There are endless ways to make money in crypto. Some folks choose to actively trade, some hodlers stow their crypto away from the light of day in a hardware wallet, many investors look to get into token sales early, while some degens dig into DeFi and yield farming.

However, there is another option that looks to make it easy and provide crypto holders with low-risk returns on their crypto. I am, of course, talking about centralized wealth management platforms like Yield App.

Now, before the alarm bells start going off and you are reminded about the utter catastrophes experienced by users who trusted platforms like Celsius and BlockFi, allow us to highlight how Yield App is different and how they have been able to weather all market conditions and thrive since 2020.

We can’t let a few poorly managed companies that mismanaged themselves straight into financial ruin wreck the whole concept of centralized wealth services. After all, there are still plenty of trusted platforms out there offering crypto yield.

In this comprehensive Yield App review, we will explore Yield App, a digital wealth platform that enables users to earn impressive returns on their digital assets safely and securely. Get ready to dive deep into the world of Yield App and discover the features, benefits, and potential risks associated with this innovative platform.

Yield App Review: Short Summary

Yield App is a regulated digital wealth platform offering yield and crypto investment opportunities along with sophisticated trading services for retail and institutional clients. Yield is generated by accessing DeFi protocols and arbitrage trading. Features include the ability to earn interest, access structured products, swap assets, deposit/withdraw fiat, and features a rewards program that is available through the YLD token.

Introduction to Yield App

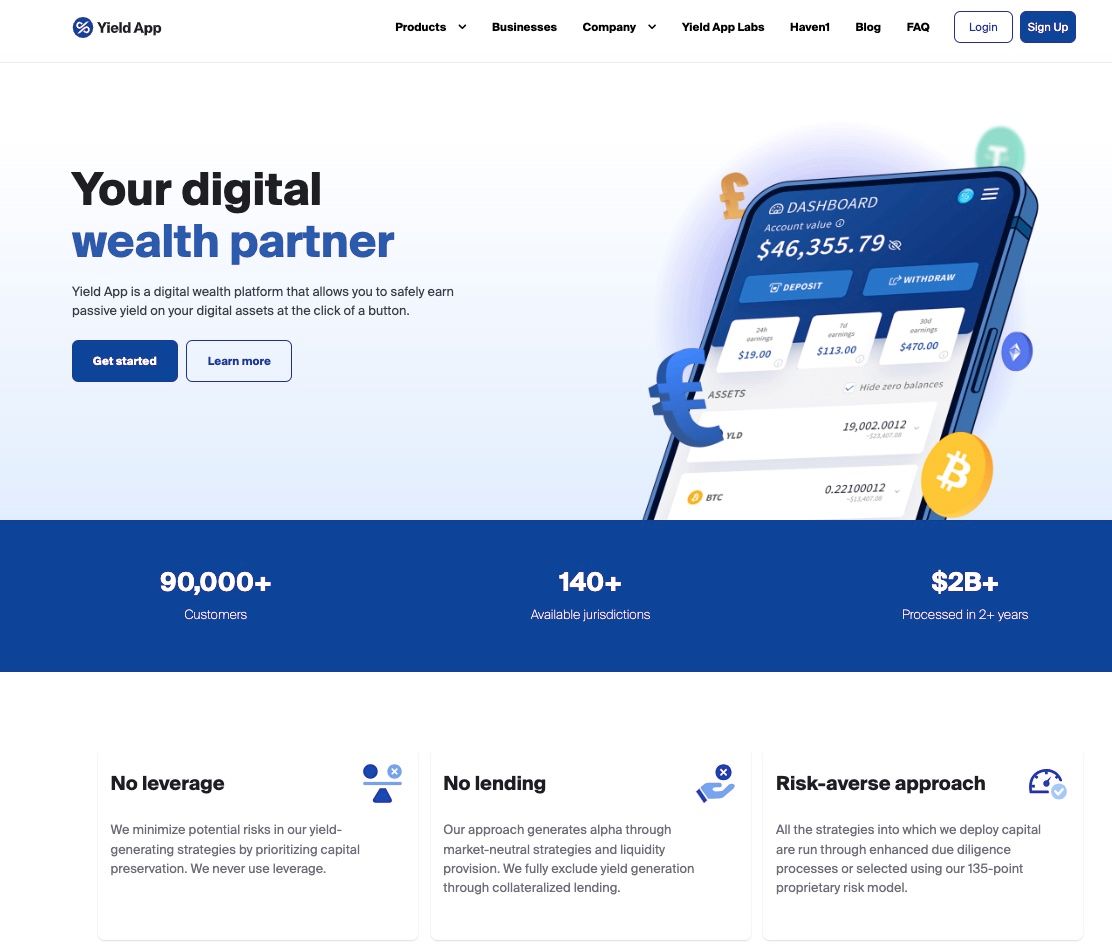

Yield App is an innovative digital wealth platform that provides users with high-yield crypto investment opportunities while ensuring the safety of users’ digital assets.

While other platforms in the past have emphasized high yields and APY on crypto that proved to be unsustainable, Yield App takes a refreshingly different approach and places a strong emphasis on safety and security over promising sky-high returns.

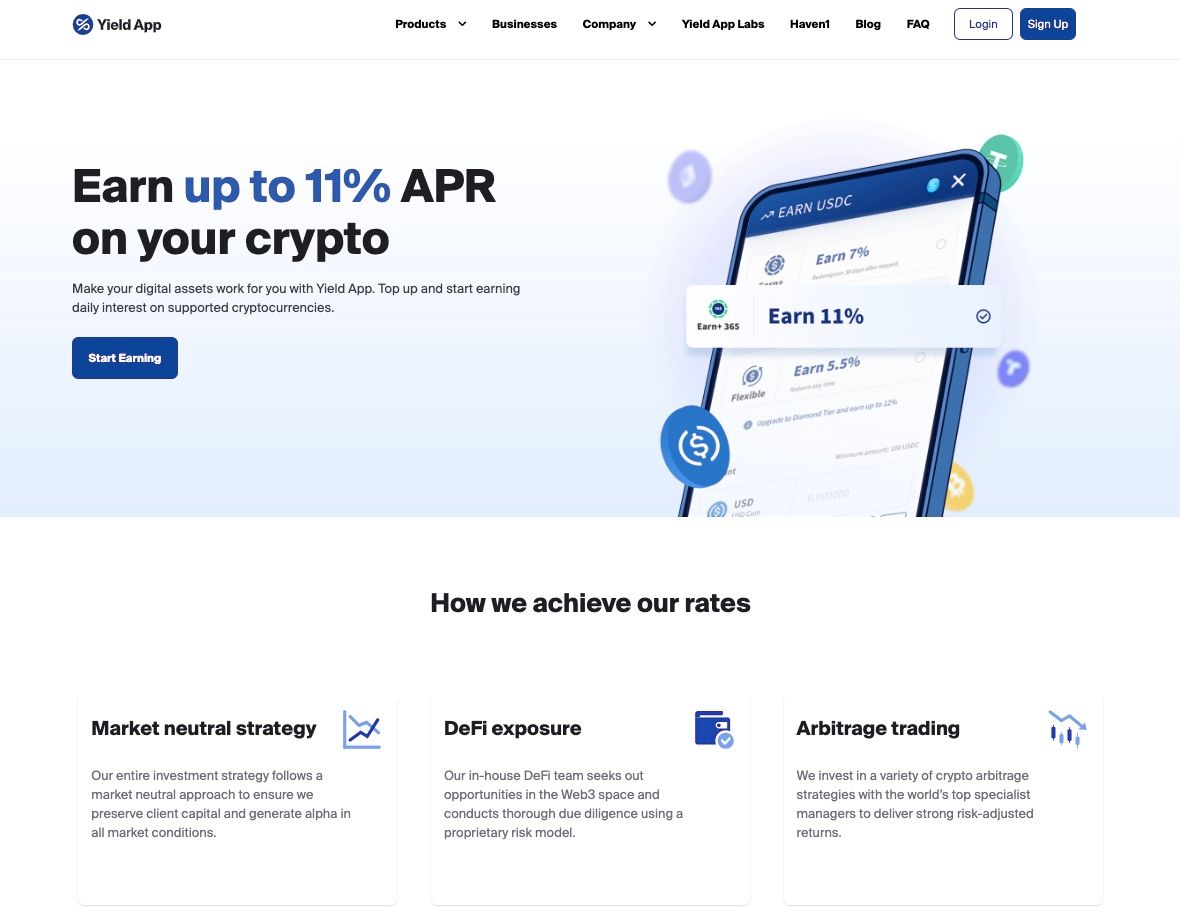

Image via yield.app

Image via yield.appIn fact, Tayler McCracken, Coin Bureau’s Editor-In-Chief had the pleasure of speaking with the Yield App team and was impressed to learn:

- Yield App does not participate in risky business practices such as unsecured lending, does not use leverage, and does not swap users' assets. If you deposit Ethereum, the Yield App team won’t sell your ETH to try and earn more yield on a high-risk doggie coin.

