46% of all the 2017 ICOs have failed and will not be coming back.

Many Projects That Raised Funds At ICO Level In 2017 Failed Miserably - Image via TokenData

Many Projects That Raised Funds At ICO Level In 2017 Failed Miserably - Image via TokenData Trawling through 900 ICOs in one sitting is a deeply depressing experience, news.Bitcoin.com can report. Abandoned Twitter accounts, empty Telegram groups, websites no longer hosted, and communities no longer tended are par for the course. A digital graveyard, complete with metaphorical tumbleweed, characterizes the crop of 2017 that decided to take the money and run. Many raised zero; some raised a couple of thousand dollars; and a handful raised over $10 million. In each case, the end result was the same though: no MVP, no alpha release, and no contribution to the decentralized web for the betterment of humanity. Kai Sedgwick - Bitcoin.com

That being said, 2017 was an all-round, incredibly successful year for Initial Coin Offerings and this is expressed by the amount of funds raised at ICO level, with figures ranging from a fiat equivalent of $4 billion to $5.6 billion. In 2016, this figure stood at ‘only’ $225 million.

So, without further ado, let’s dive into the Top 10 most prolific ICOs from Initial Price to All-Time-High.

1. NXT - ROI: 128,571.4x

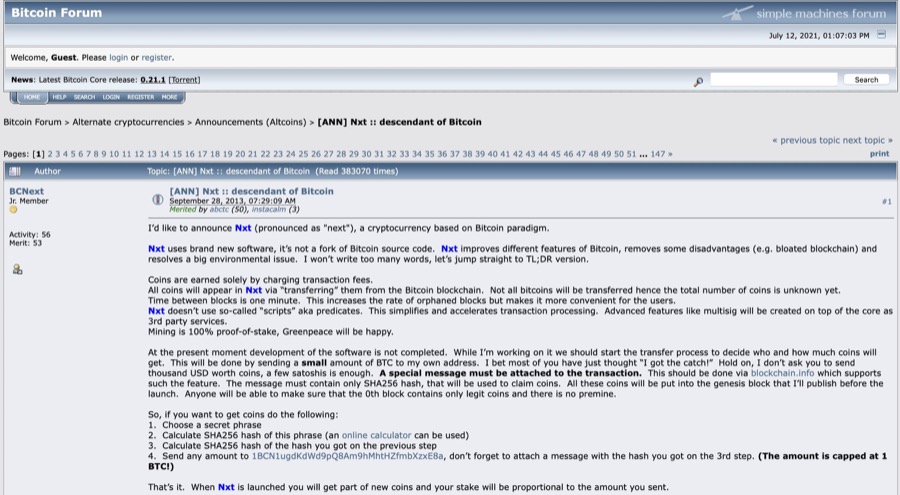

Launched in November 2013, NXT is one of the oldest blockchain projects in the space. The official announcement of the NXT Initial Coin Offering was made on a BitcoinTalk forum on September 28th 2013 by an anonymous developer. In the announcement, NXT was described as a descendant of Bitcoin and as a project designed to make BTC more scalable, more eco-friendly, and solve some of its architectural issues.

A Visual Of The NXT ICO Announcement On BitcoinTalk

A Visual Of The NXT ICO Announcement On BitcoinTalkBack in 2013, when crypto was still a relatively immature asset class, the alleged value proposition of a potential Bitcoin 2.0 token drove a tremendous amount of hype and interest in the cryptocurrency community, a sentiment that accompanied the NXT token on its surreal upward trend of 2017.

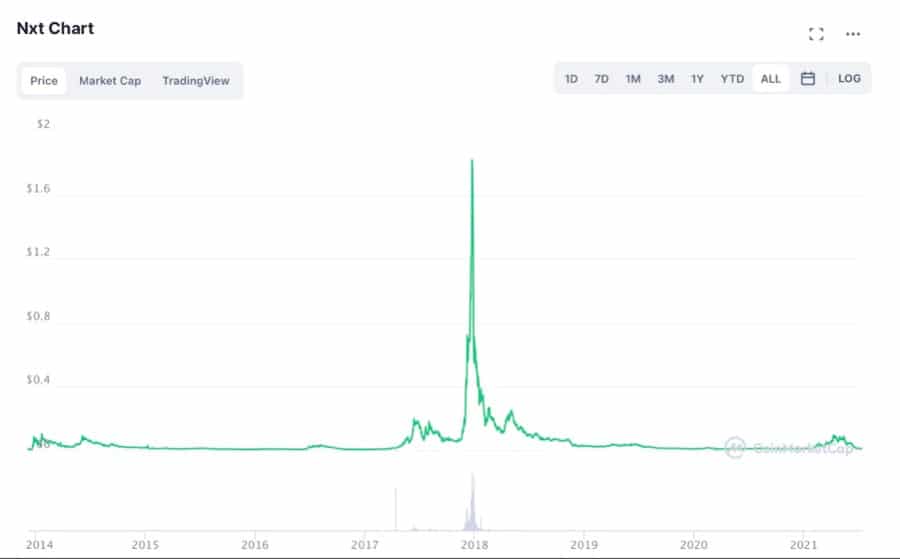

The crowdfunding campaign for the ICO was conducted on the Forum and the anonymous developer managed to amass approximately $16,800 worth of BTC, distributing 1 billion NXT tokens in total. Thus, the NXT token’s value during the ICO was only $0.0000168. At the time of writing, NXT is trading at $0.01232 and has massively retraced from its December 2017 all-time-high of $2.16.

