Bitcoin mining today is a tighter, sharper game than it was just a few years ago, and it isn’t forgiving anymore. In the past, cheap power and bigger block rewards gave miners room to make mistakes. That buffer has disappeared. The rewards are being halved, the difficulty is growing, and margins are thin.

Bitcoin mining is no longer a side hobby but a set of economic trade-offs around power costs, hardware efficiency, operational risk, payout variance and trust. The key question is whether you can mine Bitcoin profitably and consistently without taking on risks you do not fully understand. For most miners, the single most consequential choice within that bundle is the mining pool.

Pools determine how smooth your payouts are, how much fee drag you absorb over time, whether you get paid daily or wait weeks, and how exposed you are to operator decisions you do not control. They also shape Bitcoin’s decentralization in a very concrete way. Hash rate concentration is not an abstract debate. When too much mining power clusters inside a few entities, it becomes easier for external pressure, policy mandates, or internal coordination to influence what transactions make it into blocks.

That concentration is visible in real time. Public dashboards like the mempool.space mining dashboard, Blockchain.com’s pool distribution charts, and the Hashrate Index pool comparison show exactly who is finding blocks and how that distribution shifts over time. Anyone considering mining should spend time looking at those charts.

This guide covers the leading Bitcoin mining pools in 2026, pool functionality, payout models' cash impact, and profitability assessments before investing in hardware.

Key Takeaways

- Pools are more than payout smoothing now. Pool choice affects payout reliability, fee transparency, censorship exposure, and how concentrated Bitcoin’s block production becomes.

- Home mining usually only makes sense with unusually cheap power or effective heat reuse. Professional mining is an uptime and energy procurement business where scale and operations discipline decide survival.

- Electricity cost dominates returns. Above $0.10/kWh, mining is typically marginal or loss-making. Competitive operators generally need <$0.06/kWh to stay resilient through difficulty increases.

- Best pool for beginners: FPPS + low minimum payouts. ViaBTC is a strong “feature + predictability” pick, while Binance Pool is convenient if you already operate inside Binance (with custodial tradeoffs).

- Best pool for large farms: Foundry USA Pool for stability-first FPPS at industrial scale, with Luxor as a strong alternative for professional operators who want more advanced tooling and optional Stratum V2 support.

- Best pool for decentralization: Braiins Pool (and other smaller pools) helps reduce hash rate concentration, but expect more payout variance versus the biggest FPPS pools.

Note: Pool shares and fee terms can change quickly. Treat comparisons as a snapshot and verify current terms before redirecting hashpower.

Bitcoin Mining Pools: Quick Comparison

If you want a fast answer before diving deep, this section will act as a map for you.

At-a-Glance Comparison Table

Hash rate shares change constantly, so treat this as a snapshot and verify with live data before committing capital.

| Pool | Fee (Bitcoin Mining) | Payout Model | Hashrate (Hashrate Index) | Minimum Payout | Best For |

|---|---|---|---|---|---|

| Foundry USA Pool | Not publicly disclosed. Fees are applied via private contracts or tiered agreements and revealed during onboarding | FPPS | 296.1 EH/s | 0.01 BTC | Large farms, stability-first |

| AntPool | Not publicly disclosed on public pages. Fee details are shown inside the miner dashboard depending on payout model (FPPS, PPS, or PPLNS) | FPPS / PPS / PPLNS | 213.6 EH/s | 0.0005 BTC | Flexible setups at scale |

| F2Pool | FPPS: 4% · PPLNS: 2% (Bitcoin). Fees across supported coins generally range from 1%–4% depending on asset and payout scheme | PPS+ / FPPS / PPLNS | 109.6 EH/s | 0.005 BTC | Multi-coin miners |

| ViaBTC | PPS: 4% · PPLNS: 2% (as listed on ViaBTC’s official fee page) | PPS+ / PPLNS | 155.9 EH/s | 0.001 BTC | Feature-heavy users |

| Braiins Pool | 0% pool fees (from official website) | FPPS | 9 EH/s | 0.0002 BTC | Transparency-focused miners |

| Clover Pool | 4% fees on the official site | FPPS for BTC | N/A | 0.005 | Cost-sensitive miners |

| Binance Pool | 4% fee (as described on Binance Pool’s website) | FPPS | 25.9 EH/s | None | Miners already using Binance |

| EMCD | 1.5% commission for FPPS, PPS+, and PPLNS payouts (per official site) | FPPS / PPS+ / PPLNS | N/A | 0.001 BTC | Small to mid-scale miners |

| Poolin | Fees not consistently published. PPS+ and PPLNS supported, with specifics varying by configuration | PPS+ / PPLNS | 5.6 EH/s | N/A | Miners looking for bundled pool services |

| Luxor Mining | 0% pool fees for Luxor Bitcoin Pool. LuxOS firmware carries a 2.8% fee | FPPS | 38.4 EH/s | 0.001 BTC | Professional operators |

Quick Selection Guide

Pick the branch that matches your reality, not your vibe.

