So, you’re an Aussie thinking about diving into crypto, or maybe you’re already in and looking to level up. Either way, you’ve probably realized one thing: choosing a crypto exchange in Australia isn’t as simple as typing “buy Bitcoin” and hitting enter. With dozens of platforms out there promising the lowest fees, fastest trades, and best coins, how do you know which one actually delivers?

Spoiler alert: exchanges cannot all be equal, right? Some are locally regulated and beginner-friendly, others are global giants packed with advanced tools, and a few… well, let’s just say you’ll want to steer clear of anything that feels like it was coded in a basement in 2015.

In this guide, we break down the top Australian crypto exchanges for 2025; digging into their features, fees, and quirks, so you can find one that fits your style, your strategy, and your stack.

Why Choosing the Right Crypto Exchange in Australia Matters

Before diving into the nitty-gritty of trading platforms, it’s worth asking: why does choosing the right crypto exchange matter in Australia? Turns out, there’s more at stake than just low fees or a slick app. From legal protections to local conveniences, the right platform can make or break your crypto experience down under.

Local Regulations and Consumer Protection

No one wants their crypto gone faster than a kangaroo in a sprint, especially when it's parked in a dodgy exchange. Here's how Aussie rule-makers have our backs:

- ASIC oversight: The Australian Securities & Investments Commission (ASIC) regulates platforms that deal in crypto assets considered “financial products.” If an exchange offers such options, it must hold an Australian market licence or risk legal trouble. ASIC’s evolving guidance (INFO 225 & CP 381) shows they aren’t messing around, as this isn’t just paperwork, it’s about protecting your coins.

- AUSTRAC registration & KYC: If you're swapping AUD for Bitcoin, the platform must be registered with AUSTRAC under Australia’s Anti-Money Laundering and Counter Terrorism Financing Act. That means solid KYC checks, suspicious activity reports, cash transaction thresholds like reporting deposits over A$10,000, and regular compliance audits. If an exchange doesn’t keep its AUSTRAC registration in check, it can be suspended or shut down.

- Compliance = security: All this regulation isn’t bureaucracy, it’s safety. Registered, licensed exchanges are legally obligated to operate fairly, keep your details secure, and follow transaction monitoring protocols. That means they can’t just ghost you or mismanage your funds. It’s the consumer protection safety net we didn’t know we needed.

Choosing a Crypto Exchange in Australia is about Staying Compliant, Secure, and Supported in your Time Zone. Image via Freepik

Choosing a Crypto Exchange in Australia is about Staying Compliant, Secure, and Supported in your Time Zone. Image via FreepikUnique Needs of Australian Traders

Let’s narrow it down to convenience in your crypto career. Here’s what Aussie traders really need:

- AUD deposits & withdrawals: You want to bail out or cash in Australian dollars seamlessly, right? That’s only possible if the platform supports AUD natively with no shady conversions or extra fees.

- Bank integrations (PayID, POLi, Osko): Quick moves matter in crypto. Using PayID, POLi for instant bank transfers, or Osko (real-time 24/7 interbank payments) is huge. It lets Aussies move money fast and dodge delay-related FOMO.

- 24/7 support in AEST: Whether you're a night owl trading altcoins or a morning person checking gains, customer support aligned with Australian Eastern Standard Time is also of utmost importance. Nothing beats calling someone at 8 PM and actually getting help.

Comparison Table

| Exchange | Verification Speed | AUD Deposit/Withdrawal | Supported Cryptos | Fees | Security | Mobile App Rating | Beginner Friendly |

|---|---|---|---|---|---|---|---|

| Independent Reserve | Fast | Bank transfer, PayPal, card | 32+ | 0.5% → 0.02% (trading); free EFT withdrawals | ISO 27001, cold storage, insured | 4.7 (iOS) | Moderate |

| Swyftx | Fast | Bank, card, PayID | 440+ | 0.6% (trading); free AUD transfers | 2FA, standard security | 4.5 (iOS) | High |

| CoinSpot | Fast | PayID, bank transfer, card | 530+ | 0.1% market, 1% instant; free AUD withdrawals | ISO 27001, cold storage, audits | 4.8 (iOS) | High |