- Yield App is registered in the European Union as a Virtual Assets Service Provider, or VASP, by Italy’s Organismo Agenti e Mediatori (OAM).

- Along with comprehensive security and risk management, the platform is also secured by Fireblocks.

- Tim Frost, the CEO and Founder has built and incubated several high-growth fintech companies that now serve millions, including digital asset payment provider WIREX.

- Justin Wright, Group COO and Co-Founder, has 25 years of experience in investment banking, funds management and consulting experience.

- Lucas Kiely, the CIO, has 25 years of experience heading up equities derivatives with high-profile companies such as UBS, Credit Suisse, and more.

- Kurtis Wong, Executive Director of Structured Products, was previously the executive director at J.P. Morgan and worked in FX trading at HSBC.

- Jorg Huges, now retired but who helped build Yield App from the beginning, was a former director at Deutsche Bank.

Talk about an all-star lineup. These guys didn’t just crawl out of the woodwork and decide to run a crypto platform from their parents’ basement as we see with so many crypto platforms. This is the kind of talent and experience that is good to see behind a platform of this calibre.

With a mission to unlock the full potential of digital assets, the Yield App platform offers advanced services such as high-yield crypto earn portfolios, crypto structured products, and bespoke trading services.

It has secured US$4.9 million in funding and operates under an EU Virtual Assets Service Provider (VASP) registration in Italy, making it one of the very few regulated digital wealth platforms. With over 100,000 users worldwide, Yield App’s native token, $YLD, offers loyal community members increased yields and additional benefits.

The ingenious technological infrastructure of Yield App effortlessly bridges the realms of conventional and decentralized finance, creating a user-friendly pathway to the benefits of DeFi. This innovation is fortified by the dedicated research and development arm, Yield App Labs, which boasts a proficient team well-versed in the domain of DeFi. This in-house entity not only advances cutting-edge technology but also forges alliances and investments with Web3 initiatives that align with Yield App's vision of a future unbound by permission constraints.

In 2023, Yield App acquired Trofi Group, a wealth management platform that provides structured products for cryptocurrencies. This was a strategic acquisition as Trofi Group has over 30 years of experience serving derivatives units to the likes of HSBC and J.P. Morgan, services that are now available to Yield App clients. This includes structured products such as Dual Currency, Range, Sharkfin and Target.

Trofi Group’s co-founders Andrew Lam and Kurtis Wong, who combined have nearly 30 years of experience working on the derivatives desks at HSBC and J.P. Morgan, joined Yield App with the mission of building out crypto-structured products that meet the same rigorous standards as their traditional finance equivalents.

Image via yield.app

Image via yield.appIt is commonly stated in the crypto industry that it is important to look for platforms that are building in the bear market as it shows a high likelihood of being able to thrive in a bull market, and Yield App has certainly been busy in 2023. Along with the Trofi acquisition, they also partnered with Trovio to launch a $35M DeFi Fund.

The Trovio DeFi Fund will offer investors the opportunity to allocate capital to a yield-generating strategy found in the DeFi ecosystem. The actively managed strategy is managed by Trovio’s asset management team in partnership with Yield App’s experienced risk management team.

The new investment vehicle, backed by $35 million in capital, emphasizes capital preservation by utilising Yield App's proprietary sentiment analysis tools to mitigate market volatility. Yield App's DeFi team's expertise and risk model, encompassing 135 measured variables across security assessment pillars, further contribute to robust risk management strategies.

CEO of Yield App Tim Frost had this to say about the Trovio partnership:

“We are proud to bring the cutting-edge expertise of our world-class DeFi risk management team and our industry-leading proprietary risk model to Trovio, a leading asset manager in the digital asset space. This exciting partnership presents an unprecedented opportunity to explore the synergies between our two businesses and we look forward to collaborating with Trovio on this offering.” (Source)

Benefits of Yield App Compared to TradFi or DeFi Platforms

One of the most appreciated aspects of Yield App is that it combines the best of both worlds: the high yields of decentralized finance (DeFi) and the security and convenience of traditional banking.

Unlike traditional banks, which offer low or even negative interest rates on deposits, Yield App offers up to 11% APY on your USD stablecoins. Good luck getting that at a bank.

Interest is generated from day one, with flexible products available without lock-up periods or hidden fees. You can also withdraw your funds anytime you want, with no penalties or delays. Some of the higher-yield products involve a minimum lock duration of 30 or 365 days and require locking YLD tokens, which we will cover later.

So, access to crypto and higher yields along with less red tape and restrictions make Yield App better than a bank, but what about DeFi?

Many of us who have been kicking around the blockchain for a while often forget just how much of a hassle DeFi can be. Think back to the first time you set up a MetaMask wallet, wrote down a recovery phrase, bridged tokens, signed a transaction, and had the transaction fail due to too low of a gas fee. DeFi interaction is not a familiar process, nor is the interface user-friendly and the DeFi protocol platforms themselves leave a lot to be desired from a user perspective.

How Your Friend Looks as You Explain The Concept of Liquidity Pools, Yield Farming, Recovery Phrases, and Why There is Something Called a HarryPotterObamaSonic10Inu Token. Image via Shutterstock

How Your Friend Looks as You Explain The Concept of Liquidity Pools, Yield Farming, Recovery Phrases, and Why There is Something Called a HarryPotterObamaSonic10Inu Token. Image via ShutterstockDeFi access needs to be easy. If we are going to onboard millions of users into crypto, interacting with a bridging platform then a DEX then a lending protocol via a browser extension wallet that is at high risk of phishing exposure and accidentally signing malicious transactions is not the way to mass adoption. That is where platforms like Yield App come into play.

Unlike other DeFi platforms, which require technical knowledge and experience to use, Yield App makes it easy and accessible for everyone. You don’t need to worry about managing wallets, keys, gas fees, or smart contracts. Users can simply deposit their funds into their Yield Wallet and let the platform do the rest. The Yield Portfolio is a diversified and optimized portfolio of DeFi assets that is managed by a team of experts and audited by reputable firms. You can also track and manage your portfolio performance and returns using the user-friendly interface of the Yield.app mobile app or web app.

Sleek, Well-Designed and Simple User Interface. Image via yield.app

Sleek, Well-Designed and Simple User Interface. Image via yield.appTo put it simply, Yield App taps into DeFi protocols on the back end to generate yield while providing a user-friendly front-end interface for users.

Benefits & Drawbacks of Yield App

Yield App undoubtedly offers attractive crypto investment possibilities and makes DeFi accessible to all. However, it’s essential to consider the potential drawbacks as well. Yield App has not disclosed which DeFi protocols they utilize to earn yield and the asset support isn’t the greatest. Fortunately, this is getting better in time and they recently added AVAX and BNB Chain into the mix.

When it comes to safety, deposits on Yield App are not protected by any governmental deposit scheme. With all that being said, Yield App has implemented several security measures to protect users’ digital assets, making it a relatively safe platform for crypto investments. Yield App goes to excruciating lengths in ensuring the safety and security of user funds, leaving us impressed with the findings, which will be covered later on.

Beyond the security measures of the platform, other pros come in the form of fee-free swaps, the ease of fiat on and offramp services, a unique IBAN for every user, making withdrawals from the platform seamless, and the ability to manage how the interest is allocated in the various earn products.

Yield App utilizes a blend of DeFi and market-neutral tactics including crypto arbitrage to produce secure returns on digital assets. It works in collaboration with external managers to ensure these returns. Furthermore, the platform is backed by reputable advisors and partners like:

- Simon Dixon’s BnkToTheFuture

- TrustSwap

- Yeoman’s Capital

- PALcapital

- Alphabit Fund

- Digital Strategies

In sum, Yield App deploys an extensive security and risk management framework to carefully vet all avenues of capital exposure and provides users with one of the safest and most reputable platforms in the industry for institutional and retail clients looking for crypto yield.

Key Features of Yield App

Yield App is a digital asset wealth management platform that enables users to earn interest on their cryptocurrency holdings through a Yield App account. Some of the key features of Yield App include:

- Immediate and no-cost on-ramp for GBP and EUR

- Dedicated IBAN for each user- Helps ensure seamless transfer of funds between accounts

- Daily compounding of interest

- Rewards program with bronze, silver, gold, and diamond tiers that offer up to 11% APY on cryptocurrencies.

- Market-neutral strategies: Yield App uses market-neutral strategies to generate returns and carefully evaluates the risk of every capital deployment. This approach is less risky than lending out customer funds, which is a common practice in DeFi platforms.

- Security: Yield App uses 256-bit encryption to protect users' accounts. Additionally, Yield App never lends out customer assets, which contributed to the fall of platforms like Voyager and Celsius, and follows a stringent risk management and diversification strategy to protect client capital.

- Diversification: Yield App aggregates user funds and invests them in a diverse portfolio of DeFi pools. This allows investors to diversify their investment portfolio and spread their risk.