Prioritize: predictability + low minimum payouts.

- Faster, steadier cashflow matters more than squeezing basis points.

- Clear payout thresholds reduce waiting risk.

Prioritize: uptime, fee structure at scale, payout flexibility.

- Downtime becomes a direct revenue leak.

- Volume terms matter more than headline fees.

Validate: whether low fees are offset elsewhere.

- Spread, payout method, or policy changes can erase savings.

Hash rate concentration has real consequences.

Consider: smaller pools or decentralized models like P2Pool.

- Expect more variance in exchange for independence.

Convenience versus custody is the trade.

Option: Binance Pool can be convenient, with custodial tradeoffs.

- Integrated trading and settlement.

- Added platform and custody risk.

Market Share & Centralization Snapshot

| Mining Pool | Estimated Hash Rate Share |

|---|---|

| Foundry USA | ~30% |

| AntPool | ~18% |

| ViaBTC | N/A |

| F2Pool | ~2% |

| Binance Pool | ~2% |

Note: Figures are sourced from Hashrate Index, reflect the trailing 12 months, and are current as of Dec. 24, 2025.

The table shows a mining landscape dominated by a small number of large pools, with Foundry USA alone accounting for roughly a third of total hash rate and AntPool controlling a significant additional share. Smaller pools such as F2Pool and Binance Pool represent only a small fraction of network hash rate, while some operators do not disclose enough data to estimate their share reliably. This imbalance reflects the economic gravity of scale, where miners often gravitate toward large, stable pools for payout predictability, even as it concentrates block production into fewer hands.

Hash rate concentration does not imply an imminent attack, but it does increase systemic risk. When a handful of pools control most block production, external regulation, policy pressure, or internal coordination can have an outsized impact on transaction inclusion and network neutrality. Choosing smaller pools, where economically viable, directly reduces this concentration and strengthens Bitcoin’s censorship resistance without requiring protocol changes.

What Is a Bitcoin Mining Pool?

A Bitcoin mining pool is a service that coordinates miners so they can combine hash power and share block rewards. Pools exist because the probability of a small miner finding a block alone has collapsed as total network hash rate has grown. Even powerful modern ASICs represent a tiny fraction of total hash power, something that becomes obvious when you look at the scale shown on the mempool.space mining dashboard.

Pools aggregate hash power, construct block templates, distribute work, and pay miners based on their contribution. In practical terms, a pool turns mining from a lottery ticket into a steadier income stream. The tradeoff is fees and reliance on a pool operator to behave competently and honestly.

Today, that tradeoff is no longer optional for most miners. Solo mining still exists, but it behaves more like speculative variance than income unless you operate at a very large scale with significant capital buffers.

If you'd rather watch, here's our video on the topic:

Solo Mining vs Pool Mining

The choice between solo mining and pool mining is fundamentally about variance and survivability.

Solo Mining Explained

Solo mining means running your own node and keeping the entire block reward if you find a block. The upside is maximum sovereignty and no pool fees. The downside is probability. Even with modern ASICs, expected waiting times can stretch into months or years. Long periods of zero revenue are normal, not exceptional. That makes cash-flow planning extremely difficult unless you operate at scale with deep reserves.

Pool Mining Explained

Pool mining smooths that variance by paying miners for submitted work rather than full block discovery. You contribute shares, and the pool converts those shares into payouts using a defined model. You give up some sovereignty and pay fees, but in return you get a predictable income.

Pros and Cons Breakdown

| Category | Solo Mining | Pool Mining |

|---|---|---|

| Block Rewards | Full block reward if you find a block | Rewards shared based on contributed hash rate |

| Payout Frequency | Extremely rare and unpredictable | Regular, predictable payouts |

| Income Variance | Very high | Low to moderate |

| Hardware Requirements | Very high to be competitive | Flexible, works at small and large scale |

| Upfront Risk | High risk of long dry spells | Lower risk due to pooled hash power |

| Fees | No pool fees | Pool fees typically 1–3% |

| Operational Complexity | High (node setup, monitoring, luck management) | Low to moderate (pool handles coordination) |

| Best For | Large operators, lottery-style miners, decentralization purists | Hobbyists, small farms, income-focused miners |

| Network Impact | Maximizes decentralization per miner | Increases efficiency but can increase pool concentration |

Best Bitcoin Mining Pools in 2026

Mining pools influence payout reliability, fee transparency, censorship exposure, and how much control miners retain over their hashpower. Below are the most relevant Bitcoin mining pools today, each presented using an identical structure for direct comparison.