| Binance Australia | Fast | Currently suspended | 350+ | 0.1% trading; BNB discount | Cold storage, 2FA, under scrutiny | 4.8 (iOS) | Moderate |

| Digital Surge | Fast | PayID, bank transfer | 300+ | 0.5% (trading); free AUD transfers | 2FA, cold wallets | 4.1 (iOS) | High |

| Kraken | Fast | Bank transfer | 350+ | 0.25%/0.4% (maker/taker); varies with volume | Cold storage, 2FA, no major breaches | 4.7 (iOS) | Moderate |

| Coinbase | Fast | PayID, Osko, card, bank transfer | 200+ | 0.4%/0.6% (maker/taker); free AUD withdrawals | Over 95% cold storage, insurance | 4.5 (iOS) | High |

Top 7 Crypto Exchanges for Australians in 2025

With dozens of platforms out there, finding a reliable crypto exchange in Australia can feel overwhelming. We’ve narrowed it down to the top 7, each approved, secure, and suited for Aussies' needs.

Independent Reserve

Australia’s OG crypto exchange was founded in Sydney in 2013. Known for its serious security chops — the ISO 27001, 1:1 reserves, and deep-diving OTC desk. This platform’s built for Aussies who want trust and professionalism without compromising usability.

Reliable, Aussie-Regulated with Insurance Reflects Serious Security at Independent Reserve. Image via Independent Reserve

Reliable, Aussie-Regulated with Insurance Reflects Serious Security at Independent Reserve. Image via Independent ReserveFeatures

- Strong local track record: ASIC-regulated, AUSTRAC-registered, and the first Aussie exchange to get crypto insurance.

- AUD support + OTC desk: Fast bank transfers, PayPal, credit/debit options, plus an OTC desk for orders from A$50,000 to A$50 million, complete with personal brokers and same-day settlements.

- Trading tools: 24/7 support, leveraged trading up to 5x, advanced order types, mobile/desktop apps, and recurring buys through dollar-cost averaging and AutoTrader.

Fees

- Trading Fees: Starts at 0.50%, dropping to 0.02% for whales with high volume.

- AUD Deposits: Free above A$100; otherwise, A$0.99. Debit/credit & PayPal: 1% fee.

- Withdrawals: AUD via EFT is free; instant withdrawals A$1.50; crypto withdrawal fees vary (e.g. 0.0002 BTC, 0.005 ETH).

✅ Pros

- Reliable, Aussie-regulated, with insurance, reflects serious security

- Feature-rich platform: recurring buys, leveraged trading, advanced APIs, OTC for big players

- Deep liquidity via OTC desk, perfect for institutional investors

❌ Cons

- Base trading fees are higher than some global platforms (0.5%) if you're not a heavy trader

- Smaller coin selection (~32 vs hundreds on global platforms)

- Liquidity on altcoin pairs can be lighter, with more slippage if you're trading obscure tokens

