The Coin Bureau prides itself on bringing you the best and the brightest in the glittering crypto universe. From reviews to guides to in-depth analyses, you've probably used The Coin Bureau's successful YouTube channel and website to uncover the hidden gems of the crypto world. But hold on to your crypto wallets folks for we're about to embark on an adventure into the murky depths of the crypto jungle.

Today, we'll unravel the secrets of Yobit, a crypto exchange that has a lot of mixed reviews online. To say there are a couple of things you need to know before signing up for Yobit would be an understatement.

Before we move any further, please know that even though we're diving head-first into the Yobit exchange, which isn't the type of Triple-A-rated exchange we normally cover, our mission is serious business — we take our role as your trusty crypto guides seriously. In an industry rampant with scams, we consider it our duty to separate the genuine from the fraudulent and the innovative from the ludicrous. While we might crack a few jokes, our commitment to arming you with the right knowledge remains unshakable.

With that out of the way, it's time to grab your magnifying glasses, put on your detective hats and officially begin this YoBit review.

YoBit Exchange Summary:

Yobit is a centralized cryptocurrency exchange of unconfirmed current location but original ties in Russia. The platform offers access to hundreds of digital currencies. The online grapevine has been buzzing with accusations that Yobit is a scam. But wait, there's more! Yobit was also found to be running a side hustle in 2018 as the promoters of pump-and-dump schemes, which, of course, is illegal.

The Key Features of YoBit Are:

- YoFarm

- YoDice

- InvestBox

- YoStep

YoBit Overview

For cryptocurrency exchanges, first impressions matter. The most credible exchanges are aware of this and go on a charm offensive because they understand they're not just selling crypto services, but also trust, reliability and the promise that users' investments are treated with the utmost care. This is why many platforms dedicate prime real estate on their homepages to flaunt their accomplishments. Security protocols are proudly paraded, and an "About Us" section serves as an origins story.

Not YoBit though.

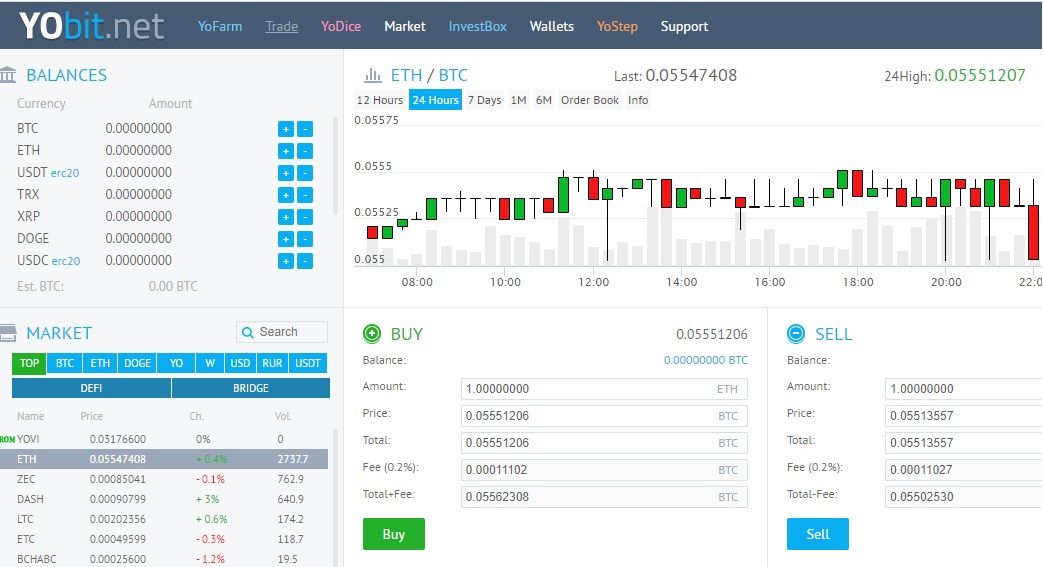

Where Homepages Go to Hibernate. Image via YoBit

Where Homepages Go to Hibernate. Image via YoBitInstead of the red carpet treatment, you're met with a homepage that appears to be stuck in a time warp. As I navigated through the digital labyrinth that is YoBit, I couldn't help but wonder if they hired a mad scientist to create the layout, mixing equal parts chaos and confusion. The homepage hits you like a tornado of information overload. There's no calm before the storm; just an immediate onslaught of charts and graphs without warning.