Foundry USA Pool

Foundry USA Pool has become the dominant force in Bitcoin mining by hash rate, largely by catering to large North American industrial miners. Backed by Foundry Digital, the pool emphasizes reliability, regulatory alignment, and predictable operations over experimentation. Its growth mirrors the broader institutionalization of Bitcoin mining in the U.S., making it a central pillar of today’s mining landscape. Foundry-affiliated miners are estimated to have mined ~1.4–1.6 million BTC since the pool launched in 2021.

Payout Methods

FPPS pays both block rewards and transaction fees with predictable settlements.

Fees

Foundry does not publish a public percentage fee. Its official pool documentation describing its FPPS payout structure explains that rewards are distributed net of pool terms and agreements, with pricing typically disclosed during onboarding rather than on open pages.

Who it’s For

Very large, compliance-focused miners prioritizing stability and predictable cash flow.

Pros

- Highly consistent payouts

- Strong uptime and infrastructure

- Widely supported by enterprise firmware

Cons

- Significant hashrate concentration

- Centralization risk at the network level

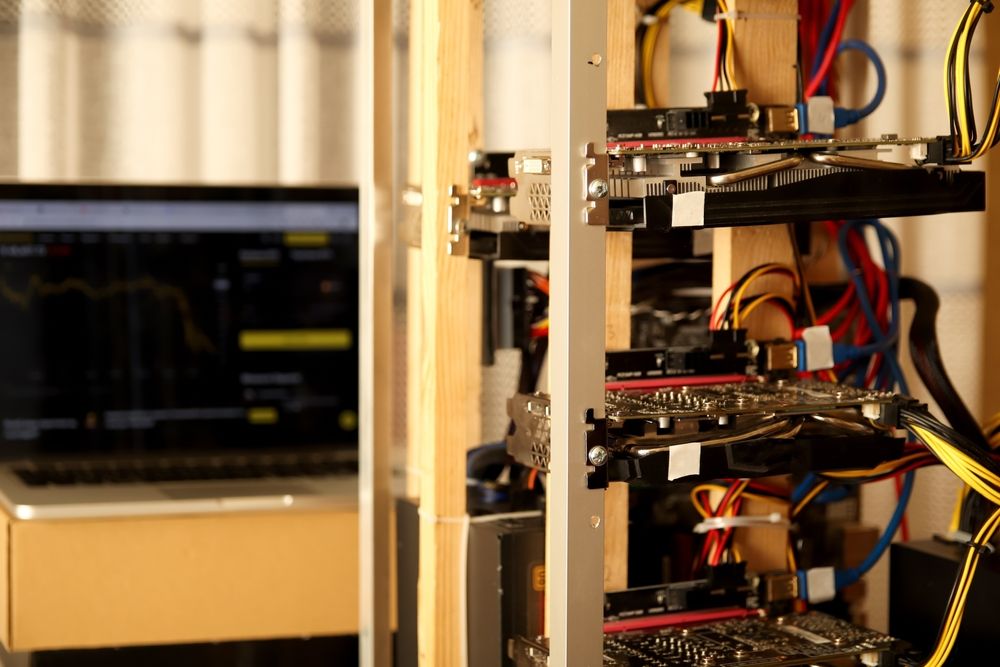

Mining Pools Influence Payout Reliability And Fee Transparency. Image Via Shutterstock

Mining Pools Influence Payout Reliability And Fee Transparency. Image Via ShutterstockAntPool

AntPool is one of the longest-standing Bitcoin mining pools and is operated by Bitmain, the world’s largest ASIC manufacturer. This close relationship with Bitmain hardware gives AntPool deep roots in the global mining ecosystem, particularly among operators running Antminers. While its interface and tooling feel dated to some, AntPool remains a major player thanks to its scale, flexibility, and long operational history. AntPool-connected miners have collectively mined ~1.7–1.9 million BTC since inception.

Payout Methods

Choice between FPPS and PPLNS, plus a solo mining option.