NXT Is Currently Way Off Its Highs Of $2.16 And Despite Being Relatively Unheard-Of, NXT Indeed Represents The Most Prolific ICO In Crypto History - Image via CoinMarketCap

NXT Is Currently Way Off Its Highs Of $2.16 And Despite Being Relatively Unheard-Of, NXT Indeed Represents The Most Prolific ICO In Crypto History - Image via CoinMarketCap At present, NXT is a fully-operational advanced blockchain project that provides users with an ‘out-of-the-box’, modular toolset enabling them to build their own blockchain-based applications. The NXT platform also has its own asset exchange, a marketplace and messaging system.

While NXT seems to have somewhat disappeared from the main scene, it does however preserve the title of the highest return on investment in a cryptocurrency ICO with a whopping 12,857,100% ROI for its early-stage investors!

2. Ethereum - ROI: 14,026.8x

Pretty much anyone who is relatively well-versed in the crypto world will have heard of the absolute goliath that is Ethereum. Ethereum is an open-source, public, distributed ledger platform that enables users to create and run their own decentralised applications (dApps), as well as implement and use smart contracts.

Ethereum, The Second Most Valuable Crypto Asset

Ethereum, The Second Most Valuable Crypto Asset Vitalik Buterin, the visionary mind behind the project, has become somewhat of an idol in the crypto space and Ethereum is considered by many to be the ultimate blockchain infrastructure, as well as a quintessential trailblazer of this technology. Through the Enterprise Ethereum Alliance, the project works in cooperation with hundreds of major clients, including the world’s largest corporations, with a finality to forward the implementation of blockchain technology and smart contract applications in real-world businesses.

The success of Ethereum quite frankly speaks for itself and with the constant, on-going development in its infrastructure, as well as the highly-anticipated ETH 2.0 sharding architecture, Ethereum is set to completely disrupt the financial industry as we know it. In fact, Ethereum has already established relations with major financial entities such as Visa and is set to begin collaborating with the California-based credit card provider.

Ethereum Is Establishing Connections With Finance's Leading Companies

Ethereum Is Establishing Connections With Finance's Leading Companies In March 2021, Visa announced that it would start settling transactions with crypto partners in USDC on Ethereum. The credit card giant is already partnering with 35 digital currency platforms, including Coinbase, crypto.com, BlockFi and Bitpanda which collectively have more than 50 million active users.

Thus, thanks to its smart contracts, DeFi-NFT dApps, sharding and decentralised lending and borrowing protocols, it is clear that Ethereum constitutes a true power house in the digital asset space and it should also come as no surprise that ETH remains the second most valuable cryptocurrency by market capitalisation after Bitcoin.

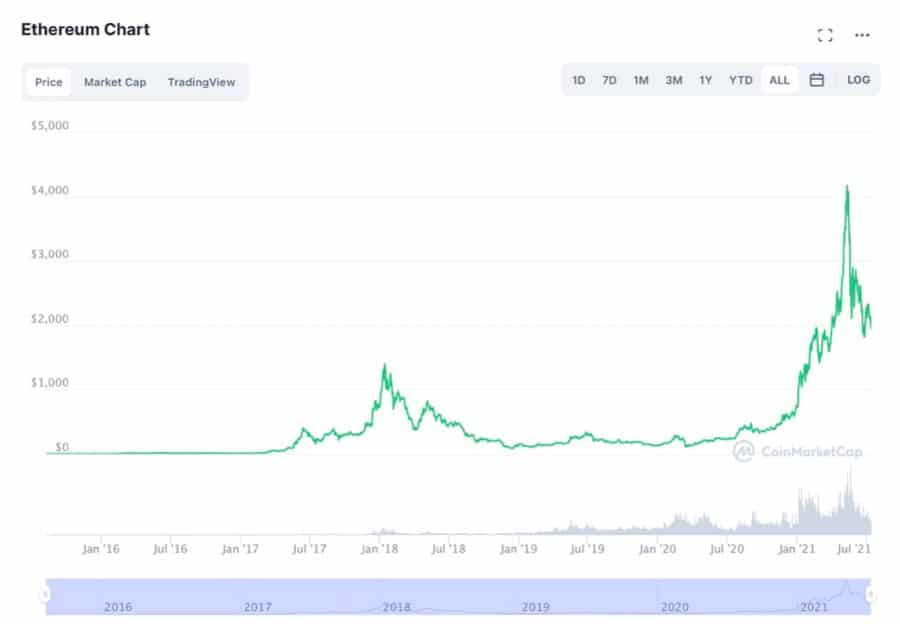

With regards to its Initial Coin Offering, Ethereum’s ICO was held in the summer of 2014 and, naturally, it was a massive success. ETH’s team managed to raise $15.5 million and sold 50 million ETH tokens at the price of $0.311 per token.

ETH Has Been Rapidly Climbing Since Its ICO Price Of $0.311 - Image via CoinMarketCap

ETH Has Been Rapidly Climbing Since Its ICO Price Of $0.311 - Image via CoinMarketCap At the time of writing, ETH is trading at $2,030 and the token peaked at a staggering all-time-high of $4,362.35 on May 12th 2021. While Ethereum is currently down approximately 53% from its ATH, early-stage investors who purchased the token at ICO for $0.311 are up over 6,000x on their initial investment. However, those who managed to sell ETH at its all-time-high of $4,362.35 would have gained over 14,000x ROI, a mind-blowing 1,402,600% gain!