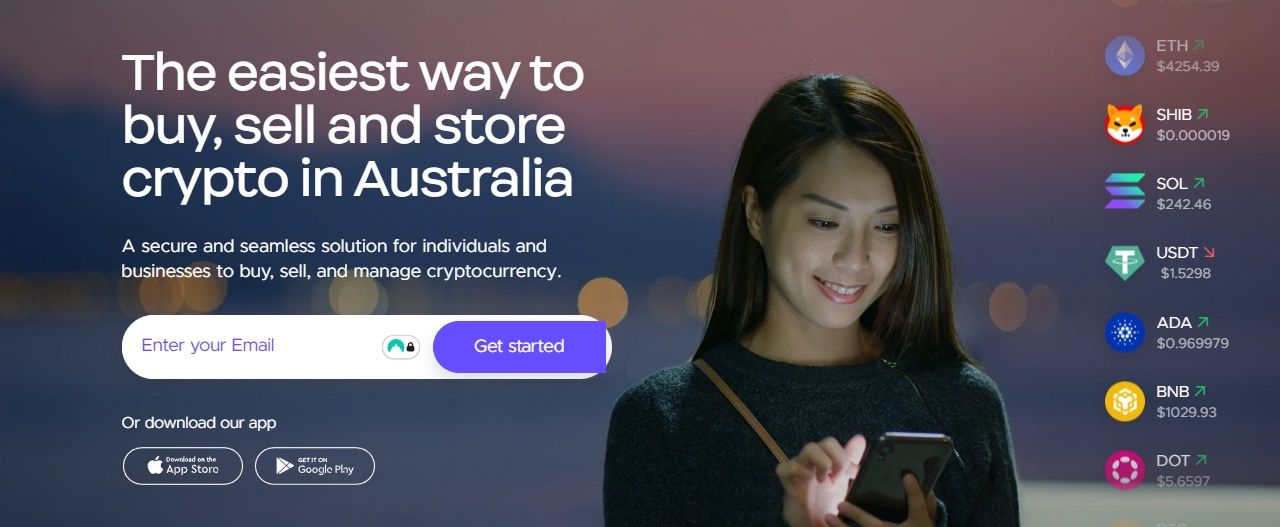

Swyftx

Swyftx, an Australian-based cryptocurrency exchange, is designed with user-friendliness in mind. Its intuitive interface and demo mode make it an excellent choice for beginners looking to enter the crypto market without feeling overwhelmed.

Swyftx brings a User-Friendly Interface Suitable for Beginners. Image via Swyftx

Swyftx brings a User-Friendly Interface Suitable for Beginners. Image via SwyftxFeatures

- Beginner-Friendly Interface & Demo Mode: Swyftx offers a clean, customizable interface suitable for both desktop and mobile users. The demo mode provides A$10,000 in virtual funds, allowing users to practice trading strategies without financial risk.

- Asset Variety: With over 440 cryptocurrencies available, including major coins like Bitcoin and Ethereum, as well as a range of altcoins, Swyftx caters to diverse investment interests.

- Mobile Experience & Customer Support: The mobile app is optimized for both iOS and Android, featuring customizable widgets and real-time market data. Customer support is accessible 24/7 via live chat, to ensure assistance is always available.

Fees

- Trading Fees: Regular fees are at 0.6%, but depending on the 30-day trade volume, fees can be lowered.

- AUD Deposits & Withdrawals: No fees for AUD deposits and withdrawals via bank transfer or PayID deposits. Card fees depend on the platform being used, along with any applicable bank charges.

✅ Pros

- User-friendly interface suitable for beginners.

- An extensive range of cryptocurrencies is available for trading.

- Demo mode for risk-free practice.

- 24/7 customer support via live chat.

❌ Cons

- No margin or derivatives trading options, which may limit advanced trading strategies.

- Staking features have been discontinued as of January 2023 due to regulatory challenges.

CoinSpot

CoinSpot, established in 2013, has become one of Australia's most popular cryptocurrency exchanges, boasting over 3 million users. Its user-friendly interface and extensive range of features make it a go-to platform for both beginners and seasoned traders.

