While the ICO market can be exciting, and very profitable for those that get into the right project at the right time, no one has ever claimed that it’s a stable arena.

And now we have statistics to back up what we’ve already guessed at – ICOs are failing at an alarming rate if you’re an ICO investor.

A survey earlier this year by news.bitcoin.com found that despite raising $3.88 billion in 2017 (per Coinschedule.com) 46 percent of all the ICOs launched in 2017 ended as failures. The survey looked at data for over 900 crowdsales and concluded that nearly half failed either during their fundraising, or later by not delivering a product.

This agrees with the “State of the Token Market” report issued by Fabric Ventures and TokenData which concluded that just 48% of 2017 ICOs were successful. Additionally, the “State of the Token Market” report found that the top 10 out of 435 successful sales raised 25% of the total capital. Many ICOs raised just several thousand dollars, and the median capital raised was just $4.5 million.

No one in the cryptocurrency ecosphere was surprised by the data, as the number and scope of scams and frauds within the ICO space is well known to those with even the most basic cryptocurrency experience.

While ICOs had a mixed track record in 2017, we can’t help but think that the failure rate of traditional companies is as high or higher than that of the 2017 crop of ICOs. In fact, some this Forbes article claims that nearly 90% of all start-up companies fail within the first five years.

The reasons are varied, but the most commonly cited are a lack of financial stability, poor management, or simply the lack of a really unique or revolutionary idea.

So, even though the data has proved that the failure rate among ICOs was quite high in 2017, there’s no safe haven for investors in traditional start-up companies.

Are ICOs Really That Risky?

The news.bitcoin.com survey also used data from TokenData, finding 902 crowdsales that were scheduled in 2017.

Out of that massive list they found that 142 failed during their funding stage and an additional 276 failed during the first months following their ICO. Some simply didn’t have the community to keep going, some lacked the motivation to keep going, and some simply faded away with the money raised in the ICO.

Making things worse are the 113 ICOs that were deemed to be “semi-failures”, because at the time of the survey it wasn’t possible to determine the status of the project due to a lack of communication from the development team.

That means that out of 902 ICOs in 2017, 59 percent of them were failures, or will soon become failures.

Image via tokendata.io

Image via tokendata.ioThat failure rate might seem high and too risky, and it is risky, but when compared with data from traditional start-up companies it isn’t all that dire.

According to this Wall Street Journal article, appropriately titled “The Venture Capital Secret: 3 Out of 4 Start-Ups Fail”, fully 75% of all start-ups never return cash to their investors.

The article is based on a survey done by Harvard Business School senior lecturer Shikhar Ghosh, where he looked at more than 2,000 venture backed companies who raised more than $1 million in funding between 2004 and 2010.

So, it seems it doesn’t matter if your business is a bricks-and-mortar business or a blockchain business, the risks of failure will be high for any start-up.

Examining ICO Failures

One thing is certain in the cryptocurrency world. Everything is currently very fluid and dynamic. I don’t just mean price changes either. I’m referring to the technology that powers blockchain technologies, which in some cases seems to change almost overnight.

Every ICO being launched is aiming to revolutionize something, but with the rapid changes taking place, there are times that the idea is outdated even as the ICO is occurring.

And some spaces are simply too crowded, with too many players vying to solve a problem, albeit in different fashions. In these cases the weak players are sure to die out. And these issues mean some projects are doomed to fail before they even get started.

Remember, blockchain technology is far from mainstream adoption, While the masses are just learning about Bitcoin and the basics of blockchain technology, these start-up companies launching ICOs are working in areas most people hardly know exist, and wouldn’t understand even if they do hear about them.

At the same time, the mainstream media loves to trumpet the failures in this space, due to lack of understanding and a resistance to change. Not to mention that bad news attracts more eyeballs and viewers.

The Death of ICOs

Image via Fotolia

Image via FotoliaDuring the research phase of the news.bitcoin.com survey they reported coming across hundreds of abandoned social media accounts and websites that were simply missing. Many of these are the projects that weren’t projects at all, but simple cash grabs.

Of those that did get through their funding stage, many raised just a handful of thousands of dollars, and the median amount raised was only $4.5 million. And the ones that do survive include quite a few that are still in the alpha phase of development, with no real product on the horizon for months if not years.

Does this mean ICOs are suffering a slow death?

Hardly. The concept of crowdfunding is just as new as the blockchain, and it’s simply too good an idea to give up. It will remain, and ICOs will remain. What will change is the regulation of ICOs.

While die-hard cryptocurrency and blockchain enthusiasts may hate the idea of regulation, the fact is that it is a necessary evil if this technology is ever to reach the mainstream. The masses of people need protection, and regulations will give it to them, at least to some extent.

Compare that with the current environment, where a group of developers could theoretically create an ICO, launch it, and take off with the money all on the same day. And with no regulations around the industry there would be no recourse for investors to ever recover their money.

The greatest number of ICO failures in 2017 were those created simply to raise cash and then take off. And that has gotten us to 2018, where countries around the world have either outright banned ICOs (China, South Korea), or are working feverishly to develop a regulatory framework that will make ICOs a safer bet.

The Improving ICO Landscape

While we may have seen a 59 percent failure rate from the 2017 class of ICOs, we could see that number falling in the wake of regulations. And we should also see the ones that do appear being more developed and legitimate.

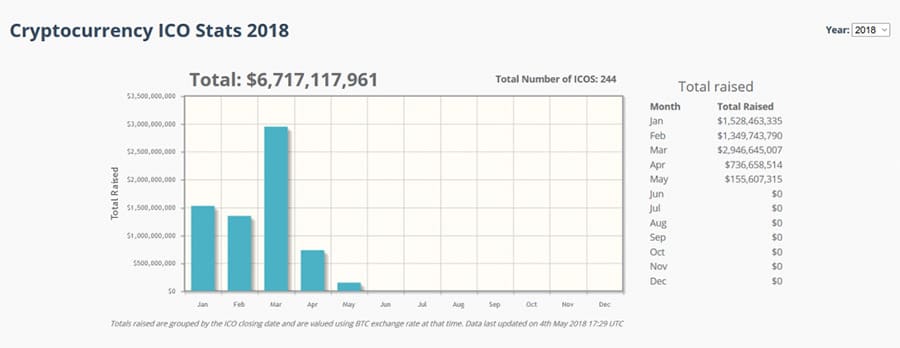

In fact, that seems to be the case already in 2018, with Coinschedule.com reporting 244 ICOs so far in 2018, but TokenData showing just 60 failures – or roughly 25%

Image via tokendata.io

Image via tokendata.ioThere will still be failures with the blockchain space, because that’s simply the nature of the business world. What we hope is that the number of failures will drop, and more importantly, those that do find success become the leaders within the blockchain space.

And while there have been failures, there certainly hasn’t been any slowdown in ICOs. As the chart above shows, the first four months of 2018 have already exceeded 2017, with over $6.7 billion being raised by ICOs, even though the pace of issuance points to less total ICOs this year. It’s possible that the space is already self-governing to some extent, and that only legitimate projects with actual products are attracting capital.

If that’s the case, and we begin to see regulations as well, the ICO landscape could become more fruitful for venture capitalists than traditional start-ups. Even now South Korea is looking to reverse its 2017 decision to ban ICOs.

Could it be that regulators in South Korea see an improving landscape for ICOs? It would certainly be a positive move for blockchain startups, and for the cryptocurrency ecosystem in general, which suffered from the South Korean ban last year.

There’s one thing for certain though. Blockchain is here to stay, and blockchain startups will find ways to raise capital. Whether that continues to be via ICOs or not remains to be seen. It’s very exciting times indeed.