Even Guy Can’t Quite Believe These Numbers! - CoinBureau's Top 5 ICOs

Even Guy Can’t Quite Believe These Numbers! - CoinBureau's Top 5 ICOs Given its cutting-edge technology, all-star dev team, blockchain infrastructure and price history, Ethereum is considered by many to be ‘too big to fail’, a rather controversial statement that cannot be said for many of the other crypto assets in the space. However, in Ethereum’s case, this actually seems to be quite the rational conclusion.

3. IOTA - ROI: 13,110x

The IOTA project derives its name from the term IoT, or ‘Internet Of Things’, and therefore inherently strives to build a future blockchain infrastructure in which many different ‘things’, be it applications, automated services and even cars can interoperate and communicate with one another. An example of this could be a smart fridge capable of automatically re-ordering specific items and having the products delivered directly to one’s door, for instance. Given the growing technological demand for automation services, IOTA seeks to provide the go-to token for IoT transactions.

IOTA, The Internet Of Things Blockchain - Image via IOTA.org

IOTA, The Internet Of Things Blockchain - Image via IOTA.org Interestingly, IOTA doesn’t actually use a full blockchain to perform its transactions but runs on a system called The Tangle. For blockchain-based assets such as Bitcoin there is a transaction fee levied for all transactions occurring on the network, irrespective of the transaction value. Tangle, instead, is more fluid, scalable and becomes quicker and more powerful with time, whereas blockchain gets slower and less productive. Furthermore, IOTA’s Tangle is basically free as it has no block rewards and its nodes do not need fees to verify transactions.

These IOTA-native architectural features allow for the creation of a more self-sufficient, sustainable blockchain infrastructure that seeks to tackle some of the most pressing issues in the space, primarily that of scalability. These elements, combined with the functionality of IoT technology, make IOTA a particularly innovative and stand-out project, and it is thus not at all surprising that the project’s ICO enjoyed such incredible upward momentum.

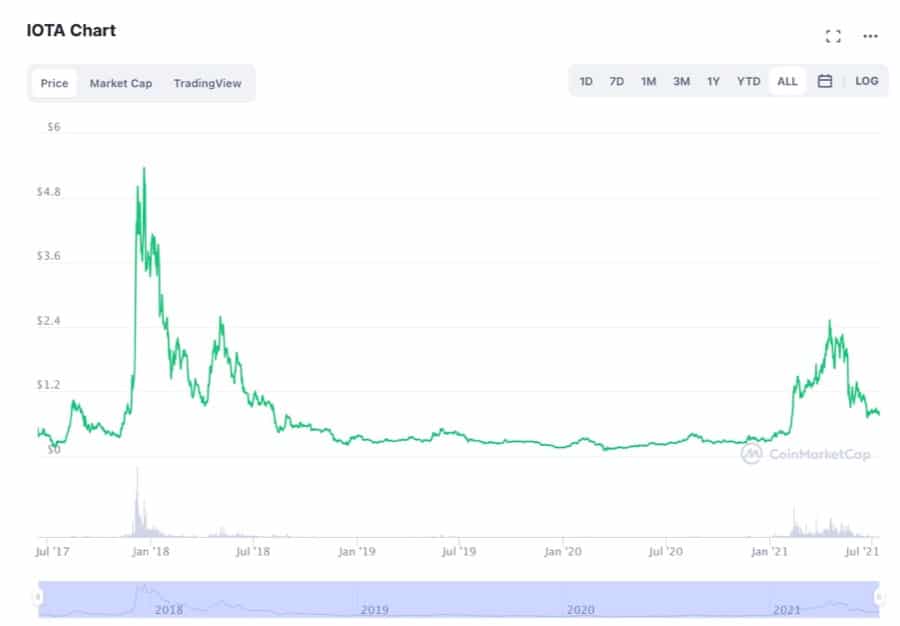

Since Its Inception IOTA Has Enjoyed An Exceptional Upward Trend With Its Token Hitting An All Time High Of $5.69 In December 2017 - Image via CoinMarketCap

Since Its Inception IOTA Has Enjoyed An Exceptional Upward Trend With Its Token Hitting An All Time High Of $5.69 In December 2017 - Image via CoinMarketCap Speaking of IOTA’s ICO, the IoT-oriented project raised $434,000 in late 2015 and all of one billion IOTA tokens were sold at ICO level for a price of $0.000434. The IOTA token, called MIOTA, put in a staggering all-time-high of $5.69 on December 19th 2017, indicating a gain of 1,311,000% for early-stage investors!

These metrics, therefore, most definitely place IOTA as one of the top contenders and most profitable ICOs of the 2017 bull run.

4. Alias - ROI: 6,740x

Formerly known as Spectrecoin, Alias launched back in November 2016 as a ‘privacy-focused’ crypto asset. One of the most important features of the Alias token is that it can be transferred and received globally with complete anonymity. Alias strives to push the boundaries of what governments around the world are willing to tolerate from digital currencies, however it has not yet broken through to the mainstream.

ALIAS, The Privacy Preserving Cryptocurrency - Image via CoinMarketCap

ALIAS, The Privacy Preserving Cryptocurrency - Image via CoinMarketCap To prioritise privacy and anonymity, Alias combines blockchain with a tokenised ring signature scheme. In cryptography, a ring signature is a kind of digital signature that can be done by any member of a group of users holding the keys. Thus, because of the users’ anonymity, it is impossible to trace which member of the group signed for a transaction.

In addition, Alias utilises the Tor network to increase the network-level privacy. All the nodes communicate with one another exclusively via Tor, which essentially means that Alias transactions go through a series of ‘middlemen’ before reaching their destination, thus becoming untraceable. Moreover, the Alias network even offers a system to hide the fact that it uses Tor via a technology known as OBFS4.