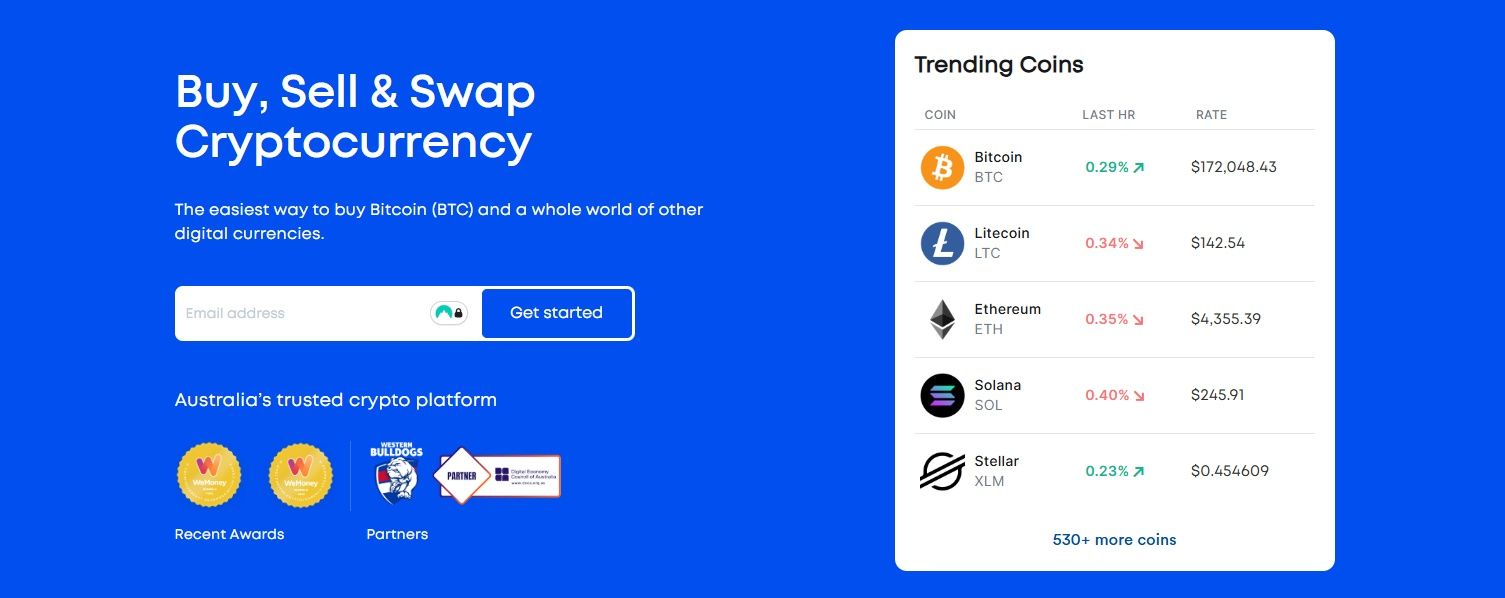

CoinSpot Offers an Extensive Selection of 530+ Cryptocurrencies. Image via CoinSpot

CoinSpot Offers an Extensive Selection of 530+ Cryptocurrencies. Image via CoinSpotFeatures

- High Trust Level Among Australian Users: CoinSpot's commitment to security and compliance has earned it a strong reputation. It was the first Australian crypto exchange to receive ISO 27001 certification and is a certified member of Blockchain Australia.

- NFT Marketplace and Staking: CoinSpot offers an NFT marketplace, allowing users to purchase NFTs using various cryptocurrencies.

- Fee Transparency and Security Certifications: CoinSpot maintains clear fee structures and robust security protocols, including two-factor authentication and offline asset storage. It also underwent an external statutory financial audit in accordance with Australian Auditing Standards.

Fees

- Trading Fees: Market orders incur a 0.1% fee, while instant buy/sell/swap transactions have a 1% fee.

- Deposit Fees: Deposits via PayID and direct bank transfers are free. Cash deposits attract a 2.5% fee, and card payments have a 1.22% fee.

- Withdrawal Fees: AUD withdrawals to bank accounts are free. Cryptocurrency withdrawal fees vary depending on the asset.

✅ Pros

- Extensive selection of over 530 cryptocurrencies.

- User-friendly interface suitable for beginners.

- Robust security measures, including ISO 27001 certification.

- 24/7 customer support via live chat.

❌ Cons

- Higher fees for instant transactions compared to some competitors.

- Limited advanced trading features, such as derivatives or margin trading.

- NFT marketplace has a smaller selection compared to dedicated NFT platforms.