The absence of an "About Us" section leaves users in the dark about the faces behind the curtain. As other exchanges flaunt their security measures, Yobit seems to keep theirs in the shadows.

The lack of vibrancy is also profound. As you step into YoBit's homepage, you're greeted by an uninspired colour palette. While other exchanges splash their homepages with a kaleidoscope of colours, YoBit's designers decided to embrace mundanity. Of course, this isn't necessarily wrong, but it is decidedly out of step with the lively atmosphere of the crypto world.

Then, there's the issue of the HQ itself. Depending on where you look, Yobit is based on a different continent. Crunchbase puts the HQ in Panama City. According to YoBit's own LinkedIn page, the exchange is based out of Russia. On top of that, its Company House profile in the UK shows the business as "dissolved" as of July 2018. For what it's worth, most news outlets consider Russia as YoBit's home base even as its X (formerly Twitter) profile puts the HQ in Panama.

Speaking of X, YoBit has the reply button disabled. My two Satoshis? The exchange has erected a digital force field around its presence on X due to numerous allegations accusing it of running a scam. The reply button might be off, but questions and concerns continue to linger.

Though, we should also point out the other side of the coin and grasp a straw for a possible defense. Some users online have defended the platform as an advocate for privacy, with the team and users being anonymous and unknown. There is no KYC needed to trade, so it has attracted the attention of traders who wish to remain anon.

Here at the Bureau, we understand the need for privacy and anonymity and support anyone's right to privacy, but ultimately it is up to you to decide if the need for privacy outweighs user safety.

Who Founded YoBit?

This is a mystery fit for Sherlock Holmes!

YoBit has anonymous founder(s). Nobody knows for sure who founded the exchange, but Pavel Krymov is considered to be the founder or at least someone associated with YoBit. This information is available through amateur investigations by those who have suffered from Krymov's schemes. As a result, it should be taken with a grain of salt.

Krymov's name itself doesn't set off any alarm bells but dig a little and you'll find information on his endeavours that read like a who's who of questionable enterprises and check every box in the "How To Not Run A Legitimate Business" playbook.

At least six financial pyramids — Questra World, Forex Trend, Panteon Finance, A.G.A.M and Skopalin — have been connected to Krymov. Together, his businesses have fetched him $30 million.

The Man Behind a Series of Financial Pyramids That Make Jenga Towers Look Stable. Image via Facebook

The Man Behind a Series of Financial Pyramids That Make Jenga Towers Look Stable. Image via Facebook In February 2018, Krymov was arrested over allegations of setting up fraud financial schemes. His notoriety is so high that there's a Facebook page called “STOP Krymov,” which has over 3,000 members. The group, however, appears to have stopped being active as its last post was in February 2017, a year before Krymov's arrest. There's also little information available on whether his arrest yielded any results for law enforcement agencies.

YoBit Features and Benefits

Even for an exchange shrouded in mystery, YoBit has an array of features, but they fall short by a wide margin in comparison to most other exchanges.