- Compliance: Yield App is registered in the European Union as a Virtual Asset Service Provider (VASP) by Italy’s Organismo Agenti e Mediatori (OAM).

- User-friendly interface: Yield App has a user-friendly interface that makes it easy to use the platform. The Yield App mobile app is also available, which allows users to access all the same features as the web platform.

Yield App offers a variety of features designed to facilitate the management of digital assets. In the following subsections, we’ll delve deeper into the functionalities of:

- Yield Wallet

- Yield Earn

- Yield Pro

- Yield App Angel Launchpad

- Instant Swaps on Crypto and Fiat

- Fiat Deposits, Withdrawals, and Buying Crypto

- The mobile experience

- Unlocking rewards with the Yield App YLD Token.

Each of these features has been designed to make managing digital assets easier and more efficient.

Yield Wallet

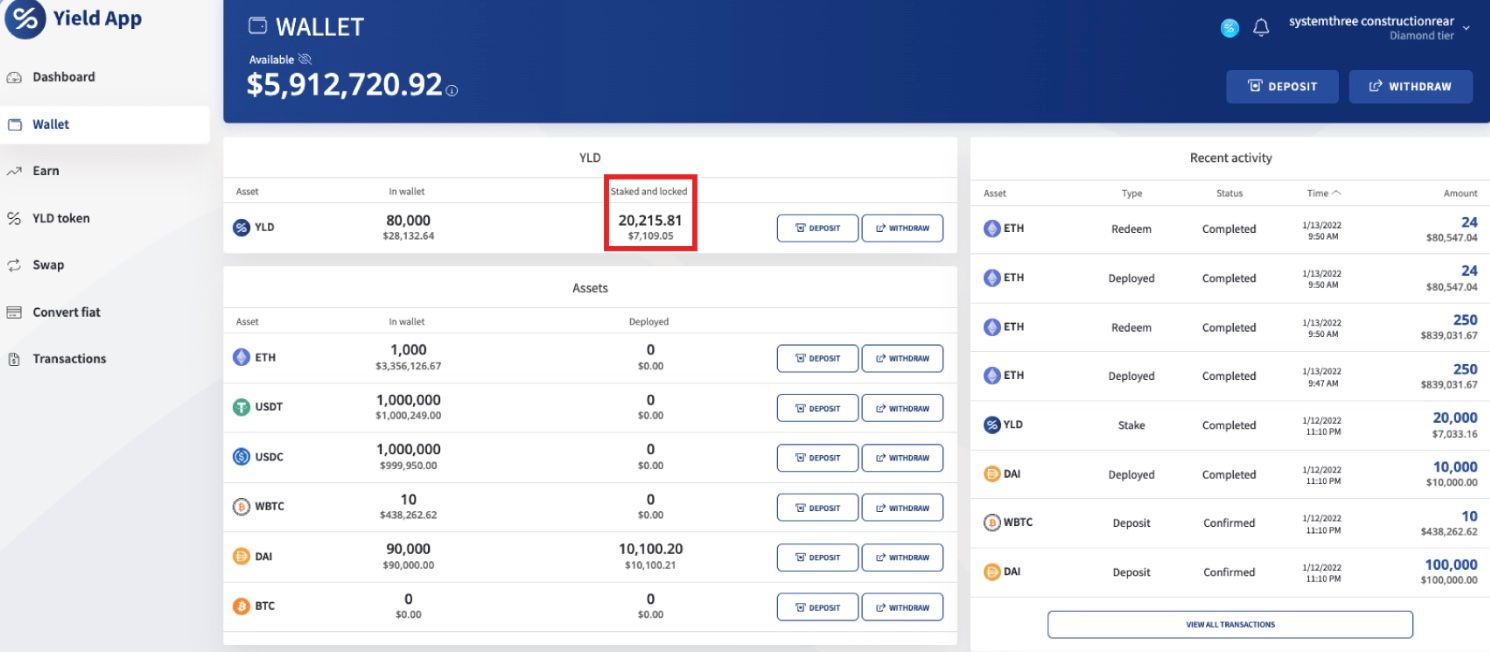

Yield App has developed an in-house custodial wallet that was launched with the V2 platform upgrade. The function of the wallet is to act as a multi-asset, cross-chain wallet that exists within the Yield App.

With safety being of paramount concern, Yield App has recently integrated with Fireblocks, a leading wallet service provider that features insurance on all assets in custody and in transit.

A Look At the Yield Wallet Highlighting the Portion of Assets Staked. Image via yield.app

A Look At the Yield Wallet Highlighting the Portion of Assets Staked. Image via yield.appThe wallet is protected by the institutional-grade security measures utilized by the rest of the app which we will cover in a later section and the wallet’s architecture is shielded within ring-fenced data infrastructure that includes data centers, chain dedicated nodes, bespoke hardware security modules, user databases, portfolio engines and a regulatory risk management suite.

The Yield Wallet is the area that shows assets held and is where you will go to manage your assets and make deposits or withdrawals.

Yield Earn

Here we get into the driving attraction to Yield App, the ability to earn on your crypto assets. Yield App provides users with daily, compounding interest.