Fees

AntPool does not list a fixed fee percentage on its public pages. Its official site confirms FPPS, PPS, and PPLNS payout models, with fee details shown inside the miner dashboard on the official platform.

Who it’s For

Miners using Bitmain hardware who want payout flexibility.

Pros

- FPPS and PPLNS options

- Solo mining available

- Large, global hashrate base

Cons

- Outdated UX

- Tight coupling to Bitmain ecosystem

F2Pool

F2Pool is one of the earliest Bitcoin mining pools still operating today, with a strong presence across Asia, Europe, and North America. Over time, it has evolved into a broad, multi-coin mining platform rather than a Bitcoin-only specialist. This makes F2Pool especially attractive to miners who want exposure to multiple networks, though Bitcoin-focused operators may find its fee structure and tooling less optimized for single-asset strategies. F2Pool miners are estimated to have produced ~1.3–1.5 million BTC to date.

Payout Methods

PPS+, combining stable payouts with transaction fee sharing.

Fees

According to F2Pool’s own support documentation, Bitcoin mining fees vary by reward scheme: FPPS incurs a 4% fee and PPLNS a 2% fee on F2Pool’s Bitcoin pool. Litecoin mining on F2Pool carries a 4% PPS fee, and Kaspa mining shows a 1% PPLNS fee in the official fee table. F2Pool’s publicly documented fees across 40+ supported coins generally sit in the 1%–4% range, depending on payout scheme and asset.

Who it’s For

Miners interested in merge mining and multi-coin operations.

Pros

- Merge mining advantage

- Extensive multi-coin support

- Transparent hashrate reporting

Cons

- Less appealing for Bitcoin-only miners

- Higher effective fees

ViaBTC

ViaBTC positions itself as a modern, feature-rich mining pool designed to be accessible without sacrificing flexibility. In addition to traditional pool services, ViaBTC has built an ecosystem that includes smart mining modes, analytics tools, and optional add-ons aimed at simplifying operations. This makes it a popular choice for small to mid-sized miners who want more control and insight without running complex infrastructure. ViaBTC-connected miners have mined approximately ~900,000–1.1 million BTC since the pool’s launch in 2016.

Payout Methods

PPS+, PPLNS, and Smart Mining, which dynamically switch strategies.

Fees

According to ViaBTC's official page, it lists mining fees at 4% for PPS and 2% for PPLNS.

Who it’s For

Small to mid-scale miners seeking flexibility and ease of use.

Pros

- Smart mining features

- Multiple payout options

- Beginner-friendly interface

Cons

- Cloud mining offerings add counterparty risk

- Fee structure can become opaque

Braiins Pool

Braiins Pool, formerly known as Slush Pool, carries a unique legacy as the first Bitcoin mining pool ever created. Today, it leans heavily into transparency, protocol research, and decentralization values rather than pure scale. Closely tied to the Braiins development team, the pool often attracts technically proficient miners who care as much about Bitcoin’s long-term health as short-term profitability. Braiins Pool participants have collectively mined ~1.25–1.4 million BTC since 2010.

Payout Methods

PPLNS only, rewarding long-term participation.

Fees

Braiins Pool publicly states 0% pool fees.

Who it’s For

Technically proficient miners aligned with decentralization principles.

Pros

- Strong transparency standards

- Early Stratum V2 adoption

- Clear fee disclosure

Cons

- Higher payout variance

- No FPPS option

Clover Pool

Clover Pool is a newer entrant that competes by leaning into data, analytics, and aggressive pricing rather than sheer size. Its platform emphasizes visibility into miner performance, making it appealing to operators who want granular insight into efficiency and uptime. While its hash rate share is smaller than the largest pools, Clover Pool has carved out a niche among cost-conscious miners who value transparency and metrics. Clover Pool miners have mined ~120,000–180,000 BTC so far.

Payout Methods

FPPS with regular settlements.

Fees

Clover Pool advertises a 4% fee on its website.

Who it’s For

Cost-sensitive miners who value detailed performance data.

Pros

- Strong analytics dashboard

- Stable payouts

Cons

- Smaller hashrate share

Binance Pool

Binance Pool extends Binance’s exchange ecosystem directly into Bitcoin mining, allowing rewards to flow seamlessly into Binance accounts. This tight integration appeals to miners who already rely on Binance for trading, liquidity, or custody. The trade-off is increased centralization and custodial exposure, making Binance Pool a convenience-first option rather than a decentralization-focused one. Based on historical pool share data published by BTC.com and Binance’s publicly visible block submissions, Binance Pool-connected miners are estimated to have mined ~500,000–650,000 BTC to date.