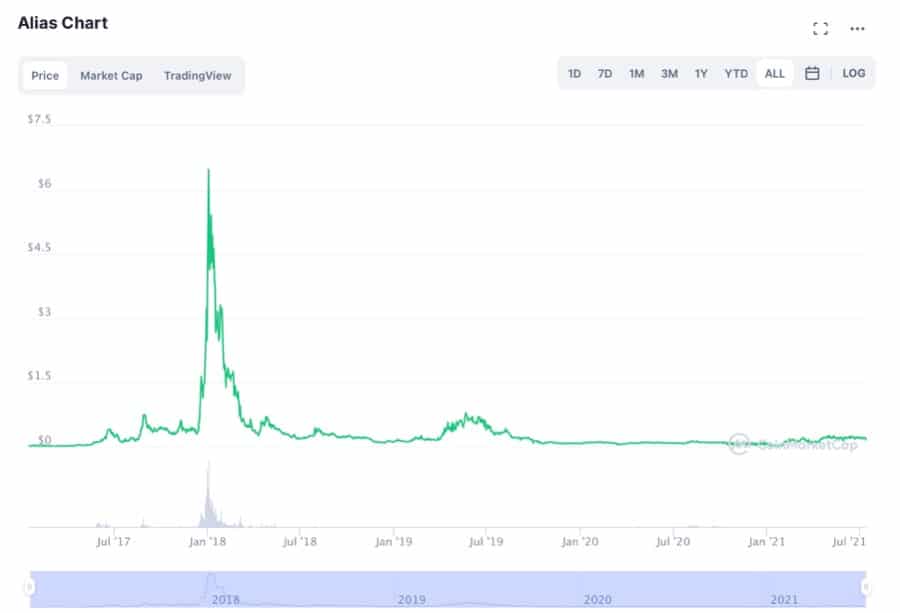

On January 2nd 2018, Alias Peaked At An ATH Of $6.74 But Is Currently Down Over 95% - Image via CoinMarketCap

On January 2nd 2018, Alias Peaked At An ATH Of $6.74 But Is Currently Down Over 95% - Image via CoinMarketCapThe Spectrecoin-Alias team held an anonymous ICO from November 18th 2016 to January 6th 2017, in which 19 million tokens were sold and $15,500 were raised. The ICO price of Spectrecoin was $0.001. The privacy-first crypto asset is currently trading at $0.18 and suffered a heavy retracement from its all-time-high of $6.74. Early-stage investors who purchased the Alias token at ICO are currently up 180x, however, those who managed to sell at its ATH secured an ROI of 674,000%!

To this day, there seems to be a growing demand for privacy assets in the crypto space, with projects such as Tornado Cash, Monero and Zcash being at the forefront of the ‘privacy first’ movement. This is because privacy coins constitute a good alternative for any crypto holder seeking to conceal their identity and who consider transactions a personal, private matter. However, on the flip side, given the extreme level of security inherent in privacy coins this has at times led to them being used for illicit activities.

5. Neo - ROI: 6,151.5x

Formerly known as Antshares, Neo is a Chinese open-source blockchain project that is sometimes referred to as ‘China’s Ethereum’. Besides implementing smart contract applications, Neo also incorporates decentralised commerce, digital assets and identification into its architecture.

NEO, A Blockchain Infrastructure That Is Much More Than China's Ethereum - Image via Neo.org

NEO, A Blockchain Infrastructure That Is Much More Than China's Ethereum - Image via Neo.org Rebranded to Neo in 2017, the project aims to automate the management of digital assets through the use of smart contracts, with the eventual goal of building a distributed network-based smart economy system. Furthermore, NEO’s developers are creating a blockchain that would represent legal proof of ownership and will be accepted by the broader society, not just the cryptocurrency community.

Assets can be easily digitised on the NEO blockchain in an open, decentralised and transparent manner that is free of intermediaries and their costs. In addition, users are able to record, buy, sell, exchange or calculate various kinds of assets. The Neo platform allows for linking the physical asset with an equivalent and unique digital avatar on its network, while also supporting the protection of assets. Those assets registered on its platform have a validated digital identity and are protected by law.

At the time of Neo’s ICO, there probably wasn’t even a single investor in the space doubting whether it would be worth investing in Neo. This is because ‘China’s Ethereum’ had gained the support of such big names as Alibaba and Microsoft so, naturally, the ICO held in October 2015 was a huge success. Neo sold 17.5 million tokens raising $556,500, and a year later the project had a second crowd sale in which it sold 22.5 million tokens and raised over $4.5 million!