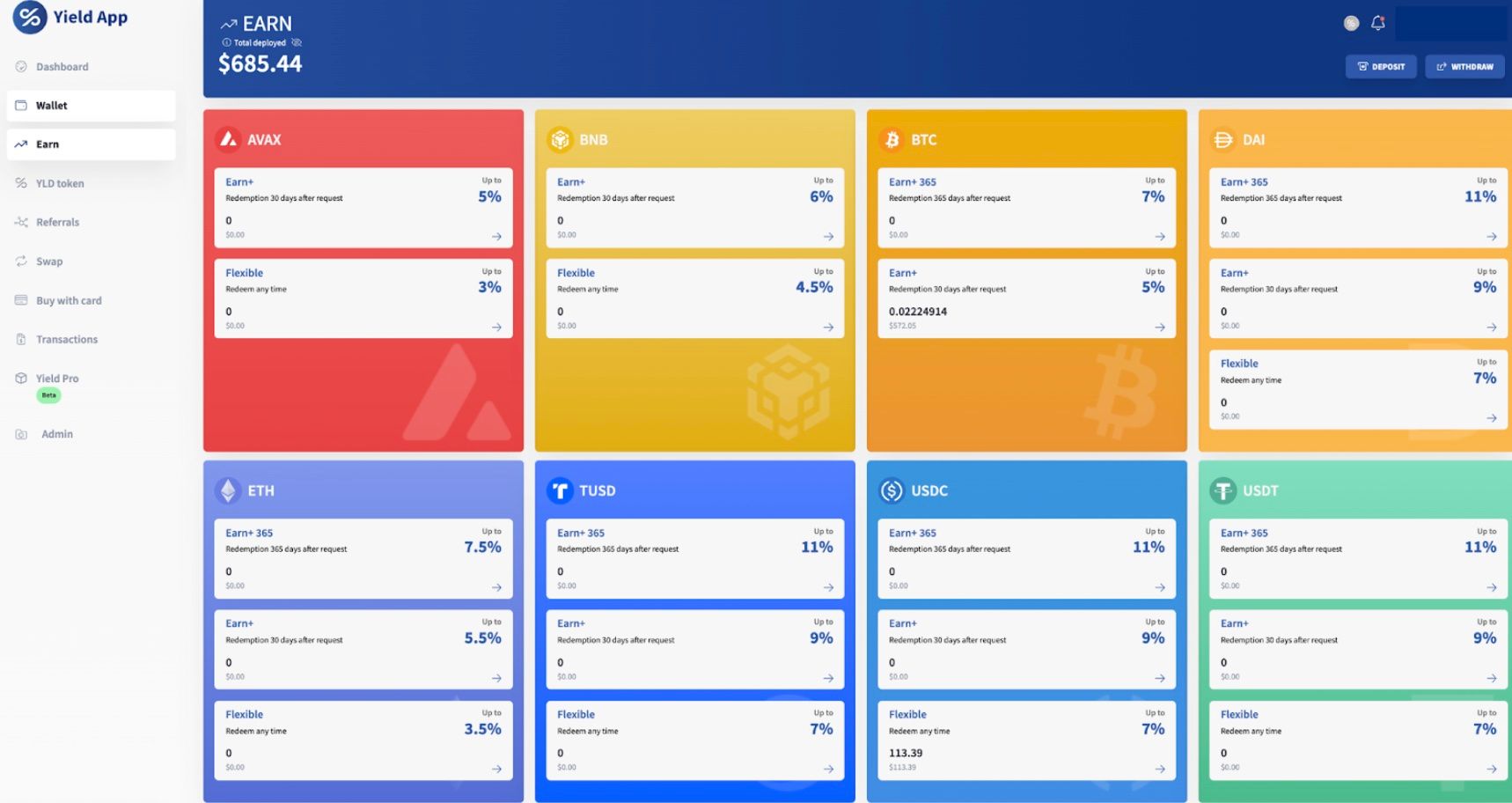

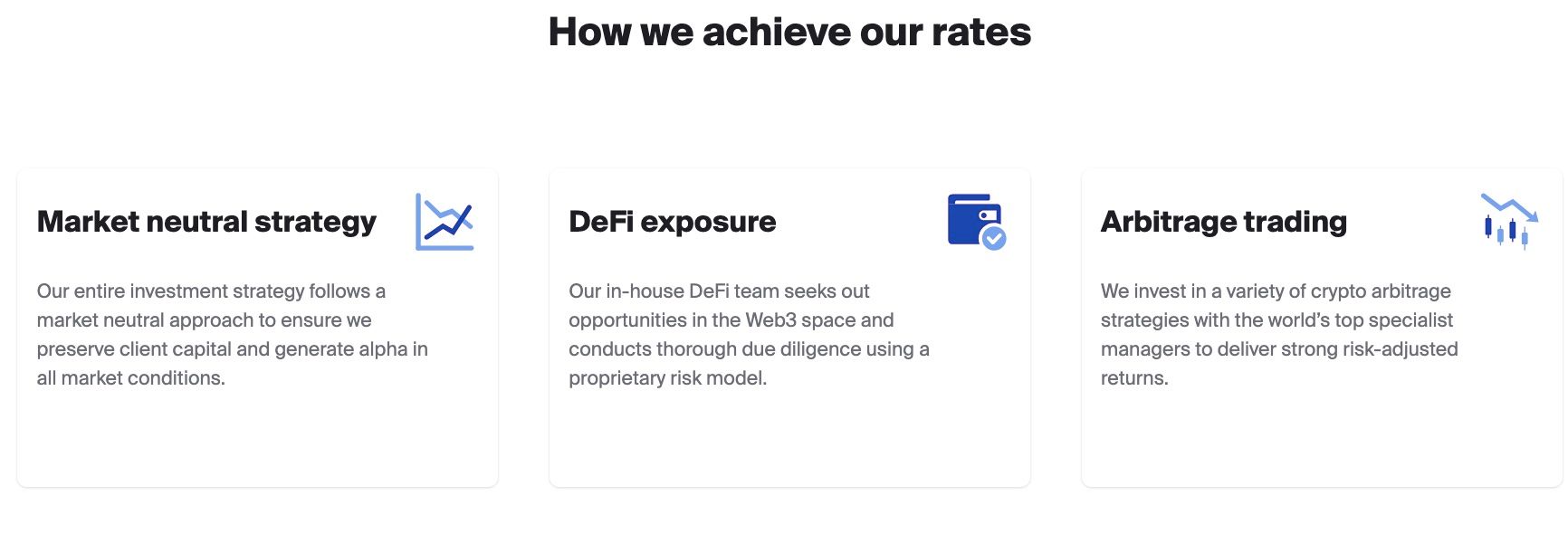

Source: yield.app

Source: yield.appThe platform uses a market-neutral strategy to ensure client capital is preserved and that alpha can be generated in all market conditions. Through carefully vetted DeFi exposure, the Yield App team sources low-risk opportunities in the world of Web3.

Image via yield.app

Image via yield.appThere are three basic products under the Earn category that enable users to start earning:

Earn+365- This product offers the highest returns of up to 7% on Bitcoin, 11% on Stablecoins and up to 12% for users who lock up YLD tokens for 12 months. Assets in this category need to be locked up for a minimum of 365 days.

Earn+- This product requires tokens to be locked for a minimum of 30 days to achieve rates such as up to 5% on Bitcoin, 5.5% on Ethereum, and up to 9% on Stablecoins.

Flexible- As the name implies, assets exposed to this product remain liquid and can be redeemed at any time with no lock duration. Rates go up to 3.5% on Ethereum and up to 7% on Stablecoins.

These rates are subject to the Loyalty Tiers, which we will cover below.

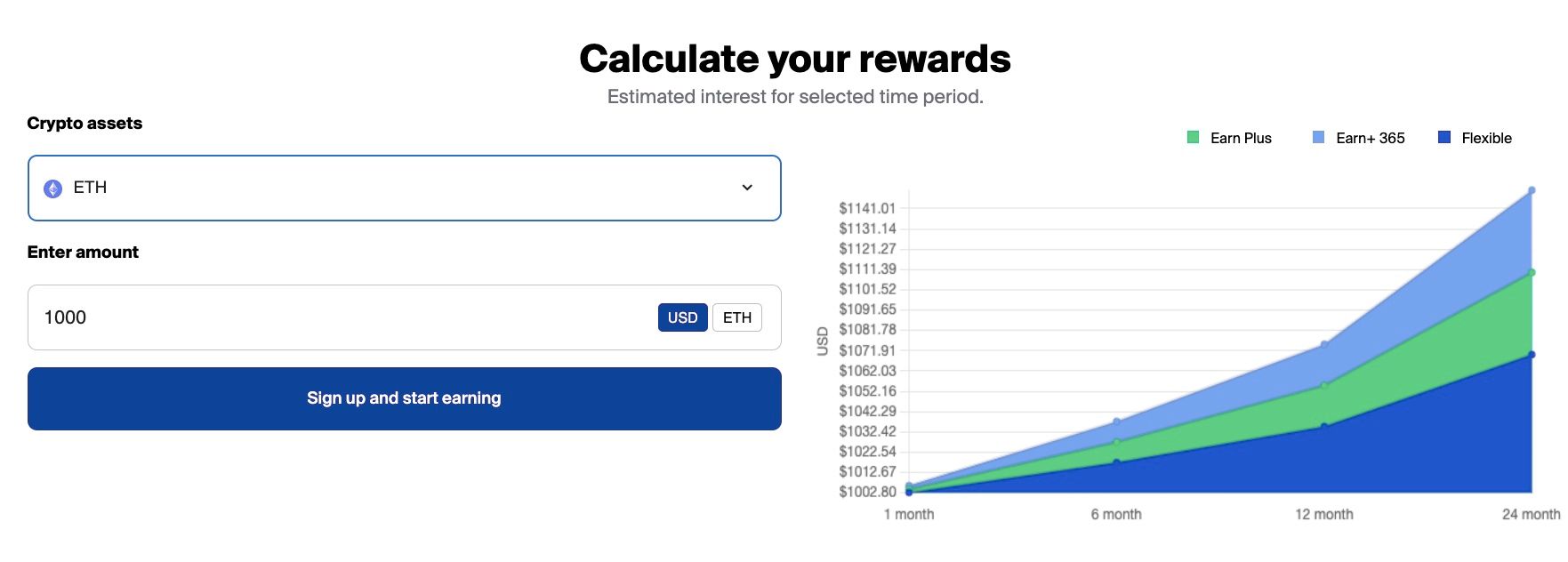

I would like to highlight this handy Rewards Calculator that shows how much you can earn on your crypto:

Calculator Showing How a 1K Ethereum Investment Would Have Performed in the 3 Different Products. Image via yield.app

