It’s been several weeks since crypto markets and its participants were shocked by the news that leading exchange FTX was billions of dollars in debt. Its insolvency and mismanagement of investor funds has created a massive backlash in the industry, and it will likely be months until the full ramifications of the failure are known.

Understandably, there are some huge questions in the aftermath of the initial failure. Not least among those is how government regulators, who have thus far been fairly slow moving when it comes to regulating crypto markets, would respond to the allegations that FTX tapped into customer accounts to fund risky bets. This is something unheard of in traditional markets, where regulations prevent exchanges from mixing client funds with operational funds, or using deposited funds for risky trading and investments.

Washington and Wall Street were quick to respond to the failures at FTX by launching new investigations and expanding existing investigations. Both the U.S. Department of Justice and the U.S. Securities and Exchange Commission are looking very closely at the activities that brought FTX to its knees.

Additionally, members of the U.S. Congress from both political parties are also calling for further action as a result of the collapse. Ironically several politicians and regulatory authorities have been alleged as complicit in the shenanigans at FTX. Likely we will never know the full truth of the matter.

Congressional members are saying that it was the regulatory ambiguity in the U.S. that allowed FTX to become a massive offshore exchange. This has led to calls for clearer operational guidelines for crypto exchanges. Naturally this will come in the form of increased regulation in the industry.

The fact that regulators apparently had no view into some of the major projects that fell apart this year – such as Celsius, Three Arrows, Luna and now FTX, are being brought out as precisely the reason tighter regulations are required.

But is regulation really the answer? Sam Bankman-Fried, the former CEO at FTX, was a huge proponent of regulation himself. He made large contributions to Washington politicians and was often in Washington to lobby for regulation of the crypto industry.

The truth is that regulations, while ostensibly meant to protect investors, in reality are in place to protect the large institutions and power brokers who work behind the scenes.

The Centralization of Crypto

Those of us with an interest in the history of crypto might remember the message left in the genesis Bitcoin block by Satoshi Nakamoto:

“The Times 03/Jan/2009 Chancellor on brink of second bailout for banks”.

That message is quite prophetic as many media outlets have compared the meltdown at FTX with the massive banking crisis of 2007/2008. Regulations did nothing to stop banks from mismanaging funds, and the subsequent collapse of several major banking institutions – notably Lehman Brothers – left massive repercussions for the financial ecosystem.

That message doesn’t say more regulations were needed to protect us from greedy banksters. It tells us that financial power needs to be taken from centralized entities like banks – and exchanges – and that every person on the planet should be able to hold the freedom of their own finances. If everyone who had money at FTX would have been self-custodying their funds such a failure could never have occurred.

The problem here isn’t the lack of regulation for crypto exchanges and other businesses. The problem is that we’ve allowed the traditional financial model to take over, bringing us full circle to what Nakamoto worked so hard to avoid.

Image via Twitter

Image via TwitterNakamoto’s gift of Bitcoin and blockchain technologies to the world is special for what it promises: The beginning of the era of financial decentralization. The possibility of having trustless economics, without the interference of centralized third-parties working for their own interests. Unfortunately, in our greed, we’ve turned away from what may have been one of the greatest gifts of the modern era.

Greed is what got us Here

Just as greed has led to most, if not all of the meltdowns in traditional, centralized financial markets, so too has it brought us to this juncture in crypto. Greed from the top down.

Nakamoto never intended for centralized entities to control Bitcoin or any blockchain project. Just the opposite in fact. However, as Bitcoin began to gain traction and value, the first centralized entities began to spring up. Certainly there was some altruism in these initial businesses. Blockchain was hard to understand and transact with, and the centralized companies made it easier for the masses to get involved. Surely that was worth creating centralized firms to help the people.

But at the core of that was greed. These companies have always been made for profit. Centralized exchanges and centralized mining do not benefit the majority, they only benefit the small minority at the top of such organizations.

Because the centralized companies made it easier for people to get involved with crypto the industry began growing more rapidly. Centralized entities became entrenched, controlling the crypto markets even as they spoke publicly about the benefits of decentralization and taking control of your financial freedom. In truth, we were giving away the financial freedoms and potential for trustless economies promised to us by the creation of Bitcoin.