YoFarm

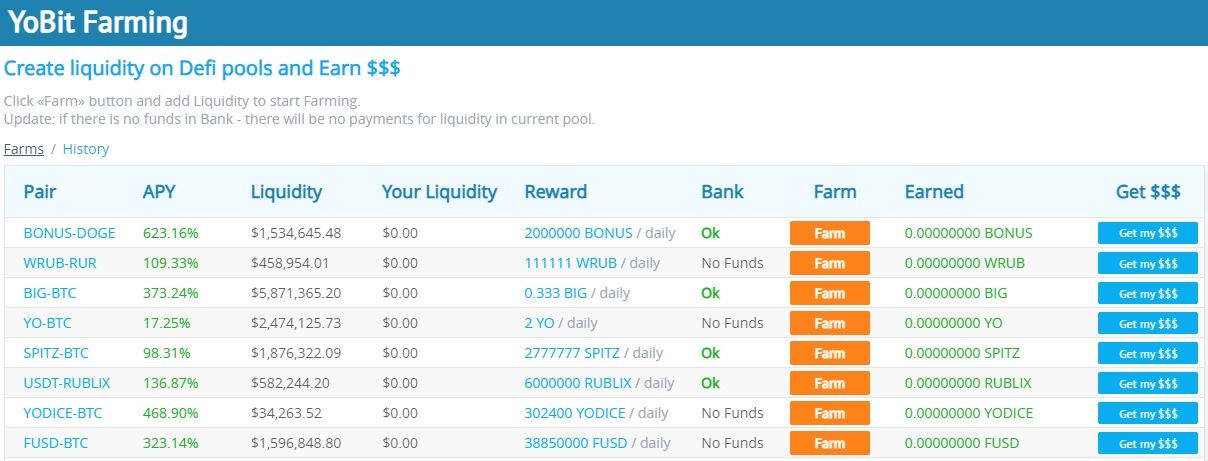

In decentralized finance, liquidity farming (also known as yield farming) is a concept where users can earn rewards by providing liquidity to a decentralized exchange (DEX) or a liquidity pool. YoBit has 23 liquidity pools to choose from with eye-popping APY.

YoBit Offers Eye-Popping APY on its DeFi Pool Product. Image via YoBit

YoBit Offers Eye-Popping APY on its DeFi Pool Product. Image via YoBitThe BONUS-DOGE pair has liquidity of over $1.5 million is APY stands at 623.16%. YODICE-BTC pair's APY is 468.90%. The lowest APY of 4.39% is offered in the BTC-USDT pair.

YoDice

In YoDice, users can roll the virtual dice and, depending on the amount of Bitcoin they wager, earn YoDice tokens as a form of reward.

Here's a breakdown of how it works:

- Wagering Bitcoin: Users can participate in the dice game by placing a bet in Bitcoin. The minimum amount to play is 0.001 BTC, and the more you bet, the greater the potential reward in YoDice tokens.

- Token Rewards: The amount of YoDice tokens earned is directly proportional to the size of the bet. The larger the bet, the more tokens you receive as a reward. The token rewards are structured in tiers:

- For a bet greater than 0.001 BTC, you get 10 YoDice tokens.

- For a bet greater than 0.01 BTC, you get 110 YoDice tokens.

- For a bet greater than 0.1 BTC, you get 1200 YoDice tokens.

- For a bet greater than 1 BTC, you get a whopping 13,000 YoDice tokens.

- Withdrawal Every 10 Minutes: The earned YoDice tokens can be withdrawn at your discretion, with the platform allowing withdrawals every 10 minutes.