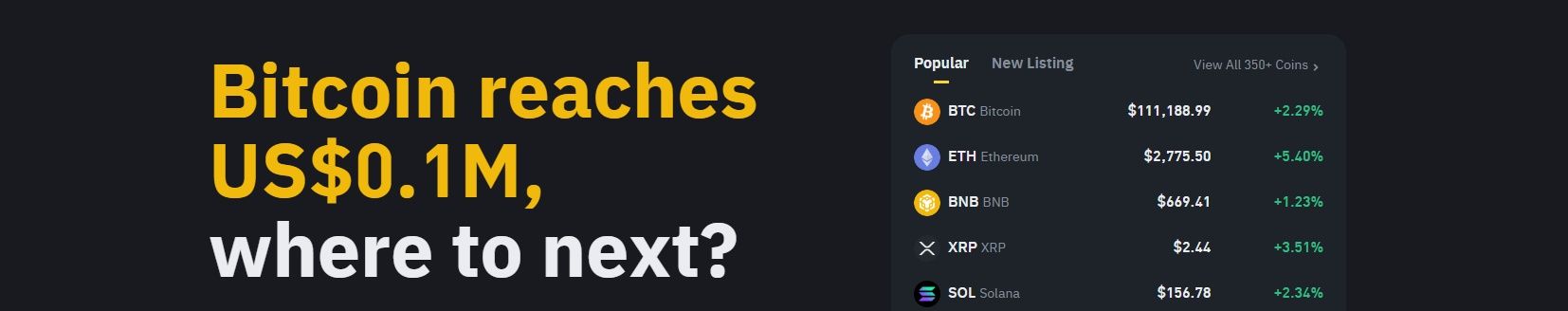

Binance Australia

Binance Australia is the local arm of the world's largest cryptocurrency exchange by trading volume. It offers Australian traders access to a vast array of digital assets and advanced trading features. However, it's essential to be aware of its evolving regulatory status within the country.

Binance is the World's Largest Cryptocurrency Exchange by Trading Volume. Image via Binance

Binance is the World's Largest Cryptocurrency Exchange by Trading Volume. Image via BinanceFeatures

- Access to Global Liquidity: Binance holds around 59% of all stablecoin reserves on centralized exchanges, reinforcing its role as the leading global crypto liquidity hub and capital deployment platform.

- Advanced Trading Tools and Low Fees: The platform offers a comprehensive suite of trading options, including spot, margin, and futures trading with leverage up to 125x. Trading fees are competitive, starting at 0.1% and can be reduced by 25% when using Binance Coin (BNB) for fee payments.

Fees

- Trading Fees: Standard trading fees are 0.1%, with discounts available when using BNB.

- Deposit and Withdrawal Fees: AUD deposits and withdrawals via PayID are currently suspended due to third-party provider issues. Cryptocurrency withdrawal fees vary depending on the asset.

✅ Pros

- Extensive selection of over 350 cryptocurrencies.

- Advanced trading features suitable for experienced traders.

- Competitive trading fees with additional discounts using BNB.

❌ Cons

- Suspension of AUD deposits and withdrawals via PayID.

- Regulatory challenges, including the cancellation of its Australian financial services license in April 2023.

- Being sued by the ASIC after allegedly failing to provide adequate compliance systems.

- The platform may be complex for beginners due to its advanced features.

Don't forget to check out our detailed review of Binance.

Digital Surge

Digital Surge is a Brisbane-based crypto exchange that has carved out a niche for itself by offering a user-friendly platform tailored for Australian traders. With a focus on simplicity and transparency, it's become a go-to choice for both beginners and seasoned investors looking for a hassle-free trading experience.

Features like Recurring Buys, Trigger Orders, and Price Alerts are Seamlessly Integrated. Image via Digital Surge

Features like Recurring Buys, Trigger Orders, and Price Alerts are Seamlessly Integrated. Image via Digital SurgeFeatures

- AUD Bank Transfers and Low Spreads: Digital Surge supports instant AUD deposits and withdrawals via PayID and bank transfers, all without fees. The platform boasts some of the lowest spreads in Australia, averaging around 0.5%, ensuring traders get competitive pricing on their transactions.

- User Interface for Beginners: The platform's intuitive design makes it accessible for newcomers to the crypto space. Features like recurring buys, trigger orders, and price alerts are seamlessly integrated, allowing users to automate their trading strategies with ease.

- Education Hub and Support: Digital Surge offers a comprehensive 'Learn Crypto' section, providing educational resources to help users understand the crypto market better. Additionally, their Australian-based support team is available via live chat and email, ensuring assistance is readily available when needed.

Fees

- Trading Fees: A flat 0.5% fee applies to buy, sell, and swap transactions. High-volume traders can benefit from reduced fees.

- Deposit and Withdrawal Fees: AUD deposits and withdrawals are free. Cryptocurrency withdrawal fees vary depending on the asset, aligning with network fees.

✅ Pros

- Instant AUD deposits and withdrawals via PayID and bank transfers.

- Competitive trading fees and low spreads.

- User-friendly interface suitable for beginners.

- Comprehensive educational resources and responsive customer support.

❌ Cons

- Limited to Australian users; not available for international traders.

- Does not support credit card deposits.

- Lacks advanced trading features like margin or derivatives trading.