However, the collapse of FTX, and other centralized platforms in 2022, may have given us some hope of returning to the decentralized freedom promised by blockchain technology.

Code is Law

While the mainstream is clamoring for more regulation in the crypto space, the truth is that decentralized protocols can provide far greater protections for investors and users of this revolutionary financial system. The tenet of Code is Law ensures compliance through software. It brings objectivity to the space, providing the rules of interaction and setting down the judgments that keep platform users safe.

It’s true that hacks have occurred, resulting in losses, but platforms are becoming better at defending themselves from hacks, and at recovering funds when they do occur. As the space matures the code laws will become increasingly hardened, keeping hackers at bay. And the immutability of the blockchain means tracking down funds stolen by hackers becomes increasingly easy.

The same cannot be said for centralized traditional pillars of finance. When losses occur here, as we’ve seen at FTX, they are caused by the unethical actions of those in charge of these companies. Far worse than the hacks seen in the crypto space, the failures at centralized entities can lead to billions of dollars of unrecoverable assets.

If we allow code to govern then much of this simply cannot occur. Code does not have discretion. It cannot be ignored or skirted by criminal or unethical humans. Code can provide all of the protections and freedoms that we seek from blockchain projects.

We the People

One shift in the wake of the FTX collapse is a return to control over our own money by We the People. Centralized exchanges have seen record withdrawals following the collapse of FTX. Interestingly these withdrawals have largely not been back into the fiat currency controlled by central bankers and the traditional financial system. Instead these withdrawals are being made into self-custody wallets. We the People are keeping our money in crypto, but taking back the control of it as was intended from the start.

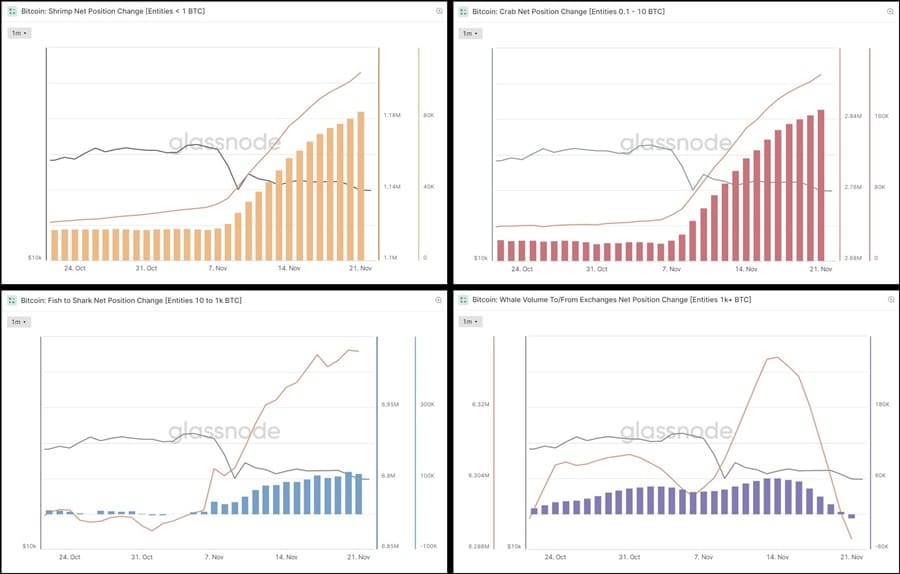

Data analytics provider Glassnode reports that Bitcoin investors were withdrawing Bitcoin to self-custody at a historic rate of 106k $BTC/month following the reports of FTX’s collapse.

Ether and stablecoins have seen similar redemptions, with roughly $2.5 billion in ETH moved to self-custody along with $2 billion in stablecoins.

While exchange outflows are often considered a proxy for a shift to a hodler mentality, in this case it seems as if the outflows are a result of a sharp decline in trust for centralized exchanges. The phrase “not your keys, not your coins” has taken on a renewed imperative among the crypto faithful. And the fact that flows are not being exchanged into fiat currency shows that there’s still a strong belief among the people in the power of decentralization and the blockchain to take back power from exchanges, banks, and ultimately governments.