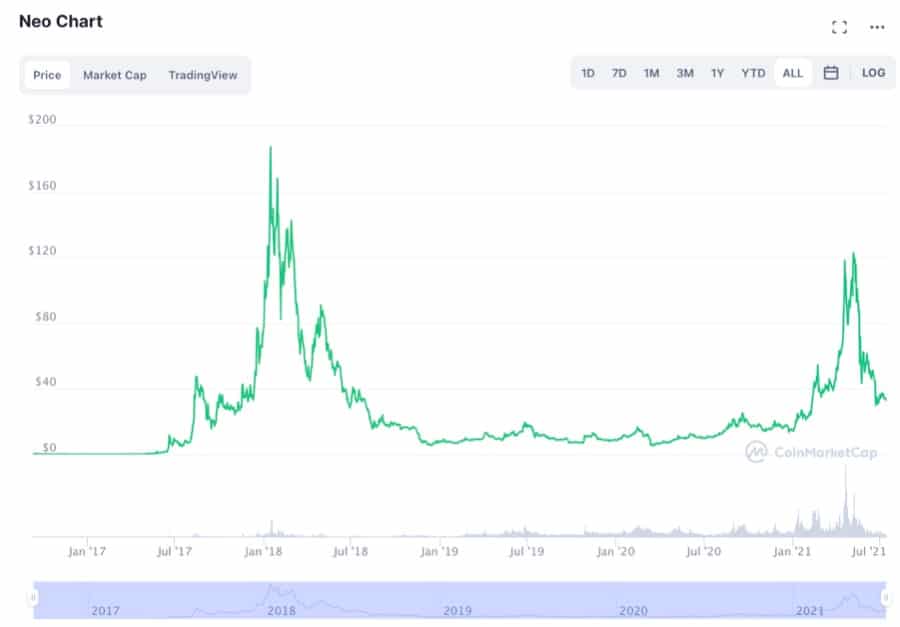

Neo Has Remained Relevant Throughout Both The 2017 And The 2020-2021 Bull Markets - Image via CoinMarketCap

Neo Has Remained Relevant Throughout Both The 2017 And The 2020-2021 Bull Markets - Image via CoinMarketCap The original ICO price of the Neo token was $0.032 and now, at the time of writing, the token is trading at around $33 which is already a 1000x away from its ICO price. However, more interestingly, Neo peaked at an all-time-high of $196.85 on January 15th 2018, returning investors over 600,000% ROI.

6. BNB - ROI: 4,606.2x

Binance Coin (BNB) is an exchange-based token created and issued by the leading cryptocurrency exchange Binance. Initially created as an ERC-20 asset on Ethereum in July 2017, BNB was then migrated to Binance Chain in February 2019 and became the native token of the Binance Chain.

BNB, Binance's Native Asset - Image via BinanceAcademy

BNB, Binance's Native Asset - Image via BinanceAcademy Been Binance’s native asset, BNB has seen massive growth in interest throughout the years and has enjoyed considerable price appreciation with several rounds of token burn events, which have pushed up the BNB token as one of the Top 10 most valuable crypto assets by market capitalisation. Furthermore, BNB’s enjoys extensive liquidity across exchanges and DeFi protocols, and it can be traded in over 300 trading pairs across 120 exchanges tracked.

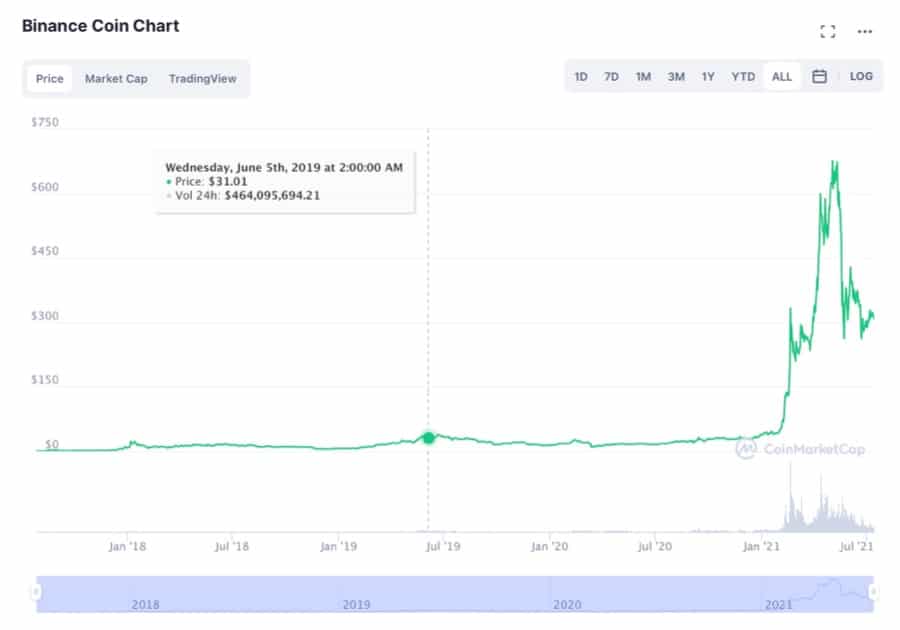

At The Time Of Writing, BNB Sits At $312, Down More Than 50% From Its ATH. Image via CoinMarketCap

At The Time Of Writing, BNB Sits At $312, Down More Than 50% From Its ATH. Image via CoinMarketCap The BNB ICO took place in the summer of 2017, which saw 100 million Ethereum-based BNB tokens sold at a price of $0.15 per token and $15 million raised. BNB ICO investors are currently up over 2000x, whereas those who managed to sell BNB at its ATH of $690.93, in May 2021, gained over 400,000% ROI.

The Top 3, Guy-Approved Reasons For BNB's Historical Success: Use Cases, Tokenomics, Binance BNB Burn - CoinBureau YouTube

The Top 3, Guy-Approved Reasons For BNB's Historical Success: Use Cases, Tokenomics, Binance BNB Burn - CoinBureau YouTube The bulk of BNB’s use cases stems from the Binance Smart Chain (BSC), which is essentially a centralised clone of Ethereum that requires BNB to pay for transaction fees. The BSC ecosystem has grown exponentially throughout 2020 and 2021, with numerous DeFi and NFT projects utilising it as their base layer and the huge variety of IDOs and launchpad projects operating on the BSC network.