Kraken

Kraken is a well-established global cryptocurrency exchange that has been serving Australian traders since it acquired Bit Trade in 2020. Known for its robust security measures and a wide range of trading options, Kraken caters to both beginners and seasoned investors looking for a reliable platform.

Kraken is Famous for its Robust Security and Wide Range of Trading Options. Image via Kraken

Kraken is Famous for its Robust Security and Wide Range of Trading Options. Image via KrakenFeatures

- Trusted Global Exchange with Aussie Access: Kraken offers Australian users access to a vast array of cryptocurrencies, with over 350 assets available for trading. The platform supports AUD deposits and withdrawals, making it convenient for local traders.

- Deep Liquidity and Futures Trading: Kraken provides deep liquidity across various trading pairs, ensuring efficient trade execution. For advanced traders, Kraken offers margin trading and futures contracts with leverage options, catering to diverse trading strategies.

- Security History and Global Reputation: Kraken has built a strong reputation for security, employing measures such as majority of deposits held in offline cold storage and servers housed in secure facilities under 24/7 surveillance. Notably, Kraken has not suffered any major hacking incidents, underscoring its commitment to safeguarding user assets.

Fees

- Trading Fees: Kraken utilizes a maker-taker fee model, with fees starting at 0.25% for makers and 0.40% for takers. High-volume traders can benefit from reduced fees based on their 30-day trading volume.

- Deposit and Withdrawal Fees: AUD deposits and withdrawals are supported via bank transfers, with fees varying depending on the method used. Cryptocurrency withdrawal fees are subject to network conditions and vary by asset.

✅ Pros

- Extensive selection of over 350 cryptocurrencies.

- Advanced trading features, including margin and futures trading.

- Strong security measures with a clean track record.

- Support for AUD transactions, catering to Australian users.

❌ Cons

- The platform's interface may be complex for beginners.

- Limited AUD trading pairs compared to other currencies.

- Some users have reported delays in AUD deposits due to banking processes.

Check out our complete review of Kraken as well.