Net exchange position change by address size. Image via Glassnode

Net exchange position change by address size. Image via GlassnodeThe flow hasn’t slowed for the most part either. The charts above show the net change in exchange positions by investors of various sizes. The smallest investors, those with 10 BTC or less, have continued to move their Bitcoin to self-custody at staggering rates. The larger Fish and Sharks, with balances from 10 BTC to 1,000 BTC, have slowed the increase in withdrawals, but the amounts remain historically high.

The outlying chart is the Bitcoin whales, who have over 1,000 BTC. These entities have returned their coins to the exchanges. This group is also most likely to include the ultra-wealthy, those who could benefit most from Bitcoin continuing on the path to centralization. We can only hope that smaller addresses won’t see this and revert to their prior reliance on centralized platforms.

The Battle between the CEX and the DEX

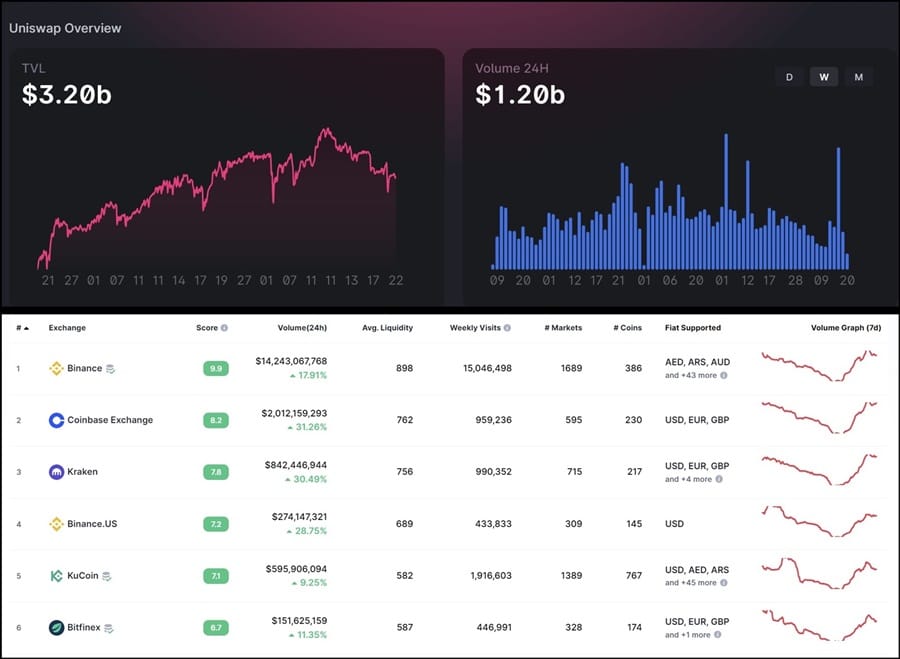

Another effect seen from withdrawals from centralized exchanges is a jump in trading volumes at the decentralized exchanges. This is a positive development, and one we can hope continues. Trading volumes at Uniswap, the largest of the DEXs, remains above $1 billion on average since the collapse of FTX. This is more than all but two of the centralized exchanges.

Unfortunately, data also shows trading volumes recovering at the centralized exchanges. This could be an early sign of things returning to the way they were, though this uptick in trading volumes could also be a result of whale money returning to the exchanges.

Images via info.uniswap.org and CMC

Images via info.uniswap.org and CMCExperts Warn Against Centralization

The strong feelings against centralization among those who are closest to the crypto industry should serve as a warning to us all. In no way was crypto created to be controlled by centralized organizations. In fact, just the opposite. It has been hoped that the trustless money and financial systems promised by blockchain technology and associated cryptocurrencies can help rid us of a broken financial system headed by central banks whose money printing erodes all of our wealth.

Ethereum educator Anthony Sassano says, “The collapse of FTX has shown people the dangers of storing their funds with centralized crypto entities. Post-withdrawals, I hope that this translates to people withdrawing their ETH stake from centralized providers and using one of the decentralized solutions (or solo staking).”

There are so many decentralized options for staking and trading your ETH that there’s no reason to even consider the centralized alternatives. This isn’t 2016, when figuring out how to get fiat exchanged for crypto was a chore.