In terms of tokenomics, BNB has an initial supply of 200 million and only 50% of the maximum supply was sold at ICO to investors. BNB’s total supply has been consistently shrinking every quarter ever since Binance began its quarterly BNB buy-back and burn program. To do this, Binance takes a cut of all the trading fees on its platform each quarter to buy back and burn BNB tokens.

This essentially creates a deflationary infrastructure in which the demand and buying pressure for BNB remains high and the reduction in BNB supply inherently allows for greater price appreciation. The macro-economic importance of BNB in the crypto ecosystem, especially in DeFi and the emerging world of NFTs, somewhat explains its solid uptrend momentum throughout the years, an uptrend that is most likely destined to continue.

7. Stratis - ROI: 3,237.1x

Stratis is another cryptocurrency that has been around for quite some time but has not yet managed to break into the world of leading digital currencies. The company, based in the UK, prides itself on having a platform that is compatible with various programming languages, giving businesses the ability to create and design custom applications with relative ease.

Stratis, The Microsoft-Backed Blockchain Network - Image via Medium

Stratis, The Microsoft-Backed Blockchain Network - Image via Medium Throughout its existence, the Stratis project has attracted many major enterprises, with the most notable being Microsoft (MSFT). Indeed, the project’s slogan is ‘We Make Blockchain Easy For You’ and has created a comprehensive platform that integrates with .NET and C#, which is one of the main reasons for its on-going success. Microsoft themselves actually added Stratis’ Blockchain-as-a-Service (BaaS) to its Azure cloud service, which is aimed at businesses wishing to create in-house blockchain solutions.

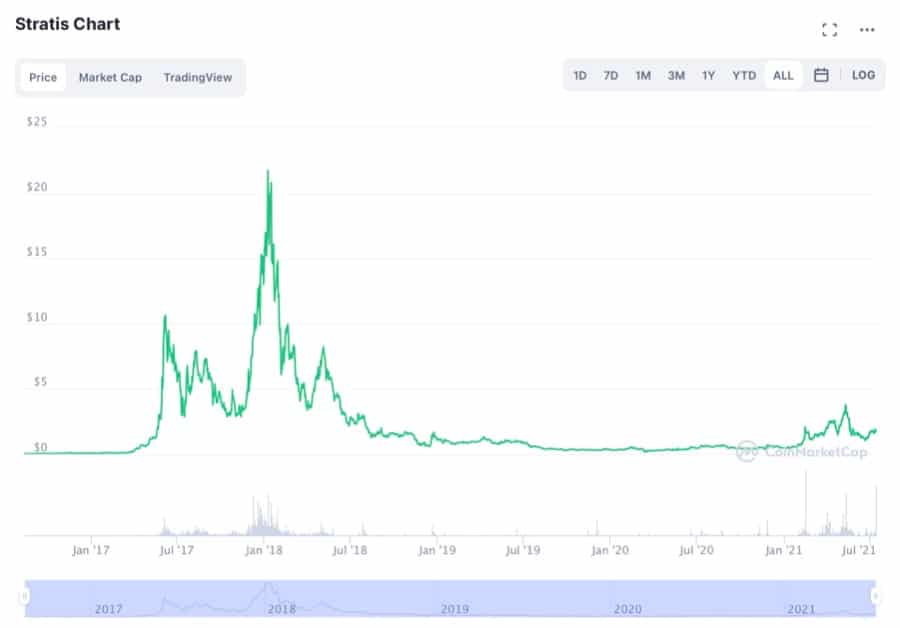

Of course, given the support of tech industry leaders, Stratis enjoyed a very successful ICO in July 2016. The project managed to raise over $600,000 and sold its Stratis native tokens for $0.007 per token.

Stratis Has Retracted From Its ATH Of $22.66 - Image via CoinMarketCap

Stratis Has Retracted From Its ATH Of $22.66 - Image via CoinMarketCapThe Strax token is currently trading at $1.74 and has heavily retraced from its $22.66 all-time-high of January 2018. From its ICO price to ATH, Stratis delivered investors over 3000x gains, and if ICO investors were to trade in their Strax now they be up over 24,000%.

8. Cardano - ROI: 1,020x

Cardano is one of the most well-established projects in the space and is firmly placed within the Top 10 most valuable cryptocurrencies by market cap. Cardano strives to create a platform for smart contracts and decentralised applications with a focus on advanced functionality and scalability. One of the project’s leading figures and major catalysts is Charles Hoskinson, who was one of the initial founders of Ethereum.

Cardano, A Revolutionary Blockchain Project Founded By The Ex-Ethereum Charles Hoskinson

Cardano, A Revolutionary Blockchain Project Founded By The Ex-Ethereum Charles Hoskinson Like Vitalik Buterin or Polkadot’s Gavin Wood, Hoskinson is also considered to be somewhat of a crypto rockstar and is idolised across the space. Cardano implements a proof of stake (PoS) protocol called Ouroboros, in contrast with Bitcoin and Ethereum which use a proof of work (PoW) system. Cardano is particularly known for its emphasis on technical research and academic papers, which have contributed to the project’s rigorous approach to development. Furthermore, Cardano’s development has been structured over 5 different deadlines that need to be achieved, with these being Byron, Shelley, Goguen, Basho and Voltaire.