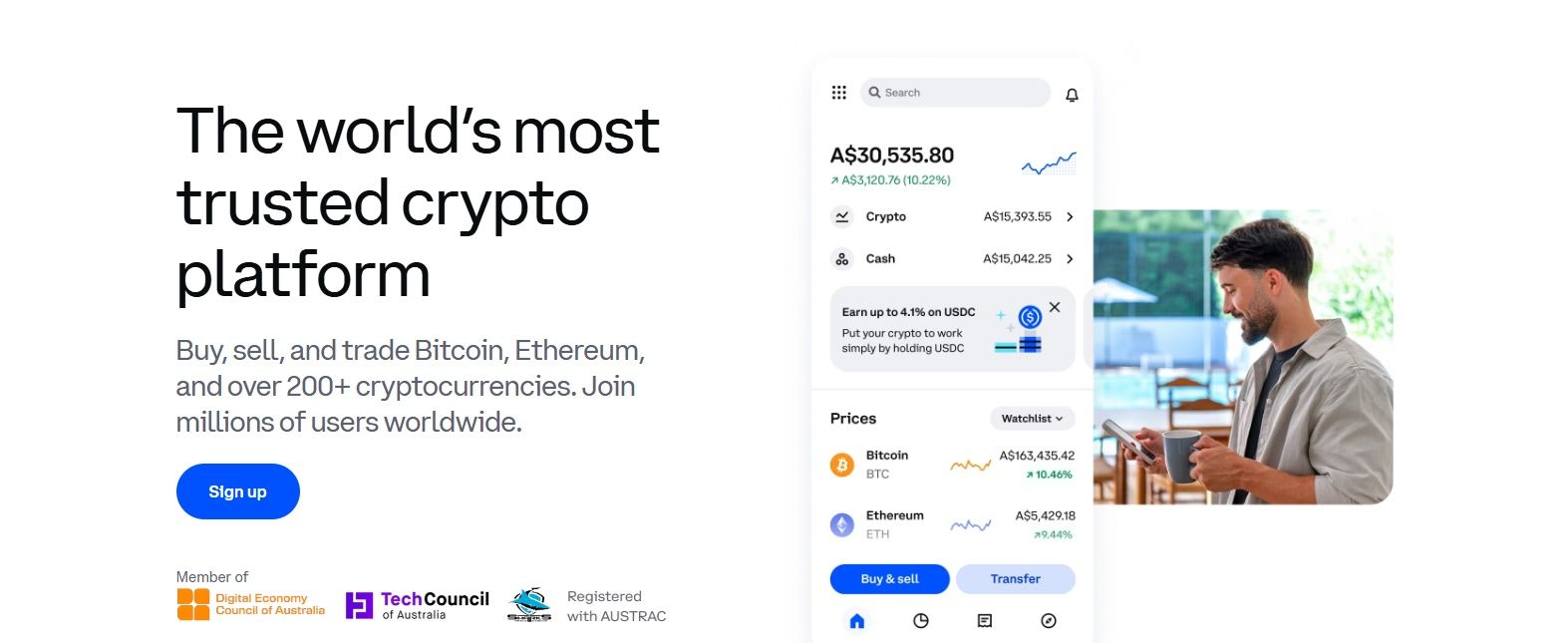

Coinbase

Coinbase, a major U.S.-based cryptocurrency exchange, has been operating in Australia since its relaunch in October 2022. Known for its user-friendly interface, it's often recommended for beginners entering the crypto space. However, Australian users should be aware of certain limitations and fees associated with the platform.

Coinbase Offers a User-Friendly Interface Suitable for Beginners. Image via Coinbase

Coinbase Offers a User-Friendly Interface Suitable for Beginners. Image via CoinbaseFeatures

- Simple Onboarding for Aussies: Coinbase offers a straightforward sign-up process, requiring only basic personal information and identification. The platform's intuitive design makes it easy for newcomers to navigate and execute trades.

- Integration with Major Payment Methods: Australian users can fund their accounts using cards, PayID, Osko, and bank transfers, with transactions processed instantly.

- Fees, Security, and Local Relevance: Coinbase charges 0.4% for makers and 0.6% for takers fee, making it one of the more expensive options for Australian users. On the security front, Coinbase is renowned for its robust measures, including storing 98% of customer funds in offline cold storage and providing insurance coverage for digital assets held on the platform.

Fees

- Trading Fees: 0.4% for makers and 0.6% for takers, which is more than most exchanges offer.

- Deposit and Withdrawal Fees: Coinbase supports AUD withdrawals with zero fees to Australian bank accounts, PayID, Osko, and cards.

✅ Pros

- User-friendly interface suitable for beginners.

- Strong security measures, including cold storage and insurance coverage.

- Access to a wide range of over 210 cryptocurrencies to trade.

❌ Cons

- Higher fees compared to competitors.

Don't miss our exclusive Coinbase review.

Key Factors to Consider When Choosing an Exchange

Narrowed down your options? Great. Now comes the real test of figuring out which exchange is actually worth trusting with your AUD and crypto game plan.

Look for 2FA, Biometric Logins, and Withdrawal Whitelists. Image via Freepik

Look for 2FA, Biometric Logins, and Withdrawal Whitelists. Image via FreepikSecurity Features

A solid exchange should offer cold wallet storage for the majority of user funds, keeping assets offline and safe from hackers. Look for 2FA, biometric logins, and withdrawal whitelists as these are basic but powerful defenses. Bonus if the exchange offers insurance or has a solid track record of responding swiftly to incidents.

Fee Structures

Don’t just look at the headline trading fee, factor in the spread (the buy-sell price gap), which can quietly cost you more. Also check for deposit and withdrawal charges, especially on cards and instant transfers. And keep an eye out for hidden fees like currency conversions or minimum transaction thresholds.

Supported Assets and Trading Pairs

Most exchanges support major cryptos like BTC, ETH, and SOL, but if you’re into altcoins or staking, dig deeper. Direct AUD pairs are a huge plus as they simplify trades and help avoid unnecessary conversions and fees.

Platform Usability and Mobile Experience

An exchange should feel intuitive, whether you're on desktop or mobile. Check app store reviews for bugs or usability issues. If you’re new, a demo account can be a huge asset, letting you practice without real money on the line.

Choosing the right exchange is less about flashy branding and more about security, usability, fees, and control. Get these fundamentals right, and the rest of your crypto journey will feel a whole lot smoother.