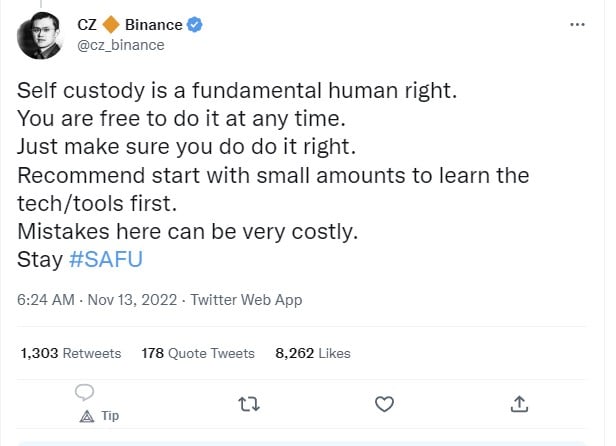

Binance CEO Changpeng “CZ” Zhao said, “Self custody is a fundamental human right. You are free to do it at any time. Just make sure you do do it right. Recommend start with small amounts to learn the tech/tools first. Mistakes here can be very costly. Stay #SAFU.”

Note that this exhortation to use self custody comes from the CEO of the largest centralized exchange by trading volume. He is also quite likely the one who started the run on the FTT token that was eventually the downfall of FTX. Sure, he was probably just taking out a competitor, not thinking about how the fall of FTX would start many other questions around the centralization of crypto.

Speaking to Cointelegraph during the Pacific Bitcoin conference on Nov. 10-11 MicroStrategy’s Michael Saylor said, “In systems where there is no self-custody, the custodians accumulate too much power and then they can abuse that power. So self-custody is very valuable for this broad middle class, as it tends to create [...] this power of checks and balances on every other actor in the system that causes them to be in continual competition to provide transparency and virtue.”

Where have we seen an abuse of power from centralized entities after they’ve accumulated that power? Many, many times throughout history. The most recent is the financial crisis that sparked the creation of Bitcoin, but if you look back through history you’ll see too many examples of those who are powerful or rich (or both) abusing their power. Remember, “Power corrupts, but absolute power corrupts absolutely.”

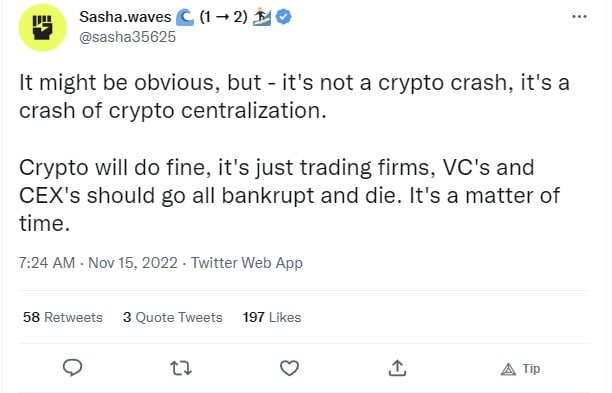

Finally, Sasha Ivanov, founder of Waves, had this to say, “It might be obvious, but - it's not a crypto crash, it's a crash of crypto centralization. Crypto will do fine, it's just trading firms, VC's and CEX's should go all bankrupt and die. It's a matter of time.”

Waves is a multi-purpose blockchain platform launched in 2016 which supports various use cases including decentralized applications (DApps) and smart contracts and seeks to use blockchain to improve processes or create new services. And we can hope that Sasha is correct.

Be Careful What You Wish For – You Might Get It

Regulations are one way to institute protections for the people, but they are not the only way. The problem with regulations is that they can get out of control, and can give too much power to governments. What good is it to protect yourself from hackers if you ultimately give up all your freedoms to the government in the quest for safety?

The promise of blockchain and crypto was to allow for complete financial freedom of the individual. Let every person become their own bank, and do away with systemic failures and government bailouts to faceless corporations. Yes, that does mean each person also needs to take responsibility for their finances, but isn't that better than allowing yourself to be controlled and manipulated financially?

While it is true that greater regulation of the crypto space might have protected you from the likes of Celsius, Three Arrows, Luna and now FTX, the real question is whether crypto be controlled by such centralized entities? Crypto was never intended to be centralized, and I think that this year has shown us that is true. If we are fortunate the failure of these centralized entities, culminating with the FTX implosion, will put us back on the path of decentralization.