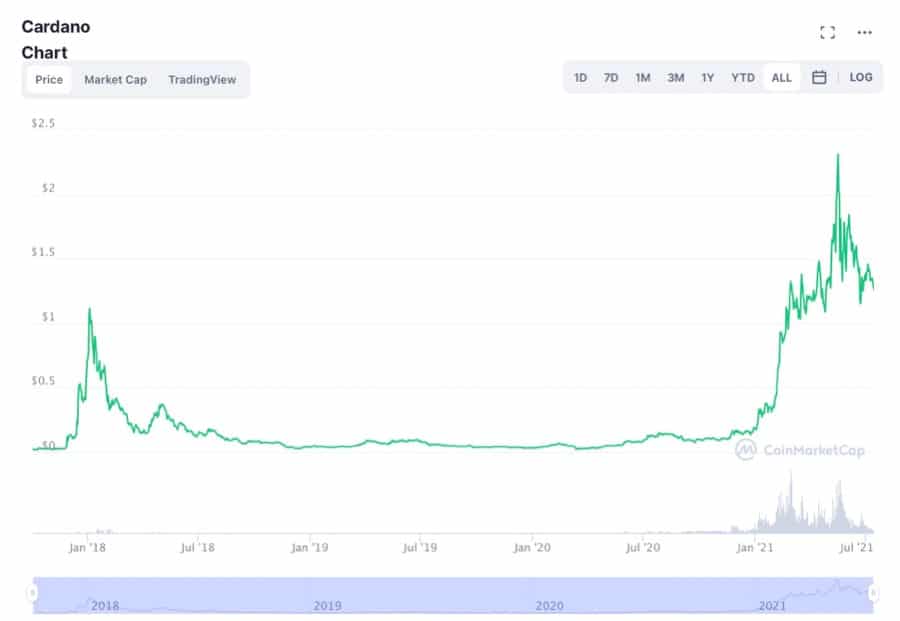

Launched in late 2017, Cardano’s native token ADA experienced a massive upward spike within three months of its ICO, an uptrend that saw its token rise from an initial price of $0.0024 to a local all-time-high of approximately $1.20 at the beginning of January 2018. Despite the project being nothing more than an idea at the time, Cardano attracted such high levels of interest that made it seem like the real ‘Ethereum killer’ had ultimately arrived.

A Visual Of The Huge Spikes Experienced By Cardano’s ADA Token - Image via CoinMarketCap

A Visual Of The Huge Spikes Experienced By Cardano’s ADA Token - Image via CoinMarketCap In order to fund its development, Cardano raised $62.2 million for its Initial Coin Offering. The pre-launch token sale of ADA ran from September 2015 to January 2017 and was undertaken over 4 different tranches. During the sale the average price paid for 1 ADA was $0.0024.

Currently, ADA is trading at approximately $1.30 but on May 16th 2021 ADA peaked at an all-time-high of $2.46. This means that if ADA’s ICO holders were to cash in their tokens today they would receive an approximate gain of 54,100%, whereas ICO holders who sold at ADA’s 2021 ATH price of $2.46 secured a whopping 1,020x ROI.

9. Ark - ROI: 1,000x

Ark is a blockchain infrastructure that is designed to be as efficient as possible, and is all about integration and collaboration. Ark’s goal is to create an entire ecosystem of linked blockchains, essentially bringing them together into one, massive spiderweb of use cases.

Ark, The Blockchain Solution For Everyone

Ark, The Blockchain Solution For EveryoneBack in 2017, Ark was deemed one of the most ambitious projects in the crypto space, a sentiment that was in fact reflected in its major upward momentum from July 2017 to January 2018. Ark is not an Ethereum-based, ERC-20 token but it runs on its own developed blockchain.

To this day, Ark’s vision is to be an all-in-one blockchain platform enabling users to deploy blockchain structures with the push of a button, seamlessly implement smart contract applications or create decentralised cross-chain bridge architectures. In the not so distant future, as Web 3.0 propositions become more of a reality, there could be hundreds of different dApps and utility tokens that need to communicate with each other. Ark, therefore, strives to become the ultimate distributor of cross-chain interoperability features in order to fuel Web 3.0 development and intercommunication.

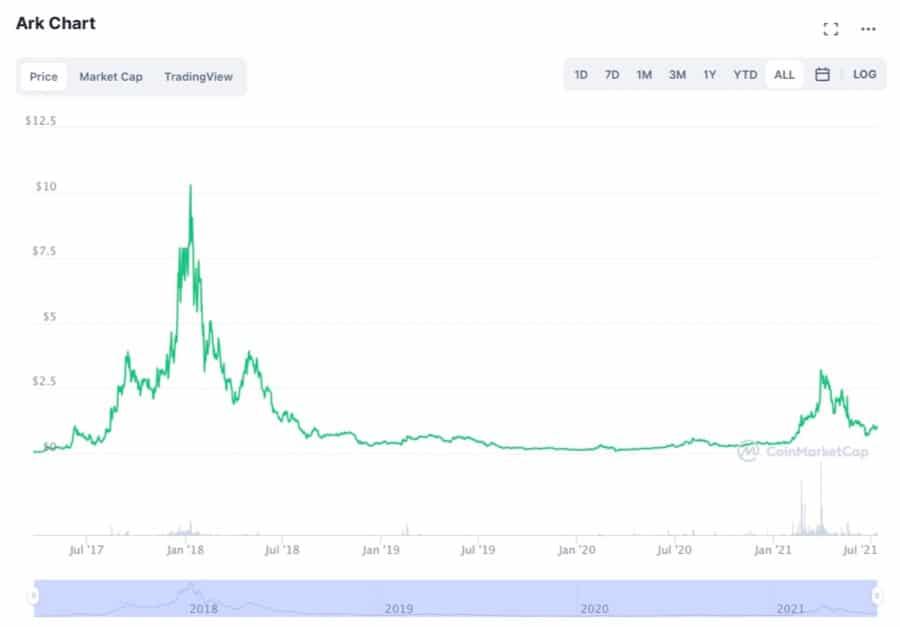

With regards to Ark’s Initial Coin Offering, the project held its ICO from November to December 2016, managing to raise almost $950,000. Its token’s ICO price was $0.01. Investors who participated in Ark’s ICO and managed to sell at its all-time-high of $9.99, on January 9th 2018, secured a gain of 100,000%, effectively a 1000x ROI.