The Role of Regulation and Licensing in Australia

Crypto goes beyond coins and exchanges. It also stands on the rules that keep the space fair and secure. As the U.S. and European countries have their own regulations with respect to crypto, Australia is no exception. Let's check out some regulation and licensing perspectives in Australia.

While many would take Regulation in Crypto as a Killjoy, it’s Actually Peace of Mind. Image via Freepik

While many would take Regulation in Crypto as a Killjoy, it’s Actually Peace of Mind. Image via FreepikRegistered and Compliant Exchanges

If a crypto exchange operates in Australia, it must be registered with AUSTRAC as this isn’t optional. AUSTRAC monitors digital currency providers under anti-money laundering and counter-terrorism laws. That means compliant platforms must verify customer identities, track transactions, and report anything suspicious.

Using unregistered exchanges? That’s risky. Without AUSTRAC oversight, you're exposed to platforms that may lack basic protections. AUSTRAC can even suspend or cancel registrations if a platform is deemed high-risk.

Then there’s the Australian Consumer Law (ACL), which ensures that all businesses, crypto included, treat customers fairly. If a platform misleads you or fails to deliver its services properly, the ACL gives you a way to fight back.

Tax Implications for Crypto Traders

The Australian Taxation Office (ATO) sees crypto as an asset, not money. So, any time you sell, swap, or use crypto in a way that generates profit, you may trigger a Capital Gains Tax (CGT) event. That means keeping detailed transaction records is critical.

To catch under-reporting, the ATO pulls data directly from exchanges. If your tax return doesn’t match their records, expect questions.

Luckily, tools like Koinly and CoinLedger integrate with most exchanges. They can import your trade history and spit out tax reports ready for lodgement, saving you time, and possibly, fines.

While many would take regulation in crypto as a killjoy, it’s actually peace of mind. Knowing your platform is registered, your trades are tracked properly, and your taxes are in check. That’s how you trade with confidence.

Security Tips for Australian Crypto Investors

Crypto’s a wild ride, and while the gains can be exciting, the risks are very real. From dodgy phishing scams to platform hacks, you’ve got to take security into your own hands. Here are a few no-nonsense tips every Aussie trader should keep front of mind.

A few Smart Habits can make all the Difference between Sleeping Easy and Sweating over a Hack. Image via Freepik

A few Smart Habits can make all the Difference between Sleeping Easy and Sweating over a Hack. Image via FreepikUse Hardware Wallets for Large Holdings

If you’re holding significant amounts of crypto, keeping it on an exchange is like storing gold bars at your local servo. Instead, invest in a hardware wallet which is a physical device that stores your private keys offline. It’s hands-down the safest way to protect your digital assets from online threats.

Enable 2FA and Email Alerts

At the very least, enable two-factor authentication (2FA) on every account. It’s a basic, but powerful, layer of defense. Also turn on email or SMS alerts for logins and transactions. This way, you’ll know immediately if anything fishy is going on.

Stay Vigilant About Phishing Scams

Fake websites, scam emails, shady Telegram groups, you name it and they’re out there. Always double-check URLs, avoid clicking on unsolicited links, and never share your recovery phrase. If it smells off, it probably is.

Diversify Across Exchanges If Necessary

Putting all your crypto eggs in one exchange basket? Risky. Even if a platform is reputable, things can go south. By spreading your holdings across multiple exchanges, you reduce the impact if one ever gets compromised or frozen.

Securing your crypto is essential. A few smart habits can make all the difference between sleeping easily and sweating over a hack. Treat your digital assets like real money, because they are.

Final Thoughts

Finding the best crypto exchange in Australia means finding the right fit for you. The exchange must, first of all, suit your own personal requirements. Maybe you’re after ultra-low fees and pro-level tools. Maybe you just want a platform that doesn’t make you feel like you need a PhD in blockchain to buy your first Bitcoin.

The good news? Australia’s crypto scene is packed with solid options, whether you’re a total beginner, a seasoned trader, or somewhere in between. From ironclad security and smooth AUD transfers to demo accounts and NFT marketplaces, there’s something for everyone.

And remember, your needs might change over time. The platform you start with isn’t necessarily the one you’ll stick with forever, and that’s perfectly fine. The key is to choose one that keeps your assets safe, your costs low, and your crypto journey on track.

Also Read