Payout Methods

FPPS with rewards credited to Binance accounts.

Fees

Binance Pool describes 4% FPPS fees on its website

Who it’s For

Miners who are already using Binance for trading and custody.

Pros

- Seamless ecosystem integration

- Low minimum payout

- Immediate liquidity access

Cons

- Mandatory KYC

- Custodial and centralization risk

EMCD

EMCD markets itself as more than just a mining pool, positioning its platform as an all-in-one mining and crypto management ecosystem. Alongside pool services, it offers wallets, yield products, and additional tools aimed at simplifying life for smaller operators. This bundled approach can be attractive for miners who want everything under one roof, though it comes with higher complexity and platform reliance. EMCD-affiliated miners have collectively mined ~200,000–300,000 BTC.

Payout Methods

FPPS with optional ecosystem incentives.

Fees

EMCD advertises a 1.5% commission for FPPS, PPS+ and PPLNS payouts on its website.

Who it’s For

Miners seeking integrated wallets and yield options.

Pros

- Wallet and staking integration

- Clean interface

- Additional ecosystem tools

Cons

- Higher minimum payout requirements

Poolin

Poolin is a long-running mining pool that combines pool services with optional hosting and infrastructure offerings. It has historically attracted miners looking for bundled solutions rather than standalone pool access. While it remains a recognizable name in mining, operational reliability and support quality have become more important considerations than headline features for prospective users. Poolin-connected miners have historically produced ~800,000–1 million BTC, with output varying significantly by market cycle.

Payout Methods

PPS+ and PPLNS.

Fees

Poolin outlines PPS+ and PPLNS payout options on its website, but does not consistently publish a single headline Bitcoin pool fee.

Who it’s For

Miners seeking bundled pool and hosting solutions.

Pros

- Merge mining support

- Hosting services available

- Established infrastructure

Cons

- Support quality can be inconsistent

Luxor Mining

Luxor Mining is aimed squarely at professional and institutional operators, positioning itself closer to a financial services provider than a traditional mining pool. Beyond standard FPPS payouts, Luxor offers advanced tooling, Stratum V2 support, and even hashrate derivatives. This makes it well-suited for large-scale miners with sophisticated operational needs, but less approachable for beginners. Luxor-connected miners have mined approximately ~250,000–350,000 BTC, with production accelerating alongside institutional adoption.

Payout Methods

FPPS with customizable settlement options.

Fees

Users enjoy 0% pool fees when mining on Luxor Bitcoin Pool. However, LuxOS firmware operates on a 2.8% fee structure, according to official documentation.

Who it’s For

Large-scale and institutional mining operations.

Pros

- Stratum V2 support

- Hashrate derivatives

- Institutional-grade tooling

Cons

- Higher complexity

- Not beginner-friendly

How Bitcoin Mining Pools Work

Pools follow a consistent technical flow under the hood.

Mining Profitability is Determined by a Narrow Set of Variables. Image Via Shutterstock

Mining Profitability is Determined by a Narrow Set of Variables. Image Via ShutterstockPool Mining Mechanics

Under the hood, pools measure contribution using shares. A share is proof that your ASIC performed real work, but at a lower difficulty than the full network. This allows pools to measure contribution frequently, even though actual block discoveries are relatively rare events.

The basic idea is simple. A mining pool builds a block and sends out work to its miners. Miners keep hashing and sending in shares, and when someone finds a real block, the pool gets the reward and pays everyone based on how the pool is set up.

Proof of Work Refresher

This entire system sits on top of Bitcoin’s Proof of Work mechanism. Proof of Work secures the network by making block creation computationally expensive. After the 2024 halving, the block subsidy is 3.125 BTC per block, with transaction fees added on top. As subsidies shrink over time, transaction fees become an increasingly important component of miner revenue.

Payout Models Explained

Payout models determine how variance and risk are shared between miners and pool operators.

- PPS pays a fixed amount per share, shifting variance risk to the operator.

- FPPS extends PPS by including transaction fees, producing the smoothest cash flow.

- PPLNS pays based on shares submitted within a rolling window, reducing operator risk and fees but increasing variance.

Bitcoin Mining Profitability: Real-World Examples

Mining profitability is determined by a narrow set of variables. Hardware efficiency, electricity pricing, difficulty, and pool fees dominate outcomes. The examples below illustrate how those variables interact at three common scales.

Small Home Miner (1 ASIC)

This scenario reflects the smallest practical entry point into modern Bitcoin mining.