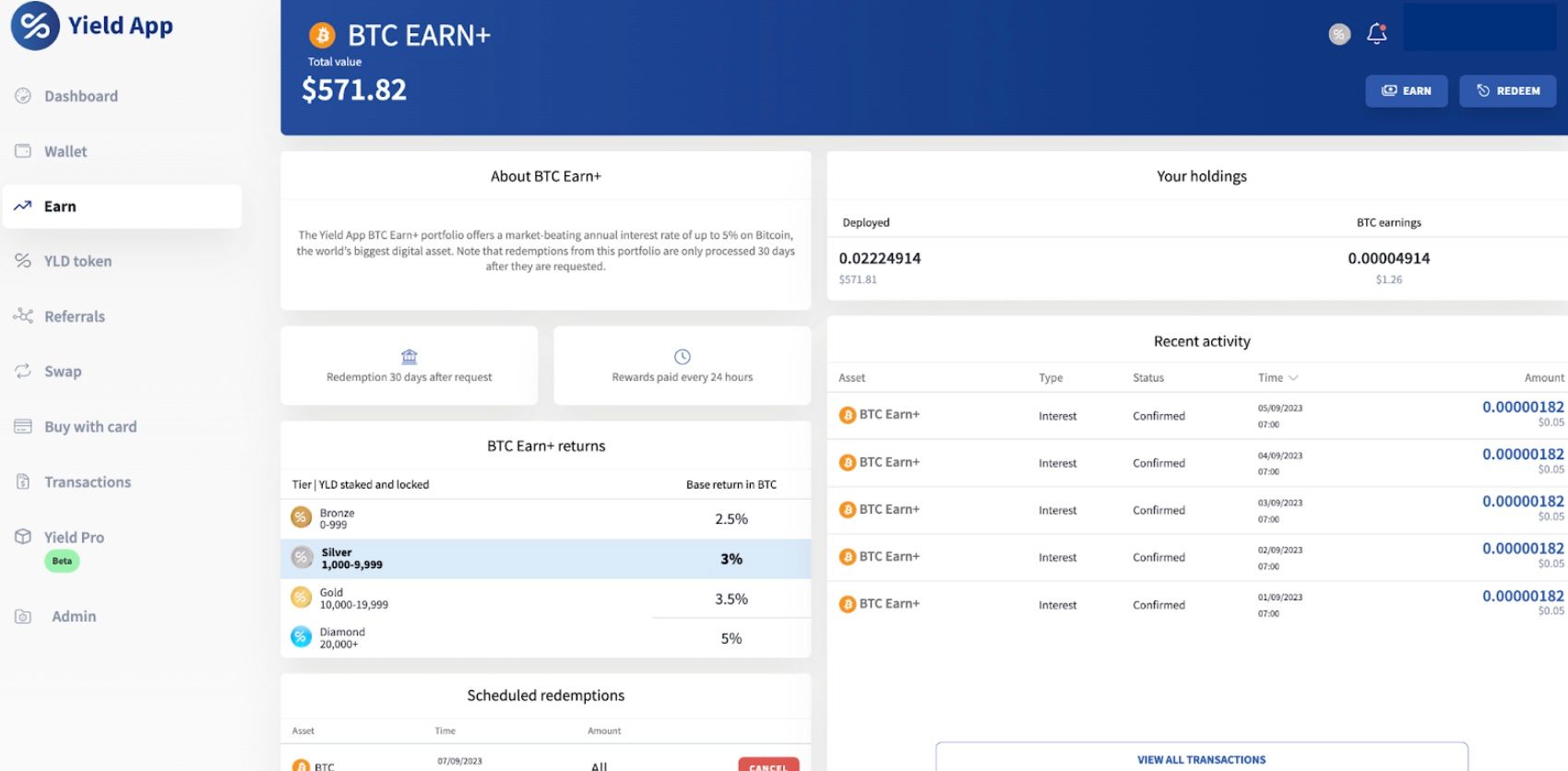

Calculator Showing How a 1K Ethereum Investment Would Have Performed in the 3 Different Products. Image via yield.appHere is a look at the Earn screen, users can see all their available portfolios categorized by asset for simple and clear navigation and gain insights into individual assets' returns and deployed funds.

A Look at the Earn Screen. Image via Yield App

A Look at the Earn Screen. Image via Yield AppYield Pro

Yield Pro offers advanced structured products made possible through Yield App’s acquisition of Trofi Group. These products are generally higher risk and better suited for sophisticated investors, however, there are also principal-protected products on the way for users who prefer a capital guarantee plus the potential for upside. Fortunately, Yield Pro also offers a simulator app that allows users to test out the structured products risk-free before allocating live capital.

Image via yield.app

Image via yield.appAt the time of writing, there are three products available in Yield Pro with more products to be introduced at a later stage.

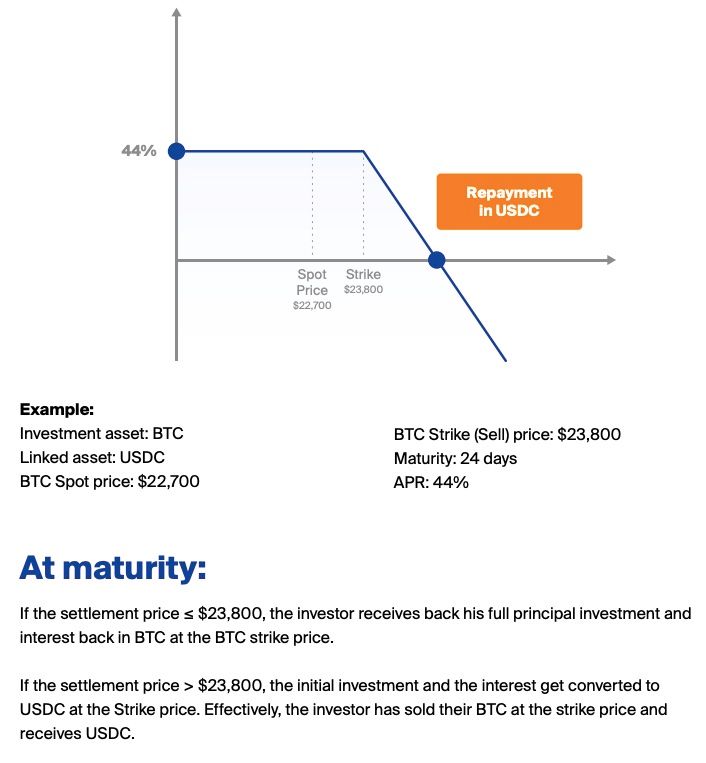

Sell-High Dual Currency- This product is suitable for clients who are holding a cryptocurrency, and are happy to sell this asset at a higher-than-current market price should prices appreciate. The investor can choose the maturity period (in days) from a wide range of available options.

Here is an example taken from Yield App’s Sell-High Dual Currency Fact Sheet:

Image via yield app Fact Sheet

Image via yield app Fact SheetBuy-Low Dual Currency- This product is the inverse to the Sell-High Dual Currency. You can learn more about it in the Buy-Low Dual Currency Fact sheet.

Yield App Angel Launchpad

In 2024, Yield App announced that they would be launching their Angel Launchpad, providing users with an opportunity to invest in early-stage crypto projects before they launch their token to the public.

The Angel Launchpad is a platform designed to support early-stage projects in the crypto space and provide them with the necessary resources, guidance and exposure needed to give them their best chances of success at launch.

For users, the Launchpad provides access to tokens at discounted sale prices before they are available to the public. This type of investing was traditionally reserved for VCs and privileged investors, so it is great to see Yield App launch this type of initiative.

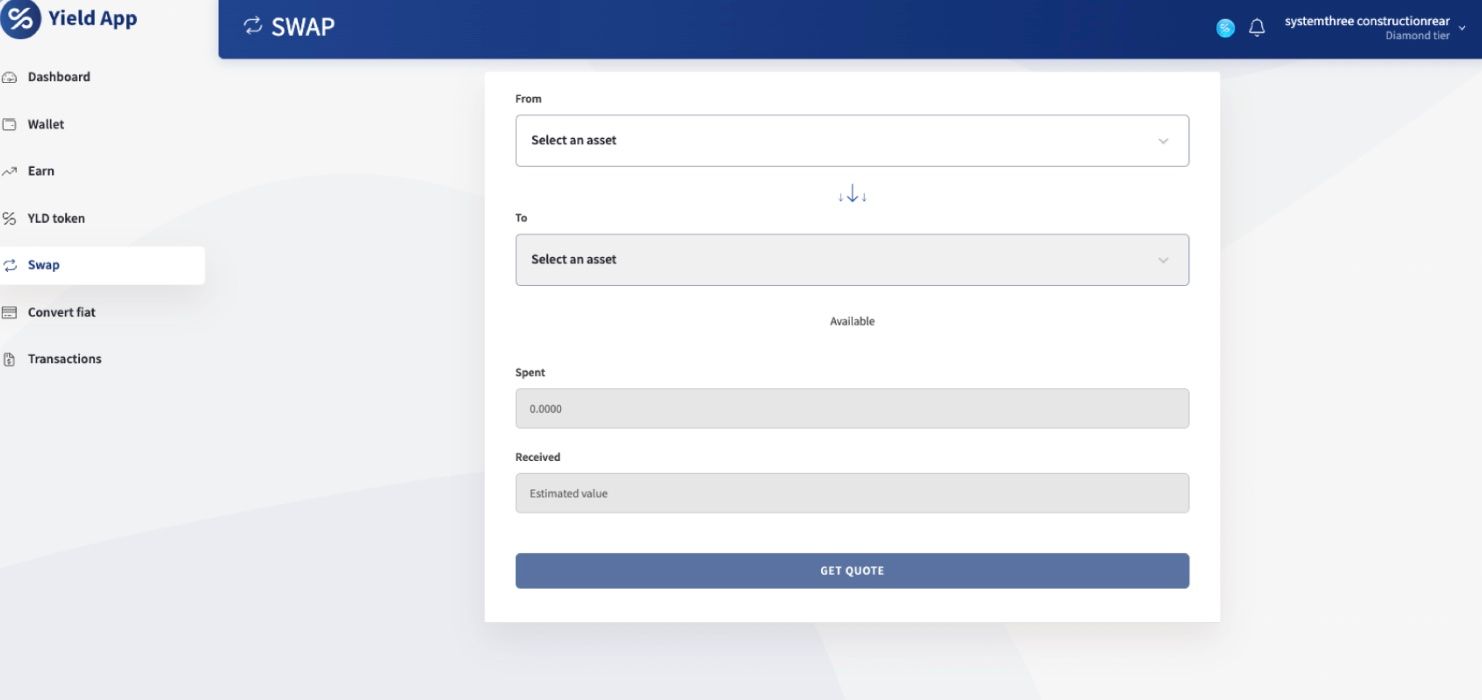

Swap Assets

Swap is the appropriately named feature that allows users to seamlessly swap between supported cryptocurrencies on Yield App. Users who have completed KYC level 2 requirements and have funds in their wallet can utilize this function to exchange any of the supported assets.