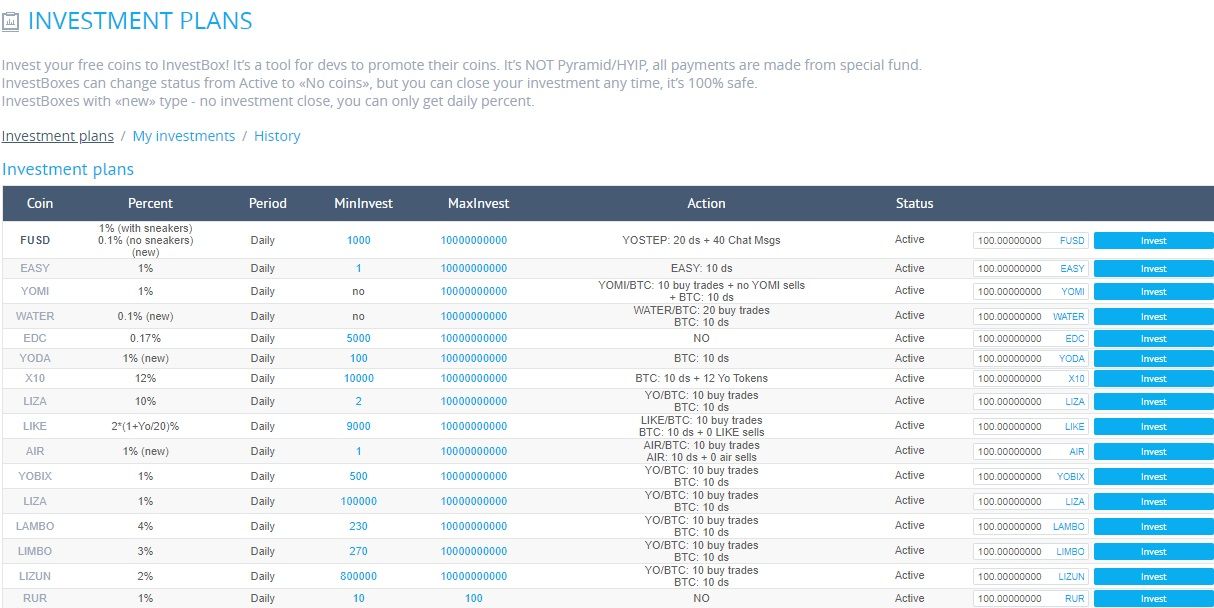

InvestBox

YoBit stresses that its investment plans are not pyramids or high-yield investment plans. It's also “100% safe.” Anytime there is a claim that something is 100% safe, it may be a good idea to run for the hills. In YoBit's world, "pyramid" is probably just a geometric shape and has absolutely nothing to do with dubious financial structures.

Sweet Dreams of Safety In the Whimsical World of YoBit. Image via YoBit

Sweet Dreams of Safety In the Whimsical World of YoBit. Image via YoBitThis works in the same manner as crypto lend programs, where users lend their free coins to generate yield. At YoBit, these plans offer daily returns of as much as 5%. BTC offers one of the highest returns (15% weekly), but you'd have to invest at least 50 BTC.

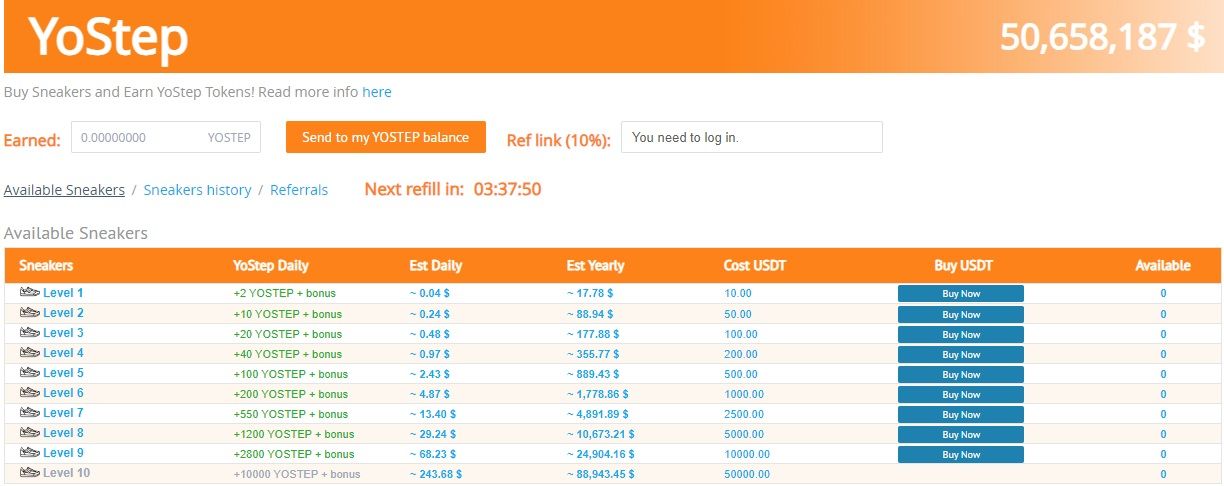

YoStep

YoBit has taken the opposite approach to the Move2Earn movement.

YoStep rewards users daily with YOSTEP tokens if they purchase virtual sneakers via YoBit. In order to get these rewards, users must perform simple daily actions on the exchange such as playing the YOSTEP coin dice game daily for at least 10 times. At 10 USDT, the barrier to entry is low, but you can spend as much as 50,000 USDT.