- Hardware

A current-generation SHA-256 ASIC in the ~200 TH/s class, such as the Antminer S21, is a reasonable benchmark for home mining in terms of efficiency and power draw. - Power cost

A continuous load of roughly 3.5 kW results in approximately 84 kWh of daily electricity consumption. At a residential rate of $0.10 per kWh, electricity costs alone are about $8.40 per day. - Pool fees

Most large Bitcoin mining pools charge between 1% and 3%, as reflected across pool comparison tools like MiningPoolStats. - Net result

At typical residential power rates, a single modern ASIC is usually near break-even or slightly unprofitable once pool fees, downtime, and minor overhead are accounted for. This can be verified using calculators such as CryptoCompare or NiceHash. - Profitability verdict

At around $0.10 per kWh, home mining is generally marginal unless offset by unusually low power costs or effective heat reuse.

Serious Home Miner (5 ASICs)

At this scale, mining begins to behave like a small operational setup rather than a hobby.

- Hardware

Five modern ASICs in the ~200 TH/s class provide roughly 1 PH/s of total hash rate with a combined continuous power draw near 17.5 kW. - Power cost

At $0.07 per kWh, daily electricity costs are approximately $29 to $30.

At $0.10 per kWh, electricity costs rise to roughly $42 per day, materially compressing margins. - Pool fees

A 2% pool fee represents a permanent reduction in output. As difficulty increases over time, this fee compounds in absolute terms. Fee assumptions used by tools such as MiningPoolStats and CryptoCompare explicitly reflect this drag. - Net result

With competitive electricity pricing and stable uptime, this scale can support predictable cash flow, particularly when paired with FPPS or PPS-style payout models. - Profitability verdict

Five ASICs can be economically viable under disciplined operating conditions, but margins remain sensitive to electricity pricing and difficulty growth.

Professional Mining Farm (100 ASICs)

At this scale, mining becomes an infrastructure business with industrial constraints.

- Industrial power

A fleet of 100 ASICs operating at ~3.5 kW each requires approximately 350 kW of continuous load, typically necessitating industrial power contracts or colocated infrastructure. - Labor

Ongoing labor is required for monitoring, maintenance, repairs, firmware management, and downtime response. Labor costs become a recurring operational expense rather than an exception. - ROI timeline

Return on investment is measured in months to years and is highly sensitive to difficulty trends tracked on mempool.space and Blockchain.com’s difficulty charts. - Bull vs bear scenario

In bullish conditions, price appreciation can temporarily outpace difficulty increases. In flat or bearish markets, difficulty often remains elevated while revenue compresses, extending ROI timelines and eliminating undercapitalized operators. - Profitability verdict

At this scale, success depends more on power procurement, uptime discipline, and treasury management than on hardware alone.

What Actually Determines Profitability

Across all scales, a small number of variables dominate mining economics.

- Electricity cost

Electricity is typically the highest and most predictable cost. Small differences in $/kWh often outweigh differences in pool fees, a reality reflected in tools such as CryptoCompare and NiceHash. - BTC price sensitivity

Mining revenue is denominated in BTC, while expenses are paid in fiat. Price volatility directly impacts short-term profitability. - Difficulty growth

Rising difficulty reduces output over time, even during periods of flat price action. - Pool fee drag

Pool fees permanently reduce gross output. Payout model selection affects how variance is distributed, but fees compound regardless of market conditions.

Simple Profitability Calculator

This framework provides a first-pass check on mining economics.

Formula

Net Profit (per day) = (BTC mined × BTC price) − (Power kW × 24 × $/kWh) − Pool fees − Overhead

Example calculation

- A single 3.5 kW ASIC consumes 84 kWh per day.

- At $0.10 per kWh, electricity costs are $8.40 per day.

- If gross revenue is estimated at $9 per day using CryptoCompare and pool fees are 2%, profitability disappears once overhead is included.

Rule-of-thumb warnings

- If profitability depends primarily on BTC price appreciation, the operation is speculative.

- If true, all-in power costs are unknown and ROI estimates are unreliable.

- Assumptions should always be cross-checked using at least one independent calculator such as CryptoCompare or NiceHash.

Bitcoin Mining Requires Powerful Hardware. Image Via Shutterstock

Bitcoin Mining Requires Powerful Hardware. Image Via ShutterstockBitcoin Mining Hardware: What You Need to Join a Pool

Hardware sets the ceiling for mining profitability, but infrastructure determines whether you ever reach it. Efficiency matters more than headline hash rate, and operational reliability matters more than either. Modern Bitcoin ASICs cluster around higher hash rates with significantly improved joules-per-terahash efficiency. That efficiency gap is not cosmetic. Over time, it decides which miners survive difficulty increases and which get priced out.