Image via yield.app

Image via yield.appBeing able to seamlessly swap between crypto, or from crypto to fiat, is a massive perk in my opinion, and doing so without fees? Bonus!

The interface for swapping assets is also quite straightforward and intuitive.

A Look at the Simple to Use Swap Feature. Image via Yield App

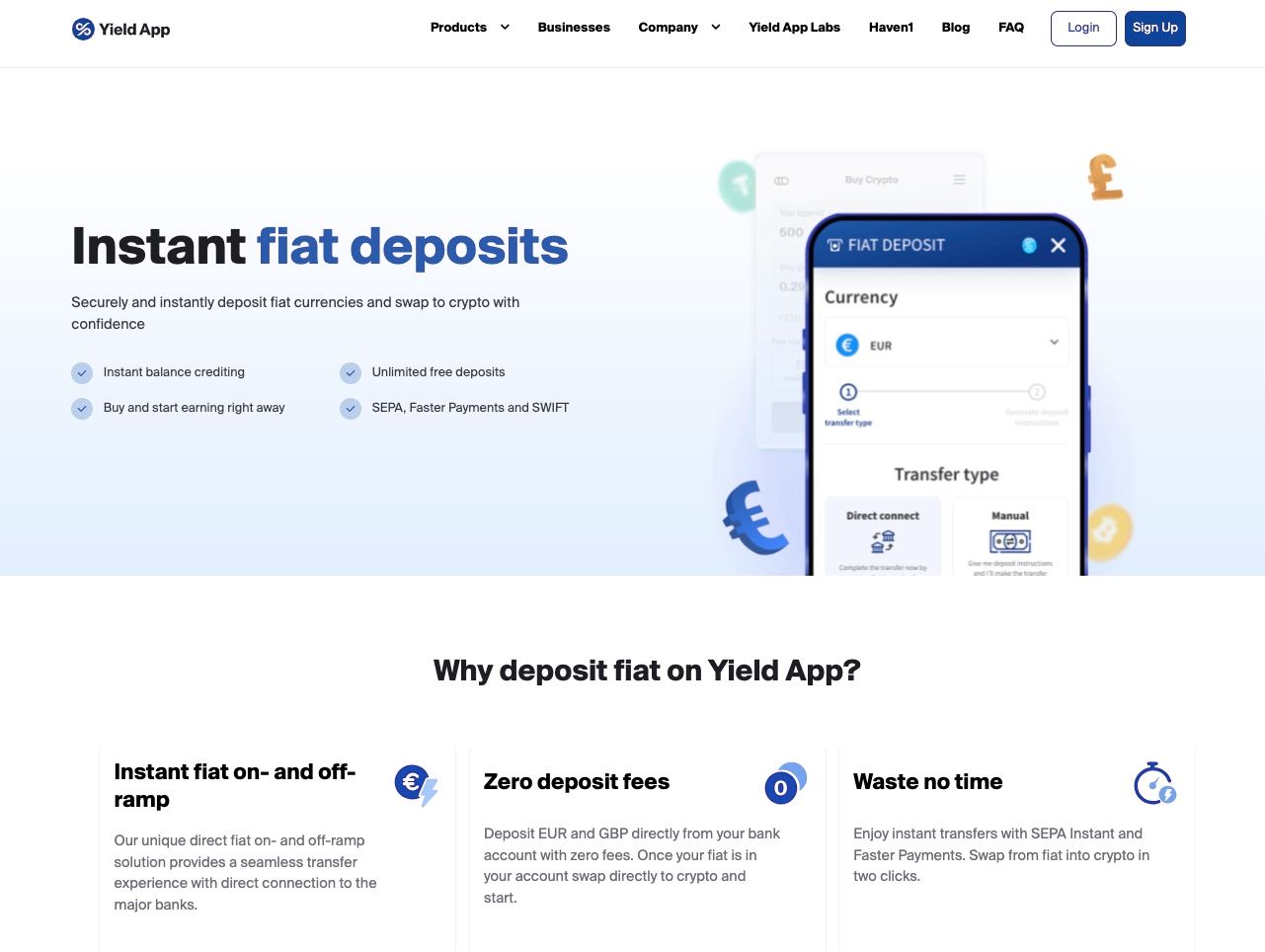

A Look at the Simple to Use Swap Feature. Image via Yield AppFiat Deposits, Withdrawals, and Buying Crypto

Here is another one of Yield App’s strengths, their robust fiat rails and gateway. I guess all those years spent in banks by members of the executive team have taught them a thing or two about how to handle fiat the right way.

I don’t know about you, but as someone who works hard for my Satoshis, I have no desire to use crypto platforms that cannot execute bank deposits and withdrawals.

Pro Tip!: Although convenient, most crypto platforms that support the purchase of crypto via bank or credit card charge a pretty hefty fee for that convenience. If you plan on making frequent crypto purchases, try and find a platform that can facilitate bank deposits to get the most bang for your buck.

Save on Fees and Take Advantage of Fee-Free Deposits. Image via Yield App

Save on Fees and Take Advantage of Fee-Free Deposits. Image via Yield AppYield App has passed all the required criteria from the authorities and auditors to be able to facilitate direct connection to a user’s bank account for seamless GBP and EUR transfers. Additionally, each Yield App user is assigned their own banking IBAN, meaning withdrawals from Yield App come from an account in your name.

For any of you that have had crypto transactions censored by your bank, you will understand how helpful this is. Users can benefit from immediate Euro (EUR) and British Pound (GBP) deposits and withdrawals, made possible by Yield App's collaborations with top-notch fiat service providers.

Seamlessly move funds between your bank account and Yield App through virtual IBANs, ensuring a smooth and protected process. In addition, the minimum amount to deposit stands at just 1 EUR/1 GBP making it extremely convenient to try the feature before fully committing.

While deposits are free, fiat withdrawals will be subject to the following fees:

- EUR 0.1% with a minimum of 15 EUR

- GBP 0.1% with a minimum of 15 GBP

To purchase cryptocurrencies on Yield App, users can swap fiat deposited via bank transfer or use a credit card, or Apple/Google Pay through the Yield Buy Crypto feature. In order to utilize this feature, users must have completed KYC level 2.

As for crypto withdrawal fees, users can expect the following fees if they choose to withdraw their crypto:

| Asset/Network | Withdrawal Fee | Maximum Amount |

| BTC | 0.0007 BTC | 0.0008 BTC |

| ETH (ERC-20) | 0.01 ETH | 0.03 ETH |

| USDC/USDT/DAI (ERC-20) | $10 | $100 |

| BNB (BEP-20) | 0.005 BNB | 0.01 BNB |

| YLD (ERC-20) | 20 YLD | 100 YLD |

| AVAX | 0.05 AVAX | 0.1 AVAX |

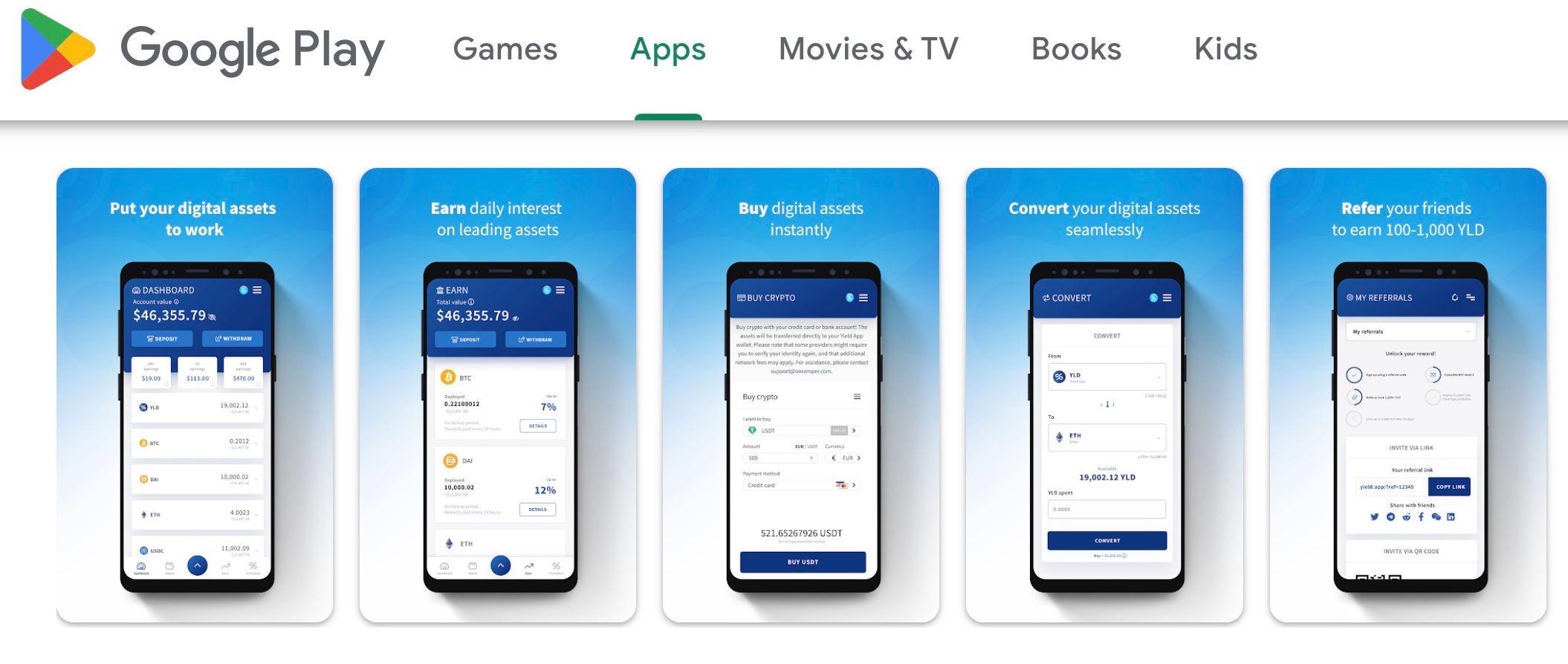

Exploring the Yield App Mobile Experience

The Yield App mobile experience provides users with an intuitive and user-friendly interface for managing their digital wealth on the go. The mobile app allows users to:

- Buy

- Swap

- Earn

- Stake

Moreover, it features fingerprint/face ID that comes on most modern mobile devices for enhanced security.

Yield App Mobile Wallet. Image via Google Play

Yield App Mobile Wallet. Image via Google PlayAs far as ratings and reviews go, the app itself appears to be well-made and functional, with an impressive 5-star rating on Google Play.

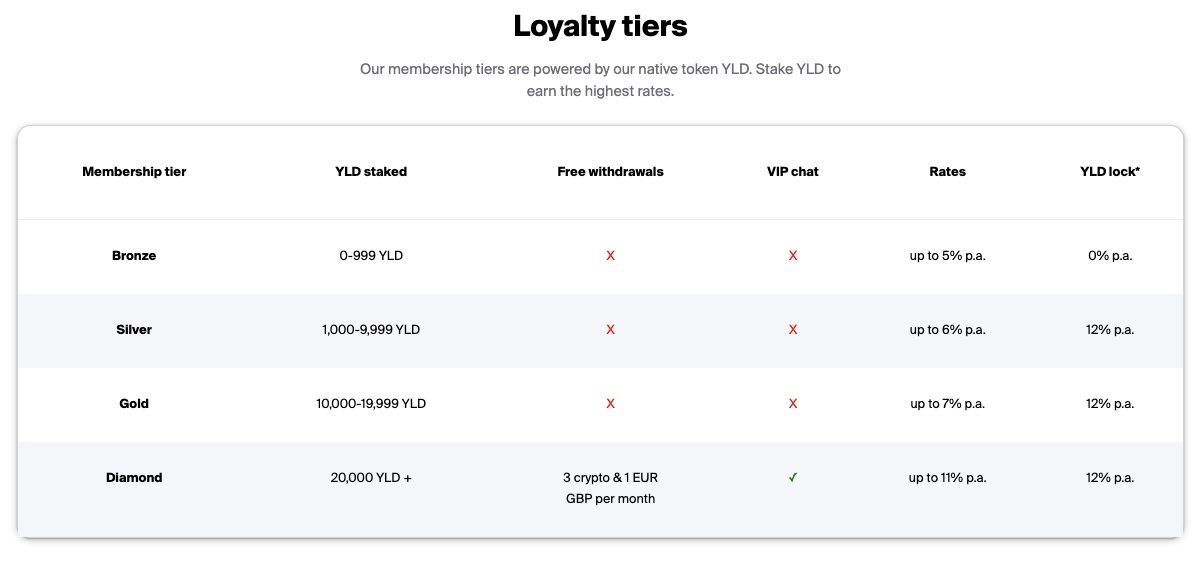

Unlocking Rewards with the Yield App YLD Token

The Yield Token, YLD, serves as a membership token that allows users to unlock higher interest rates and additional benefits by advancing up the tier structure.

Here is a look at the loyalty tier levels running from bronze to diamond:

Yield App Tiers. Image via Yield App

Yield App Tiers. Image via Yield AppTo unlock rewards with the Yield App token, YLD token holders must hold a specified amount of YLD in their Yield App wallet, with daily rewards earned based on their YLD balance.

Here are some quick facts about and benefits of the Yield Token:

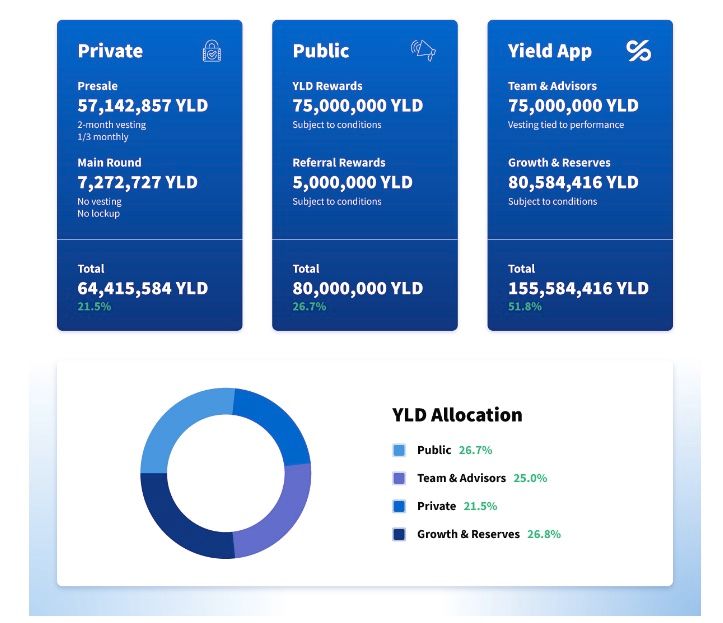

- YLD has a total supply of 300 million tokens, allocated as follows:

Yield Token Distribution. Image via yield.app/blog

Yield Token Distribution. Image via yield.app/blog- Users receive up to a 11% APY by holding YLD tokens in the app. YLD tokens generate up to 12% annualized holding rewards, paid daily in YLD.

- 45,000,000 YLD will be distributed as YLD rewards to users.

- The final token unlock according to the vesting schedule will be Q1 of 2025.

Yield App’s Haven1 Blockchain

Yield App is more than just a yield generation platform. In 2023 the team announced that they would be launching their own EVM-compatible blockchain, Haven1.

Haven Blockchain. Image via haven1.org

Haven Blockchain. Image via haven1.orgHaven1 was established out of the need for a secure blockchain to drive mass adoption of on-chain finance.

The team has identified the following core issues in traditional blockchain and DeFi, which inspired the need to create something better:

“Over 5b has been lost in DeFi due to hacks and exploits, resulting in a loss of faith in the security of blockchain technology. This has contributed to regulatory uncertainty and stifled the adoption of web3” (source)

Haven1 aims to overcome these challenges and provide the next evolution in blockchain technology.

Haven1 benefits. Image via YouTube/Haven1

Haven1 benefits. Image via YouTube/Haven1Haven1 does this by implementing a unique provable identity framework. By combining the cold storage of assets and robust network-level risk controls to mitigate malicious activity, Haven1 will help to ensure that users can confidently transact in a secure manner on the Haven1 network.

This provable identity makes it possible to achieve use cases such as on-chain lending that can zero in on real-world credit scores to prove creditworthiness.

The network also focuses on the tokenized future that we all know is coming, combining blockchain technology with real-world assets such as property, stocks, bonds, commodities, etc.

The Haven1 network does not seek to be the next “Ethereum Killer” but rather, seeks to complement Ethereum as a Sidechain as shown below:

Haven1 complements Ethereum. Image via haven1

Haven1 complements Ethereum. Image via haven1There is already a growing ecosystem on Haven1, with applications such as HavenSwap, HavenLend and HavenPerps.