YoBit Has Taken the Opposite Approach to the Move2Earn Movement. Image via YoBit

YoBit Has Taken the Opposite Approach to the Move2Earn Movement. Image via YoBitThere are a few rules to be mindful of:

- Users will get rewards for sneakers twice a day.

- The temporary purchase limit for one user is 80 sneakers. However, holders of the Yo token can purchase up to 160 sneakers.

- The number of sneakers up for grabs is limited. As a result, refills occur in small quantities on an hourly basis from 12 to 22.

- Users need to play the Dice game at least 10 times to get successful payments.

- The sneakers can need repairs once a month, for which YO tokens can be used at 5% of the cost.

YoBit Supported Cryptocurrency and Trading Volume

According to CoinGecko, the YoBit exchange has 441 coins and 3,865 trading pairs available. Among the coins users can buy and sell include BTC, ETH, TRX and XRP. Some of the trading pairs include DOGE-BTC, ETH-BTC, BTC-RUR, ETH, USDT and BIG-BTC.

It's important to note that YoBit has a history of listing nonexistent trading pairs. In June 2016, the WAVES token was paired with BTC. Blockchain platform Waves said in a statement at the time that the exchange never "took part in the Waves crowdsale or possesses even the smallest number of coins." Unsurprisingly, Waves wasn't able to contact YoBit for corrective action.

Over the past 24 hours, YoBit trading volume was $167.9 million.

YoBit Fees

Depositing coins on YoBit is free, but you will be hit with withdrawal fees of 0.00050000. What that's denominated in wasn't made clear by the exchange but we're guessing BTC.

The exchange also accepts the prepaid QIWI Wallet, which boasts over 20.3 million active consumer accounts. A quick review of the wallet's page on Google Play shows the app is plagued with the same problems as YoBit — users are unable to withdraw money. Users have raised concerns about having to pay €4 for "verification" to get a refund, while others were blocked after initiating a transfer.

In addition, all the transactions conducted on the website are irreversible, which means YoBit doesn't support direct deposits via debit or credit cards.

YoBit's fees can be viewed on its dedicated fees page.

Supported Countries

According to Coinigy, YoBit supports the US, EU, and Commonwealth of Independent States, which include countries like Russia, Moldova, Armenia and Belarus, among others. Though if we know anything about the cryptocurrency regulatory landscape in the United States, it is highly doubtful that US users are being legally represented accurately here. Unless, who knows, maybe Mr. Gensler himself is the anonymous founder of Yobit…We joke.

We were also unable to verify where Coinigy found this information. The Yobit site simply states:

“Yobit.net website is completely legal and cryptocurrency trade is allowed by legislation of nearly all the countries worldwide.” (Source)

This is a dodgy disclaimer statement if we've ever seen one. There is no mention of any oversight by any regulatory committee or authorities. Most reputable exchanges will provide license numbers or regulation numbers that you can verify with regulatory authorities. Just stating “We're legal” is about as confidence-inspiring as “Trust me, bro.”

YoBit also has registered companies in the Isle of Man and Belize along with servers in Russia.

Customer Support

YoBit claims that it responds to most customer queries within an hour, with some taking as much as 24 hours. Probably in an alternate universe!

If accounts online are anything to go by, it's like the Bermuda Triangle of customer service — enquiries go in, but the responses appear to have taken a vacation to an island where emails are never opened and tickets are forever lost. The average response time for a crypto exchange is more than two hours, according to the Annual Global Crypto Customer Support Report by ACX.

Multiple users have accused YoBit of being unresponsive to emails, tickets, Telegram and direct messages. So, next time you reach out to YoBit with a burning question, bring your patience and perhaps a crystal ball to predict when, or if, the response will arrive.

YoBit Security

While credible exchanges proudly flaunt their security measures like badges of honour, YoBit seems to keep its security protocols under wraps, leaving users in the dark, squinting at the pages in the hope of discerning some hidden meaning.