Current-Generation ASICs (2024–2025)

At this point, efficiency and reliability matter far more than headline hash rate. Newer ASICs are built to squeeze more work out of every watt, which is what actually keeps miners afloat as difficulty rises and margins compress.

Most competitive operations today rely on machines like Bitmain’s Antminer S21 series or MicroBT’s WhatsMiner M60 lineup, both designed around newer chip architectures that prioritise joules per terahash rather than raw output. Firmware maturity also matters more than many beginners expect. Vendors with stable software and long-term support tend to deliver solid uptime and fewer operational headaches. This is why many miners choose custom firmware solutions like Braiins OS, which allow you to tune machines for efficiency instead of chasing maximum hash rate at any cost.

The bottom line is simple: modern ASICs are not just faster. They are more power-efficient, easier to manage, and more predictable over time, which usually justifies the higher upfront spend.

Older ASICs (Still Viable vs Dead)

Older ASICs are not automatically worthless, but the window where they make sense is narrow. In practice, only late S19-class machines and direct equivalents remain viable without access to exceptionally cheap electricity.

Models like the Antminer S19, S19 Pro, and WhatsMiner M30 series can still work if power costs are low and uptime is carefully managed. Anything earlier tends to struggle under today’s network difficulty. Once efficiency drops too far, even small increases in electricity prices can flip a setup from marginally profitable to outright loss-making.

Running the numbers through a real-world mining profitability calculator from NiceHash makes this reality clear very quickly. Older machines often look acceptable on paper until power costs, difficulty adjustments, and downtime are factored in.

Unless you have ultra-cheap power or already own the hardware, most older ASICs are effectively living on borrowed time.

Supporting Equipment

ASICs do not operate in isolation. Power delivery, cooling, noise control, and electrical safety are non-negotiable, not optional upgrades.

Modern ASICs draw sustained high loads, which means dedicated circuits, proper breakers, quality cabling, and surge protection are essential. Poor electrical setup is one of the fastest ways to damage hardware or create serious safety risks. Cooling is just as critical. Without proper airflow and heat management, even the best machines will throttle, shut down, or degrade faster than expected.

Noise is another commonly underestimated issue. Most ASICs operate well beyond comfortable residential noise levels, which is why miners often use sound-dampened enclosures or isolate their hardware entirely. Bitmain highlights this in its official setup and safety guidance.

Supporting equipment may not be exciting, but it often determines whether a setup runs smoothly or constantly fights itself.

Minimum Budget Scenarios

Bitcoin mining is capital-intensive and energy-driven. Below are three realistic entry points, showing where mining shifts from experimentation to an actual business.

- ASIC: Entry-Level Setup

Estimated budget: $4,500–$8,000

A single modern ASIC (Antminer S21 / WhatsMiner M60 class) delivers roughly 180–220 TH/s while consuming around 3 kW to 3.6 kW. This setup is best viewed as a learning tool rather than a reliable profit engine.

At residential electricity rates above $0.10/kWh, mining will almost certainly operate at a loss. Break-even conditions typically require electricity below ~$0.07/kWh, as reflected in data from the Cambridge Bitcoin Electricity Consumption Index, which shows power costs as the dominant variable for small-scale miners.

This tier is most useful for understanding ASIC operations, noise, heat management, firmware behavior, and pool mechanics.

- 5 ASICs: Small-Scale Commercial Mining

Estimated budget: $22,000–$40,000

With five ASICs, the total hashrate approaches ~1 PH/s and the continuous power demand rises to roughly 16 kW to 18 kW. At this level, standard residential electrical setups usually become insufficient.

Electricity pricing now determines viability:

- Profitable: <$0.06/kWh

- Marginal: $0.06–$0.08/kWh

- Unviable long-term: >$0.08/kWh

Cooling efficiency, uptime, and hosting costs start to materially impact returns. This is often the minimum scale where professional hosting becomes viable, with current market pricing visible via Bitcoin mining hosting benchmarks.

- 50+ ASICs: Semi-Industrial Operation

Estimated budget: $200,000–$500,000+

With 50+ ASICs, mining transitions into an infrastructure and energy business. Power draw exceeds 150 kW, and costs shift away from hardware toward transformers, cooling systems, monitoring, staffing, and maintenance.