Ark Is Currently Down 90% From Its ATH Of $9.99 - Image via CoinMarketCap

Ark Is Currently Down 90% From Its ATH Of $9.99 - Image via CoinMarketCapAt the time of writing, the Ark token is trading at approximately $1, a 10x away from its all-time-high. If ICO investors were to cash in their Ark tokens now, they would walk away with a 10,000% return on their original investment.

Ultimately, it should come as no surprise that Ark was such a success back in 2017. In fact, if we consider the level of interest that cross-chain bridges such as parachains and interoperability platforms are generating today, the value proposition of an all-in-one, cross-chain communication blockchain such as Ark would have driven major hype and attention in the 2017 crypto community. The 2017 Ark-induced hype is furthermore reflected in its token’s historical 1000x upward trend.

10. Lisk - ROI: 517.2x

Lisk is an open source blockchain platform powered by LSK tokens that allows developers to write decentralised applications in the JavaScript programming language. Lisk gives developers the ability to build applications on their own sidechain linked to the Lisk network, with their own custom token.

Lisk, The Leading JavaScript Dapp Development Platform

Lisk, The Leading JavaScript Dapp Development PlatformWhen the project first launched at the beginning of 2016, it was the world’s first modular blockchain-based platform meaning that besides its mainchain, hosting its native LSK token, it offered other several sidechains that could tap into the infrastructure of the main chain and benefit from its features. Some advantages of sidechains include strengthened security, improved transaction processing power and the flexibility to create various services, such as managing dApp transactions directly on the sidechain.

Because of its innovative architecture at the time, Lisk gained the support of two early-Ethereum backers, namely IOHK-Cardano’s founder Charles Hoskinson and venture capitalist Steven Nerayoff, who join the Lisk team as project advisors.

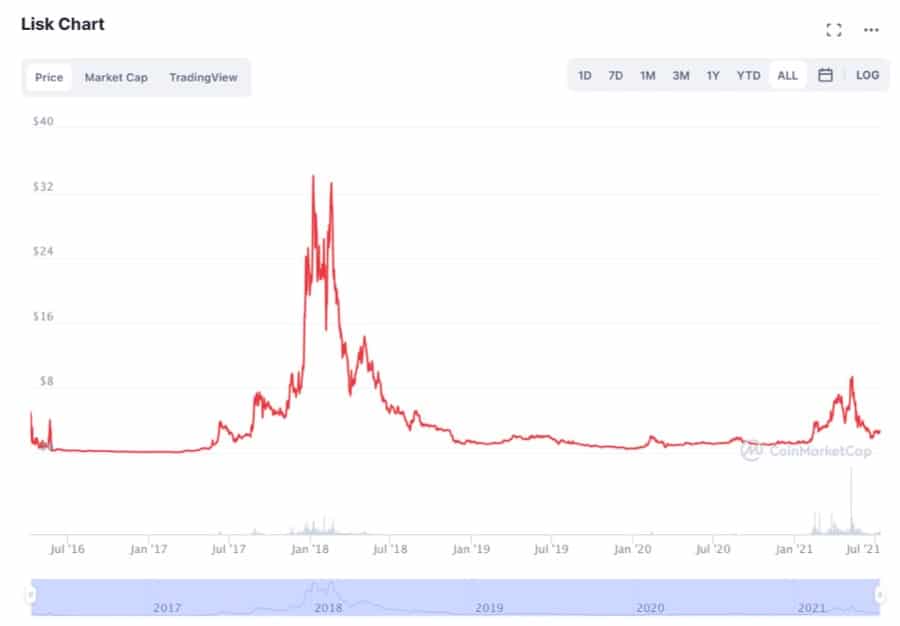

Lisk’s architectural modularity, sidechain design and Ethereum backing ignited high levels of interest across the space and allowed the project to enjoy an astounding Initial Coin Offering. Held in February and March 2016, the crowdfunding campaign brought the Lisk team $5.7 million, who sold the project’s native token for $0.076.

The Lisk Token Has Massively Retraced From Its ATH Of $39.31 - Image via CoinMarketCap

The Lisk Token Has Massively Retraced From Its ATH Of $39.31 - Image via CoinMarketCap Today, Lisk trades at approximately $2.50, indicating a major retraction from its January 2018 all-time-high of $39.31. Investors who purchased Lisk at ICO price, are currently up over 30x. However, those who managed to sell at ATH gained more than 500x ROI, equating to a very decent 51,700%.

In Conclusion

The year 2017 was an incredibly fertile landscape for ICOs and saw a huge variety of projects raise capital and launch their tokens on the market. While an estimated 46% of these projects quite literally went to zero, the remainder enjoyed huge upward momentum and bullish spikes.

While some of these 2017 projects have now gone out of fashion and are not trendy enough for today’s crypto market, the ones that survived actually turned out to be ultimate leaders in the digital asset space.

Essentially, what this means is that ICOs offer investors the invaluable opportunity to get in early on cutting-edge, avant-garde, revolutionary projects that are set to entirely disrupt the space. There is a catch, however, as ICOs come with inherent risks and remain highly speculative products, but the ultimate challenge resides in spotting the right ICO at the right time.