The experts over at Token Metrics dove in and performed an in-depth review and analysis of Haven1 and concluded the following:

“Haven1 stands out as a promising solution in the blockchain space, aiming to redefine secure on-chain finance by merging security, regulatory compliance, and user experience. Its strategic approach, robust technology, and strong backing position it as a potential game-changer in the DeFi ecosystem. While still in its early stages, the project shows promise in terms of innovation, architecture, and commitment to quality and user-centric design” (Source)

Notable scores from the findings that are worth highlighting are:

- Code Quality: 15/15 (perfect score)

- Developer-Friendly: Fast 20-50 minute comprehension

- Post-Mainnet Projection: An Impressive 83.64% Score

To find out more about this exciting innovation in blockchain technology and the Haven1 Token, feel free to check out the links below:

- Haven1.org

- Haven1 Ecosystem

- Haven1 Litepaper

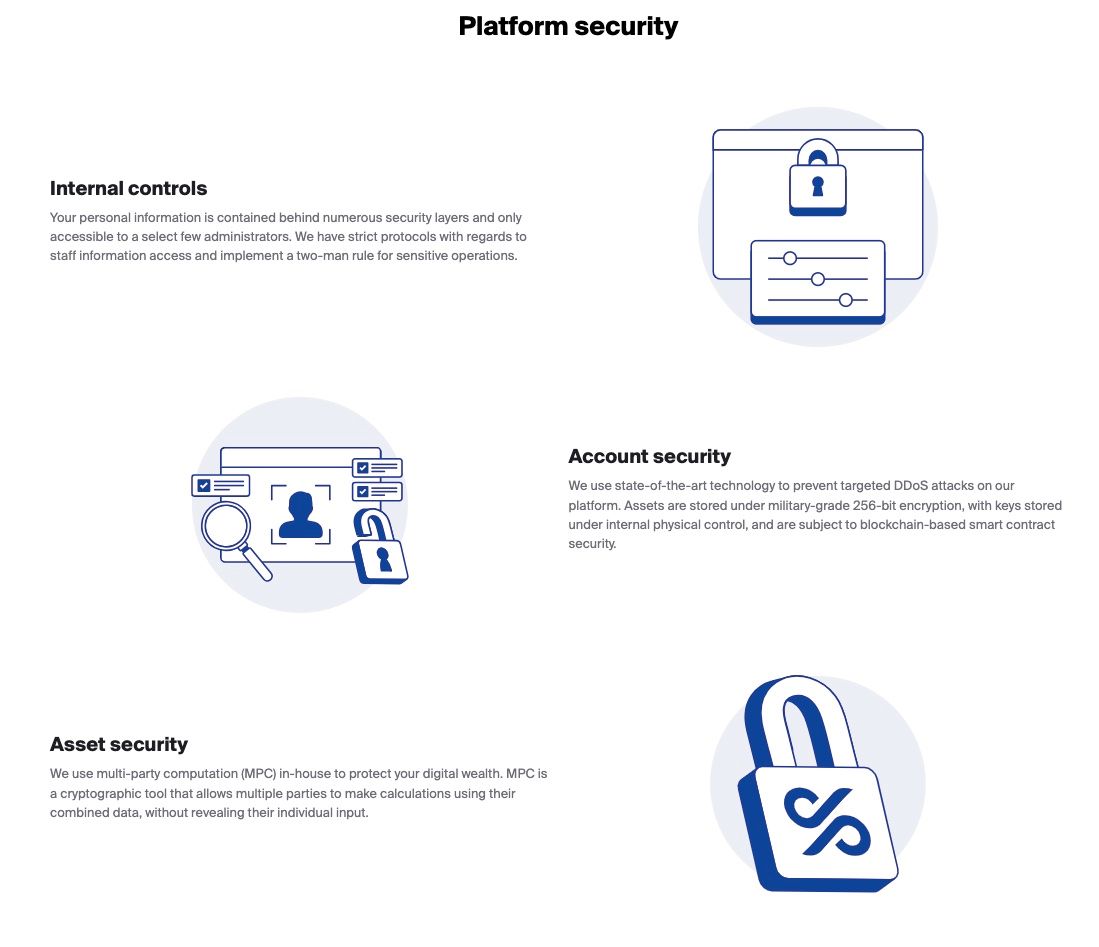

Protecting Your Digital Assets

Ensuring the safety of users’ digital assets is a top priority for Yield App. The platform has implemented several security measures, such as:

- Two-factor authentication

- Activity logging

- Session monitoring

- Alert emails

- Address whitelisting

- Bug Bounty

Yield App utilizes 256-bit encryption to ensure that users’ accounts are secure. This is a very high-level security measure and provides increased protection from unauthorized access to personal data.

By incorporating these security measures, Yield App aims to provide a safe environment for users to invest and earn interest on their digital assets.

Robust Risk Management: The team at Yield App, consisting of skilled experts, created an advanced 135-point proprietary risk model. This intricate model considers elements like the security of contracts, past track record, liquidity, and the quality of governance. Less than 10% of the protocols manage to meet their rigorous evaluation criteria, underscoring their unwavering dedication to ensuring security.

Diversified Strategy Approach: A range of investment tactics are employed, with a notable focus on crypto arbitrage, capitalizing on price inconsistencies among various exchanges or markets to achieve financial gains. They utilize techniques such as liquidation arbitrage, volatility arbitrage, and triangulation arbitrage, which have proven over time to perform well especially when the market experiences significant fluctuations. This methodology helps to ensure a strong level of diversification, diminishing the likelihood of portfolio setbacks and vulnerabilities at individual junctures.

Advanced Security Measures: The platform functions with security protocols of institutional calibre, upholds the most rigorous worldwide regulatory benchmarks, and upkeeps elevated platform security. Rigorous measures are in place to safeguard both your digital assets and personal data, meticulously crafted to align with the most stringent global data regulations.

Yield App Security. Image via Yield App

Yield App Security. Image via Yield AppTo dive a little deeper into the due diligence framework, Yield App focuses on the following key risks that exist in the Defi ecosystem:

- Smart Contract Risk: To hedge against smart contract risk, Yield App uses an internal proprietary 135-point risk model to analyze all aspects of market exposure.

- Platform Risk: Using state-of-the-art technology and enhanced security features, Yield App employs a strict screening process to vet the platforms they utilize for asset exposure.

- Counterparty Risk: Yield App utilizes the expertise of external audits, ongoing third-party monitoring, risk assessment, and strict diversification rules.

- Market Risks: Risks such as impermanent loss are mitigated by ensuring that the platform never engages in risky leveraged investments and ensure they diversify across assets and platforms. All liquidity pools allocated to are large and curated.

By engaging in highly liquid and low-risk strategies, diversifying, and following a rigorous risk and governance framework, Yield App was able to avoid exposure to over-leveraged and risky parts of crypto that led to disasters such as the UST implosion and the 3-Arrows Capital fiasco. Yield App also avoided similar fates of collapsed platforms Celsius, BlockFi and Voyager, ultimately surviving tough market conditions and gaining trust in the industry.

Yield App Membership Tiers and Benefits

Yield App offers four membership tiers.

- Bronze

- Silver

- Gold

- Diamond

These tiers are determined by the amount of YLD users hold in their wallets. Each tier comes with its own set of advantages, including higher interest rates, access to exclusive products, and additional rewards. Diamond Tier clients enjoy access to an exclusive discord community where they can engage with the team and other Diamond Tier clients.

Relationship Manager Program: Top-tier service is available through Yield App's distinctive Relationship Manager initiative. Clients who meet the criteria by depositing $100,000 (USD equivalent) are designated as VIP members. With an assigned Relationship Manager at their disposal, clients will benefit from a tailored singular point of contact for assistance, swift resolution of inquiries, and privileged entry to upcoming products and services.

Supported Cryptocurrencies on Yield App

Yield App supports several cryptocurrencies for investment and earning interest, including stablecoins like USDC, USDT, DAI, or TUSD, Ethereum (ETH), Bitcoin (BTC), Binance Coin (BNB), Avalanche (AVAX) and YLD tokens.

Diving into the Yield App Bitcoin Fund

Yield App offers a Bitcoin Fund that enables users to invest their Bitcoin and earn up to 7% APY. The minimum deposit for the Yield App Bitcoin Fund is 0.005 BTC.

APY will depend on a user’s tier level and the highest APY will be experienced by Diamond Tier users who hold 20,000 YLD.

Customer Support and Assistance

Yield App offers a range of customer support options to assist users, including 24/7 live chat on their website, Telegram and Discord, a help center with FAQs available on their website or by contacting [email protected].

Yield App Referral Program and Rewards

Yield App offers a referral program that rewards both parties $25 in BTC when they sign up using their friend’s unique referral link or QR code.

Yield App Referral Program. Image via Yield App

Yield App Referral Program. Image via Yield AppThis is a great incentive for users who are advocates of the platform and want to earn a bonus for spreading the word.

Yield App Review: Summary

In conclusion, Yield App presents a compelling opportunity for investors seeking high-yield crypto investment possibilities. With its diverse features, user-friendly interface, and commitment to safety and regulation, Yield App stands out as a promising platform for managing and growing your digital assets. As with any investment, it’s important to weigh the pros and cons and conduct thorough due diligence before diving in.

With the information provided in this comprehensive review, you are now equipped to decide whether Yield App is the right platform for you.

Disclaimer: This is a paid review, and as such, the views and opinions expressed within it do not reflect those of the Coin Bureau. The inclusion of this content on the Coin Bureau platform should not be interpreted as an endorsement or recommendation of the project or product being discussed. The Coin Bureau assumes no responsibility for any actions taken by readers based on the information provided within this article. Readers are encouraged to conduct their own research and due diligence before making any investment decisions.