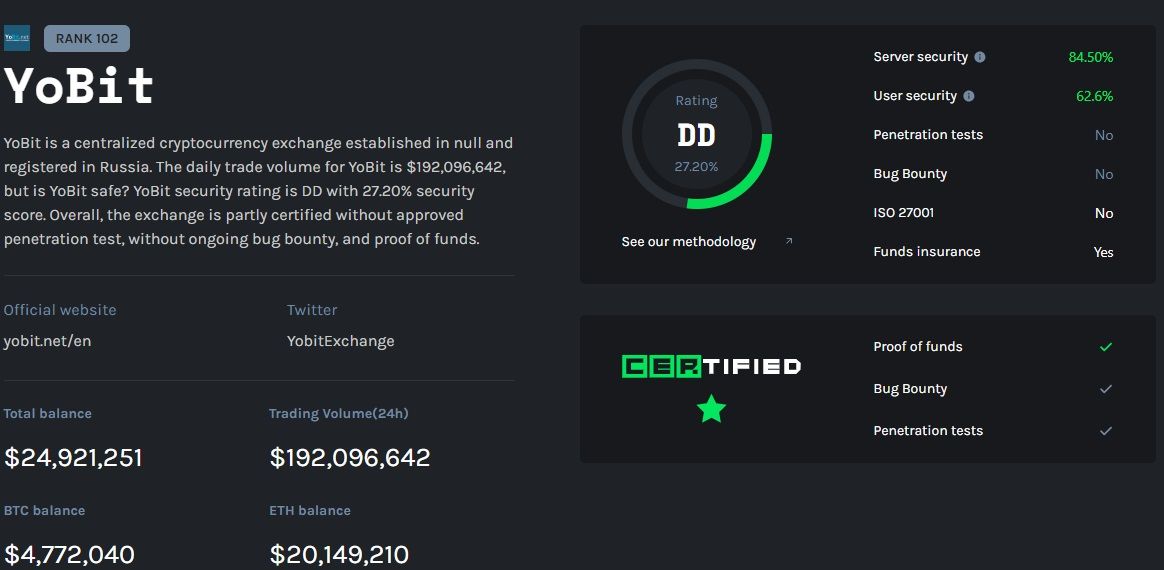

CER Assigned YoBit a Poor DD Rating. Image via CER

CER Assigned YoBit a Poor DD Rating. Image via CERAccording to CER, an independent crypto security and auditing firm, YoBit doesn't even break the top 100 crypto exchanges in terms of security. In addition, the exchange hasn't undergone penetration testing, has no bug bounty and is not ISO 27001 certified. CER assigned YoBit a poor DD Rating. However, it's important to note that YoBit isn't believed to have ever suffered a hack, which is a positive.

The absence of a comprehensive display of security measures on YoBit's part raises questions about the exchange's commitment to ensuring the safety of user funds. Credible exchanges acknowledge that user trust is earned through transparency. In this regard, YoBit's approach appears to deviate from the norm, potentially eroding the confidence users place in the platform.

Exchanges To Consider Instead

For crypto enthusiasts, there are several reputable exchanges to choose from that prioritize user trust and security. We suggest looking into SwissBorg, Coinbase, Kraken and Bybit.

Each of these exchanges boasts a user-friendly interface, a wide range of supported cryptocurrencies and a robust security infrastructure. In addition, they provide various features, including spot trading, futures trading, staking, educational resources and margin trading.

YoBit Review: Closing Thoughts

YoBit's unconventional approach to transparency, security and communication certainly sets it apart from the norm, in what many would consider quite concerning ways.

Security, a cornerstone for user trust, is shrouded in ambiguity. While credible exchanges proudly showcase their security measures, YoBit opts for a different strategy, keeping its security framework hidden. This lack of transparency, coupled with the exchange's poor security ranking, criminal history, and unverified claims of legality raise legitimate concerns about the safety of user funds. Customer support, touted as responsive by YoBit, appears to be elusive and the exchange's commitment to prompt responses appears questionable.

Users must weigh the allure of YoBit's eccentricities against the foundational pillars of trust, security, and transparency that define a reliable cryptocurrency exchange. If KYC-free trading is the primary draw to YoBit, we recommend checking out our article on the Top Non-Custodial Exchanges.