Competitive operations typically require electricity below ~$0.05/kWh, often secured through direct power purchase agreements or access to excess energy.

For a broader context on how large compute loads interact with energy markets, the International Energy Agency’s electricity market analysis provides useful framing.

Key Factors When Choosing a Mining Pool

Choosing a mining pool is less about chasing the biggest name and more about aligning incentives, costs, and risk tolerance. The wrong pool won’t just reduce upside. It can quietly bleed returns over time.

Fees and Payout Models

Pool fees compound. A difference of 1% may feel trivial month to month, but over a full difficulty cycle, it meaningfully impacts net BTC mined. FPPS pools provide predictable income but often bake fees into the payout structure. PPLNS pools can look cheaper, yet variance and downtime amplify real-world costs.

Over long horizons, miners should think in terms of net sats retained, not advertised percentages. This is especially relevant as fee revenue becomes a larger share of block rewards post-halving, a trend tracked closely by Blockchain.com’s mining revenue data.

Hash Rate and Pool Size

Large pools offer smoother payouts and lower variance, but at the cost of influence concentration. Smaller pools introduce higher variance, yet often distribute the hashrate more evenly across the network.

The trade-off is stability versus independence. Pool size also affects block discovery frequency, which directly impacts payout cadence. Current hashrate distribution data from BTC.com’s pool statistics highlights just how concentrated block production has become.

Security and Reputation

Pool security is rarely visible until something breaks. DDoS attacks, payout interruptions, and infrastructure failures tend to surface during periods of high volatility.

Beyond technical resilience, reputation matters. Pools can censor transactions, comply selectively with regulations, or change payout terms with limited notice. Operator trust is a real variable, especially as transaction filtering becomes more common. Historical censorship debates are well documented in discussions around OFAC-compliant mining.

Mining Pools Reduce Variance, But Introduce Systemic Risks. Image Via Shutterstock

Mining Pools Reduce Variance, But Introduce Systemic Risks. Image Via ShutterstockRisks Involved in Bitcoin Mining Pools

Mining pools reduce variance, but they introduce systemic risks that solo mining avoids. Understanding these risks is essential before committing hashpower.

Centralization Risks

When too much hashpower concentrates under a small number of pool operators, the network becomes more fragile. In extreme cases, this raises the theoretical risk of a 51% attack or coordinated transaction censorship.

While such attacks remain unlikely, distribution still matters. Bitcoin’s security model assumes decentralized participation, not a handful of operators controlling block templates. The implications of hashrate concentration are explored in depth by Cambridge’s Bitcoin mining research.

Pool Operator Risks

Pools are businesses. They can be mismanaged, under-capitalized, or opaque.

History provides examples of delayed withdrawals, unclear accounting, and sudden shutdowns. Transparency failures often appear only after stress hits the system. Miners should pay attention to proof-of-reserves style disclosures, public communication, and past incident handling. Industry failures across crypto infrastructure are cataloged in Chainalysis’ annual crime and risk reports.

When Bitcoin Mining Is (and Isn’t) Worth It

Mining is not binary. It exists on a spectrum shaped by energy costs, scale, and operational discipline.

Profitable Scenarios

- Electricity consistently below ~$0.05/kWh

- Access to modern, high-efficiency ASICs

- Ability to manage downtime and heat effectively

- Long-term conviction in holding mined BTC

Marginal Scenarios

- Electricity between ~$0.06–$0.08/kWh

- Small-scale operations with limited optimization

- Reliance on hosted mining with variable fees

- Sensitivity to short-term BTC price moves

Unprofitable Scenarios

- Residential electricity above ~$0.10/kWh

- Older-generation ASIC hardware

- Inability to tolerate payout variance

- Expectation of passive income without active management

Closing Thoughts on Bitcoin Mining Pools

There is no single “best” Bitcoin mining pool. The right choice depends on scale, electricity costs, payout tolerance, and how much control you want over your hashpower. FPPS pools favor predictability but quietly reduce long-term output through fees, while PPLNS pools can be more efficient if you can tolerate variance and dry spells. Chasing the lowest advertised fee matters far less than understanding how fees, variance, and transaction rewards interact over time.

In the end, mining success is decided by electricity math, not pool branding. Pool tweaks add or subtract basis points, but power pricing determines survival. As hash rate concentrates, pool choice also carries political and censorship risk, making decentralization a practical consideration, not a theoretical one. Mining must be run like an operating business, reviewed regularly as conditions change. For many, there will be moments when buying spot BTC is simply the more rational move.